Free PDF Printable Invoice Template for Easy and Professional Billing

In today’s fast-paced business world, having a streamlined and professional method for requesting payments is essential for maintaining good relationships with clients. A well-structured billing document not only ensures clarity but also reflects the professionalism of your company. Whether you are a freelancer, a small business owner, or a large enterprise, it’s important to have an easy-to-use system for generating such documents.

Customizable billing solutions allow you to tailor each request based on specific client needs, ensuring that all relevant information is included. From payment terms to contact details, a properly designed document reduces misunderstandings and promotes smoother transactions.

By utilizing an accessible format, you can easily create, store, and send your billing statements, making the process more efficient and less time-consuming. The convenience of having ready-made options for creating your records enables you to focus on other critical aspects of your business while ensuring that your financial requests are sent out promptly and accurately.

What is a PDF Printable Invoice Template

Creating a clear and structured document to request payment for services or goods is an essential part of running any business. This type of document helps both businesses and clients understand the payment terms, items or services provided, and any relevant details that ensure a smooth financial transaction. One of the easiest ways to create and distribute such documents is by using pre-designed formats that are easy to customize.

A customizable document format can be filled with specific details such as company information, payment instructions, and a summary of the products or services offered. These formats are often available in a format that preserves the original design and ensures it looks professional across various devices and platforms.

Key Features of a Customizable Document

- Ease of Use: No need for complicated software, as these files can be filled out using basic text editing tools.

- Flexibility: You can personalize the layout to fit the specific needs of your business or industry.

- Time Efficiency: Streamline the creation process and eliminate the need to design each document manually.

- Accuracy: Pre-built fields and sections reduce the likelihood of mistakes or missing details.

- Professionalism: Ready-made designs ensure that your documents are clear, structured, and easy to read, reflecting well on your business.

- Customization: These options can be tailored to suit specific business needs, allowing for easy incorporation of your logo and contact details.

Benefits of Using PDF Invoice Templates

Utilizing pre-designed formats for generating payment requests offers a range of advantages that can simplify the billing process and enhance professionalism. These customizable documents ensure that businesses can quickly create accurate, well-organized records without needing to start from scratch each time a transaction occurs. The efficiency and ease of use provided by such options allow for faster turnaround times and fewer errors.

By relying on established designs, companies can maintain consistency in their communication with clients, ensuring that each document looks polished and follows a standardized structure. This consistency fosters trust and credibility, which is essential in any business relationship.

Key Advantages of Using Pre-Designed Formats

Why Businesses Choose Pre-Designed Solutions

- They save time and effort, enabling staff to focus on other important tasks.

- They provide an accessible solution that doesn’t require specialized software or training to use.

- They ensure that all necessary information is included, such as payment terms, contact details, an

How to Customize Your Invoice Template

Customizing your billing documents is an essential step in tailoring them to reflect your business’s unique needs and branding. A flexible format allows you to adjust the layout, fields, and content to accurately represent the details of each transaction. Whether you’re working with a simple document or a more complex form, making these adjustments ensures that your communications are both professional and aligned with your business identity.

When personalizing a document for payment requests, start by adding your company’s logo, contact details, and business information. This helps create a branded experience for your clients. Additionally, you can modify sections such as item descriptions, quantities, and payment terms, depending on the services or goods you provide. Ensuring that the document is clear and concise will help maintain good client relations and minimize misunderstandings.

Finally, it’s important to keep your layout clean and organized. A cluttered document can be difficult to read and may lead to confusion. Prioritize simplicity and clarity while keeping all relevant information easily accessible.

Best Tools for Creating PDF Invoices

When it comes to generating payment requests, using the right tools can significantly improve the efficiency and accuracy of the process. There are numerous software options available, each offering unique features and customization options to meet the specific needs of businesses. The best tools not only make it easy to create professional-looking documents but also streamline the overall workflow, allowing for faster billing and fewer errors.

From user-friendly online platforms to robust desktop applications, these tools allow businesses of all sizes to create clear, consistent, and easily shareable documents. Many also offer additional features such as automatic calculations, tax integration, and cloud storage, making the invoicing process even more efficient.

Top Software for Payment Request Creation

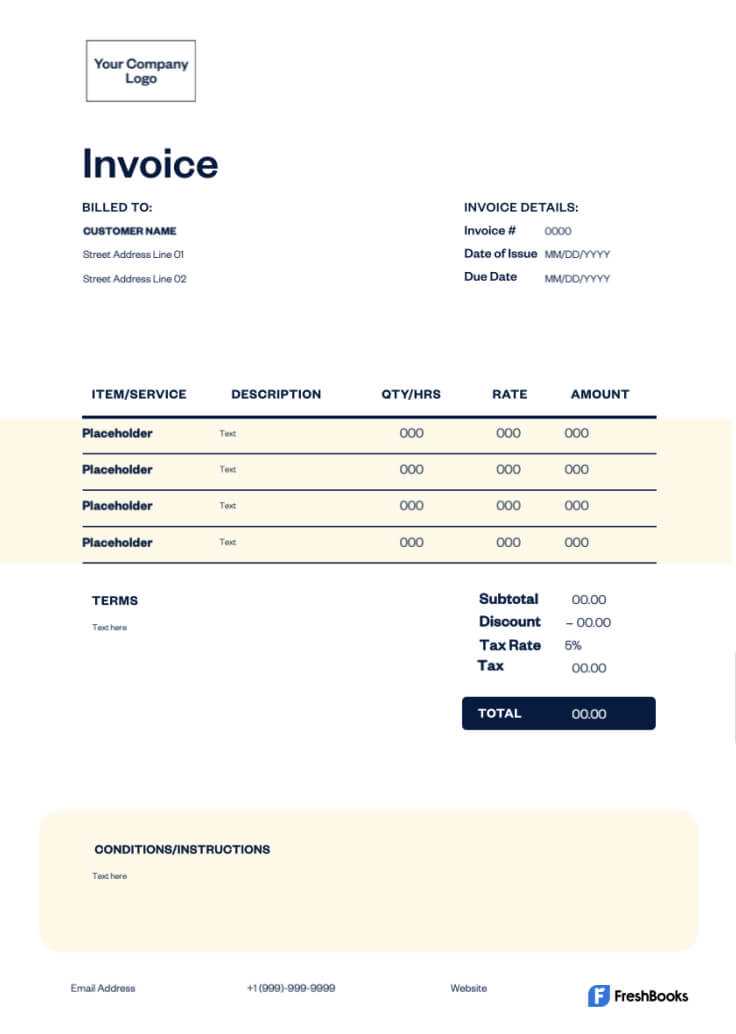

- FreshBooks: A cloud-based tool with customizable layouts and integrated time-tracking features, making it ideal for service providers.

- Wave: A free, easy-to-use tool that offers templates for creating and sending detailed financial records.

- Zoho Invoice: This tool offers a wide range of customization options, including recurring billing and multi-currency support for international businesses.

- QuickBooks: Known for its accounting features, QuickBooks also provides an invoicing module that integrates seamlessly with your financial data.

Additional Features to Look For

- Customization Options: Choose a tool that allows you to adjust fonts, colors, and sections to align with your branding.

- Automation: Look for tools that can automatically calculate taxes, discounts, and totals to save time and reduce errors.

- Cloud Integration:

Why Choose PDF Over Other Formats

When it comes to creating and sharing documents, choosing the right format is crucial for ensuring compatibility, consistency, and ease of use. Some formats offer flexibility but may lack the reliability and universal accessibility that others provide. The format you select can impact how your content is displayed, printed, or shared across various devices and platforms.

Universal Compatibility

One of the biggest advantages of using a specific format is its ability to be opened and viewed consistently across different operating systems and devices. Unlike other formats that may require specific software or plugins, the format in question ensures that your document will look the same no matter where it’s accessed–whether on a desktop, laptop, tablet, or smartphone.

Secure and Professional Presentation

Another significant reason to opt for this format is its professional presentation. This format preserves your layout, fonts, and images exactly as you designed them. It ensures that your content is presented in a clean, organized way, without risk of distortion or alteration, making it ideal for official use or business communication.

Feature Other Formats PDF Format Document Appearance May vary depending on software Consistent across all devices Device Compatibility Requires specific software or apps Accessible on most devices without extra software Security Can be easily edited or tampered with Offers encryption and password protection By opting for a format that guarantees security, compatibility, and a professional appearance, you can ensure your documents are always reliable and easily shared with others, without the risk of misrepresentation or technical issues.

How to Download a Printable Invoice

Downloading a ready-to-use document for billing or financial purposes is a straightforward process that allows you to access a structured file for printing or digital sharing. Whether you are preparing a transaction record for personal or business use, obtaining the right format ensures that all necessary details are included and easily accessible.

Step 1: Access the Document

The first step is to find the specific form you need. Most online services or platforms provide a user-friendly interface where you can select the desired document format. This could be through a customer portal, email link, or directly from a service provider’s website. Once you find the correct option, look for the download button or link to proceed.

Step 2: Download the File

After selecting the document, click on the provided link or button. The file will typically begin downloading automatically to your computer or device. If prompted, choose a location on your device where you’d like to save it for easy access. The file will be ready for either printing or digital use, depending on your needs.

Once downloaded, you can open and review the document to ensure all details are accurate and complete before printing or sharing electronically. The document will be formatted for easy readability and ready for use in your required tasks.

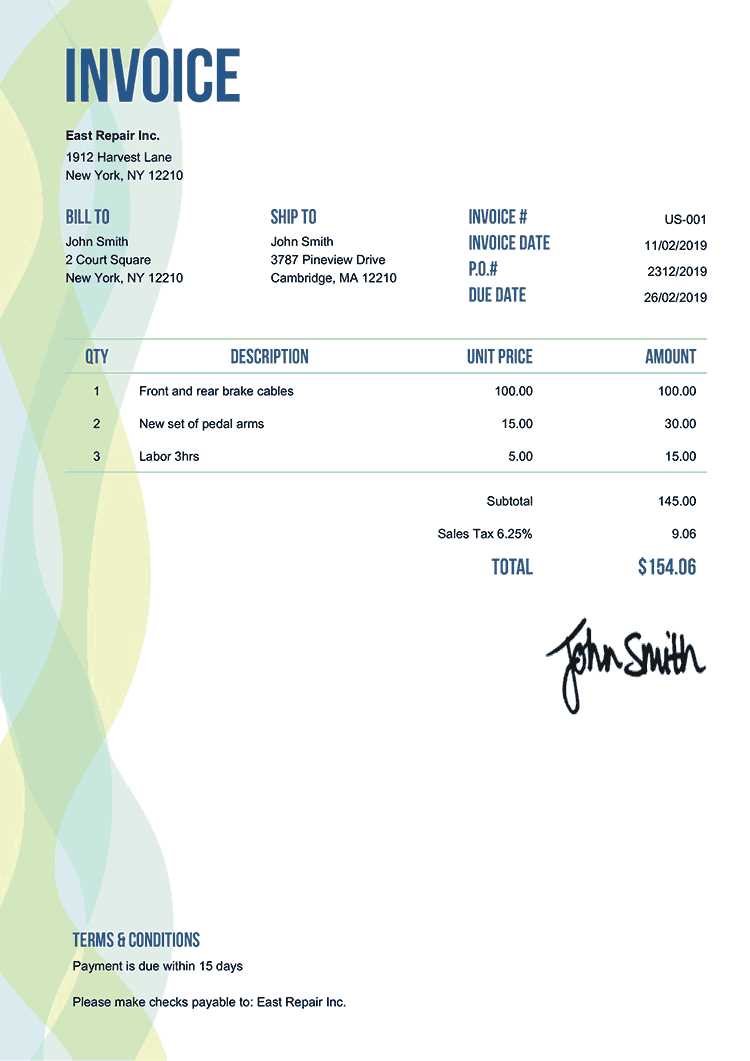

Common Features in Invoice Templates

When creating a document for billing purposes, there are several key components that help ensure clarity, organization, and professionalism. These features are typically included to make the process smoother for both the sender and the recipient, providing essential information in a well-structured format. Whether you are designing your own or using a pre-made form, understanding these common elements can help streamline your financial transactions.

Essential Information for Clear Communication

To avoid confusion, most documents of this kind include specific details about the transaction, such as the buyer and seller’s contact information, a list of products or services provided, and the agreed-upon amounts. This basic data helps both parties keep track of the transaction history and ensures transparency.

Customization Options

Many billing documents come with customizable sections that allow you to add unique identifiers, payment terms, and company branding. This flexibility helps make the document match the specific needs of your business, offering a more personalized touch while maintaining consistency and professionalism.

Feature Purpose Contact Details Ensures clear identification of both parties involved in the transaction Itemized List Breaks down the products or services provided for clear understanding Pricing Information Displays unit prices, totals, and taxes for accurate financial tracking Payment Terms Defines the due date and any penalties for late payments Company Branding Enhances professionalism and helps with brand recognition Incorporating these elements into your financial documentation ensures that the process is smooth, organized, and easy to understa

Design Tips for Professional Invoices

Creating a well-designed document for billing purposes is crucial for leaving a positive impression on your clients. A professional layout not only enhances clarity but also reflects the quality of your business. A visually appealing and organized document ensures that all key information is easy to find and understand, making the transaction process smoother for both parties.

Keep the Layout Clean and Simple

When designing a document for financial transactions, clarity is key. Avoid overcrowding the page with too much information or unnecessary graphics. Focus on the essential details, such as contact information, payment terms, and itemized listings, and make sure there’s plenty of white space around them. A simple, clean layout will make the document easier to read and more professional-looking.

Use Consistent Branding and Fonts

Incorporate your company logo, color scheme, and consistent fonts to make the document recognizable and aligned with your brand identity. Using clear, readable fonts like Arial or Times New Roman ensures that the text is legible, even when printed. Avoid using too many different fonts or overly decorative styles, as they can distract from the content.

Design Element Best Practices Fonts Use easy-to-read fonts such as Arial or Helvetica for main text, with larger sizes for headings. How to Add Payment Terms to an Invoice

Including clear payment terms in your billing documents is essential to set expectations and ensure timely payments. These terms outline when the payment is due, any late fees, and acceptable methods of payment. By providing these details upfront, you protect both your business and your client from misunderstandings and disputes.

To add payment terms, it’s important to clearly state the due date, any discounts for early payment, and penalties for late payment. Make sure this section is visible and easy to find, typically near the bottom or in a designated area. The goal is to ensure the recipient understands their financial obligations without confusion.

Payment Term Description Due Date The date by which payment must be received. This is typically set to a specific number of days from the issue date, such as “30 days from issue.” Late Fees Specify any additional charges applied if payment is not received by the due date, such as “1.5% per month after the due date.” Early Payment Discount Offer incentives for early payment, such as “2% discount if paid within 10 days.” Accepted Payment Methods List the payment options available, such as bank transfer, credit card, or online payment systems. By clearly communicating payment terms, you foster transparency and professionalism, which can lead to faster payments and a better relationship with your clients.

Including Tax Information in Your Invoice

Properly including tax details in your billing document is essential for compliance and transparency. It ensures that both you and your client are clear on the total cost of the transaction, including applicable taxes. Correctly displaying this information not only helps avoid disputes but also ensures your business meets local tax regulations.

When adding tax information, make sure to specify the type of tax being charged, the applicable rate, and the total amount. This can vary depending on your location or the type of products and services provided. Clear tax breakdowns help your clients understand how the total is calculated and why specific amounts are added.

Tax Information Description Tax Type Specify whether it’s a sales tax, VAT, or another type of tax, depending on local regulations. Tax Rate Indicate the percentage applied to the total amount, such as “5%” or “VAT at 20%.” Tax Amount Clearly show the calculated tax based on the subtotal and the applicable rate. Total Amount Include the final amount due, which should incorporate both the subtotal and tax amount. By including accurate tax details, you ensure that both parties understand the financial implications of the transaction. This level of transparency helps build trust with clients and minimizes the risk of any legal or financial issues down the line.

Incorporating Your Business Logo

Adding your business logo to a billing document serves as an important step in creating a professional and cohesive brand identity. The logo not only helps clients recognize your company instantly but also adds an element of trust and credibility to the transaction. A well-placed logo makes your document look more polished and reinforces your brand in every communication with your clients.

Where to Place Your Logo

The logo should be placed in a prominent yet balanced location on the page. Typically, it’s positioned at the top, either in the center or to the left, ensuring it’s the first thing the recipient sees. This placement ensures that your branding is visible without overpowering the essential details of the document. It should enhance, not detract, from the clarity of the information presented.

Choosing the Right Size and Resolution

It’s crucial to select a logo image with a high resolution to avoid pixelation or blurriness when printed. The size should be large enough to be easily recognizable, but not so large that it takes away from the readability of the document. A small, clean logo placed strategically creates a professional appearance without cluttering the page.

Consideration Best Practice Placement Top left or center, ensuring visibility without overwhelming the content. Size Maintain a balanced size – large enough for visibility, but not too large to distract. Resolution Use a high-quality image to avoid pixelation, ensuring clarity in both digital and print formats. Consistency Ensure the logo aligns with your brand’s visual identity and matches other business materials. By incorporating your logo, you not only enhance your document’s visual appeal but also strengthen your brand presence. Every interaction with clients is an opportunity to reinforce your business identity, and a branded document helps make a lasting impression.

How to Organize Your Invoice Records

Keeping your billing documents organized is essential for efficient financial management. Properly storing and tracking these records not only ensures you stay on top of your payments and expenses but also helps with tax reporting and auditing. An organized system allows you to quickly access any past transaction details when needed, reducing stress and saving time.

Use a Digital Filing System

In today’s world, a digital filing system is often the most efficient way to store and organize your records. Use folders or a cloud-based system to categorize your documents by date, client, or project. This method allows you to easily search for specific files and share them with others when necessary. Additionally, keeping digital copies ensures that you have backups in case of physical damage or loss.

Label and Categorize Your Documents

When organizing your records, labeling is key. Use a clear and consistent naming convention that includes essential details such as the client name, date of the transaction, and a unique identifier. This can help you quickly locate a specific document without sifting through endless files. Categorizing documents by type (e.g., paid, unpaid, pending) also provides better visibility and control over outstanding payments.

Organization Method Benefits Digital Storage Easy access, backup, and sharing capabilities. Consistent Naming Improves searchability and reduces the time spent finding records. File Categorization Helps track the status of payments and identify outstanding amounts quickly. By follow

Why Accurate Invoicing is Important

Ensuring the accuracy of your billing documents is essential for maintaining a smooth financial operation. Mistakes in the details–whether it’s a wrong amount, incorrect date, or missing information–can lead to confusion, delays in payment, and potential disputes. Accurate records not only help your business maintain a professional image but also facilitate better cash flow management and compliance with tax regulations.

Building Trust with Clients

Accurate documentation reflects your attention to detail and professionalism. When clients receive error-free bills, it strengthens their trust in your business. Clear, precise records make it easier for clients to verify the charges, minimizing the chances of misunderstandings or dissatisfaction. This trust is critical for building long-term relationships and repeat business.

Ensuring Legal and Financial Compliance

Incorrect or incomplete billing can lead to legal complications, especially when it comes to tax reporting and audits. For example, failing to include the proper tax rate or not documenting the right payment terms can result in penalties or issues with regulatory bodies. Maintaining precise records ensures your business operates within the law and avoids unnecessary complications.

Consequence Impact of Inaccurate Records Client Disputes Misunderstandings about charges may lead to delayed payments or lost clients. Cash Flow Issues Errors can result in delayed or missed payments, affecting business liquidity. Legal Penalties Incorrect details can lead to fines or tax complications during audits. In summary, maintaining accurate billing records is not just a matter of keeping track of payments–it is a critical aspect of managing your business reputation, ensuring financial

How to Handle Invoice Errors

Errors in financial documents are a common occurrence in business transactions, but it’s essential to address them quickly to maintain professionalism and avoid confusion. Whether it’s a mistake in calculations, incorrect details, or missing information, knowing how to efficiently correct these issues can help preserve trust and ensure smooth operations. The key to resolving discrepancies lies in clear communication and prompt action.

Once an error is identified, it’s crucial to review the document thoroughly and ensure that all other details are correct before making adjustments. Inaccurate entries, such as wrong amounts or incorrect dates, can lead to delays in payments or misunderstandings with clients. The first step in handling such discrepancies is to notify all involved parties and provide a corrected version with clear explanations for the amendments.

Common Errors Possible Solutions Incorrect calculations Double-check all figures and recalculate totals. Reissue the document with revised amounts. Wrong client or company details Ensure the correct contact information is used. Send an updated version with proper details. Omitted services or items Review the original agreement and include missing details. Provide a corrected version with an explanation. Unclear payment terms Clarify terms and conditions in the updated version to avoid confusion about deadlines or methods. By maintaining accuracy and clear communication, any errors can be resolved quickly and effectively, preventing any disruption to your financial processes and client relationships.

Managing Different Invoice Formats

In business transactions, the ability to handle various document formats is essential for ensuring smooth communication with clients and partners. Different formats serve specific purposes and cater to diverse needs, whether for legal compliance, convenience, or professional branding. Understanding how to manage and choose the right format for each situation can enhance efficiency and maintain consistency in financial documentation.

Digital Formats offer the advantage of easy distribution, fast processing, and environmental benefits. Files that are shared electronically are often more flexible, allowing for quick modifications and seamless storage. However, it’s crucial to ensure that the format used can be accessed by all involved parties, especially if specialized software is required to view or edit the document.

Printed Versions are still necessary in certain cases where physical records are preferred or legally required. These are typically used when hard copies are essential for filing or official documentation. While the production and distribution may take longer, printed documents are often seen as more formal and may be necessary in some jurisdictions for tax or regulatory purposes.

Mixed Formats combine both electronic and printed options to offer flexibility. In this case, digital files may be sent as a preliminary draft, with physical copies delivered later for final approval or signature. This approach can cater to clients who prefer one format over the other while ensuring that all needs are met.

Format Advantages Challenges Digital Quick to send, easy to store, eco-friendly Software compatibility, security risks Printed Official, physical record, universally accepted Slower delivery, environmental impact Mixed Flexib Top Free Invoice Templates Available

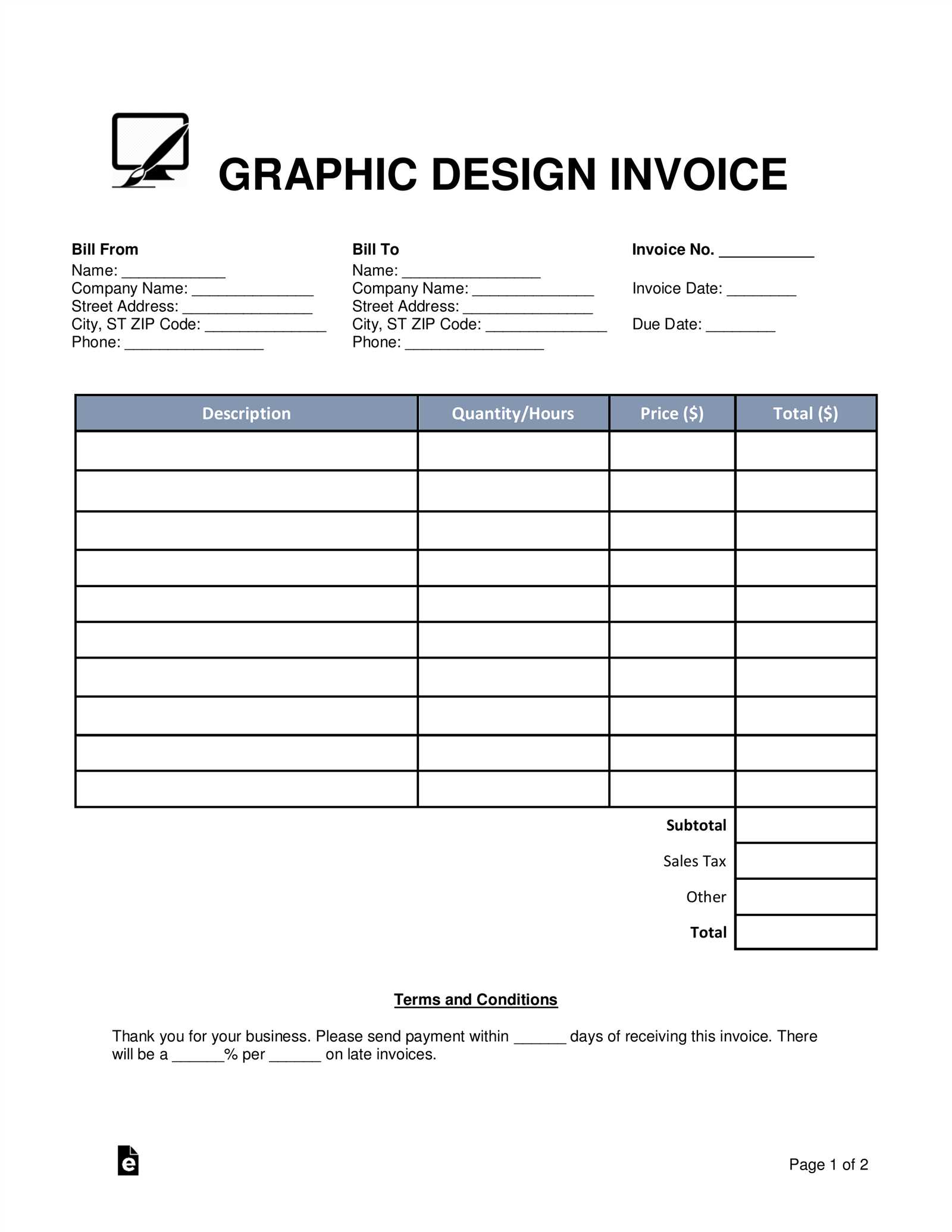

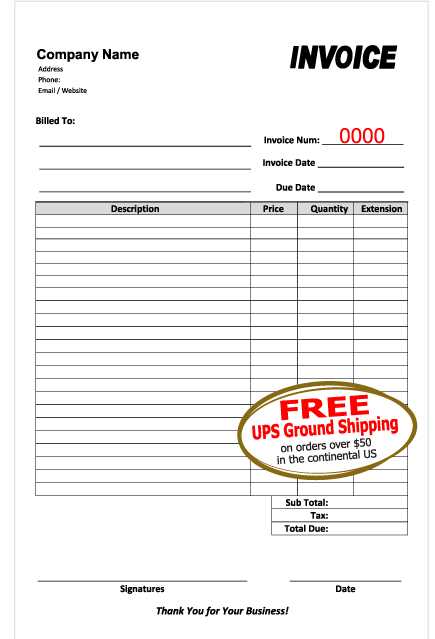

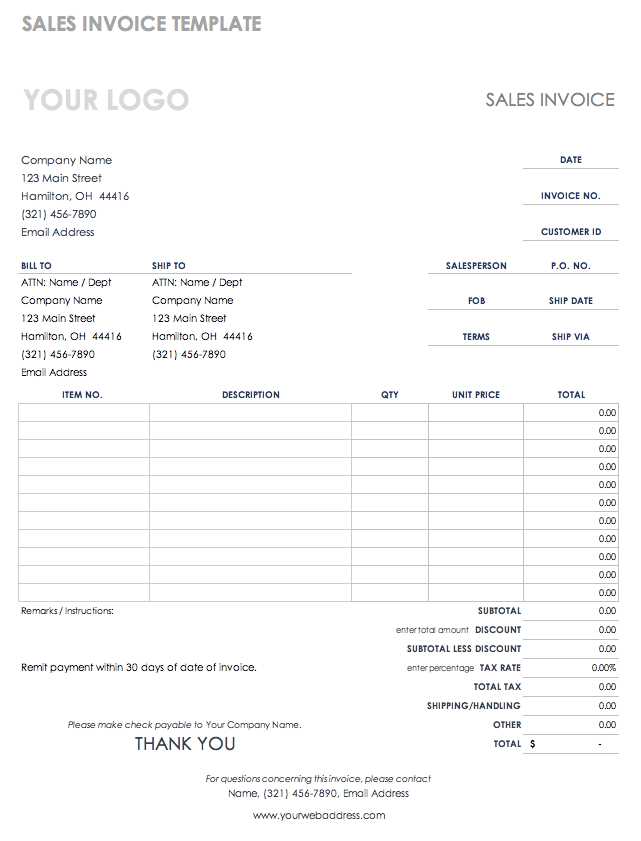

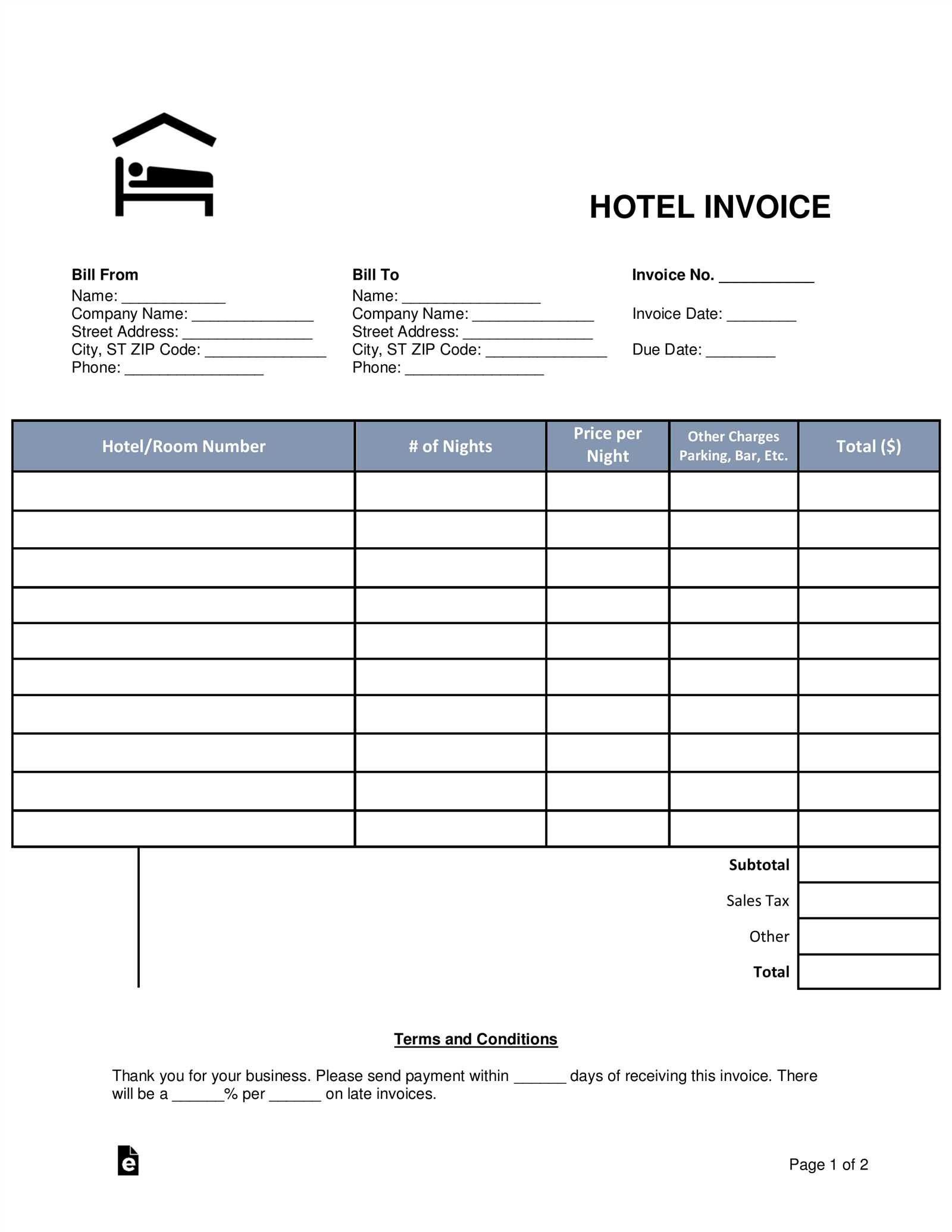

For businesses of all sizes, using the right format for financial documentation is essential. Whether you’re a freelancer, a small business owner, or part of a larger organization, having access to pre-designed layouts can save time and ensure consistency. There are a variety of free designs available online, offering customizable options that suit different industries and needs. These options can help you maintain a professional appearance while simplifying the process of tracking payments and managing client relations.

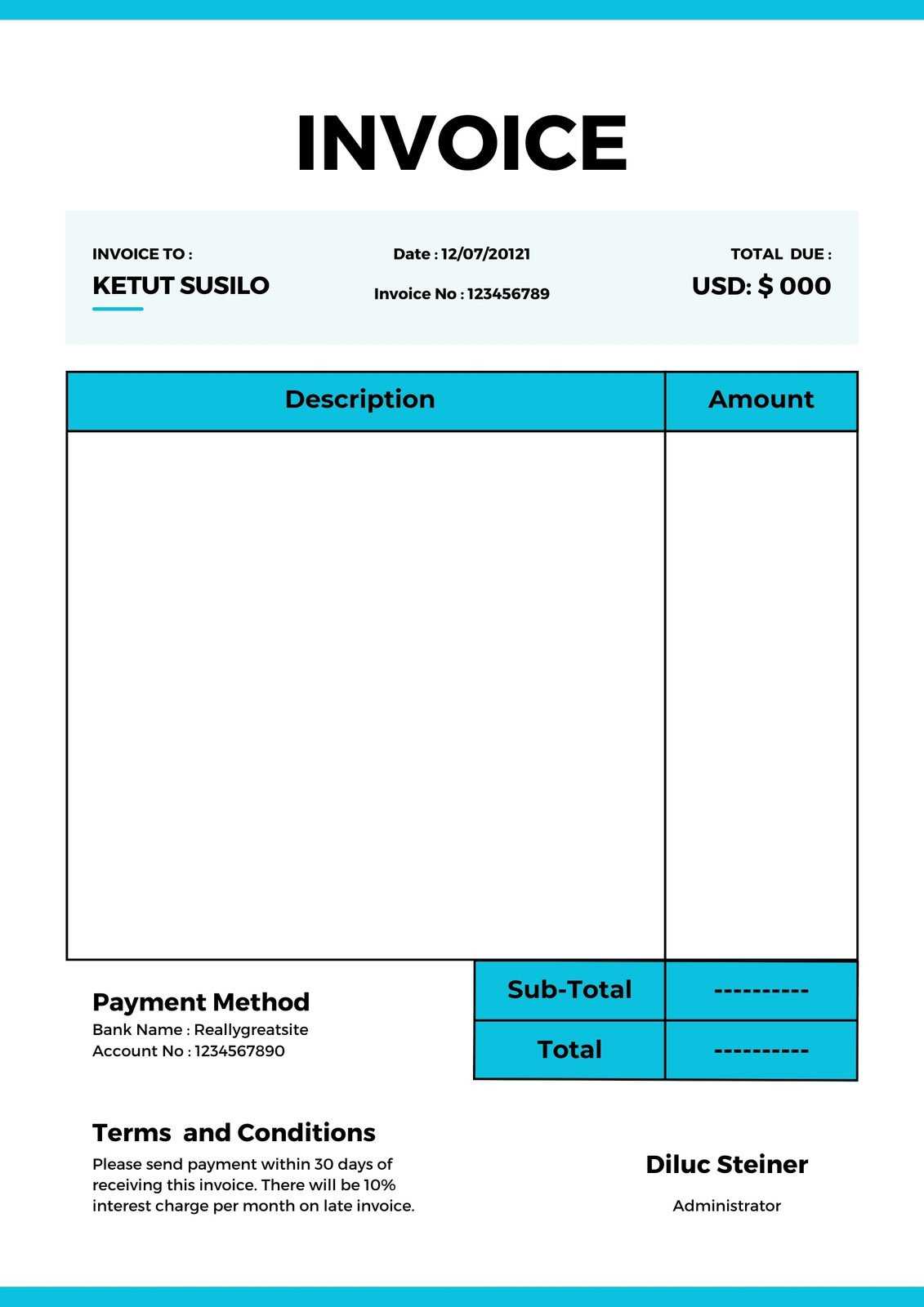

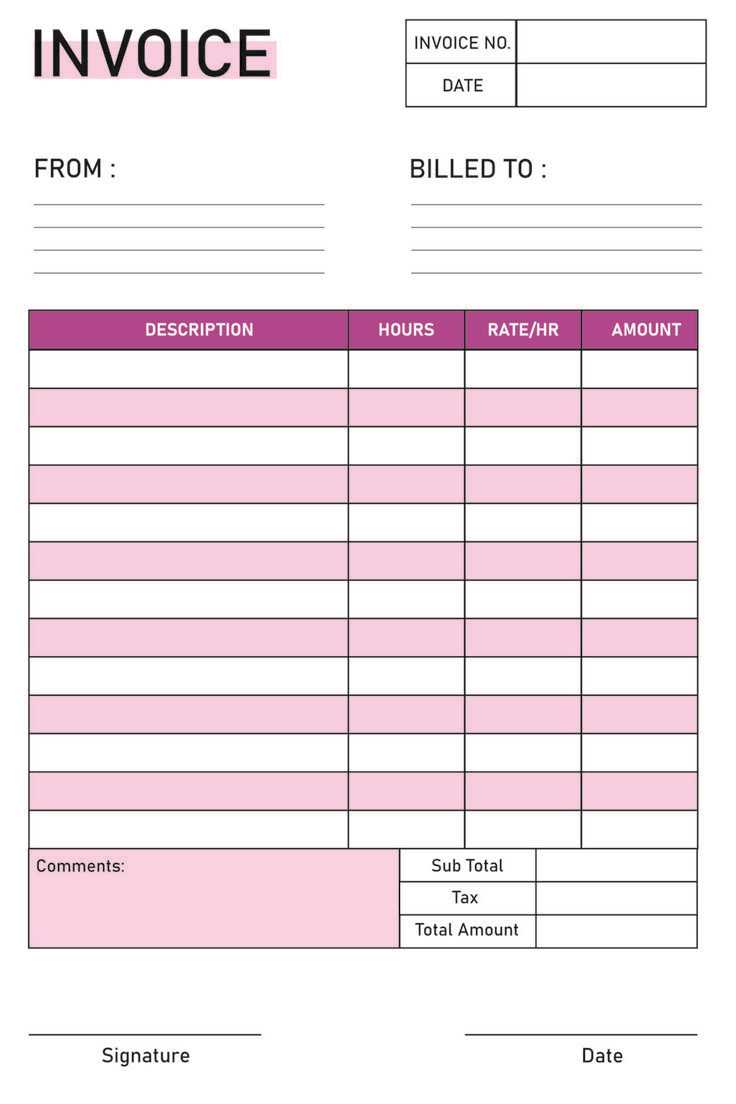

Minimalist Design

Simple and clean formats are ideal for those who prefer a straightforward approach. These layouts focus on the essential details, presenting the information in an easy-to-read manner. The design is uncluttered, making it suitable for small businesses or freelancers who want to convey professionalism without extra embellishments. You can easily add your company logo and customize fonts to match your brand identity.

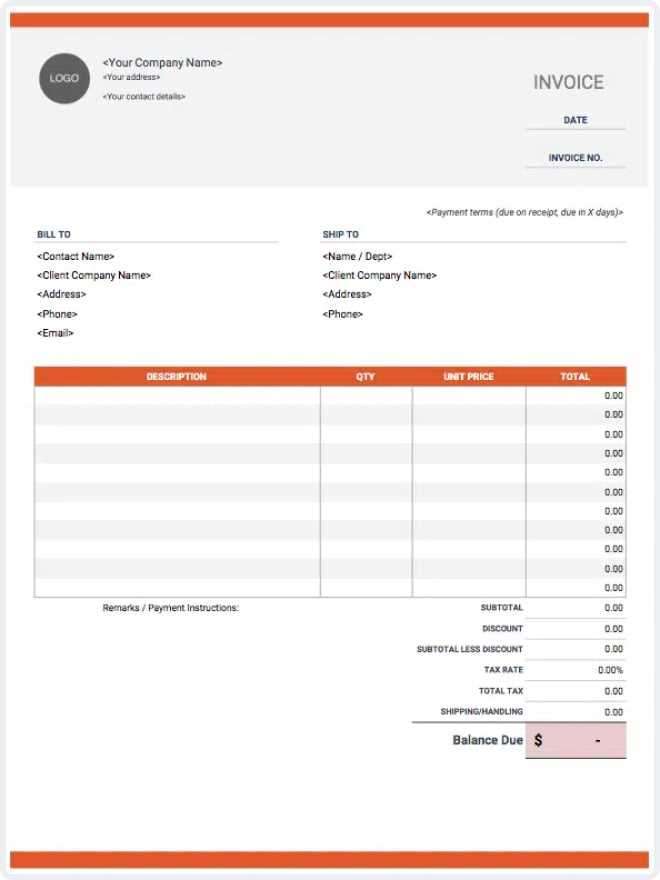

Detailed and Professional Layouts

If your business requires a more structured and formal document, you can find comprehensive formats that offer sections for terms, itemized services, and payment schedules. These designs often include more complex fields such as discounts, taxes, and additional notes. They are perfect for service-based businesses or any organization that needs to provide clear, detailed billing to clients. Many of these layouts are pre-configured for compliance with legal or industry standards, ensuring that your documents meet all necessary requirements.

Customization options are key to making these designs fit your business. Most free designs allow you to adjust fields, colors, and other details, ensuring that the final document aligns with your brand and professional style.

Security Considerations for PDF Invoices

When sharing sensitive financial documents, protecting the integrity and confidentiality of the information is crucial. These records often contain personal and business details that can be exploited if they fall into the wrong hands. To mitigate security risks, it’s essential to implement measures that safeguard against unauthorized access and tampering. Below are key considerations to ensure your digital documents remain secure throughout their lifecycle.

1. Password Protection

One of the most effective ways to secure documents is by using password protection. This adds an extra layer of security, ensuring that only authorized individuals can access the content. Consider the following tips when using passwords:

- Use strong, unique passwords that combine letters, numbers, and special characters.

- Change passwords periodically and avoid reusing them for multiple files.

- Share passwords securely, using encrypted communication methods when necessary.

2. Digital Signatures and Encryption

Digital signatures and encryption provide a means to verify the authenticity of documents and protect the content from unauthorized alterations. Here’s how to use them effectively:

- Digital Signatures: A digital signature ensures that the document has not been tampered with and verifies the sender’s identity. This adds credibility to the document and helps prevent fraud.

- Encryption: Encrypting your files ensures that only those with the decryption key can view the contents, making it nearly impossible for unauthorized users to access or alter the information.

3. Secure File Sharing Methods

How you share your documents plays a significant role in security. Instead of sending sensitive files via unencrypted email or unsecured platforms, consider using the following options:

- Cloud storage services with built-in encryption and access control features.

- Secure file transfer protocols (SFTP) that provide a more secure way of exchanging files.

- Password-protected links for sharing documents safely over the web.

By employing these best practices, you can protect your business and clients from potential security threats and ensure that all financial records remain safe and confidential.