Free Microsoft Invoice Templates for Excel

Efficiently managing business finances requires reliable tools for generating accurate and clear payment requests. Using a well-designed document format ensures that all essential information is captured while saving time on manual calculations. With the right tool, creating and sending invoices becomes a straightforward task that supports professional communication with clients.

Free-to-use resources offer customizable layouts that cater to different business needs. These ready-made formats can be adapted for various industries, whether you’re running a small business, freelance service, or large enterprise. The ability to modify elements like amounts, dates, and company details makes these documents versatile and highly practical.

Adopting an easy-to-use solution allows for streamlined operations without the need for specialized software or complicated setups. By leveraging simple yet powerful tools, businesses can produce polished documents that reflect their professionalism and efficiency. Whether you’re new to managing business finances or looking for ways to simplify the process, these tools are designed to meet your needs.

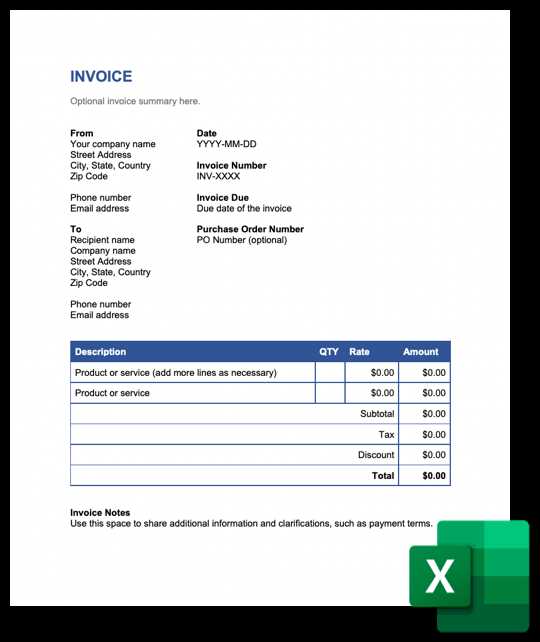

Microsoft Invoice Templates for Excel

Creating accurate and professional billing documents is an essential part of running a successful business. Using pre-designed document layouts allows you to generate and customize detailed payment requests quickly. These convenient options enable users to easily manage and track transactions while maintaining a polished, professional appearance in every document.

With a variety of available layouts, businesses can choose one that best suits their specific needs. Whether for a small project, large enterprise, or personal services, these layouts offer flexibility and simplicity. They can be adapted for various industries, such as freelance work, consulting, retail, and more. The following are the core features that make these solutions highly effective:

Key Features of Billing Layouts

| Feature | Description | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customizable Fields | Adjust text, dates, and figures based on individual client or business needs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Simple Calculations | Built-in formulas help automate arithmetic, such as taxes or totals. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Professional Design | Ensure a clean, structured format that conveys trustworthiness and clarity. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Easy Editing | Modify layout, colors, and fonts to match your brand’s style. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Multiple Currencies | Support for various currencies, useful for international transactions. |

| Feature | Benefit |

|---|---|

| Automated calculations | Reduces manual math and errors, saving time on every document |

| Predefined structure | Ensures consistency and clarity with minimal effort |

| Customizable fields | Allows for quick adjustments to suit different needs |

Ultimately, by eliminating redundant tasks and offering built-in organization, these tools significantly cut down the time and effort required for routine documentation, making them an invaluable resource for businesses of all sizes.

Free Invoice Templates vs Paid Solutions

When it comes to creating business documents, there are often two main options: using no-cost resources or investing in premium tools. Each choice comes with its own advantages and limitations. While free resources provide an easy and cost-effective starting point, paid options tend to offer more advanced features, customization, and support. Understanding the differences between these two approaches can help businesses make the right decision based on their needs and budget.

Advantages of Free Resources

Using no-cost resources can be an appealing choice, especially for small businesses or freelancers just starting out. These ready-made solutions are easily accessible and often include basic features such as itemized listings, automatic calculations, and predefined fields. They can be quickly customized to suit a variety of needs without any financial commitment. For businesses with straightforward billing needs, these options may provide all the functionality required without the need for additional expenses.

Benefits of Paid Solutions

On the other hand, premium tools offer more robust features that can make a significant difference in efficiency and professionalism. Paid solutions often come with advanced customization options, such as personalized branding, integration with accounting software, and additional support. These tools can help businesses scale more easily by automating workflows, offering detailed reporting, and ensuring compliance with local regulations. Furthermore, paid options often come with customer support, ensuring quick assistance if issues arise.

Ultimately, the choice between no-cost and premium options depends on the complexity of your needs, the volume of documents you handle, and the level of professional polish you require.

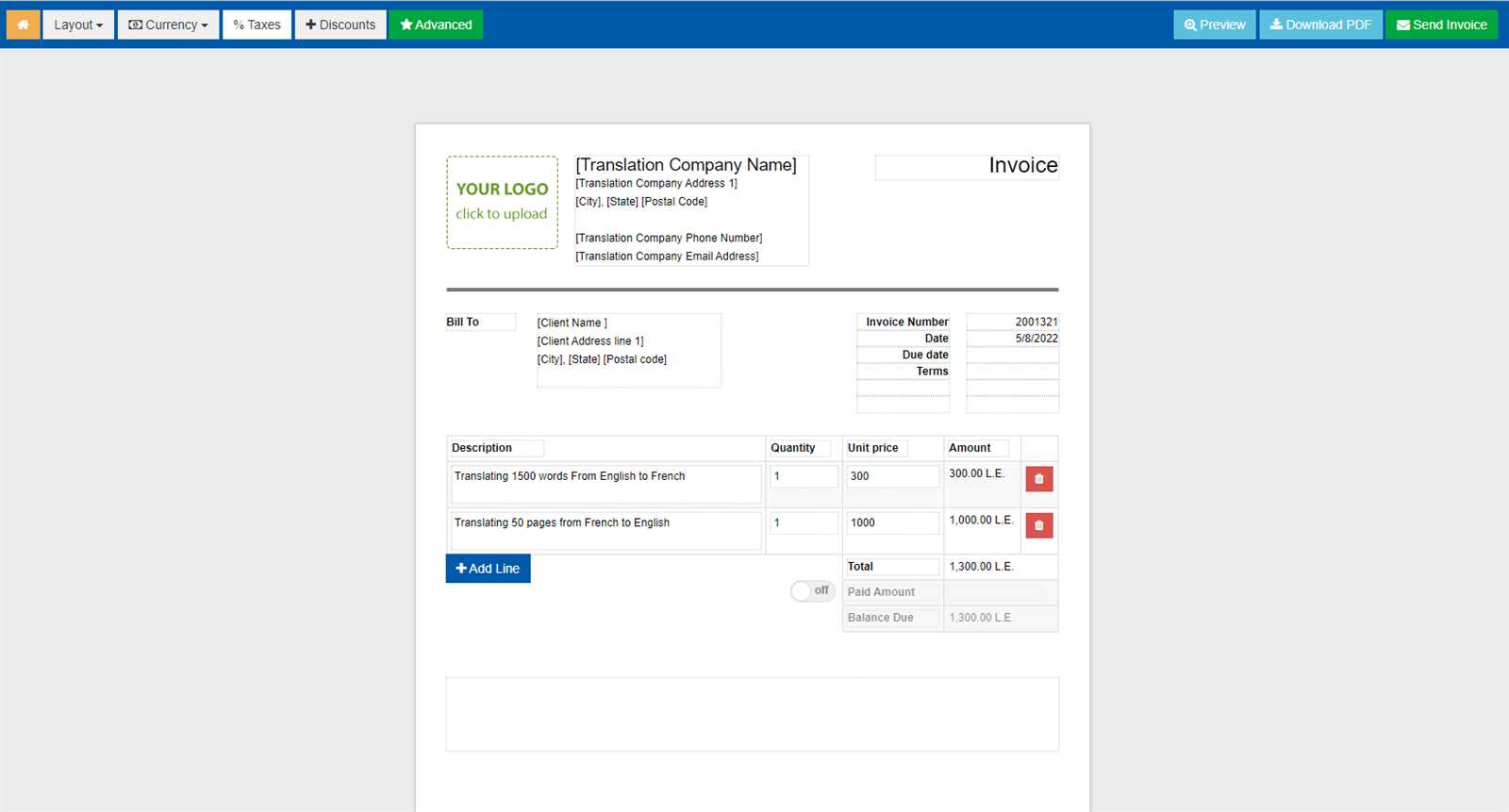

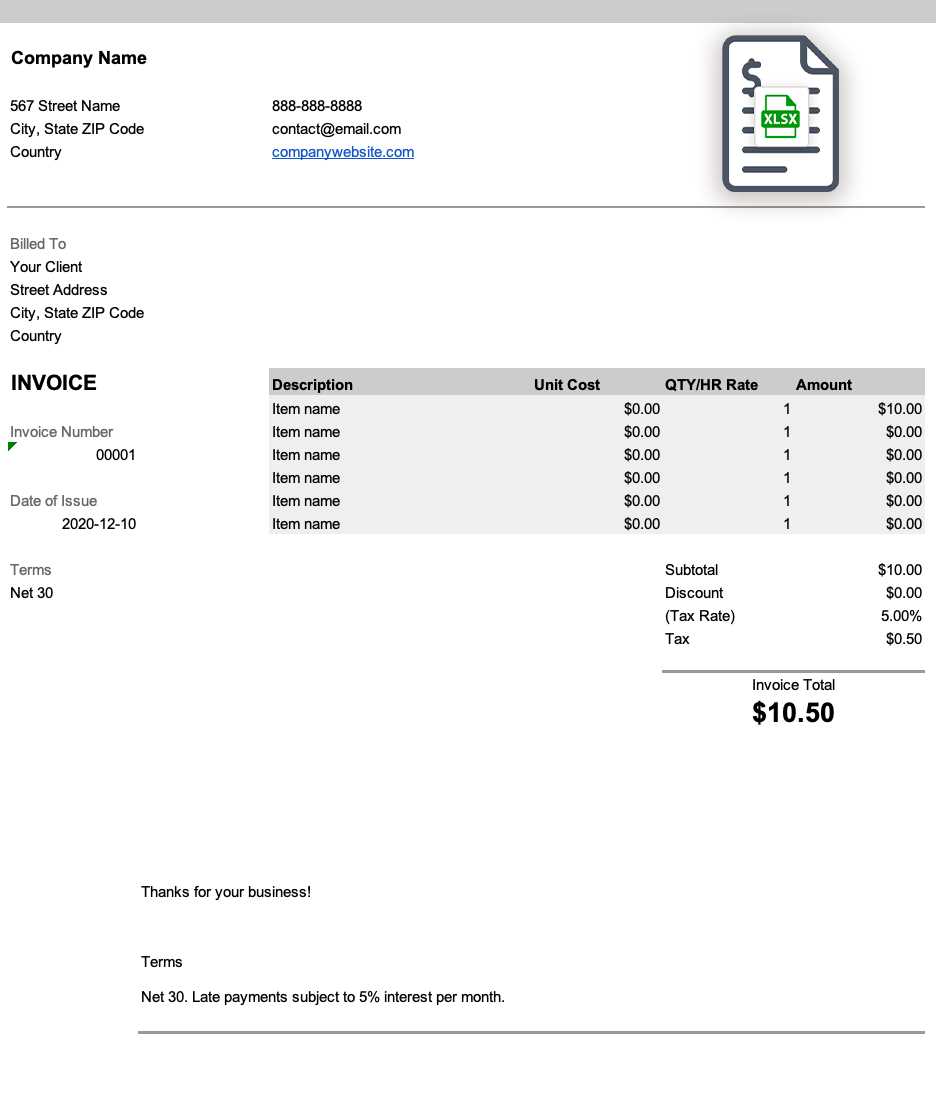

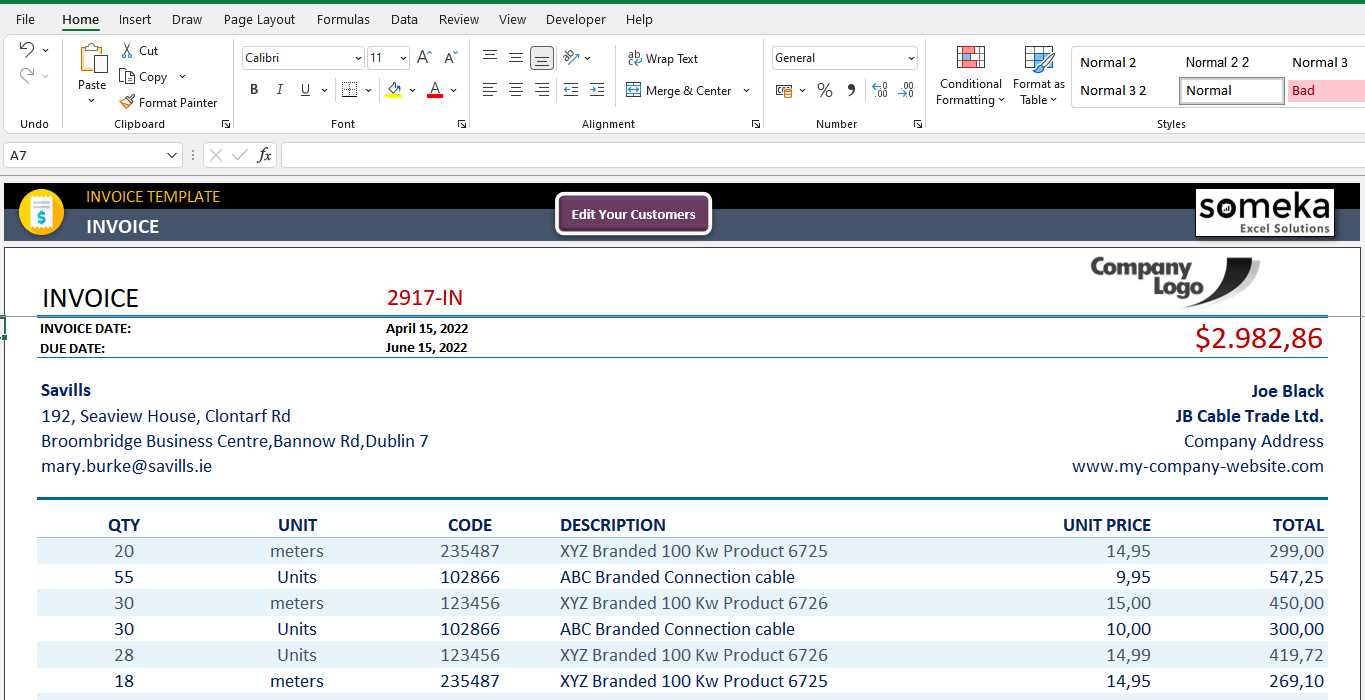

How to Create an Invoice from Scratch in Excel

Creating a billing document from the ground up allows for full control over its structure and content. By starting with a blank sheet, you can design a document that meets your specific needs, whether for a one-time project or ongoing client work. The process involves organizing key sections such as contact details, service descriptions, and financial totals while ensuring the layout remains clear and professional.

Step 1: Set Up the Document Structure

Begin by setting up the basic framework of your document. At the top, include your business name, logo, and contact details. Below this, create space for your client’s name, address, and contact information. This helps both parties identify the document quickly. Add a unique reference number, date, and payment terms to make the document official and trackable.

Step 2: Organize the Billing Information

Next, add a table to detail the goods or services provided. Include columns for descriptions, quantities, unit prices, and total amounts for each item. Make sure to leave a row at the bottom for the subtotal, taxes, and any applicable discounts or adjustments. The final step is to calculate the total amount due. Using simple formulas in the sheet will ensure that these values update automatically as you input new data.

By following these steps, you can create a functional and professional document tailored to your business requirements.

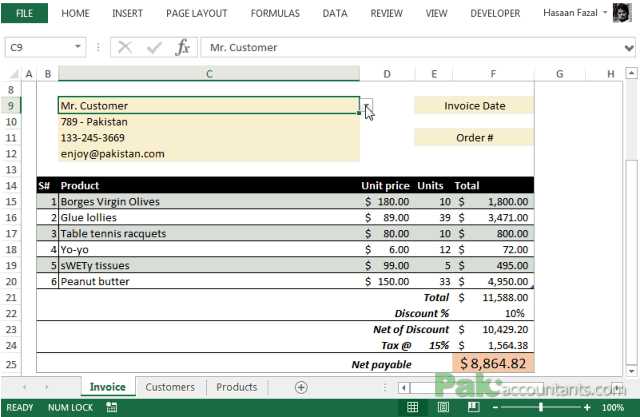

Tracking Payments with Excel Invoice Templates

Monitoring payments is crucial for maintaining accurate financial records and ensuring timely cash flow. Using a structured document to track outstanding and received payments allows you to stay organized and keep a clear overview of your business transactions. This method provides a quick way to check the status of any unpaid balances, as well as to confirm when payments have been made and processed.

Setting Up Payment Tracking Fields

When creating a document for tracking payments, it’s important to include several key fields. Start by adding columns for invoice numbers, payment due dates, and total amounts. Next, create a field where you can record the amount received, and a status column to indicate whether the payment is complete, pending, or overdue. Including a section for notes allows you to document any special payment arrangements or reasons for delays. This structured approach makes it easier to review your financial status and take action when necessary.

Automating Payment Updates

One of the biggest advantages of using a digital document is the ability to automate updates. By incorporating simple formulas, such as summing up paid amounts and calculating the remaining balance, you can easily track progress without manual calculations. Additionally, conditional formatting can be applied to highlight overdue payments in a different color, ensuring that they are promptly addressed. This automation saves time and reduces the risk of overlooking important details.

By effectively organizing payment information, you can streamline your financial workflow and maintain up-to-date records with minimal effort.

Common Errors to Avoid with Invoices

When creating billing documents, small mistakes can lead to confusion, delayed payments, or even disputes. It is essential to be aware of common errors that can occur during the document creation process, as these mistakes may impact the professionalism of the document and the accuracy of the transaction. Avoiding these pitfalls ensures smooth communication with clients and helps maintain clear financial records.

| Error | Consequence | Solution |

|---|---|---|

| Missing or incorrect contact details | Delays in communication, inability to follow up on payments | Double-check all contact information for accuracy |

| Omitting payment terms | Confusion over when payment is due | Always specify payment due date and terms clearly |

| Incorrect calculation of totals | Disputes over amount owed, delayed payments | Use formulas to automate calculations and check totals |

| Failure to include unique reference numbers | Difficulty in tracking payments, confusion on both ends | Assign a unique reference number to every document |

Attention to detail can prevent these common mistakes, ensuring that your documents are both accurate and professional. Double-checking calculations, payment terms, and contact information can save time and effort in the long run, helping to build trust with clients and improve the efficiency of financial transactions.

How to Automate Invoice Calculations in Excel

Automating calculations in your billing documents can save a significant amount of time and reduce the risk of errors. By using built-in formulas and functions, you can ensure that totals, taxes, and discounts are calculated accurately every time you create a new document. This process not only streamlines your workflow but also increases the overall efficiency of your financial tracking.

Step 1: Set Up Basic Formulas

The first step in automating calculations is to set up basic formulas for adding up item prices. For each product or service, include a column for the quantity, unit price, and total. You can then use a simple multiplication formula to calculate the total for each line item.

- Example: In a new column, enter the formula =Quantity * Unit Price to calculate the total for each item.

Step 2: Calculate Subtotal, Tax, and Total

After calculating the individual item totals, you can automate the subtotal, tax, and overall total calculations:

- For the subtotal, use the SUM function to add up all the item totals. Example: =SUM(Cell Range).

- To calculate tax, apply the tax rate to the subtotal. Example: =Subtotal * Tax Rate.

- Finally, calculate the total by adding the subtotal and tax. Example: =Subtotal + Tax Amount.

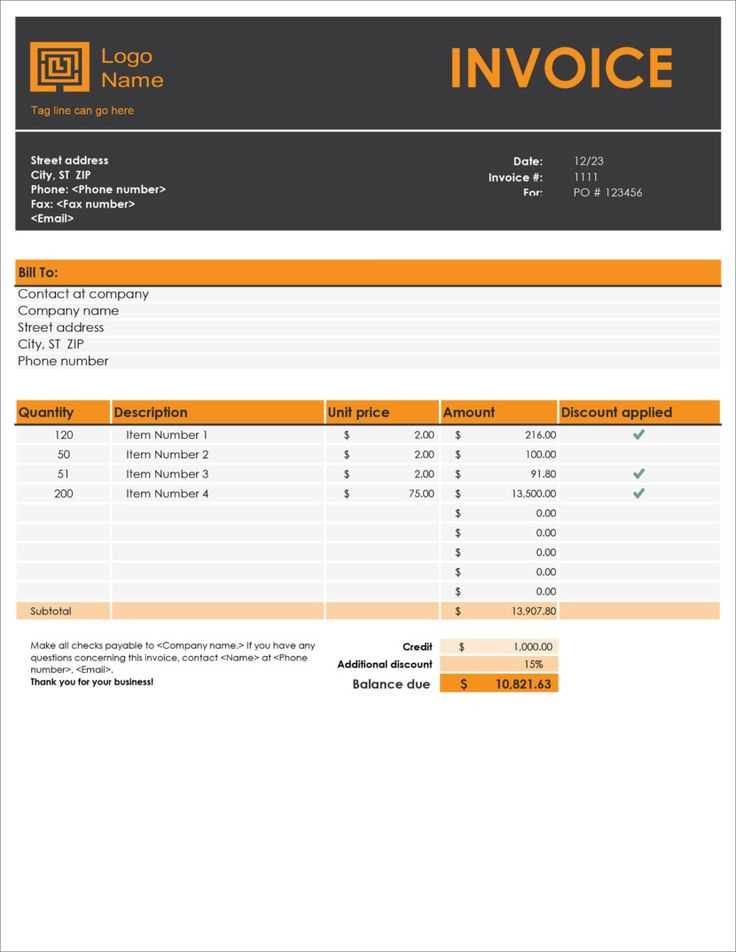

Step 3: Add Conditional Formatting for Clarity

To make the document easier to read and track, use conditional formatting to highlight key information, such as overdue payments or large balances. For example, you can set up rules to automatically change the color of overdue amounts or use bold text for the final total.

- Highlight the row with the total amount due, or change the color of unpaid amounts to visually alert you.

By incorporating these simple steps, you can automate the most common calculations in your billing documents, making the process faster, more accurate, and more professional.

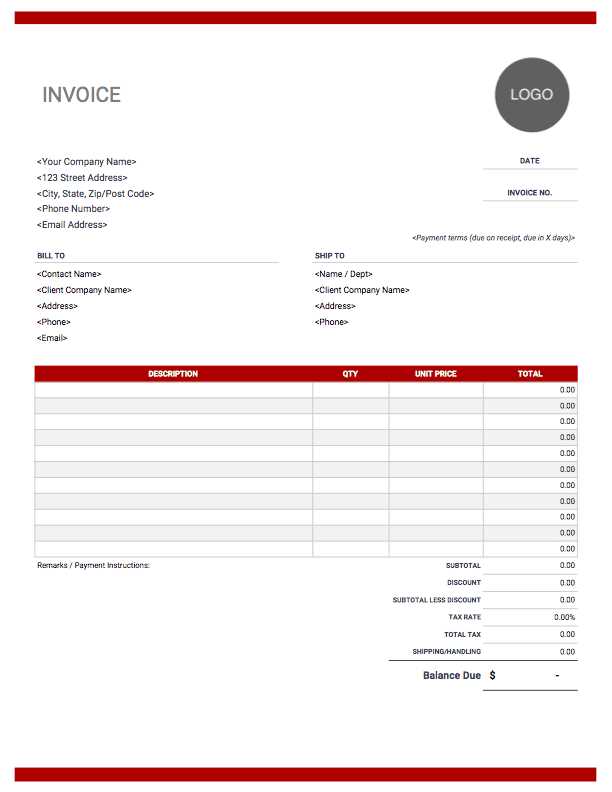

Best Practices for Using Excel Invoice Templates

When utilizing pre-designed billing documents in a spreadsheet format, it’s important to follow a set of best practices to ensure your records are accurate, professional, and consistent. Proper use of these documents can save time, reduce errors, and improve the overall efficiency of your financial processes. Here are some key practices to follow when working with these tools.

1. Customize the Document for Your Business

While ready-made sheets provide a solid foundation, it’s essential to tailor them to your specific needs. Customization helps maintain consistency with your brand identity and ensures that all necessary information is included.

- Replace generic placeholders with your company’s logo, contact information, and business details.

- Ensure that payment terms, such as due dates or late fees, are clearly stated and suited to your business model.

- Add any additional fields that may be relevant to your business, such as discount codes, project reference numbers, or specific service descriptions.

2. Ensure Accuracy in Calculations

One of the main advantages of using a digital document is the ability to automate calculations. Make sure all formulas are correctly set up to calculate totals, taxes, and discounts automatically. This minimizes human error and speeds up the process.

- Double-check that formulas are linked to the correct cells and ranges.

- Use simple functions like SUM, PRODUCT, and fixed tax rates to ensure accurate total amounts.

- Regularly update tax rates or discount percentages to reflect current conditions.

3. Maintain Consistency with a Standard Format

Consistency is key when using spreadsheets to handle billing. A standardized format not only helps you stay organized but also makes your documents easier to

How to Protect Your Excel Invoice Files

Securing sensitive documents is crucial when handling financial records. Whether you’re managing client details, transaction history, or personal accounting, protecting your files from unauthorized access is essential. Fortunately, there are several methods available to ensure that your data remains safe from theft, loss, or accidental modifications. This section will guide you through various strategies to safeguard your spreadsheets effectively.

1. Use Strong Password Protection

Password protection is one of the simplest and most effective ways to lock your documents. By setting a strong, unique password, you prevent unauthorized users from opening or editing your files. Avoid using easy-to-guess passwords and instead opt for a combination of letters, numbers, and special characters.

2. Restrict Editing Permissions

Limiting who can make changes to your file helps to maintain its integrity. In many spreadsheet programs, you can set permissions that allow users to view the file without being able to alter its contents. For example, by enabling “read-only” access, you can prevent accidental modifications or intentional tampering.

| Permission Type | Description |

|---|---|

| Read-Only | Users can view the file but cannot make any changes. |

| Editing | Users can make changes to the document. Always restrict this to trusted individuals. |

| Admin | Full access to edit, delete, and set permissions for others. |

By using these features, you can control who has access to alter critical information, reducing the risk of errors or malicious activity.

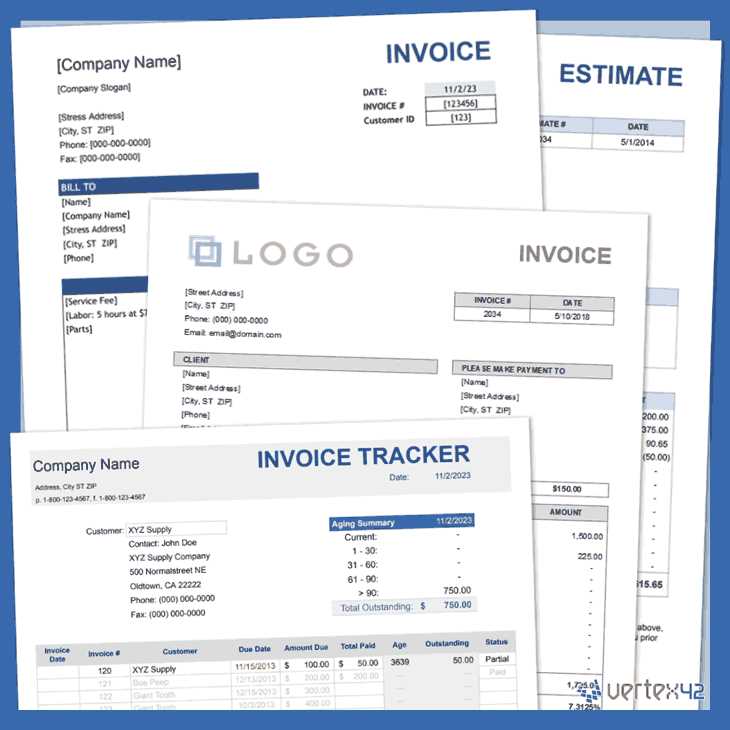

Top Resources for Free Excel Templates

Finding high-quality resources for creating professional and efficient spreadsheets is essential for individuals and businesses alike. There are numerous online platforms offering ready-made documents that can help streamline your workflow and save valuable time. These sources provide a variety of options for different purposes, from personal budgeting to financial management, allowing you to select exactly what fits your needs.

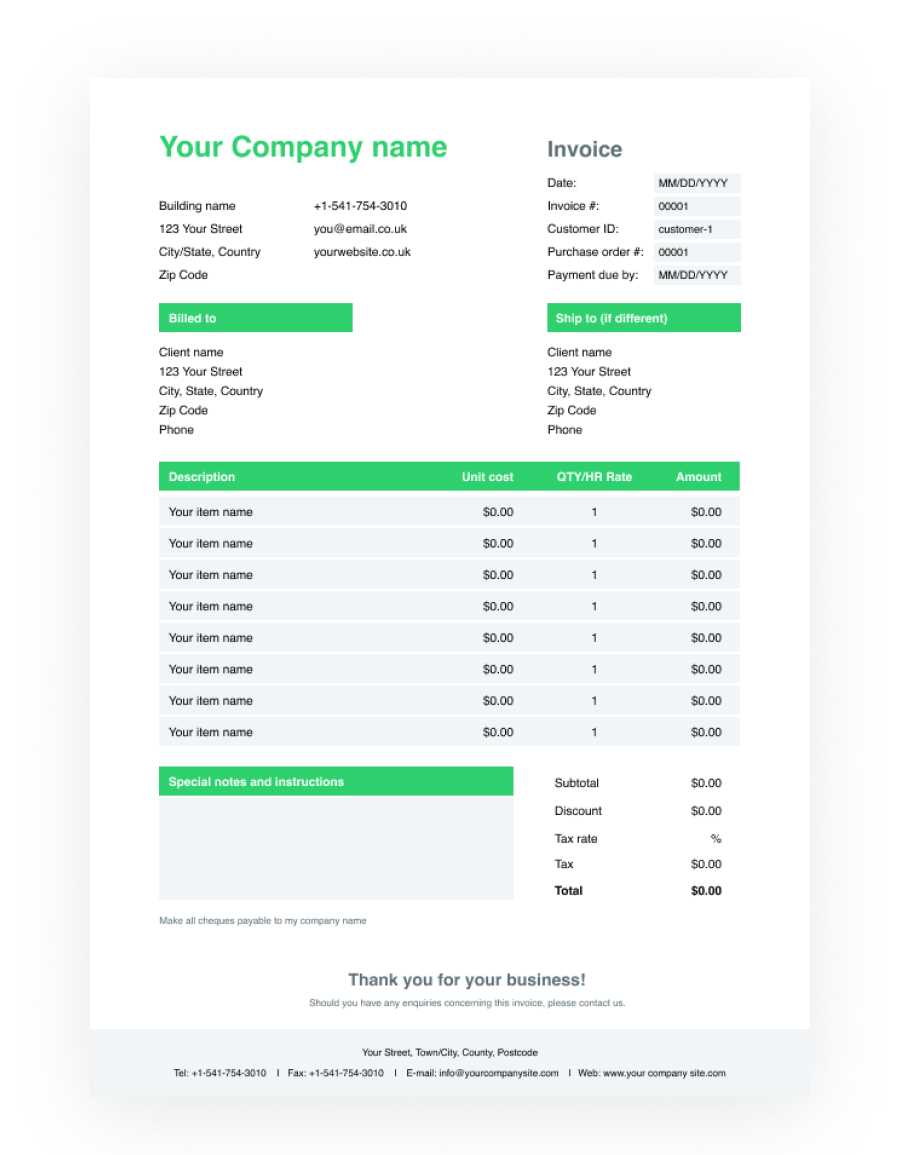

1. Google Sheets Template Gallery

Google’s cloud-based tool offers an extensive collection of pre-designed sheets that can be accessed and customized with ease. With a variety of categories ranging from project management to financial tracking, this platform ensures that users can quickly find what they need, without the hassle of starting from scratch.

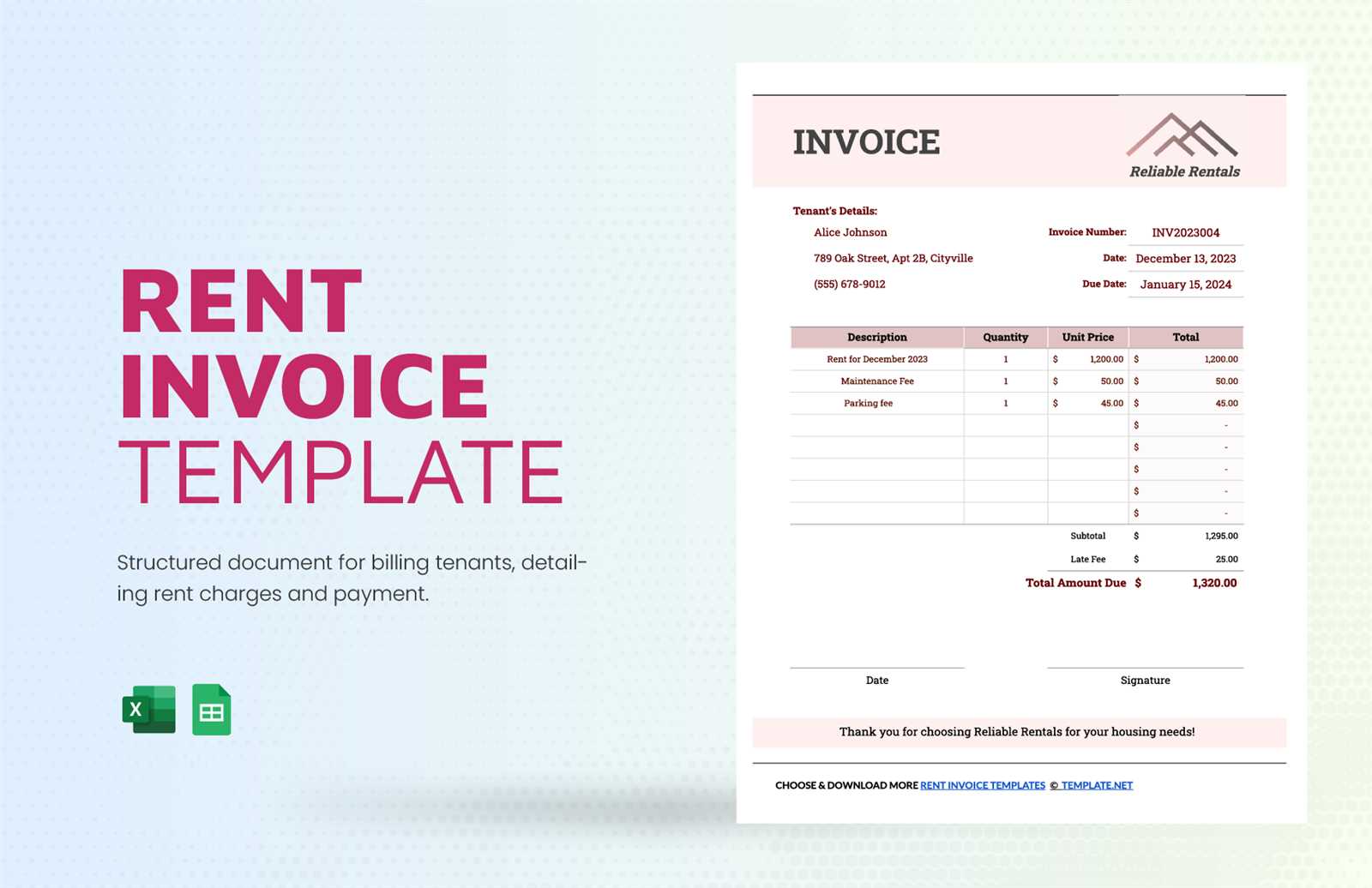

2. Template.net

Template.net is a popular resource for downloadable documents. Whether you’re looking for a professional document for your business or a personal tracking sheet, this site offers numerous designs with customizable options. The website’s interface is user-friendly, making it easy to locate a suitable layout for any task.

| Resource | Type of Documents | Key Features |

|---|---|---|

| Google Sheets | Project management, financial tracking, personal budgeting | Cloud-based, real-time collaboration, customizable designs |

| Template.net | Business, personal finance, and organizational sheets | Wide variety, easy-to-navigate, editable formats |

| Vertex42 | Accounting, scheduling, budgeting | Professional designs, multiple formats available |

These platforms provide a wide selection of resources to suit your needs, whether you require a simple sheet or a more complex document for your daily activities or busine

Excel Invoice Templates for Small Businesses

For small businesses, managing client payments and maintaining accurate financial records is essential for smooth operations. A well-organized document for billing can help ensure timely payments, minimize errors, and keep track of outstanding balances. Using pre-designed files allows entrepreneurs to focus more on running their business while streamlining the invoicing process.

1. Simple Billing Formats

A simple document format is perfect for businesses with straightforward billing needs. These designs typically include sections for client details, product or service descriptions, amounts, and payment terms. A minimalistic structure helps keep everything clear and easy to understand, both for the business owner and the client.

2. Detailed Financial Records

For businesses that require more detailed tracking, a comprehensive format with additional sections for taxes, discounts, and payments made may be beneficial. These documents can also include areas for tracking due dates, overdue payments, and outstanding balances, which help to maintain a better overview of your financial status.

| Format Type | Best For | Key Features |

|---|---|---|

| Simple Billing | Small businesses with straightforward billing | Easy to use, clear layout, quick customization |

| Comprehensive Financial | Businesses needing detailed financial tracking | Tax calculations, payment status, discount management |

| Recurring Payments | Businesses offering subscription-based services | Automatic calculations, payment schedules, reminder features |

By choosing the right format, small businesses can enhance their invoicing process, ensuring efficiency and professionalism while maintaining organized financial records.

Integrating Excel Invoices with Accounting Software

For businesses looking to streamline their financial processes, combining spreadsheet documents with accounting software offers a powerful solution. This integration allows for seamless data transfer, reducing manual entry and minimizing errors. By automating the synchronization between documents and accounting systems, businesses can ensure accurate record-keeping, improve efficiency, and gain a clearer financial overview.

1. Benefits of Integration

Connecting billing documents with accounting software can save time and enhance accuracy. Instead of manually entering transaction data, businesses can automatically import information from spreadsheets into their financial software. This process reduces the risk of mistakes and ensures consistency across both platforms. Additionally, the integration allows for real-time tracking of payments, expenses, and balances, which helps businesses stay on top of their financial health.

2. Methods for Connecting Spreadsheets and Accounting Software

There are several ways to link documents with accounting tools. Some software platforms offer built-in import features that allow users to directly upload their spreadsheets. For more complex needs, third-party integration tools and APIs can sync data between multiple applications. Additionally, cloud-based software solutions enable automatic updates, ensuring that both your documents and accounting system are always in sync.

| Integration Method | Suitable For | Key Benefits |

|---|---|---|

| Built-in Import Features | Small to medium-sized businesses | Simple setup, quick data import, real-time synchronization |

| Third-Party Tools | Businesses with cus

How to Share and Print Excel InvoicesOnce you have created a professional billing document, the next step is sharing and printing it effectively. Whether you’re sending it via email to clients or printing it for physical records, it’s important to know the best practices for both methods. Efficiently managing these tasks ensures smooth communication with clients and helps maintain organized business records. 1. Sharing Documents

Sharing billing documents digitally is an essential part of modern business communication. Here are a few ways you can share your files with clients:

2. Printing DocumentsFor those who prefer physical copies or need to keep hard records, printing your documents is straightforward. Here are the steps to ensure a clean and professional printout:

By following these guidelines, you can ensure that your documents are easily shared and professionally printed, providing a smooth experience for both you and your clients. |