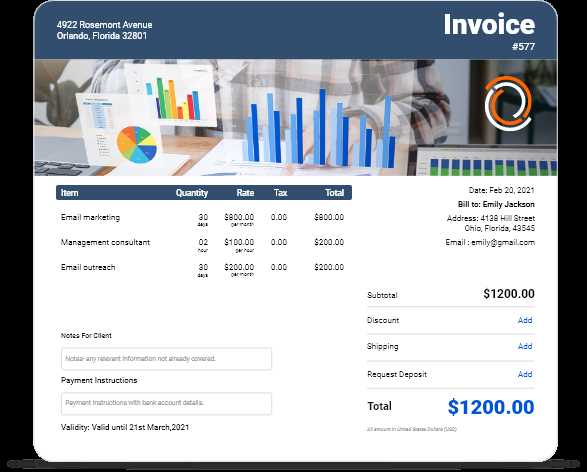

International Commercial Invoice Template Excel for Easy Global Transactions

When conducting cross-border business, one of the essential tools for maintaining smooth operations is an accurate and organized financial record. Clear documentation ensures that both parties understand the terms of a deal and agree on payment details, reducing misunderstandings and delays. Having a well-structured financial form helps to streamline processes and makes it easier to manage transactions efficiently.

For businesses engaged in global trade, using a customizable document format is vital to adapt to different regional requirements and currency conventions. By designing a form that includes all necessary fields and details, companies can ensure they meet legal standards while also making transactions simpler. With the right structure in place, managing sales, purchases, and shipments becomes much easier, especially when the document can be tailored for various markets.

In this guide, we explore the benefits of using a flexible and adaptable document format for businesses. We’ll discuss how to design, customize, and manage these documents effectively, and how such tools can play a key role in enhancing communication and improving financial transparency across borders.

Global Business Payment Document Design

For any business involved in cross-border transactions, having a well-structured financial document is crucial. A standardized format allows companies to maintain consistency and professionalism when dealing with clients or partners in different countries. This type of document ensures clarity in financial dealings, outlining key details such as the amounts due, product descriptions, and payment terms, which are essential for smooth business operations.

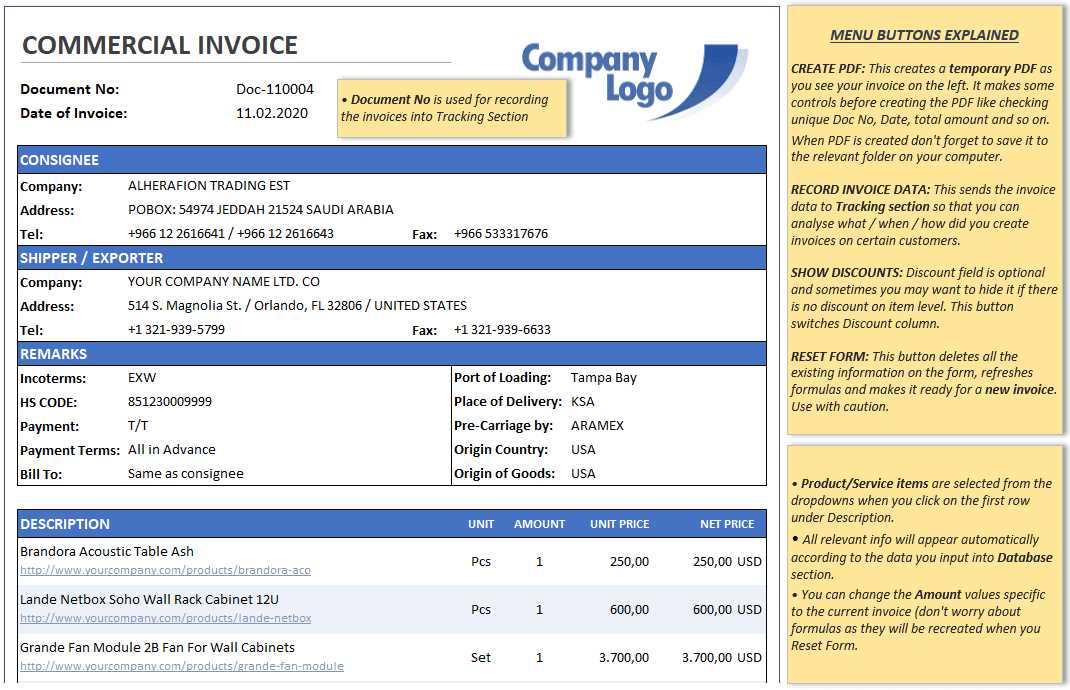

A customizable format is especially important as it allows businesses to adjust the layout and content based on specific needs and local requirements. This flexibility ensures that all necessary information is captured in a way that complies with international trade practices, such as currency conversion, taxes, and shipping details. With the right design, companies can not only save time but also avoid errors that may arise from using generic or non-specific documents.

Using an editable document format makes it easy for businesses to manage their records and keep track of payments. Whether you’re dealing with multiple shipments or different pricing structures, a tailored format helps to simplify the invoicing process, making it more efficient and transparent for both parties involved. Having such a system in place can significantly improve overall financial management and streamline global operations.

What is a Global Payment Document Format

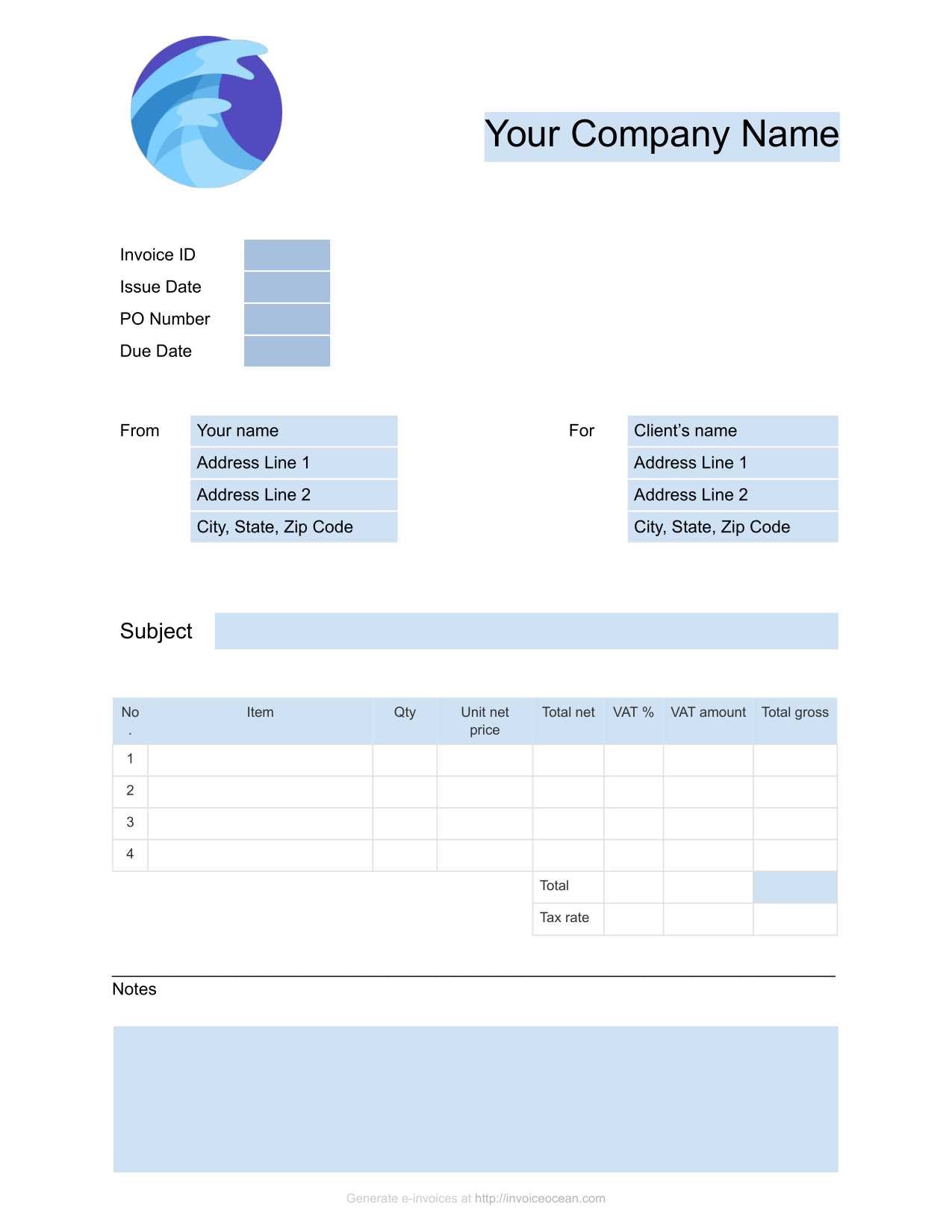

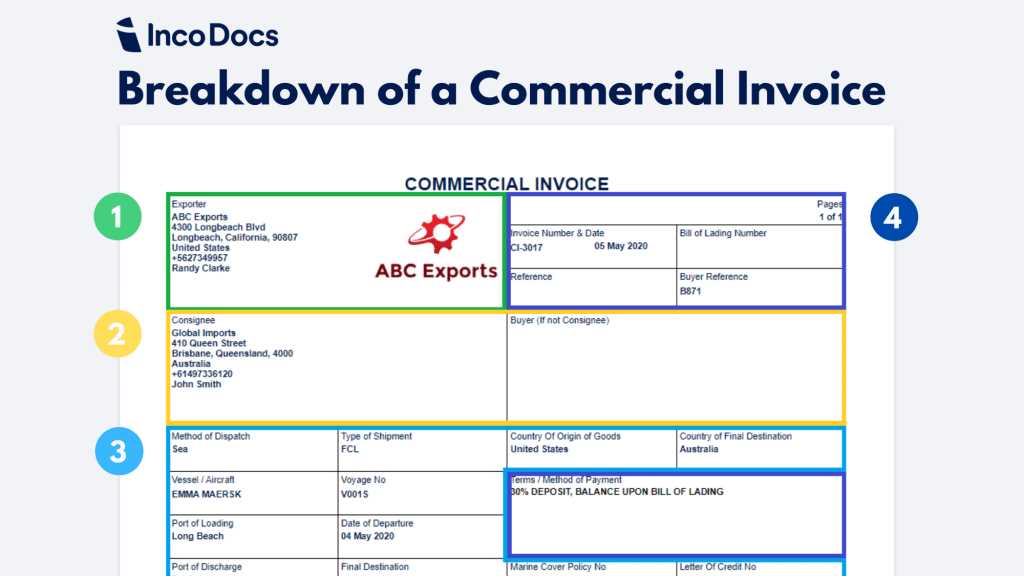

A payment document designed for international transactions is a structured form that businesses use to request payments for goods or services provided to clients across borders. This document typically contains important details about the transaction, such as product descriptions, quantities, prices, and payment terms, to ensure both parties are clear on the agreed-upon terms. It serves as a key reference for both the buyer and the seller, helping to avoid misunderstandings and ensuring smooth financial exchanges.

Key Features of a Global Payment Record

- Transaction Details: The document outlines what has been sold, including quantities, descriptions, and prices.

- Payment Terms: It specifies when the payment is due and what methods are accepted.

- Currency Information: The currency in which the payment is to be made is clearly stated, along with any conversion rates, if applicable.

- Shipping and Handling: Any relevant shipping details, including costs, are often included in the document.

- Legal Requirements: The format often includes information about taxes, customs, and other regulations that vary by country.

Why Use a Structured Format

Having a clearly defined structure ensures that both parties in the transaction are aligned in terms of expectations and obligations. With a standardized format, companies can easily create and manage such documents without having to draft new ones from scratch for every transaction. This simplifies record-keeping, improves efficiency, and reduces the chances of errors that could delay or complicate payment processing.

Benefits of Using Spreadsheets for Payment Documents

Utilizing spreadsheets for creating financial records offers numerous advantages that can simplify the management of business transactions. These tools allow for easy organization, customization, and automation, all of which contribute to streamlining administrative tasks. With features like built-in formulas and data analysis capabilities, spreadsheets help ensure that payment details are accurate and efficient, reducing the chances of manual errors.

Key Advantages of Using Spreadsheets

- Automation of Calculations: Spreadsheets can automatically calculate totals, taxes, and discounts, eliminating the need for manual calculations and ensuring accuracy.

- Easy Customization: You can adjust the layout and structure of the document to suit your specific needs, making it adaptable to different regions or industries.

- Quick Updates: It’s simple to modify or update payment details, quantities, and pricing without needing to create a new document from scratch each time.

- Data Storage and Organization: All information is stored in a digital format, making it easier to track and retrieve past transactions when needed.

- Integration with Other Tools: Spreadsheets can be easily integrated with other business software, such as accounting programs, helping to create a seamless workflow.

- Reduced Paperwork: By using digital records, businesses can minimize paper usage and streamline document management processes.

Time and Cost Efficiency

One of the most significant benefits of using spreadsheets is the time and cost savings. With ready-made formulas and templates, businesses can create financial records quickly without needing specialized software or extensive training. Furthermore, because spreadsheets are widely accessible, there are no additional costs for purchasing or maintaining complex invo

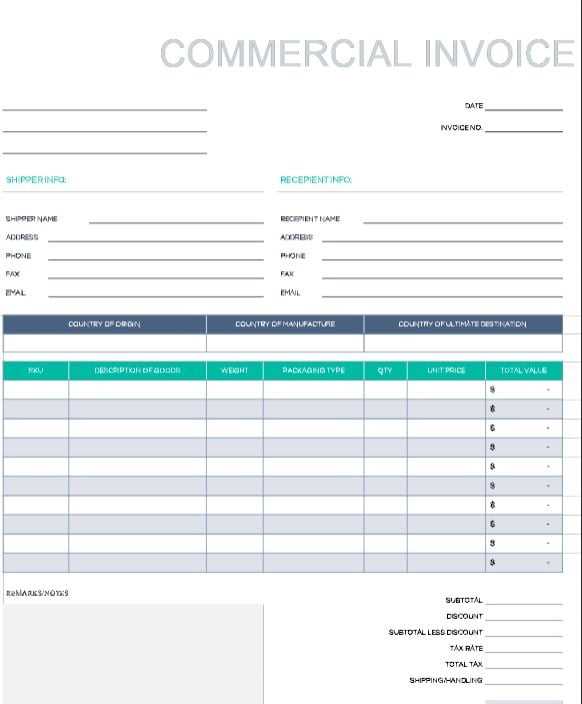

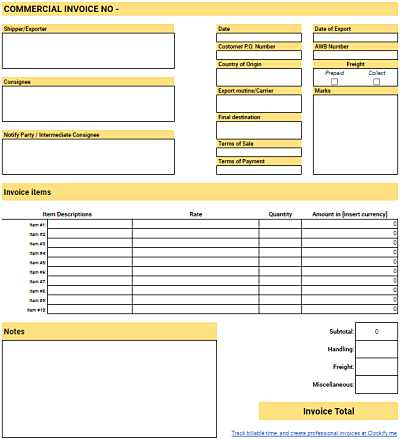

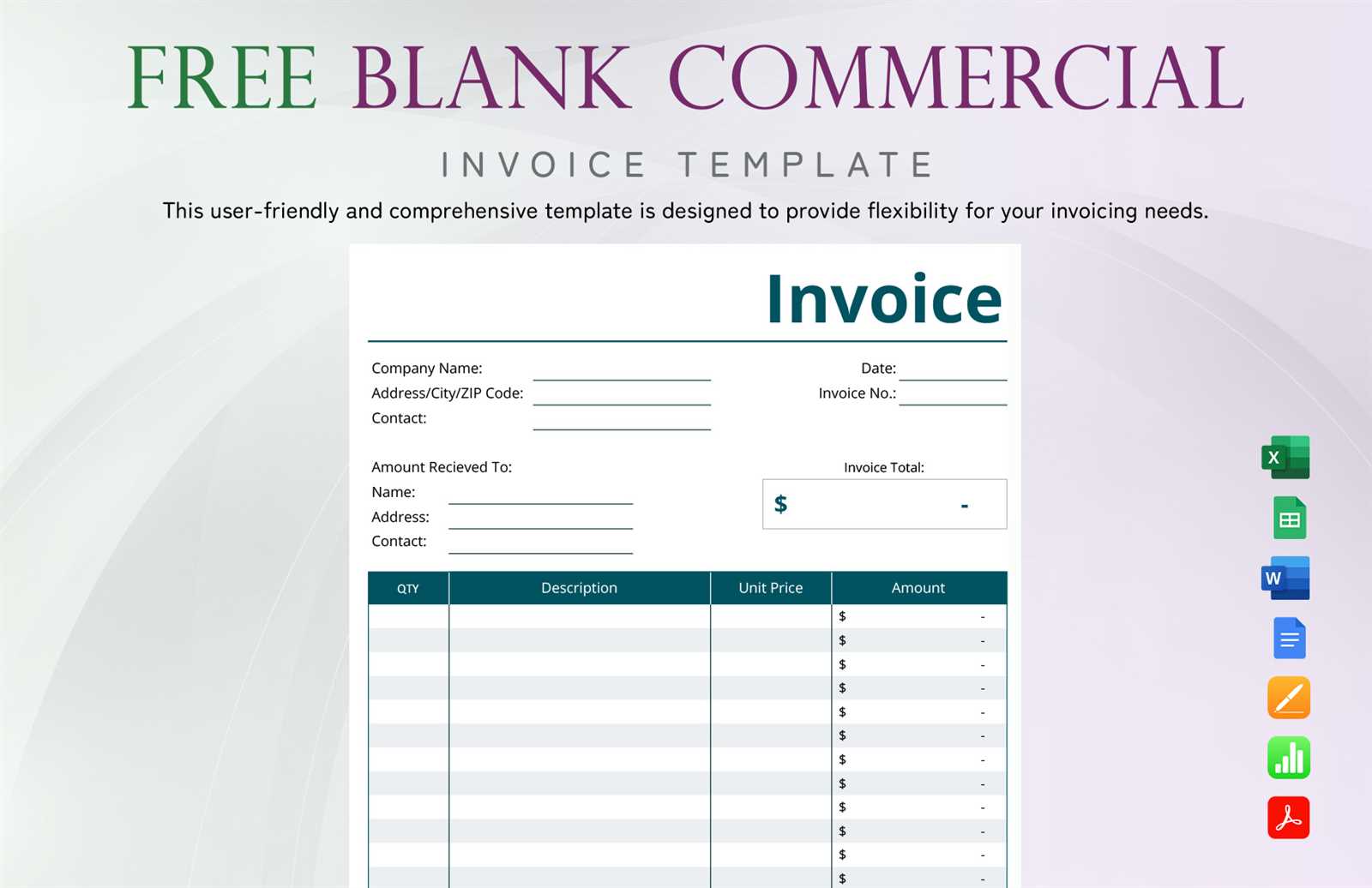

How to Customize Your Payment Document Format

Customizing your payment document allows you to tailor it to your specific business needs and ensure it meets local requirements. By adjusting the layout and adding or removing sections, you can create a document that best represents your brand and makes financial transactions more efficient. Personalizing the format also ensures that all necessary information is included and displayed clearly, which is especially important when dealing with clients from different regions.

Steps to Customize Your Document

- Choose a Clear Layout: Start with a clean and professional design that highlights the most important information, such as transaction details, payment terms, and client data.

- Add Relevant Fields: Depending on your business type, include specific fields like tax rates, shipping costs, or discount details that apply to the transaction.

- Adjust Branding: Incorporate your company’s logo, color scheme, and contact details to make the document visually align with your brand identity.

- Include Legal Requirements: Ensure that any mandatory legal or regulatory information, such as tax IDs or customs declarations, is included based on the destination country.

- Make It Mobile-Friendly: Ensure that the document is easy to read and interact with on various devices, especially when sharing electronically.

Customizable Sections in Your Document

| Section | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Company name, logo, contact details, and document title. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Client Information | Recipient’s name, address, and payment terms. |

| Feature | Benefit |

|---|---|

| Automation | Automatic calculations for totals, taxes, and discounts, reducing the risk of human error. |

| Customizability | Ability to tailor the layout and content to meet specific needs, such as varying tax rates or shipping costs. |

| Data Organization | Helps keep all transaction details organized in one place, making it easier to track and access past records. |

| Integration | Can easily integrate with other software for tasks like accounting or customer relationship management. |

| Cost-Effectiveness | Eliminates the need for expensive specialized software, as most businesses already have access to spreadsheet tools. |

By using a spreadsheet for payment management, businesses can ensure that all necessary information is accurately recorded and easily updated. The convenience of having a centralized system for tracking payments and generating financial records makes this tool ideal for both small and large-scale operations. Its versatility and ability to adapt to different business needs make it a go-to solution for managing financial transactions efficiently.

How to Avoid Common Payment Document Errors

Errors in financial records can lead to confusion, delays, and even disputes between businesses and clients. Small mistakes in the details of a transaction can snowball into bigger issues if not addressed promptly. Ensuring accuracy in your payment documentation is essential to maintaining professionalism and smooth business operations. By focusing on key areas that are prone to errors, businesses can significantly reduce the chances of mistakes and improve the efficiency of their financial processes.

Common Mistakes and How to Prevent Them

- Incorrect Contact Information: Double-check the names, addresses, and contact details of both parties. Ensure they are up-to-date and correctly entered to avoid delivery or communication issues.

- Missing or Incorrect Payment Terms: Clearly state when and how the payment should be made. Ambiguities in payment schedules or methods can lead to delayed payments.

- Calculation Errors: Always use formulas to automate totals, taxes, and discounts. This reduces the chances of human error and ensures the amounts are correct.

- Omitting Taxes and Fees: Make sure all applicable taxes, shipping fees, and other charges are clearly stated. Leaving these out can cause misunderstandings about the total amount due.

- Incorrect or Missing Product Details: Always list the correct product descriptions, quantities, and unit prices. Misunderstandings here can lead to disputes over what was purchased.

- Failure to Include Legal or Regulatory Information: Depending on the

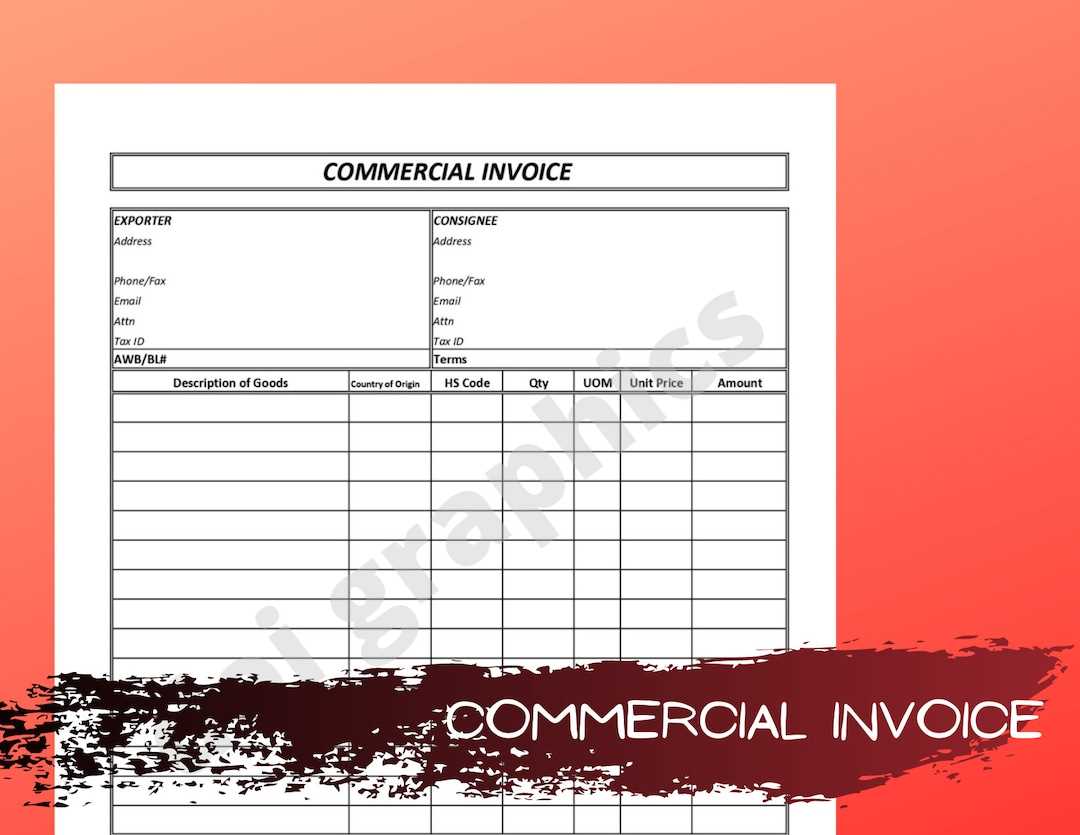

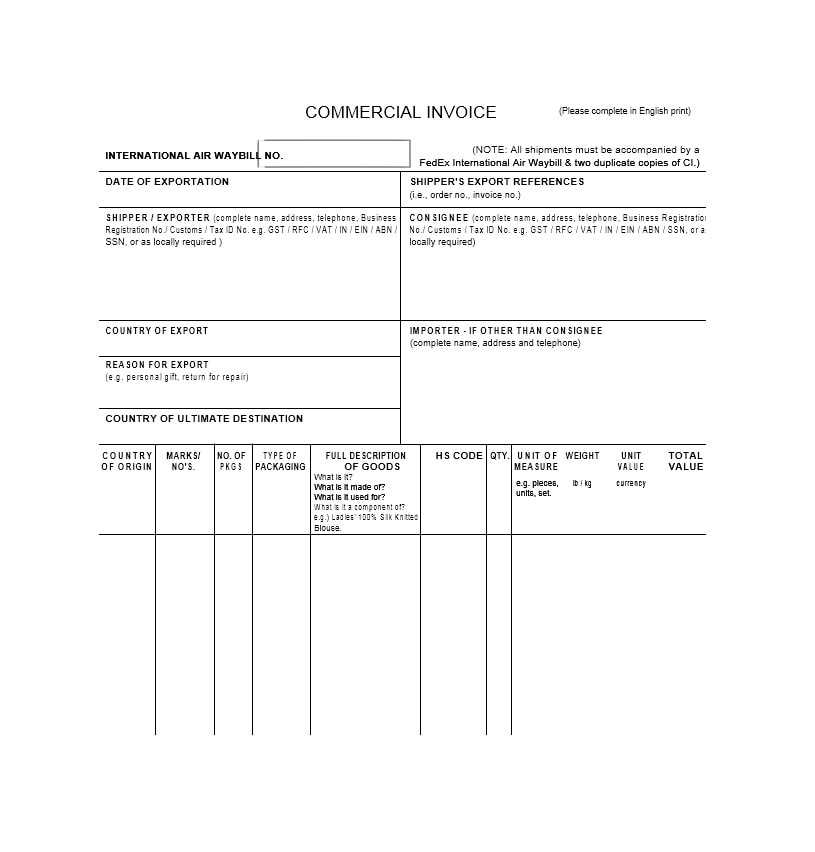

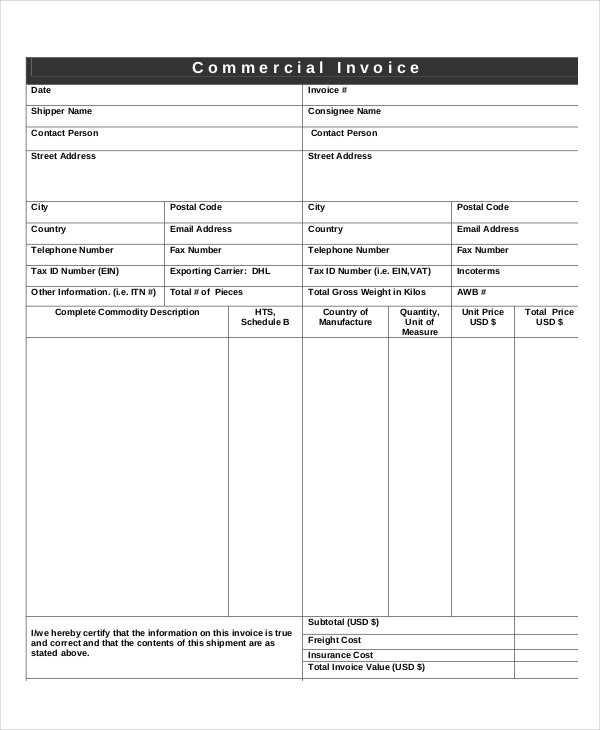

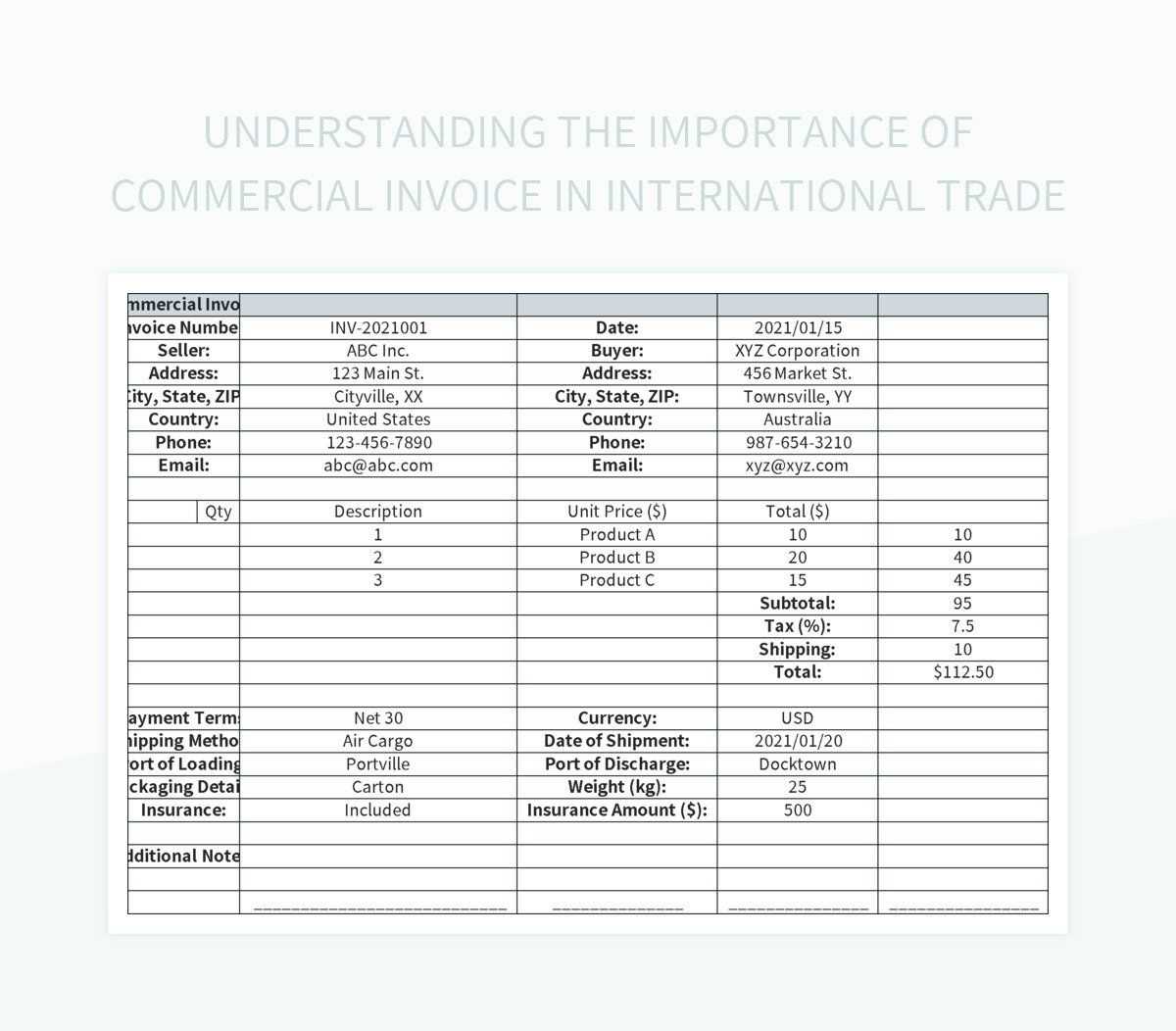

Essential Information for Global Payment Documents

When dealing with transactions across borders, it’s crucial to include specific details in your financial records to ensure smooth processing and compliance with local regulations. These documents serve as the official record of the transaction and must contain all relevant information that confirms the terms of the deal, as well as satisfies both legal and logistical requirements. Missing or incorrect details can result in delays, disputes, or non-compliance with the tax or customs laws of the involved countries.

Key Elements to Include

- Seller and Buyer Information: The names, addresses, and contact details of both parties involved. Accurate contact information ensures that both the buyer and the seller can communicate effectively if any issues arise.

- Transaction Date: The date when the deal was made should be clearly marked to ensure that the payment terms, such as due dates, are correctly calculated.

- Itemized List of Products or Services: A detailed description of the items being sold, including quantities, unit prices, and total amounts. This section helps avoid any misunderstandings about the products or services provided.

- Payment Terms: Clear terms outlining when the payment is due, acceptable payment methods, and whether any deposits or partial payments are required. This ensures both parties are on the same page regarding financial obligations.

- Currency and Amount Due: The currency in which payment should be made, as well as

Global Trade and Payment Document Requirements

Engaging in cross-border business transactions requires adherence to specific documentation standards to ensure compliance with various regulations, taxes, and customs duties. When goods or services are exchanged between countries, the payment records must include detailed information that satisfies both parties’ needs and fulfills legal obligations. These requirements may vary depending on the countries involved, but having a standardized structure helps simplify the process and ensures smoother operations.

Key Documentation Requirements for Global Transactions

In global trade, there are several critical elements that must be included in payment documentation to avoid delays and legal issues. Below is a list of some of the essential components needed for a transaction to comply with international trade laws:

Requirement Description Exporter and Importer Information The name, address, and contact details of both the seller (exporter) and the buyer (importer), ensuring that the transaction can be traced back to the correct parties. Customs Information For goods crossing borders, customs codes, classifications, and declarations may be necessary to comply with local regulations. Product Description and Quantity A detailed list of the products or services provided, including exact quantities, unit prices, and total amounts. This ensures that there are no misunderstandings about what has been exchanged. Payment Terms Clear terms specifying when and how payment is to be made, including any deposits or conditions for payment. This reduces the likelihood of disputes over financial obligations. Currency and Exchange Rate How to Add Tax Information in a Financial Record

Including tax information in financial documents is crucial for ensuring that all obligations are met and that the transaction complies with local and international tax laws. Properly documenting taxes can prevent future issues, such as disputes or penalties. Adding tax details can be done easily using the right structure, helping both businesses and clients keep track of applicable charges and ensuring transparency.

Steps to Include Tax Information

- Determine Applicable Tax Rates: First, you need to identify which taxes apply to the transaction. These could include sales tax, VAT, or customs duties, depending on the nature of the goods or services and the countries involved.

- Calculate the Tax Amount: Once the tax rate is determined, multiply it by the subtotal of the transaction to calculate the tax amount. You can use a simple formula to ensure accurate calculations.

- Clearly Display Tax Information: Create separate sections or columns in your document for each type of tax. Label each section with the relevant tax name (e.g., VAT, sales tax) and provide the corresponding rate and amount due.

- Include Total Tax and Final Amount: Summarize all tax charges at the bottom of the document, and ensure that the final amount due reflects both the subtotal and any applicable taxes.

Example of Tax Breakdown

Description Amount Subtotal $100.00 VAT (10%) $10.00 Total Amount Due $110.00 By following these simple steps, you can ensure that tax information is clearly documented and accurate. This transparency helps avoid confusion and ensures that both parties are aware of the tax obligations associated with the transaction.

Currency and Conversion Tips for Payment Documents

When dealing with cross-border transactions, it’s crucial to account for different currencies and ensure accurate conversions. Handling currency discrepancies can be tricky, but with the right approach, businesses can avoid confusion and ensure both parties are on the same page. Properly documenting the currency used in the transaction and including conversion rates when necessary helps streamline the payment process and minimizes errors.

Best Practices for Handling Multiple Currencies

- Specify the Currency: Clearly state the currency in which the transaction is to be completed. This eliminates ambiguity and helps the buyer and seller agree on the payment amount upfront. Use standard currency abbreviations (e.g., USD, EUR, GBP) for clarity.

- Include the Exchange Rate: If a conversion between currencies is involved, always include the exchange rate used at the time of the transaction. This ensures transparency and helps prevent misunderstandings when payments are made.

- Use an Automated Conversion Tool: To ensure accuracy, consider using an automated tool or software for currency conversion. This can help avoid mistakes and ensure up-to-date rates are used in real-time transactions.

- Calculate and Display the Final Amount: After applying the exchange rate, show both the original amount and the converted amount in the relevant currency. This allows for easy reference by both parties and ensures all charges are accounted for.

Example of Currency and Conversion Breakdow

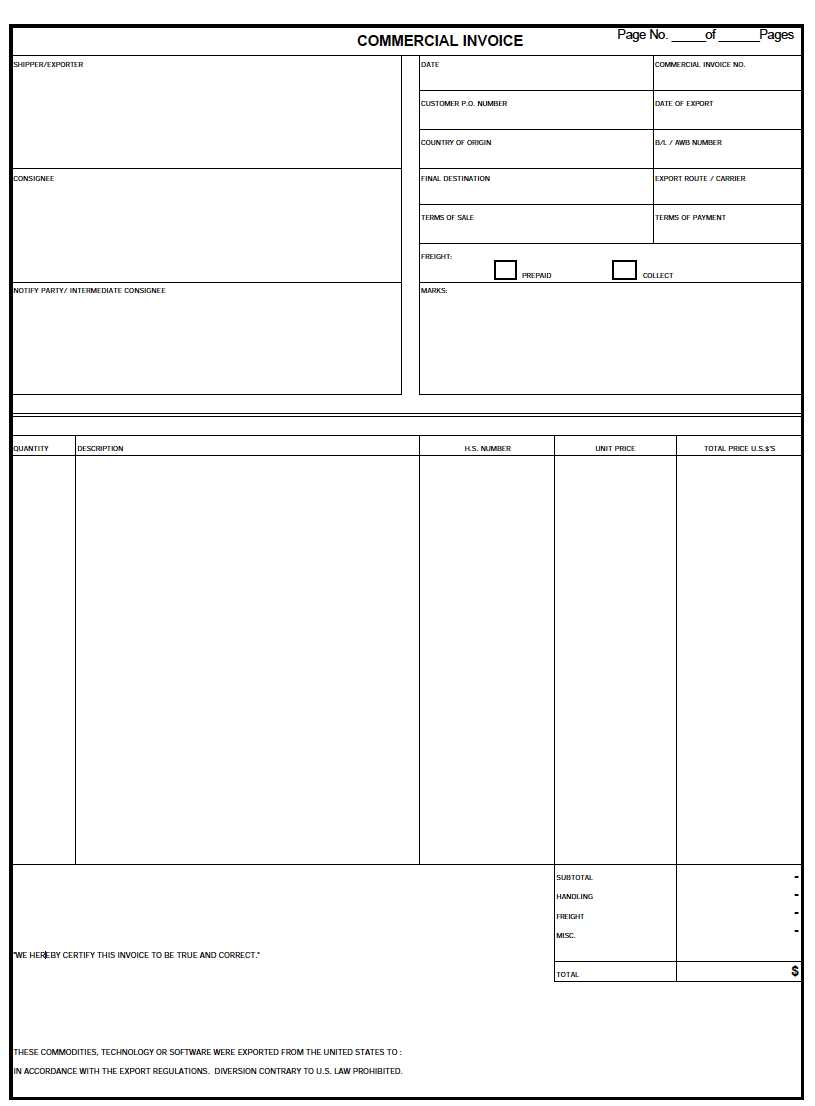

How to Handle Multiple Shipments on One Payment Record

When dealing with multiple shipments for a single transaction, it’s important to properly organize and document each shipment to avoid confusion and ensure accurate payment. In these cases, all relevant details, such as quantities, shipping dates, and tracking numbers, must be clearly outlined. Effectively managing such records helps both the seller and buyer track the goods and payments, while preventing potential issues related to incomplete or incorrect shipments.

Steps to Organize Multiple Shipments on One Document

- Break Down Each Shipment: List each shipment separately with distinct details such as shipment date, quantity, and price for each delivery. This ensures transparency and allows both parties to track what was delivered and when.

- Use Clear Descriptions: Provide a clear description of the products in each shipment, including any relevant serial numbers or batch codes. This is especially important if the goods differ in quantity or type across multiple deliveries.

- Include Tracking Numbers: If available, add the tracking numbers for each shipment. This helps both parties monitor the movement of goods and confirms that the shipments are progressing as planned.

- Summarize Each Delivery: At the bottom of the record, include a summary of each shipment’s total cost, shipping fees, and any additional charges that apply to that particular delivery. This will give a clear picture of the overall cost, broken down by shipment.

Example of Multiple Shipments on One Document

Shipment # Shipment Date Product Description Quantity Price per Unit Tracking Number Total 1 March 1, 2024 Product A 100 $10.00 XYZ123 $1,000.00 2 Designing a Payment Document for Different Countries

When preparing financial documents for clients or partners in different nations, it’s important to tailor the content and format to meet regional regulations and expectations. Different countries have varying requirements when it comes to tax information, language preferences, currency formats, and legal obligations. Ensuring that these factors are properly addressed helps facilitate smooth transactions and strengthens professional relationships across borders.

Key Considerations for Global Documents

- Language and Terminology: Make sure that the document is written in a language understood by both parties. For example, if you are dealing with clients in Germany, you may want to provide a translation or use bilingual terms to avoid confusion.

- Currency and Amount: Specify the currency in which the transaction will be conducted. If you are dealing with multiple currencies, indicate the exchange rates used and ensure the converted amounts are clearly presented.

- Tax Rates and Legal Compliance: Different regions may have specific tax rates or other financial obligations. Ensure that the appropriate taxes, such as VAT or GST, are applied correctly according to local laws. Include any tax identification numbers or legal codes required by the jurisdiction.

- Formatting for Regional Preferences: Some countries may use different date formats or numbering conventions. For example, the US typically uses “MM/DD/YYYY” for dates, while many European countries use “DD/MM/YYYY.” Ensure the document aligns with the local standard for ease of understanding.

Customizing a Payment Record Example

Description Amount (USD) Amount (EUR) Subtotal $1,200.00 €1,080.00 Tax (20% VAT) $240.00 €216.00 Total Due $1,440.00 €1,296.00 By customizing the financial documents to fit the specific needs of each country, businesses can improve communication and ensure smoother processing of payments and shipments. Understanding the regulatory and cultural differences in financial documentation is essential for successful global trade.

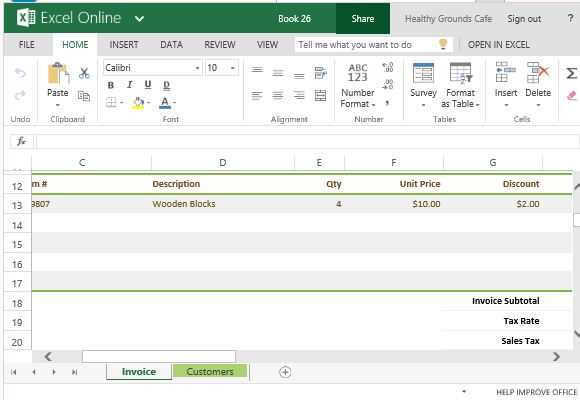

Automating Your Billing Process with Spreadsheet Tools

Automating the billing process can save significant time and reduce the risk of errors in financial documentation. By using spreadsheet software, businesses can create systems that automatically calculate totals, apply taxes, and even generate payment records without manual input for each transaction. This level of automation enhances efficiency, ensures accuracy, and allows business owners to focus on more strategic tasks.

Steps to Automate Billing Tasks

- Set Up Predefined Formulas: Use built-in formulas to calculate the totals, taxes, and discounts automatically. For example, applying a formula to multiply the unit price by quantity or to calculate tax based on a predefined rate ensures that these numbers are always accurate and up-to-date.

- Create Templates with Dynamic Fields: Build a dynamic system where you can simply input new customer or transaction data, and the spreadsheet will auto-populate the rest of the fields. This can include customer details, product information, and any relevant payment terms.

- Implement Drop-Down Lists: For commonly used options such as payment terms, currencies, or product categories, use drop-down lists to minimize typing and ensure consistency across all your records.

- Link Multiple Sheets for Easy Tracking: If you manage multiple clients or products, consider linking different sheets to track information like order history, outstanding balances, or specific payments. This way, updates made in one section will automatically

Exporting and Sharing Your Billing Files

Once you have created a detailed payment document, it’s essential to share it efficiently with your clients or partners. Exporting and sharing these files in a secure, easily accessible format can streamline communication and ensure the information is received without issues. Proper file sharing also helps maintain professionalism and reduces the risk of errors during the transfer process.

Best Practices for Exporting Payment Documents

- Choose the Right Format: For easy access and compatibility across different devices and software, consider exporting your files as PDF or CSV. PDFs ensure the document’s formatting remains intact, while CSVs can be used for data processing or integration with other systems.

- Ensure File Security: Before sharing payment documents, especially if they contain sensitive information, consider password-protecting the file or using encrypted email services. This ensures that only authorized parties can access the file.

- Organize Files for Easy Access: Name files clearly with the client’s name, date, or reference number to avoid confusion. For instance, “Invoice_ClientXYZ_2024-03-15” allows both parties to quickly locate the relevant document when needed.

- Share via Trusted Channels: Share the documents using secure and reliable platforms, such as email with encryption, cloud storage, or secure file-sharing platforms. This ensures that the file reaches the intended recipient without risk of being lost or tampered with.

Efficient Sharing Example

File Name Format Sharing Method Status Invoice_ClientABC_2024-03-15 PDF Email (Encrypted) Sent PaymentRecord_ClientXYZ_2024-03-16 CSV Cloud Storage (Link) Shared By exporting and sh

Legal Considerations for Cross-Border Billing Documents

When creating payment records for transactions involving parties from different countries, it is essential to understand the legal requirements that govern such documents. Legal obligations can vary depending on the jurisdictions involved, and failure to comply with local regulations can lead to penalties or disputes. By ensuring that your documents include all necessary legal information and are formatted according to the relevant laws, you protect both your business and your clients.

Key Legal Elements to Include in Cross-Border Payment Documents

- Tax Identification Numbers: Many countries require businesses to include tax identification numbers (TINs) or VAT numbers for both the seller and the buyer. This is crucial for tax reporting and ensuring compliance with local tax laws.

- Proper Currency and Conversion: Ensure that the payment amount is clearly specified in the agreed-upon currency, and if conversions are necessary, include the applicable exchange rate used at the time of the transaction. This helps avoid misunderstandings or discrepancies in the final amount.

- Legal Terms and Conditions: Some regions may have specific clauses that need to be included in payment records, such as dispute resolution procedures or delivery terms (e.g., FOB, CIF). These terms protect both parties in case of any issues with the transaction.

- Compliance with Local Regulations: Different countries have different requirements for the structure of payment documents, including mandatory disclosures or specific formatting for taxes and fees. Make sure to research the relevant regulations in both the seller’s and buyer’s jurisdictions.

Example of Legal Considerations in a Payment Record

Description Amount Tax Identification Number Legal Terms Product A $500.00 US123456789 FOB Shipping Point How to Track Payments Using Spreadsheet Templates

Efficiently managing and tracking payments is essential for maintaining healthy cash flow in any business. Using a spreadsheet to monitor payment status, due dates, and outstanding amounts allows you to stay organized and ensure that no payment is overlooked. By setting up a simple yet effective system, you can easily track what has been paid, what is due, and when payments are expected.

Steps to Track Payments

- Set Up a Payment Log: Start by creating a dedicated sheet where you can log all transactions. Include fields such as customer name, amount due, payment date, payment status, and method of payment (e.g., credit card, bank transfer).

- Use Formulas to Calculate Outstanding Balances: Set up formulas that automatically calculate the outstanding balance for each transaction. For example, you can subtract the amount paid from the total amount due, allowing you to quickly see how much remains to be paid.

- Track Payment Status: Include a column to indicate the payment status–whether it’s “Paid,” “Pending,” or “Overdue.” This makes it easy to spot any payments that need follow-up and ensures that you don’t miss important deadlines.

- Set Up Conditional Formatting: Use conditional formatting to highlight overdue payments. For example, you can change the cell color to red if a payment is overdue, making it easy to identify problematic accounts at a glance.

Example of a Payment Tracking Sheet

Customer Name Amount Due Amount Paid Outstanding Balance Status Client A $1,000.00 $500.00 $500.00 Pending Client B $750.00 $750.00 $0.