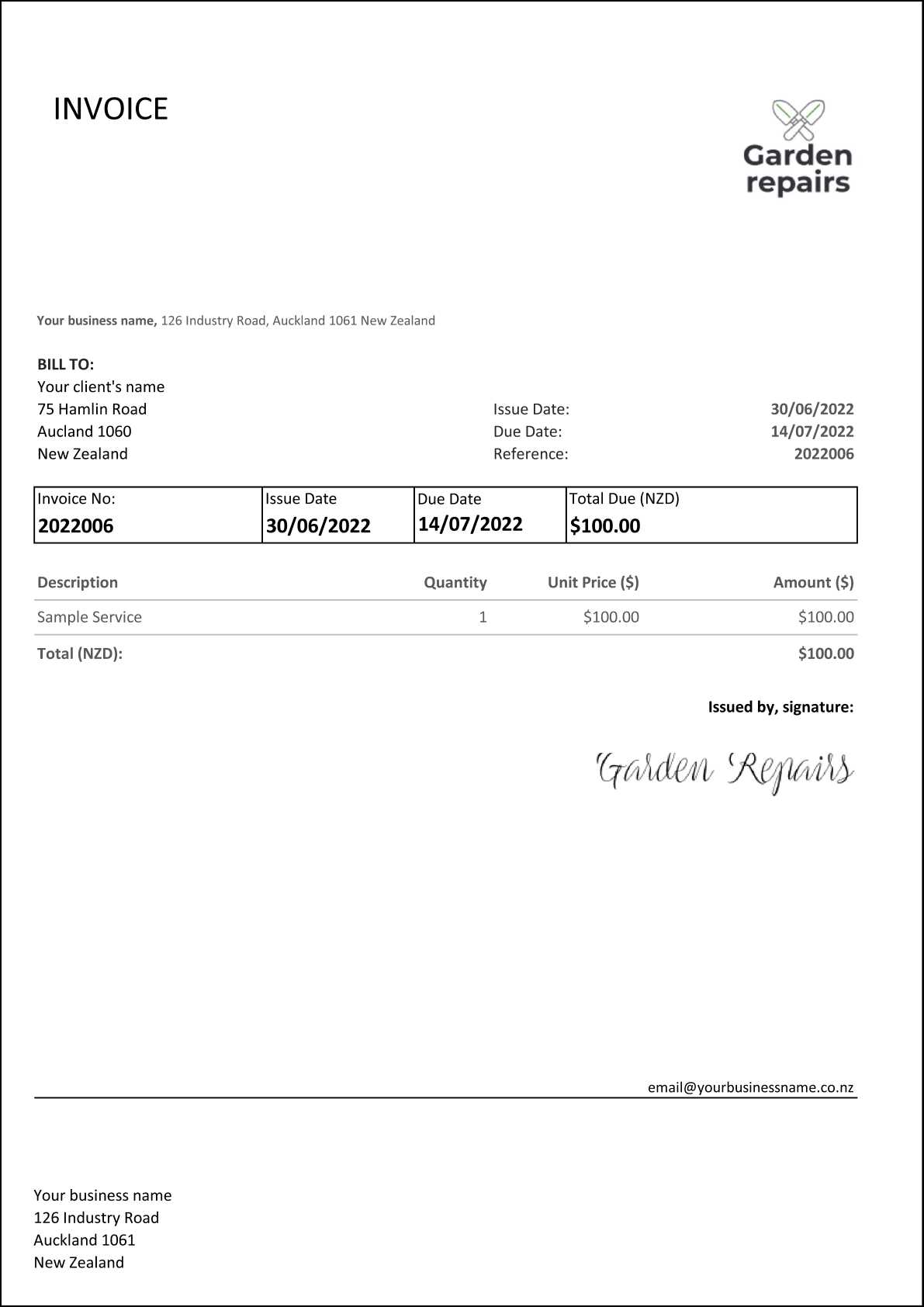

Download Free Spanish Invoice Template for Easy Billing

For businesses operating in any region, having a reliable and professional method of managing billing and payments is crucial. Whether you’re a freelancer, small business owner, or part of a larger company, it’s important to ensure your financial records are clear, accurate, and comply with local regulations. Using the right tools to create these documents can save time and reduce errors, while also helping to maintain good relationships with clients.

Efficient document creation involves more than just filling in fields; it requires attention to detail and an understanding of legal requirements. In certain regions, there are specific elements that need to be included in every transaction record. These details help avoid confusion and ensure that both parties are on the same page when it comes to payment terms and obligations.

With the availability of customizable formats, creating professional business records is easier than ever. These formats help streamline the process, whether you are managing a large volume of transactions or simply need to issue a few records each month. Having access to pre-designed structures allows for quicker document preparation, ensuring you stay focused on other important aspects of running your business.

Spanish Invoice Template Overview

For businesses working within the Spanish market, having a structured approach to creating financial records is essential. The format for documenting transactions must align with legal requirements and local business practices. A well-designed document helps maintain clarity between a service provider and a client, ensuring that all necessary details are included for proper tracking and compliance.

Key Elements of a Proper Document

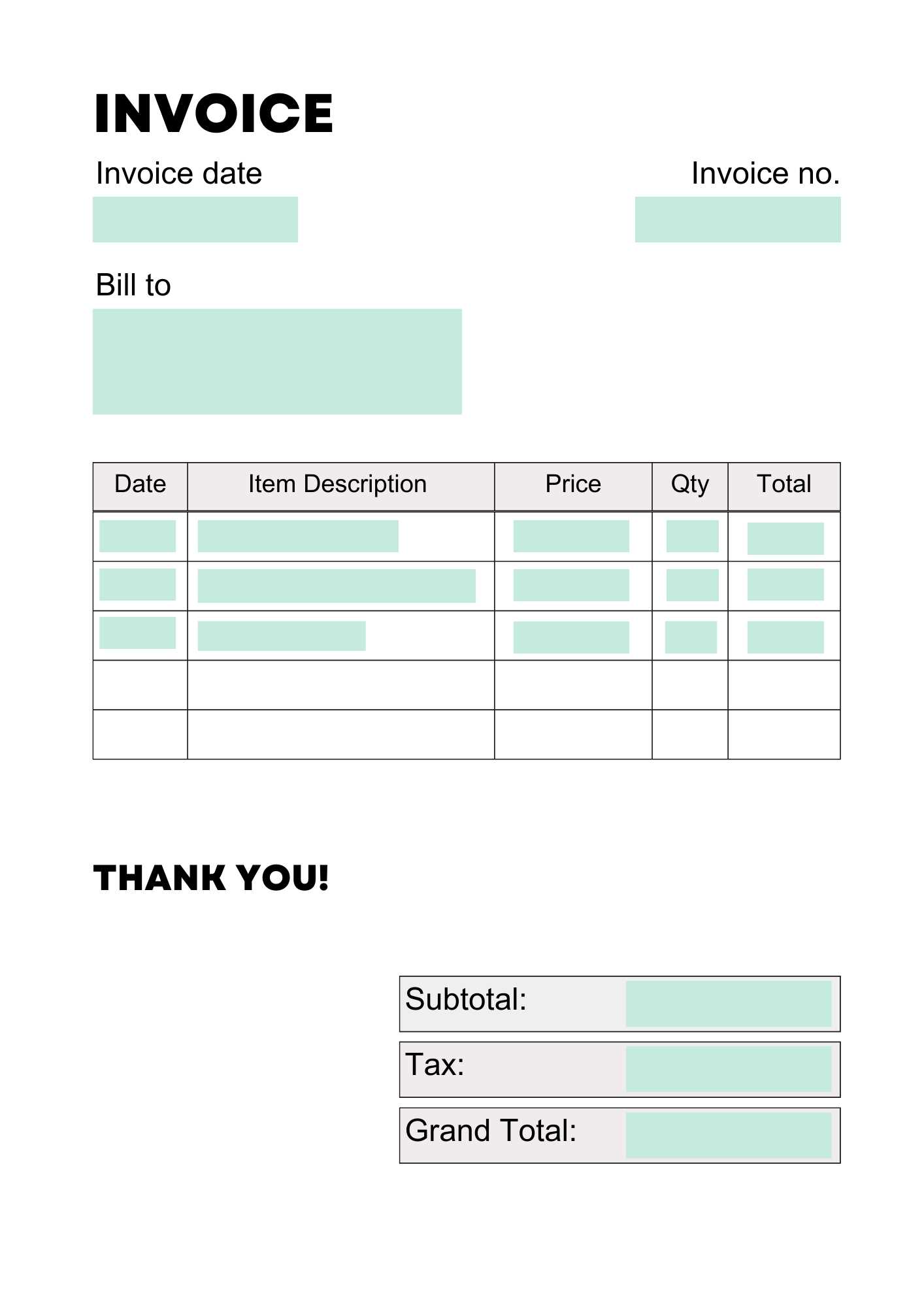

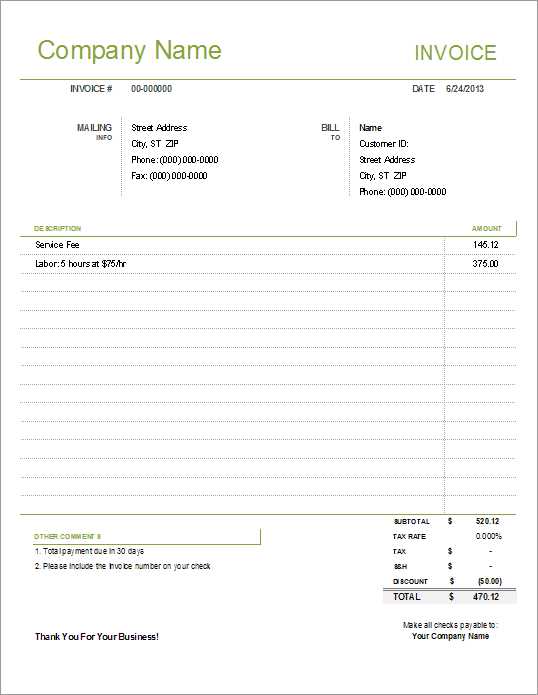

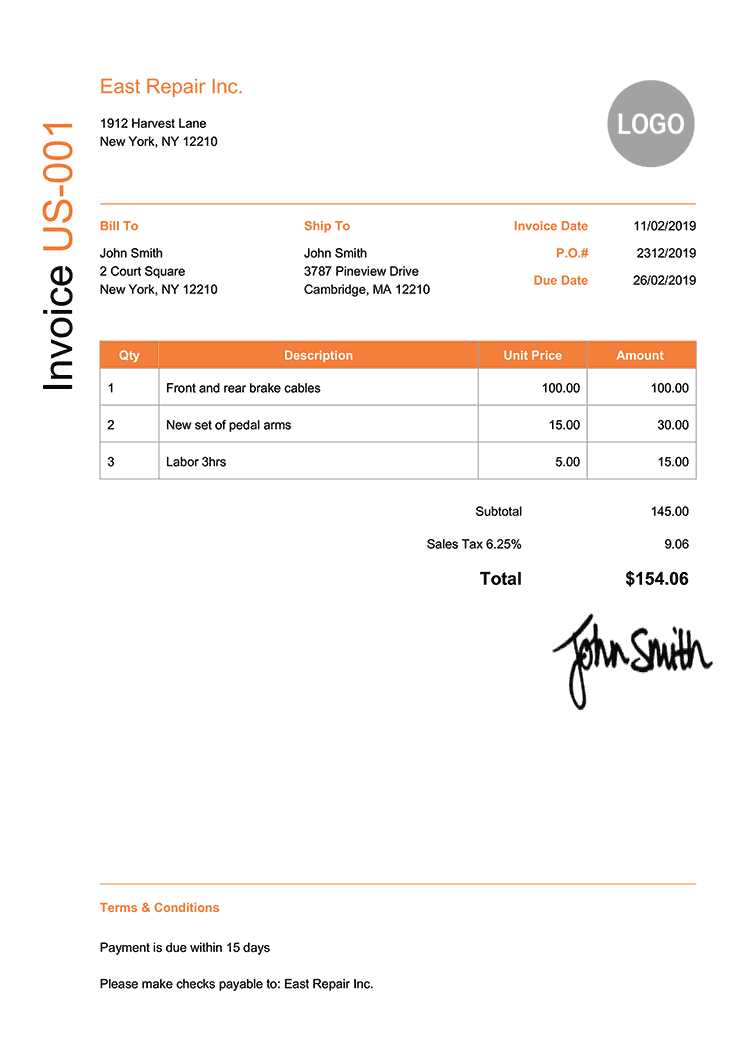

When creating such documents, certain components are mandatory to ensure that they are legally valid and provide both parties with the necessary information. These are some of the essential elements that must be present:

- Client and company details: Include full names, addresses, and tax identification numbers.

- Description of services/products: A clear breakdown of the goods or services provided.

- Payment terms: Include deadlines, payment methods, and penalties for late payments.

- Tax information: Specific tax rates and applicable VAT charges should be outlined.

- Sequential numbering: Each record must have a unique reference number for tracking purposes.

Why Use a Pre-Formatted Structure

Using a pre-made structure for creating financial documents offers several benefits for businesses:

- Time-saving: Pre-designed formats eliminate the need to start from scratch every time.

- Accuracy: Templates ensure that all required fields are included, reducing the risk of errors.

- Consistency: Maintaining a standard format helps build professionalism and trust with clients.

- Compliance: A well-structured document ensures adherence to local regulations, minimizing legal risks.

Why Use a Spanish Invoice Template

For businesses, having a reliable method for creating financial records is essential for smooth operations and maintaining professionalism. A pre-designed format provides an organized structure for all the necessary details, making it easier to produce documents that are clear, accurate, and compliant with local regulations. By using a standardized approach, businesses can save time and avoid errors that may arise from starting each record from scratch.

Efficiency is one of the main reasons to adopt a ready-made structure. It allows you to quickly fill in the required fields without worrying about formatting or missing important information. This efficiency is especially valuable for businesses that handle multiple transactions daily, as it reduces administrative burdens and speeds up the billing process.

Additionally, using a set structure ensures accuracy and consistency across all records. When you use a pre-built format, you reduce the chances of omitting key details like tax rates, payment terms, or client contact information. This consistency can help build trust with clients and avoid misunderstandings.

Moreover, these structures help businesses remain compliant with local legal requirements. Different regions have specific regulations regarding how business records should be presented, and using a pre-designed solution ensures that all mandatory fields are included and formatted correctly. This can protect your business f

Key Features of Spanish Invoices

When preparing business documents, it is essential to include certain key elements to ensure they are both professional and legally compliant. Each document should have a structured layout that clearly presents all the necessary information. This not only helps to maintain clarity between parties but also ensures that the transaction is properly recorded and can be easily referenced in the future.

Legal requirements play a significant role in the format and content of such documents. In many regions, there are specific details that must be included to meet regulatory standards. These elements help avoid legal complications and ensure the document serves its intended purpose.

Some of the most important features to include are:

- Document number: A unique reference number for easy tracking of each record.

- Party details: Full names, addresses, and tax identification numbers of both the service provider and the client.

- Clear description of services or goods: A detailed breakdown of what was provided, including quantities, rates, and individual prices.

- Tax information: Relevant taxes, including VAT, must be clearly listed, with applicable rates specified.

- Payment terms: These include the total amount due, payment methods, and deadlines, along with any penalties for late payments.

By ensuring that these features are present and accurate, businesses can avoid confusion, build trust with clients, and streamline their financial processes. Additionally, a well-structured document provides peace of mind, knowing that all relevant details are covered for both accounting and legal purposes.

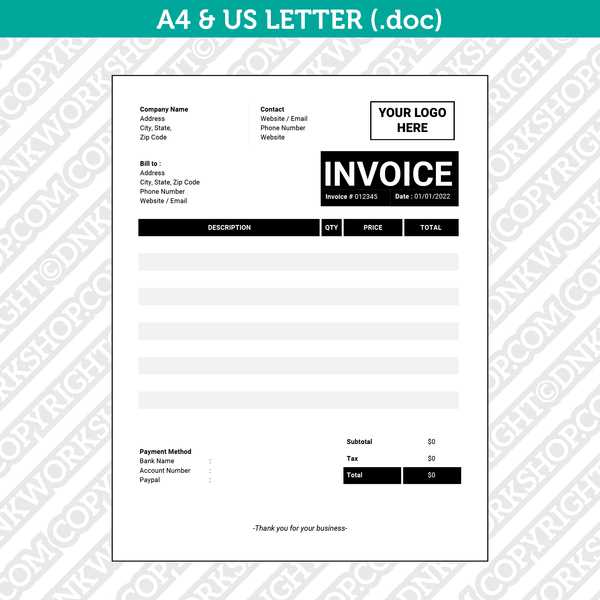

How to Customize Your Template

Adapting a pre-designed format to fit your business’s unique needs is a simple but essential step in streamlining the billing process. Customization allows you to align the document with your branding, client requirements, and specific business practices, ensuring that the final record reflects your professionalism while staying compliant with local standards. Here’s how you can tailor a standard structure to better suit your operations.

The first step in personalizing your document is to adjust the layout and design. This includes:

- Adding your company logo: Incorporate your business’s logo at the top of the page to reinforce brand recognition.

- Choosing colors and fonts: Use company-specific colors and fonts to maintain consistency with your other materials.

- Setting up the header: Customize the header with your business’s name, address, and contact information for easy identification.

Once the layout is set, the next step is to modify the content sections. These are the areas where you can add more specific details related to each transaction:

- Client information: Adjust the fields to include client-specific details such as their name, address, and tax ID number.

- Description of services: Create custom fields or options to describe the products or services you offer more clearly, including unit prices and quantities.

- Payment instructions: Add payment terms that suit your business model, including deadlines, accepted methods, and penalties for overdue payments.

Finally, ensure that legal and tax-

Benefits of Digital Invoices in Spain

As businesses continue to adopt modern solutions, the transition from paper-based documentation to digital records offers significant advantages. Digital formats provide increased efficiency, security, and ease of access, all of which contribute to smoother financial management. For companies operating within Spain, embracing electronic records is becoming a key factor in staying competitive and compliant with regulations.

Key Advantages of Digital Records

Switching to electronic records brings several important benefits for businesses:

- Speed: Digital documents can be created, sent, and stored much faster than traditional paper versions. This helps businesses process payments quickly and reduces administrative time.

- Cost savings: Reducing paper use and eliminating printing and mailing costs can significantly lower operational expenses.

- Environmental impact: By going digital, companies contribute to sustainability efforts by reducing paper waste and minimizing their carbon footprint.

- Accessibility: Electronic records are easier to store, organize, and retrieve, allowing quick access to past transactions from any device with an internet connection.

Legal and Compliance Benefits

Using digital solutions also helps businesses stay compliant with local and international regulations. In Spain, electronic records are fully recognized as legally valid if they meet the necessary requirements. The use of certified digital formats ensures that businesses can easily meet tax obligations and provide proof of transactions when required. Additionally, electronic documentation facilitates efficient communication with authorities and reduces the risk of errors related to manual processing.

By adopting digital records, businesses not only improve internal processes but also align with current technological trends, offering greater transparency, security, and convenience for both clients and regulatory bodies.

Common Mistakes to Avoid in Spanish Invoices

When preparing financial records, attention to detail is critical. Even small errors can lead to confusion, delays in payments, or legal complications. Whether you’re a freelancer or part of a larger business, it’s essential to be aware of the common mistakes that can occur when creating transaction documents, especially in a new market with specific requirements. Avoiding these pitfalls ensures that your records are professional, accurate, and compliant with local laws.

Failure to include required information is one of the most common mistakes. Missing key details can cause delays in payments or disputes with clients. Always ensure that you include:

- Client details: Full name, address, and tax identification number.

- Clear description of services or products: Be specific about what was provided, including quantities, unit prices, and any applicable discounts.

- Accurate tax information: Correct VAT rates and amounts must be clearly indicated, as incorrect tax information can result in penalties.

- Proper payment terms: Clearly state payment due dates and any late fees to avoid misunderstandings.

Another mistake is incorrect document numbering. Each transaction record must have a unique sequential number. This helps both you and your clients keep track of payments and ensures that the documents comply with legal requirements. Skipping this step can create confusion and hinder financial recordkeeping.

Inaccurate or incomplete tax calculations can also create significant problems. Many regions, including Spain, have complex tax regulations that must be followed precisely. Make sure that the tax rate applied is correct, and that taxes are calculated based on the right amount, taking into account any exemptions or deductions that may apply.

Finally, poor formatting can make a document look unprofessional and difficult to understand. Use clear headings, organized sections, and readable fonts to ensure that all necessary details stand out.

How to Include Spanish VAT Information

When preparing transaction records, including the correct tax information is crucial for ensuring legal compliance and transparency in business dealings. For businesses operating in Spain, including the proper Value Added Tax (VAT) details is not just a requirement–it is essential for maintaining accuracy in financial documentation. Knowing where and how to present this information correctly can prevent errors and avoid legal complications.

Understanding VAT rates is the first step. In Spain, VAT is typically charged at standard rates, but some goods and services may be eligible for reduced rates or exemptions. The most common VAT rates are:

- Standard rate: 21% for most goods and services.

- Reduced rates: 10% for certain goods and services, such as hospitality or transport services.

- Super-reduced rate: 4% for basic necessities, including some food products and medicines.

Each document must clearly show the applicable VAT rate for the products or services provided. Here’s how you can include this information:

- Specify the VAT rate: Clearly state the VAT rate applied to each item or service, whether it’s the standard rate or a reduced one.

- Breakdown of amounts: For clarity, show the price before tax, the VAT amount, and the final price with tax included.

- Tax identification number: Include your business’s tax ID number and, if applicable, your client’s VAT number. This ensures both parties are properly registered for VAT purposes.

- Display VAT as a separate line: The VAT amount should be shown on a separate line so it is easily identifiable. This allows clients to clearly see the amount they are paying for tax.

Additionally, clear documentation of VAT helps when filing taxes, as businesses need to report bot

Understanding Invoice Numbering in Spain

Properly numbering business records is crucial for organization, legal compliance, and smooth accounting. In Spain, as in many other countries, the numbering of financial documents must follow a specific, sequential system that ensures traceability and reduces the risk of duplication or errors. This system helps businesses maintain clear and accurate records for both internal use and regulatory purposes.

Legal Requirements for Document Numbering

In Spain, each record must be assigned a unique number that follows a strict chronological order. This numbering system is not only important for your internal records but is also required by tax authorities to monitor and verify business transactions. Here are some key points to keep in mind:

- Sequential numbering: Documents must be numbered consecutively, without any gaps or repetitions, to ensure proper tracking.

- Unique identifiers: Each number must be distinct and assigned to a single transaction or record, preventing confusion or misidentification.

- Format consistency: The numbering format should be clear and consistent across all documents to facilitate easy identification and retrieval.

Best Practices for Numbering Records

To make the numbering system work efficiently and remain compliant with Spanish regulations, businesses should consider the following best practices:

- Start with a clear prefix: Adding a business identifier or year to the number (e.g., “2024-001”) can help distinguish different years or departments.

- Avoid skipping numbers: Ensure that every document gets a sequential number, even if some records are void or canceled, to maintain consistency.

- Record cancellations: If a document is canceled or corrected, it should still be numbered in sequence, with a note indicating the cancellation to prevent gaps in the seque

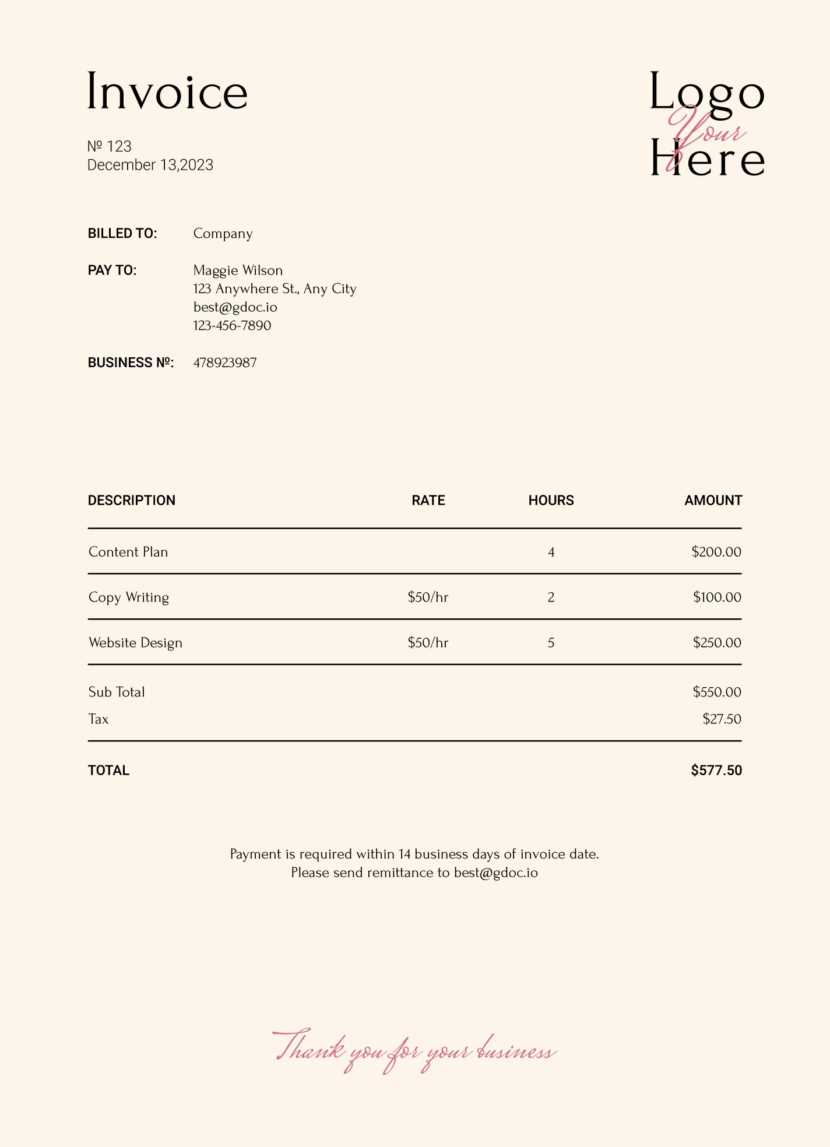

Spanish Invoice Template for Freelancers

Freelancers often face unique challenges when it comes to managing their finances, especially when dealing with multiple clients and varying payment terms. Having a structured format for documenting transactions is essential to stay organized and professional. A well-organized document ensures clarity for both the freelancer and the client, making the billing process smoother and more efficient.

Essential Elements for Freelancers

When creating a business record for freelance work, there are several key elements that must be included to ensure accuracy and compliance. These are the basic components that should be part of every document:

Section Description Freelancer’s Information Name, address, and tax identification number of the freelancer. Client’s Information Client’s full name, address, and tax ID number. Service Description Detailed breakdown of the services provided, including rates, quantities, and unit prices. Payment Terms Clear details about the amount due, payment methods, deadlines, and any late fees. Tax Information Relevant tax rates and amounts, with the total calculated price including taxes. Special Considerations for Freelancers

Freelancers should also consider adding some additional elements to their records to further streamline their business operations:

- Hourly Rates or Project Fees: Clearly state whether the work is billed by the hour or as a flat project rate.

- Project Milestones: If the project is ongoing, it’s helpful to break down the payment into milestones, specifying what work is expected at each stage.

- Discounts and Promotions: If applicable, include any discounts or promotional rates you offer to clients, ensuring they are reflected in the final amount.

By maintaining a clear and professional structure, freelancers can ensure smooth transactions with their clients, reduce the risk of errors, and enhance their overall business efficiency.

Legal Requirements for Invoices in Spain

When creating financial records for transactions, it’s important to adhere to local regulations to ensure both compliance and transparency. In Spain, there are specific legal requirements that businesses must follow to ensure their documents are valid and recognized by tax authorities. These requirements cover everything from the details included in the document to how it is numbered and stored.

The Spanish government has set out clear rules to regulate business transactions and ensure proper tax collection. Businesses are required to issue documents that contain certain mandatory information, which must be presented in a clear and organized manner. Failure to comply with these legal obligations can lead to penalties, audits, or disputes with clients.

Here are the essential legal requirements to consider when creating business records:

- Sequential Numbering: All records must be numbered consecutively, without any gaps or duplicates. This helps ensure accurate tracking and auditing of transactions.

- Tax Identification Number (NIF/NIE): Both the business and the client’s tax identification numbers must be included. This is necessary for the correct reporting of VAT and for verifying the tax status of both parties.

- Full Details of the Parties Involved: You must include the full name, address, and contact information of both the seller and the buyer. This ensures that the document is linked to the correct entities.

- Clear Description of Goods or Services: A detailed breakdown of the goods or services provided, including quantities, unit prices, and the total value before taxes.

- Tax Rate and Amount: The applicable VAT rate must be clearly indicated, along with the VAT amount, and the total amount due (including tax).

- Start with the Key Sections: Focus on the main sections of the document first–these include the header, item descriptions, payment terms, and the amounts. Ensure that all numerical figures remain the same, but that words and descriptions are appropriately translated.

- Use Correct Financial Terminology: Spanish has specific terms for financial and legal matters. For instance, “amount due” should be translated as “monto a pagar,” and “due date” becomes “fecha de vencimiento.” Make sure to use terms that are commonly understood in business and legal contexts.

- Pay Attention to Formatting: While the language is changing, the structure of the document should remain intact. Be sure to preserve the layout, headings, and overall organization to ensure clarity.

- Translate Legal and Tax Terms: If the document includes specific tax or legal language, make sure to use the correct equivalent terms. For example, “VAT” should be translated as “IVA” (Impuesto sobre el Valor Añadido), and “tax identification number” as “número de identificación fiscal.”

- Proofread and Verify Accuracy: Once the translation is complete, double-check all details for accuracy. A simple error, like incorrect numbers or a mistranslated term, could lead to confusion or legal issues. It’s a good idea to have a professional translator or a native speaker review the document for quality assurance.

- Currency and Amounts: Clearly specify the currency in which the transaction is being made. This could be the local currency of the client or your own, depending on the agreement. Be sure to indicate the exchange rate if it applies and include the total amount in both currencies, if necessary.

- Taxation and Compliance: Different countries have different tax rules, and in some cases, international businesses might be exempt from certain taxes. Ensure you understand whether VAT or other local taxes need to be applied to your transactions. Specify which taxes are applicable and provide the correct tax ID numbers for both parties.

- Payment Terms: Clearly define payment terms, including the due date, methods of payment, and any late fees or discounts. International clients may have specific preferences for payment methods, such as bank transfer, PayPal, or credit card. It’s important to agree on the payment method in advance to avoid delays.

- Language and Localization: Consider translating the document into the client’s preferred language or including bilingual information if necessary. Ensure that the terminology used is clear, and that both parties fully understand the terms and conditions outlined in the document.

- Legal Details: Include all relevant legal information, such as your

Best Software for Spanish Invoices

When managing business records, having the right software can save time and reduce the risk of errors. There are numerous tools available that help automate the process of creating professional documents, track payments, and manage taxes, especially for businesses operating in Spain. Using the right invoicing solution ensures compliance with local regulations, simplifies the financial management process, and improves overall business efficiency.

Top Features to Look for in Software

Before selecting software, it’s important to consider the key features that can support your business needs. The right software should not only help with the creation of documents but also with payment tracking, reporting, and tax management. Here are some must-have features:

- Customization Options: The ability to customize fields, layout, and design to match your business’s branding or specific industry requirements.

- Tax Compliance: Integration with the local tax system to automatically calculate VAT or other applicable taxes based on current rates and regulations.

- Multi-currency and Multi-language Support: If you work with international clients, it’s helpful to have a tool that can manage different currencies and languages.

- Cloud-based Accessibility: Cloud-based tools offer flexibility and accessibility, allowing you to create and access documents from anywhere at any time.

- Payment Integration: Integration with popular payment gateways for smooth transactions and easy tracking of paid and outstanding amounts.

Best Tools for Creating Business Records

Here are some of the top-rated software solutions that cater specifically to businesses operating in Spain and other regions, helping ensure smooth billing and financial management:

- Billin: A Spanish invoicing solution designed to help small businesses generate professional records, track payments, and manage tax compliance. It offers multi-language support and cust

Using Spanish Invoice Templates on Mobile

In today’s fast-paced business world, managing transactions and financial documentation on-the-go has become a necessity. Mobile apps provide a convenient way for businesses to create, send, and manage their financial records directly from their smartphones or tablets. By using mobile-friendly solutions, entrepreneurs and freelancers can generate professional documents, monitor payments, and track project progress, all from the palm of their hand.

Why Use Mobile Invoice Solutions

There are several advantages to using mobile applications for managing business records, especially for small business owners or freelancers. Here are a few reasons why mobile tools are becoming increasingly popular:

- Accessibility: With mobile apps, you can create and send documents anytime, anywhere, whether you’re at a meeting, on-site with a client, or traveling. This makes it easier to maintain professionalism and meet deadlines even when you’re away from the office.

- Real-Time Updates: Mobile solutions often provide real-time notifications when a document has been viewed or paid, helping you stay on top of your financial transactions and communication with clients.

- User-Friendly Interfaces: Many mobile apps are designed with simplicity in mind, providing intuitive interfaces that allow even those with minimal technical skills to generate professional documents quickly and easily.

- Cloud Integration: Many mobile tools sync with cloud storage, making it easy to back up and access all your business records from multiple devices. This also ensures that your documents are safe and accessible even if your phone is lost or damaged.

Features to Look for in Mobile Tools

When selecting a mobile application for creating and managing your business records, consider the following features to ensure it meets your needs:

- Payment Status Indicators: Include clear sections within your document that indicate the status of each transaction. This could be as simple as adding checkboxes or a “paid” label next to the relevant amounts. This way, you can easily identify which payments have been completed and which are still outstanding.

- Payment Due Dates: Always include a payment due date on your documents. Setting clear deadlines helps clients understand when payment is expected, and it provides a reference for tracking late or overdue payments.

- Payment Method Information: Track the method of payment used, whether by bank transfer, credit card, or online payment system. This provides a clear record of how payments were made and can help resolve any disputes about missing payments or transaction errors.

- Consistency: Pre-built formats ensure that your records have a consistent look and feel, which helps maintain professionalism and reduces the need to manually adjust formatting every time.

- Reduced Errors: Using pre-set fields and structured layouts minimizes the risk of missing essential information or formatting mistakes, which can be common in manually created documents.

- Quick Customization: Templates allow you to quickly adjust the details, such as client names, amounts, and services provided. Instead of starting from scratch ever

Differences Between Invoice Formats in Spain

When it comes to financial documentation, there are various formats and structures that businesses in Spain need to follow. These formats differ depending on factors such as the type of transaction, the nature of the business, and the legal requirements. Understanding these differences is crucial for ensuring compliance with local tax laws and streamlining business operations. Each format serves a specific purpose, and knowing when to use which type can help you avoid potential issues with clients or regulatory authorities.

Types of Financial Documents in Spain

In Spain, there are several types of records that businesses can issue, each with its own specific guidelines and requirements. These documents can generally be divided into two categories: documents used for regular transactions and those used in special cases. Below are some key examples:

- Regular Business Documents: These are the standard records used for typical sales transactions and services rendered. They include details like products or services, payment terms, and tax information.

- Proforma Documents: Often used as a preliminary estimate or offer before a sale is finalized, this type of document outlines expected costs but does not serve as an official request for payment.

- Rectification Documents: Used to correct errors or omissions in previous records. These documents help ensure that the financial records remain accurate and compliant with regulations.

- Credit and Debit Notes: These are used for adjusting the amounts on previous documents, often in cases where there was a return of goods or a change in pricing.

Key Differences Between Formats

Different formats have distinct elements and structures. The major differences between them stem from their purpose and how they need to be handled from a legal and tax perspective. Below are some of the key distinctions:

- Taxation Requirements: Regular documents generally need to include tax information, suc

Free Spanish Invoice Template for Your Business Needs

How to Track Payments with Spanish Templates

Efficiently tracking payments is crucial for maintaining a smooth cash flow and ensuring that clients meet their financial obligations. Using structured documents to record transactions can simplify the process and help you stay organized. Whether you’re working with clients in Spain or internationally, having a clear record of outstanding and paid amounts allows you to manage your finances better and avoid confusion or disputes.

Methods to Track Payments

There are various ways to track payments when using financial documents. Many invoicing solutions now come with built-in features that automate much of the process, but there are a few key strategies to help ensure accuracy:

Tools for Payment Tracking

How to Save Time with Templates

Streamlining administrative tasks is essential for running a productive business. One of the most time-consuming activities for entrepreneurs and small businesses is creating and managing documents. Using pre-designed, customizable solutions for generating professional records can save significant time, reduce errors, and help maintain consistency across your documentation. By implementing ready-made formats, you can focus on more important tasks while ensuring that your documents meet professional standards.

Benefits of Using Pre-Designed Formats

By adopting customizable formats for your financial records, you can greatly reduce the time spent on repetitive tasks. Here are some key advantages:

How to Translate an Invoice to Spanish

Translating a business record into another language is essential when dealing with clients, suppliers, or partners in a different country. For businesses operating internationally, ensuring that financial documents are accurately translated is key to maintaining clear communication and avoiding misunderstandings. When translating a document into Spanish, it’s important to ensure that the terminology is correct, the structure follows local standards, and all legal and financial terms are accurately conveyed.

Here are the essential steps to follow when translating a business document into Spanish:

By following these steps, you ensure that your financial records are correctly translated, clear for your Spanish-speaking clients, and compliant with local regulations. Accurate translations help maintain professionalism and avoid miscommunications, especially in important matters like payments and contracts.

Creating Invoices for International Clients

When working with clients across borders, it’s crucial to ensure that financial documents meet both international and local standards. Billing practices may differ significantly from one country to another, and a clear, well-structured document helps avoid confusion and ensure timely payments. Creating a professional business record for international clients requires attention to detail, including understanding the unique needs of clients in different regions, addressing currency differences, and ensuring compliance with relevant tax laws.

Key Considerations for International Billing