Free Business Invoice Template for Quick and Easy Invoicing

For many professionals, creating billing documents can be time-consuming. Having a pre-designed form can simplify the entire process, ensuring that all necessary details are organized and presented clearly. By utilizing a standardized document, you reduce the chance of errors and keep your records consistent, making each transaction smoother and more reliable.

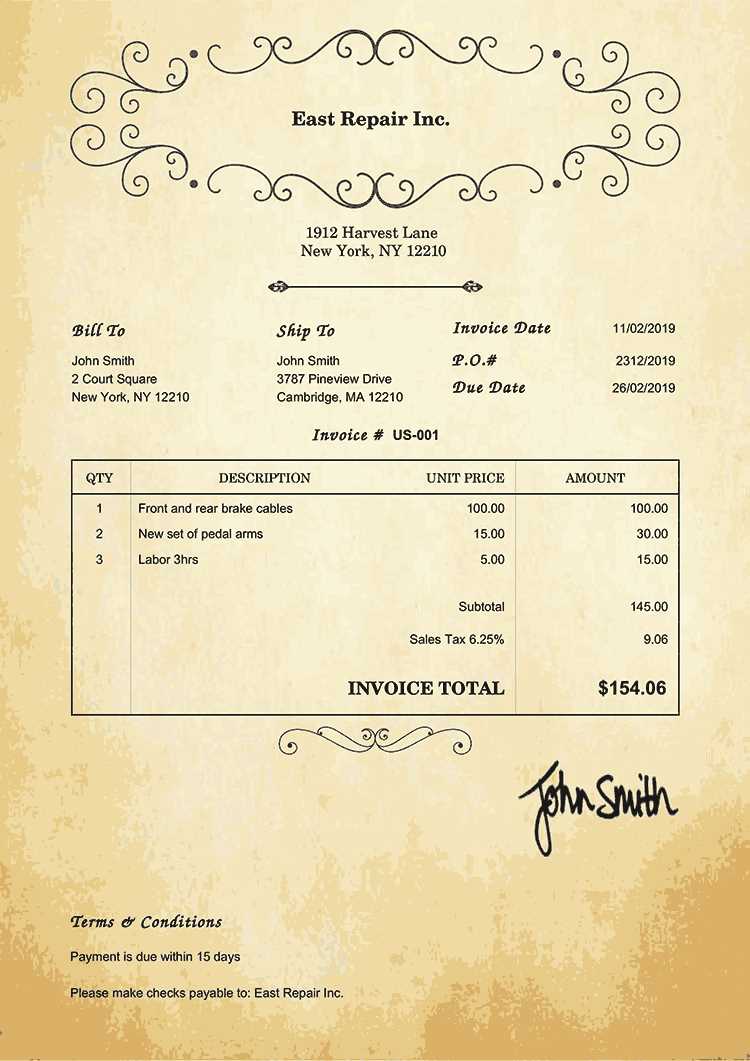

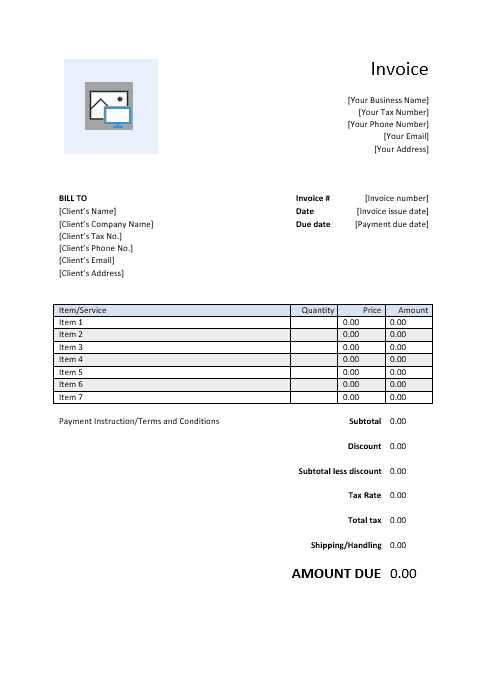

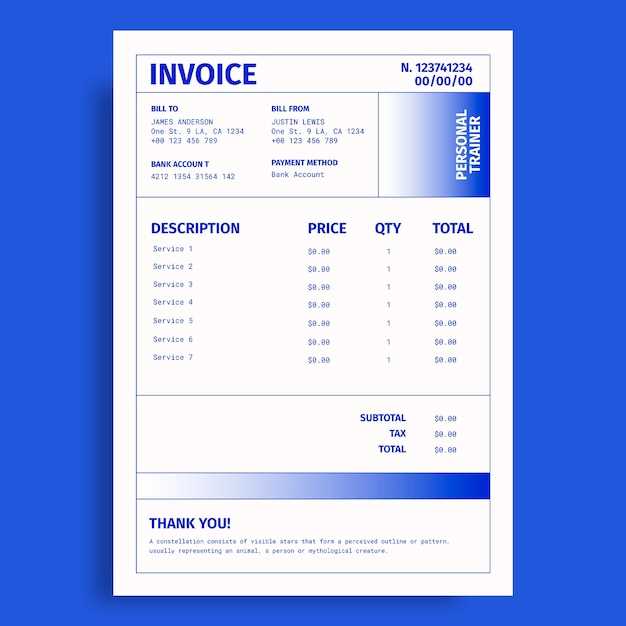

Using customizable forms allows you to add a personal touch while maintaining a professional appearance. You can adjust colors, logos, and layout to match your brand’s identity, enhancing your company’s image with every transaction. These forms are suitable for a wide variety of industries and can be easily adapted for specific needs.

Whether you’re managing a few clients or a larger customer base, having an efficient way to handle payments saves time and effort. The use of pre-made forms can make your work more productive and help you keep track of transactions effortlessly. With a well-structured approach, you’ll foster better client relationships, minimize administrative burdens, and improve your overall workflow.

Essential Guide to Free Invoice Templates

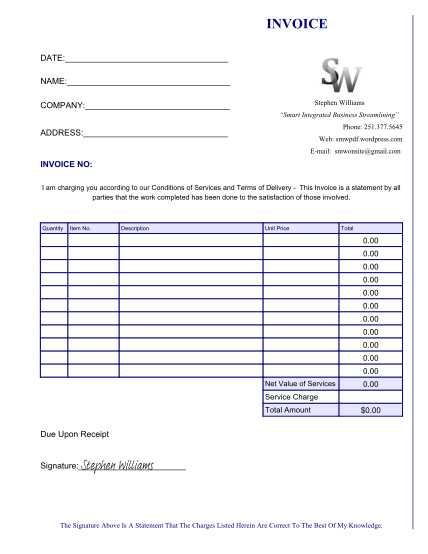

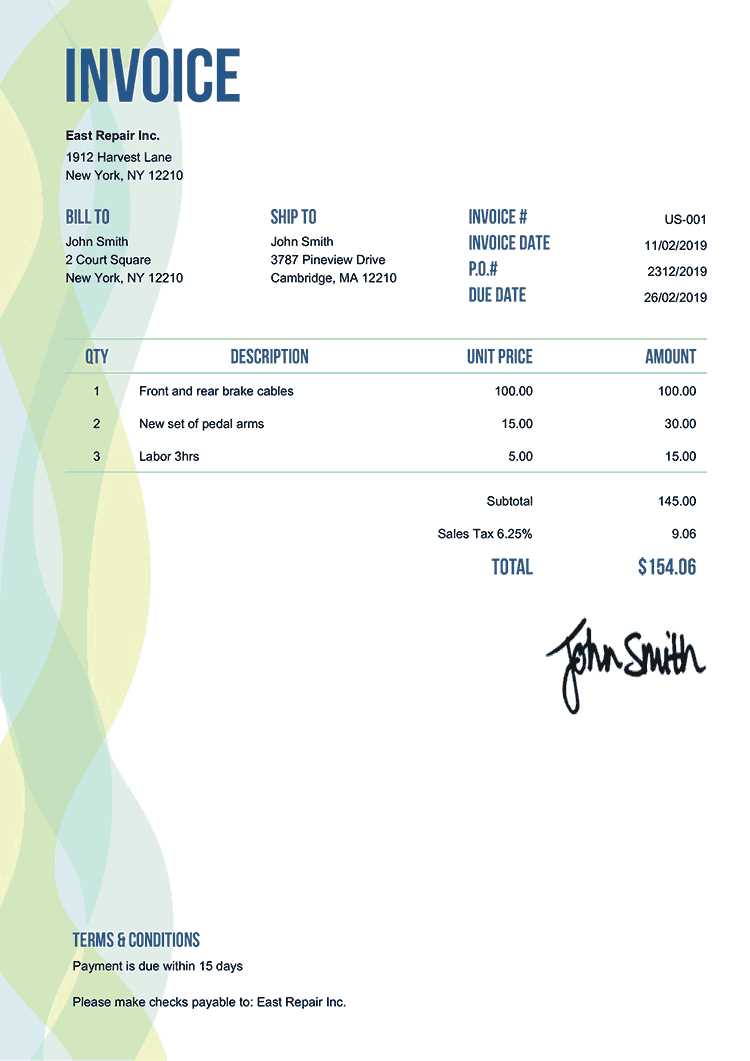

Creating a structured and professional document for billing purposes is crucial for any growing enterprise. Properly designed forms simplify the payment process and help both the sender and receiver keep accurate records of transactions. A well-organized layout not only makes it easier to understand the details but also leaves a positive impression on clients, highlighting reliability and professionalism.

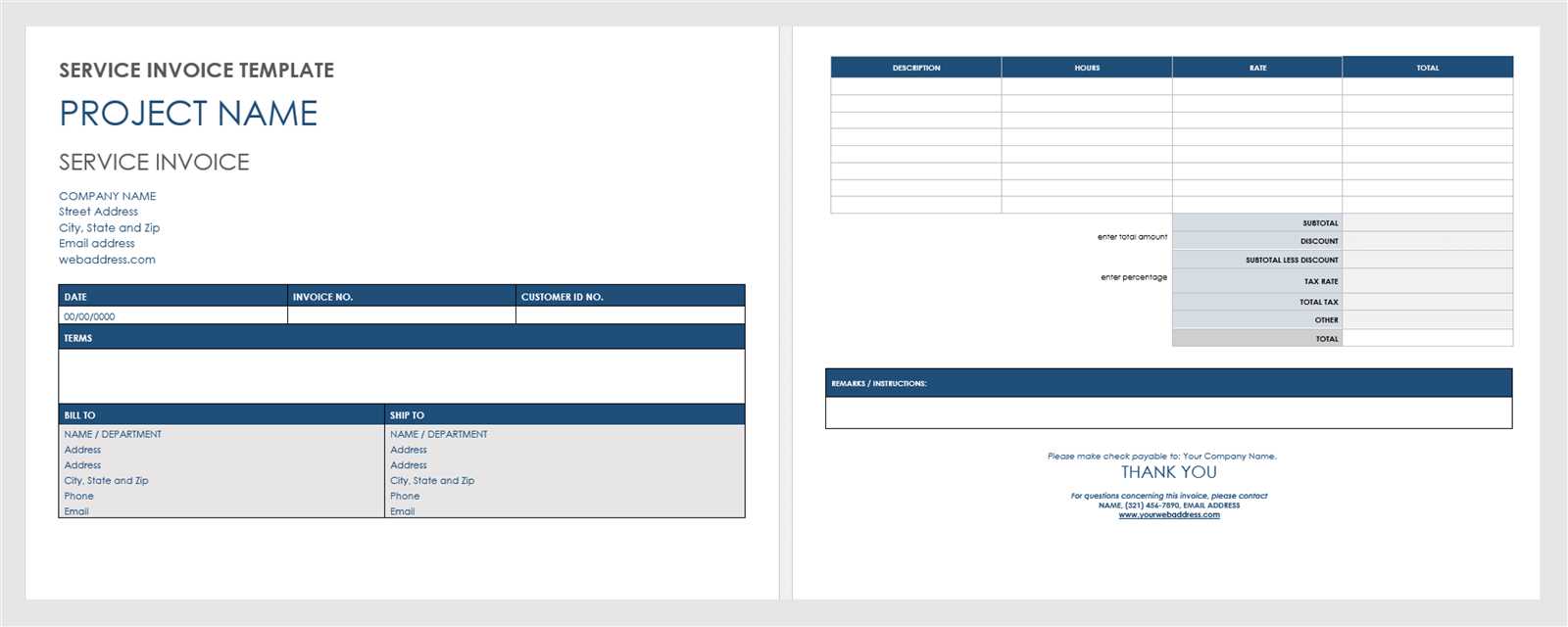

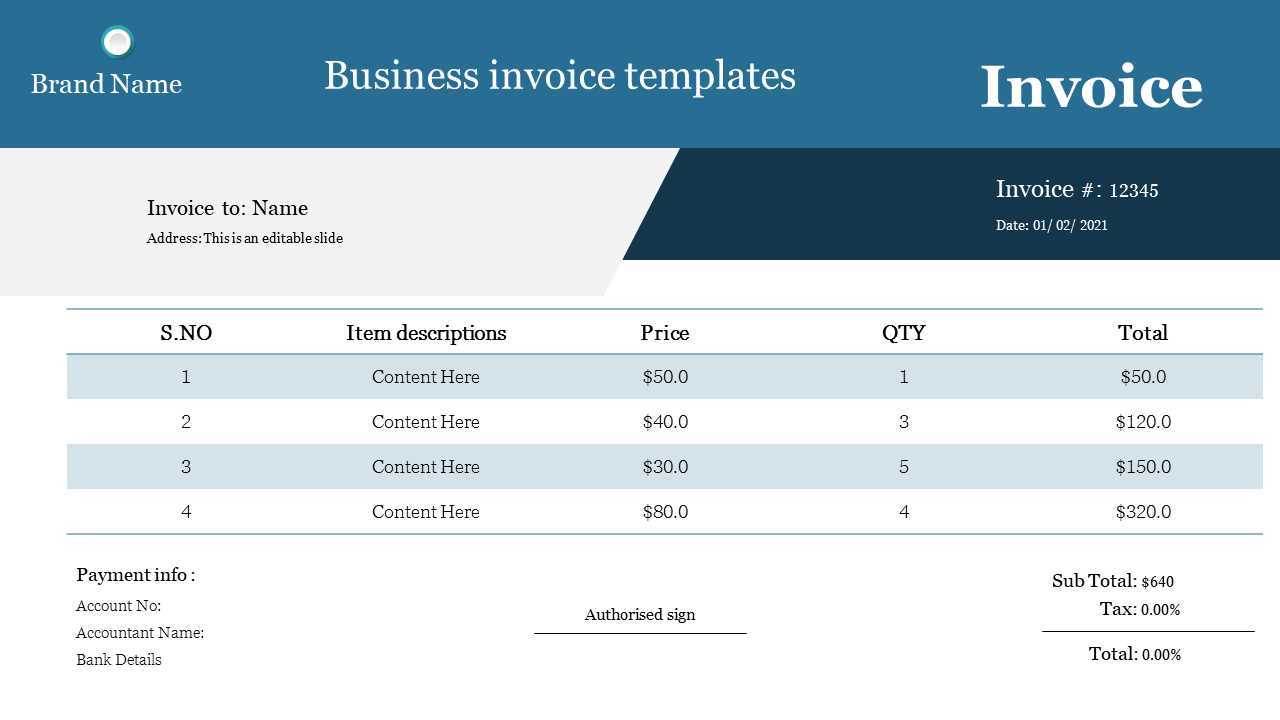

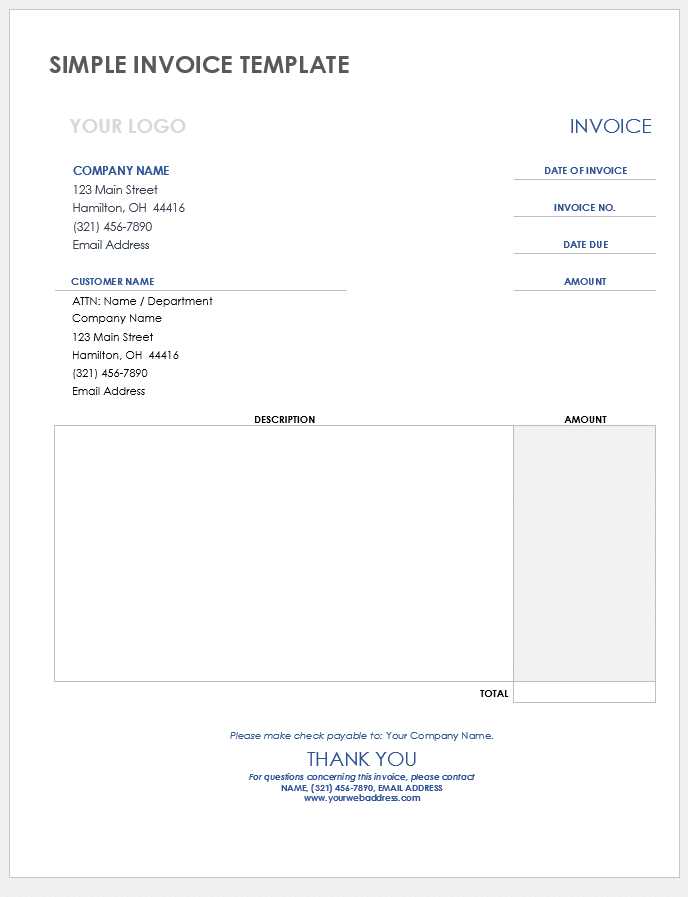

To get the most out of a pre-made billing form, it’s essential to choose one that aligns with your specific needs. Some forms are better suited for detailed service descriptions, while others focus on simple itemized lists. Selecting the right format helps in conveying the information clearly and avoids confusion, ensuring smooth transactions every time.

Customization options are another key advantage. Many pre-built forms allow users to incorporate personal branding elements, such as logos, colors, and fonts, making the document look cohesive and aligned with your company’s identity. This flexibility means you can maintain a professional look

Benefits of Using Invoice Templates

Having a consistent approach to billing can greatly enhance both efficiency and accuracy. Ready-to-use forms provide a streamlined solution for creating payment documents, ensuring that every essential detail is covered while saving valuable time. These forms are designed to simplify the process, making it easy to maintain organized and professional records.

Time savings are one of the most significant advantages of pre-made billing formats. By starting with a structured layout, you can quickly fill in details without having to create a new design from scratch. This efficiency is especially useful for small teams or individual professionals who need to manage multiple clients or projects.

Using a standard layout also minimizes errors. With a consistent structure, there’s less risk of omitting critical information, which

How to Choose the Right Template

Selecting the appropriate format for your billing needs is essential for maintaining efficiency and professionalism. Different layouts serve various purposes, so identifying the right one can simplify the payment process and ensure all required details are accurately displayed. Choosing wisely helps you save time and provides clients with a clear, consistent experience.

To make an informed decision, consider the type of service or product you offer. If you handle projects with multiple items or detailed descriptions, a design with sections for line items, quantities, and rates may be ideal. For simpler services, a more streamlined document could be more effective, allowing quick entry of core information.

Customization options are also key. Look for layouts that allow adjustments to colors, fonts, and branding elements, so you can align the document with your identity. A personalized look can stren

Customizing Your Invoice Layout

Tailoring the layout of your billing document allows you to present a professional image while meeting specific needs. Customization provides flexibility, enabling you to adjust design elements and content so that each document aligns with your brand identity and conveys important information clearly.

One of the primary ways to personalize your layout is by adding brand elements. Including your logo, brand colors, and specific fonts creates a cohesive look that clients can instantly recognize. This approach helps reinforce your identity and shows attention to detail, which can strengthen client confidence in your services.

Organizing sections effectively is another essential aspect of customization. Depending on your industry, you might need areas for item descriptions, hourly rates, or project milestones. Structuring these sections to match the details of your work

Saving Time with Ready-Made Templates

Pre-designed billing forms can be a tremendous asset for professionals seeking efficiency in their financial workflow. By using these layouts, you skip the lengthy process of designing documents from scratch, allowing you to focus more on essential tasks and less on administrative duties. Ready-made forms provide all necessary elements in a structured format, ensuring you spend less time setting up each document.

Below is a comparison of the time saved using ready-made forms versus creating layouts manually:

| Task | Manual Setup | Using Ready-Made Forms | Time Saved | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Design and Layout | 1-2 hours | 5-10 minutes | Up

Saving Time with Ready-Made TemplatesPre-designed billing forms can be a tremendous asset for professionals seeking efficiency in their financial workflow. By using these layouts, you skip the lengthy process of designing documents from scratch, allowing you to focus more on essential tasks and less on administrative duties. Ready-made forms provide all necessary elements in a structured format, ensuring you spend less time setting up each document. Below is a comparison of the time saved using ready-made forms versus creating layouts manually:

As shown, these pre-made forms can help professionals optimize their time. With minimal setup required, you can ensure your documents maintain a polished appearance without compromising valuable hours. This efficiency not only benefits you but also improves the client experience, as they receive clear, consistent communication with every transaction. Tips for Designing Effective InvoicesCreating compelling billing documents is crucial for ensuring clarity and professionalism in financial communications. A well-designed form not only conveys necessary information but also enhances the overall client experience. Here are several practical tips to help you craft effective billing documents. Keep It Simple and Clear

Include Essential Information

By adhering to these guidelines, you can create documents that are not only functional but also contribute to a positive professional image. An effective layout ensures that clients can easily understand their obligations and fosters timely payments. Best Formats for Digital InvoicesSelecting the appropriate format for your billing documents is essential for ensuring compatibility and ease of use. Different formats offer various advantages, from ease of editing to professional presentation. Below are some of the most effective formats for electronic billing documents.

Choosing the right format depends on your needs and preferences. By understanding the benefits of each option, you can select a method that enhances communication and provides a positive experience for your clients. Top Mistakes to Avoid in Invoicing

Creating financial documents can be a straightforward task, but several common pitfalls can lead to confusion and delayed payments. Being aware of these missteps is crucial for maintaining professionalism and ensuring timely transactions. Below are some frequent errors to steer clear of when preparing your financial requests. Incomplete Information

Inconsistent Formatting

By avoiding these mistakes, you can enhance clarity in your financial communications and foster a more efficient payment process. Ensuring your documents are complete and well-structured will not only reflect positively on your professionalism but also contribute to stronger client relationships. How to Ensure Invoice Accuracy

Maintaining precision in your billing documents is essential for promoting trust and reliability with your clients. Errors can lead to disputes, payment delays, and ultimately damage your professional reputation. Here are several strategies to help guarantee that your financial documents are accurate and error-free. Double-Check All Details

Review each element before sending out your documents. Ensure that all amounts are correct, services rendered are accurately described, and client information is up-to-date. A thorough review can catch simple mistakes that could lead to larger issues down the line. Utilize Software ToolsConsider using specialized software or online services designed for creating billing documents. These tools often include built-in checks and balances that minimize the risk of human error. They can also help automate calculations and maintain consistent formatting. By implementing these practices, you can significantly enhance the accuracy of your financial communications, fostering smoother transactions and a more professional relationship with your clients. Maintaining a Consistent Invoice StyleHaving a uniform appearance in your billing documents is vital for establishing brand identity and professionalism. A consistent style not only enhances readability but also builds trust with your clients. Here are some key practices to ensure that your financial communications maintain a cohesive look.

By following these practices, you can ensure that your billing documents not only look professional but also convey your brand effectively, leaving a lasting impression on your clients. Tips for Clear Payment TermsEstablishing unambiguous payment conditions is essential for smooth financial transactions. When clients understand their obligations clearly, it reduces confusion and promotes timely payments. Here are some valuable recommendations to ensure your payment terms are straightforward and effective.

By implementing these strategies, you can foster a better understanding of payment expectations, leading to improved financial relationships with your clients. How Invoices Impact Cash FlowThe management of financial documentation plays a crucial role in maintaining a healthy flow of funds within any organization. Properly structured financial requests can influence the timing and amount of incoming revenue, directly affecting the ability to meet operational expenses and invest in growth. Understanding this relationship is vital for effective financial planning and stability. Timing of Payments

The timing of when payments are made can significantly impact an organization’s liquidity. Promptly issued financial requests encourage quicker responses from clients, facilitating faster revenue collection. Conversely, delays in sending these documents can result in postponed payments, which can strain cash reserves and hinder the ability to manage expenses effectively. Clarity and Accuracy

Ensuring that financial requests are clear and accurate can minimize disputes and accelerate payment processes. When clients clearly understand their obligations and the details of the request, it reduces the likelihood of delays caused by misunderstandings or errors. This clarity contributes to more predictable cash inflows, allowing for better financial forecasting and planning. Creating Invoices for Small Businesses

For small enterprises, the process of generating financial documents is essential for ensuring timely payments and maintaining cash flow. A well-structured request for payment not only facilitates smooth transactions but also reflects professionalism. This section will explore key considerations and steps in crafting effective financial documents for smaller organizations. When designing financial documents, small enterprises should keep the following points in mind:

By focusing on these aspects, small organizations can create effective financial documents that promote timely payments and establish a solid professional reputation. Legal Considerations in Business InvoicingUnderstanding the legal landscape surrounding the creation and management of financial documents is crucial for any enterprise. Compliance with relevant laws and regulations not only protects the organization but also helps in maintaining professional integrity. This section highlights essential legal factors to consider when generating financial requests. Compliance with Tax RegulationsOne of the primary legal obligations is to ensure that all financial documents comply with tax requirements. This includes accurately reporting sales tax, value-added tax, or other applicable charges. Failure to adhere to tax laws can result in penalties and legal complications. Data Protection and PrivacyAnother critical consideration is the protection of sensitive information. Organizations must comply with data protection regulations, ensuring that personal and financial information of clients is securely handled. This includes implementing adequate measures to prevent data breaches and unauthorized access. By being aware of these legal considerations, organizations can better navigate the complexities of financial document management while safeguarding their interests and those of their clients. Tracking and Organizing Your InvoicesEffective management of financial requests is essential for maintaining healthy cash flow and ensuring timely payments. Keeping meticulous records not only simplifies the process of tracking payments but also enhances overall efficiency in operations. This section explores strategies for managing and organizing financial documents. Implementing a Tracking SystemEstablishing a systematic approach for monitoring financial documents can significantly reduce errors and oversight. Consider using software solutions or spreadsheets that allow you to:

Organizing Financial DocumentsA well-structured filing system is crucial for quick retrieval and reference. Here are some tips to organize your financial records:

By implementing these strategies, organizations can streamline their financial document management, leading to improved cash flow and reduced administrative burdens. Converting Estimates to Invoices Easily

Transitioning from initial cost projections to formal billing can streamline the payment process and enhance client relationships. By efficiently converting quotations into formal requests for payment, you can ensure clarity and consistency in your financial communications. This section outlines simple strategies to facilitate this transition. Utilizing Software ToolsMany digital solutions are designed to simplify the conversion process. Here are some features to look for:

Standardizing Your ProcessEstablishing a clear process for converting cost estimates to formal requests can improve efficiency. Consider the following steps:

By leveraging technology and establishing a consistent workflow, you can make the transition from estimates to formal payment requests seamless and efficient. Future Trends in Digital InvoicingThe evolution of electronic billing systems is set to redefine how financial transactions are conducted across various industries. As technology advances, the landscape of payment requests continues to adapt, promising greater efficiency, accuracy, and security. This section explores emerging trends that are likely to shape the future of electronic billing. Increased AutomationAutomation is anticipated to play a significant role in streamlining the creation and management of payment requests. Key developments include:

Enhanced Security MeasuresAs the reliance on digital transactions grows, so does the need for robust security protocols. The following innovations are expected to emerge:

By embracing these trends, organizations can not only improve their financial processes but also foster stronger relationships with clients through efficient and secure transaction handling. |