Free Sole Trader Invoice Template for UK in Excel Format

For independent business owners in the UK, managing financial transactions effectively is crucial for smooth operations. One of the key tasks in maintaining professionalism is ensuring that all payment requests are clear, detailed, and easy to understand. A well-organized document can help avoid confusion, ensure timely payments, and even assist with tax filing at the end of the year.

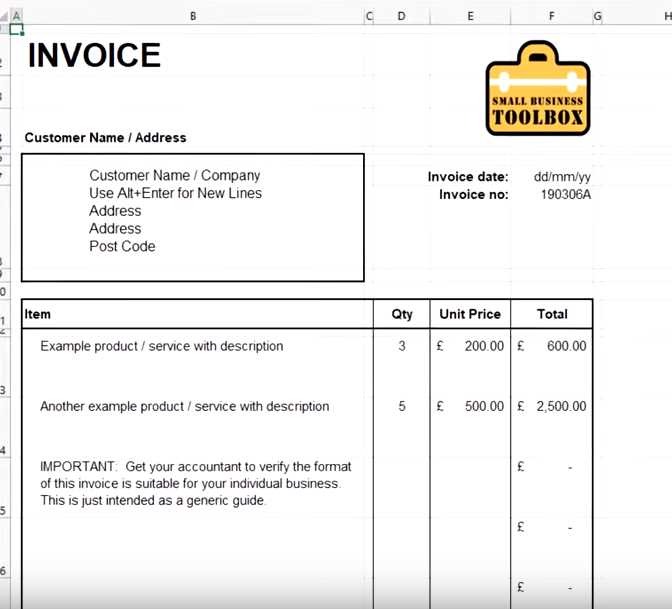

With the right tools, setting up these documents can be simple. By using the right resources, freelancers can generate customized records that look professional and meet all legal requirements. For many, the ease and flexibility of working with digital tools like spreadsheets makes this process both efficient and affordable.

Setting up a reliable system for issuing these records can save significant time and effort in the long run. Whether you’re just starting or have years of experience, having access to the correct document format can ensure consistency and accuracy in all your transactions.

Using such resources is not just about ease–it’s about professionalism and building trust with your clients.

What is a Sole Proprietor Payment Request?

A payment request is an essential document for any independent business owner or freelancer. It serves as a formal way to request payment for goods or services provided, ensuring clarity between the business and its clients. This document outlines the transaction details, such as the amount due, services rendered, and payment terms, making the process of financial exchange transparent and professional.

For self-employed individuals, these documents are not just a way to get paid–they are also a tool for tracking business finances and meeting legal obligations. Whether you’re offering consulting services, designing products, or providing technical support, these forms can be customized to suit various industries and client needs.

Key Elements of a Payment Request

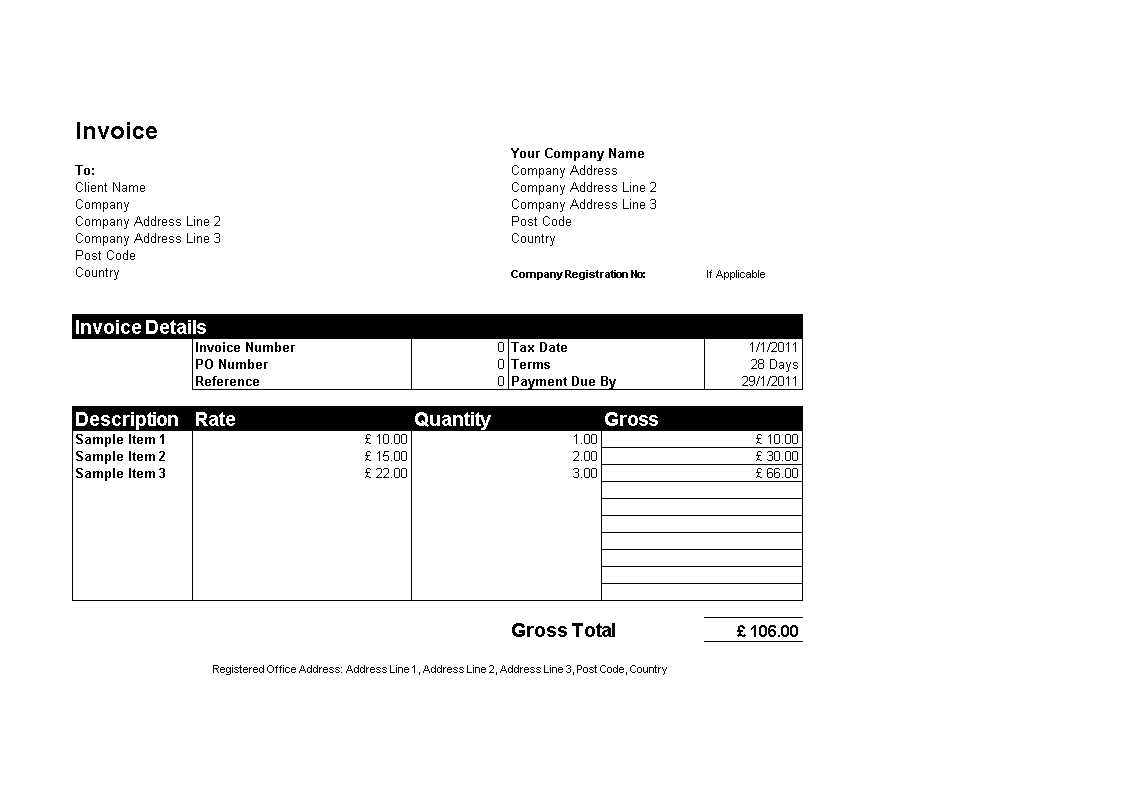

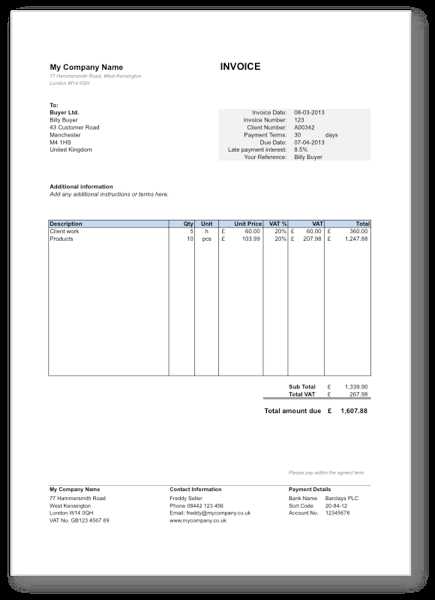

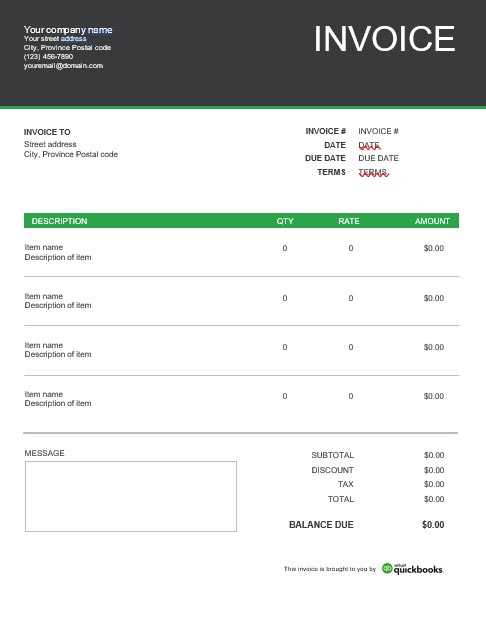

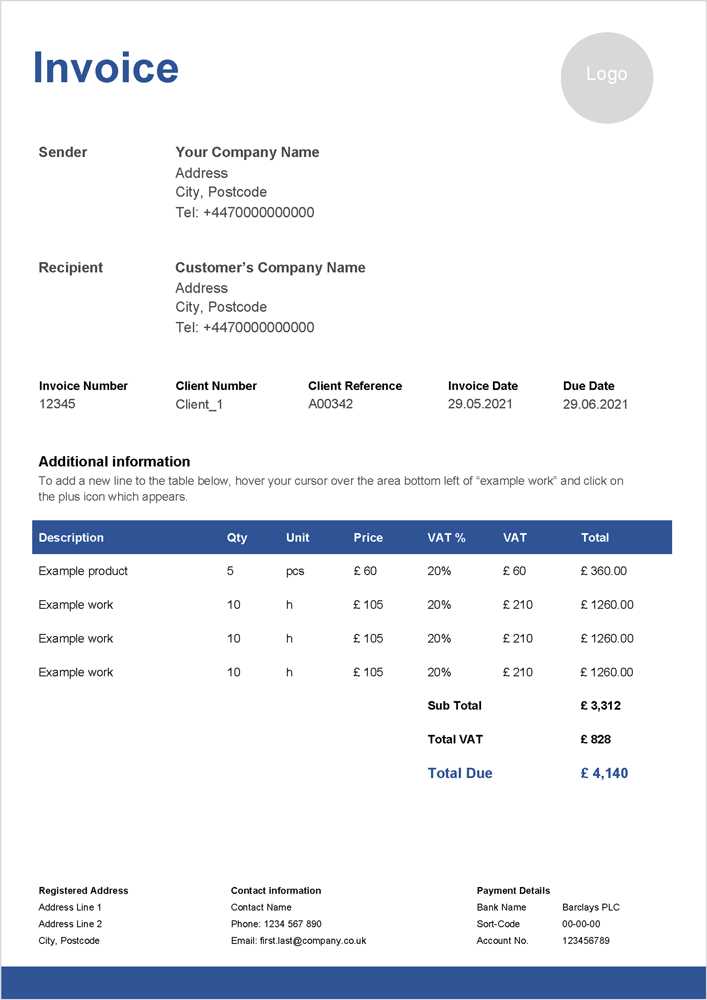

Every document should contain specific details to ensure it is clear and legally sound. These include the client’s contact information, a description of the service or product, the total cost, and the due date. Depending on the type of business, it may also include tax details and payment instructions. Below is a simple example of what these documents might look like:

| Field | Description |

|---|---|

| Client Name | The name of the person or business receiving the goods or services. |

| Service/Product Description | A brief explanation of what was delivered. |

| Amount Due | The total sum to be paid for the provided service or product. |

| Due Date | The deadline by which payment must be made. |

| Payment Methods | Instructions on how the client can pay (bank transfer, online payment, etc.). |

Why a Payment Request is Crucial for Independent Professionals

For individuals

Why Use Spreadsheets for Billing?

For independent business owners and freelancers, managing finances efficiently is essential for long-term success. One of the most effective ways to handle payment requests is by using spreadsheet software. This tool offers flexibility, ease of use, and the ability to customize documents, making it an ideal choice for professionals who need to quickly create and manage payment records.

Spreadsheets are a powerful solution for tracking income, calculating totals, and organizing data. They allow for automation of certain calculations and ensure that all necessary details are included in each document. This not only saves time but also reduces the risk of errors, leading to more accurate and professional payment records.

Benefits of Using Spreadsheets for Billing

Customizability: Spreadsheet software provides the freedom to design documents that suit specific needs, whether it’s adding tax details, payment terms, or personalized branding. You can create a structure that works for your business and adapt it as your needs change over time.

Efficiency: With built-in formulas, spreadsheets automatically calculate totals, taxes, discounts, and other variables. This eliminates the need for manual calculations, reducing the chance of mistakes and saving valuable time.

Tracking and Organization

Using spreadsheet software also enables better organization of financial data. Each document can be saved digitally, and payments can be tracked in a central location. This makes it easier to manage records, monitor cash flow, and generate reports for tax season. Additionally, with cloud storage, you can access your files from anywhere, ensuring that you never lose track of important transactions.

Ultimately, spreadsheets simplify the invoicing process, making it more accessible, accurate, and efficient for small business owners.

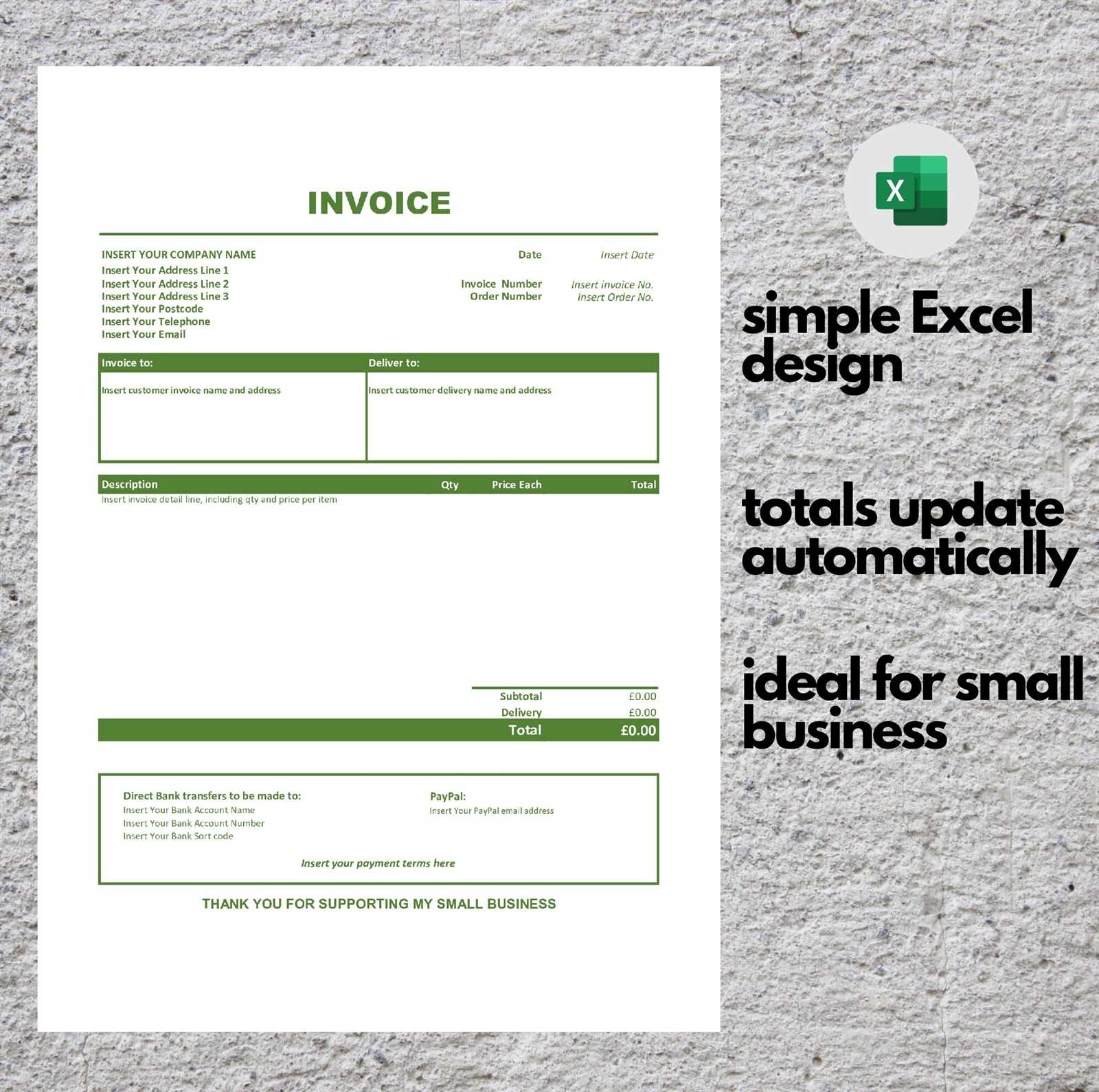

Benefits of Using Pre-Designed Payment Documents

For independent professionals, streamlining the process of generating billing records can significantly improve efficiency. Pre-designed payment documents offer a quick and reliable solution for those who need to create clear and consistent records without starting from scratch every time. These ready-made formats are customizable, easy to use, and can save valuable time when managing financial transactions.

Using pre-designed structures not only ensures accuracy but also enhances professionalism. When dealing with clients, having a polished, well-organized document can make a lasting impression and help establish trust. Moreover, these formats often include essential fields, reducing the chances of omitting important details.

Time Savings

Efficiency is a key benefit of using pre-made formats. Instead of manually creating each record, you can simply enter the required details into an existing layout. This reduces the time spent on administrative tasks and allows more focus on core business activities. The process becomes quicker, especially if you regularly handle multiple clients or projects.

Consistency and Accuracy

With standardized designs, consistency is guaranteed. Each document will follow the same structure, making it easier to track and compare past transactions. Furthermore, many formats come with built-in calculations, such as totals and taxes, which help reduce human error and ensure that the amounts are accurate every time.

By using pre-designed structures, you can focus on delivering great services while maintaining a high standard of financial record-keeping.

How to Customize Your Payment Request

Personalizing your billing document allows you to reflect your brand, maintain professionalism, and meet the specific needs of each client. Customization ensures that your document not only looks polished but also includes all necessary information tailored to your business and industry. Whether you want to add your logo, adjust the layout, or modify the payment terms, there are several ways to make it your own.

Customizing a payment request is simple and can be done using various tools, such as spreadsheet programs or word processors. Below are a few key elements you can adjust to create a more personalized and effective document.

| Element | How to Customize | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header Information | Add your business name, logo, and contact details for easy identification. | ||||||||||||

| Client Details | Include the full name or company name, address, and contact information of the recipient. | ||||||||||||

| Service Description | Clearly describe the goods or services provided, including quantity and unit prices. | ||||||||||||

| Payment Terms | Specify due dates, payment methods, and any late fees to set clear expectations. | ||||||||||||

| Tax Information | Include tax rates, if applicable, and display the total amount with and without taxes. |

| Best Practice | Description |

|---|---|

| Include Your Details | Always include your business name, address, and contact details. This ensures your clients know who to reach out to in case of any issues or queries regarding the document. |

| Provide Clear Payment Instructions | Specify the methods of payment you accept and include necessary details, such as bank account numbers or payment platform information. This makes it easier for your clients to process payments quickly. |

| List Services or Products Clearly | Offer a clear and concise breakdown of what was provided, including dates and quantities where applicable. This helps your client understand what they are paying for. |

| Be Transparent with Terms | State payment deadlines, late fees, and any other important terms up front. Clear terms help set expectations and avoid conflicts down the line. |

| Use Professional Design | Even if you are a small business or working independently, use a clean and professional design for your document. This reflects positively on your business and encourages prompt payments. |

By following these best practices, you ensure that your documents are not only professional but also effective in facilitating timely and accurate payments from your clients.

How to Send Your Invoice to Clients

Once your billing document is ready, the next step is ensuring it reaches your client promptly and securely. The method of delivery can affect the speed of payment and the clarity of your communication. Choosing the right approach not only ensures the document is received but also contributes to the professionalism of your business.

Email is the most common and efficient way to send your document. Attach the file in a widely used format, such as PDF, to ensure compatibility and easy access for your client. In the body of your email, provide a brief, polite message, reminding the client of the payment details and due date. For example:

Dear [Client Name],

Please find attached the billing document for the services provided. Kindly refer to the payment terms and let me know if you have any questions.

Best regards, [Your Name]

If your client prefers traditional methods, postal mail is an option. However, this is typically slower and may incur additional costs. If you choose this method, ensure the document is printed clearly and included with any necessary supporting information or instructions. Using a professional envelope and addressing the letter correctly reflects well on your business.

Online Platforms are another growing option. Some businesses use third-party systems to send and track billing documents. These platforms can automate much of the process, send reminders, and even accept payments directly. If your client uses such a platform, make sure to u