Invoice Template Example for Easy Billing

For businesses of all sizes, having a clear and organized document for transactions is crucial. Whether you are a freelancer or a large company, providing clients with accurate records ensures timely payments and fosters professionalism. This guide will help you understand how to craft a polished billing statement that fits your specific needs.

With the right structure, a well-crafted statement not only details the services rendered but also builds trust with your clients. It’s important to know what information to include and how to present it in an easy-to-read format. Understanding these key elements can make your billing process more efficient and effective.

Customizing your billing format can also make your documents unique to your brand while maintaining clarity. The goal is to create a balance between professionalism and simplicity, allowing clients to understand the charges with ease. By focusing on essential details and a clean layout, you’ll ensure that your transactions run smoothly.

Invoice Template Example for Beginners

When starting a new business or freelancing, creating professional billing documents can seem overwhelming. However, once you understand the basic structure, the process becomes much easier. A clear and organized record of services provided and payments due is essential for ensuring smooth financial transactions.

For those new to creating such records, it’s important to start with a simple layout that includes the necessary details. This can include the client’s name, date of the transaction, description of services rendered, and the amount due. Keeping the design clean and easy to follow will help your clients understand their obligations without confusion.

By using a straightforward format and adjusting it according to your specific needs, you can create documents that maintain a professional appearance. This initial approach will help you establish trust with clients and streamline your billing process, even if you’re just starting out.

Why Use an Invoice Template?

Having a standardized document for billing is essential for both clarity and efficiency. Using a structured format helps ensure that all necessary information is included and easy to understand. This approach reduces the likelihood of mistakes and minimizes the time spent on creating each document from scratch.

By relying on a pre-designed format, businesses can maintain consistency in their transactions. It allows for a more professional appearance, improving how clients perceive your services. Additionally, it simplifies the billing process, especially when managing multiple clients or projects at once.

Another key benefit is the ability to automate certain elements, such as numbering or tax calculations. This not only saves time but also ensures that each document is accurate and up-to-date. Using a reliable structure ultimately streamlines the entire payment process, leading to faster transactions and better organization.

Key Elements of a Professional Invoice

A well-structured billing document should include several key components to ensure clarity and avoid confusion. Each part serves a specific purpose, whether it’s identifying the parties involved or specifying the charges for services rendered. Understanding what to include can help make your document both professional and functional.

Essential Information to Include

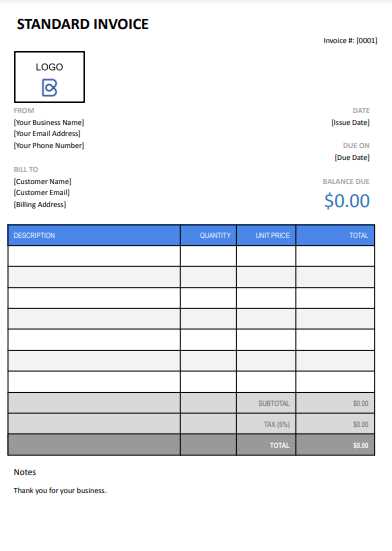

Here are the primary elements that should appear in any professional record:

- Business Details: Your name or company name, address, and contact information.

- Client Information: The name and contact details of the person or organization receiving the bill.

- Transaction Date: The date when the services were provided or the product was delivered.

- Service Description: A clear description of the work completed or the items sold.

- Amount Due: The total amount to be paid, clearly stated, including any taxes or additional fees.

- Payment Terms: The conditions under which payment should be made, such as due dates or accepted methods of payment.

Optional Yet Helpful Additions

While the above elements are essential, there are a few optional details that can enhance your document:

- Unique Reference Number: Assigning a unique number to each billing document helps in tracking and organizing.

- Notes or Special Instructions: Any additional comments or instructions for the client, such as thank-you notes or reminders about payment deadlines.

Including these elements ensures that your documents are comprehensive, clear, and professional, making it easier for clients to process payments and reducing the chances of misunderstandings.

How to Customize Your Invoice Template

Personalizing your billing document is essential for making it reflect your brand and meeting your specific needs. Customization goes beyond simply changing logos or color schemes; it also involves adjusting the structure and content to better align with your business operations. With the right approach, your document can provide both clarity and a professional appearance that stands out to clients.

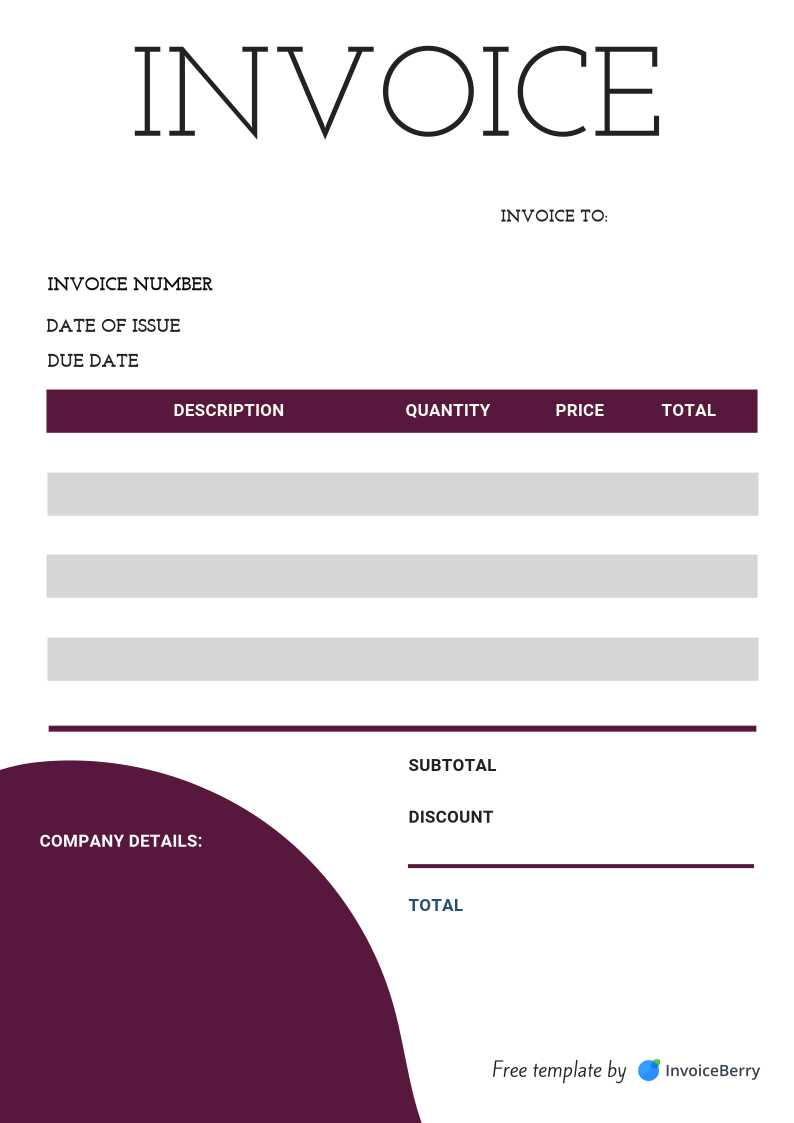

Adjusting the Layout and Design

Customizing the design of your record is one of the most straightforward ways to make it unique. Start by choosing a layout that fits your style, whether it’s a minimalist look or one that includes more detailed elements. Be sure to focus on:

- Branding: Incorporate your logo, business name, and colors to create a cohesive look.

- Legibility: Choose fonts and spacing that make the document easy to read, avoiding cluttered sections.

- Section Placement: Organize your content logically, ensuring that important details, like payment terms and due dates, are easy to find.

Including Customized Data Fields

Many businesses have unique information to include in their documents. Customizing data fields ensures that all relevant details are captured. Here’s an example of how you can organize specific charges in a clear way:

| Description | Quantity | Rate | Total |

|---|---|---|---|

| Service Fee | 1 | $100.00 | $100.00 |

| Product Sale | 5 | $20.00 | $100.00 |

| Total | $200.00 | ||

Customizing yo

Best Invoice Formats for Small Businesses

Choosing the right layout for your billing documents is crucial for small businesses. The format you use can affect both how your clients perceive your professionalism and how efficiently you manage your financial records. A simple, clear, and easy-to-understand structure is often the best approach, especially when dealing with multiple clients or projects.

For small businesses, the most effective formats are those that balance simplicity and functionality. The document should not only provide essential details but also reflect your brand identity. Here are some of the best formats that can help you stay organized while maintaining a professional image.

1. Simple and Clean Design: A minimalist layout with clear sections makes it easy for clients to find key details like payment amounts and deadlines. Use straightforward headings and organized tables to break down costs and terms.

2. Itemized Billing: If your business offers several services or products, an itemized breakdown helps clients understand exactly what they are paying for. This format allows you to list each service or product with its corresponding price, making it easy for the client to see how the total was calculated.

3. Time-Based Formats: For businesses offering hourly or project-based services, a time-based format is ideal. Include sections for the number of hours worked, the hourly rate, and the total charge, allowing for transparent billing.

By choosing a format that suits your specific business model, you can enhance clarity, streamline the payment process, and ensure that your clients are satisfied with your professionalism.

Creating an Invoice with Excel Templates

Using spreadsheet software like Excel to create billing documents is a popular choice for many small businesses. Its flexibility allows for easy customization while providing a structured layout for clear presentation of payment details. With built-in formulas and functions, Excel can automate many aspects of the billing process, making it a time-saving tool.

When creating a billing document in Excel, you can start by selecting a pre-designed layout or building one from scratch. The advantage of using Excel is the ability to quickly calculate totals, apply taxes, and track payments with minimal effort. You can also format the document to include all necessary details such as client information, payment terms, and descriptions of products or services.

Steps to create a billing document in Excel:

- Choose a Layout: Select a simple layout that includes sections for business and client details, description of services, and payment information.

- Add Formulas: Use Excel’s formula features to calculate totals, taxes, and discounts automatically, ensuring accuracy.

- Customize the Design: Adjust fonts, colors, and borders to match your business’s branding while keeping the layout professional and easy to read.

- Save and Reuse: Once your document is set up, save it as a template so you can reuse it for future billing without starting from scratch.

With Excel, creating a billing document becomes both efficient and flexible, allowing small businesses to manage their finances with ease.

Free Invoice Templates Online

Finding free resources for creating professional billing documents can save both time and money for small businesses. Numerous websites offer free layouts that are easy to customize, making it simple for anyone to create a polished billing statement without needing design skills or software expertise. These tools are especially helpful for freelancers or startups that need an efficient way to manage financial transactions.

Online platforms provide a wide range of options, from simple designs to more complex, industry-specific formats. These resources often include features that can be customized to suit your business needs, such as fields for client information, payment terms, and itemized charges. Some sites even allow you to download and use the documents in various formats, such as Word or PDF, making it easy to send or print them for your clients.

Popular Sources for Free Resources:

- Google Docs: Offers free, editable templates that you can customize for your business.

- Microsoft Office: Provides downloadable formats that work well with Excel and Word.

- Template Websites: Sites like Template.net and Invoice Simple offer free downloadable formats that can be customized easily.

- Online Generators: Tools like Wave and Zoho allow you to generate professional documents directly online.

By taking advantage of these free resources, businesses can streamline their billing processes, reduce administrative workload, and maintain a consistent, professional approach to managing payments.

Essential Features for Invoice Templates

To create an effective billing document, certain features must be included to ensure clarity, professionalism, and accuracy. These elements not only help you provide the necessary details but also make the payment process easier for your clients. A well-structured document that includes all relevant information ensures that there is no confusion and that both parties understand the terms of the transaction.

Key Components to Include:

- Contact Information: Both your business and your client’s name, address, phone number, and email should be clearly stated to avoid any communication issues.

- Unique Reference Number: Assigning a unique identification number to each document helps you keep track of transactions and simplifies record-keeping.

- Clear Itemization: A detailed breakdown of the products or services provided, including quantities, rates, and individual costs. This makes it easy for clients to verify what they are being charged for.

- Payment Terms: Include clear instructions about when the payment is due, accepted payment methods, and any late fees or discounts for early payment.

- Due Date: Always include a due date to set clear expectations for when payment should be made, reducing the risk of late payments.

- Total Amount Due: The final amount that the client owes should be clearly highlighted, including any taxes, fees, or discounts applied to the total amount.

By including these essential features, you ensure that your billing document is complete, transparent, and professional, helping to build trust with your clients and speeding up the payment process.

Invoice Template Design Tips

Creating a visually appealing and professional billing document is just as important as providing accurate information. A well-designed layout not only improves readability but also enhances your brand image. When designing a document for business transactions, focusing on clarity, organization, and visual balance can make a significant difference in how your clients perceive your company.

1. Keep the Layout Simple

A clean and simple design is often more effective than one with too many complex elements. Limit the use of excessive colors, fonts, or graphics that may distract from the important details. Stick to one or two font types, use clear headings, and organize information in sections that are easy to follow. This will ensure your document looks professional and is easy for clients to understand.

2. Make Important Information Stand Out

Highlight key details such as the total amount due, payment due date, and client information. Using bold text, larger font sizes, or color contrast can help draw attention to these important sections without overwhelming the reader. This ensures that clients can quickly find the most relevant information, reducing the chances of confusion or delayed payments.

Additional Design Tips:

- Use Grids: A grid layout helps structure your document and makes it easy to align text, numbers, and other elements.

- Incorporate Your Branding: Include your logo and use your business colors to make the document align with your overall brand identity.

- Leave Space: Adequate white space between sections ensures the document doesn’t feel cluttered, making it easier to read and navigate.

By following these design tips, you create a document that not only looks professional but also functions effectively in helping clients make timely payments.

How to Include Tax Information

Including accurate tax details in your billing documents is essential for both legal compliance and transparent communication with your clients. Properly calculating and displaying taxes ensures that there are no misunderstandings regarding the final amount due. It also helps businesses maintain organized records and avoid potential legal issues with tax authorities.

When adding tax information, it is important to clearly state the type of tax being applied, its rate, and the total amount being charged. This ensures that clients understand the breakdown of their costs and how the final figure is calculated.

Steps to include tax details:

- Specify the Tax Rate: Clearly mention the applicable tax rate, whether it’s sales tax, VAT, or other taxes, and make sure it aligns with the tax laws in your region.

- Break Down Tax Amount: Include a separate line item that lists the tax amount, calculated based on the subtotal of goods or services provided.

- Display Total Amount: Ensure that the total amount due reflects the sum of the itemized charges plus the tax applied, making it easy for your clients to verify the final payment required.

- Include Your Tax ID Number: Some jurisdictions require businesses to include their tax identification number on billing documents, so make sure this is listed if applicable.

By presenting tax information clearly and professionally, you help clients easily understand the charges and maintain accurate financial records, ensuring smooth business transactions and compliance with tax regulations.

Adding Payment Terms to Your Invoice

Clearly stating the terms of payment is a crucial part of any billing document. It sets expectations for both you and your clients, ensuring smooth and timely transactions. Including specific payment terms helps avoid misunderstandings and encourages prompt payment. Whether you offer discounts for early payments or charge penalties for late ones, defining these terms can help manage your cash flow effectively.

Key Payment Details to Include:

- Due Date: Clearly mention the date by which the payment should be made. This helps your client know exactly when to pay.

- Accepted Payment Methods: List the payment options you accept, such as credit cards, bank transfers, or checks. This ensures clients know how to complete the transaction.

- Late Payment Fees: If applicable, include details about any penalties or interest charges that will apply if payment is not received by the due date.

- Early Payment Discounts: If you offer a discount for early payments, specify the percentage off and the terms for eligibility.

Additional Tips for Clear Payment Terms:

- Keep it Simple: Use clear, straightforward language to avoid confusion.

- Be Consistent: Use the same terms for all transactions to maintain consistency and fairness.

By providing detailed payment terms, you set clear expectations and promote timely payments, improving your cash flow and reducing the risk of overdue accounts.

Invoice Template for Freelancers

Freelancers often manage their own billing and administrative tasks, making it essential to have a well-structured document for each completed project. A clear and professional document helps communicate the value of your work while also ensuring that clients understand the breakdown of services and fees. This type of document is not only important for receiving payment but also for keeping your financial records organized and transparent.

When creating such a document, it’s important to include key elements such as the scope of work, payment terms, and detailed service charges. For freelancers, providing a simple yet detailed structure ensures that clients can easily understand the charges, making it easier to facilitate payments on time.

| Service Description | Rate | Hours Worked | Total Amount |

|---|---|---|---|

| Web Design | $50/hour | 10 hours | $500 |

| Consulting | $80/hour | 5 hours | $400 |

| Total | $900 |

Including clear line items like the above makes it easy for your clients to see exactly what they are paying for. It also helps protect both parties in case of disputes, providing a transparent record of services rendered and agreed-upon rates.

Common Mistakes to Avoid in Invoices

When creating billing documents, there are several common errors that can lead to misunderstandings, delays in payments, or even legal complications. Ensuring accuracy and clarity in every aspect of the document is crucial to maintaining a professional image and fostering trust with clients. Simple mistakes can result in delayed payments or disputes, so it is important to avoid these pitfalls when drafting your charges.

Common Errors to Watch Out For

- Missing or Incorrect Contact Information: Always include the correct names, addresses, and contact details for both you and the client. Incomplete or incorrect information can lead to confusion and payment delays.

- Unclear Service Descriptions: Failing to provide a clear breakdown of the services rendered can result in confusion. Be specific and concise when describing what has been delivered, including any relevant dates and deliverables.

- Incorrect Payment Terms: Clearly define when payments are due, any penalties for late payments, and accepted payment methods. Failing to set these expectations can cause friction and delayed payments.

- Mathematical Errors: Double-check all calculations to ensure that amounts, taxes, and discounts are accurate. Mistakes in math can damage your credibility and cause payment disputes.

How to Avoid These Mistakes

- Review Before Sending: Always double-check all the details before sending your billing document to ensure all information is correct.

- Use Templates: Consider using pre-designed structures to ensure consistency and minimize the risk of mistakes.

By avoiding these common mistakes, you can create a clear, accurate, and professional document that will help ensure timely payments and prevent misunderstandings with clients.

How to Send and Track Invoices

Sending and tracking billing documents effectively is crucial for maintaining smooth financial operations. Once a document is created, it’s important to ensure it reaches the client promptly and is followed up on to ensure timely payment. Whether you’re managing a few clients or a large portfolio, having a reliable method for sending and tracking these documents will help you keep your business organized and cash flow steady.

There are various methods to send your documents, ranging from traditional paper-based approaches to digital platforms that offer faster delivery and tracking capabilities. It’s essential to choose the right method based on your client preferences and the nature of your business.

Methods to Send Billing Documents

- Email: The fastest and most common method for sending billing documents. Using PDFs ensures a professional format that can’t be easily altered by clients.

- Online Platforms: Many digital platforms allow you to send, receive, and track documents with features like payment reminders and status updates.

- Postal Mail: Some clients may prefer a physical copy. This is less common in today’s digital age but can still be used for formal business transactions.

Tracking the Status of Your Documents

Once sent, it’s important to track the status of your billing documents. Here’s how you can manage this process efficiently:

| Method | Tracking Option |

|---|