Download Free Invoice Template for Effortless Billing

Managing your finances and ensuring smooth transactions with clients requires clear and accurate billing records. Whether you’re a freelancer, small business owner, or contractor, having a standardized format for your financial documents is essential. It not only helps you stay organized but also presents a professional image to your clients. Creating these documents from scratch can be time-consuming, but luckily, there are ready-made solutions that simplify the process.

Ready-made billing solutions offer customizable formats that you can easily fill in with your information. By using these pre-designed files, you save valuable time and reduce the risk of making errors. These tools allow you to quickly generate clear, concise records that can be shared with clients or used for accounting purposes. They are designed to fit a variety of business needs, so you can find an option that best suits your workflow.

With so many accessible resources available today, there’s no need to start from zero when it comes to creating financial documents. In the following sections, we’ll explore how you can make the most of these options to enhance your billing process, increase efficiency, and ensure a hassle-free experience for both you and your clients.

Invoice Template Download for Beginners

For those just starting their business or freelance career, creating professional billing records can feel overwhelming. Many newcomers struggle with formatting and structuring financial documents correctly, which can lead to mistakes or missed opportunities for clarity. Fortunately, using pre-designed, customizable formats can simplify the process and ensure your documents look polished every time.

These ready-made formats are perfect for beginners as they offer a straightforward solution to creating consistent, clear, and error-free records. Whether you’re invoicing clients for the first time or trying to organize your financial paperwork, these resources can save you significant time and effort. Here’s how to get started:

- Choose a suitable format: Look for a pre-made design that fits your business needs. Many options are tailored for specific industries, such as consulting, design, or construction, and feature all necessary fields to capture key information.

- Customize fields: Adapt the document to include your business details, client information, and the services or products you’ve provided. Simple adjustments ensure the document reflects your specific transaction.

- Fill in accurate details: Input accurate pricing, dates, and payment terms. Accuracy is critical for maintaining professionalism and ensuring smooth payment processing.

- Save and reuse: Once customized, save the document on your computer or cloud storage, and reuse it for future transactions. With one simple adjustment, you can create new records whenever needed.

Using ready-made formats removes the guesswork from the process, allowing you to focus on your work while ensuring your financial documentation remains neat and professional. For beginners, this can be a game-changer in managing their business operations effectively.

Why You Need an Invoice Template

Having a structured and consistent way to document transactions with clients is essential for any business. Properly formatted billing records ensure that your financial dealings are clear, professional, and easy to understand. Without a standardized approach, you risk confusion, delayed payments, or even missed business opportunities. A well-designed document helps you communicate the necessary details, such as services rendered, payment terms, and contact information, in an organized manner.

By using pre-designed billing formats, you save time and avoid errors that can arise from creating documents from scratch. These tools offer a consistent layout that is easy to fill in with transaction details, ensuring you never forget important information. Additionally, they help establish a professional image, signaling to clients that you are organized and trustworthy.

Beyond professionalism, clear financial records make it easier to track your business income and manage taxes. Having accurate documentation for each transaction simplifies accounting, audits, and reporting. This streamlined approach not only helps you stay organized but also ensures that your clients are on the same page, fostering stronger, more transparent business relationships.

Choosing the Right Invoice Format

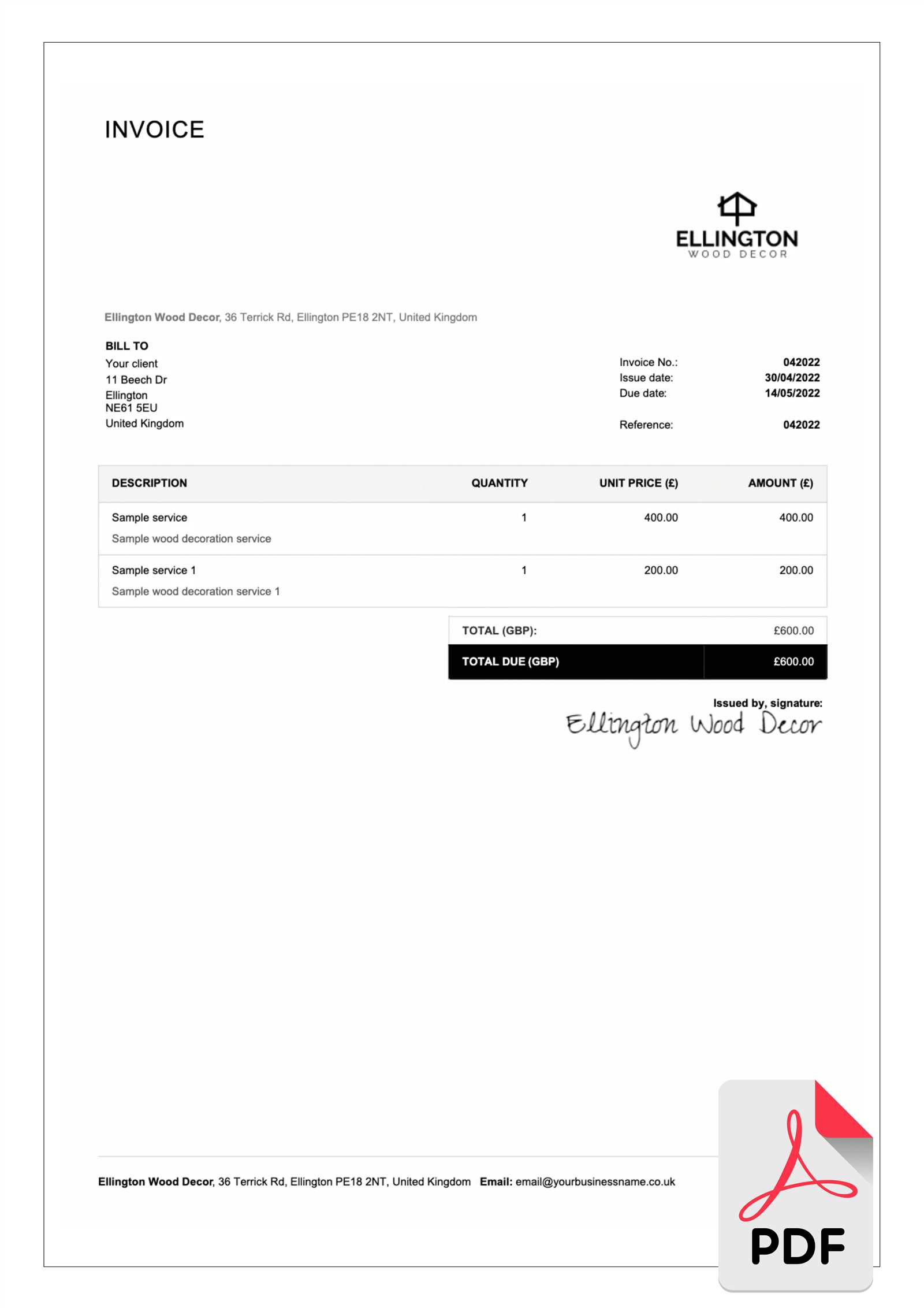

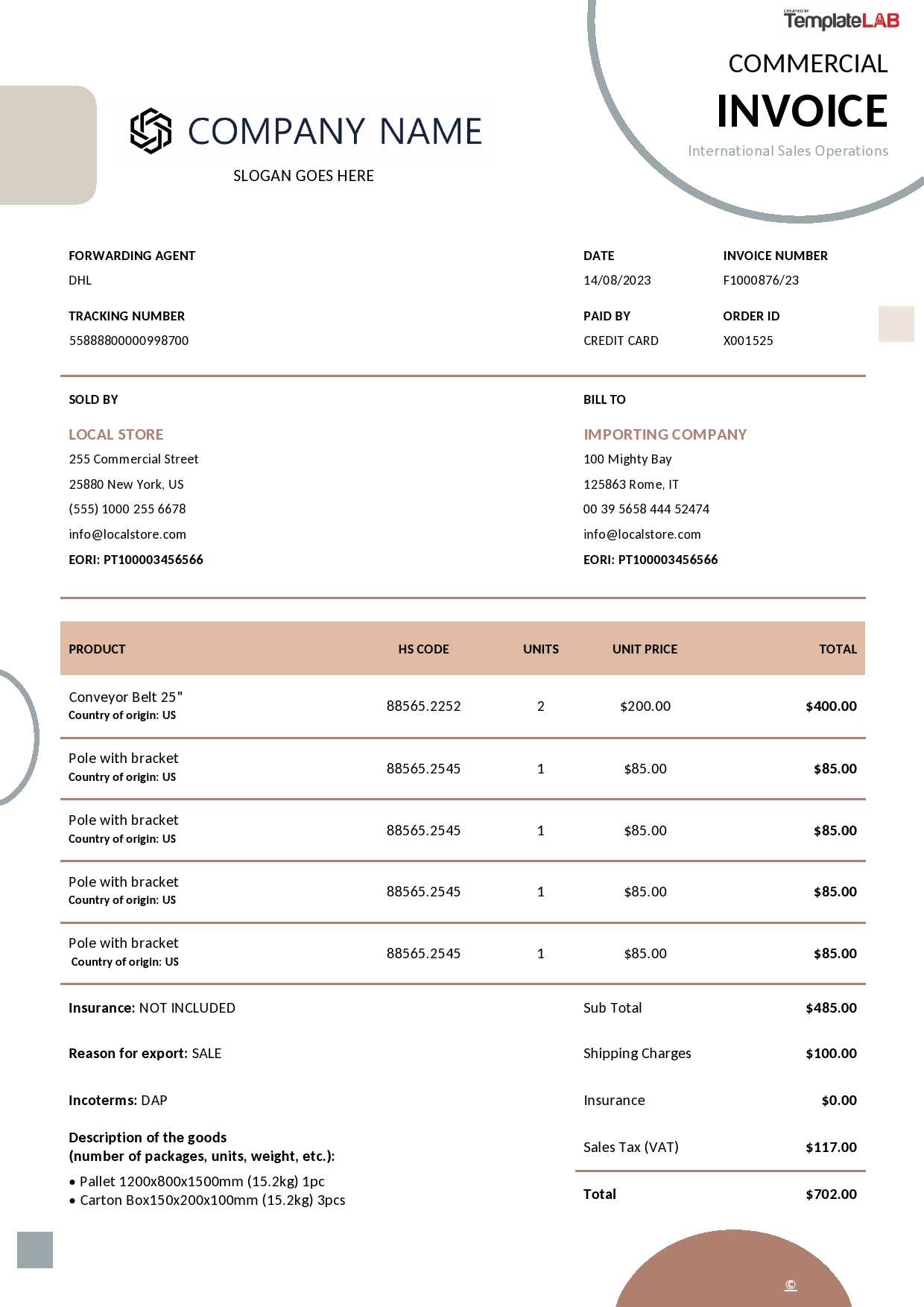

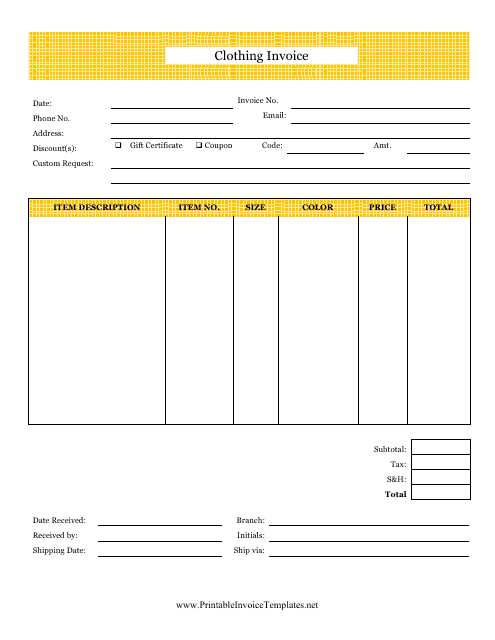

Selecting the right document layout is crucial for creating clear, professional records that suit the needs of your business. The format you choose should not only reflect the type of work you do but also ensure that all necessary details are presented in a straightforward manner. An effective design can streamline communication with clients, making transactions smoother and ensuring that all required information is included.

There are several factors to consider when choosing a format for your financial documents. These include the nature of your business, the type of services you provide, and the preferences of your clients. Below is a simple guide to help you decide on the best layout:

| Business Type | Recommended Format |

|---|---|

| Freelancers (e.g., designers, writers) | Simple and clean design with space for hourly rates and project details |

| Service Providers (e.g., plumbers, electricians) | Detailed layout with sections for labor costs, materials, and service description |

| Product-Based Businesses | Table-based layout for itemized product listing, quantity, and price per unit |

| Consultants | Professional, structured layout with clear breakdowns for consultation hours and rates |

Choosing the appropriate layout ensures that your clients receive all the relevant details they need in a clear, digestible format. It also helps you avoid confusion over pricing, terms, or services, which can lead to delayed payments or disputes. By tailoring your document design to your business type, you present a polished, organized appearance that reflects well on your professionalism.

How to Customize Your Invoice Template

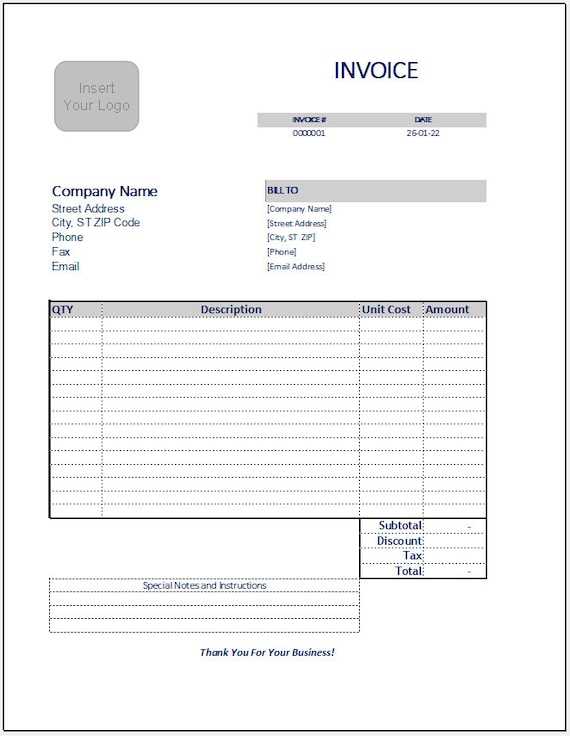

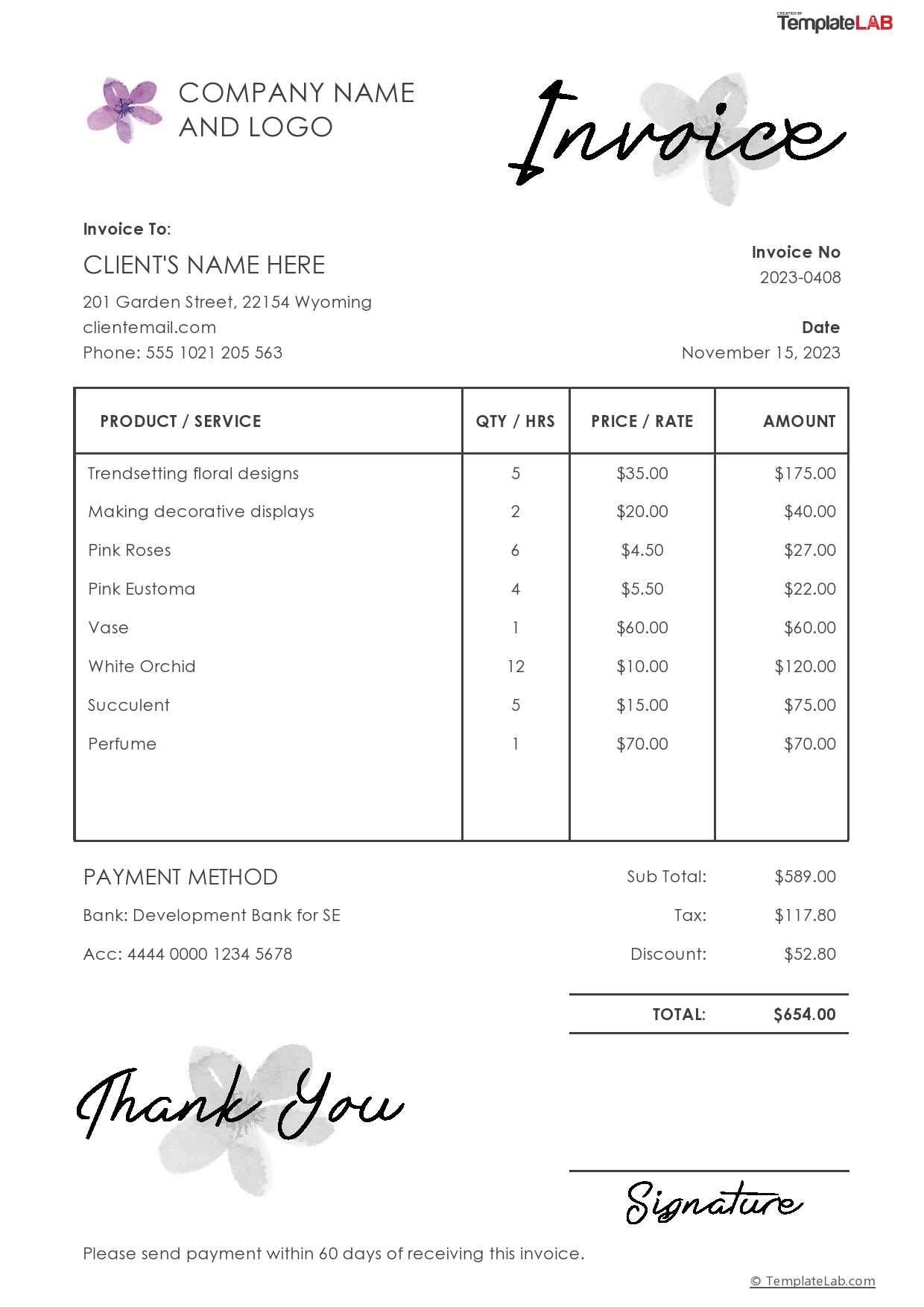

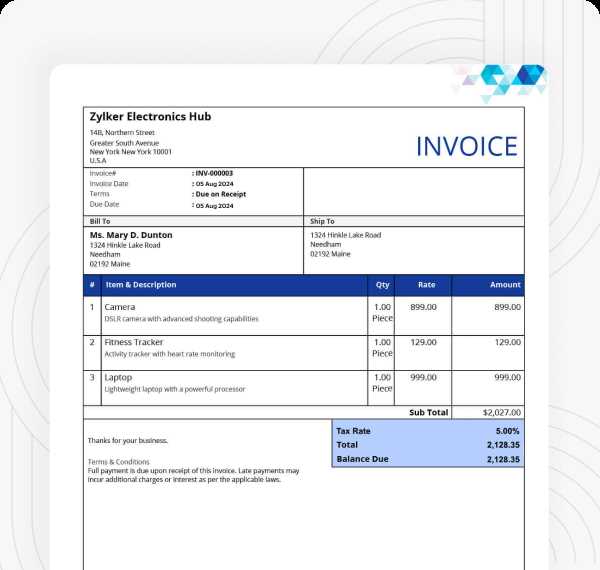

Once you have chosen a suitable layout for your billing records, it’s time to personalize it to reflect your business. Customization ensures that your financial documents accurately represent your services, your branding, and your specific transaction details. Whether you’re a freelancer or a small business owner, tailoring your format makes your paperwork more professional and aligned with your unique needs.

Here are some key areas to focus on when modifying your document:

- Business Information: Add your company name, address, contact details, and logo at the top of the page. This makes your document look professional and ensures that clients can easily reach you if needed.

- Client Details: Include your client’s name, address, and contact information. This helps avoid confusion and ensures the document is correctly associated with the right party.

- Payment Terms: Clearly outline payment methods, due dates, and any late fees or discounts. Customizing these terms makes sure that both you and the client are on the same page regarding financial expectations.

- Itemized Breakdown: List all services or products provided, along with their corresponding rates. Make sure the format is clean and easy to read, using tables if necessary to organize information clearly.

- Branding: Integrate your brand’s colors and fonts into the design to create a cohesive, professional look. This adds a touch of personality and reinforces your brand identity.

By modifying the basic layout to fit your specific business model, you ensure that each document you send is not only functional but also a reflection of your brand’s professionalism. Customization gives you full control over how your billing records are presented, making them more aligned with your operations and more easily understood by your clients.

Free vs Premium Invoice Templates

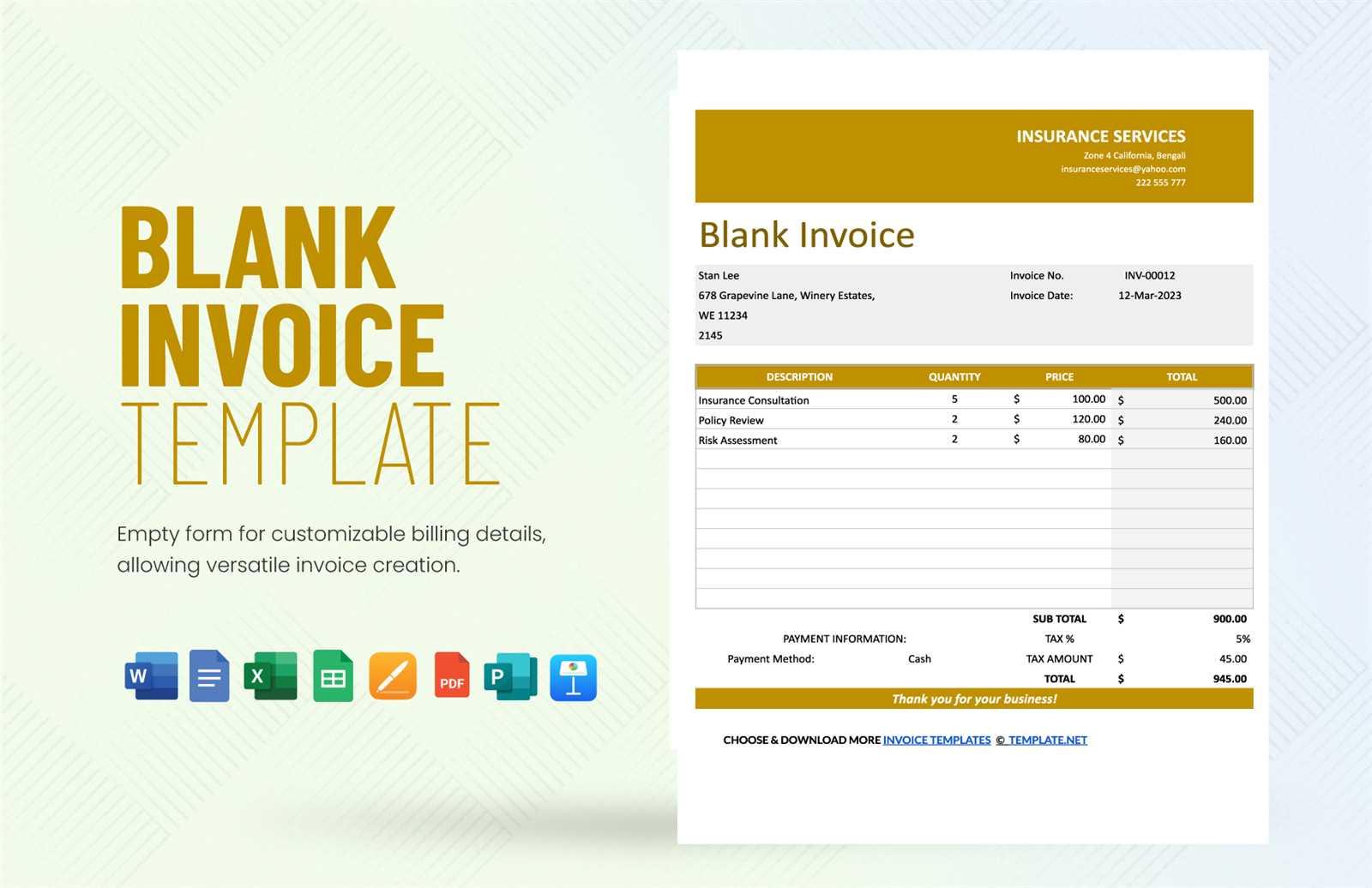

When choosing a document layout for managing business transactions, individuals often face the decision of whether to go with a free or a paid version. While both options offer functional designs, the distinction lies in the level of customization, features, and overall professionalism. Understanding the differences can help make an informed choice that aligns with specific business needs.

Benefits of Free Options

Free designs are readily available and suitable for those who need a basic structure without any advanced features. These formats often come with minimalistic designs that can be sufficient for small businesses or casual users. They provide an accessible starting point, allowing quick use with no upfront cost. However, they may lack advanced customization options or sophisticated layouts.

Advantages of Paid Alternatives

Premium solutions, on the other hand, offer greater flexibility and more polished, professional-looking results. These often come with additional tools, such as automated calculations or integrated branding options, that make them more suitable for established companies or those looking for high-quality presentation. The investment in a premium option typically provides a more seamless and efficient experience, with more frequent updates and customer support.

In summary, the choice between free and premium options depends on the specific needs of your business. While the free versions can be a good starting point, paid solutions generally provide more robust features that help streamline processes and enhance overall appearance.

Common Mistakes in Invoice Creation

Creating financial documents can sometimes lead to errors that complicate transactions and cause confusion. These mistakes often result from a lack of attention to detail or misunderstanding key requirements. By recognizing and avoiding common pitfalls, businesses can ensure a smoother process and avoid potential disputes with clients or partners.

Frequent Errors to Avoid

- Incorrect or Missing Contact Information: Failing to include accurate details, such as business name, address, and contact numbers, can lead to delays in payment or communication issues.

- Unclear Item Descriptions: Vague or unclear descriptions of products or services provided can result in misunderstandings. It’s crucial to list all details clearly.

- Omitting Payment Terms: Not specifying when the payment is due or what methods are acceptable can lead to confusion and delayed payments.

- Wrong Calculation of Totals: Simple arithmetic mistakes or overlooking applicable taxes can lead to incorrect amounts being requested.

- Failure to Include an Invoice Number: Without a unique identifier, tracking payments and managing records becomes difficult.

How to Avoid These Issues

- Double-Check Information: Always review the document before sending it to ensure that all details are accurate and complete.

- Use Clear Language: Ensure that every item or service is listed with a clear description and the correct price.

- Include Payment Instructions: Make sure your terms and conditions are visible and explicit, including the due date and acceptable payment methods.

- Use

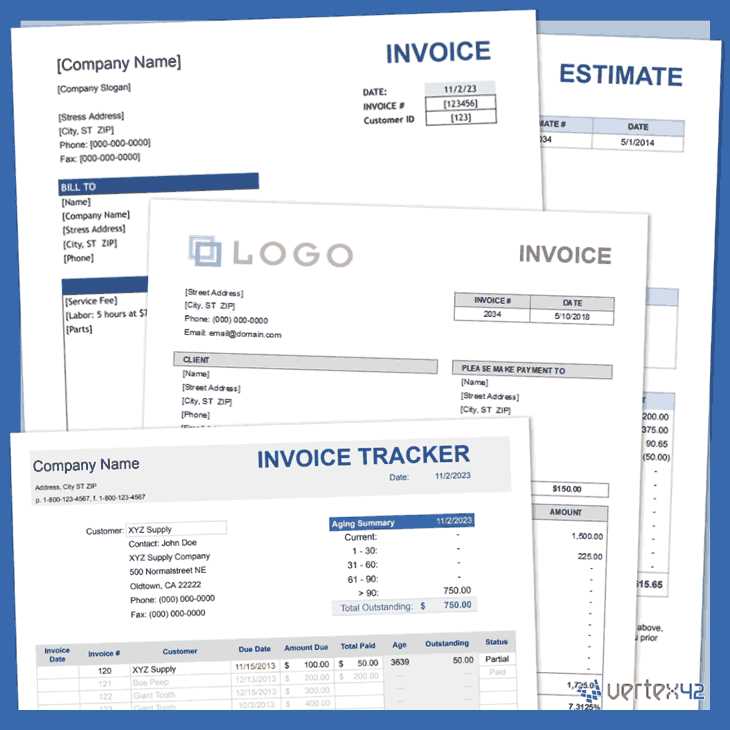

Best Invoice Template Tools to Use

When managing business transactions, having the right tools can streamline the process and save valuable time. Whether you’re looking for a simple design or a comprehensive solution that integrates with your accounting software, various tools are available to help create professional and accurate financial documents. These tools can provide you with the flexibility to customize your records, automate calculations, and maintain consistent branding across all communications.

Top Tools for Quick and Easy Creation

For those seeking a fast and straightforward solution, the following tools offer user-friendly interfaces and pre-designed structures:

- Canva: Known for its design flexibility, Canva provides numerous customizable options for creating visually appealing documents. It offers both free and paid features to meet different business needs.

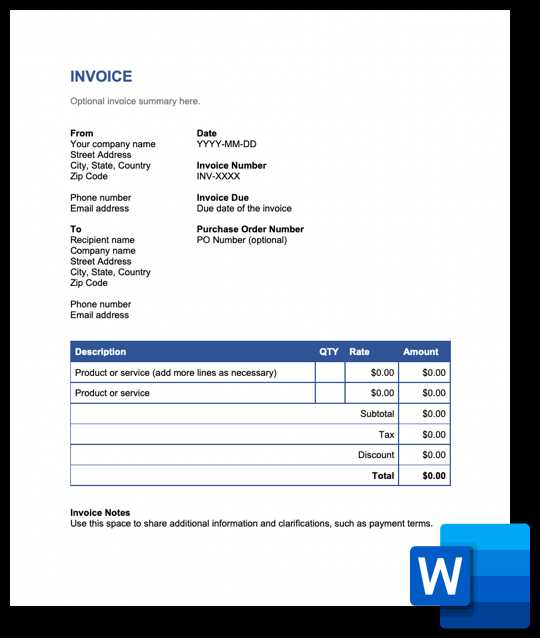

- Microsoft Word: A classic tool that comes with basic templates suitable for various industries. Easy to use, with the ability to add custom branding and details.

- Google Docs: A free alternative with collaborative features. It allows multiple users to edit the same document simultaneously, making it a great option for teams.

Advanced Tools for Integration and Automation

For businesses looking to integrate document creation with other software or automate key processes, the following options provide more advanced features:

- QuickBooks: This comprehensive accounting software allows you to generate professional documents automatically, link them with your financial data, and track payments easily.

- FreshBooks: A cloud-based solution designed for small businesses, offering customizable designs, automated billing, and integrated reporting features.

- Zoho Invoice: A highly rated tool with extensive automation capabilities, including recurring billing, automated reminders, and multiple payment gateway integrations.

These tools cater to different busines

How to Organize Your Invoices

Properly managing your financial records is essential for maintaining a clear overview of your business transactions. Effective organization helps ensure that payments are tracked efficiently, documents are easy to find when needed, and your business remains compliant with tax regulations. A well-structured approach can save time and reduce the risk of errors or missed payments.

Steps to Stay Organized

- Create a Filing System: Whether digital or physical, setting up a clear system for storing your documents is crucial. Use folders or cloud storage platforms with descriptive names for easy retrieval.

- Sort by Date: Organizing documents chronologically allows for quick access to recent transactions and makes it easier to track outstanding payments.

- Use Unique Identifiers: Assign a unique number or code to each document to help identify and track them. This will be especially useful when handling large volumes of records.

- Keep Records by Client or Project: Group documents by customer or project to easily manage and reference past transactions, helping with future billing and audits.

Digital Organization Tools

- Accounting Software: Tools like QuickBooks, FreshBooks, or Zoho Invoice offer integrated systems for organizing, tracking, and storing financial documents in one place.

- Cloud Storage Solutions: Platforms like Google Drive, Dropbox, or OneDrive provide secure and accessible storage for digital files, enabling easy sharing and collaboration with team members or clients.

- Document Management Systems: Specialized software like Evernote or Zoho Docs can help you organize and categorize your records with enhanced search functionality, making it simple to locate any document when needed.

By setting up a

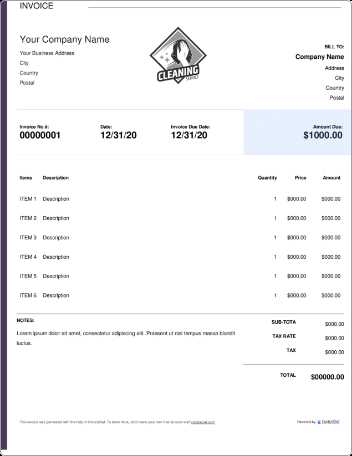

Printable Invoice Templates for Businesses

For many businesses, having the ability to print financial documents quickly and professionally is essential. These documents not only serve as formal records but also play a key role in ensuring timely payments and clear communication with clients. Printable options provide businesses with the flexibility to produce hard copies as needed while maintaining consistency in design and content.

Benefits of Printable Formats

- Physical Documentation: A printed record can be handed over in person or sent via postal mail, providing clients with a tangible copy for their records.

- Easy Customization: Many printable solutions allow for customization, from adding business logos to adjusting layout elements, ensuring each document reflects the company’s branding.

- Professional Appearance: A well-structured, printed document adds an extra level of professionalism that can enhance client trust and satisfaction.

Where to Find Printable Options

- Online Platforms: Websites like Canva, Microsoft Word, or Google Docs offer pre-designed formats that can be customized and printed easily. They allow for immediate editing and printing from any device.

- Accounting Software: Many accounting programs, such as QuickBooks or FreshBooks, include the option to generate printable versions directly from your digital records, streamlining the entire process.

- Design Software: For businesses seeking highly customized or unique designs, tools like Adobe InDesign or Illustrator offer full creative control over the format and layout of printed documents.

By choosing the right tools, businesses can ensure their financial documents not only meet legal and operational requirements but also align with t

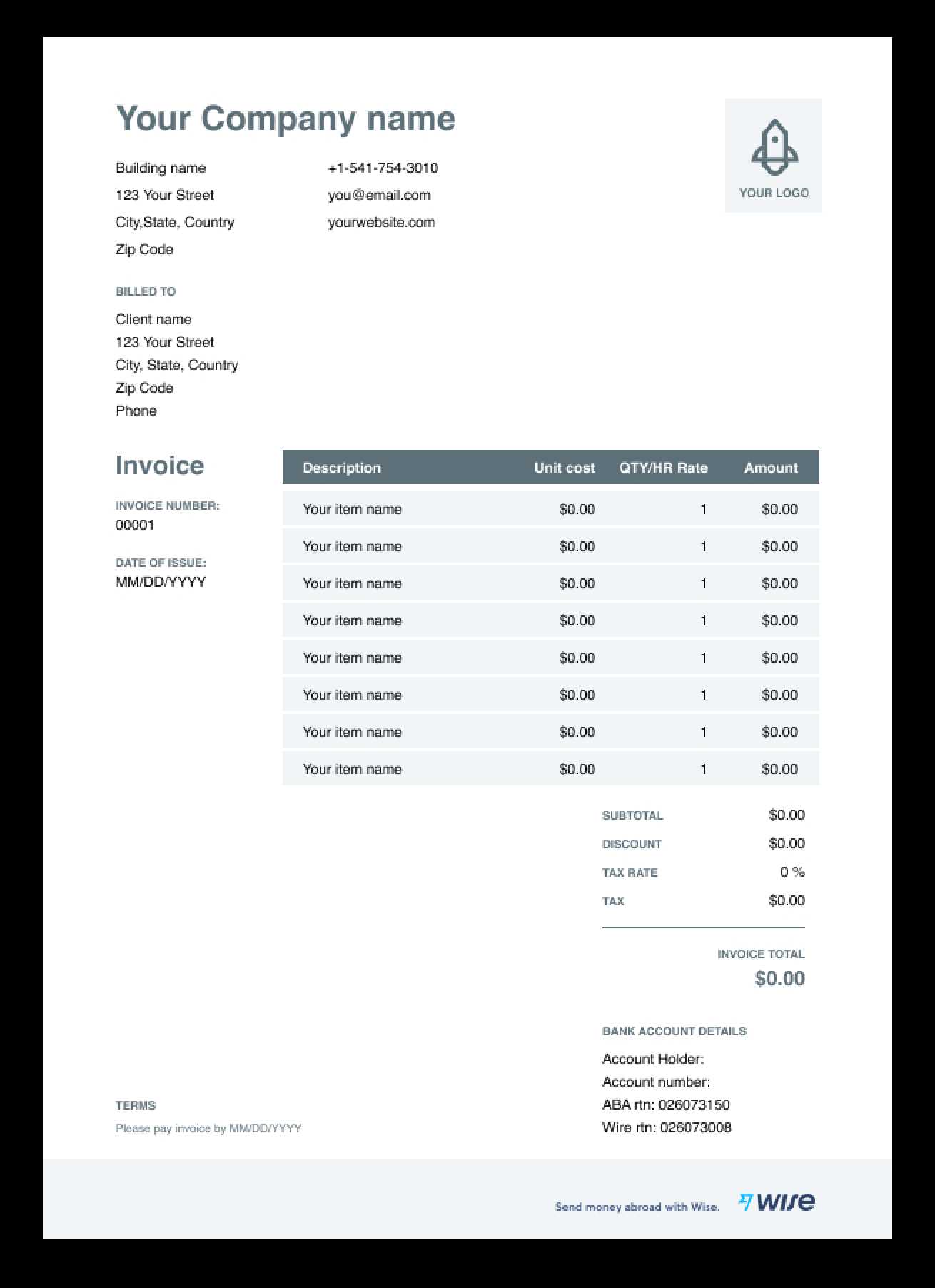

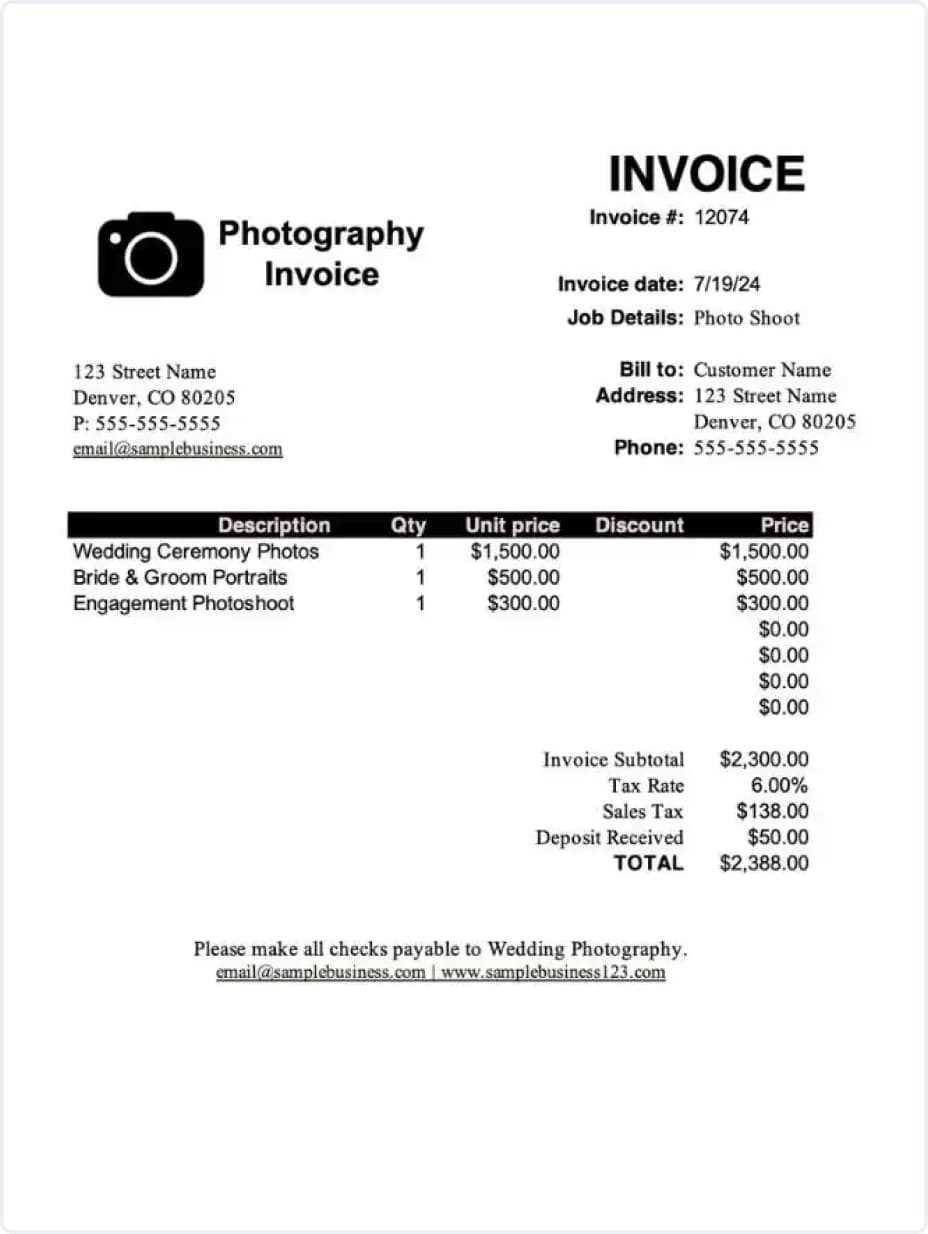

Invoice Templates for Freelancers and Contractors

Freelancers and contractors often face unique challenges when it comes to billing clients. Unlike traditional employees, they are responsible for managing their own financial records, ensuring they maintain a professional image while also keeping track of various projects and payments. A well-structured billing document can help streamline this process, making it easier to keep records clear, professional, and efficient.

Why Freelancers Need a Solid Billing Structure

- Consistent Cash Flow: By using clear and professional documents, freelancers can ensure timely payments and reduce delays caused by unclear terms or formats.

- Record Keeping: A structured document helps track the work completed, payment status, and any additional costs or adjustments for each project.

- Professional Image: Having a polished, standardized format can help build trust with clients, showing that the freelancer operates with the same level of professionalism as larger businesses.

Essential Features for Freelance Billing Documents

- Clear Contact Information: Including both your details and those of the client ensures there’s no confusion about who is responsible for payment.

- Detailed Breakdown of Services: Clearly itemizing each task or service rendered makes it easy for clients to understand what they’re paying for.

- Payment Terms: Make sure to include when the payment is due, preferred methods, and any late fees

How to Save Time with Templates

For businesses and freelancers, managing administrative tasks efficiently is key to maintaining focus on core activities. Utilizing pre-designed structures for financial records can significantly reduce the time spent on creating documents from scratch. These ready-to-use options allow you to quickly input necessary details and instantly generate professional documents, streamlining the entire billing process.

Key Time-Saving Benefits

- Consistency: By using the same format every time, you avoid the need to manually recreate layouts or worry about inconsistent designs, making the process faster and more reliable.

- Quick Customization: Pre-built structures can be easily adapted to fit different clients, projects, or services, saving you the effort of reformatting each time.

- Automation: Many tools offer automatic calculations, such as tax or totals, which speeds up the document creation process and reduces the risk of human error.

How to Make the Most of Pre-designed Options

- Choose the Right Tool: Select a tool that fits your business needs, whether it’s simple customization or advanced automation features.

- Store Frequently Used Data: Keep client details, pricing, and terms saved within your chosen platform to reduce repetitive data entry.

- Review and Finalize Quickly: Templates allow you to quickly review, edit, and send documents without starting from scratch, ensuring faster response times and fewer delays.

By integrating these pre-made solutions into your workflow, you’ll save valuable time while maintaining a professional and efficient billing process.

Ensuring Accuracy in Your Invoices

Maintaining precision in your financial records is essential for fostering trust with clients and avoiding delays in payment. Errors in the details of these documents can lead to confusion, disputes, and a loss of credibility. By implementing a systematic approach to creating and reviewing documents, you can ensure that all information is correct and professionally presented, reducing the likelihood of mistakes.

Steps to Ensure Accuracy

- Double-Check Contact Information: Always verify that both your and the client’s contact details are correct to avoid any communication issues.

- Review Itemized Descriptions: Provide clear, concise descriptions for every product or service to avoid ambiguity and ensure the client understands what they’re being charged for.

- Confirm Payment Terms: Clearly state the due date, late fees, and accepted payment methods to ensure that the client is fully aware of the terms.

- Recheck Calculations: Ensure that totals, taxes, and discounts are correctly calculated. Using automated tools can reduce the risk of human error.

- Use Consistent Formatting: Keeping the layout uniform helps to avoid missing any critical details and makes it easier for both you and your client to read and understand the document.

Tools to Help with Accuracy

- Accounting Software: Platforms like QuickBooks or FreshBooks automatically generate detailed, error-free records, reducing the chance of mistakes.

- Automated Calculators: Many document creation tools include built-in calculators that automatically adjust totals, taxes, and discounts based on input.

- Spell Check and Proofreading: Utilize proofreading tools to catch spelling or grammatical error

What to Include in Your Invoice

When preparing a financial document for a client, it’s important to include all necessary details to ensure clarity and avoid any confusion. A well-structured document not only specifies the services provided but also sets clear expectations regarding payment terms. By including the right information, you can help foster a smooth and professional transaction.

- Business Information: Include your business name, address, contact number, and email address, so the client can easily reach you if needed.

- Client Details: Clearly list the client’s name, company name (if applicable), and contact information to ensure that there are no misunderstandings about who the payment is for.

- Unique Reference Number: Assign a unique reference number or code to each document for easier tracking and future reference.

- Description of Services or Products: Provide a detailed breakdown of what was provided, including any relevant dates and quantities. This helps the client understand exactly what they are being billed for.

- Amount Due: Clearly specify the amount owed for each item or service, as well as the total balance. Be sure to include any taxes, discounts, or additional fees, if applicable.

- Payment Terms: State the payment due date, as well as any late fees or penalties for delayed payments. This ensures that the client is aware of the time frame in which payment should be made.

- Accepted Payment Methods: Include the different ways the client can make payment, such as bank transfer, credit card, or online pay

How to Download and Use Invoice Templates

For business owners or freelancers, having a ready-made document to handle billing can save time and ensure accuracy. By using pre-designed formats, you can quickly create and send professional requests for payment. These documents typically follow a structured format, making it easier to include all necessary details without missing any critical information.

To get started, find a platform that offers customizable options for generating billing forms. Most services allow you to choose from a variety of designs that suit different needs, whether for simple transactions or detailed service agreements. Once you’ve found a suitable model, you can either edit it directly on the platform or download it for use on your computer.

Once you’ve obtained the document, it’s important to customize it according to your specific requirements. Fill in fields such as contact information, the nature of the service, amounts, and payment terms. Adjust the format if needed to match your branding or to ensure that the content fits the purpose of the transaction. After customizing, the document can be saved, printed, or sent electronically to clients.

Here’s a basic example of a structure you might encounter:

Field Purpose Business Name Identifies the party issuing the request Client Information Details about the recipient of the payment Description of Service Clear summary of what is being billed Amount Due The total charge for the service rendered Due Date Deadline by which payment should be made Payment Instructions Guidelines on how to submit the payment Invoice Template Software for Easy Management

For those looking to streamline the process of creating and tracking financial documents, specialized software can be a game changer. These tools offer a range of customizable features that allow users to quickly generate professional documents, manage transactions, and stay organized with minimal effort. Whether you’re a small business owner or a freelancer, using the right software can significantly improve efficiency and accuracy in handling financial records.

Key Features for Effortless Document Creation

The best software solutions provide ready-made designs that can be tailored to meet your specific needs. Users can adjust various elements, such as adding company branding, customizing sections for payment terms, and including itemized lists of services or goods. These programs typically include easy-to-fill fields and automated calculations to ensure everything is accurate, reducing human error.

Enhanced Organization and Tracking

Beyond document creation, these tools offer robust management features. They allow you to keep track of all issued documents, monitor payment statuses, and set reminders for upcoming deadlines. With features like automatic reminders and centralized tracking, you can focus more on growing your business and less on administrative tasks.

Benefits of Using Specialized Software:

- Time-saving automation for document creation

- Customizable fields for specific needs

- Efficient tracking of payments and due dates

- Professional and polished results every time

Incorporating such tools into your routine can help maintain financial organization, improve client relationships, and ensure timely payments with less effort.

Design Tips for Professional Invoices

Creating visually appealing and effective documents is essential for making a strong impression on clients. A well-crafted design not only enhances readability but also conveys professionalism and attention to detail. Implementing a few key principles can help ensure that your financial documents stand out and communicate all necessary information clearly.

Essential Design Elements

- Consistent Branding: Use your business colors, logo, and fonts to create a cohesive look that reflects your brand identity.

- Clear Structure: Organize content into sections, such as contact information, itemized services, and payment details, to improve readability.

- Whitespace: Incorporate ample whitespace to avoid clutter and allow the reader to focus on key information.

- Legible Fonts: Choose easy-to-read fonts and appropriate sizes to ensure all text is accessible to the recipient.

Improving Functionality

- Highlight Important Information: Use bold or larger font sizes for crucial details, such as total amounts due and due dates.

- Include Payment Instructions: Clearly outline how clients can submit payments to avoid confusion and delays.

- Add a Summary Section: Provide a brief overview of services rendered to give clients a quick reference.

- Use Itemized Lists: Break down charges into individual items to enhance transparency and help clients understand the billing process.

By incorporating these design tips, you can create polished documents that reflect your professionalism and facilitate smooth transactions.

How to Track Paid and Unpaid Invoices

Keeping track of financial documents and payments is crucial for maintaining smooth cash flow and avoiding any confusion with clients. By monitoring the status of your documents, you can easily identify which transactions have been completed and which are still pending. This system helps in managing overdue payments and ensures you stay on top of your financial obligations.

Simple Tracking Methods

One of the easiest ways to monitor payment status is by creating a simple tracking sheet or using software with built-in management tools. A table with clear columns for document details, amounts, and payment status can help organize your records. You can mark the status of each document as “paid,” “unpaid,” or “overdue” to quickly assess the situation.

Using a Tracking Table

Here’s an example of how to structure a tracking table to help you stay organized:

Document Number Client Name Amount Due Date Status #00123 John Doe $500 10/10/2024 Paid #00124 Jane Smith $300 10/15/2024 Unpaid #00125 Benefits of Using a Digital Invoice Template Switching to digital solutions for creating and managing financial documents offers numerous advantages. By adopting digital formats, businesses can streamline the entire billing process, reducing manual effort while ensuring accuracy. This shift not only saves time but also enhances the overall client experience by providing quicker and more professional interactions.

Key Advantages of Digital Formats

- Efficiency: Generate and send documents in minutes, avoiding the need for manual creation and repetitive data entry.

- Accuracy: Automated calculations reduce the risk of errors, ensuring that amounts and totals are correct every time.

- Cost-Effective: Eliminate printing and mailing costs, and reduce paper usage with digital files.

- Convenience: Easily access, update, and store records online, simplifying tracking and future reference.

Enhanced Client Experience

- Professional Appearance: Present clean, polished documents that build trust and credibility with clients.

- Faster Payments: By providing clients with easily accessible and shareable documents, you reduce delays in payment processing.

- Environmental Impact: Using digital formats contributes to sustainability by minimizing paper waste.

Utilizing digital solutions not only improves internal processes but also creates a smoother, more efficient experience for clients and partners alike.