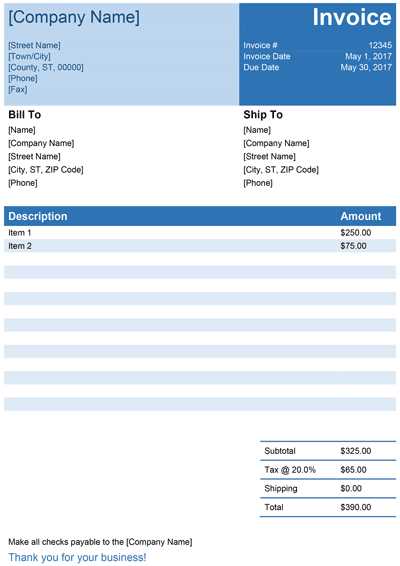

Download Invoice Template for Word 2016

Efficiently managing financial records is a crucial aspect of any business operation. The process of generating formal billing documents can be streamlined with the right tools, allowing businesses to maintain clarity and professionalism in their transactions. With the right approach, crafting these essential papers becomes a simple task that saves time and enhances credibility.

Customizable formats offer flexibility, making it possible to adjust details according to specific needs, while maintaining a standardized look. This adaptability ensures that all necessary information is presented clearly, from itemized charges to contact details and payment terms.

Using easy-to-edit documents not only speeds up the creation process but also reduces the likelihood of errors. Whether you’re a small business owner or part of a larger organization, having access to a practical, flexible solution can make managing payments and tracking transactions simpler than ever.

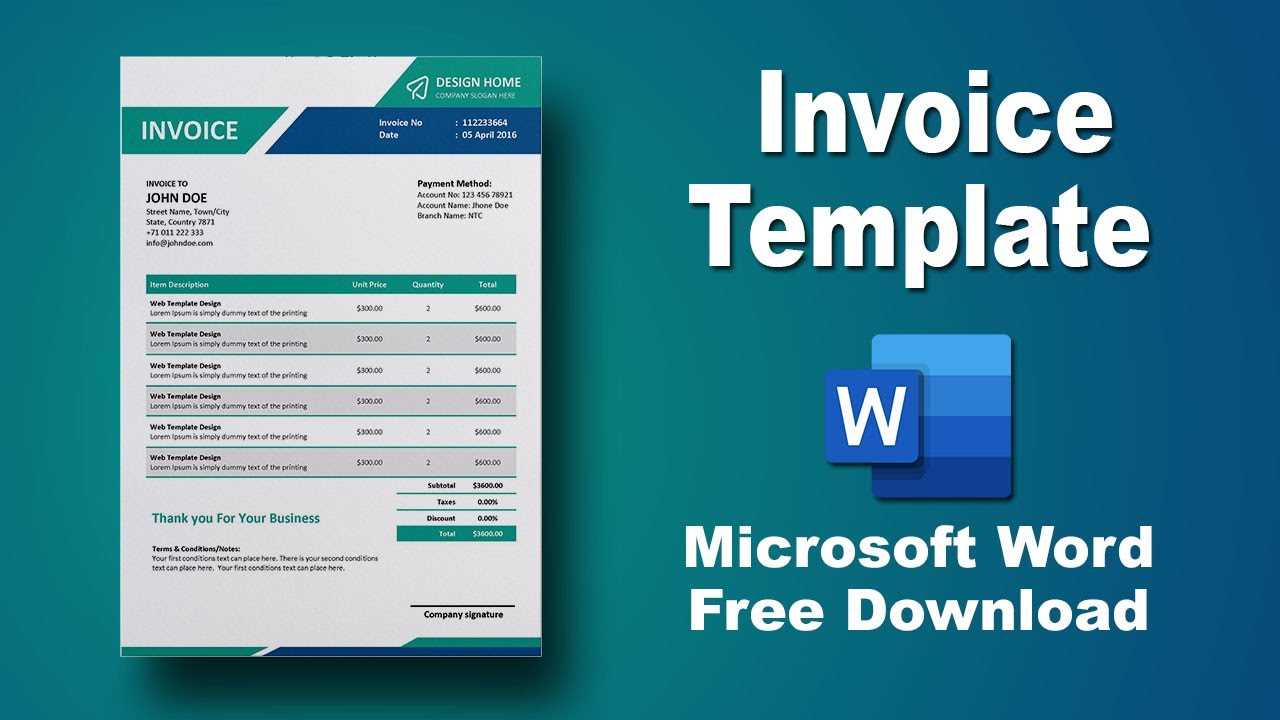

Invoice Template Word 2016 Overview

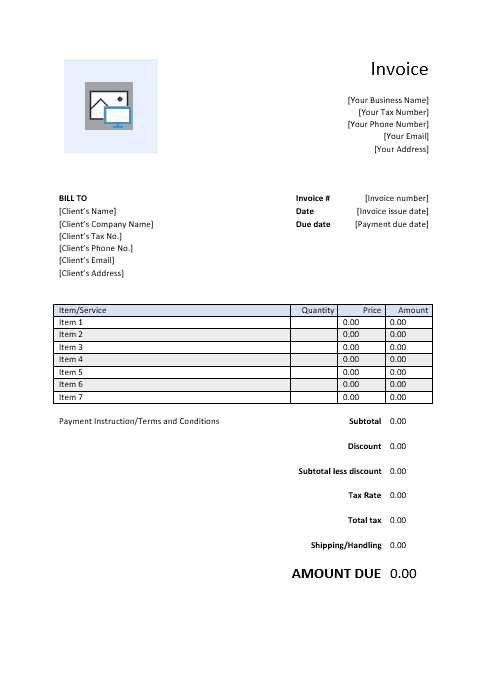

Creating formal billing documents doesn’t have to be a complex task. With the right tools, generating professional-looking statements becomes both quick and efficient. These tools are designed to help users easily structure and format their financial records, ensuring all important details are included while maintaining a polished appearance.

The built-in solutions in modern software offer ready-to-use formats that can be quickly customized. These formats are ideal for anyone looking to save time and avoid the hassle of starting from scratch. They provide a clear structure for documenting transactions, making it easy to input information and adjust sections as needed.

These pre-designed formats also help ensure that key elements like item descriptions, payment terms, and contact details are always included. With a few simple adjustments, users can tailor the documents to fit their specific needs, whether for individual clients or business-wide use. This combination of ease of use and flexibility makes it an ideal choice for managing financial documents efficiently.

Why Use Invoice Templates in Word

Having a structured format for creating professional documents is essential for businesses of all sizes. Using pre-designed options for formal financial papers allows for quick and accurate generation, saving time while ensuring that all necessary details are included. These solutions are especially useful for those who need to produce such documents regularly without compromising on quality or accuracy.

Time Efficiency

Creating custom documents from scratch each time can be time-consuming and prone to errors. Pre-made formats provide a clear structure that requires minimal adjustments, allowing users to focus on the specific details of each transaction rather than formatting. This significantly reduces the time spent on administrative tasks.

Consistency and Professionalism

One of the main advantages of using ready-made designs is the consistency they offer. With uniform styles and layouts, every document maintains a professional appearance, reflecting positively on your business. Consistency in design also helps customers quickly understand key details, such as payment terms and item descriptions.

| Benefit | Explanation |

|---|---|

| Time-saving | Quickly generate documents without starting from scratch. |

| Accuracy | Reduce the likelihood of mistakes when entering transaction details. |

| Professional appearance | Ensure every document looks polished and consistent. |

Benefits of Customizable Invoice Designs

The ability to personalize financial documents provides significant advantages, allowing businesses to tailor each record to their unique needs. Customizable designs offer flexibility, enabling users to adjust content, style, and structure to better reflect their brand and the specific nature of the transaction.

One of the main advantages of this approach is the ability to create consistent and professional-looking records that align with your company’s identity. Customizable layouts give you control over the design, ensuring that the final document meets both functional and aesthetic requirements.

- Brand Identity: Tailor the document’s appearance to reflect your company’s logo, color scheme, and overall visual style.

- Flexibility: Adjust layouts, fonts, and sections to better fit specific client needs or transaction types.

- Clear Communication: Modify content and structure to emphasize key details, such as payment terms or item descriptions.

- Consistency: Ensure uniformity in your documents, contributing to a polished and professional image.

With these customizable options, businesses are able to maintain a high level of professionalism while enhancing communication with clients. The freedom to modify these documents as necessary ensures that each one is both functional and visually appealing, creating a seamless experience for both the sender and the recipient.

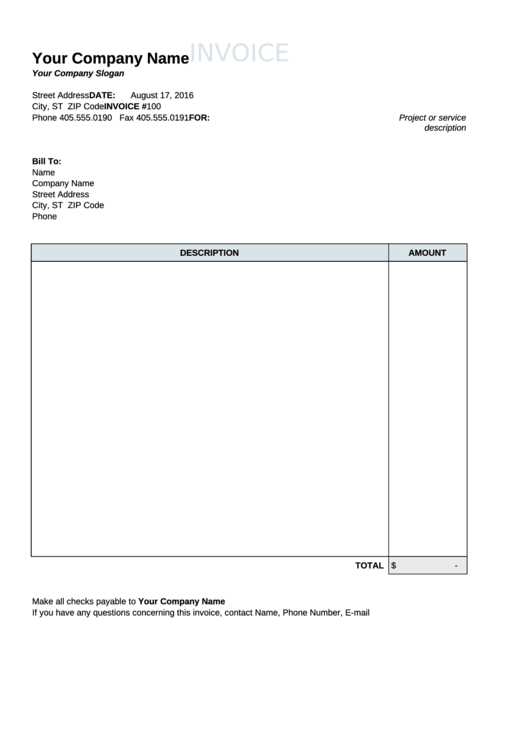

How to Find Free Invoice Templates

Finding high-quality, no-cost solutions for generating formal billing documents is easier than ever. Many platforms offer a wide variety of ready-to-use options that can be accessed and customized to suit your specific needs. These resources are perfect for small businesses or individuals looking to save time and money while creating professional documents.

Popular Online Resources

There are numerous websites offering free document designs, from basic layouts to more complex formats. Here are some of the most reliable platforms:

- Office Software Providers: Many office software companies offer free, downloadable files compatible with their programs.

- Business Websites: Websites dedicated to entrepreneurship and business management often provide free resources, including financial document designs.

- Template Marketplaces: Online marketplaces host a variety of free and paid options, with filters to narrow down choices based on your requirements.

Customizing and Editing Free Designs

Once you’ve found the right design, it’s important to customize it according to your specific preferences. Most online resources allow users to adjust details such as:

- Text sections

- Fonts and colors

- Layout and structure

- Logo insertion

Editing these designs ensures that your documents reflect your brand and professional style while including all necessary details for each transaction. With a little effort, you can create polished, custom records without any added expense.

Steps to Edit Invoice Templates

Editing pre-designed billing documents is a straightforward process that allows users to customize each aspect of the record to meet their specific needs. Whether you’re adjusting for different clients or altering payment terms, the process of personalizing these documents is quick and easy, ensuring accuracy and professionalism every time.

Follow these steps to make effective changes to your document:

- Open the Document: Start by opening the file in your chosen application, ensuring it’s ready for edits.

- Modify the Text: Update the sections for contact details, item descriptions, prices, and payment terms to reflect the current transaction.

- Customize the Layout: Adjust sections such as headings, columns, or footer information based on your business’s requirements.

- Insert Branding Elements: Add your company’s logo, colors, or custom fonts to maintain a consistent brand identity.

- Review for Accuracy: Double-check all information, ensuring no errors in amounts or customer details before finalizing the document.

- Save and Export: Once all changes are complete, save the file in the desired format, whether for printing or digital sharing.

By following these simple steps, you can quickly tailor any document to suit your needs, ensuring it meets professional standards and reflects your business practices accurately.

Key Features of Word 2016 Templates

The built-in solutions in modern software offer a wide range of useful features that make creating professional documents easier and more efficient. These pre-designed layouts are designed with functionality in mind, ensuring that users can quickly input relevant information while maintaining a structured, polished appearance. Below are some of the key advantages of using these ready-made formats.

Customizable Layouts

One of the standout features is the ability to easily modify the design. Whether you need to adjust text placement, change the layout, or add/remove sections, the flexibility provided by these designs ensures that each document can be tailored to your specific needs. This adaptability is crucial for businesses that require different formats for various clients or transactions.

User-Friendly Interface

The ease of use is another key benefit. The designs are made with intuitive controls, allowing even those with limited experience to quickly make changes. Features such as drag-and-drop editing and pre-filled sections simplify the process, reducing the learning curve for new users.

| Feature | Description |

|---|---|

| Easy Customization | Quickly modify sections, fonts, colors, and layouts to suit your needs. |

| Pre-filled Sections | Common details like address, payment terms, and items are already included. |

| Professional Appearance | Ensures every document maintains a clean, organized layout. |

By leveraging these key features, users can create and modify documents efficiently, ensuring consistency and professionalism across all generated files.

Creating Professional Invoices Easily

Generating formal billing records doesn’t have to be a complicated task. With the right tools, you can quickly produce polished, professional documents that accurately reflect your transactions. By using pre-designed layouts, businesses can save time and ensure that every important detail is included in a clear, organized manner.

Simple and Efficient Editing

Many software options offer easy-to-use formats that allow users to input relevant information with minimal effort. Editing fields such as amounts, client details, and service descriptions can be done quickly, ensuring the document is ready for submission in no time. Customization options let users adjust the structure and design to match their brand identity.

Enhancing Professionalism

Using structured designs ensures that every document maintains a consistent, professional appearance. With pre-set sections for all necessary details, you can be confident that your records will be both functional and aesthetically pleasing. Consistency in design adds to your credibility, showing clients that you pay attention to the smallest details.

Adding Your Business Logo to Templates

Incorporating your business logo into formal documents is a great way to reinforce your brand identity and maintain a consistent professional image. Whether you’re creating financial records, contracts, or other business-related documents, adding your logo helps make your communications easily recognizable to clients and partners.

Here’s how you can efficiently add your logo to pre-designed formats:

- Prepare Your Logo: Ensure that your logo image is clear and high-resolution for a crisp appearance. Save it in a commonly used format like PNG or JPEG.

- Open the Document: Open the pre-designed file where you want to add your logo.

- Insert the Logo: Use the “Insert” function to place your logo in the desired location, usually at the top or in the header of the document.

- Adjust Size and Position: Resize and position the logo so it doesn’t overwhelm the rest of the document, ensuring it complements the layout.

- Save the Document: Once your logo is in place, save the document in your preferred format for easy sharing and printing.

By adding your logo to every document, you enhance your company’s visibility and create a cohesive look that helps build trust and professionalism with your clients.

Setting Up Payment Terms in Word

Clearly defining payment terms in formal documents is essential for ensuring smooth transactions and managing financial expectations. By specifying due dates, discounts for early payment, or late fees, you help both parties understand their obligations and avoid potential misunderstandings.

Customizing Payment Terms

Most pre-designed formats allow easy customization of payment terms, letting you specify:

- Due Date: Indicate when the full payment is expected.

- Early Payment Discounts: Offer incentives for clients to pay before the due date.

- Late Payment Penalties: Outline any additional fees for overdue payments to encourage timely transactions.

Best Practices for Payment Terms

When setting up payment terms, ensure that they are clear and concise. Avoid using jargon or overly complex language that could confuse your clients. Keep it simple and specify the most relevant details, such as payment methods accepted and any applicable taxes or additional charges. This clarity helps maintain a professional relationship and ensures that both parties are aligned on the financial aspects of the transaction.

Formatting Tips for Invoices in Word

Creating a well-structured and easy-to-read billing document is essential for maintaining a professional appearance and ensuring clear communication with clients. The layout and formatting play a significant role in how the information is perceived, and proper organization can help prevent errors and delays in payment.

Here are some practical tips to help you format your billing documents effectively:

- Use Clear Section Headings: Ensure that each part of the document is clearly labeled, such as contact information, service description, payment details, and due date. This makes it easier for the recipient to locate key information.

- Keep It Simple and Clean: Avoid clutter by using a minimalist design. Stick to simple fonts and adequate spacing to improve readability.

- Highlight Important Information: Use bold or underlined text for key details like total amount due or payment due date. This draws attention to the most important aspects of the document.

- Use Tables for Clarity: Organize information, such as service items and costs, in neat tables to make it easier to follow. Tables also help ensure consistency in the document’s layout.

- Consistent Alignment: Align text and numbers consistently, particularly for amounts. This gives your document a clean, organized appearance and makes it easier to read.

By following these formatting tips, you can create documents that not only look professional but also enhance the client experience, ensuring smoother communication and more efficient processing of payments.

Common Mistakes to Avoid in Invoices

Creating accurate and clear billing records is crucial for smooth transactions and maintaining a professional reputation. However, errors can easily slip through, leading to confusion, delays, or disputes. Recognizing and avoiding common mistakes can help streamline your process and ensure that payments are received promptly.

Errors in Contact Information

One of the most common mistakes is incorrect or incomplete contact information. This includes wrong client details, outdated addresses, or missing payment methods. Always double-check that your records are up to date to avoid miscommunication or delayed payments.

Ambiguous Payment Terms

Vague or unclear payment terms can create confusion between you and your clients. Ensure that the payment due date, method, and any applicable penalties for late payment are clearly stated. Consistency and clarity are key to avoiding misunderstandings.

Incorrect Calculations

Incorrect amounts or math errors can cause serious problems. Double-check all sums, including taxes, discounts, and total amounts due. Accuracy is crucial for maintaining trust and ensuring smooth financial transactions.

Missing or Incomplete Descriptions

Another frequent mistake is omitting details about the services or products provided. Always provide a full description of what the charges are for, including the quantity, rate, and any other relevant information. This helps avoid confusion and ensures that both parties are on the same page.

By carefully reviewing your documents and avoiding these common pitfalls, you can ensure that your billing records are clear, professional, and accurate.

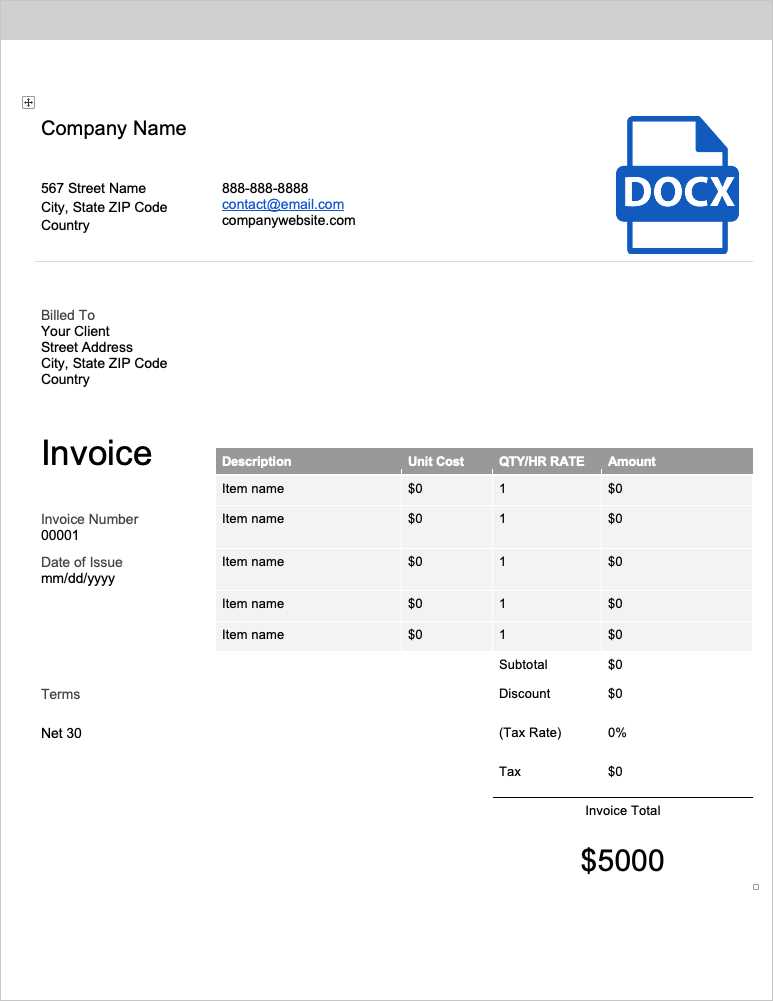

How to Save and Share Your Invoice

Once your billing document is completed, it’s important to know how to save and share it efficiently. Properly saving the document ensures that it can be accessed later, while choosing the right sharing method guarantees that your client receives it in a timely manner. Whether sending it electronically or printing a physical copy, having a clear plan for saving and distributing is essential for smooth business operations.

Saving Your Document

Before sharing, make sure to save your document in an appropriate format. Common file types include PDF, which preserves the layout and prevents edits, and DOCX, which allows for further edits if necessary. Here are some tips for saving your document:

- Choose the Right Format: Saving as a PDF ensures that the layout remains intact, regardless of the recipient’s software.

- File Naming: Use clear and consistent naming conventions to easily identify and retrieve the document later. For example, include the client’s name and the date in the file name.

- Save in a Secure Location: Store the document in a folder where it can be easily accessed but remains secure. Consider using cloud storage for backup purposes.

Sharing Your Document

Sharing your document efficiently can save time and ensure that it reaches the right person. The method you choose depends on your client’s preferences and the urgency of the payment. Here are some ways to share your document:

- Email: Email is the most common and fastest way to send documents. Attach the saved file and include a brief message outlining the payment details.

- Online Platforms: For clients who use online payment platforms, uploading the document directly to their portal is often an option.

- Saves Time: Pre-designed layouts allow quick entry of client details, saving time compared to creating new documents from scratch.

- Professional Appearance: With a clean and well-organized layout, businesses can present a professional image that helps build trust with clients.

- Consistency: Consistent billing practices across all documents ensure clarity for both the business owner and the client, reducing the risk of errors.

- Easy Customization: Many formats allow easy customization to suit the specific needs of each client or service, without losing the original structure.

- Increased Efficiency: Small business owners can focus on the important aspects of their work, such as delivering quality services, while automating the billing process.

- Accurate Record Keeping: Ready-made forms help ensure that all necessary information is included, reducing the chance of missing key details that could lead to confusion or disputes later on.

- Flexibility: These formats often come with built-in fields that can easily be adjusted to fit various business types, from freelancers to small enterprises with multiple clients.

- Label Files Clearly: Name your documents clearly to identify their purpose and usage, such as “Client Name – Service Type” or “Project X – Payment Request.”

- Create Separate Folders: Organize your files into different folders based on criteria like client type, service category, or frequency of use. This helps you find the right format faster.

- Use Consistent Structure: Maintain a consistent layout across all formats to ensure that you can easily navigate them, even if they are customized for different clients.

- Save Custom Versions: If you frequently make modifications to certain formats for different clients, consider saving customized versions to avoid starting from scratch every time.

- Pre-fill Common Information: If you have regular clients or recurring services, pre-fill common fields like contact details or service descriptions to speed up document creation.

- Use Software for Bulk Processing: Some business management tools allow you to batch process multiple documents, whic

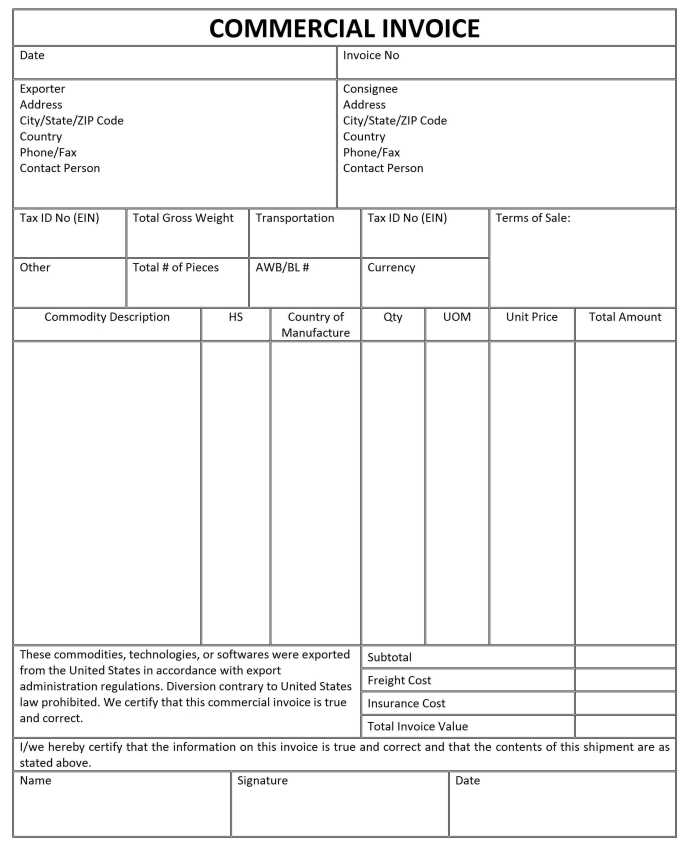

Customizing Tax and Discount Fields

When managing business transactions, it’s essential to accurately reflect taxes and discounts in billing documents. Customizing the fields for taxes and discounts allows you to tailor the structure to meet your specific needs, ensuring that all financial details are clear and precise. Properly modifying these fields not only simplifies the billing process but also ensures compliance with relevant tax laws and enhances transparency for your clients.

Customizing tax and discount sections can be done in a few simple steps, allowing for flexibility in how they are applied to different products or services. Adjusting these fields gives you the ability to reflect various rates based on geographical location, client type, or service provided. Here’s how you can effectively manage and modify these fields:

Adjusting Tax Fields

Taxes can vary depending on the region, service, or product, so it’s important to make sure the tax field is flexible enough to handle multiple rates and types. Here are a few tips for adjusting tax fields:

- Set Default Rates: Configure default tax rates that can be easily adjusted for each transaction, ensuring accuracy without having to manually input values every time.

- Include Multiple Tax Lines: If your business is subject to multiple tax rates (e.g., local, state, or federal), you can add separate

Using Word to Track Invoice Payments

Managing payment records efficiently is essential for maintaining financial accuracy and ensuring smooth cash flow. While many accounting software tools offer advanced tracking features, using document editors can also serve as an effective method for keeping track of outstanding payments. By setting up a simple system in a document editor, you can track payments, monitor overdue amounts, and maintain an organized record of all financial transactions.

When using a document editor for tracking payments, it’s important to structure the information clearly. You can create a payment log within the same document used for creating your financial records, ensuring that both documents are readily accessible. Here’s how you can effectively use a document editor to track payments:

Creating a Payment Log

Setting up a clear and organized payment log is the first step. The table format allows you to track relevant details such as the client’s name, payment due date, payment status, and amounts paid. Below is an example of how to structure this log:

Client Name Invoice Date Amount Due Amount Paid Payment Status Due Date John Doe January 10 $500 $500 Paid January 24 Jane Smith February 12 $300 $0 Pending February 26 ABC Corp March 1 $1000 $500 Partial March 15 Updating the Payment Status

Once you have set up your log, the n

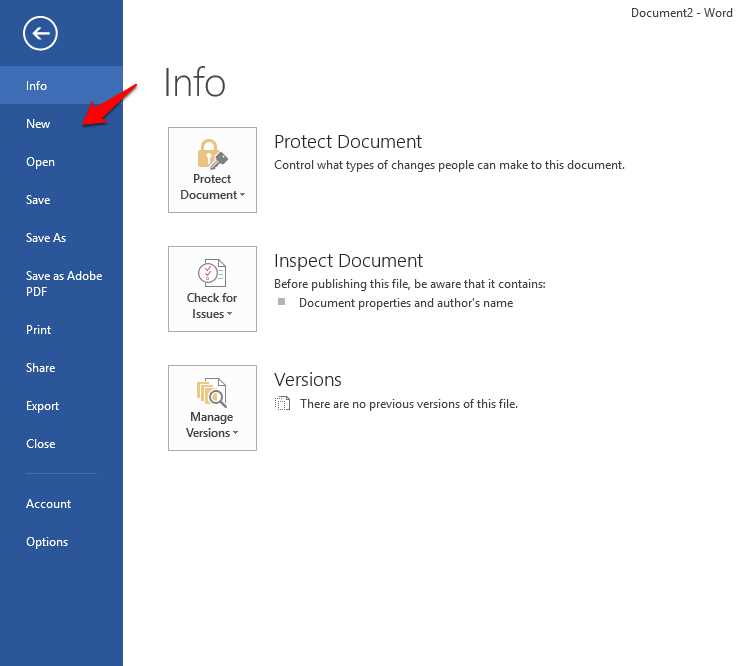

How to Print Your Document from Word

Printing your financial documents directly from a document editor is a straightforward process. Whether you’re preparing a record for physical distribution or need a printed copy for your files, ensuring that your document is properly formatted and ready for printing is essential. By following a few simple steps, you can easily print your document with all the necessary information intact, presenting it in a professional and clean format.

Before printing, ensure that your document is correctly set up. This includes checking margins, fonts, and spacing. Once you’re satisfied with the layout, the next step is to access the print settings.

Steps to Print Your Document

To print your document, follow these steps:

- Open your document: Launch the document you wish to print.

- Check your formatting: Review your content to ensure everything is aligned and the layout looks professional.

- Open the print dialog: Go to the “File” menu and select the “Print” option.

- Select your printer: Choose the printer you want to use from the list of available printers.

- Adjust print settings: Ensure the correct page size, margins, and number of copies are set.

- Preview your document: Use the “Preview” option to see how it will appear once printed.

- Print your document: Once everything is set, click the “Print” button to start the process.

Tips for a Smooth Printing Process

Here are a few tips to ensure a smooth printing experience:

- Use high-quality paper: For a more professional lo

Best Practices for Organizing Financial Documents

Effectively managing and organizing financial documents is crucial for maintaining smooth business operations. A well-organized system ensures that important records are easily accessible, helps prevent errors, and makes it simpler to stay on top of payments and financial tracking. By implementing a few best practices, you can streamline your process and keep everything in order.

Key Strategies for Organizing Your Documents

Here are some strategies to help you maintain an efficient system:

- Use a consistent naming convention: Establish a uniform system for naming your files to make it easier to search for specific documents. For example, include the client name, date, and a reference number in the file name.

- Organize by categories: Group documents into categories based on their type, such as “Sales,” “Expenses,” and “Payments.” This way, you can quickly locate related records when needed.

- Utilize folders and subfolders: Create main folders for broad categories and use subfolders for specific details, like individual client files or project-specific documents.

- Maintain digital and physical copies: Ensure you have both digital and hard copies of important documents, with backups for digital files stored in secure cloud storage or on external drives.

- Implement a numbering system: Use sequential numbers or dates for your documents, which helps avoid confusion and ensures each do

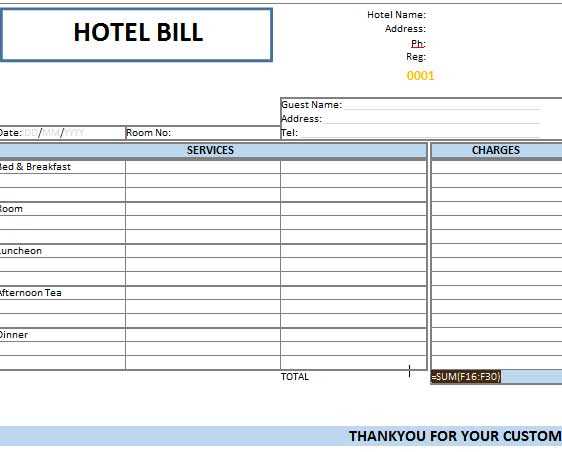

Invoice Templates for Small Businesses

For small business owners, managing billing efficiently is a key component of maintaining financial stability and professionalism. Customized billing forms can save time, reduce errors, and ensure that every detail is captured accurately. By using ready-made billing formats, small businesses can streamline their administrative tasks and focus more on growing their operations.

Advantages for Small Businesses

Utilizing ready-to-use formats brings several benefits to small business owners. Here are some of the primary reasons why these tools are essential:

How Small Businesses Can Benefit from Using Ready-Made Formats

Small businesses can greatly benefit from incorporating these ready-to-use forms into their workflow. Here’s how:

By using these formats, small businesses can maintain a streamlined and professional appr

How to Handle Multiple Invoice Templates

When running a business, it’s common to need various document formats for different clients, services, or types of transactions. Managing multiple billing documents can seem overwhelming, but organizing them effectively ensures that you can work efficiently while maintaining a professional appearance. By properly handling and storing different formats, you can save time and reduce errors when generating documents for diverse needs.

Organizing Multiple Formats

Managing multiple forms requires a methodical approach to ensure quick access and easy customization. Here are some strategies to help handle various formats more efficiently:

Streamlining Document Creation

Efficient document creation involves knowing when to use each format and customizing them as needed. Here’s how to streamline the process: