Free Draft Invoice Template Excel for Easy and Professional Billing

Managing finances efficiently requires well-organized tools for generating business statements. One of the most important aspects of this process is ensuring that each transaction is clearly outlined and easy to process. With the right approach, creating billing sheets can be both fast and accurate, helping you stay on top of your operations.

Using spreadsheet software offers a practical way to structure these financial documents. It allows for customization, flexibility, and easy tracking of payments. Whether you’re running a small business or freelancing, having the right format to record transactions saves time and prevents errors.

In this guide, you will discover how to efficiently set up these financial documents in a simple yet professional way. By the end, you’ll understand how to optimize these tools for your business needs, ensuring that each document sent is clear, organized, and effective in managing your billing tasks.

Draft Invoice Template Excel Guide

Creating clear and professional billing documents is essential for any business. The right format ensures that you can present charges, terms, and details in a way that is easy to understand, while also helping you keep track of financial transactions. A well-organized billing structure minimizes errors and speeds up the payment process, whether you’re working with clients or managing your own operations.

One of the most efficient ways to manage this process is through a customizable, user-friendly document in a spreadsheet program. By using this tool, you gain flexibility, as it allows you to adjust fields, add custom elements, and save the format for future use. With just a few simple steps, you can generate a polished document that suits your business style and meets client expectations.

In this section, we’ll walk you through the essential steps of creating these types of documents. From setting up basic sections to incorporating payment terms and calculating totals, you will learn how to create a streamlined, efficient process for your business’s financial paperwork.

Why Use a Draft Invoice Template

Having a structured format for creating billing documents can significantly simplify financial management. Using a pre-designed framework helps save time and ensures consistency across all your business transactions. By adopting a ready-to-use structure, you can focus on the important aspects of your work, rather than worrying about formatting or missing essential information.

Another key advantage is the ability to streamline your processes. With a customizable layout, you can quickly generate documents without having to start from scratch each time. This efficiency reduces the risk of errors and improves the overall professionalism of your communications with clients or partners.

Benefits of Using a Structured Layout

By using an organized structure, you can ensure that each document includes all the necessary details, such as contact information, payment terms, and itemized charges. This consistency not only saves time but also builds trust with your clients, as they receive clear and accurate statements.

How It Helps Save Time and Reduce Errors

Instead of manually entering data or recreating the layout each time, a predefined structure allows you to focus on content rather than formatting. This time-saving feature enables you to handle a higher volume of transactions without sacrificing accuracy.

| Benefit | Description | ||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time-saving | Quickly generate documents with pre-set fields and design. | ||||||||||||||||||||||||||||||||||||||||

| Consistency | Ensure that every document follows the same professional format. | ||||||||||||||||||||||||||||||||||||||||

| Accuracy | Reduce the chance of missing important information or making mistakes. | ||||||||||||||||||||||||||||||||||||||||

| Professionalism | Provide a polished, uniform look tha

Why Use a Draft Invoice TemplateHaving a structured format for creating billing documents can significantly simplify financial management. Using a pre-designed framework helps save time and ensures consistency across all your business transactions. By adopting a ready-to-use structure, you can focus on the important aspects of your work, rather than worrying about formatting or missing essential information. Another key advantage is the ability to streamline your processes. With a customizable layout, you can quickly generate documents without having to start from scratch each time. This efficiency reduces the risk of errors and improves the overall professionalism of your communications with clients or partners. Benefits of Using a Structured LayoutBy using an organized structure, you can ensure that each document includes all the necessary details, such as contact information, payment terms, and itemized charges. This consistency not only saves time but also builds trust with your clients, as they receive clear and accurate statements. How It Helps Save Time and Reduce ErrorsInstead of manually entering data or recreating the layout each time, a predefined structure allows you to focus on content rather than formatting. This time-saving feature enables you to handle a higher volume of transactions without sacrificing accuracy.

How to Customize Invoice Templates

Personalizing your billing documents is crucial for making them reflect your unique business style. Customization allows you to tailor the layout, content, and design to suit the specific needs of your clients and industry. By adjusting key elements, you can create documents that are both functional and professional, helping to strengthen your brand’s image and streamline your financial processes. Customizing your billing structure is straightforward and can be done in just a few steps. The following points highlight key areas to focus on when adjusting the format to meet your business needs:

Once you’ve customized these elements, you can save your adjusted layout for future use. This ensures that you always have a professional document ready to go, without the need to recreate the structure each time. Steps to Customize Your Document

By following these steps, you can ensure that your billing documents are not only functional but also aligned with your business goals and client expectations. How to Customize Invoice TemplatesPersonalizing your billing documents is crucial for making them reflect your unique business style. Customization allows you to tailor the layout, content, and design to suit the specific needs of your clients and industry. By adjusting key elements, you can create documents that are both functional and professional, helping to strengthen your brand’s image and streamline your financial processes. Customizing your billing structure is straightforward and can be done in just a few steps. The following points highlight key areas to focus on when adjusting the format to meet your business needs:

Once you’ve customized these elements, you can save your adjusted layout for future use. This ensures that you always have a professional document ready to go, without the need to recreate the structure each time. Steps to Customize Your Document

By following these steps, you can ensure that your billing documents are not only functional but also aligned with your business goals and client expectations. Steps to Create a Draft InvoiceCreating a professional billing document is essential for clear communication between you and your clients. The process of preparing this document can be broken down into simple steps that ensure all necessary details are included. By following a straightforward approach, you can quickly generate accurate and polished statements that reflect your business practices. The key to an efficient document is organization. By structuring the document in an easy-to-read format, you ensure that both you and your clients understand the terms, amounts, and deadlines clearly. Below are the essential steps to follow when crafting a new document for a financial transaction: Essential Information to Include

Formatting and Organization Tips

Once the document is created, you can save it for future use or modify it for new transactions. By following these simple steps, you’ll ensure that your financial communications are both efficient and professional. Choosing the Right Template for Your Business

When managing financial transactions, selecting the correct document format can significantly impact your workflow and efficiency. The right design ensures clarity, professionalism, and ease of use, helping you maintain organized records while meeting industry standards. Whether you’re handling payments, receipts, or any form of monetary exchange, the format you choose should align with the nature of your business and its specific needs. Before selecting a format, consider factors such as the complexity of your transactions, the volume of documentation you handle, and the level of customization required. A well-structured layout will not only save time but also reduce the chances of errors or omissions, ultimately contributing to smoother operations and better customer relationships. For small businesses, simplicity is key, while larger companies might require more detailed options to cover a broader range of services. The ability to customize fields, add branding elements, and include specific terms and conditions are also essential aspects to keep in mind. By taking these factors into account, you can ensure that the chosen solution meets both practical and professional needs. Common Mistakes When Using Invoice TemplatesEven with the best tools, errors can still occur when creating financial documents. Common mistakes often stem from overlooking important details or misunderstanding certain fields. These mistakes not only affect the accuracy of your records but can also lead to delays in payments, customer confusion, and legal complications. Being aware of these pitfalls can help you create more reliable and professional documents. 1. Missing or Incorrect Contact Information

One of the most frequent mistakes is not providing complete or accurate contact How to Automate Your Invoicing ProcessAutomating the process of creating and sending payment requests can save significant time and reduce human error. By setting up systems to handle routine tasks such as document generation, data entry, and delivery, you can streamline your financial operations and ensure timely payments. Automation helps maintain consistency, improve accuracy, and free up valuable time for other business activities. 1. Use Accounting Software to Generate Documents AutomaticallyModern accounting platforms offer the ability to automatically generate payment requests based on pre-set information. By linking your client records and transaction history, these tools can populate essential fields such as amounts, due dates, and service descriptions without manual input. This reduces errors and ensures that the documents are always aligned with your current pricing and client details. 2. Set Up Recurring Billing for Regular ClientsIf you have clients who make regular payments, consider setting up recurring billing in your software. This feature will automatically create and send payment requests at specified intervals, eliminating the need for manual updates each time. Recurring billing also ensures that payment terms are consistently applied, and reminders are sent when necessary. Managing Multiple Invoice Templates in ExcelWhen handling a range of different payment requests for various clients or services, organizing your document formats becomes essential for efficiency and consistency. Managing multiple document layouts can seem daunting, but with the right approach, you can streamline the process and ensure all records are up-to-date and correctly formatted. By using a structured system, you can maintain clarity and avoid confusion between different formats. Here are some key strategies to effectively manage multiple document formats:

By following these practices, you can keep multiple layouts organized, saving time and improving your overall efficiency when handling financial documents. Invoice Template Design Best PracticesCreating clear and professional documents for financial transactions is essential for maintaining a positive business reputation and ensuring smooth operations. A well-designed document not only improves readability but also helps prevent errors, reduces confusion, and enhances client trust. When designing such documents, certain best practices can help you achieve consistency, clarity, and professionalism. Here are some key design principles to follow:

By following these best practices, you can ensure that your financial documents are not only functional but also professional, making it easier for clients to process payments on time and with clarity. Formatting Tips for Clear InvoicesProper formatting plays a crucial role in ensuring that financial documents are easy to understand and process. A well-structured document eliminates confusion, reduces errors, and speeds up the payment process. Clear formatting also enhances professionalism, making it easier for clients to find the key information they need. Here are some essential tips for formatting your financial documents effectively. 1. Organize Information into SectionsBreaking the document into distinct sections ensures that all necessary details are easy to locate and understand. A typical document should include the following key sections:

2. Use Tables for ClarityTables are an excellent way to organize financial details such as item descriptions, quantities, rates, and totals. By using tables, you can keep your content aligned and easy to read, ensuring there’s no ambiguity. Here are a few tips for using tables:

By implementing the Tracking Payments with Excel InvoicesKeeping track of payments is essential for maintaining a healthy cash flow and ensuring that all transactions are properly recorded. Using a spreadsheet to monitor payments allows for efficient tracking, easy updates, and clear visibility of any outstanding balances. With the right setup, you can quickly determine which payments are overdue, which have been completed, and which are pending. Here are some strategies to help you effectively track payments through a spreadsheet. 1. Set Up a Payment Tracking SheetStart by creating a dedicated sheet within your workbook for payment tracking. This sheet should include columns for all relevant details, such as:

2. Use Conditional Formatting to Track StatusOne effective way to monitor payment status is by using conditional formatting. This allows you to visually distinguish between completed, pending, and overdue payments. For example:

By applying this method, you can quickly scan your sheet and identify which payments need follow-up, ensuring that nothing is missed. 3. Create Payment Reminders and AlertsTo stay on top of overdue payments, set up automatic alerts or reminders in your system. You can use formulas to calculate payment due dates and set reminders for the days leading up to or after the due date. This proactive approach will help you maintain consistent follow-up without manually tracking each transaction. By organizing your payments in this way, you can significantly reduce administrative work, avoid errors, and ensure timely payments, contributing to smoother cash flow management for your business. How to Save Time with Draft InvoicesStreamlining the process of preparing financial documents can greatly reduce the time spent on administrative tasks. By using pre-set layouts that can be easily adjusted, you eliminate the need to start from scratch each time. This not only saves time but also ensures consistency across all documents, improving your workflow and reducing the likelihood of errors. Below are some strategies to help you save time when preparing payment requests. 1. Use Pre-Filled FieldsOne of the easiest ways to save time is by setting up fields that automatically fill in with common details, such as client names, addresses, and payment terms. This reduces the need for manual data entry and ensures accuracy in every document. For example, when creating a new payment request, the client’s details can be pulled from an existing database or record. 2. Create a Master Document for Quick CustomizationBy maintaining a master document with all standard sections–such as business information, common services/products, and payment terms–you can easily customize the content for each client or transaction. This method allows for quick adjustments without needing to format each document individually. Here’s a simple table layout to help you organize key information:

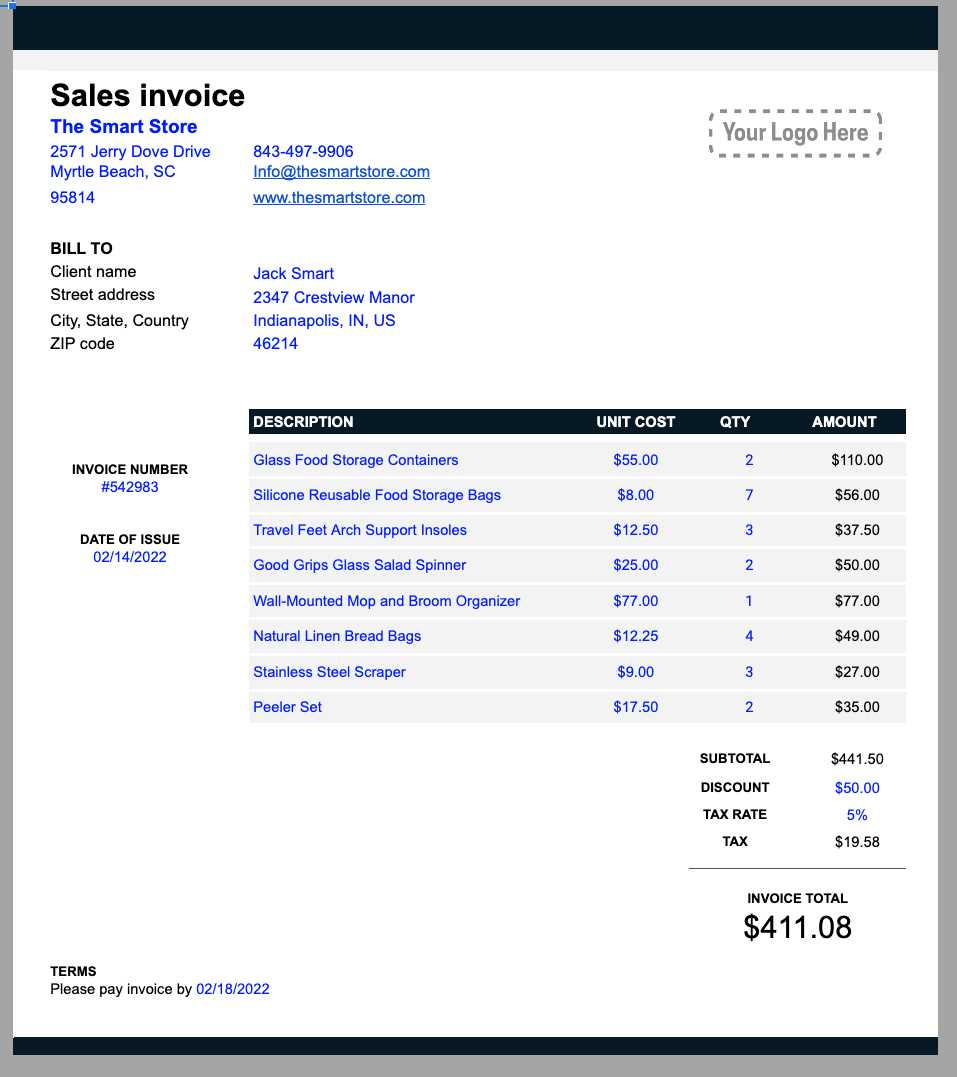

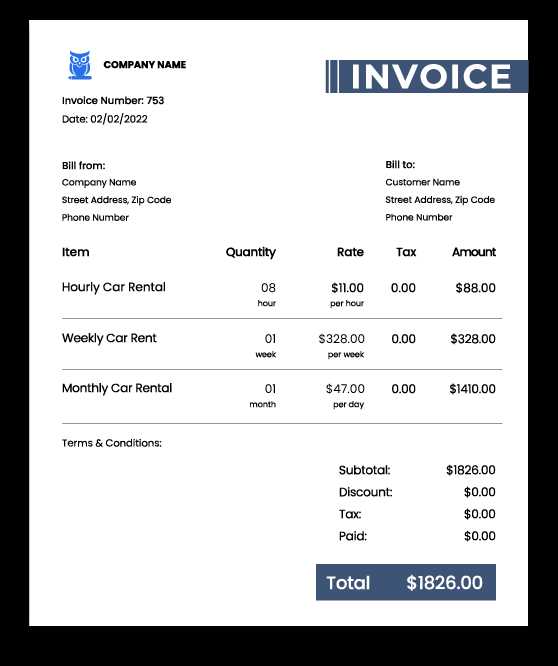

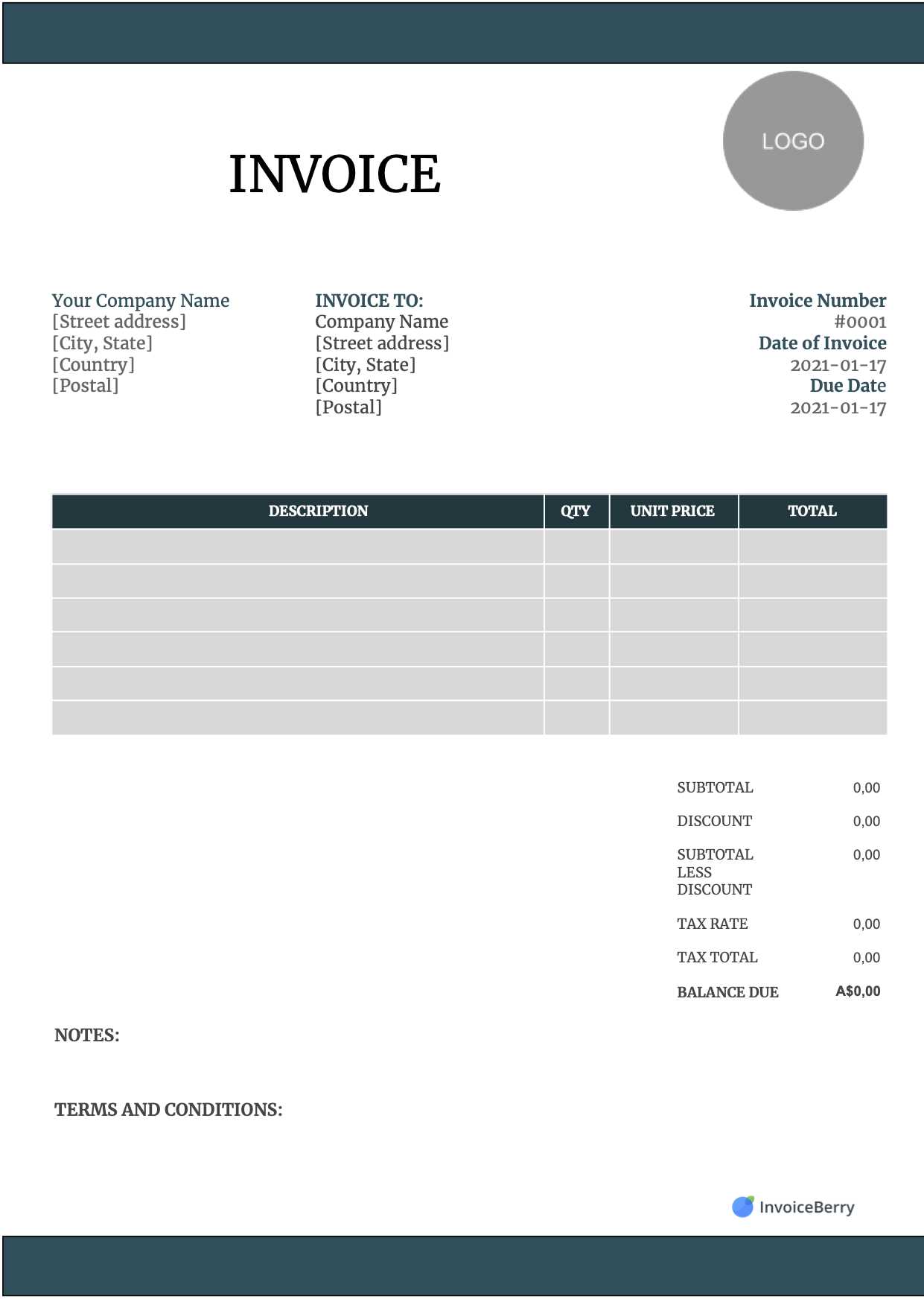

With this approach, most of the document will be pre-populated, allo Free Excel Invoice Templates to DownloadFinding the right format for creating payment documents can save both time and effort, especially for small businesses or freelancers. Downloadable options allow you to quickly get started without needing to design a new layout from scratch. These free resources offer flexibility, allowing customization to suit different types of transactions and industries. Below are some options to consider when looking for ready-made document layouts that can streamline your financial workflow. 1. Simple and Clean DesignsFor those who prefer straightforward, no-frills documents, simple designs with essential fields are a great choice. These layouts typically include sections for service descriptions, amounts, and payment terms, without unnecessary details. They are ideal for businesses that require clear and concise documents for quick processing.

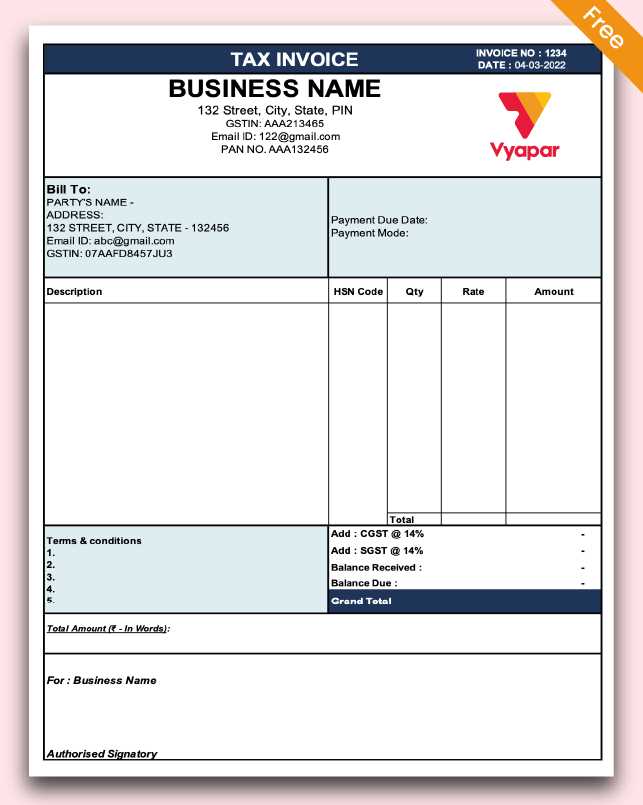

2. Detailed and Customized LayoutsFor more complex billing needs, detailed layouts that allow for multiple items or services, payment breakdowns, and additional terms are available. These formats provide sections for tax calculations, discounts, and even late fee policies, making them ideal for businesses with diverse offerings or multiple clients to manage.

|