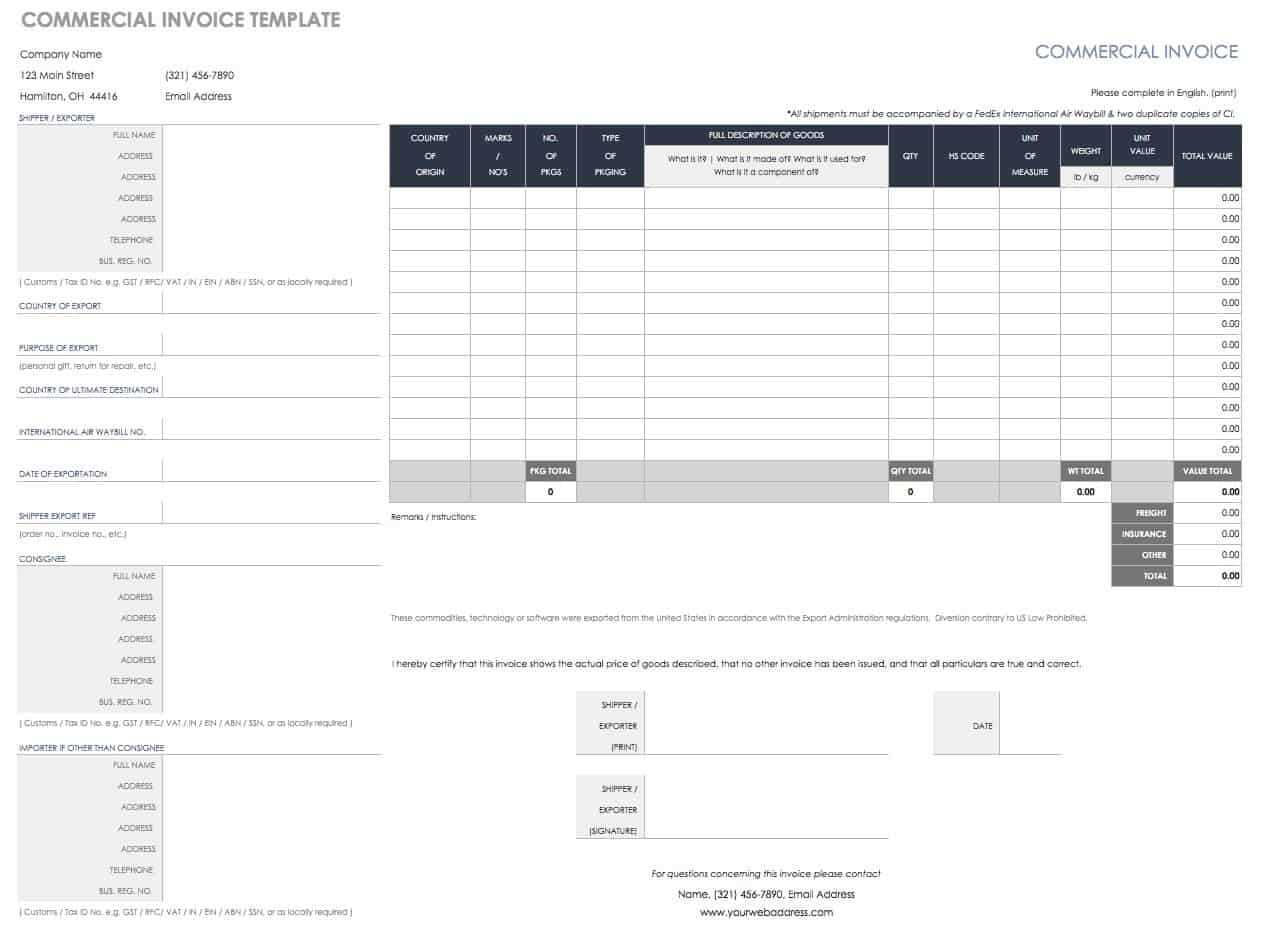

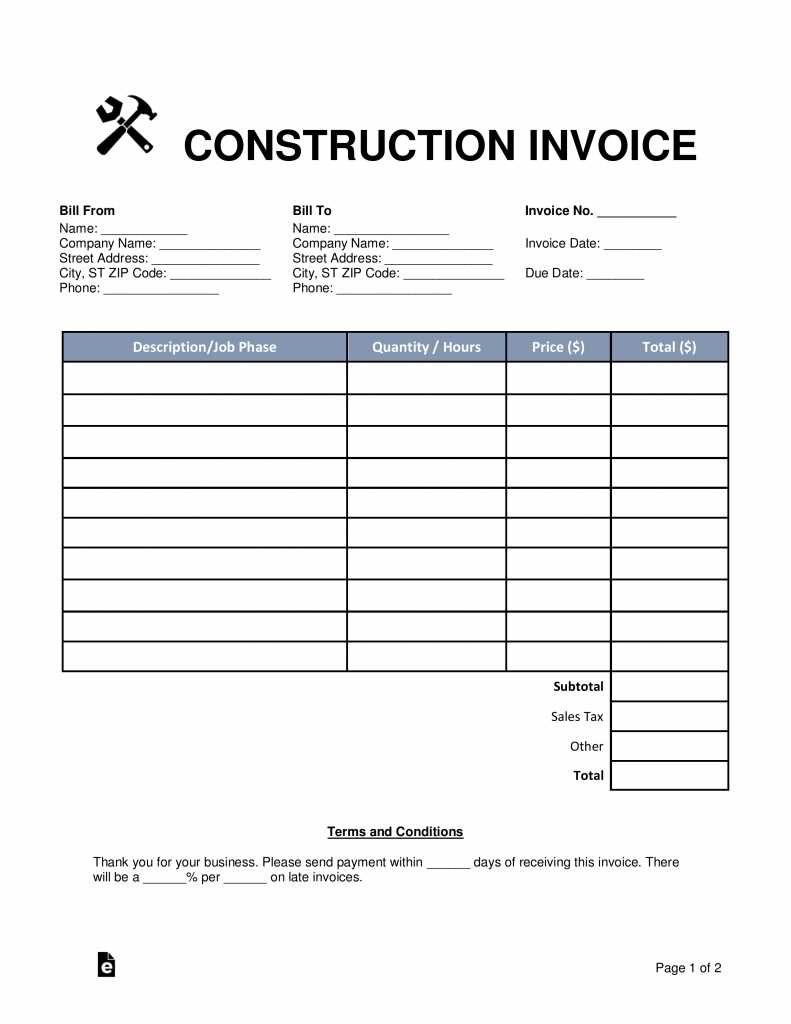

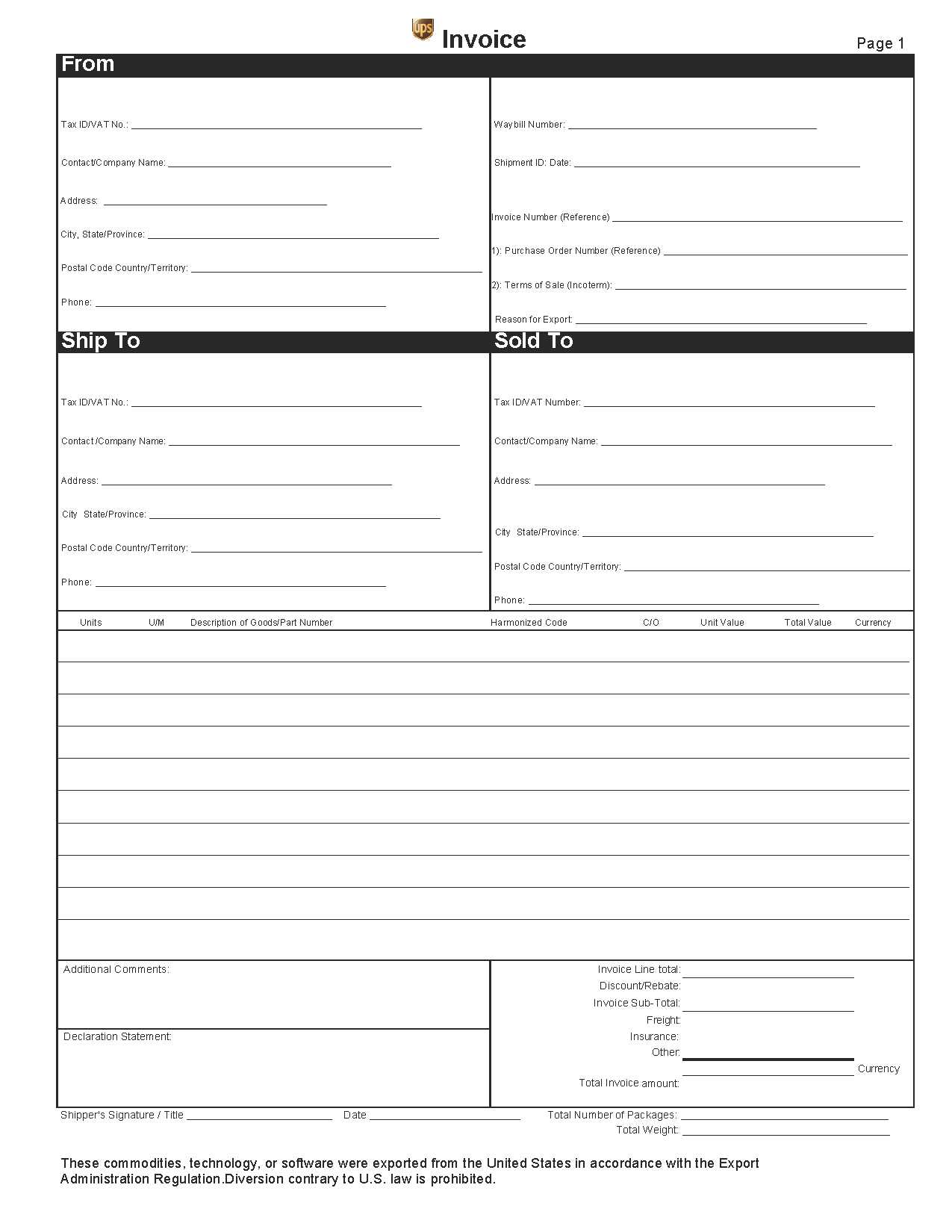

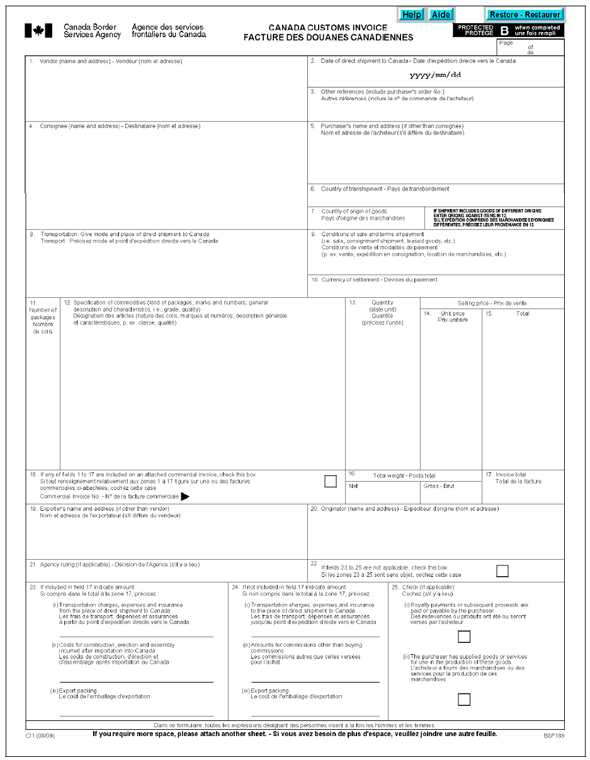

Free Blank Commercial Invoice Template for Easy Customization

When running a business, it’s crucial to have an organized and professional system for managing financial transactions. One of the most important documents in this process is the official billing form used to outline goods or services provided, payment terms, and other essential details. A well-designed version of this document not only ensures clarity but also helps businesses maintain smooth operations and comply with legal requirements.

Having a standard form available for these purposes is invaluable for both small startups and large corporations. By using a standardized version, you can save time, reduce errors, and make your payment processes more efficient. Whether you’re dealing with international clients or local businesses, a properly structured document can facilitate smoother communication and help prevent misunderstandings.

In this guide, we’ll explore how to create, customize, and use these forms effectively. We’ll also provide insight into where you can access free resources to help streamline your business transactions. With the right tools and knowledge, managing your financial paperwork can become a seamless part of your workflow.

What is a Commercial Invoice?

A billing document is a critical piece of paperwork used by businesses to request payment for goods or services provided. This document serves as a formal request, outlining the details of the transaction, such as the items sold, their prices, payment terms, and the identities of both the seller and the buyer. It plays a vital role in accounting and record-keeping, as well as ensuring both parties have a clear understanding of the terms of the deal.

Key Components of a Billing Document

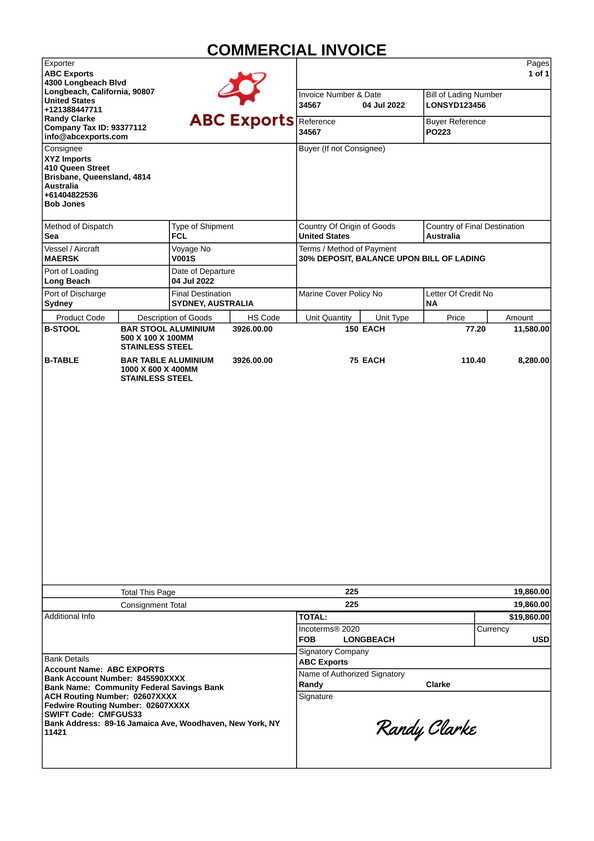

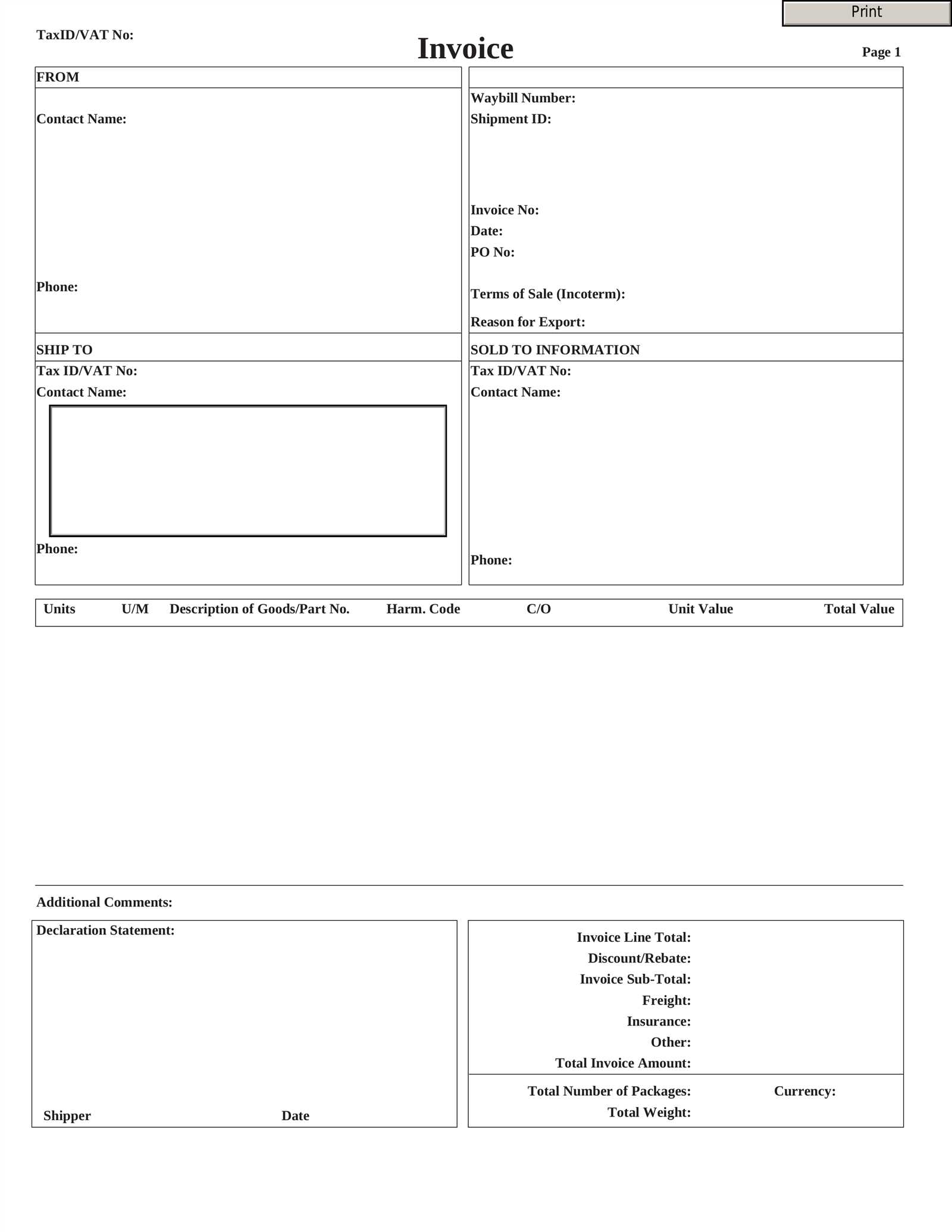

While there may be some variation depending on the type of transaction or industry, the core elements of this document generally remain consistent. These typically include the seller’s contact information, a unique reference number, a description of the products or services, pricing details, and any applicable taxes or shipping costs. Additionally, it often specifies the agreed payment terms, including due dates and accepted methods of payment.

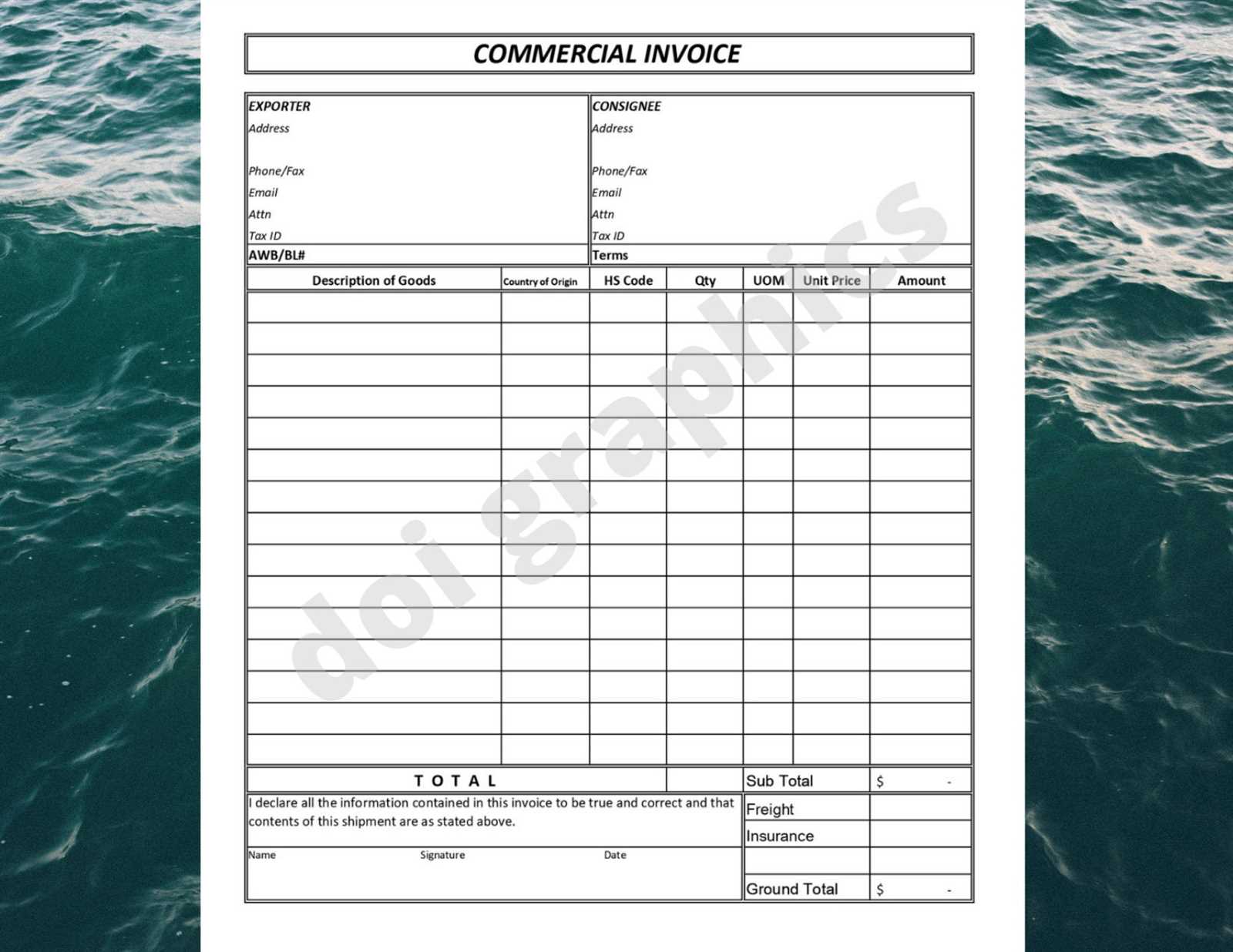

The Role of Such Documents in International Trade

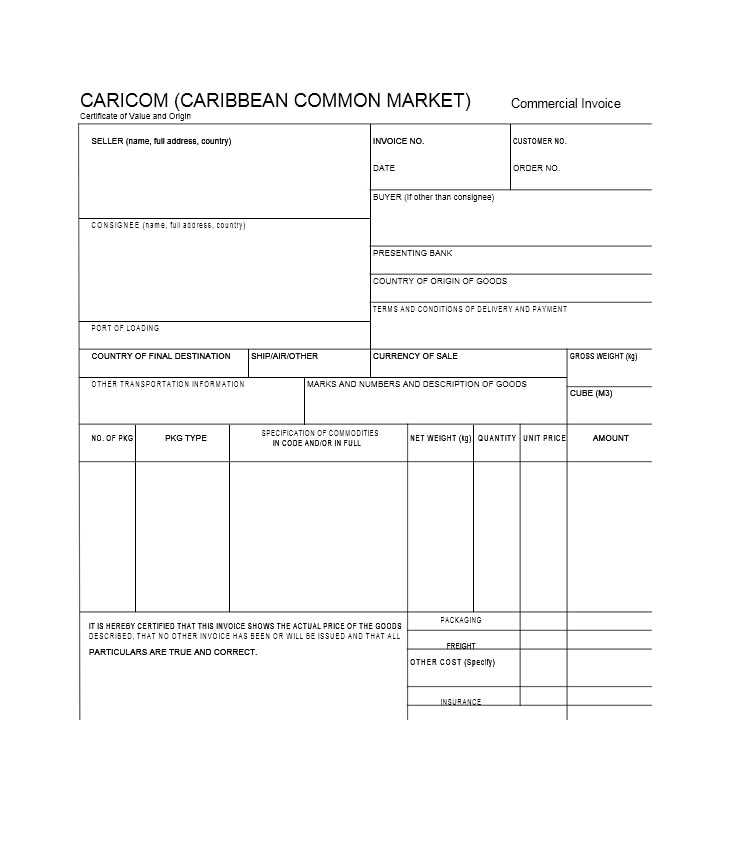

In international transactions, this document is especially important. It not only facilitates communication between the parties but also ensures compliance with customs regulations. For shipments crossing borders, this document often accompanies the goods, allowing customs officials to assess duties and taxes based on the itemized list provided. Therefore, having an accurate and well-structured document can prevent delays and additional costs during the import or export process.

In summary, this document is much more than just a payment request; it serves as a detailed record of the transaction and an essential tool for financial management, accountability, and legal compliance.

Importance of Using a Template

Using a standardized document for billing purposes is essential for businesses of all sizes. It ensures consistency, saves time, and reduces the risk of errors. By relying on a pre-designed format, companies can focus on the content rather than reinventing the layout for each transaction. A well-structured format helps streamline processes and ensures all necessary details are included, ultimately supporting smoother financial operations.

Here are some key benefits of utilizing a standardized document:

- Consistency: A uniform structure for all transactions makes it easier to track records, manage accounts, and compare past dealings.

- Efficiency: Pre-designed formats speed up the process, allowing employees to quickly fill in relevant details without worrying about layout or structure.

- Professionalism: Using a polished, standard document reflects positively on the business, enhancing credibility and trustworthiness with clients.

- Compliance: Many industries require specific information to be included in a billing document. A template helps ensure all legal and regulatory requirements are met.

- Customization: Templates allow for easy adjustments to suit specific business needs while maintaining the core structure.

In addition to these advantages, using a standardized form also helps minimize the likelihood of overlooking important details, such as taxes, discounts, or payment deadlines. A template ensures that all required fields are included and correctly formatted, reducing the chances of confusion or mistakes that could delay payment or create disputes.

How to Create a Billing Document

Creating a formal document to request payment for goods or services involves several important steps. The goal is to ensure that the document contains all necessary information for both parties to understand the terms of the transaction. A well-constructed form not only helps to ensure prompt payment but also serves as a reliable record for accounting and legal purposes. By following a clear structure, businesses can minimize errors and make the payment process smoother for both the seller and the buyer.

Step 1: Include Key Information

The first step in creating this document is to ensure that it contains the essential details about the transaction. This includes the seller’s and buyer’s contact information, a unique reference number for easy identification, a detailed description of the products or services, and pricing. Also, include the date of the transaction, payment terms, and any applicable shipping or handling fees. These elements are crucial for providing clarity and avoiding misunderstandings between both parties.

Step 2: Choose the Right Format and Layout

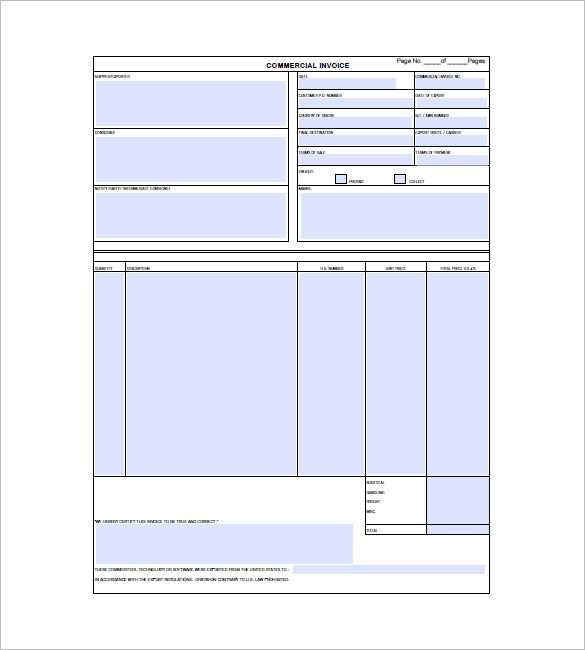

The next step is selecting the right layout. While the content is important, how it’s organized matters just as much. A clear and clean design ensures that all the information is easy to read and navigate. Group similar data together (e.g., billing and shipping information) and use headings or sections to visually separate different parts of the document. This organization will help recipients quickly find what they need, enhancing the document’s overall effectiveness.

By following these steps, you can create a well-structured and professional document that meets both your business needs and any legal or regulatory requirements. This will not only facilitate smooth transactions but also contribute to efficient record-keeping and better communication with clients.

Key Elements of a Billing Document

When creating a formal request for payment, it’s essential to ensure that the document includes all necessary information for both parties involved in the transaction. A well-structured document not only helps to clarify the terms of the deal but also ensures legal and financial accuracy. By including specific details, you can avoid confusion and ensure that the transaction is processed efficiently.

The following are the key components that should be included in every payment request document:

- Seller’s and Buyer’s Information: This includes the name, address, and contact details of both parties. Proper identification of both sides is crucial for transparency and communication.

- Unique Reference Number: A unique reference number or document ID is important for tracking the transaction and facilitating future communication or audits.

- Description of Goods or Services: Clearly describe the items sold or services rendered, including quantities, unit prices, and any other relevant specifications.

- Pricing and Total Amount: The total cost, including individual item prices, taxes, discounts, and any additional fees such as shipping, should be clearly listed to avoid confusion.

- Payment Terms: Include the agreed-upon payment due date, payment methods accepted, and any late payment penalties or discounts for early payment.

- Shipping and Handling Details: If applicable, provide information about delivery terms, including shipping charges, delivery date, and the carrier used fo

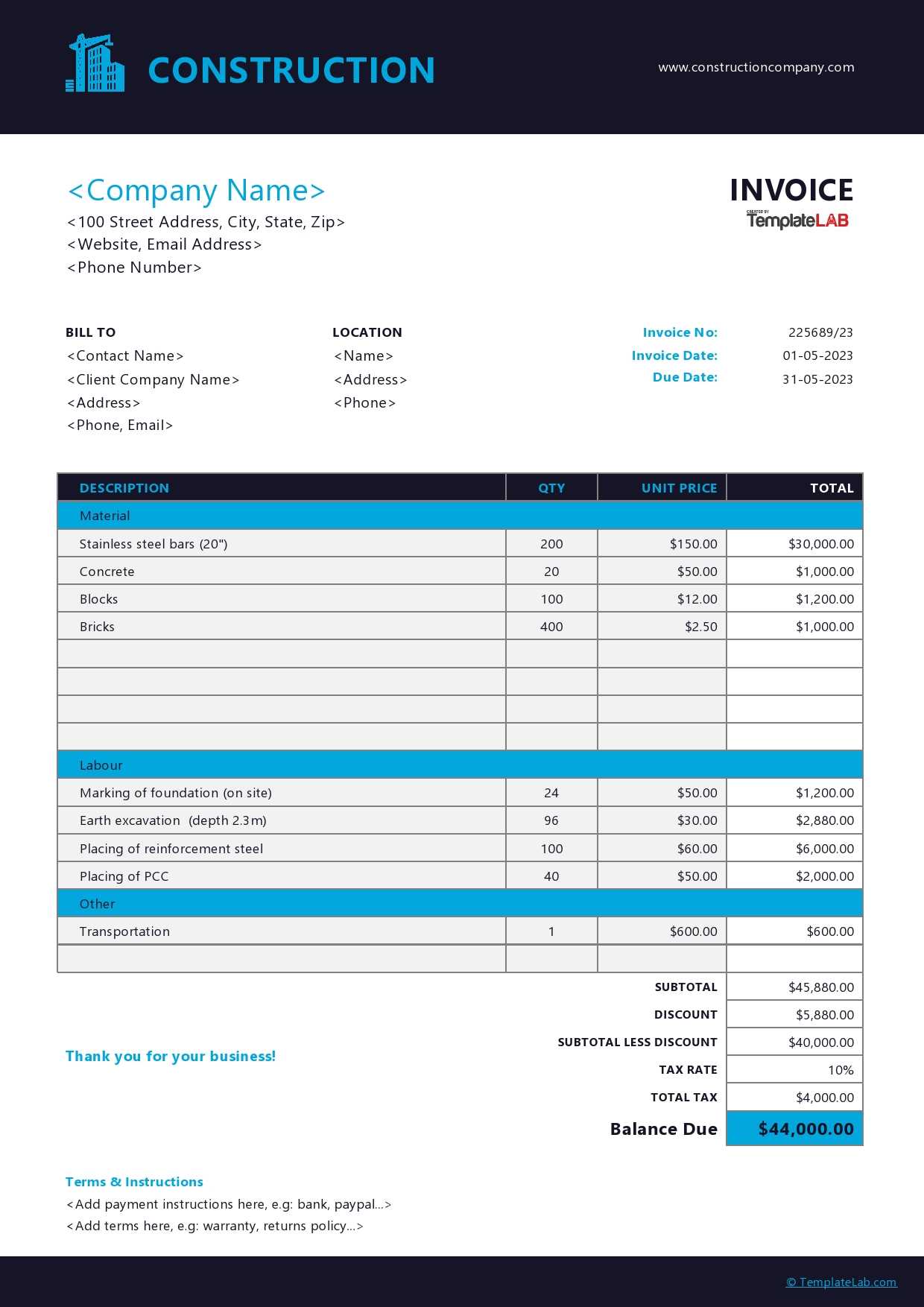

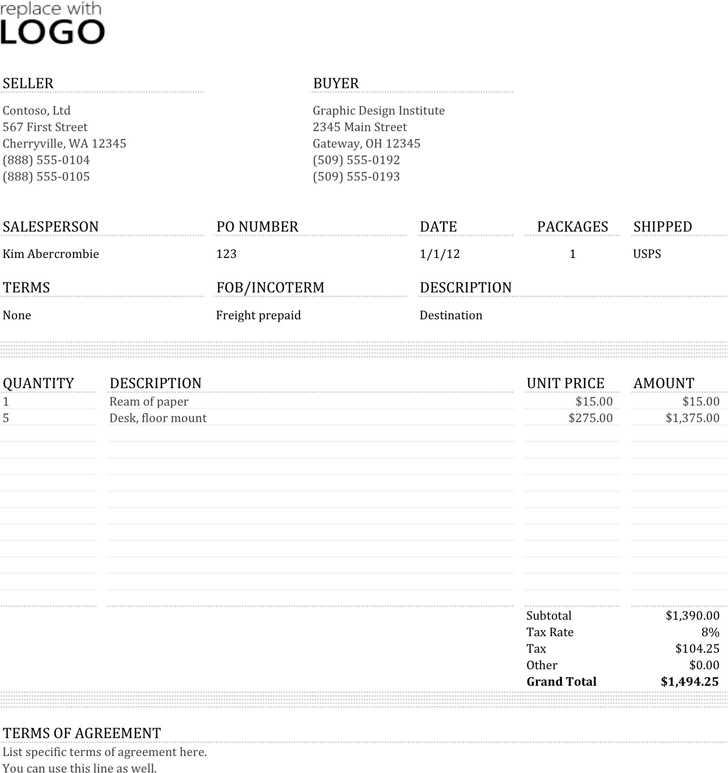

Free Pre-Designed Forms for Businesses

For businesses looking to streamline their financial processes, using a pre-designed document can save valuable time and effort. These ready-made forms allow companies to quickly create accurate billing statements without having to worry about formatting or missing important details. With various options available for download, businesses can find a design that suits their needs and easily adapt it to their specific transactions.

Where to Find Free Forms

Many websites offer free downloadable versions of these forms that can be customized for individual business requirements. These free resources are especially useful for startups and small businesses looking to maintain professional standards without the cost of expensive software. Some popular platforms that offer these free resources include:

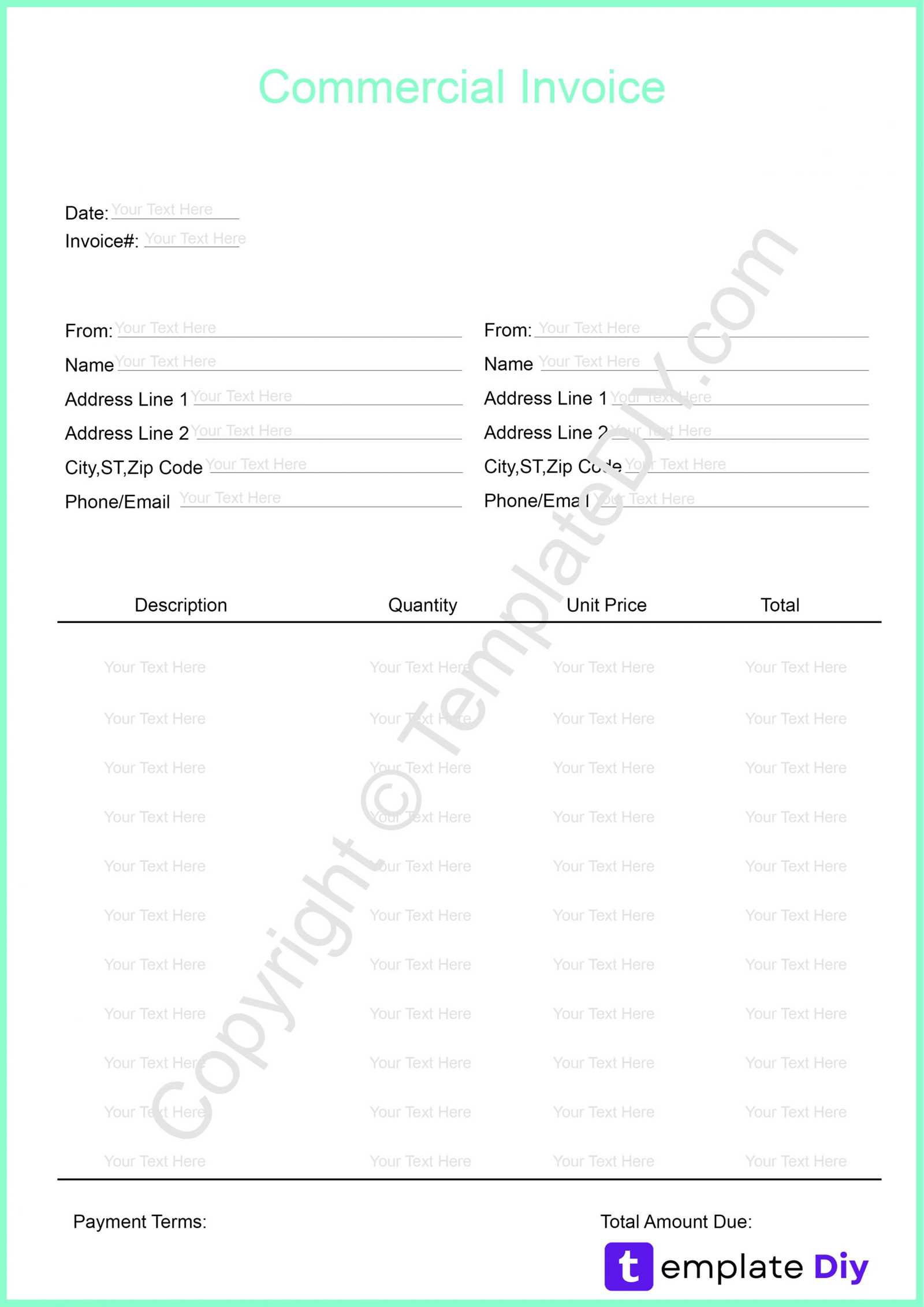

- Template Websites: Dedicated sites provide a range of options for different types of businesses, from freelancers to large corporations.

- Business Software Providers: Many business management platforms offer free downloadable forms as part of their service, even for those not using their paid plans.

- Online Document Creators: Websites like Google Docs or Microsoft Word provide free document creation tools with customizable options, including pre-built forms for business transactions.

Advantages of Using Free Resources

Using these free pre-made forms offers several benefits:

- Cost-Effective: These forms are free to download and can be used indefinitely, eliminating the need for expensive design software or hiring professionals.

- Quick Setup: Instead of star

Where to Find Billing Document Forms

For businesses looking to streamline their payment processes, finding the right form to request payment is essential. Fortunately, there are numerous resources available online where businesses can download ready-made documents that meet their needs. Whether you’re a small startup or a larger organization, these resources offer an easy way to maintain professional standards without the hassle of creating custom forms from scratch.

Popular Sources for Ready-Made Forms

Here are some of the most reliable places where you can find downloadable forms:

- Dedicated Template Websites: These websites offer a variety of pre-designed forms that you can download and customize to suit your business requirements.

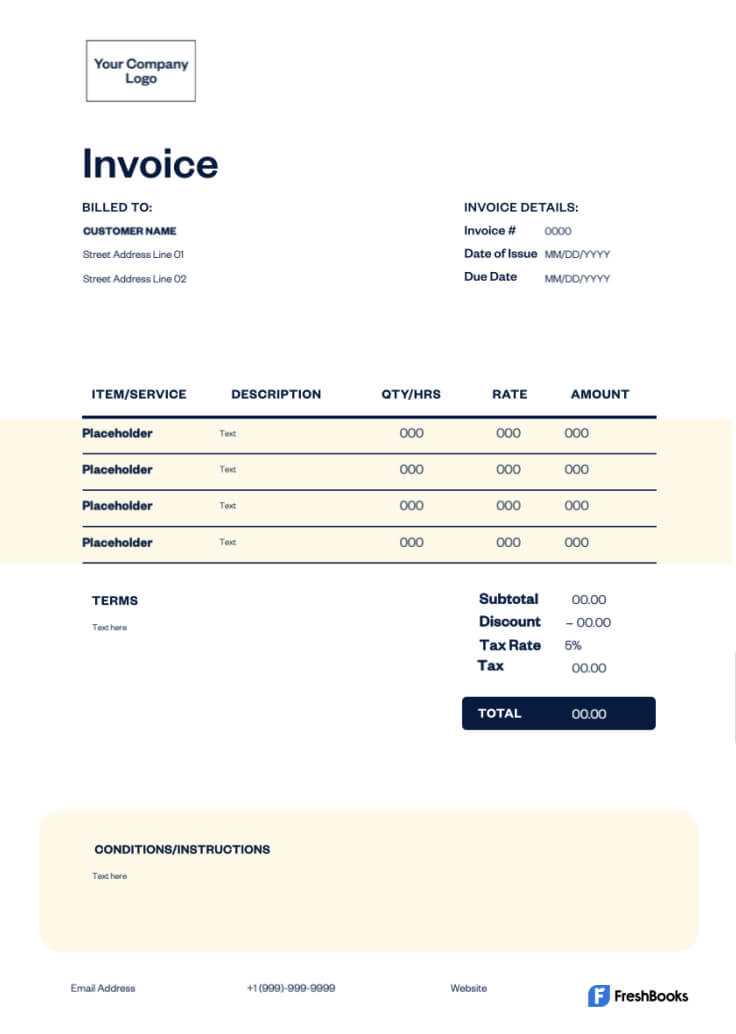

- Business Software Providers: Many business management platforms, such as QuickBooks or FreshBooks, offer free or paid form templates as part of their service package.

- Document Creation Tools: Platforms like Google Docs and Microsoft Word offer easy-to-use document creation tools with customizable options, including forms for financial transactions.

- Online Marketplaces: Websites such as Etsy or Template.net provide both free and paid form options for businesses seeking professional, customizable designs.

Considerations When Choosing a Source

When selecting a source for your billing document, consider the following:

- Customization Options: Ensure that the form you choose is easily editable to include your business details and specific transaction information.

- Industry-Specific Needs: Some businesses may need specialized forms, such as those with customs codes for international shipments or tax information. Look for resources that cater to your specific industry requirements.

Customizing Your Billing Document Tailoring a standard billing document to fit your specific business needs is crucial for maintaining a professional appearance and ensuring accuracy. Customization allows you to adjust the layout, content, and design to reflect your brand, meet legal requirements, and include any transaction-specific information. Whether you’re dealing with different types of products or offering various payment options, personalization helps create a seamless experience for both you and your clients.

Key Areas to Customize

Here are the key elements you should consider adjusting when customizing your billing document:

- Business Branding: Incorporate your company logo, colors, and font style to ensure consistency with your brand identity. This makes the document look more professional and aligned with your business image.

- Contact Information: Always ensure that your contact details, including business address, phone number, and email, are clearly visible and up to date.

- Payment Terms: Customize payment options, including due dates, accepted methods (bank transfer, credit card, etc.), and late fee policies to match your company’s policies.

- Itemized List: Ensure that each product or service is clearly described, including unit prices, quantities, and any relevant discounts or promotions. This detail will help avoid confusion and disputes.

- Legal and Tax Information: If required, make sure to include legal disclaimers, tax information (like VAT numbers), or customs codes for international transactions.

Using Software Tools for Easy Customization

If you use software for your business ope

Common Mistakes to Avoid

When creating a billing document, small errors can lead to confusion, delays, and even disputes. It’s essential to pay attention to the details and ensure that every aspect of the form is accurate and clear. By being aware of common mistakes, businesses can improve their financial processes and avoid unnecessary complications. Here are several key mistakes to watch out for when preparing a payment request document.

1. Missing Essential Information

One of the most common errors is forgetting to include important details. Omitting any necessary information can cause confusion or delays in processing payments. Key elements such as:

- Seller’s and buyer’s contact information

- Product descriptions

- Payment terms

- Due dates

must always be present to ensure clarity and prevent misunderstandings.

2. Incorrect or Ambiguous Pricing

Another frequent mistake is incorrectly calculating the total amount or providing unclear pricing information. This can lead to payment delays or disputes. Always double-check that:

- Unit prices are accurate

- Taxes and shipping fees are correctly applied

- Discounts or special offers are clearly stated

Ensure the final amount is easy to understand and matches the agreed-upon terms.

3. Failing to Follow Legal Requirements

For in

Why Accuracy is Crucial for Billing Documents

Ensuring the accuracy of a billing document is essential for maintaining trust between businesses and their clients. Errors in the details, whether related to pricing, dates, or contact information, can lead to misunderstandings, delayed payments, and potential disputes. For a business to maintain a professional reputation and smooth financial operations, it is vital that every aspect of the document is precise and clear. Even small mistakes can create complications that may affect cash flow, legal compliance, and customer relationships.

Consequences of Inaccurate Documents

Inaccurate billing documents can lead to various negative outcomes. These include:

Issue Potential Consequence Incorrect Pricing Disputes with clients over the final amount due, potentially harming business relationships. Missing Payment Details Delays in payment processing and difficulty tracking financial records. Wrong Dates Late payments or confusion about payment deadlines, resulting in penalties or late fees. Missing Tax or Legal Information Compliance issues, particularly with international transactions, leading to customs delays or legal fines. Maintaining Accuracy for Smooth Transactions

To prevent these issues, businesses must prioritize accuracy by carefully reviewing each document before sending it to clients. Using automated tools or reliable software can help reduce human error and streamline the process. Additionally, always double-check the

Commercial Document vs Proforma Document

When dealing with international trade or even domestic transactions, it’s important to understand the difference between two types of financial documents: the final payment request document and the proforma version. Both are used in business dealings, but they serve distinct purposes and are applied at different stages of the transaction process. Understanding these differences can help ensure that the right form is used at the right time, avoiding confusion and facilitating smoother business operations.

Key Differences

Here are the main distinctions between a final billing document and a proforma document:

- Purpose: A final document is issued when a transaction has been completed, and payment is expected. A proforma document, on the other hand, is often provided before the actual sale is made to outline the terms of the deal.

- Legality: A final payment document serves as a legal record of the sale and can be used for accounting, tax, and customs purposes. A proforma document is not legally binding and does not represent an actual sale.

- Details: A final document includes accurate and final prices, quantities, and terms. A proforma document may have tentative details that are subject to change, such as estimated costs or quantities.

- Use in Shipping: Proforma documents are often used for customs purposes or to obtain quotes, while final documents are used when goods or services have been delivered, and payment is due.

- Timing: The proforma document is issued before the sale, often to provide a preliminary idea of costs, whereas the final payment document is issued after the sale, when goods or services are delivered and the amount is due for payment.

When to Use Each Document

Choosing the right document depends on the stage of the transaction:

- Use a Proforma Document: When providing an estimate or making a preliminary agreement before finalizing the terms of the sale. It can also be helpful when negotiating prices, securing financing, or dealing with international shipments that require customs documentation.

- Use a Final Payment Document: When the transaction has been completed, and payment is due. This document serves as a formal request for payment and a record of the completed sale.

By understanding the distinctions between these two forms, businesses can ensure that they use the right document for each stage of their transactions, improving efficiency and reducing potential for misunderstandings.

Choosing the Right Format for Your Billing Document

Selecting the appropriate format for your billing document is crucial for ensuring clarity and efficiency in business transactions. The format you choose can influence how easily your client can process the document, make payments, and maintain accurate financial records. There are different options available, ranging from simple, text-based formats to complex designs with advanced features, and the right choice depends on your business needs, industry, and customer preferences.

Factors to Consider When Choosing a Format

When deciding on the format of your payment request document, consider the following factors:

Factor Consideration Business Size A small business may prefer a simple, easy-to-fill-out format, while larger businesses may need more complex layouts that include additional sections for multiple products or services. Customer Type If you deal with international clients, you may need a format that includes fields for customs information or tax details. For local clients, a straightforward document may suffice. Legal and Tax Requirements Depending on your region, the document may need to adhere to specific legal or tax requirements, such as including VAT numbers or compliance codes. Ensure the format supports these details. Payment Method If you accept various payment methods (bank transfers, credit cards, checks), the format should clearly display the relevant payment instructions to avoid confusion. Ease of Customization Choose a format that is easy to edit, especially if your billing details change regularly. Editable digital formats, such as Word or Excel files, allow for flexibility. Digital vs Paper Billing Documents

When it comes to handling business transactions, choosing between digital and paper billing documents can have a significant impact on efficiency, security, and overall workflow. Each option comes with its own set of advantages and challenges, and the decision ultimately depends on your business needs, industry, and preferences. As digitalization continues to rise, many businesses are shifting to electronic documents, but paper forms are still used by some for their familiarity and tangibility. Understanding the key differences between the two options can help you determine which format best suits your operation.

Advantages of Digital Billing Documents

Digital forms have gained significant popularity due to the many benefits they offer. Some of the key advantages include:

- Convenience: Digital documents can be created, edited, and sent instantly. This eliminates the need for physical transportation or mailing, speeding up the process.

- Cost-Effective: There are no printing, paper, or postage costs associated with digital billing. This can result in long-term savings for businesses.

- Environmental Impact: Using digital formats helps reduce paper waste, contributing to a more eco-friendly business practice.

- Easy Storage and Organization: Digital files can be stored securely in the cloud or on a server, making it easier to track, search, and organize past transactions.

- Automated Features: Many digital tools allow businesses to automate calculations, add recurring charges, and track payments, streamlining the billing process.

Advantages of Paper Billing Documents

While digital options are on the rise, there are still b

Best Practices for Billing Document Design

Designing a professional and functional billing document is crucial for ensuring that your business transactions are clear, efficient, and well-received by clients. A well-organized document not only reflects the professionalism of your business but also helps to avoid misunderstandings and delays in payments. By following some simple design principles, you can create a document that is easy to read, complete, and aligned with your brand identity.

Key Design Principles

When designing your payment request form, consider the following best practices:

- Clarity and Simplicity: Keep the design clean and straightforward. Avoid cluttered layouts or overly complex designs that might confuse the reader. Use simple fonts and clear headings to guide the reader through the document.

- Consistent Branding: Include your business logo, colors, and contact information in the design to reinforce your brand identity. This helps to make your billing document recognizable and professional.

- Logical Layout: Arrange the information in a logical order that mirrors the way most people read: left to right, top to bottom. Start with essential details like your company name, client information, and transaction specifics, followed by the cost breakdown, payment terms, and any additional instructions.

- Legible Fonts: Use fonts that are easy to read both on screen and in print. Avoid overly stylized fonts or small text that may be hard to decipher. Stick to standard fonts such as Arial, Helvetica, or Times New Roman.

Essential Elements to Include

Incorporate the following key sections into your design to ensure that all necessary information is captured and easily accessible:

- Header: The top of the form should clearly display your business name, logo, and contact information, as well as the document title (e.g., “Payment Request” or “Billing Statement”).

- Client Details: Include the name, address, and contact information of the client or company being billed. This helps avoid confusion if multiple transactions are happening simultaneously.

- Itemized List: Clearly list the products or services provided, including descriptions, quantities, unit prices, and total amounts. This makes it easier for clients to review and verify charges.

- Payment Terms: Specify the payment method, due date, and any applicable late fees or discounts. This sets clear expectations and helps ensure timely payment.

- Footer: Add any necessary legal disclaimers, payment instructions, or thank-you messages. This section can also include your business’s bank details or online payment links if relevant.

Additional Tips for Effective Design

- Use White Space: White space helps separate sections and makes the document easier to read. Avoid cramming too much information into one space.

- Highlight Important Information: Use bold or underlined text to highlight critical details such as total amounts due or due dates. This draws attention to key items and ensures that clients don’t overlook them.

- Consider Mobile Compatibility: Many clients now access documents on their mobile devices. Ensure your design is responsive and readable on all screen si

How to Use a Billing Document Format

Using a pre-designed billing document format can save time and ensure accuracy when preparing financial records for your business transactions. These formats provide a structured layout, allowing you to easily fill in necessary details without having to create a new document from scratch each time. By following a few simple steps, you can quickly generate professional and organized payment requests that meet both your needs and your client’s expectations.

Steps to Use a Billing Document Format

Follow these basic steps to efficiently use a predefined billing format:

- Download the Format: Start by choosing a format that aligns with your business requirements. Many options are available, from simple spreadsheets to more complex word processing files. Once you find one, download it to your computer or cloud storage.

- Customize the Header: The header typically contains essential information about your business, such as your name or company name, logo, and contact details. Ensure these are up-to-date and reflect your current branding.

- Fill in Client Information: Enter the recipient’s name, company (if applicable), and contact details. This helps personalize the document and ensures that the payment request reaches the correct party.

- Input Transaction Details: In the designated section, list the products or services provided, including the quantities, unit prices, and the total for each item. Double-check for accuracy to avoid mistakes that could delay payment or cause confusion.

- Specify Payment Terms: Include clear terms such as the payment method, due date, and any late fees or early payment discounts. This helps set expectations for both parties.

- Review and Finalize: Once all the information is entered, carefully review the document for accuracy. Verify the totals, check the client details, and ensure no essential fields are missing. Once satisfied, save the document and prepare to send it to your client.

Tips for Using Billing Document Formats Effectively

- Keep It Consistent: Use the same format for all your transactions to create consistency and professionalism. This will help both you and your clients become familiar with the layout and make future billing easier.

- Regularly Update Information: Ensure your contact details, payment instructions, and any other relevant information are up-to-date. This prevents errors and ensures that your clients can easily reach you if necessary.

- Save Time with Automation: Some formats allow for automated calculations or integration with accounting software. If possible, take advantage of these features to streamline the process and reduce the risk of manual errors.

By following these steps and tips, you can effectively use a structured billing format to generate accurate and professional documents, improving the efficiency of your business’s financial processes.

Legal Requirements for Billing Documents

When preparing financial documents for business transactions, it is essential to ensure that all legal requirements are met to avoid complications with authorities, clients, or tax agencies. Different regions and industries may have specific laws and regulations regarding what information must be included in such documents. These legal requirements serve to ensure transparency, protect both the buyer and seller, and comply with local or international trade laws.

Key Legal Elements to Include

While the exact legal requirements can vary depending on your location and the nature of the transaction, several key elements are typically required to make a billing document legally valid. Some of these include:

- Business Information: Your business name, address, and tax identification number (TIN) or VAT registration number must be clearly stated. This allows authorities to link the document to your business for tax and compliance purposes.

- Client Information: Similarly, the client’s name, address, and contact details should be included. This ensures the correct party is being billed and protects both sides in case of disputes.

- Item Descriptions: A clear and accurate description of the goods or services provided is essential. It helps ensure that both parties understand what has been delivered and protects against potential legal issues over the specifics of the transaction.

- Payment Terms: The payment terms, including the due date, total amount, and any agreed-upon payment methods, must be specified. This is critical for enforcing payment timelines and resolving disputes regarding late payments.

- Tax Information: If applicable, details regarding sales tax, VAT, or any other taxes must be included. This is particularly important for international transactions and ensures compliance with tax regulations in different jurisdictions.

- Unique Identifier: Many jurisdictions require a unique document reference number for each transaction. This helps to track and organize documents for both your business and governmental pu

How to Store and Organize Billing Documents

Efficient storage and organization of financial documents are vital for ensuring easy access, reducing clutter, and maintaining compliance with legal and tax regulations. Properly managing these records can save valuable time when preparing for audits, tax filings, or resolving disputes. Whether you store documents physically or digitally, having a clear and consistent system in place will help streamline your workflow and ensure that important files are always available when needed.

Best Practices for Storing Billing Documents

Here are some essential practices to help you store and organize your financial records effectively:

- Establish a Centralized System: Choose a centralized location for storing all your documents, whether digital or physical. This makes it easier to retrieve them when needed and ensures consistency across your records.

- Organize by Date: A chronological order is one of the simplest and most effective ways to organize records. Create folders or categories for each year or month, and store documents accordingly. This helps you quickly locate specific transactions.

- Label and Name Files Clearly: Ensure that every document is properly labeled with relevant information, such as the client’s name, transaction date, and a unique reference number. For digital records, use file names that are easy to search and recognize.

- Use Categorization for Different Types: For businesses with diverse transactions, it may be helpful to categorize documents based on transaction type (e.g., products, services, refunds, or expenses). This makes it easier to track specific kinds of records and quickly identify the information you need.

- Secure Sensitive Information: Store sensitive financial information in secure