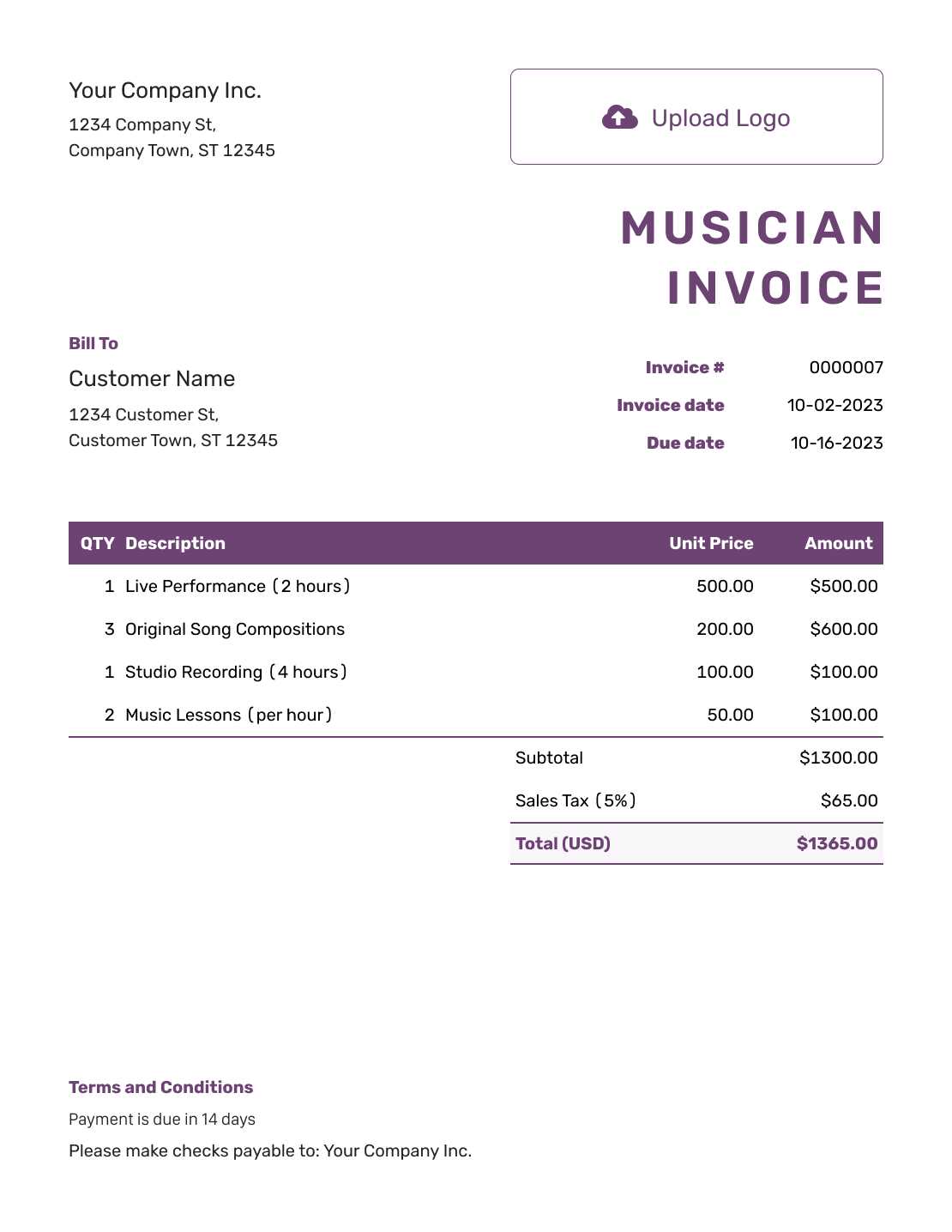

Music Performance Invoice Template for Musicians and Event Organizers

For musicians and performers, getting paid for their work is essential. Whether you’re playing at a concert, hosting a private event, or collaborating with other artists, having a clear and professional way to request payment is crucial. A well-organized financial record helps avoid misunderstandings and ensures you receive fair compensation for your time and talent.

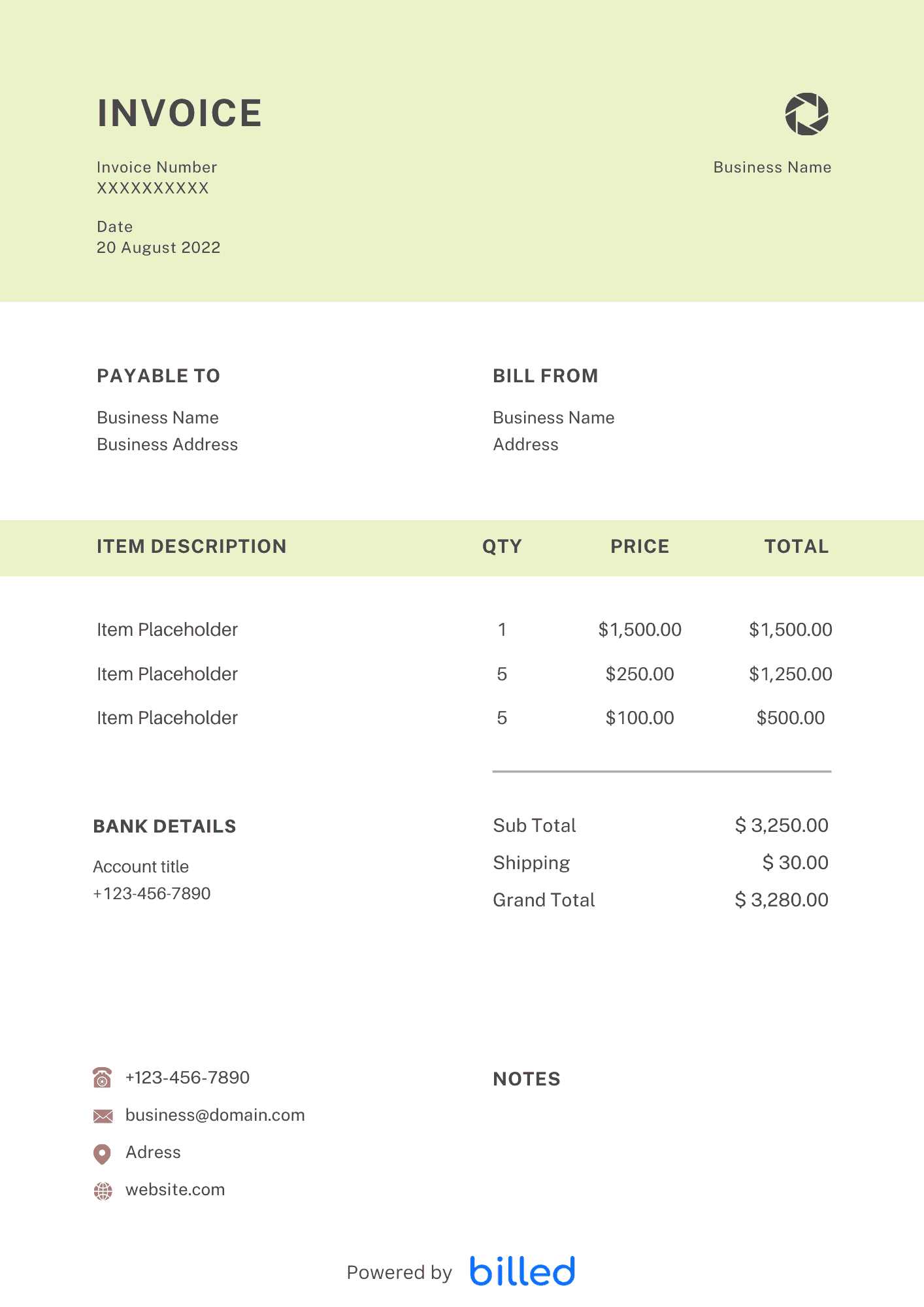

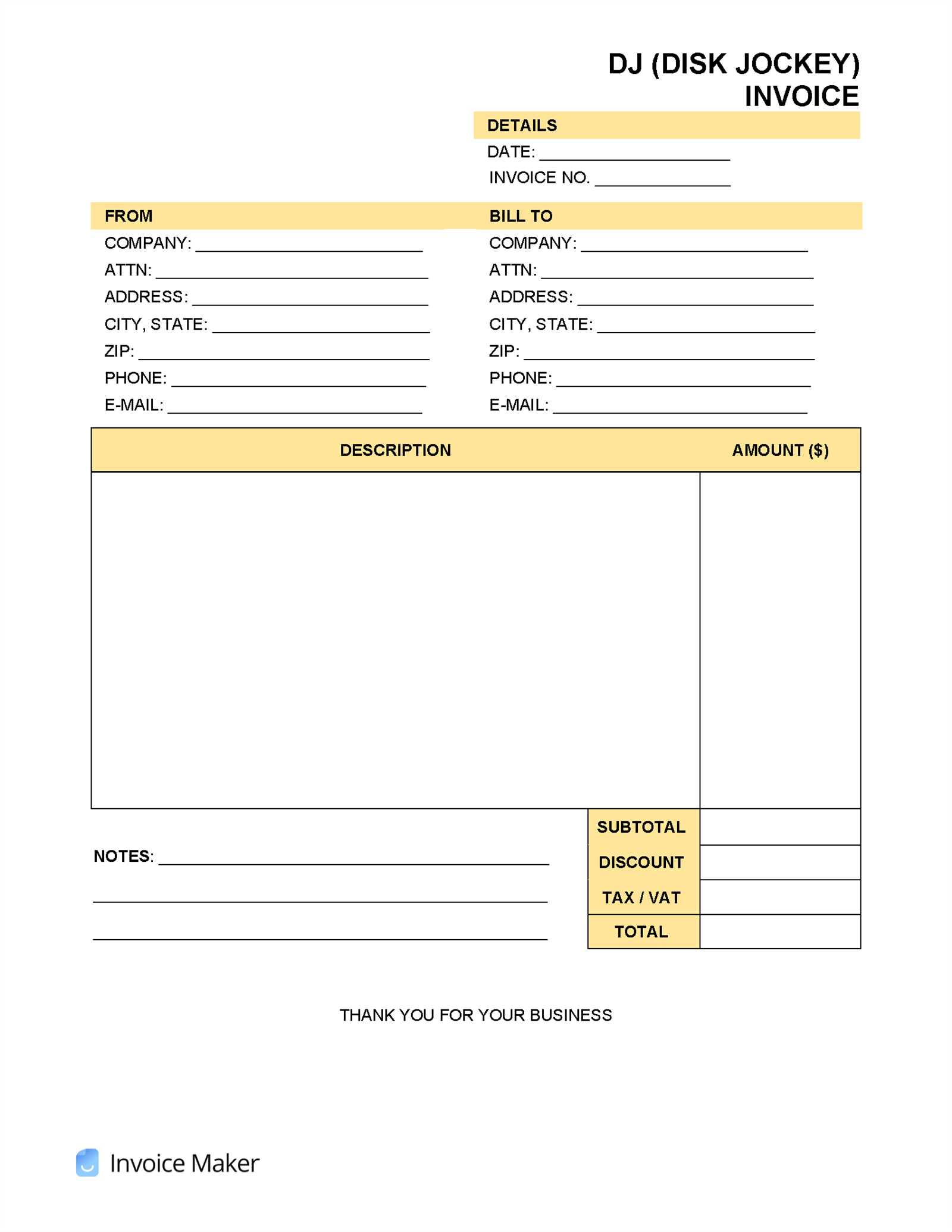

Designing a document to request payment should be straightforward but effective. It needs to include key details such as the amount due, payment terms, and other relevant information that ensures clarity between you and your client. With the right structure, these documents become not only a tool for transaction but also a way to reinforce professionalism and trust.

In this guide, we will explore how to craft a comprehensive and easy-to-use document that serves both your needs and those of your clients. From choosing the right format to understanding the necessary components, this article will help you create a flawless request for payment every time.

Music Performance Invoice Template Guide

Creating an effective document for requesting payment is a key step for any performer or artist. A well-organized document can make the process smoother for both parties, ensuring that you are compensated for your work and that all financial transactions are transparent. This guide will walk you through the essential elements of an ideal document that covers all necessary details.

Essential Components to Include

To ensure that your request for payment is clear and professional, certain information should always be present. Here’s a checklist of the most important elements to include:

- Personal and Client Information: Both your contact details and those of the person or organization you are working with.

- Date and Event Information: The date of the service and details about the event or collaboration.

- Amount Due: The agreed-upon amount, broken down if necessary (e.g., hourly rate, flat fee, etc.).

- Payment Terms: When and how payment is expected (e.g., within 30 days, via bank transfer or check).

- Bank Details or Payment Methods: Information for easy payment processing.

- Additional Notes: Any relevant information or special instructions related to the transaction.

Best Practices for Creating Your Document

Once you have all the necessary information, the next step is making sure your document is easy to read and professional. Follow these best practices:

- Use a Simple Layout: Keep your document clean and organized. Avoid clutter and focus on key details.

- Stay Consistent: Use a consistent font, spacing, and style throughout the document. This will give it a polished, professional look.

- Include Clear Payment Instructi

Why You Need a Music Invoice

When it comes to being compensated for your artistic work, having a structured document to outline the agreed-upon fees is essential. It serves not only as a formal request for payment but also as a tool to protect both you and your clients by ensuring that all terms are clearly understood. Whether you’re working with event organizers, private clients, or collaborators, this document plays a crucial role in creating transparency and establishing a professional relationship.

Here are several key reasons why this document is necessary for any artist or performer:

- Clarifies Payment Terms: It clearly outlines how much is owed, when it is due, and how payment should be made, preventing any misunderstandings.

- Establishes Professionalism: Sending a well-crafted request for payment shows that you take your work seriously and are organized, which can lead to better client relationships and repeat business.

- Legal Protection: In case of disputes or non-payment, having a documented agreement can serve as evidence in resolving conflicts.

- Helps with Financial Tracking: It allows you to keep detailed records of your earnings, which is helpful for budgeting and tax purposes.

- Promotes Timely Payment: By specifying the due date and payment methods, you can encourage clients to pay on time and avoid unnecessary delays.

In short, having a well-organized request for payment benefits both you and your clients, ensuring smooth transactions and a professional approach to your craft.

How to Create a Simple Invoice

Creating a straightforward document to request payment for your services doesn’t have to be complicated. With the right approach, you can build a clear and effective document that ensures both you and your clients are on the same page. The key is to include all necessary information in a simple, easy-to-understand format.

Key Steps to Follow

Follow these steps to create an efficient and professional payment request:

- Include Your Contact Information: At the top of the document, list your name, address, phone number, and email so that the client knows how to reach you if needed.

- Client Details: Below your contact information, include the name and address of the person or organization you are working with. This helps to identify who the payment is due from.

- Event or Service Information: Specify the nature of the work, including the date(s) of the event or service provided. This gives context for the charges.

- Payment Amount: Clearly state how much is owed. If there are multiple charges (e.g., hourly rates, flat fees), break them down to avoid confusion.

- Payment Terms: Indicate when and how the payment should be made, such as within 30 days by bank transfer or via another method.

- Thank You Note: A short note of appreciation for the client’s business can leave a positive impression and encourage future work.

Formatting Tips for a Clear Document

Once you have the necessary details, it’s important to ensure that the document is clean and easy to read. Keep the layout simple and organized, using bold headings and consistent fonts. Ensure that key details like the total amount due and the payment due date stand out. This will help the client quickly find the information they need.

By following these basic steps, you can create an effective and professional document that ensures smooth payment transactions every time.

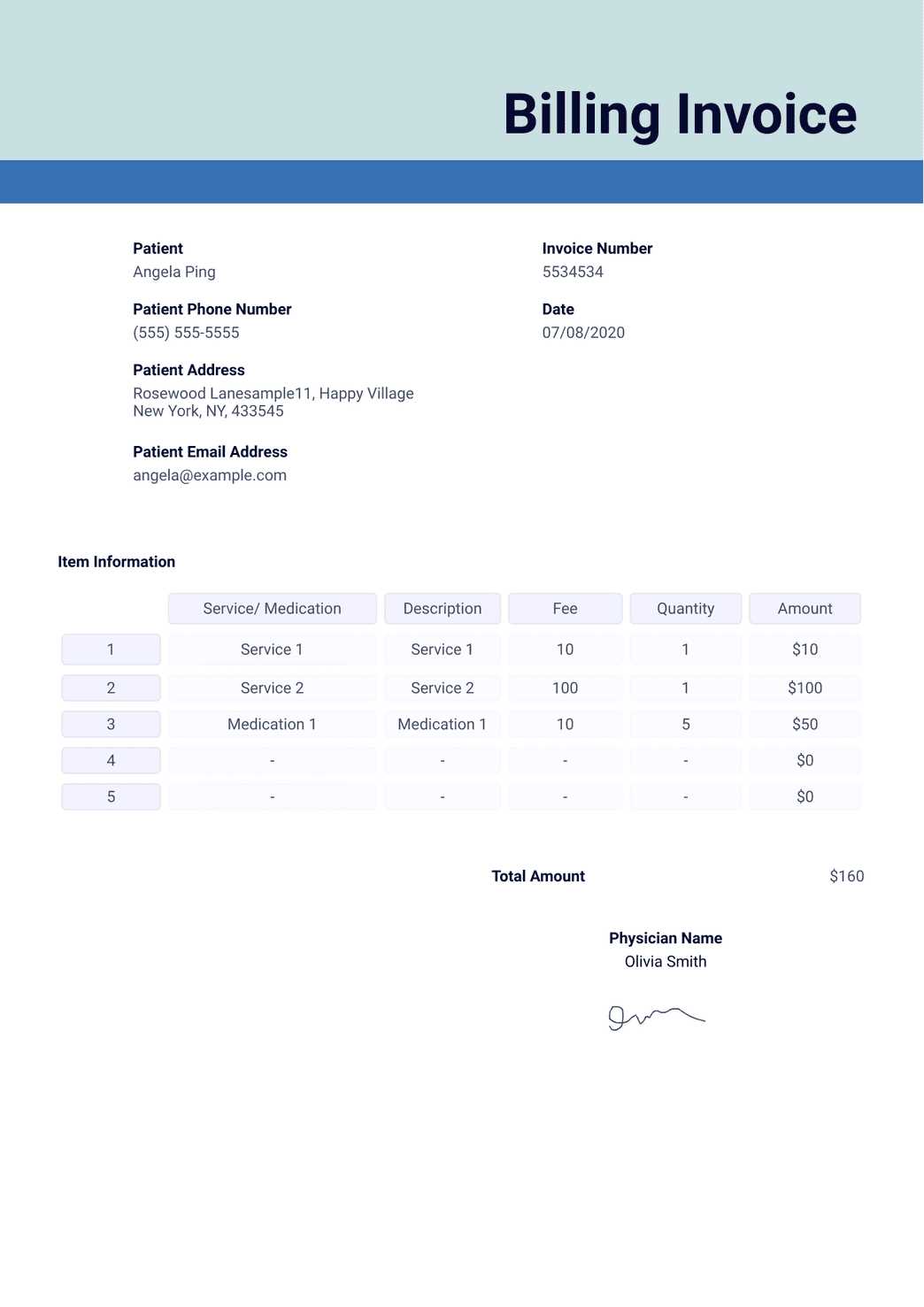

Essential Information for Music Invoices

When requesting payment for services rendered, certain details must be included to ensure both clarity and professionalism. These key components help establish the terms of the transaction and ensure that the client has all the information they need to process the payment correctly. Failing to include any of these elements can lead to confusion or delays.

Important Details to Include

The following elements should always be present in a payment request document:

- Your Contact Information: Clearly list your name, address, phone number, and email so the client can reach you if needed.

- Client’s Details: Include the full name, address, and any relevant contact information for the person or company being invoiced.

- Invoice Number: Assign a unique number to each document for easy tracking and reference.

- Date of Service: Specify when the service was provided, so both parties are aligned on the timeframe of the work completed.

- Description of Services: Provide a brief breakdown of the work performed or event held, including any relevant details such as hours worked or specific tasks completed.

- Total Amount Due: Clearly state the amount owed, including any taxes, fees, or discounts if applicable. If multiple charges are involved, break them down item by item.

- Payment Terms: Include when payment is due and how it should be made (e.g., bank transfer, check, online payment platform).

- Late Payme

Choosing the Right Invoice Format

Selecting the appropriate format for your payment request document is an important step in ensuring that the transaction goes smoothly. The format should be easy to understand, well-organized, and professional. A clear, simple structure helps both you and the client stay on the same page, reducing the likelihood of errors or misunderstandings.

Key Considerations When Choosing a Format

There are several factors to take into account when deciding how to present your request for payment. Here are some important elements to consider:

- Clarity and Readability: Choose a format that presents information in a straightforward and easy-to-read manner. Avoid excessive use of text or complicated structures that could confuse the client.

- Customization Options: Depending on your needs, select a format that allows you to easily add custom details, such as specific work descriptions, payment terms, or branding elements.

- Professional Appearance: Ensure that the layout looks polished and neat. A professional-looking document reinforces your credibility and enhances your reputation.

- Compatibility: Make sure the format you choose is compatible with your software and easily shareable with your client. Common formats include PDF, Word, and Excel, which are accessible to most people.

Popular Formats for Payment Requests

Here are some of the most commonly used formats for creating a payment request document:

- PDF Format: This is the most widely us

How to Calculate Performance Fees

When determining the amount to charge for your services, it’s important to account for all factors that contribute to the overall cost. Whether you’re working for a specific event or on an hourly basis, calculating your fee accurately ensures that you are fairly compensated for your time and effort. This section will guide you through the process of calculating a fair and reasonable fee for your work.

Factors to Consider When Setting Fees

Several factors can influence the amount you charge for your services. Consider the following when setting your rate:

- Time Spent: The duration of the work is often the most straightforward factor. If you’re charging by the hour, make sure to track the actual time spent performing or preparing.

- Complexity of the Task: More complex tasks or performances may justify a higher rate. Consider how much effort, skill, or preparation is required to complete the work successfully.

- Location: If the work requires travel, you should factor in transportation costs, accommodation (if needed), and time spent traveling.

- Market Rates: Research what others in your field charge for similar services to ensure your fees are competitive yet fair.

- Special Requests or Additional Services: If you are asked to perform extra tasks outside your normal scope of work, be sure to account for these when calculating your fees.

Different Methods for Calculating Fees

There are several approaches you can take when calculating how much to charge for your services. Below are a few common methods:

- Hourly Rate: If you charge by the

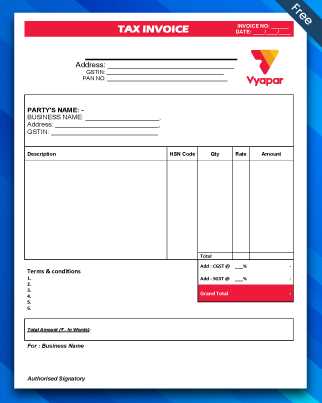

Handling Taxes in Music Invoices

When requesting payment for services rendered, it’s essential to understand how taxes affect the total amount due. Depending on your location and the nature of the services provided, taxes may need to be applied to the final fee. This section will guide you through the process of calculating and adding taxes to your request for payment to ensure compliance with local regulations.

There are various tax considerations to keep in mind, including sales tax, VAT (Value Added Tax), and income tax. Different regions have different rules for what services are taxable, so it’s important to research local tax laws or consult with a professional accountant. Below, we’ll outline the common steps to ensure taxes are handled correctly.

How to Calculate and Add Taxes

Once you’ve determined the applicable tax rate, you can easily calculate how much needs to be added to the final amount. Here’s a simple breakdown:

Service Amount Tax Rate Tax Amount Total Amount Due $500 10% $50 $550 $800 5% $40 $840 In the table above, you can see how to calculate the tax amount by multiplying the service amount by the applicable tax rate. Onc

Designing a Professional Invoice

Creating a well-designed payment request document is crucial for establishing professionalism and ensuring that clients understand all the necessary details. The layout should be clear, organized, and easy to follow, reflecting the quality of your services. A polished design not only helps avoid confusion but also strengthens your brand and leaves a lasting impression on clients.

Key Design Elements for a Professional Document

To ensure your document looks professional and is easy to read, consider incorporating the following design elements:

- Logo and Branding: Include your logo and use your brand colors and fonts to create a cohesive look. This helps clients immediately recognize your business and adds credibility.

- Clean Layout: Keep the design simple and uncluttered. Use plenty of white space to make the document easy on the eyes and help important details stand out.

- Clear Section Headings: Use bold or larger fonts for section headings, such as “Payment Terms” or “Service Details,” to guide the reader through the document.

Customizing Your Invoice for Different Gigs

When you’re providing services for various events, it’s important to tailor your payment request to fit the specifics of each job. Customization ensures that all details are relevant to the particular project and client, which can help avoid confusion and ensure prompt payment. Whether you’re handling a small private event, a large corporate job, or a recurring engagement, adapting your document to suit the situation will demonstrate professionalism and clarity.

Adjusting for Event Type

Each type of gig or engagement may require different information or breakdowns. Here’s how to customize your document depending on the nature of the work:

- One-Time Events: For one-off gigs or engagements, ensure you include specific details such as the event date, venue, and the nature of your services. This helps the client understand what they are paying for, as these are typically single occurrences.

- Recurring Work: For ongoing jobs, consider adding sections that detail the terms of recurring payments, including the frequency and duration. You might also offer discounted rates for long-term engagements.

- Private Clients vs. Corporate Clients: When dealing with individual clients, you might keep things simple and straightforward. For corporate clients, you may need to add more formal sections, such as tax identification numbers, references to contracts, or payment schedules.

Including Specific Details for Different Services

Tailoring the content to reflect the type of service you are offering can help clarify the charges for the client. Here are some aspects to consider:

- Hourly vs. Flat Rate: If you’re charging by the hour, make sure to clearly list the number of hours worked and the rate. If you’re charging a flat fee, specify what that fee covers and any additional costs (e.g., travel, equipment rental).

- Additional Services: If you’ve been asked to perform extra tasks, such as providing equipment or offering additional time, ensure those are itemized separately. This transparency helps clients understand exactly what they are paying for.

- Special Requirements: If you have specific client requests (such as special setups, particular performance conditions, or customized services), make sure to note these clearly in the document.

By customizing your request for payment based on the nature of the event and the client’s needs, you ensure that all aspects of the work are properly accounted for, which helps create trust and makes the payment process more efficient.

Common Mistakes to Avoid in Invoices

When requesting payment for your services, it’s essential to ensure that your document is accurate and clear. Even small errors can lead to confusion, delayed payments, or even damaged professional relationships. This section highlights some of the most common mistakes that can occur when creating a payment request and offers tips for avoiding them to ensure a smooth process.

Missing or Incorrect Information

One of the most frequent errors is failing to include crucial details or providing incorrect information. Here are some of the common oversights:

- Incorrect Dates: Always double-check the service date and the payment due date. Errors in these fields can cause confusion and delay processing.

- Wrong Amounts: Ensure that the amount due is accurate, including taxes, discounts, and additional fees. Miscalculations can lead to disputes.

- Missing Contact Details: Make sure both your contact details and the client’s are listed clearly. This ensures that both parties can easily get in touch if there are questions about the payment.

- Omitting Terms: Always include clear payment terms. Whether you require payment upfront or within a specific number of days, specifying this will prevent misunderstandings.

Lack of Professionalism

A poorly formatted document can make a bad impression. Avoid these common mistakes to ensure your document looks professional:

- Unclear Layout: Keep your design clean and simple. Avoid overcrowding the document with too much text or unnecessary graphics, as this can distract from the important details.

- Unprofessional Language: Use clear, concise, and polite language. Avoid informal phrases or abbreviations that could make the document seem less professional.

- Missing or Incomplete Terms: Always specify payment instructions, accepted payment methods, and any late fees. This clarity helps clients understand what is expected.

By being mindful of these common mistakes and taking the time to proofread and organize your payment request, you can ensure a smooth transaction and maintain a professional image.

Best Tools for Creating Invoices

Creating a professional payment request can be made easier with the right tools. Whether you prefer using online software, desktop applications, or even simple spreadsheet templates, choosing the best tool for your needs can save you time, reduce errors, and ensure your documents look polished. This section explores some of the best tools available to help you create accurate and well-designed payment requests.

Top Software for Payment Requests

There are numerous online tools and software that make it simple to generate professional-looking documents. Here are some of the most popular and effective options:

- FreshBooks: Known for its user-friendly interface, FreshBooks offers customizable templates and an easy-to-use platform for creating, sending, and tracking payment requests. It also integrates well with accounting tools.

- QuickBooks: A comprehensive solution for invoicing and accounting, QuickBooks provides powerful tools to track payments, expenses, and create detailed financial reports.

- Wave: Ideal for small businesses and freelancers, Wave offers a free invoicing solution with customizable templates and features such as automatic payment reminders and online payment processing.

- Zoho Invoice: A robust tool that allows you to create, send, and manage requests for payment. Zoho Invoice also provides customizable templates and integrates with a variety of payment platforms.

- Invoice Ninja: This free tool offers great customization options and allows you to track time and manage multiple clients efficiently. Invoice Ninja is a great option for freelancers and small business owners.

Spreadsheet-Based Solutions

If you prefer a more hands-on, customizable approach, spreadsheet software like Microsoft Excel or Google Sheets can be an excellent choice. T

Understanding Payment Terms and Conditions

Clear payment terms and conditions are essential for ensuring smooth transactions and maintaining professional relationships. By specifying the details of when and how payment is expected, both parties can avoid misunderstandings and ensure that the financial aspects of the agreement are clear. Understanding these terms is key for both service providers and clients, as it sets the expectations and protects the rights of both parties.

Key Payment Terms to Include

When creating a payment request, it’s important to include specific terms that outline when payment is due, the accepted methods of payment, and any penalties for late payment. Below are some common terms and conditions that should be clearly defined:

Payment Term Description Due Date The date by which payment must be made. This can be a specific date or a number of days after the service date (e.g., 30 days net). Late Fees Charges that apply if payment is not made by the due date. Late fees should be clearly stated, including the percentage or flat fee that will be added to the total. Discounts If you offer early payment discounts, this should be included in the terms. For example, a 10% discount for payments made within 7 days of the service date. Accepted Payment Methods Specify which forms of payment are acceptable, such as bank transfers, credit cards, PayPal, or checks. Refunds and Cancellations Clarify your policy regarding refunds or cancellations in case the client is dissatisfied or needs to cancel the service. Why Payment Terms Matter

Clearly outlining payment terms ensures that both parties understand the expectations and responsibilities involved. This minimizes disputes and helps prevent confusion about when and how the transaction should be completed. For service providers, setting clear terms also ensures that you are paid on time and in full for the work performed. For clients, these terms provide clarity and transparency, helping to avoid unexpected charges or payment issues.

Incorporating detailed payment terms and conditions into you

Setting Up Your Invoice Template

Creating a well-structured document for requesting payment is an essential part of maintaining professionalism and ensuring a smooth transaction. The layout should be simple, organized, and easy to follow, with all necessary information clearly presented. Setting up this document properly from the beginning will save time, reduce errors, and help establish a positive relationship with your clients.

Start by deciding on the format and design that works best for your needs. Whether you’re using an online tool, spreadsheet, or word processor, it’s important to have a consistent structure that can be reused for future requests. This will make the process more efficient and professional every time you need to generate a payment request.

Be sure to include all essential details, such as your contact information, the client’s details, a description of the services provided, payment terms, and the total amount due. A clean and clear layout ensures that clients can quickly find the information they need and that there is no ambiguity about what is being charged.

Once you have set up a basic layout, you can customize it to reflect your brand. Add your logo, use your brand’s colors and fonts, and include any other personal touches that make the document feel like it belongs to you. This consistency not only adds a professional touch but also helps with recognition in the future.

By taking the time to properly set up your document for requesting payment, you create a system that is easy to use, reduces confusion, and makes your professional transactions more efficient and organized.

Incorporating Your Brand into Invoices

Your payment request documents are more than just functional–they are an extension of your professional image. By incorporating elements of your brand, you can ensure consistency across all your business communications and reinforce your identity with every transaction. Whether it’s the use of a logo, specific color schemes, or a particular font style, adding your brand to these documents helps maintain a cohesive and professional appearance.

Elements to Include for Brand Consistency

There are several key elements that can reflect your brand’s identity in your request for payment, helping to create a seamless experience for your clients:

Brand Element How to Incorporate It Logo Include your logo at the top of the document to ensure instant recognition. This reinforces your brand’s presence and creates a professional look. Color Scheme Use your brand’s primary colors for headings, borders, and accents. This adds consistency and makes the document feel more aligned with your overall business identity. Font Style Choose fonts that align with your brand’s typography. Consistent use of fonts enhances readability and strengthens the visual identity of your brand. Tagline or Slogan If you have a tagline or slogan, consider adding it to your payment document. This adds a personal touch and reminds clients of your unique value proposition. Why Branding Matters

How to Send and Track Invoices

Once you have created your payment request, the next step is to send it to your client and keep track of its status. Sending and monitoring these documents is crucial to ensure timely payments and to maintain a professional relationship. By using the right tools and methods, you can streamline the process and stay organized without having to worry about missed payments or confusion.

Methods for Sending Payment Requests

There are several effective ways to send your payment requests, each with its own advantages. Depending on your preferences and your client’s needs, you can choose the method that works best:

Method Advantages Email Email is one of the most common and efficient methods. You can attach your document, include payment instructions, and receive quick confirmation from your client. Online Platforms Using dedicated invoicing platforms (like FreshBooks or QuickBooks) makes sending and tracking easy. These platforms often provide automated reminders, payment links, and the ability to track the status of each request. Postal Mail While less common today, sending a physical document may be necessary for certain clients. This can add a personal touch but typically takes longer for processing. SMS or Messaging Apps For smaller projects or informal agreements, you can send a payment request via text or messaging apps. This method is less formal but can work well for clients you have an ongoing relationship with. Tracking Payment Status

Tracking the status of your payment request is just as important as sending it. Monitoring payments ensures that you can follow up on overdue requests and address any issues promptly. There are a few strategies to keep track of your documents:

- Automated Reminders: Many invoicing platforms offer automated reminders to be sent to clients who haven’t paid by the due date. This can save you time and effort in following up.

- Manual Tracking: If you’re using a spreadsheet or physical system, make sure to create a tracking system with columns for the date sent, payment due date, and the current payment status.

- Payment Platforms: If you use an online payment system like PayPal or Stripe, you can easily track when the payment was made and confirm receipt.

- Communication Logs: Keep a record of all communications

What to Do if Payment is Late

When a payment is not made on time, it can be a source of stress and frustration. However, how you handle late payments is crucial to maintaining a professional relationship with your clients while ensuring you are compensated for your work. The key is to remain calm, follow a clear process, and communicate effectively. By taking the right steps, you can resolve the issue efficiently while minimizing any negative impact on your business.

If a payment is late, the first step is to review the payment terms outlined in your agreement. This will help you determine if the client is indeed overdue or if they are still within the grace period. Once you’ve confirmed that the payment is late, you should take action to follow up and ensure the situation is addressed promptly.

Steps to Take When Payment is Late

- Send a Reminder: The first step in addressing a late payment is to send a friendly reminder. Politely inform your client that the payment due date has passed and ask if there are any issues preventing them from completing the payment.

- Follow Up with a Second Request: If there is no response after the first reminder, send a more formal follow-up. Include a reminder of the terms, any late fees, and a new due date if necessary. You can also ask if there are any concerns or difficulties with the payment process that you can assist with.

- Apply Late Fees: If your agreement includes late payment penalties, now is the time to apply them. Be sure to clearly state the amount of the penalty and how it will affect the total balance due. This step may encourage the client to make the payment more quickly.

- Offer a Payment Plan: If the client is experiencing financial difficulties, offering a payment plan may be an option. This can help both parties avoid further conflict and ensure that you still receive compensation for your work over a longer period.

- Seek Legal Action: As a last resort, if the cli

Invoicing for Different Music Events

When it comes to charging for services at various live events, the process can vary depending on the scale and nature of the engagement. Different types of events may require distinct approaches in terms of pricing, payment structures, and the details included in the document you provide to your clients. Understanding these nuances ensures that you are compensated appropriately for your work, regardless of the event type.

For small, intimate gatherings, a straightforward request for payment may be sufficient. However, larger events or festival-type engagements may require a more detailed approach, reflecting the scope of the work, multiple team members, or added logistical expenses. Tailoring your billing document to each type of event helps keep things clear for both you and your client.

Small Events

For smaller events such as private parties or small club performances, the structure is typically more relaxed. Here, you might simply need to list the agreed-upon fee, the time spent, and any additional charges (like travel or equipment costs). A basic breakdown is sufficient for these more straightforward engagements:

- Flat Fee: A set amount for the service provided, without additional variables.

- Time-Based Charges: If the performance or service is time-bound, specify the hourly or daily rate.

- Additional Costs: Mention any out-of-pocket expenses, such as transportation, lodging, or equipment rental.

Large Events or Festivals

For larger-scale events, more detailed documentation is necessary. In these situations, you may need to account for multiple aspects of your work, such as staff, equipment, and additional time. These invoices may also reflect payment schedules, especially if the engagement is long-term or involves several stages:

- Stage Payments: For extended engagements, consider splitting the payment into stages, such as a deposit, mid-project payment, and final balance.

- Itemized Breakdown: List out each service or resource used, including staff, gear, and additional services, with spe