Cash Invoice Template for Simple and Efficient Billing

In a busy business environment, maintaining a clear and efficient billing process is essential. When payments are managed smoothly, it not only saves time but also supports a more organized workflow, reducing potential misunderstandings with clients. By using a structured approach to billing, businesses can ensure transparency and improve client satisfaction.

Choosing the right format for billing can make the process significantly easier and help avoid common errors. Using a customizable document that fits the specific needs of your business allows for both consistency and flexibility. This organized approach provides a clear record of every transaction, making it easier to track and review when needed.

With a ready-to-use format, businesses of all sizes can simplify their accounting routines. This solution is especially valuable for those who manage frequent transactions, as it helps maintain accuracy and ensures all relevant details are ca

Cash Invoice Template Guide

Establishing an effective billing document is crucial for any business looking to streamline its financial processes. A well-structured billing document not only enhances clarity but also ensures that all necessary details are easily accessible for both the provider and the client. This guide will walk you through the essential components and benefits of utilizing a structured billing document.

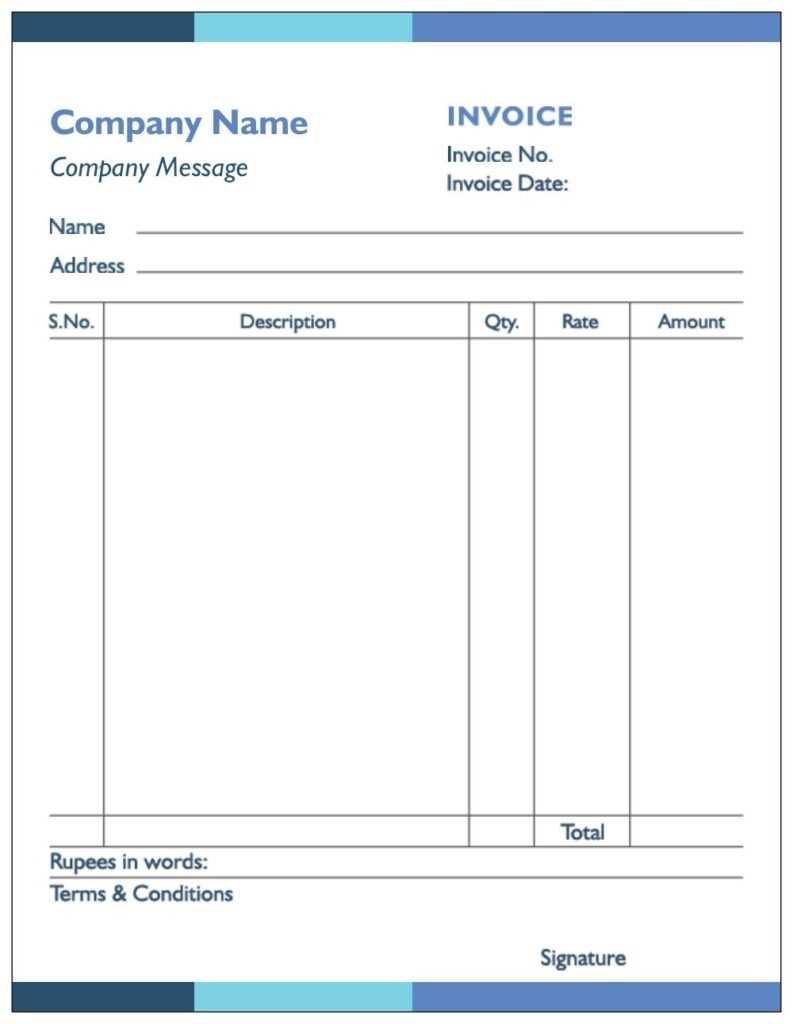

Key Components of a Billing Document

- Header Information: Include your business name, logo, and contact details.

- Recipient Information: Clearly state the client’s name and contact information.

- Date: Specify the date of the transaction or service rendered.

- Transaction Details: List the products or services provided, along with their respective prices.

- Payment Terms: Outline the payment methods accepted and any due dates.

- Total Amount Due: Clearly indicate the total sum that needs to be paid.

Benefits of Using a Structured Document

- Increases professionalism and credibility in your business dealings.

- Simplifies the tracking and management of payments.

- Reduces the likelihood of errors and misunderstandings.

- Enhances client satisfaction by providing clear and concise information.

- Facilitates quicker payment processing and cash flow management.

By incorporating these essential elements and understanding the advantages, businesses can create effective billing documents that enhance operational efficiency and foster positive relationships with clients.

Understanding the Importance of Cash Invoices

Having a clear and efficient billing document is fundamental for any business engaged in financial transactions. It serves as a formal record of goods or services exchanged, providing both the seller and the buyer with a transparent account of the transaction. This clarity fosters trust and can significantly enhance customer relations, ensuring that both parties are on the same page regarding payment expectations.

Benefits of Accurate Billing Documents

Utilizing a well-structured billing document offers numerous advantages, including:

- Record Keeping: It creates a reliable record for future reference, making it easier to track sales and payments.

- Improved Cash Flow: Clear documentation aids in timely payments, which is essential for maintaining healthy cash flow.

- Professionalism: A formalized approach reflects positively on your business image, enhancing credibility.

Impact on Business Operations

The effectiveness of a billing document directly influences overall business operations. By ensuring that all necessary details are included and communicated clearly, businesses can reduce disputes and enhance operational efficiency. A streamlined billing process minimizes confusion, allowing both businesses and clients to focus on building productive relationships rather than resolving misunderstandings.

Key Elements of a Cash Invoice

Creating a comprehensive billing document requires attention to detail and the inclusion of essential components that facilitate clear communication between the seller and the buyer. These elements not only ensure accuracy but also enhance the overall professionalism of the transaction. Understanding these key components is vital for effective financial management.

Essential Components of a Billing Document

- Business Information: Clearly display the name, logo, and contact details of your business at the top of the document.

- Client Information: Include the recipient’s name and contact details to ensure proper identification.

- Date of Transaction: Clearly indicate the date when the goods or services were provided.

- Description of Goods/Services: List the items sold or services rendered, along with brief descriptions and quantities.

- Unit Prices: Provide the cost of each item or service to enhance transparency.

- Total Amount Due: Clearly state the total cost, including any applicable taxes or fees.

- Payment Terms: Specify accepted payment methods and any deadlines for payment.

Enhancing Clarity and Professionalism

Including these key components in your billing document not only promotes clarity but also establishes trust with clients. A well-structured document reflects professionalism and helps avoid misunderstandings, ensuring that both parties are aligned regarding the details of the transaction.

How to Use Cash Invoice Templates

Utilizing a structured billing document can significantly enhance your efficiency in managing financial transactions. These documents provide a standardized format that simplifies the process of recording sales and payments. Knowing how to effectively use such documents can help streamline your operations and reduce the likelihood of errors.

Steps to Effectively Utilize Billing Documents

Follow these straightforward steps to make the most out of your billing documents:

- Select a Suitable Format: Choose a layout that fits your business needs and is easy to customize.

- Input Accurate Information: Fill in all relevant details, ensuring that business and client information is correct.

- Detail the Transaction: Clearly describe the products or services provided, including quantities and prices.

- Specify Payment Terms: Outline the accepted payment methods and any deadlines to avoid confusion.

- Review for Accuracy: Double-check all entries for correctness before sending the document to the client.

Benefits of Using Standardized Formats

Adopting a consistent approach when utilizing these billing documents can greatly enhance your professional image. It not only streamlines your workflow but also fosters trust with clients by ensuring clarity and reliability in your financial transactions.

Choosing the Right Format for Invoices

Selecting an appropriate layout for your billing documents is essential for ensuring clarity and effectiveness in your financial transactions. The right format not only enhances the professionalism of your documents but also makes it easier for clients to understand the details of their purchases. It is important to consider factors such as usability, customization, and the specific needs of your business when choosing a layout.

Various formats are available, ranging from simple and straightforward designs to more complex, visually appealing templates. A clear and organized structure will facilitate efficient communication between you and your clients, minimizing the risk of misunderstandings. Additionally, consider whether you prefer digital or printed documents, as this will influence your choice of format. Ultimately, the right choice will reflect your brand’s identity while ensuring all necessary information is presented clearly and professionally.

Benefits of Customizable Invoice Templates

Utilizing adaptable billing documents offers numerous advantages for businesses seeking to enhance their financial processes. The ability to modify these documents ensures that they can be tailored to meet specific needs, reflecting the unique branding and operational requirements of a business. This customization promotes a professional image while improving overall efficiency in transaction management.

Enhancing Professionalism and Brand Identity

One significant benefit of customizable billing documents is the opportunity to reinforce your brand identity. By incorporating your logo, color scheme, and unique formatting, you create a cohesive presentation that distinguishes your business from competitors. This attention to detail fosters trust and recognition among clients, encouraging loyalty and repeat business.

Improving Efficiency and Accuracy

Customizable documents also enhance efficiency by allowing you to include only the necessary information relevant to each transaction. This targeted approach minimizes clutter, making it easier for clients to understand the details of their purchases. Moreover, the flexibility to adjust formats means that you can quickly adapt to changes in business operations or client requirements, ensuring that your documentation remains current and effective.

Creating a Professional Invoice Layout

Designing a polished and coherent billing document is crucial for effective communication in financial transactions. A well-structured layout not only enhances the clarity of information but also reflects the professionalism of your business. By focusing on key design elements, you can create a document that is both visually appealing and functional, ensuring that all necessary details are easily accessible to clients.

Essential Design Elements

When crafting a professional layout, consider the following components:

- Consistent Branding: Incorporate your business logo and color scheme to create a unified look.

- Clear Sections: Organize the document into distinct sections, such as contact information, transaction details, and payment terms, to facilitate easy navigation.

- Readable Fonts: Choose fonts that are easy to read, maintaining a balance between professionalism and style.

- Whitespace Utilization: Use whitespace effectively to avoid clutter and enhance the overall readability of the document.

Finalizing Your Layout

Once you have established the primary elements of your billing document, review it for coherence and accuracy. Ensure that all necessary information is included and that the layout promotes a seamless reading experience. A professional-looking document not only instills confidence in clients but also contributes to a positive impression of your brand.

Essential Information for Cash Transactions

Accurate documentation is critical for ensuring smooth financial exchanges. When dealing with transactions, it is vital to include key details that facilitate clarity and accountability. This information not only helps in maintaining accurate records but also protects both parties involved in the transaction.

Key Details to Include

| Information Type | Description |

|---|---|

| Date | The date on which the transaction occurs, essential for record-keeping and tracking purposes. |

| Transaction Amount | The total sum exchanged during the transaction, clearly stated to avoid discrepancies. |

| Recipient Details | Contact information of the individual or entity receiving the payment, ensuring proper identification. |

| Payment Method | The means by which the transaction is completed, whether by cash, card, or other methods. |

| Description of Goods/Services | A brief outline of the items or services exchanged, providing context for the transaction. |

Importance of Accurate Documentation

Including these essential details in your transaction records fosters transparency and trust between parties. It also serves as a reference for any future inquiries or disputes, ensuring that both parties have a clear understanding of the agreement. Maintaining thorough records ultimately contributes to better financial management and accountability.

Saving Time with Ready-to-Use Templates

Utilizing pre-designed documents can significantly streamline the process of creating financial records. These readily available formats not only reduce the time spent on design but also ensure that all necessary elements are included consistently. By adopting such solutions, businesses can focus on their core operations while maintaining professionalism in their documentation.

Advantages of Pre-Made Formats

- Quick Setup: Immediate access to established designs allows for swift customization and use.

- Consistency: Ensures uniformity in documentation, enhancing the brand image and professionalism.

- Reduced Errors: Pre-designed structures minimize the risk of missing essential components or making mistakes.

- Time Efficiency: Saves time that can be redirected towards other important business activities.

Choosing the Right Format

When selecting a pre-designed document, consider factors such as compatibility with your existing systems, ease of customization, and the ability to meet your specific needs. By investing time in finding the right format, you can enhance efficiency and maintain high standards in your financial records.

Tips for Accurate and Clear Invoicing

Ensuring precision and clarity in financial documentation is essential for effective communication with clients. Properly structured records not only reflect professionalism but also facilitate timely payments. Implementing a few best practices can significantly enhance the quality of your financial statements.

Key Practices for Clarity

- Use Clear Language: Avoid jargon and complicated terms to ensure that all clients understand the details.

- Organize Information: Structure the document logically, grouping similar information together for easy reference.

- Include All Necessary Details: Ensure all relevant information, such as dates, amounts, and descriptions, is clearly stated.

Essential Elements to Include

| Element | Description |

|---|---|

| Contact Information | Include details of both parties for easy communication. |

| Unique Reference Number | Assign a specific identifier to each record for tracking purposes. |

| Date of Transaction | Clearly state when the service was rendered or goods were delivered. |

| Payment Terms | Outline the terms for payment, including due dates and methods. |

Best Practices for Small Business Invoices

Creating effective financial documents is crucial for small enterprises to maintain professionalism and ensure timely payments. Adopting certain best practices can streamline the billing process, reduce errors, and enhance client relationships. By implementing these strategies, small business owners can foster transparency and improve their cash flow management.

It is essential to establish a consistent format for all financial records, which not only aids in clarity but also reinforces brand identity. Including all necessary details such as services rendered, payment terms, and contact information ensures that clients have all the information they need to process payments promptly. Additionally, following up on outstanding payments with polite reminders can help maintain healthy financial practices and encourage prompt settlements.

Ensuring Compliance in Cash Invoicing

Maintaining adherence to regulatory standards in financial documentation is vital for businesses to avoid penalties and ensure smooth operations. Compliance involves understanding and implementing various legal requirements that govern financial transactions. By focusing on key areas, companies can safeguard themselves and enhance their credibility in the marketplace.

It’s essential to keep detailed records that align with local laws and industry standards. Regular audits and reviews of financial practices can help identify areas needing improvement. Below is a table outlining critical compliance aspects that businesses should monitor:

| Compliance Aspect | Description | Best Practice |

|---|---|---|

| Tax Regulations | Understanding applicable tax laws and obligations. | Regularly consult with a tax professional. |

| Record Keeping | Maintaining accurate and complete financial records. | Implement a reliable record-keeping system. |

| Client Information | Ensuring client data is protected and used appropriately. | Adopt data protection policies and practices. |

| Transaction Documentation | Providing clear and comprehensive details for each transaction. | Use standardized forms to capture all required information. |

Automating Invoice Processes with Templates

Streamlining financial documentation is essential for enhancing efficiency and reducing human error in business operations. Automation tools allow for the standardization of procedures, which leads to quicker processing times and improved accuracy. By utilizing pre-designed formats, organizations can simplify the creation and management of essential financial records, ensuring consistency across all transactions.

Benefits of Automation

Implementing automated solutions brings several advantages, including:

- Time Savings: Automated systems reduce the time spent on manual data entry and calculations.

- Increased Accuracy: Minimizing human intervention leads to fewer mistakes and discrepancies.

- Consistency: Standard formats ensure that all documents meet organizational and regulatory standards.

- Enhanced Tracking: Digital records are easier to track, retrieve, and analyze for financial insights.

Implementing Automated Solutions

To effectively automate financial documentation processes, businesses should consider the following steps:

- Choose software that aligns with the specific needs of the organization.

- Train staff on how to utilize the automation tools efficiently.

- Regularly review and update automation processes to adapt to changing business needs.

- Ensure data security measures are in place to protect sensitive financial information.