Band Performance Invoice Template for Easy and Professional Billing

Managing finances is a critical aspect of any musical career. Having a clear and organized method to request payment for your services ensures that you are paid on time and professionally. Whether you are playing at local venues or touring, it’s important to present an official and easy-to-understand document when requesting compensation.

Creating an efficient and streamlined billing system can help you avoid misunderstandings with clients and make sure that all terms are clear. By using well-structured documents that outline the details of your engagement, you can maintain trust and clarity in your professional relationships.

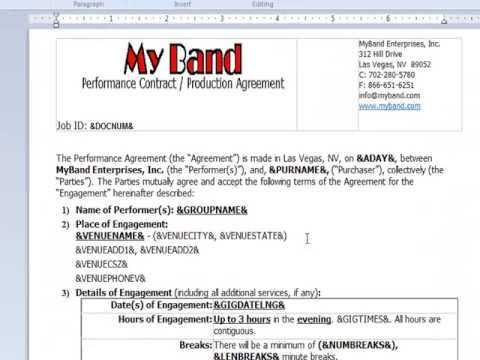

Customizable billing documents are an essential tool for musicians. They allow you to adapt each document to the specific terms of your agreements, including performance rates, dates, and payment methods. This level of customization ensures that every transaction is handled smoothly and accurately.

Band Performance Invoice Template Overview

When it comes to requesting payment for musical engagements, having a well-organized and professional document is crucial. This type of document serves as a formal request for compensation, ensuring all essential details of the arrangement are clearly outlined. It helps both the musician and the client stay on the same page and ensures that all terms are agreed upon before any work begins.

Creating a clear and concise request for payment can make the billing process more efficient, helping avoid potential disputes. With a properly formatted document, you can specify the agreed-upon rate, the duration of the gig, and any additional fees that may apply. This level of organization can also make it easier to track payments and maintain financial records.

Customizable structures are key when tailoring these documents to fit different situations. Whether you’re working with a local venue or a large event organizer, having a flexible framework ensures that each request for payment is accurately reflective of the terms you’ve set. This not only streamlines the process but also enhances your professionalism in the eyes of your clients.

Importance of Using an Invoice Template

Having a structured document for payment requests is essential for maintaining a smooth and professional business operation. By using a predefined format, you ensure that all necessary details are included and presented in an organized manner. This not only saves time but also enhances your credibility and streamlines the entire process of billing.

Without a consistent system in place, it’s easy to overlook key information or leave clients with questions about the payment terms. A well-crafted document ensures clarity and prevents misunderstandings, both of which are crucial for long-term business relationships. It acts as both a reminder and a contract, clearly outlining what is owed and when.

Benefits of Using a Structured Document

- Efficiency: Quickly generate and send accurate payment requests without missing important details.

- Professionalism: A clean and consistent format reflects well on your business, giving clients confidence in your services.

- Clarity: Clearly list terms, fees, and payment expectations, reducing the risk of confusion.

How It Helps with Record Keeping

By using a consistent system, you also create a reliable record of all transactions. This can be invaluable for tax purposes, financial tracking, and resolving any future disputes. With a clear history of engagements and payments, you can easily monitor your income and plan for future work.

Key Elements in a Band Invoice

When creating a formal request for payment, it’s essential to include specific details that ensure clarity and accuracy. A well-structured document should clearly communicate the terms of the agreement, the services provided, and the total amount due. By including all necessary information, you protect both yourself and your client, minimizing the chance for misunderstandings.

Each payment request should contain certain standard components to be effective. These components help define the transaction, outline expectations, and establish the formal nature of the agreement. Below are some of the most important elements to include in your payment request documents.

Essential Information to Include

- Contact Information: Clearly list both the provider’s and client’s details, such as name, address, and phone number.

- Service Description: Include a brief description of the services provided, such as the event date, duration, and any special requirements.

- Payment Terms: Specify the payment amount, due date, and any additional fees, such as travel or equipment costs.

- Payment Instructions: Clearly state the accepted methods of payment and any necessary account details or instructions for transferring funds.

Additional Details to Enhance Clarity

- Itemized Breakdown: If applicable, break down the cost into categories (e.g., hourly rate, travel expenses) for better transparency.

- Late Fees: Include any clauses regarding late payments to ensure that clients are aware of potential penalties for overdue invoices.

How to Customize Your Invoice

Personalizing your payment request document allows you to tailor it to the specifics of each engagement, ensuring it accurately reflects the terms you’ve agreed upon. Customization can range from adjusting the layout to modifying the content based on the nature of the job, the client, and any special arrangements made. This process not only helps maintain consistency but also ensures clarity for both parties involved.

Making adjustments to your document is a straightforward task, but it requires attention to detail. Whether you’re adding a new service fee, modifying payment terms, or adjusting contact information, each modification should be made thoughtfully to ensure the document remains professional and clear.

Steps to Customize Your Document

- Edit Client Information: Ensure that the recipient’s name, address, and contact details are always accurate to avoid any confusion.

- Adjust Service Descriptions: Tailor the description of your work based on the specific job. Include details such as the nature of the event, special requests, or specific arrangements that apply to that particular engagement.

- Update Payment Details: Modify the agreed-upon fee, payment methods, and any deadlines, ensuring they match the specifics of the arrangement.

Advanced Customization Options

- Add Personal Branding: Incorporate your logo or brand colors to make the document more professional and recognizable to your clients.

- Include Special Terms: If there are specific clauses like late fees, deposit requirements, or cancellation policies, make sure they are clearly written in the document.

Free Invoice Templates for Musicians

For musicians, having access to a ready-made payment request document can save time and reduce administrative work. Free customizable options are widely available online, offering easy-to-use formats that can be adapted for various types of engagements. These pre-designed documents help ensure that all necessary details are included, allowing you to focus more on your craft rather than on paperwork.

Utilizing a free document not only simplifies the billing process but also maintains a professional appearance, making it easier for clients to process payments quickly. Whether you are booking local gigs or larger events, these resources allow you to create accurate and efficient payment requests without starting from scratch each time.

Where to Find Free Resources

- Online Tools: Many websites offer free document generators designed specifically for musicians, providing templates you can fill out and download instantly.

- Spreadsheet Programs: Platforms like Google Sheets or Excel often have built-in templates, which can be customized to suit your needs.

- Music Industry Websites: Some organizations or industry-specific platforms offer free templates as part of their resources for musicians.

Advantages of Using Free Templates

- Cost-Effective: Free resources eliminate the need to purchase expensive software or hire someone to create documents for you.

- Time-Saving: Pre-made documents allow you to quickly generate a payment request, ensuring you get paid faster and avoid unnecessary delays.

- Customizable: Most free resources are designed to be flexible, allowing you to adjust details like pricing, dates, and additional charges as needed.

Tips for Accurate Billing in Music Gigs

Properly managing the financial side of your musical engagements is essential for maintaining a professional reputation and ensuring timely payments. Accurate billing is key to avoiding confusion, ensuring fair compensation, and building trust with your clients. By paying attention to detail and following a few best practices, you can streamline the billing process and avoid common mistakes.

Being precise with your charges, terms, and expectations from the outset helps avoid misunderstandings later. Whether you’re working with venues, event organizers, or private clients, clear communication about the cost and payment methods is crucial. Below are some tips to ensure your billing process is accurate and smooth.

Best Practices for Clear Billing

- Document Everything: Always include the exact date, time, location, and nature of the services provided. This ensures that both you and your client are on the same page regarding what was agreed upon.

- Clarify the Fees: Be explicit about your fees, including the hourly rate, flat fees, and any additional charges such as travel or equipment rental. A clear breakdown helps prevent disputes.

- Set Payment Terms Upfront: Agree on payment methods and timelines before the gig. Make sure to specify due dates and accepted forms of payment, such as cash, check, or digital transfers.

How to Avoid Common Billing Errors

- Double-Check Calculations: Before sending your payment request, review the total amount to ensure all charges are included and correct.

- Keep Detailed Records: Save copies of your billing documents and any correspondence related to payments for future reference.

- Confirm Payments: After receiving payment, send a confirmation to your client, ensuring both parties are aware that the transaction is complete.

How to Calculate Performance Fees

Determining the appropriate fee for your services is a vital aspect of managing your musical career. A fair and clear calculation ensures that you are compensated appropriately for your time, effort, and expertise. The process can vary depending on factors such as the event type, duration, location, and any additional requirements that may affect the final fee.

To calculate your fee accurately, you should consider a few key factors, such as your hourly rate, flat fees, travel expenses, and any special requests. By factoring in all potential costs, you can provide a transparent and reasonable fee structure for your clients, avoiding confusion or disputes later on.

Factors to Consider When Setting Fees

- Hourly Rate: Determine your base rate per hour or for specific services. This may vary depending on the event’s complexity or the level of preparation required.

- Flat Fees: For certain types of engagements, such as private parties or small gatherings, a flat fee may be more appropriate than an hourly rate.

- Travel and Accommodation Costs: If the event is located far from your base, include any transportation, lodging, or meal expenses in the final calculation.

- Equipment or Additional Requirements: If you’re providing extra services, such as equipment rental or special accommodations, factor these costs into the overall fee.

How to Present Your Fee Calculation

- Be Transparent: Provide a clear breakdown of how the fee is calculated so clients understand exactly what they’re paying for.

- Adjust for Market Rates: Ensure your fees align with industry standards for similar engagements, adjusting for your experience and reputation.

- Include Payment Terms: Make it clear whether the full amount is due upfront, in installments, or after the event, and specify any deposits required.

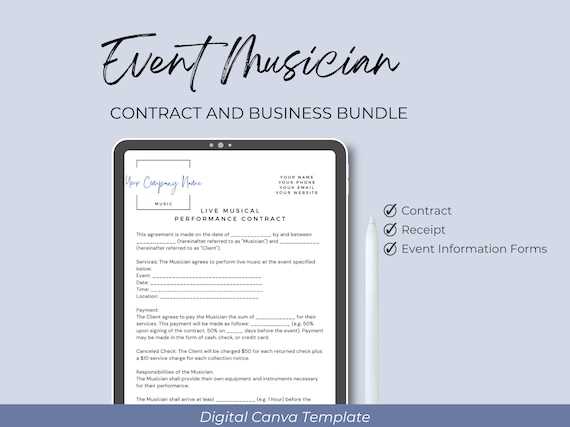

Legal Considerations in Band Invoices

When requesting payment for your musical services, it’s essential to ensure that your documents comply with legal requirements and protect your interests. Properly drafted billing documents not only clarify the terms of your agreement but also help you avoid potential legal issues down the line. It’s crucial to include the right legal language and clauses to safeguard both you and your clients.

From payment deadlines to cancellation policies, having the correct terms in your payment requests is necessary for minimizing disputes and ensuring that both parties understand their responsibilities. By incorporating legal considerations into your payment documents, you create a clear and enforceable agreement.

Key Legal Clauses to Include

- Payment Terms: Clearly state the payment schedule, including any deposits or installments, and the deadline for full payment. Specify the consequences for late payments, such as late fees or interest charges.

- Cancellation and Refund Policies: Outline your policies in case the event is canceled or rescheduled. Include conditions under which refunds are issued or retainment of the deposit is necessary.

- Dispute Resolution: Include a clause specifying how disputes will be handled, such as through mediation or arbitration, rather than litigation.

Protecting Your Intellectual Property

- Copyright Protection: If you’re providing original music or compositions, ensure your rights to intellectual property are clearly outlined. Include a statement about how your music may be used or reproduced by the client.

- Work for Hire Agreements: In some cases, you may want to clarify whether the client owns the rights to the music or if it remains yours, especially if custom work is involved.

Common Mistakes to Avoid in Invoices

Creating a payment request document might seem straightforward, but there are several common errors that can lead to confusion, delays, or disputes with clients. A small mistake in the details can have a big impact on the professionalism of your business and your ability to receive timely payment. By being aware of these common issues, you can ensure that your documents are clear, accurate, and effective.

It’s crucial to be precise with the information you include, as well as the way it’s presented. Simple mistakes, like omitting key details or miscalculating fees, can make it difficult for your clients to process payments or lead to unnecessary back-and-forth. Below are some of the most frequent mistakes to watch out for when drafting your payment requests.

Frequent Errors to Avoid

- Incorrect Client Information: Double-check the client’s name, address, and contact details to ensure there are no mistakes that could delay payment.

- Missing or Incorrect Dates: Be sure to include the date of the service and the due date for payment. An unclear or missing deadline can cause confusion about when the payment is expected.

- Ambiguous Payment Terms: Clearly state the payment method, amount due, and any additional fees. Avoid vague terms that could lead to misunderstandings later.

- Failing to Itemize Costs: Always provide a breakdown of services rendered, along with associated costs. This ensures transparency and helps the client understand what they’re paying for.

Other Pitfalls to Watch For

- Not Including Late Fees: If you charge late fees, make sure to include them clearly in your terms, so clients understand the consequences of delayed payments.

- Forgetting Payment Confirmation: After sending your request, confirm receipt with the client to ensure there are no issues with the payment process.

- Using an Unprofessional Format: Avoid using informal language or poor formatting. A clean, professional layout reflects your attention to detail and helps build trust with clients.

Tracking Payments and Due Dates

Keeping track of payments and their respective due dates is essential for managing your cash flow and ensuring timely compensation for your work. Without a proper system in place, it’s easy to lose track of outstanding amounts or miss deadlines, which can lead to delays in payments or confusion with clients. A clear and organized approach to tracking both payments received and those still pending will help maintain smooth business operations.

Having a detailed record of all payment deadlines and received amounts allows you to follow up with clients when necessary and keep your finances in order. Below is an example of how you can track payments and due dates efficiently in a table format.

| Client Name | Service Date | Total Amount | Amount Paid | Due Date | Status |

|---|---|---|---|---|---|

| Client A | January 10, 2024 | $500 | $500 | January 24, 2024 | Paid |

| Client B | January 15, 2024 | $750 | $0 | January 30, 2024 | Pending |

| Client C | January 20, 2024 | $600 | $300 | February 3, 2024 | Partially Paid |

By using a system like this, you can quickly see which clients have paid, which are still outstanding, and which are only partial

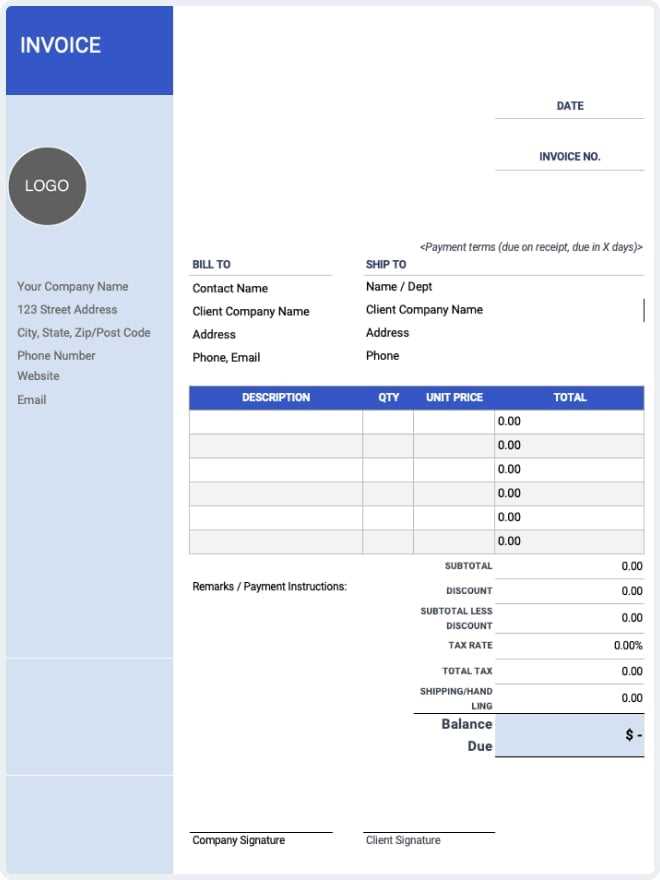

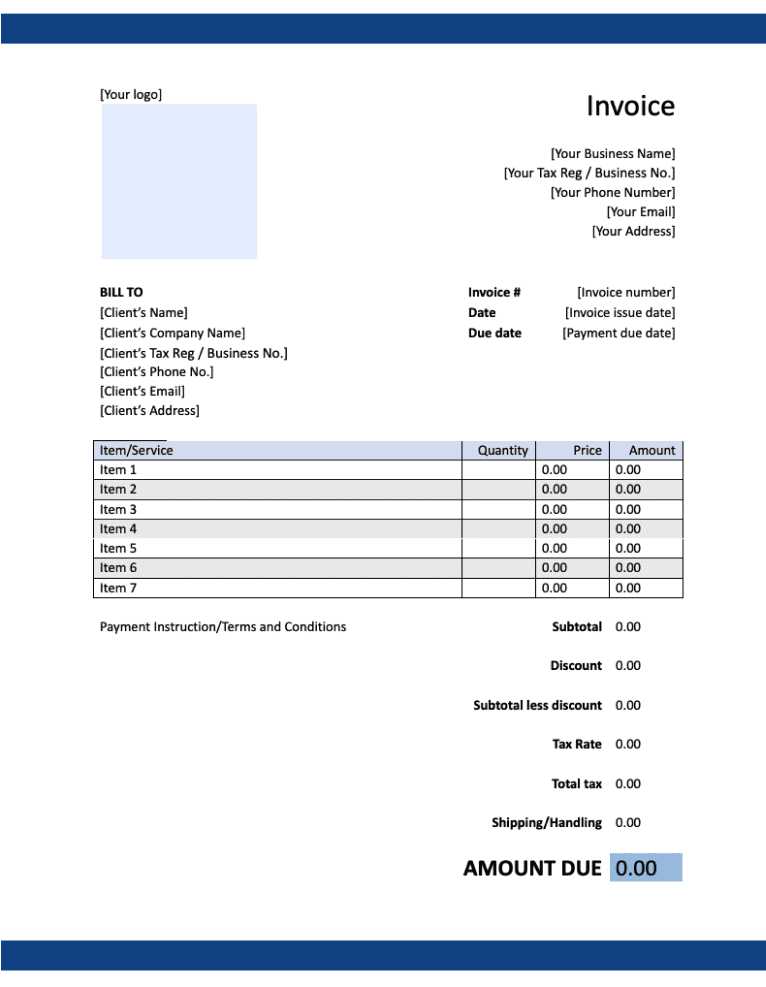

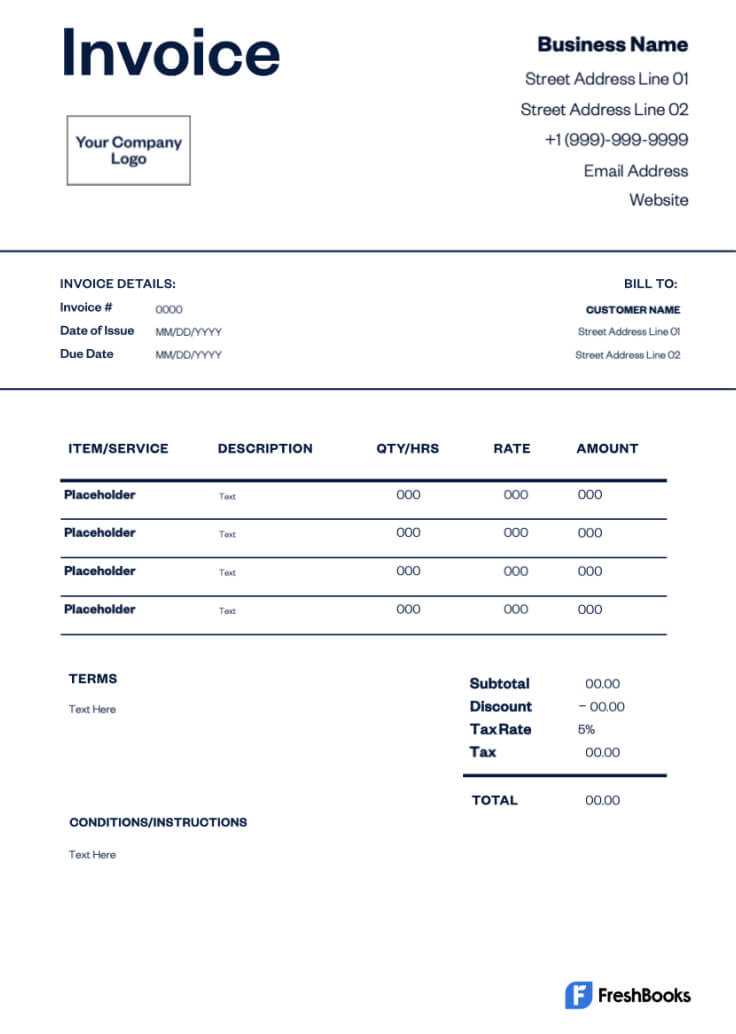

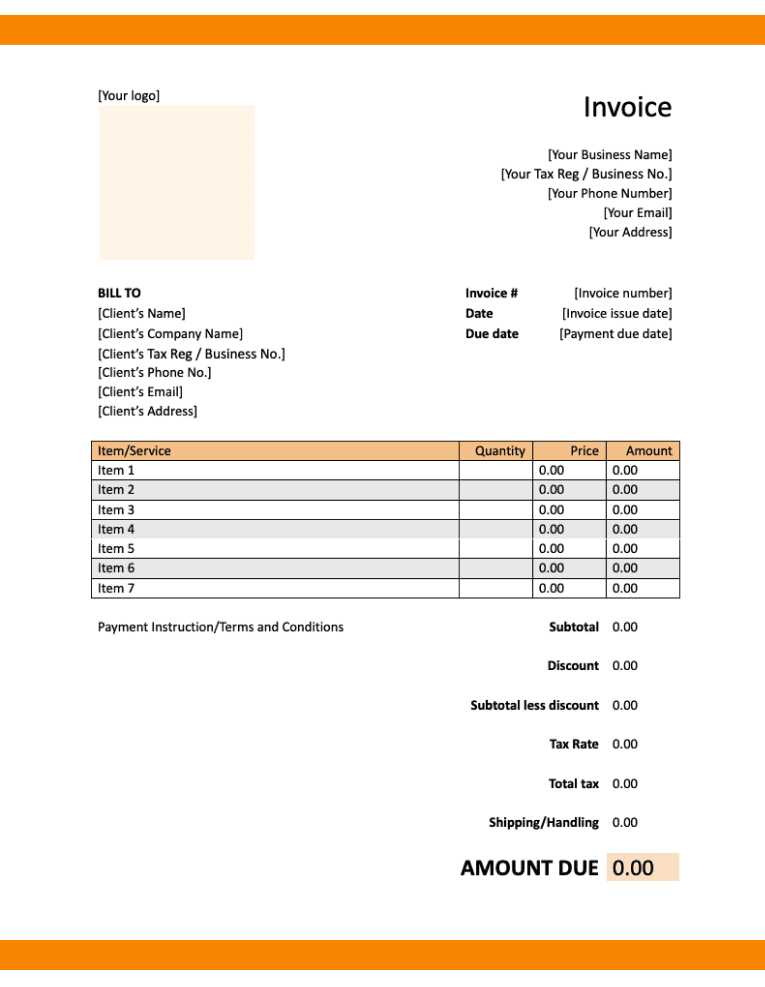

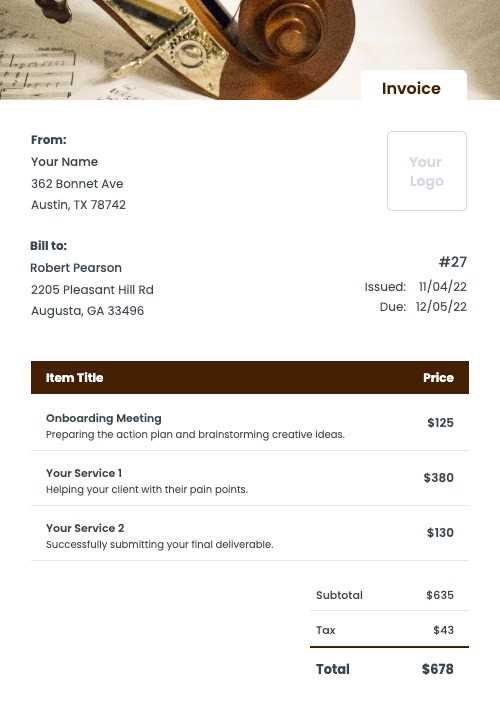

Formatting a Professional Invoice

Creating a well-structured payment request document is crucial for making a positive impression on your clients. A professional layout not only enhances readability but also ensures that all the necessary details are presented clearly and in an organized manner. Proper formatting helps clients quickly understand the charges, payment terms, and deadlines, making the entire process more efficient.

When designing a formal document for your services, it’s important to follow a few key formatting guidelines to ensure clarity and professionalism. A clean and organized presentation can help avoid confusion, prevent delays, and make your payment requests look polished.

Essential Formatting Elements

- Header Information: At the top of your document, include your business name, logo, and contact information. Make sure to clearly label the document as a “Payment Request” or something similar.

- Client Information: Include the client’s name, address, and contact details below the header. This ensures there’s no confusion about who the document is intended for.

- Date and Unique Reference Number: Include the date of the service and assign a unique reference number for easy tracking. This helps both you and the client to reference the document quickly.

Structuring the Content

- Service Breakdown: List the services provided in a clear and itemized format. Include the date, description, and cost for each item or service offered.

- Total Amount Due: At the end of the list, clearly state the total amount due, including any applicable taxes or extra fees.

- Payment Terms: Clearly mention the payment methods you accept and include the payment due date. Be specific about late fees or penalties, if applicable.

Additional Formatting Tips

- Professional Font: Use a clear, legible font like Arial or Times New Roman, and keep the font size consistent throughout the document.

- Spacing: Use sufficient spacing between sections to enhance readab

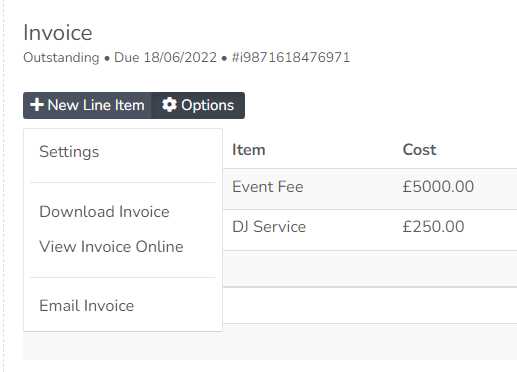

Invoice Software for Music Professionals

For musicians and other creatives in the music industry, managing payments and organizing financial records can quickly become a time-consuming task. Fortunately, specialized software can simplify this process by automating the creation of payment requests, tracking due dates, and managing client communications. Using the right tools allows you to save time, reduce errors, and maintain a professional appearance, all while keeping your finances in order.

These software solutions are designed with the needs of musicians in mind, offering intuitive interfaces and customizable features that make billing more straightforward. By using digital tools, you can focus more on your art while ensuring your business side runs smoothly and efficiently.

Benefits of Using Billing Software

- Time-Saving: Automatically generate and send payment requests, reducing the time spent on manual entry and formatting.

- Professional Appearance: Create clean, professional-looking documents that enhance your image and build trust with clients.

- Customization: Tailor each document to fit specific needs, from adding line items to adjusting terms, without having to start from scratch.

- Automated Reminders: Set up reminders for upcoming payments or overdue amounts, ensuring that you never miss a follow-up.

Top Features of Invoice Software

- Client Database: Keep track of all your clients and their details in one place, making it easy to access their information when needed.

- Customizable Templates: Choose from pre-designed templates that suit your style, or create a fully personalized layout that fits your branding.

- Payment Integration: Many software options offer direct payment integration, allowing clients to pay instantly through platforms like PayPal or credit card services.

- Expense Tracking: Track additional costs, such as travel or equipment, and include them automatically in your payment request documents.

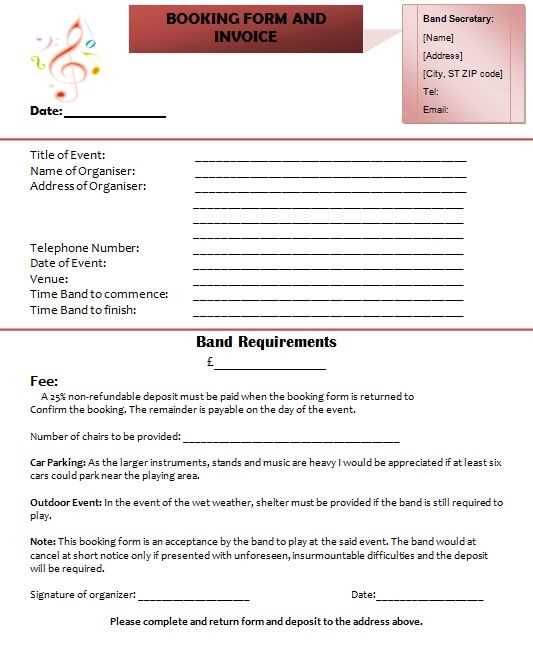

How to Handle Deposits and Advances

When booking your services, it’s common practice to request a deposit or advance to secure the engagement and ensure commitment from both parties. Handling these upfront payments properly is essential for protecting your time and effort, especially for larger events or high-demand services. By establishing clear terms for deposits and advances, you create a professional framework that minimizes the risk of cancellations or no-shows, while also ensuring that you are fairly compensated for your time.

Deposits are often a percentage of the total fee, paid before the event, while advances are usually paid in full or partially upfront. Understanding how to manage these payments effectively ensures that you maintain good relationships with clients and avoid misunderstandings about payment schedules.

Best Practices for Managing Deposits and Advances

- Specify the Amount: Clearly state the percentage or fixed amount required as a deposit. Typically, this can range from 20% to 50% of the total agreed fee.

- Include Deposit Terms: Outline the deposit payment deadlines and the conditions under which the deposit is refundable or non-refundable in case of cancellation.

- Track Payment Status: Maintain clear records of all deposits and advances received. It helps in calculating the remaining balance and ensu

Managing Multiple Gigs with Invoices

When you have multiple engagements lined up, keeping track of payments and deadlines can become overwhelming. It’s crucial to stay organized by using structured documents for each gig, so you can easily manage the financial side of your business. With a clear and consistent approach, you can efficiently handle the details of various jobs, from tracking payments to managing different terms and rates for each event.

By creating distinct records for each gig, you ensure that nothing falls through the cracks and all clients are billed accurately and on time. Keeping these financial details organized also allows you to follow up with clients in a timely manner and helps you maintain a professional reputation.

Best Practices for Managing Multiple Gigs

- Create Individual Records: For each event, create a separate payment request, even if the gigs are similar. This way, you can track each one individually, ensuring you don’t mix up details like fees, dates, and payment terms.

- Use Clear Naming Conventions: Label each document with the event name or date and a reference number to avoid confusion. For example, “Wedding_Event_June2024” or “PrivateParty_001.” This will help you quickly locate and track specific engagements.

- Set Up Automated Reminders: Use reminders for upcoming due dates, especially when you’re juggling multiple events. Setting up alerts will help you stay on top of deadlines and follow up when necessary.

- Track Outstanding Payments: Keep an organized log of paymen

How to Send and Follow Up on Invoices

Sending out payment requests and ensuring timely follow-ups is an essential part of running a successful business. The process doesn’t end with just creating and sending the document – it’s equally important to monitor and follow up on outstanding amounts. Properly managing this step ensures that you maintain a steady cash flow and a professional relationship with your clients.

By setting clear expectations and taking proactive steps to remind clients about pending payments, you minimize the risk of delays and missed payments. Here’s how to send out these documents efficiently and ensure timely payment collection.

Steps to Send Payment Requests

- Personalize the Message: When sending a payment request, ensure the email or communication is professional, polite, and personalized. Mention details about the service provided and express appreciation for the client’s business.

- Choose the Right Delivery Method: Send the document through an agreed-upon method, whether it’s via email, a payment platform, or even postal mail. Digital delivery is faster and often preferred, but ensure your client is comfortable with the method.

- Include Clear Payment Terms: In the document, ensure the payment terms are unambiguous, including the due date and the total amount due. This will make it easier for your client to process the payment without confusion.

How to Follow Up on Pending Payments

- Send a Polite Reminder: If the payment deadline has

Benefits of Using Digital Invoices for Bands

Switching to digital payment requests offers numerous advantages for those in the music industry. With the rapid growth of technology, digital tools have become an efficient solution for managing billing, reducing paperwork, and improving overall workflow. By using online payment requests, musicians and groups can streamline their financial processes and enhance their professional image.

These digital documents not only simplify administrative tasks but also offer flexibility, accuracy, and ease of access for both the service provider and the client. Below are several key reasons why digital payment requests are beneficial for music professionals.

Efficiency and Time Savings

- Instant Delivery: Digital documents can be sent immediately via email or payment platforms, eliminating delays caused by postal services.

- Automated Reminders: Many digital systems allow for automated payment reminders, reducing the time spent manually following up on outstanding balances.

- Faster Payments: With integrated payment gateways, clients can settle their dues online, often within a few clicks, speeding up the overall process.

Improved Accuracy and Record Keeping

- Error Reduction: Digital tools minimize the chance of human error, ensuring that amounts, dates, and details are accurately captured and easy to update.

- Easy Record Tracking: Keep a digital archive of all payment requests for future reference, simplifying tax preparation and financial reporting.

- Customizable Features: Many online platforms allow for easy customization, enabling you to create professional-looking documents that match your branding.