How to Write an Invoice Template for Your Business

Designing a clear and efficient billing document is essential for maintaining smooth transactions with clients. A well-organized record not only helps ensure timely payments but also reflects professionalism in your business dealings. Understanding the key components of such a document will streamline the process and make it easier for both you and your customers.

Structuring a billing document requires careful attention to detail, as it involves presenting important information in a user-friendly format. Elements like dates, amounts, and contact details should be clearly visible, while maintaining a simple, uncluttered design. The accuracy of the content is equally critical, as any errors may lead to confusion or delayed payments.

By following a set of best practices, you can create a functional and professional document that serves your business well. Customizing it to reflect your unique brand, while including necessary payment instructions, ensures a smooth financial exchange with clients. This guide will walk you through the steps of preparing a flawless document from start to finish.

How to Write an Invoice Template

Developing a structured billing document is a vital part of managing business finances effectively. A thoughtfully designed document not only facilitates prompt payments but also establishes trust with clients through its professionalism and clarity. This process involves organizing essential details to ensure smooth, efficient transactions.

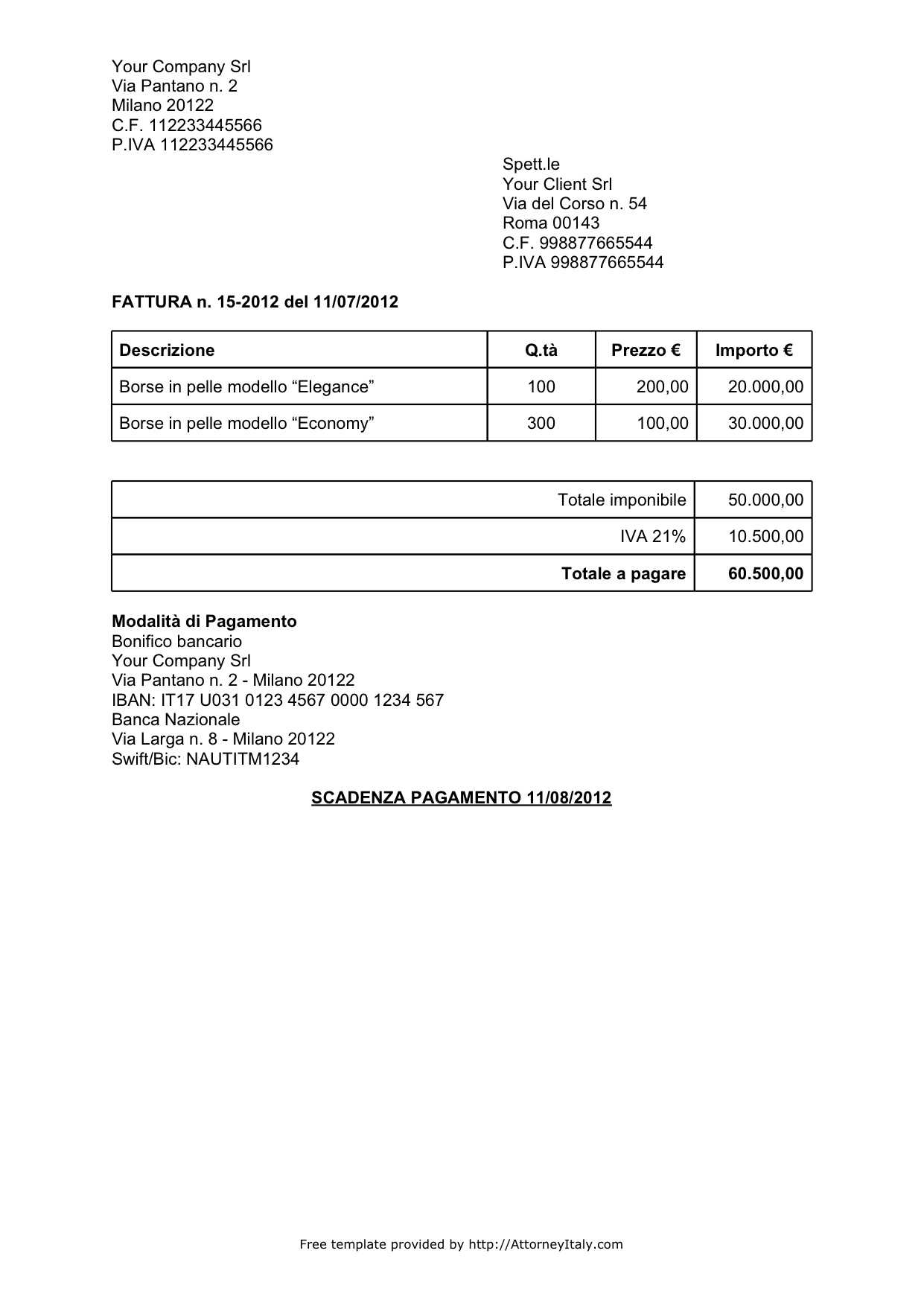

To start, include key elements that represent both your business and the client clearly. This should feature accurate contact information, transaction dates, and a breakdown of services or products provided. Structuring these sections in a logical order makes the document easy to follow, reducing the chance of misunderstandings.

Next, specifying payment terms is crucial. Clearly stated conditions help set expectations for due dates and accept

Understanding the Basics of Invoices

Creating a structured billing document is essential for smooth financial interactions between businesses and clients. A well-prepared record details the services or products provided, along with the financial terms, enabling both parties to track transactions and manage payments efficiently. Understanding the primary components of such a document ensures clarity and professionalism in your business communications.

Key Elements of a Billing Document

Each billing document should feature several core elements that give it structure and clarity. The business’s name, contact information, and date of the transaction establish the document’s foundation, allowing clients to easily recognize its origin. Additionally, an organized list of

Essential Elements of an Invoice Template

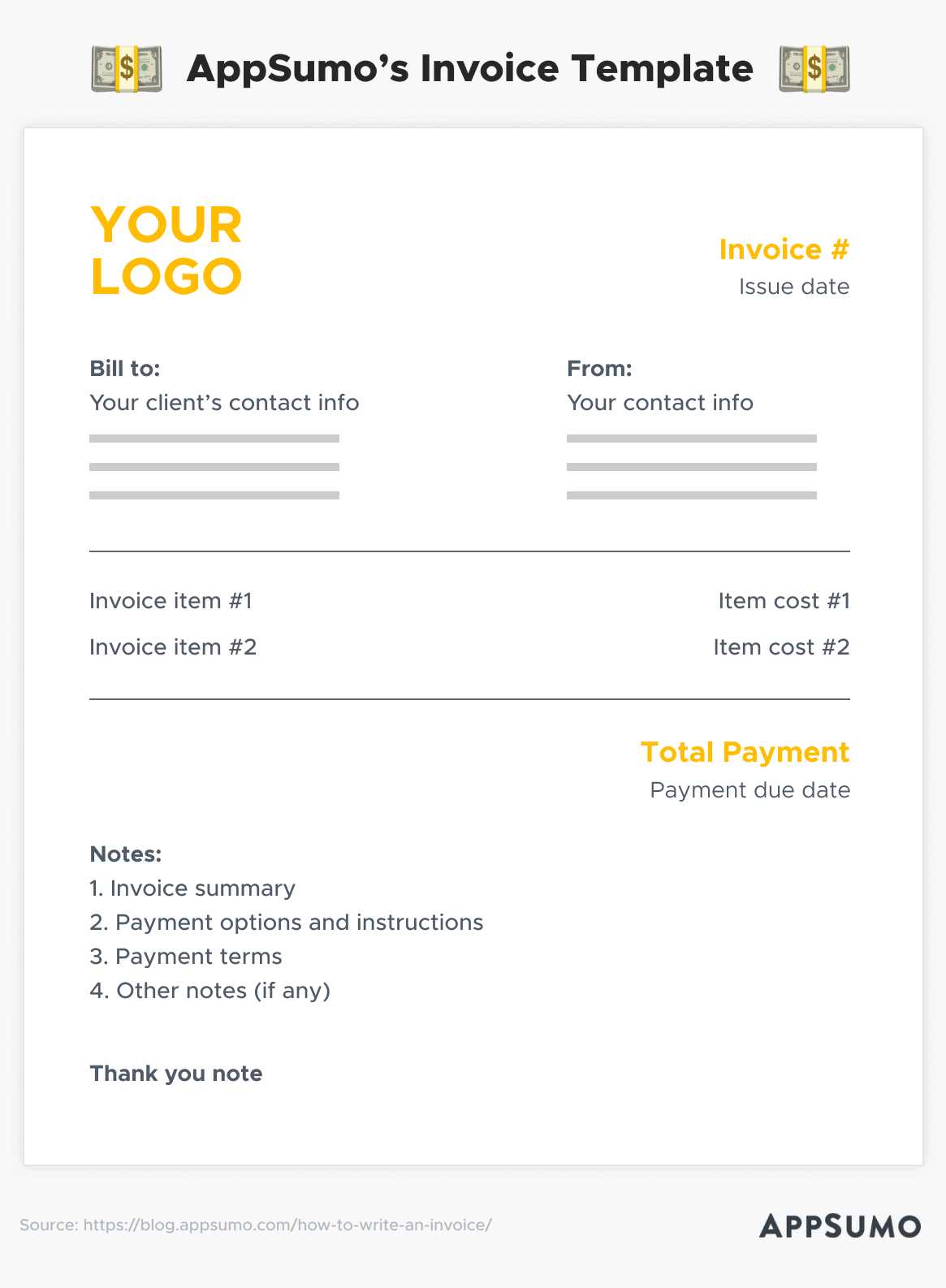

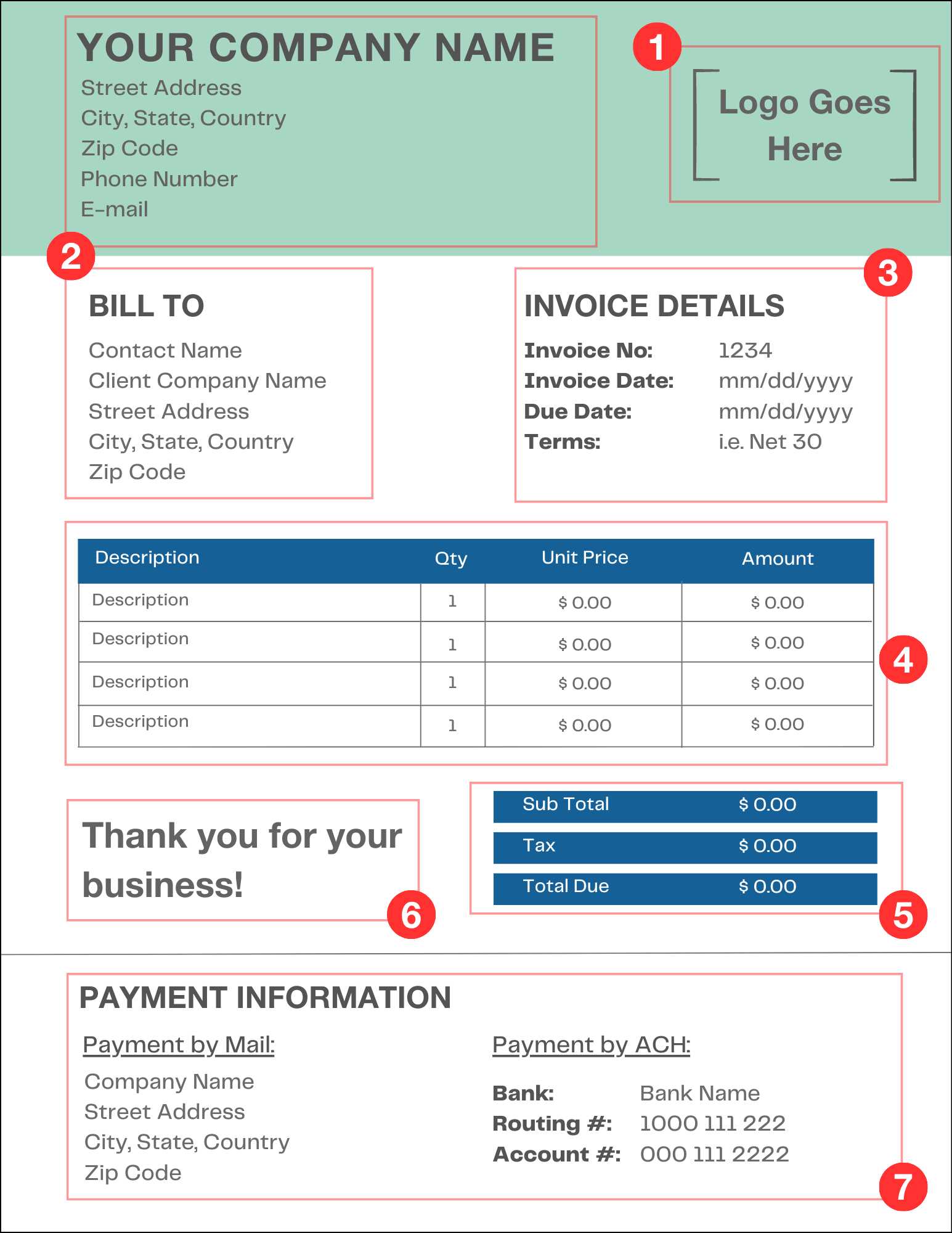

To create a clear and effective billing document, it is crucial to include specific details that provide structure and transparency. These components help ensure that both parties understand the terms of the transaction, making it easier to track payments and avoid confusion. Including key elements not only adds clarity but also strengthens the document’s professional appearance.

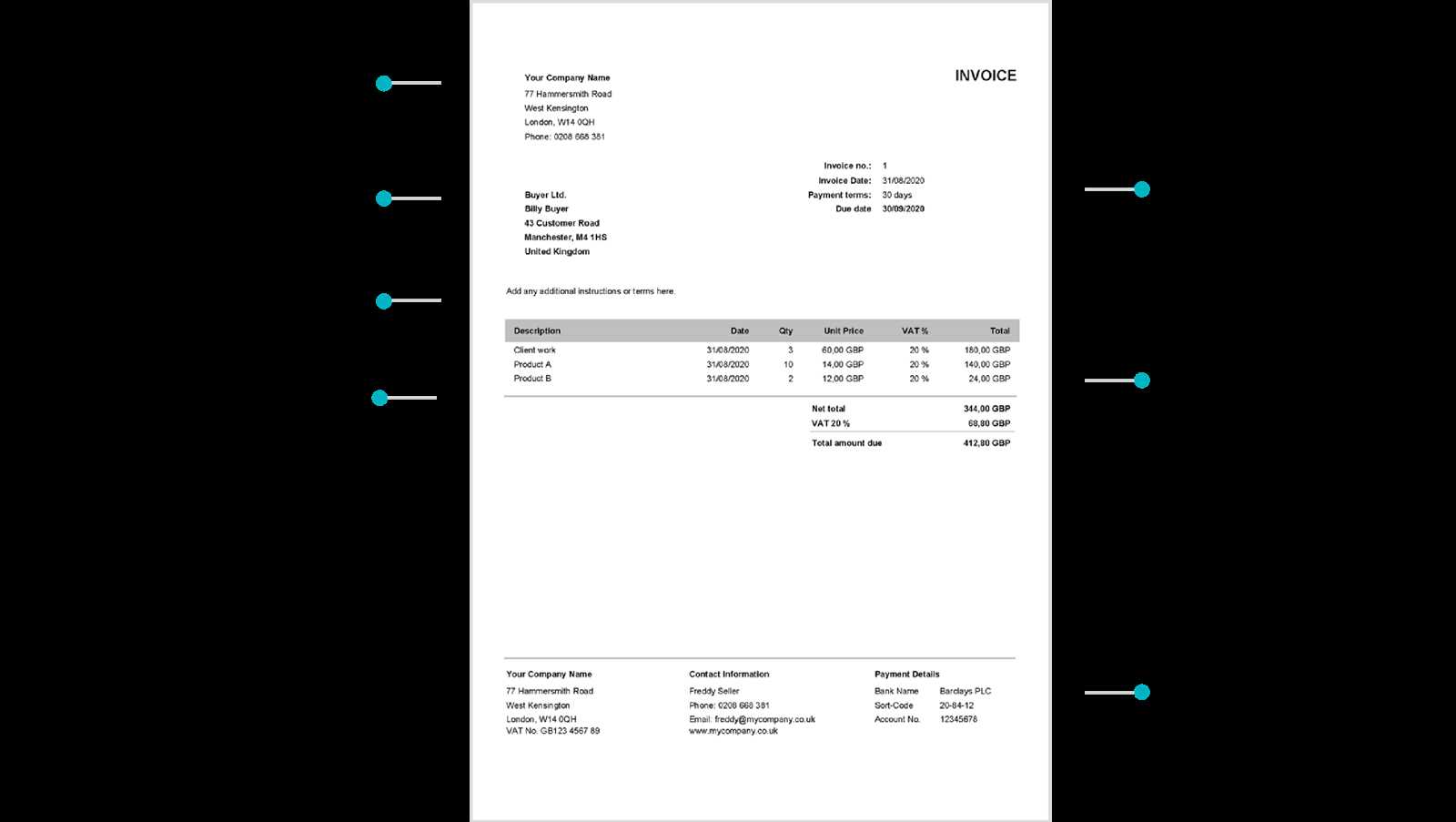

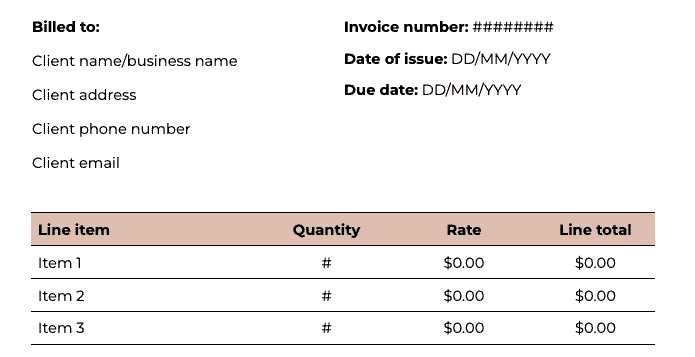

The header should display the business’s name, logo, and contact information. This section helps recipients immediately identify the sender, adding credibility and establishing brand presence. Next, incorporating the client’s information, such as name and contact details, is essential for personalization and clarity in communication.

Listing services or products in an organized format is another vital component. Each item should be described briefly, along with its price or fee. This breakdown ensures that clients understand the charges and can easily verify the details. A

Choosing the Right Format for Your Invoice

Selecting an appropriate structure for a billing document plays a significant role in ensuring clarity and ease of use. A well-designed layout allows clients to quickly locate important details, promoting a smooth transaction process. The format you choose should align with your business needs and reflect the level of professionalism you want to convey.

One of the first decisions to make is whether to use a digital or printed format. Digital documents, often sent via email or downloadable links, are convenient for quick access and easy storage. Printed versions, on the other hand, may suit businesses that prefer traditional paperwork or cater to clients with limited digital access. Regardless of the choice, maintaining a consistent look across all documents reinforces brand identity and builds client trust.

An effective format typically includes a clean, organized layout with distinct sections for each piece of information. Grouping details such as services, fees, and payment instructions in a logical order makes the document easier to follow. By choosing a clear, professional format, you can create a billing document that is both

Creating a Professional Header for Invoices

A well-designed header is essential for setting a professional tone in any billing document. This section serves as the first impression, providing key details about your business and establishing credibility. By ensuring that the header is clear and visually appealing, you enhance the document’s readability and make it easier for clients to recognize its source.

Business identification is the main function of the header. Including the company’s name, logo, and contact information–such as an address, phone number, and email–immediately informs clients of who the document is from. This not only reinforces your brand identity but also allows clients to reach out with any questions.

Another important aspect of the header is the date and unique document number. Listing the date of issue helps both parties keep accurate records, while a unique reference number, like a serial code, aids in tracking and organizing multiple transactions. Together, these elements create a professional and organized starting point for the document, ma

How to List Products and Services

Presenting offerings clearly and effectively is crucial for maintaining transparency in any billing document. A well-organized list allows clients to understand the specifics of what they are being charged for, ensuring that all details are easily accessible and comprehensible. This section serves to break down the services or goods provided, creating a clear connection between the items and their respective costs.

Organizing Items for Clarity

When detailing the offerings, consider using a structured format. This can be achieved through bullet points or a table, allowing for easy reading and quick reference. Key elements to include are:

- Description: A brief, clear explanation of each service or product.

- Quantity: The amount of each item provided.

- Unit Price: The cost of each individual service or product.

- Total Price: The overall cost for each item, calculated by multiplying the quantity by the unit price.

Using a Consistent Format

Adopting a consistent layout for listing offerings not only enhances professionalism but also helps clients navigate the document more efficiently. A recommended approach is to use a table with distinct columns for each of the aforementioned elements. This organized structure simplifies the review process, making it easier for clients to verify the charges against the services rendered. By providing a comprehensive and clear listing, you foster trust and encourage timely payments.

Incorporating Payment Terms in Invoices

Clearly defined payment conditions are essential for facilitating smooth transactions between parties. These terms set the expectations regarding when and how payments should be made, helping to avoid misunderstandings and delays. By clearly articulating these details within the document, you establish a framework that supports timely financial exchanges.

Key elements to include in the payment conditions are the due date, which specifies the exact date by which the payment should be completed. Providing a deadline not only encourages prompt payment but also helps clients manage their cash flow effectively. Additionally, including acceptable payment methods–such as bank transfers, credit cards, or online payment platforms–can make the process more convenient for clients, further promoting timely responses.

Furthermore, it can be beneficial to outline any late fees or discounts for early payments. Mentioning these incentives or penalties creates an additional motivation for clients to adhere to the agreed-upon terms. By thoughtfully incorporating these elements into your billing document, you enhance clarity and foster a professional relationship based on mutual understanding and respect.

Calculating Taxes and Discounts Correctly

Accurate computation of levies and reductions is vital for ensuring transparency and fairness in any financial transaction. Properly accounting for these elements not only influences the final amount due but also enhances the credibility of the document. By following systematic methods for calculating these figures, you can maintain trust with clients while avoiding potential disputes.

To begin, it’s important to identify the applicable tax rates based on your location and the nature of the goods or services provided. Different products may be subject to varying rates, so be diligent in researching local regulations. Once the correct tax rate is determined, apply it to the subtotal of the offerings to arrive at the tax amount. This ensures that clients are fully aware of their financial obligations.

In addition to taxes, you may also offer discounts as a means to encourage prompt payments or reward loyal customers. Clearly outline any reductions and how they are calculated, whether as a percentage or a fixed amount. Subtracting these discounts from the total before taxes are added can further clarify the final amount due. By ensuring that all calculations are precise and transparent, you foster a positive relationship with clients and promote timely settlements.

Setting Up Invoice Numbers for Organization

Establishing a systematic approach to numbering documents is crucial for maintaining clarity and order in financial records. A well-structured numbering system aids in tracking transactions efficiently and facilitates easy retrieval when needed. By implementing a coherent method, you can streamline your accounting processes and enhance overall organization.

To create a functional numbering scheme, consider using a sequential format that reflects the chronological order of issued documents. This can be achieved by starting with a base number and incrementing it with each new entry. For instance, beginning with 001 for the first document, 002 for the second, and so on, provides a clear historical record of all transactions.

Additionally, incorporating relevant identifiers can further enhance organization. This might include prefixes or suffixes that denote the year of issuance or specific client codes. For example, using “2024-001” can quickly convey the year along with the unique identifier. By adopting a strategic approach to numbering, you not only facilitate better management of financial documents but also promote professionalism in your dealings.

Designing an Easy-to-Read Layout

Creating a visually appealing and comprehensible structure for financial documents is essential for effective communication with clients. A well-designed layout enhances the readability of critical information, allowing recipients to quickly grasp the necessary details without confusion. Prioritizing clarity and simplicity in design fosters a positive impression and encourages timely payments.

Utilizing Clear Sections

To achieve a clean appearance, divide the content into distinct sections that logically flow from one to another. Key elements such as contact information, item descriptions, payment terms, and totals should be clearly separated. Employing headings and adequate spacing between sections can significantly enhance overall organization, making it easier for clients to locate specific information.

Choosing the Right Fonts and Colors

Selecting appropriate fonts and color schemes is crucial for maintaining professionalism while ensuring legibility. Opt for simple, sans-serif fonts that are easy to read, and use contrasting colors to highlight important figures. For instance, utilizing bold text for totals can draw attention to essential amounts while keeping the overall design polished and sophisticated. By focusing on an easy-to-read layout, you enhance both functionality and aesthetics in your financial documents.

Including Your Business Information Properly

Accurately presenting your organization’s details in financial documents is crucial for establishing credibility and ensuring effective communication with clients. Providing essential contact information not only aids in recognition but also facilitates prompt responses and efficient transaction processes. A well-organized section dedicated to your business information can enhance professionalism and foster trust among clients.

To achieve this, start by including your full business name prominently at the top of the document. Following that, incorporate additional details such as the registered address, phone number, and email. This allows clients to reach out easily if they have any questions or require further information. It may also be beneficial to include your business logo to reinforce branding and create a cohesive look.

Lastly, ensure that all information is up to date and accurately reflects your current business status. A clear and precise presentation of your organization’s information not only enhances the overall appearance of the document but also demonstrates your commitment to transparency and professionalism in your dealings.

Customizing Invoice Templates for Clients

Tailoring financial documents to meet the specific needs of clients can significantly enhance the relationship and demonstrate attention to detail. Personalization not only fosters goodwill but also ensures clarity and understanding of the transactions involved. A customized approach can make clients feel valued and respected, contributing to long-term partnerships.

Key Considerations for Customization

When modifying documents for individual clients, keep the following aspects in mind:

- Client Information: Ensure that the client’s name, address, and contact details are accurately included to avoid any confusion.

- Branding: Incorporate the client’s branding elements, such as logos or color schemes, to create a cohesive look that aligns with their identity.

- Specific Services: Highlight any particular services or products relevant to the client, emphasizing those that are most significant to their needs.

- Personalized Notes: Consider adding a brief message or note that acknowledges the client’s unique circumstances or recent interactions, which can enhance the personal touch.

Benefits of Customization

By customizing documents for each client, you can improve communication and reduce the chances of misunderstandings. Personalized documents can also enhance the professional image of your business, making clients feel more confident in your services. Ultimately, investing time in customization can lead to increased client satisfaction and loyalty.

How to Use Invoice Template Software

Utilizing specialized software for creating financial documents can streamline the process, enhance efficiency, and reduce errors. This technology often comes with pre-designed layouts and customizable features, making it easier for users to generate professional-grade documents quickly. By employing such tools, businesses can maintain consistency in their billing practices while saving valuable time.

| Step | Description |

|---|---|

| 1. Select Software | Choose a solution that fits your business needs, whether it’s a standalone program or an online service. |

| 2. Choose a Design | Pick a layout that aligns with your branding and is easy to read for clients. |

| 3. Input Information | Enter essential details such as your business name, contact information, and the specific items or services rendered. |

| 4. Customize Fields | Modify sections to suit individual client requirements or preferences, including terms of service and payment options. |

| 5. Review and Save | Check all information for accuracy before saving the document to ensure professionalism. |

| 6. Send to Client | Deliver the final document via email or other communication channels, ensuring clients have the necessary details at their fingertips. |

Leveraging such software can transform the way businesses handle financial documentation, allowing for greater accuracy and professionalism while catering to diverse client needs.

How to Save and Send Your Invoices

Properly managing and distributing financial documents is crucial for ensuring timely payments and maintaining a professional image. After preparing the necessary paperwork, it’s important to follow systematic procedures for saving and sending to guarantee clarity and organization.

- Choose the Right Format: Save your document in a widely accepted format, such as PDF, to ensure compatibility and preserve the layout.

- Label Appropriately: Use clear and descriptive file names, including the date and client name for easy identification.

- Organize Files: Maintain a dedicated folder for financial documents, categorizing them by client or date to simplify retrieval.

- Utilize Cloud Storage: Consider using cloud services for easy access and backup, allowing for secure sharing with clients.

When it comes to sending, consider the following:

- Email Delivery: Use email to send documents directly, ensuring a quick and efficient transmission. Include a brief message summarizing the contents.

- Follow-Up: If no response is received within a few days, consider sending a polite reminder to confirm receipt and address any questions.

- Track Communications: Maintain a record of sent documents and any correspondence related to them to track payment status and client interactions.

By implementing these practices, you can enhance your workflow and ensure your financial communications remain professional and effective.

Tracking and Managing Sent Invoices

Effectively overseeing distributed financial documents is essential for maintaining accurate records and ensuring timely payments. Implementing a systematic approach can streamline the process and reduce the chances of errors or oversights.

One effective method for tracking includes creating a comprehensive log. The following table illustrates key elements to include in your tracking system:

| Date Sent | Client Name | Document Number | Amount | Status | Due Date |

|---|---|---|---|---|---|

| 2024-11-01 | ABC Corp | 001 | $500.00 | Sent | 2024-11-30 |

| 2024-11-03 | XYZ Ltd | 002 | $750.00 | Paid | 2024-11-30 |

| 2024-11-05 | 123 Inc | 003 | $300.00 | Pending | 2024-11-30 |

Utilizing such a log helps in monitoring the following:

- Status Updates: Regularly update the status of each document to reflect whether it has been paid, is pending, or has been sent.

- Follow-Up Actions: Schedule reminders for follow-up communications if payments are not received by the due date.

- Record Keeping: Keep copies of all sent documents organized for future reference and potential audits.

By maintaining a clear tracking system, you can enhance your financial management processes, ensuring that all transactions are accurately recorded and monitored.

Common Mistakes to Avoid in Invoices

Ensuring accuracy and professionalism in financial documents is vital for smooth transactions and maintaining positive client relationships. Certain pitfalls can hinder the effectiveness of these documents, leading to confusion and delays in payment. Being aware of these common errors can help in creating more reliable records.

One frequent oversight is the omission of essential details. Neglecting to include the client’s name, contact information, or a unique reference number can create challenges in tracking payments. Additionally, unclear descriptions of services or products may lead to disputes.

Another common mistake is miscalculating totals, which can occur due to simple arithmetic errors or incorrect tax rates. It is crucial to double-check all calculations to prevent discrepancies that could frustrate clients.

Lastly, failing to specify payment terms, such as due dates or acceptable payment methods, can lead to misunderstandings. Clear communication about these terms is essential for ensuring timely payments and fostering trust between parties.

Tips for Ensuring Timely Payments

Securing prompt compensation for services rendered or products delivered is essential for maintaining a healthy cash flow. Implementing effective strategies can facilitate faster transactions and enhance relationships with clients. Here are several recommendations to consider.

Clear Communication: Establishing transparent expectations with clients from the outset is crucial. Clearly outline payment terms, including due dates and acceptable payment methods, to avoid any confusion later on.

Send Reminders: A gentle nudge can go a long way in ensuring timely payments. Consider sending reminders as the due date approaches, reinforcing the importance of adherence to the agreed timeline.

Offer Multiple Payment Options: Providing various methods for payment can simplify the process for clients, increasing the likelihood of prompt payment. Options such as credit cards, electronic transfers, or mobile payment systems cater to diverse preferences.

Incentives for Early Payment: Encouraging clients to pay early by offering discounts can be a powerful motivator. This approach not only rewards promptness but also fosters goodwill.

Follow Up on Late Payments: If payment is delayed, don’t hesitate to follow up. Politely inquire about the status of the payment and express the importance of resolving the matter swiftly. Maintaining professionalism during these interactions helps preserve positive relationships.