Online Business Invoice Template for Efficient Billing

Managing financial transactions efficiently is crucial for maintaining a smooth workflow in any enterprise. One of the most effective ways to ensure timely and accurate payments is by utilizing structured documents designed for billing purposes. These documents help you keep track of the services provided, amounts due, and the payment details required for clients to settle their accounts without confusion.

Having a well-organized structure for billing can save time, reduce errors, and present a professional image to clients. By using a carefully crafted format, businesses can ensure that all necessary information is clearly communicated and easy to follow. Whether you’re a freelancer, a startup, or an established company, customizing your invoicing documents to fit your needs is essential for efficient financial management.

In this guide, we will explore the essential components of a billing document, why it’s important to have a consistent format, and how you can easily create and customize one to fit your specific requirements. With the right approach, you can improve the clarity of your transactions and speed up payment cycles, enhancing both client satisfaction and cash flow.

Online Business Invoice Template Overview

Creating well-structured financial documents is key to simplifying the process of requesting payments for services rendered or products sold. These documents play an essential role in ensuring accuracy, clarity, and professionalism in all transactions. By using an organized format, you can guarantee that all relevant information is easily accessible for both you and your clients, reducing confusion and delays in payment.

The importance of using a consistent and clear structure for billing cannot be overstated. Such documents are not only a record of the transaction but also serve as a formal request for payment. An effective design helps you avoid errors, ensures that clients are aware of the amounts due, and provides a legal record of the exchange. With the right approach, businesses can improve efficiency and cash flow, while enhancing their overall image.

Key Features of a Professional Billing Document

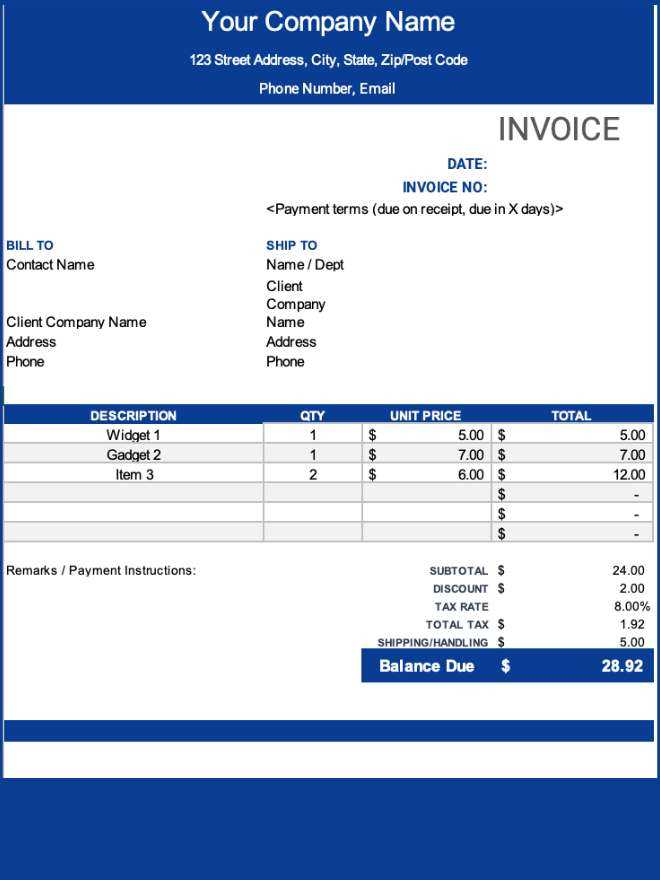

A professional document for requesting payment typically includes several crucial elements that ensure the process runs smoothly. Below are some of the core components commonly found in these documents:

| Feature | Description |

|---|---|

| Contact Information | Details such as your company name, address, phone number, and email, along with the recipient’s contact details. |

| Payment Details | Information about the amount due, payment methods, and due date. |

| Itemized List | A breakdown of the services or products provided, including quantities, rates, and totals. |

| Terms and Conditions | Information on payment terms, penalties for late payments, and any other legal conditions. |

Benefits of Using a Structured Payment Request Document

Using a well-organized document format offers several advantages. First, it improves communication between you and your clients, ensuring that all aspects of the transaction are clear. Second, it can streamline administrative tasks, as you won’t need to manually create bil

Why You Need an Invoice Template

Having a standardized format for requesting payments is essential for maintaining clarity and efficiency in financial transactions. A consistent structure ensures that every essential detail is included, reducing the chance of errors or misunderstandings between you and your clients. This not only facilitates smooth operations but also projects professionalism and builds trust with customers.

By using a predefined structure, you can save valuable time, avoid mistakes, and streamline your workflow. Without a uniform system in place, the process of manually creating billing documents for each transaction can become tedious and inconsistent. A reliable format ensures that every document looks the same and contains all the necessary details for prompt payments.

| Reason | Benefit |

|---|---|

| Consistency | Ensures that every document includes the same essential information, reducing confusion. |

| Efficiency | Speeds up the billing process, saving time on creating each document from scratch. |

| Professionalism | Creates a polished and standardized appearance that enhances your brand image. |

| Accuracy | Reduces the chance of errors in calculating amounts, payment terms, and client details. |

| Tracking | Helps with organizing and managing past transactions, making financial recordkeeping easier. |

Having a consistent system in place for generating billing documents also simplifies follow-ups, as both you and your clients will always have a clear reference. This can improve cash flow and reduce delays in payments. In essence, a reliable format is more than just a convenience–it’s a necessity for smooth financial operations.

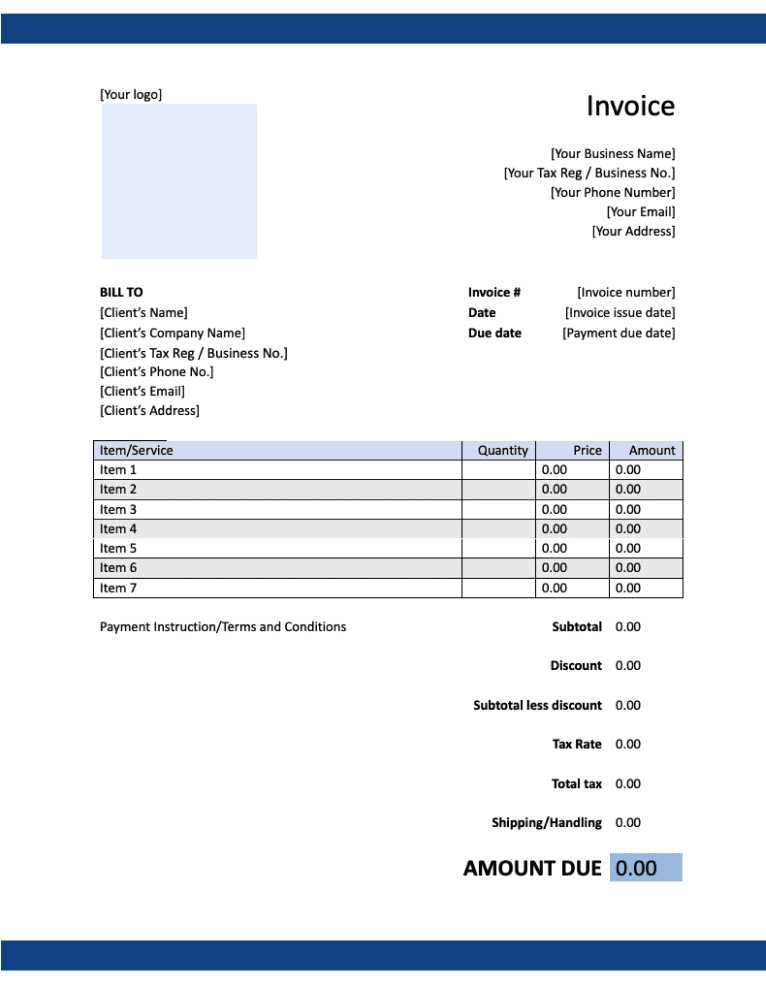

How to Create a Custom Invoice

Customizing your payment request document allows you to tailor it to your specific needs, ensuring that all the relevant details are included while reflecting your brand’s identity. Creating a document that works for you can save time and reduce errors, while also enhancing the professionalism of your transactions. Below is a step-by-step guide to help you design a customized payment request document.

- Choose a Format: Start by selecting a format that suits your style–this could be a simple document in Word, a spreadsheet, or a specialized software program. Some tools offer ready-made layouts that you can adjust to fit your needs.

- Include Your Contact Information: Ensure that your business name, address, phone number, and email address are clearly displayed at the top of the document. This allows clients to quickly identify you and reach out if needed.

- Provide Client Details: Always include the client’s name, company name (if applicable), and contact information. This ensures that the document is correctly attributed to the right person or entity.

Once you’ve set up the basic layout, it’s important to include the following details:

- Unique Document Number: Assign a unique reference number for each transaction. This will help you keep track of documents and make it easier for both you and your clients to reference specific payments.

- Breakdown of Services or Products: List the products or services you’ve provided, including quantities, unit prices, and any applicable taxes. Be clear and itemized so that clients can easily verify the charges.

- Payment Terms: Clearly define the payment due date, methods of payment accepted, and any late fees or penalties for overdue payments. This helps set clear expectations and avoid confusion.

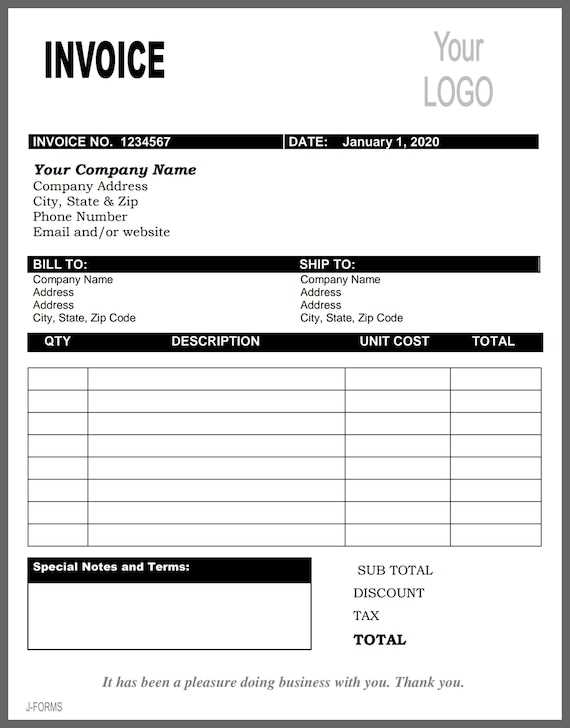

Key Elements of an Invoice

To ensure clarity and professionalism in any financial transaction, certain details must always be included in a payment request document. These core components help both the sender and the recipient understand the nature of the transaction, the amount due, and the terms of payment. Each section serves a distinct purpose in facilitating smooth and timely payments.

- Contact Information: Always start by providing your company name, address, phone number, and email, along with the recipient’s contact details. This allows both parties to easily reach out if needed.

- Unique Identifier: Each document should have a unique reference number for easy tracking. This number helps avoid confusion and serves as a point of reference for both you and the client.

- Transaction Date: Clearly state the date when the product or service was provided, as well as the date the request for payment is issued. This helps to establish a timeline for both parties.

In addition to the basic information, the following elements are essential to ensure transparency and smooth processing of payments:

- Itemized List: A detailed breakdown of the products or services provided, including quantities, unit prices, and a total for each item. This ensures the recipient understands exactly what they are being charged for.

- Payment Terms: Clearly specify the payment due date, acceptable payment methods, and any penalties for late payment. This sets expectations and helps avoid future disputes.

- Amount Due: Summarize the total amount to b

Benefits of Using Digital Invoices

Transitioning to electronic billing systems offers numerous advantages over traditional paper-based methods. Digital payment requests streamline the process of creating, sending, and tracking transactions, making it easier for both you and your clients to stay organized. By reducing manual work and paper usage, you can save time, cut costs, and improve efficiency in your financial operations.

Time-Saving and Efficiency

One of the key benefits of using digital formats is the time saved in generating and sending payment requests. With pre-built templates or automated systems, you can quickly create customized documents, eliminating the need for repetitive data entry. Once generated, electronic requests can be sent instantly via email or through integrated platforms, reducing delays that come with postal mail.

Improved Organization and Tracking

Digital systems provide enhanced organization, as they allow you to store and categorize payment requests electronically. This makes it easy to search for specific transactions, monitor overdue payments, and track the status of each request. Unlike physical copies, which can get lost or misplaced, digital documents are securely stored and accessible at any time, from anywhere.

Additionally, many digital platforms offer features like automatic reminders for overdue payments, reducing the need for manual follow-up. This results in a smoother process for both you and your clients, leading to quicker payments and fewer administrative hassles.

Overall, digital payment requests enhance the efficiency, security, and convenience of your financial management, while also contributing to a more eco-friendly and cost-effective approach to business operations.

Common Invoice Formats Explained

When creating documents to request payment for goods or services, choosing the right format is essential for ensuring clarity and efficiency. Various formats are available, each with its own advantages depending on the specific needs of the business or client. Understanding the most common structures can help you select the one that best suits your transaction type and workflow.

Here are the most widely used formats:

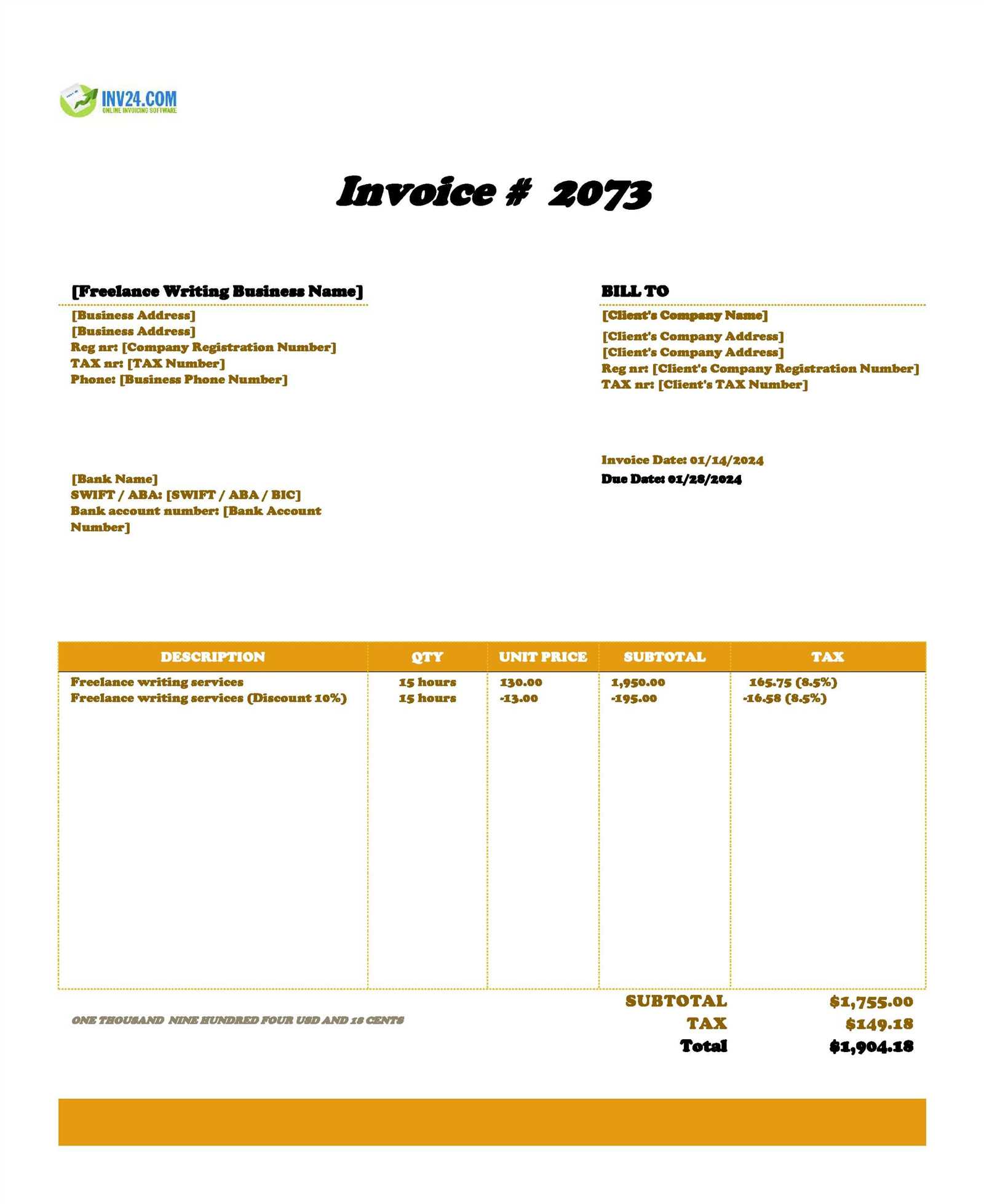

- Basic Format: This is the simplest structure, typically consisting of essential details like contact information, a list of products or services provided, and the total amount due. It’s a quick and straightforward way to request payment for smaller or one-time transactions.

- Itemized Format: An itemized format includes a detailed breakdown of each product or service, with individual prices, quantities, and totals listed separately. This format is ideal for transactions involving multiple items, ensuring that the client understands exactly what they are being charged for.

- Time-Based Format: Often used for hourly services, this format includes a breakdown of the time spent on each task, along with the hourly rate. This type is especially useful for freelancers or contractors who charge by the hour or day.

- Recurring Format: For ongoing or subscription-based services, a recurring payment request document helps automate billing by outlining the regular payment schedule (e.g., monthly, quarterly). It typically includes a section for the renewal date and payment frequency.

Each of these formats can be further customized to fit specific needs, such as adding taxes, discounts, or payment terms. Choosing the right format not only makes the document more readable but also helps set clear expectations with clients, making the payment process smoother and more efficient.

Choosing the Right Invoice Tool

Selecting the right tool for creating and managing payment requests is crucial for streamlining your financial processes. The right tool can save you time, reduce errors, and ensure that you maintain a professional appearance in all transactions. With various options available, it’s important to consider the features and functionality that best suit your needs, whether you’re handling one-time payments or ongoing billing cycles.

Key Features to Consider

When evaluating different tools for generating payment documents, focus on the features that align with your business requirements. Here are some essential aspects to consider:

Feature Benefit Customization Options Ability to tailor documents to match your brand identity and meet specific client needs. Automation Automated reminders and recurring billing capabilities help save time and reduce administrative effort. Integration with Accounting Software Smooth integration allows for easier tracking and synchronization with your financial records. Security Features Ensures that sensitive financial information is protected with encryption and secure storage. Popular Tools to Consider

There are several types of tools that can cater to different needs, from simple document creators to more complex accounting platforms. Some options to consider include:

- Spreadsheet Software: Ideal for those who prefer creating documents manually with a customizable layout.

- Accounting Software: Platforms like QuickBooks or FreshBooks allow for full financial management, including payment requests, tracking, and reporting.

- Dedicated Invoice Generators: Tools like Zoho Invoice or Invoice Ninja specialize in creating professional payment documents quickly and with minimal effort.

Ultimately, the right tool for you depends on the size and nature of your operations, as well as your preference for automation and ease of use. By selecting the appropriate tool, you can improve the efficiency and professionalism of your financial transactions.

Top Features of a Professional Template

When creating a document to request payment for goods or services, having the right features can make all the difference in presenting a professional and organized appearance. A well-designed structure not only ensures that all necessary information is included but also enhances clarity and ease of use for both parties involved. The following features are key to making your payment request document stand out and function effectively.

- Clear Branding: Your company name, logo, and contact details should be prominently displayed at the top. This ensures that your document looks professional and makes it easy for clients to recognize your business.

- Itemized Breakdown: A detailed list of services or products provided, with individual prices and quantities, helps clients understand exactly what they are being charged for. This clarity reduces confusion and builds trust.

- Easy-to-Find Total: The total amount due should be clearly visible, ideally at the bottom or in a highlighted section. This ensures that the client can quickly determine how much they owe without needing to search through the document.

- Payment Terms: Clearly state the due date, acceptable payment methods, and any late fees or penalties for overdue payments. This sets clear expectations and minimizes the chances of misunderstandings.

- Unique Reference Number: Including a unique identifier for each document allows for easy tracking and reference. This is particularly useful for both you and your clients when managing multiple transactions.

- Tax and Discount Information: If applicable, it’s important to display tax rates or any discounts clearly. This transparency helps avoid confusion and ensures compliance with tax regulations.

In addition to these basic features, a professional design can also include sections for additional terms, notes, or instructions for the client. Whether you’re working with one-time clients or long-term partners, these features ensure that your payment requests are clear, professional, and efficient.

Customizing Your Invoice for Clients

Personalizing your payment request documents for each client is essential for creating a tailored experience that reflects your professionalism and attention to detail. Customization allows you to adjust the structure, terms, and appearance to meet the specific needs of each client, ensuring that the information is relevant and easy to understand. A well-customized document not only fosters trust but also strengthens client relationships by showing that you care about their unique requirements.

Here are some key areas to focus on when customizing your payment requests:

- Client Information: Always update the recipient’s contact details, such as name, company, and address. This ensures that the document is accurate and that your client knows it’s intended for them.

- Personalized Payment Terms: If you offer flexible payment terms or discounts, make sure these are clearly stated. Some clients may have specific payment schedules, and recognizing this can enhance your client’s satisfaction.

- Branding Elements: Including your logo, brand colors, and personalized messages or notes can help reinforce your identity and create a consistent, branded experience. A simple “Thank you for your business” or a tailored message can go a long way in building rapport.

- Service or Product Descriptions: Customize the description of the products or services provided to reflect the unique nature of the client’s order. This helps avoid any ambiguity and makes the request easier to understand.

- Special Instructions: If there are any special instructions, discounts, or additional services provided, include them clearly. This transparency helps the client understand what they’re being charged for and why.

By taking the time to customize each payment request, you not only make the process more personal but also demonstrate a commitment to providing a positive client experience. A well-tailored document ensures that all necessary details are included, making it easier for your clients to process the payment promptly and accurately.

How to Add Payment Terms

Clearly stating payment terms in your billing documents is crucial for ensuring that both parties understand the expectations and timeline for settling the payment. Well-defined terms help avoid misunderstandings and ensure a smooth financial transaction. Whether you’re offering flexible payment options or strict deadlines, outlining the terms helps both you and your client stay on the same page throughout the process.

Key Elements of Payment Terms

When adding payment terms, several critical components should always be included to ensure clarity and avoid confusion:

- Due Date: Specify the exact date when payment is due. This provides a clear timeline for the client to follow and helps prevent delays.

- Accepted Payment Methods: Indicate which payment methods you accept (e.g., bank transfer, credit card, PayPal). This gives your clients clear guidance on how they can settle their account.

- Late Fees: If applicable, include any fees or penalties for late payments. This sets expectations and encourages timely payments from your clients.

- Discounts for Early Payment: If you offer discounts for early payments, mention the percentage or amount of the discount, along with the conditions under which it applies.

Best Practices for Adding Payment Terms

To make your payment terms as effective as possible, consider the following best practices:

- Be Clear and Concise: Avoid using complex language or ambiguous phrases. Clear and simple terms are easier for clients t

Best Practices for Invoice Numbering

Properly numbering your payment request documents is an essential practice for keeping transactions organized and easily traceable. A clear and systematic numbering system helps you track payments, identify specific transactions, and maintain a well-ordered financial record. By following some best practices, you can ensure that your numbering system is efficient, consistent, and professional.

Key Considerations for Invoice Numbering

When setting up a numbering system, it’s important to think about both practicality and long-term organization. Here are some key aspects to keep in mind:

- Unique Numbering: Each document should have a unique identifier to avoid confusion. This can be achieved by using a sequential numbering system that increases with each new payment request.

- Consistency: Maintain a consistent format to ensure easy tracking. Avoid skipping numbers or using random sequences. Consistency in numbering reflects professionalism and enhances organizational efficiency.

- Year and Month References: Including the year or month in your numbering system can help categorize your documents. For example, “2024-001” for the first transaction of the year or “04-001” for the first transaction of April.

- Avoid Gaps: Ensure that you don’t leave gaps in your numbering system. Each new document should follow directly from the last one to keep your records intact and orderly.

Recommended Numbering Formats

There are several formats you can choose from depending on your preferences and the nature of your

How to Include Taxes on an Invoice

Including taxes in your payment request documents is an essential step to ensure compliance with local regulations and maintain transparency with your clients. Properly calculating and presenting tax amounts not only demonstrates professionalism but also ensures that your client understands exactly what they are being charged for. It’s important to include clear details about the tax rate, amount, and any applicable rules to avoid confusion or disputes.

Here’s how you can effectively include taxes in your payment requests:

- Specify the Tax Rate: Clearly state the tax rate you are applying. This could be a percentage (e.g., 8%, 15%) or a flat rate, depending on your region’s regulations. It’s important to ensure that the tax rate is accurate to prevent any legal issues or confusion.

- Calculate the Tax Amount: Multiply the total amount of the goods or services by the applicable tax rate to determine the tax amount. For example, if the total is $100 and the tax rate is 10%, the tax would be $10. Be sure to include this calculation in your document for transparency.

- Breakdown the Tax: Display the tax amount separately from the main total. This makes it easy for clients to see how much of the overall charge is tax-related. You can include a separate line item labeled “Sales Tax” or “VAT” and show the amount clearly.

- Include Tax Registration Number (if applicable): If you are registered for tax purposes (e.g., VAT or sales tax), include your tax registration number on the document. This is often required by law, especially for businesses that operate in multiple regions or countries.

- Itemize Tax for Multiple Products or Services: If you are charging tax on multiple products or services, break down the tax amount for each item. This ensure

Ensuring Accurate Invoice Calculations

Accurate calculations in your payment requests are crucial for both maintaining client trust and ensuring that you are paid the correct amount. Mistakes in calculations can lead to confusion, delayed payments, or disputes with clients. To avoid these issues, it’s important to follow best practices when calculating totals, taxes, discounts, and other charges.

Here are some key strategies to help ensure accurate calculations in your payment request documents:

- Double-Check Item Prices: Before finalizing any document, verify that the unit prices of all items or services are correct. A small mistake in the pricing can cause significant discrepancies in the total amount due.

- Use Reliable Tools: Use automated software or spreadsheet formulas to perform calculations. This reduces human error and ensures that your numbers are accurate every time.

- Account for Discounts: If offering discounts, clearly apply them to the correct line item or total amount. Ensure that the discount is correctly calculated and deducted from the overall price.

- Verify Tax Calculations: Check that tax is applied correctly based on the applicable rate for your products or services. The tax amount should be calculated on the pre-tax total and should be displayed separately for clarity.

- Include Shipping or Handling Fees: If there are any additional charges, such as shipping or handling fees, ensure they are clearly listed as separate line items. This helps avoid any confusion over the final total.

How to Use Templates for Multiple Clients

Using a standardized format for your payment requests across multiple clients can save you significant time and effort, ensuring consistency and professionalism in your financial communications. By using a customizable format, you can easily tailor each document to suit the specific needs of different clients while maintaining a cohesive and efficient process. The key is to strike a balance between customization and consistency.

Customizing Standardized Formats for Different Clients

While you may use the same basic structure for all your documents, it’s important to make certain adjustments based on each client’s unique requirements. Here are some tips for customizing your standardized format:

- Client-Specific Information: Always update the recipient’s name, address, and contact information. Each client should receive a personalized version of the document with their details clearly listed.

- Unique Products or Services: Modify the list of products or services according to what was provided to each client. Customizing this section ensures that you’re accurately reflecting the work or goods delivered.

- Payment Terms and Deadlines: Adjust payment terms as needed, especially if you offer different terms for different clients. Some may require extended payment deadlines, while others may prefer quicker terms.

- Discounts and Special Rates: If you have specific agreements with certain clients for discounts or custom rates, include those in the document. Customizing this area ensures accurate pricing for each client.

Benefits of Using a Standardized Format

Using a consistent structure for all your financial documents offers several advantages:

- Efficiency: With a pre-designed structure, you can quickly create a new document by simply updating client-specific information and details, saving time.

- Consistency: A uniform format ensures that all your documents have the same professional appearance, reinforcing your brand image.

- Accuracy

Reducing Errors with Automated Invoices

Automating your payment request process is one of the most effective ways to minimize errors and improve accuracy in your financial documents. By using automation, you can reduce the risk of manual mistakes, ensure consistency across all transactions, and save valuable time. Automated systems can handle calculations, formatting, and client details, which helps ensure that each document is error-free and delivered promptly.

Here are several ways automation can help reduce errors in your payment requests:

- Accurate Calculations: Automated tools can calculate totals, taxes, and discounts automatically, eliminating the risk of human error in these critical areas. This ensures that your final amounts are always correct.

- Consistent Formatting: Automation ensures that every document follows the same structure and format, making it easier to track and compare past transactions. This consistency also helps prevent accidental omissions or incorrect entries.

- Automatic Client Details: With automated systems, you can store client information and use it across multiple transactions. This reduces the chance of entering incorrect or outdated contact details for each payment request.

- Real-Time Updates: Automation allows for real-time updates on payments, outstanding balances, and due dates, helping you stay informed without manually tracking each transaction. This can help you catch errors early and resolve issues quickly.

By embracing automation, you significantly reduce the chances of errors, which not only improves the accuracy of your documents but also boosts your professional image. Clients will appreciate the efficiency and reliability that come with well-managed, automated financial processes.

Integrating Invoices with Accounting Software

Linking your payment request documents with accounting software can significantly streamline your financial processes, improving both accuracy and efficiency. This integration allows for automatic data transfer between systems, reducing the need for manual entry and minimizing the risk of errors. By syncing these documents with your financial records, you can ensure that your books are always up-to-date, and transactions are easier to track and manage.

Key Benefits of Integration

Integrating your payment request system with accounting tools provides several advantages for both small and large operations:

- Time Savings: Automatically syncing your payment requests with your accounting system saves time by eliminating the need for manual data entry. The details of each document, such as amounts, tax calculations, and client information, are instantly transferred to your financial records.

- Improved Accuracy: By automating the process, you reduce human error, ensuring that the data entered into your accounting software is accurate. This leads to fewer mistakes in financial reports and balances.

- Real-Time Tracking: Integration allows you to monitor your transactions in real-time. As soon as a payment request is sent, it can be automatically logged into your accounting system, helping you track income and outstanding amounts more effectively.

- Better Reporting: With integrated systems, generating financial reports becomes easier. The data is already structured and synced, making it simpler to generate profit and loss statements, tax reports, and other key documents.

- Reduced Administrative Work: With less manual input, your team can focus on higher-level tasks rather than spending time on repetitive administrative duties. This leads to increased productivity and allows you to allocate resources more efficiently.

How t

When to Send Your Invoice

Knowing the right time to send your payment request is crucial to ensure timely payments and maintain a healthy cash flow. The timing of your financial documents can influence how quickly clients settle their balances, and it can also impact your relationship with them. Sending a request too early or too late can cause confusion or delays, so it’s important to strike the right balance and choose the best time based on the nature of the transaction and your agreement with the client.

Factors to Consider When Deciding the Timing

Here are some key factors to consider when determining the optimal moment to send your request:

- Completion of Work: Always wait until the agreed-upon work or service has been completed before sending a payment request. This ensures that the client only pays for services or products they have received and reduces the risk of disputes.

- Payment Terms: If you’ve agreed on specific payment terms (e.g., net 30, net 60), align the timing of your request accordingly. Send the payment request well in advance of the due date to give clients enough time to process and pay.

- Milestone Deliveries: For long-term projects or services delivered in stages, it may be necessary to send payment requests after each milestone is completed. This helps manage cash flow and ensures you are compensated as work progresses.

- Recurring Charges: If your agreement includes recurring services, such as subscriptions or maintenance, send your payment request at regular intervals. Make sure to notify the client beforehand about the upcoming charge to avoid confusion.

Best Practices for Timely Payment Requests

Sending payment requests at the right time can significantly improve the chances of receiving timely payments. Here are a few best practices to keep in mind:

Tracking and Managing Invoice Payments Effectively tracking and managing payments is a crucial aspect of maintaining financial health and ensuring timely cash flow. Without a clear system in place, it becomes difficult to track outstanding amounts, monitor due dates, and manage overdue payments. By implementing a well-organized tracking system, you can streamline your payment process, reduce errors, and maintain better control over your finances.

Methods for Tracking Payments

There are various approaches you can use to track payments effectively, ensuring that no transaction slips through the cracks:

- Manual Record-Keeping: If your operations are small, maintaining a manual log of payments can be a straightforward solution. You can record each transaction on a spreadsheet or ledger and manually update when a payment is received. However, this method may become cumbersome as your workload increases.

- Accounting Software: For more streamlined management, using accounting software allows you to automatically track payments. These tools can link directly to your payment requests and update your records in real-time. Most platforms offer automatic reminders, reports, and payment tracking features.

- Cloud-Based Tools: Cloud-based financial tools provide the added benefit of remote access and collaboration. These platforms often allow you to integrate with bank accounts, automatically logging received payments and updating your financial records instantly.

Strategies for Efficient Payment Management

Once you have a system for tracking payments, implementing strategies to manage them efficiently can make the process even smoother:

- Set Payment Reminders: Send timely reminders to clients about upcoming payments. Whether via email, text, or phone call, reminders help ensure that clients stay aware of due dates and don’t forget to pay.

- Follow Up on Overdue Payments: Establish a process for following up on overdue payments. Sending polite yet firm reminders can help you recover funds without damaging client relationships. Set clear protocols for escalating overdue accounts.

- Use Payment Plans: If a client is unable to pay the full amount upfront, offering payment plans can help both parties. Splitting larger amounts into manageable installments ensures you receive payments while still supporting your clients’ cash flow.

- Reconcile Accounts Regularly: Regularly reconciling your financial records with your bank statements ensures that everything is up to date and accurate. Regular checks also help identify any discrepancies early on, allowing you to address them quickly.

By employing a systematic approach to tracking and managing payments, you can avoid late payments, reduce administrative stress, and maintain smoother cash flow, all of which contribute to the long-term success of your operations.