Commercial Invoice Template for Canada

When conducting business, having a well-structured document for transactions is essential. A clear and concise document not only ensures smooth communication between parties but also helps maintain legal and financial compliance. The use of standardized formats can streamline the process and reduce the chance of errors. Businesses of all sizes rely on these documents to record exchanges, manage payments, and keep track of goods or services provided.

Effective organization is key when it comes to such paperwork. A properly formatted document provides all the necessary details, making it easy to understand and process for both the sender and the recipient. With the right structure, businesses can also avoid common pitfalls such as misunderstandings or payment delays. Whether you’re dealing with local clients or international trade, having a reliable method to document each transaction is crucial.

In this section, we will explore the components that make up an effective business form. From required fields to best practices, we will provide a practical guide to creating a professional document that meets all necessary standards. Whether you’re looking to improve your current approach or start from scratch, this information will help you navigate the essentials with confidence.

Commercial Document Format for Canadian Businesses

For businesses operating in North America, having a standardized format for transaction records is crucial. These documents are used to confirm agreements between sellers and buyers, ensuring that both parties are on the same page regarding the details of their transactions. A well-designed document ensures clear communication and helps in managing payments, shipping, and other important aspects of the business exchange.

When creating such documents, Canadian businesses need to ensure compliance with local regulations and practices. The format should include all necessary details that align with legal requirements while maintaining clarity and professionalism. Here are some key aspects to consider:

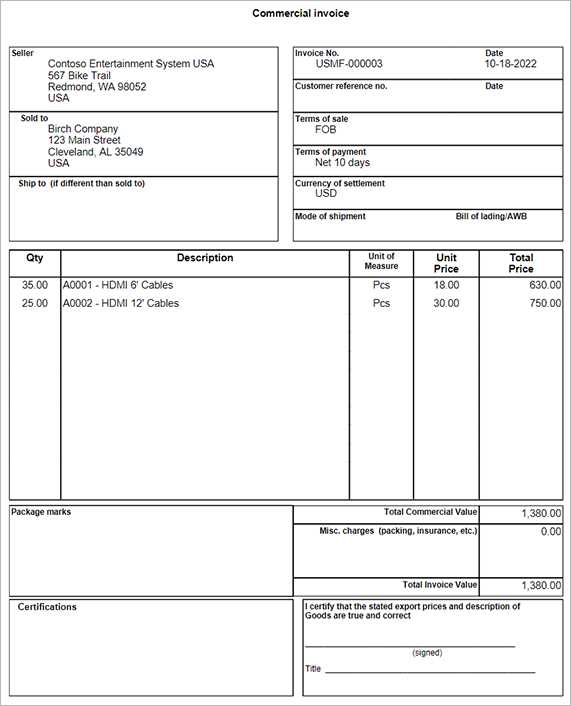

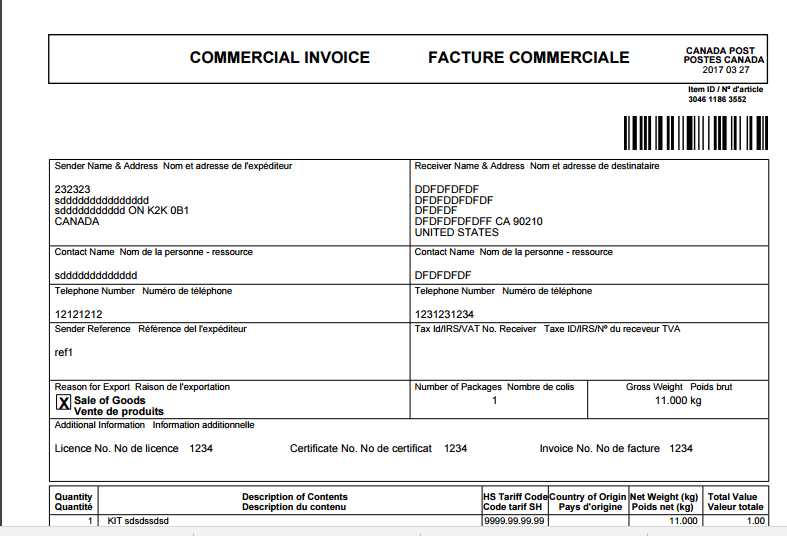

- Contact Information: Include the names, addresses, and contact details of both the sender and recipient.

- Description of Goods or Services: Clearly define what is being exchanged, including quantities, prices, and specifications.

- Payment Terms: Specify the agreed-upon payment schedule, methods, and any discounts or penalties.

- Shipping Information: Outline the delivery method, dates, and any tracking details if applicable.

- Taxes and Duties: Ensure all relevant taxes and duties are clearly itemized, in line with Canadian tax regulations.

- Legal and Compliance Statements: Add any necessary legal clauses to ensure the document complies with local laws.

By following these guidelines, businesses can create accurate and legally sound records for every transaction. A standardized document not only protects your business but also builds trust with clients and partners. It is important to regularly update the format to account for any changes in regulations or business practices to stay current and compliant.

Why Use a Template for Invoices

Using a predefined structure for transaction documents offers numerous benefits for businesses. With a consistent layout, businesses can ensure all necessary information is included and easily accessible. This approach saves time, reduces errors, and enhances the professional appearance of the paperwork. A well-organized document increases efficiency and ensures smooth processing for both the seller and the buyer.

Efficiency and Time Savings

One of the primary advantages of using a ready-made structure is the significant time savings. Instead of creating a new document from scratch for every transaction, businesses can simply input the relevant details into a pre-designed format. This quickens the process and allows companies to focus on other important tasks. Templates also help avoid redundant steps, such as reformatting or retyping standard information.

Accuracy and Consistency

Templates help maintain consistency across all business records. By following a fixed structure, businesses are less likely to overlook important details or make mistakes. Whether it’s the inclusion of contact information, product descriptions, or payment terms, a template ensures that every necessary element is accounted for. This consistency fosters professionalism and builds trust with clients and partners.

Essential Elements of a Business Transaction Document

To ensure clarity and prevent misunderstandings, every business transaction record should include several key components. These elements provide all the necessary information to both parties and ensure smooth processing of payments and deliveries. A well-structured document not only helps with financial and legal compliance but also reflects the professionalism of the business.

Key Components to Include

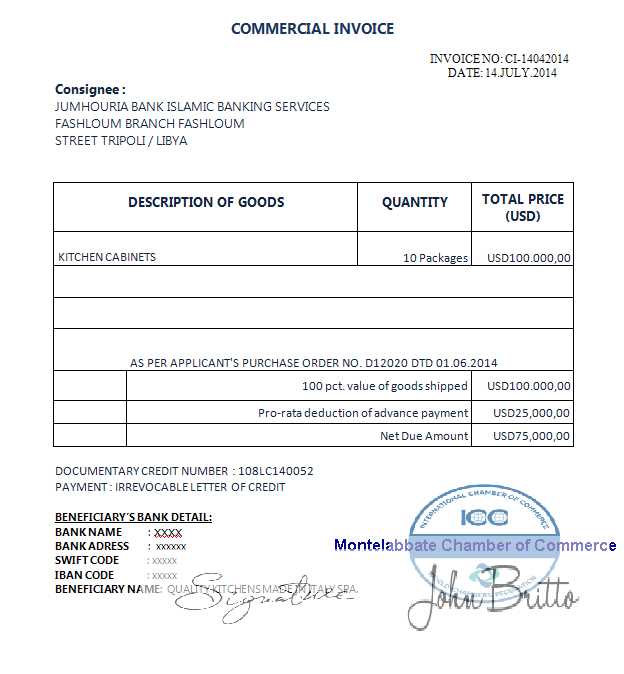

Here are the critical elements that must be included in any business document used for transactions:

- Seller and Buyer Information: The document should contain complete contact details of both the seller and the buyer, including names, addresses, and phone numbers.

- Detailed Description of Goods/Services: Clearly outline the products or services being exchanged. Include quantities, unit prices, and any specifications or serial numbers.

- Transaction Date: The date the agreement or transaction took place must be included to ensure accurate record keeping and payment tracking.

- Payment Terms: Specify the agreed payment methods, due dates, and any terms regarding early payment discounts or late payment penalties.

- Shipping Information: Indicate the delivery method, expected delivery date, and any tracking details if applicable.

- Tax and Duty Information: Include relevant taxes, duties, and other fees that may apply to the transaction according to local laws and regulations.

Additional Considerations

In addition to these core elements, there may be other relevant information depending on the nature of the transaction. For instance, businesses involved in international trade may need to include customs declarations or origin certificates. Including any additional information ensures transparency and reduces the likelihood of disputes.

Customizing Your Business Transaction Document

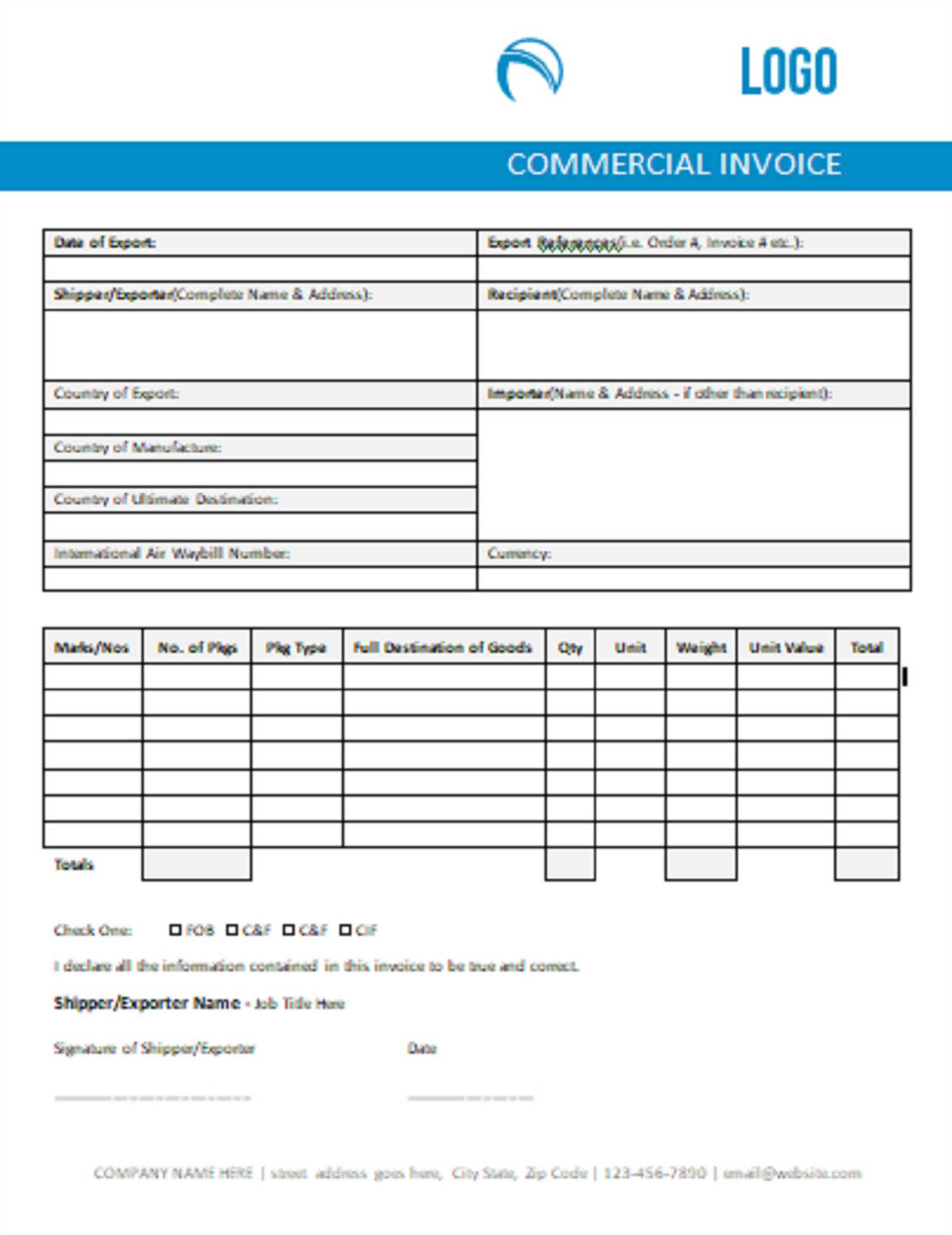

Adapting your transaction record to fit the specific needs of your business is an essential step in creating a professional and efficient system. Customizing the layout, structure, and information can help ensure that each document is tailored to the unique requirements of your clients and operations. By making these adjustments, businesses can present a more polished image and streamline their processes.

Here are some key ways to customize your document:

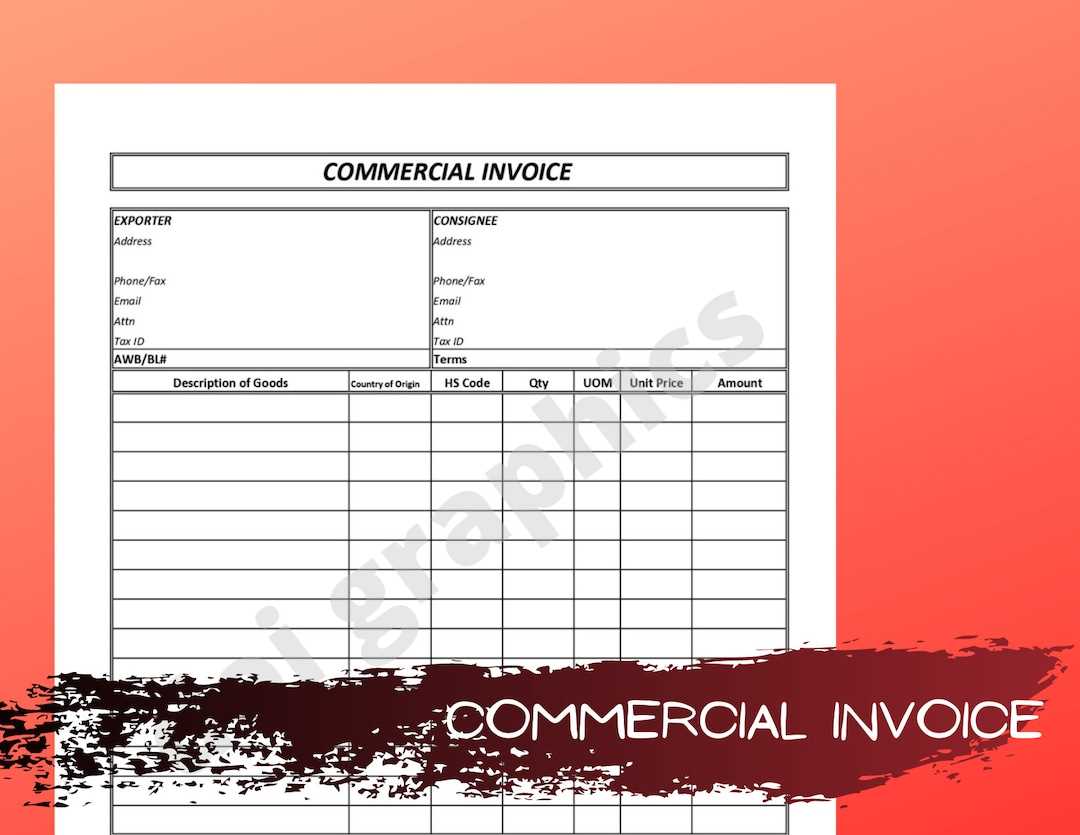

- Branding Elements: Incorporate your business logo, color scheme, and contact information at the top of the document. This makes the document instantly recognizable and reinforces your brand identity.

- Custom Fields: Depending on your industry, you may need to add specific fields. For example, if you’re selling goods, you may want to include serial numbers, SKU codes, or special product categories.

- Adjust Payment Terms: Tailor the payment terms section to reflect your preferred billing cycles, discount offers, and any late fees applicable to your business.

- Shipping Details: If you’re dealing with international shipments, customize the shipping section to include specific international delivery terms, customs codes, and carrier information.

- Legal Statements: If required by local or industry-specific regulations, add relevant legal disclaimers or terms and conditions to ensure your business remains compliant with the law.

By tailoring these elements to your business model, you ensure that each transaction document not only meets your needs but also serves as a clear, professional communication tool with your clients.

Understanding Canadian Tax Regulations

For businesses operating in North America, understanding the local tax system is essential for compliance and financial planning. Tax regulations dictate how businesses handle the sale of goods and services, including the calculation and reporting of taxes on transactions. Familiarity with these rules ensures that your operations align with legal requirements and helps prevent any costly mistakes.

Types of Taxes to Consider

There are various types of taxes that businesses may need to account for in their transaction records, such as:

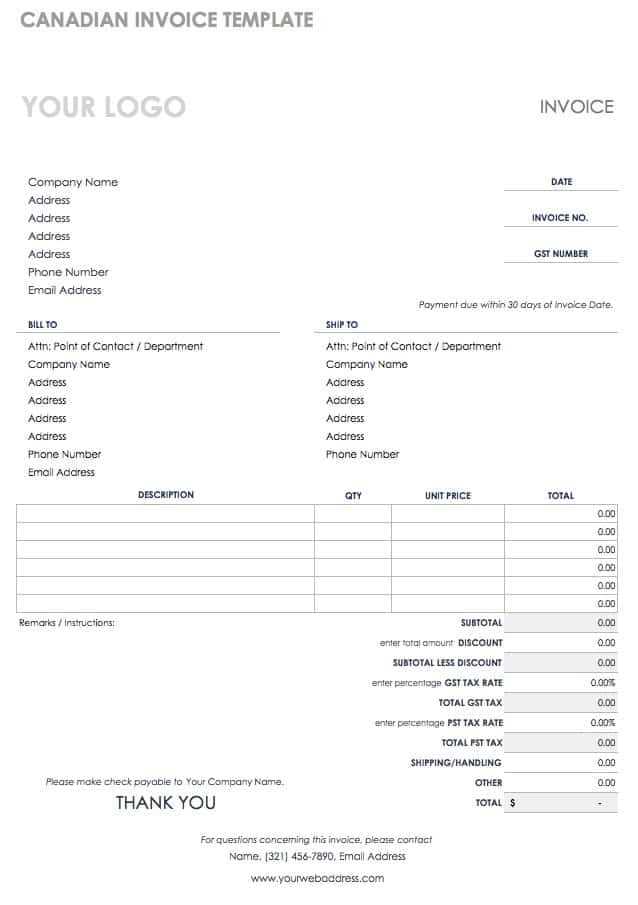

- Goods and Services Tax (GST): A federal tax applied to most goods and services sold in the country.

- Provincial Sales Tax (PST): A tax imposed by certain provinces, applicable to specific goods or services.

- Harmonized Sales Tax (HST): A combined federal and provincial tax used in some provinces, simplifying the tax process for businesses operating across multiple regions.

Tax Documentation and Compliance

It is critical to include the proper tax details on your transaction documents. This may include clearly indicating the applicable tax rate, calculating the tax amount, and ensuring the document reflects the correct total including all taxes. In addition, businesses must file tax returns on time and keep accurate records of all transactions for auditing purposes.

By adhering to these regulations, businesses ensure they remain compliant and avoid penalties. Keeping updated on any changes to tax laws is also essential, as regulations can evolve and affect your accounting practices.

How to Include Shipping Details

Shipping information is a crucial part of any business transaction record, as it provides both the seller and buyer with essential details about the delivery of goods or services. Accurately documenting shipping terms helps prevent misunderstandings and ensures that both parties are clear on how and when the items will arrive. Properly including this information also aids in tracking and resolving potential delivery issues.

Key Shipping Information to Include

When documenting shipping details, make sure to include the following essential elements:

- Shipping Address: Provide the full delivery address, including street, city, province, and postal code. This ensures the shipment is sent to the correct location.

- Shipping Method: Specify the delivery service or carrier used (e.g., air freight, ground shipping, courier). This helps clarify the expected timeline for delivery.

- Tracking Number: If available, include a tracking number that allows the recipient to monitor the progress of the shipment.

- Expected Delivery Date: Clearly state the estimated date or time frame for when the goods should arrive at the destination.

- Shipping Charges: List any costs associated with delivery, including taxes, fees, or any prepaid charges.

Additional Considerations

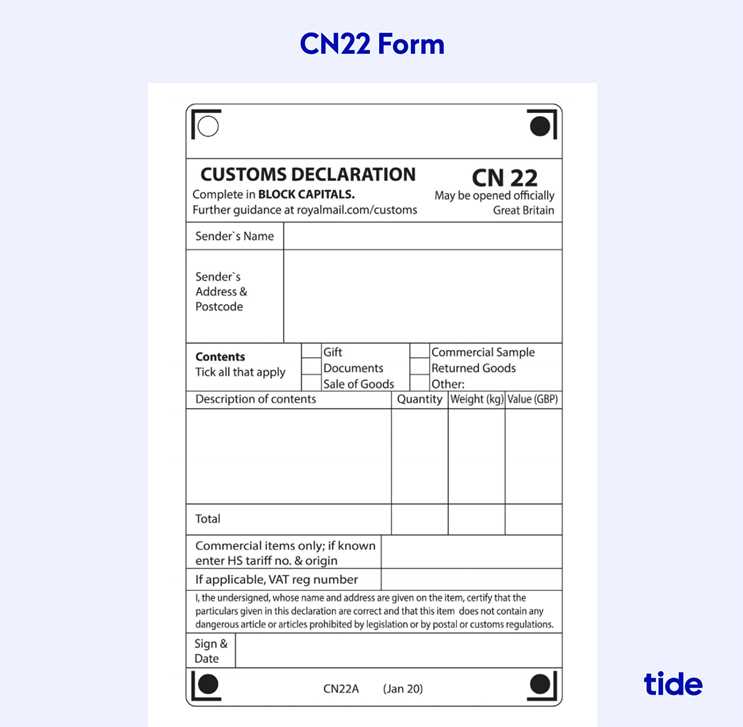

In some cases, it may also be necessary to include customs details or special delivery instructions. For international shipments, this might involve specifying customs codes, declarations of origin, or other regulatory requirements. Including these details helps ensure that the goods are processed smoothly through customs and reach their destination without delays.

Common Mistakes in Document Creation

Creating accurate transaction records is essential for maintaining smooth business operations. However, many businesses make mistakes when preparing these documents, which can lead to confusion, delays in payments, and even legal issues. Understanding and avoiding common errors ensures that your documents are both professional and legally compliant.

Here are some common mistakes businesses make when creating transaction documents:

| Common Mistake | Explanation | How to Avoid | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Incorrect Contact Information | Incorrect or missing contact details can delay communication and payment processing. | Double-check all addresses, phone numbers, and email addresses before sending the document. | ||||||||||||||||||||||||||||||||||||

| Omitting Key Transaction Details | Failing to include item descriptions, quantities, or prices can create confusion. | Ensure all goods or services are clearly listed with their corresponding prices and quantities. | ||||||||||||||||||||||||||||||||||||

| Unclear Payment Terms | Vague payment terms can result in delayed payments or disputes. | Clearly state payment deadlines, methods, and penalties for late payments. | ||||||||||||||||||||||||||||||||||||

| Missing Tax Information | Not including tax amounts or rates can cause legal and financial issues. | Ensure taxes are calculated and displayed correctly according to local regulations. | ||||||||||||||||||||||||||||||||||||

| Benefit | Description | How It Helps | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Efficiency | Automating and digitizing documents saves time by eliminating manual processes. | Quick creation, editing, and distribution of documents reduce administrative delays. | ||||||||||||||||||||||||

| Cost-Effectiveness | Digital documents eliminate the need for printing, paper, and postage. | Lower operational costs as a result of fewer resources being consumed. | ||||||||||||||||||||||||

| Easy Access and Storage | Digital records are easy to store, search, and retrieve, saving physical space. | Improved organization and faster access to transaction data when needed. | ||||||||||||||||||||||||

| Security | Digital files can be encrypted and backed up, reducing the risk of loss or theft. | Enhanced protection of sensitive business and customer data. |

| Required Element | Description |

|---|---|

| Business Identification | Full legal names, addresses, and tax numbers of both the buyer and seller. |

| Date of Transaction | The precise date when the exchange took place, ensuring clarity in financial reporting. |

| Amount and Currency | Exact monetary values and the currency used, clearly indicating applicable taxes. |

| Goods or Services Provided | Detailed description of the products or services delivered, including quantity and price. |

| Tax Details | Proper application of GST, HST, or PST depending on the province of the transaction. |

Tax Obligations and Compliance

For businesses operating within Canada, it is important to account for Goods and Services Tax (GST), Harmonized Sales Tax (HST), or Provincial Sales Tax (PST) depending on the location of the transaction. Each of these taxes has specific requirements regarding their inclusion and the applicable rates, which vary by region. Properly accounting for these taxes helps businesses avoid penalties or disputes with the Canada Revenue Agency (CRA).

Automating the Invoice Process

Streamlining the process of documenting financial transactions can save businesses significant time and reduce the likelihood of errors. By leveraging technology, companies can automate routine tasks, ensuring greater accuracy and efficiency. Automation not only speeds up operations but also helps maintain consistency, making it easier to comply with legal and financial requirements. With the right tools, businesses can minimize manual entry, allowing staff to focus on more strategic aspects of the organization.

Key Benefits of Automation

Automating transaction records brings numerous advantages, including:

- Increased Efficiency: Automation reduces the need for manual intervention, speeding up the process and ensuring timely documentation.

- Enhanced Accuracy: By eliminating human error, businesses can ensure that all financial data is correct and consistent.

- Better Record Keeping: Automated systems can store transaction details in an organized manner, simplifying retrieval during audits or reviews.

- Improved Cash Flow Management: Timely and accurate records help track payments and outstanding balances, allowing for better cash flow forecasting.

Choosing the Right Tools

To fully benefit from automation, selecting the right software is crucial. There are various solutions available, ranging from simple tools to more complex platforms that integrate with other business systems. When choosing software, it’s important to consider:

- Ease of Use: The tool should be user-friendly, even for non-technical staff.

- Customization:

Best Practices for Invoice Delivery

Delivering payment records to clients in a timely and professional manner is essential for maintaining healthy business relationships. The method and timing of delivery can significantly impact the efficiency of the payment process and contribute to overall customer satisfaction. By following a few best practices, businesses can ensure smooth communication, prompt payments, and minimal disputes. It is important to establish clear guidelines for how and when these documents should be sent to clients.

Best Practice Description Timely Delivery Ensure records are sent promptly after the completion of a transaction. Delays can lead to confusion and late payments. Clear and Professional Format Ensure that all documents are well-organized, clear, and free from errors. Professional presentation promotes trust and avoids misunderstandings. Multiple Delivery Channels Offer clients different ways to receive their records, such as through email, postal service, or secure online portals. This flexibility accommodates client preferences. Confirmation of Receipt Whenever possible, confirm that the recipient has received the document. This could be done through an automated response or follow-up communication. Clear Payment Terms Include payment due dates, methods, and any relevant late fees or discounts in the document. This helps prevent confusion and delays. By implementing these best practices, businesses can ensure smoother operations, reduce the likelihood of payment delays, and strengthen client relationships. Proper delivery methods not only improve efficiency but also foster trust and professionalism with customers.

How to Track Unpaid Invoices

Managing outstanding payments is a critical aspect of maintaining healthy cash flow in any business. Keeping track of overdue amounts ensures timely follow-ups and reduces the risk of bad debts. Implementing an effective system for monitoring unpaid transactions helps businesses stay organized, improve collections, and avoid financial stress. By regularly reviewing unpaid records, companies can take prompt action to resolve outstanding balances.

Steps to Track Unpaid Balances

- Set Up a Monitoring System: Use accounting software or a simple spreadsheet to keep track of payment due dates and amounts. Ensure the system provides clear visibility of outstanding balances.

- Establish Payment Terms: Clearly communicate payment deadlines and conditions at the outset of every transaction to avoid confusion later.

- Send Reminders: Regularly send friendly reminders as the due date approaches and follow up promptly once payments are overdue. Automated reminders can save time.

- Track Payment History: Maintain a history of payments and any communication with the client regarding overdue amounts. This will help in case disputes arise.

- Set Up Alerts: Use alerts to notify you when payments are overdue, so you can take appropriate action quickly without missing deadlines.

Utilizing Reporting Tools

Many accounting systems offer built-in reports that can help you easily identify unpaid transactions. These tools categ

Using Invoice Templates for Small Businesses

For small businesses, managing financial documentation efficiently is crucial for both operational success and regulatory compliance. Using pre-designed documents for billing purposes can streamline the process, saving time and reducing errors. These ready-to-use formats allow business owners to focus on other important aspects of their operations while ensuring that all the necessary information is included. This practice is especially valuable for small enterprises that may not have dedicated accounting staff.

Benefits of Using Pre-Formatted Documents

Adopting ready-made billing formats offers numerous advantages, particularly for smaller businesses that need to maintain professionalism without complex systems. Some of the key benefits include:

- Consistency: Pre-designed formats ensure that every record follows a standard structure, reducing the chance of missing important details.

- Time-Saving: Instead of creating documents from scratch, business owners can quickly input relevant information and send them out, speeding up the process.

- Professional Appearance: Customizable designs allow businesses to present clear, professional documents that foster trust with clients.

- Easy Record-Keeping: Having a standardized approach simplifies the organization and retrieval of past transactions, which is crucial for audits or financial reviews.

Customizing to Fit Your Needs

While using pre-designed formats is efficient, small businesses can still customize them to reflect their unique needs. Personalizing elements like business branding, payment terms, or tax calculations ensures that the documents align with the company’s specific operations and industry requirements. Many software tools or online platforms offer options for adding logos, adjusting fields, and incorporating specific payment terms, making it easy to tailor each record without compromising consistency or accuracy.

In conclusion, utilizing ready-made billing structures is a smart choice for small businesses, providing efficiency, consistency, and a professional