Remittance Invoice Template for Efficient Payment Tracking

Efficient financial management often requires clear and precise documentation to track payments and confirm transactions. Having the right tools in place helps businesses stay organized and reduces the risk of errors. Whether for personal or business use, a well-designed payment confirmation form plays a crucial role in keeping everything transparent and manageable.

Creating a reliable document for confirming payments involves more than just listing numbers. It should provide a clear summary of the transaction, including important details like the amount paid, the date of payment, and relevant reference numbers. By using a customizable format, businesses can ensure they meet their unique needs while maintaining professional standards.

Customizing this kind of form offers numerous benefits, from improving accuracy to enhancing communication with clients and vendors. Whether you’re handling routine transactions or more complex agreements, having a tailored solution can make payment tracking smoother and more efficient.

Effortlessly managing payment-related tasks not only saves time but also builds trust with your clients, offering them clear proof of their transactions. This guide will walk you through the essentials of creating, customizing, and using these documents effectively, so you can optimize your payment tracking processes.

What is a Payment Confirmation Document

A payment confirmation document is a structured form used to record the details of a financial transaction between a payer and a payee. It serves as an official record that verifies the completion of a payment, providing both parties with clear information about the transaction. This form ensures transparency, helps prevent misunderstandings, and can be used for bookkeeping or tax purposes.

Typically, this document includes key elements such as the amount paid, the date of payment, and reference numbers that link the payment to a specific invoice or agreement. It may also outline any discounts or additional charges associated with the transaction. By having this type of record, both the payer and the recipient can track the flow of funds and confirm that the agreed-upon payment terms have been met.

Customizable formats allow businesses and individuals to create a form that meets their specific needs, ensuring that all relevant details are captured. With the right layout and structure, such documents can streamline the payment process, making it easier to manage finances and maintain accurate records.

Using this form not only ensures proper documentation of each payment but also enhances the efficiency of financial operations. It provides a secure and standardized way to confirm that payments have been processed, fostering trust and accountability between the involved parties.

Why Use a Payment Confirmation Form

Using a dedicated form to confirm payments is essential for ensuring accuracy and professionalism in financial transactions. Without a clear and structured record, both the payer and recipient may face confusion regarding payment details, leading to potential disputes or administrative errors. This type of document serves as a reliable proof that a transaction has been completed as agreed.

One of the main benefits of using such a form is its ability to streamline communication between the two parties. With all the necessary details–like the payment amount, date, and reference numbers–clearly outlined, both parties have an immediate, easy-to-access reference. This reduces the chance of misunderstandings and ensures that everyone is on the same page regarding the transaction.

Consistency in using a standard form is another advantage. A well-designed document helps establish a uniform process for all payments, whether they are one-time or recurring. This consistency simplifies record-keeping and makes it easier to track payments over time, which is invaluable for accounting and financial management.

Efficiency is also a key reason to adopt such a system. Customizing the form to fit your needs allows for quicker processing, reducing the time spent manually creating records or verifying details. With an automated or pre-designed format, businesses can save valuable resources and avoid human errors in the financial documentation process.

Benefits of Customizing Your Payment Confirmation Form

Customizing your payment confirmation form can bring significant advantages, ensuring that the document fits your specific needs and enhances the efficiency of your financial processes. By adjusting the layout, fields, and content to reflect your business or personal preferences, you can create a more streamlined and professional record that meets all necessary requirements.

- Improved Efficiency: A customized form allows for quick data entry, reducing the time spent on manual adjustments. With pre-set fields for essential information, the form can be filled out faster, ensuring timely processing of transactions.

- Better Organization: Tailoring the document to include only the most relevant details for your business helps keep things organized. You can remove unnecessary fields and focus on the data that matters most for tracking payments and managing records.

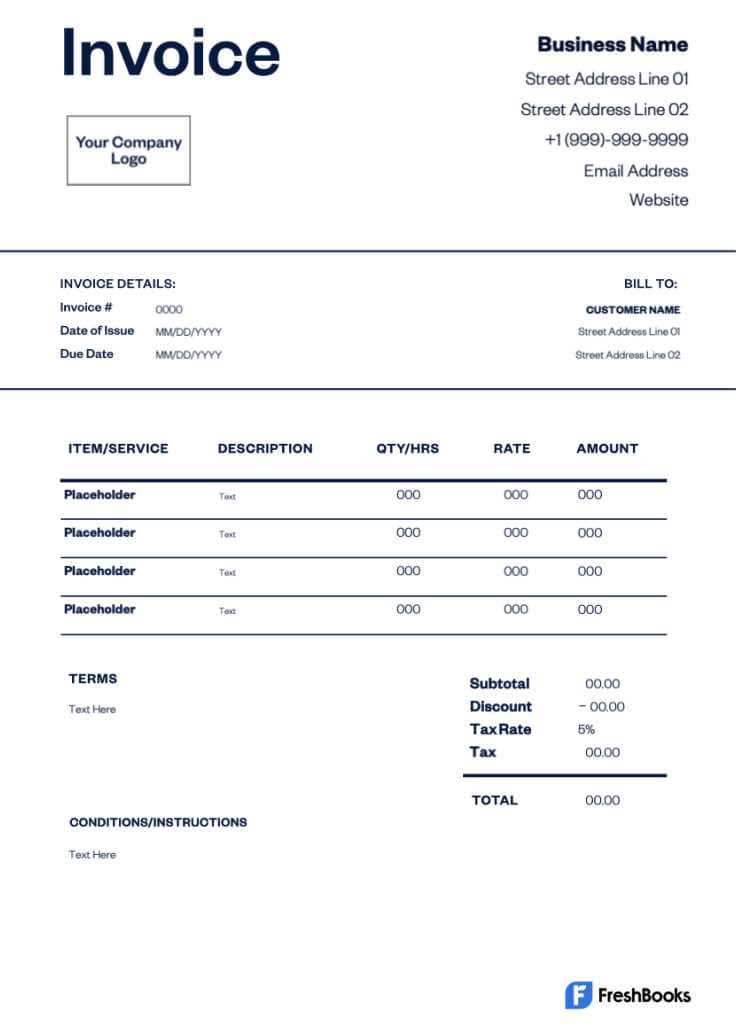

- Branding and Professionalism: Customizing the form to include your company logo, contact details, and branding elements helps maintain a consistent image across all communications. A professional, branded document can strengthen client trust and enhance your business’s credibility.

- Enhanced Accuracy: By defining the layout and content, you can ensure that all necessary information is included every time. Custom fields specific to your needs help reduce the likelihood of missing details or including irrelevant ones.

- Legal and Compliance Readiness: Customization ensures that the document includes all legally required information, such as tax identification numbers or payment terms, helping you stay compliant with financial regulations.

In summary, customizing your payment confirmation form not only saves time and reduces errors but also adds value by aligning the document with your specific business processes, improving both operational efficiency and customer satisfaction.

Essential Elements of a Payment Confirmation Document

A well-structured payment confirmation document includes several key elements that ensure both clarity and completeness. These components help to outline the details of the transaction, providing a clear record for both parties. Having all the necessary information included in a standardized format helps prevent errors, reduces misunderstandings, and ensures proper tracking of payments.

Key Information to Include

The most important elements to include in any payment confirmation are the basic details of the transaction. These typically cover:

- Payment Amount: Clearly specify the total amount being paid, including any applicable taxes or fees.

- Payment Date: Include the exact date the payment was made to ensure accurate record-keeping.

- Reference Number: A unique identifier for the transaction helps both parties track the payment, particularly in case of disputes or inquiries.

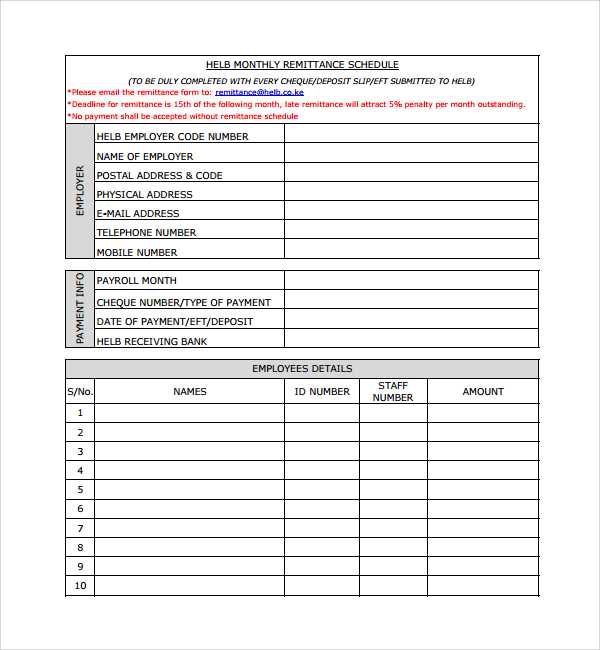

- Payer and Payee Information: Name, address, and contact details for both parties are essential for clarity and future reference.

Additional Features for Customization

While the basic elements are necessary, there are additional details that can enhance the document’s usefulness and relevance:

- Payment Method: Indicate how the payment was made (e.g., bank transfer, credit card, cheque), which helps in understanding the payment process.

- Itemized Breakdown: For larger or more complex transactions, listing the specific items or services being paid for can clarify the purpose of the payment.

- Terms and Conditions: Include any agreed-upon terms, such as payment deadlines or discounts, to ensure both parties are on the same page.

Including these essential elements in your payment confirmation document not only improves transparency but also streamlines financial record-keeping and communication.

How to Create a Payment Confirmation Document

Creating a payment confirmation document is a straightforward process that involves organizing the relevant details of a transaction into a clear, professional format. By following a simple structure and including all necessary information, you can ensure that both parties involved in the transaction have an accurate and easily accessible record of the payment.

Step-by-Step Process

Follow these basic steps to create an effective payment confirmation form:

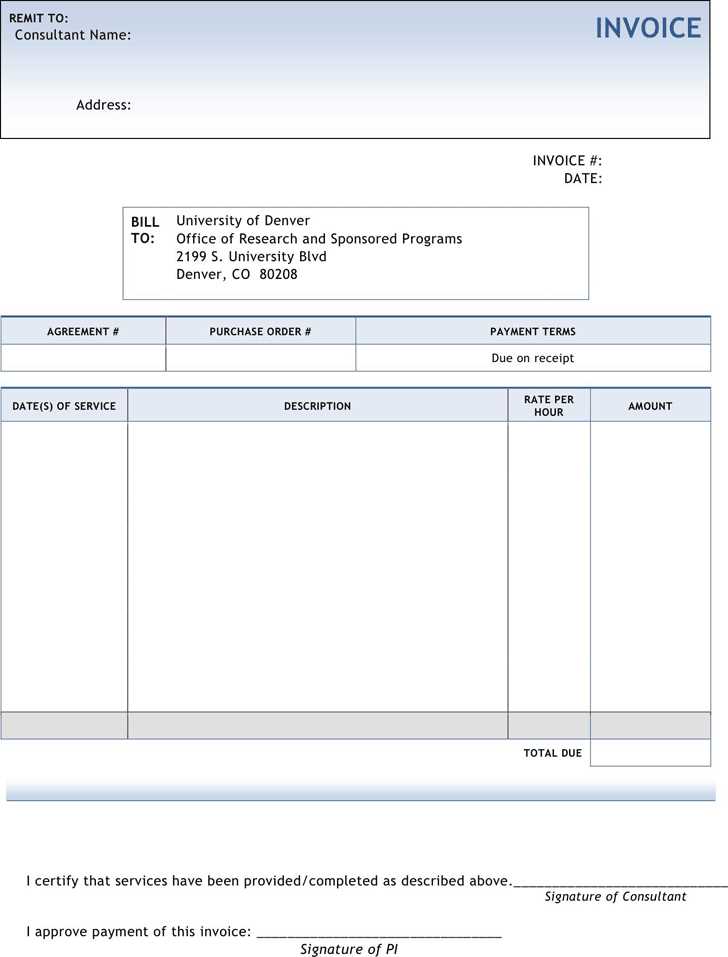

- Start with Header Information: Include the name and contact information of both the payer and the payee at the top of the document.

- Include Transaction Details: Specify the payment amount, the payment date, and the reference number that links the payment to a specific agreement or invoice.

- Provide Payment Method: Indicate how the payment was made, such as via bank transfer, credit card, or check.

- Finalize with Additional Information: If applicable, add itemized details of the goods or services paid for, along with any special terms or conditions.

Sample Layout

Here’s a simple example of how the document might look once it’s created:

| Field | Details | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Payer Information | John Doe, 123 Main St, [email protected] | ||||||||||||||||||||||||||||||||

| Payee Information | X

Top Tools for Designing Payment Confirmation FormsDesigning a professional and efficient payment confirmation form requires the right tools that can help streamline the process and ensure that all necessary information is included. The best tools offer customization options, ease of use, and flexibility, allowing you to create forms that suit your specific business needs. Whether you are looking to create a simple record or a more detailed document, choosing the right tool can save time and improve accuracy. Popular Design Tools for Payment RecordsHere are some of the top tools you can use to create customized payment confirmation forms:

|