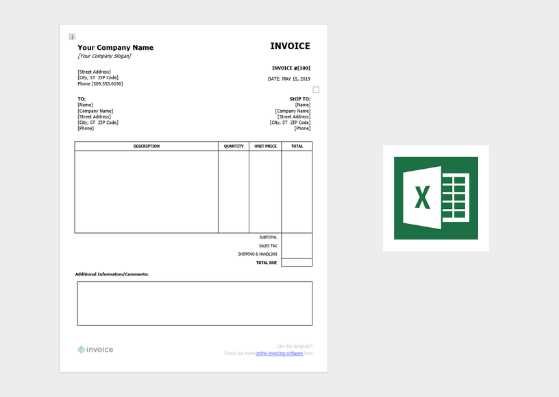

Best Free Invoice Templates to Download for Your Business

Managing business transactions requires having the right tools to ensure smooth and efficient operations. One essential tool for any business owner is a well-structured document to outline payment terms, amounts, and dates. These documents are crucial for maintaining professionalism and ensuring clear communication with clients.

Fortunately, there are many resources available online that offer high-quality, customizable formats that can save time and improve the accuracy of your financial records. Whether you are a freelancer, a small business owner, or part of a larger organization, having access to these ready-made files can make your job easier and more efficient.

In this article, we will explore where to find these useful resources, how to personalize them to suit your business needs, and the key features that make these tools indispensable for anyone who needs to manage payments and transactions effectively.

Top Documents for Professional Billing

When managing financial transactions, having access to ready-made, customizable documents can streamline your process and ensure consistency. Whether you are just starting a new business or need to improve your current system, having the right structure is crucial for clear and professional communication with clients.

There are numerous high-quality resources available online that offer easy-to-use documents, tailored to various business needs. These resources can help you maintain accuracy and stay organized, saving you time and reducing the risk of mistakes. You can find documents that fit any industry, from freelancers to larger enterprises, ensuring that you can always present a polished and professional appearance.

By using these carefully designed files, you can quickly create clear and concise records that cover all the necessary details, including payment terms, services rendered, and due dates. Many platforms also offer user-friendly options for customization, so you can personalize them to reflect your branding and business requirements.

Why Use Billing Documents for Your Business

Having a structured document for financial transactions is essential for businesses of all sizes. Using pre-designed forms can simplify the process of recording payments, ensuring you maintain clarity and professionalism. These tools help you stay organized, reduce errors, and ensure that all necessary details are included in every transaction.

One of the biggest advantages of using pre-made forms is the time saved in creating consistent, accurate records. Instead of starting from scratch each time, you can use a ready-to-fill-in layout that captures all the relevant details, allowing you to focus on other aspects of your business. This level of organization is not only practical but also demonstrates a high level of professionalism to your clients.

Here are some key reasons why these tools are crucial for your business:

| Reason | Benefit |

|---|---|

| Consistency | Uniform documents across all transactions help create a professional image and prevent confusion. |

| Efficiency | Reduces the time spent creating financial records, allowing you to focus on other important tasks. |

| Customization | Tailor the document to suit your specific needs, including adding your company logo or adjusting payment terms. |

| Accuracy | Pre-structured forms ensure that all necessary details are included, reducing the risk of mistakes or omissions. |

| Tracking | Easy to organize and track payments, improving your financial record-keeping. |

Top Features of an Effective Billing Document

For any business, having a clear and professional document to outline payment details is crucial. An effective document not only ensures that clients understand what they are being charged for but also serves as an essential tool for record-keeping and tracking financial transactions. To maximize its usefulness, this document must include certain key elements that help facilitate smooth transactions and reduce the likelihood of errors or confusion.

Clear and Detailed Information

One of the most important aspects of an effective financial document is clarity. Every transaction detail should be easily understandable. This includes clear item descriptions, quantities, unit prices, and the total amount due. Including all necessary information such as your company’s contact details, payment terms, and due dates helps eliminate any ambiguity, ensuring both parties are on the same page.

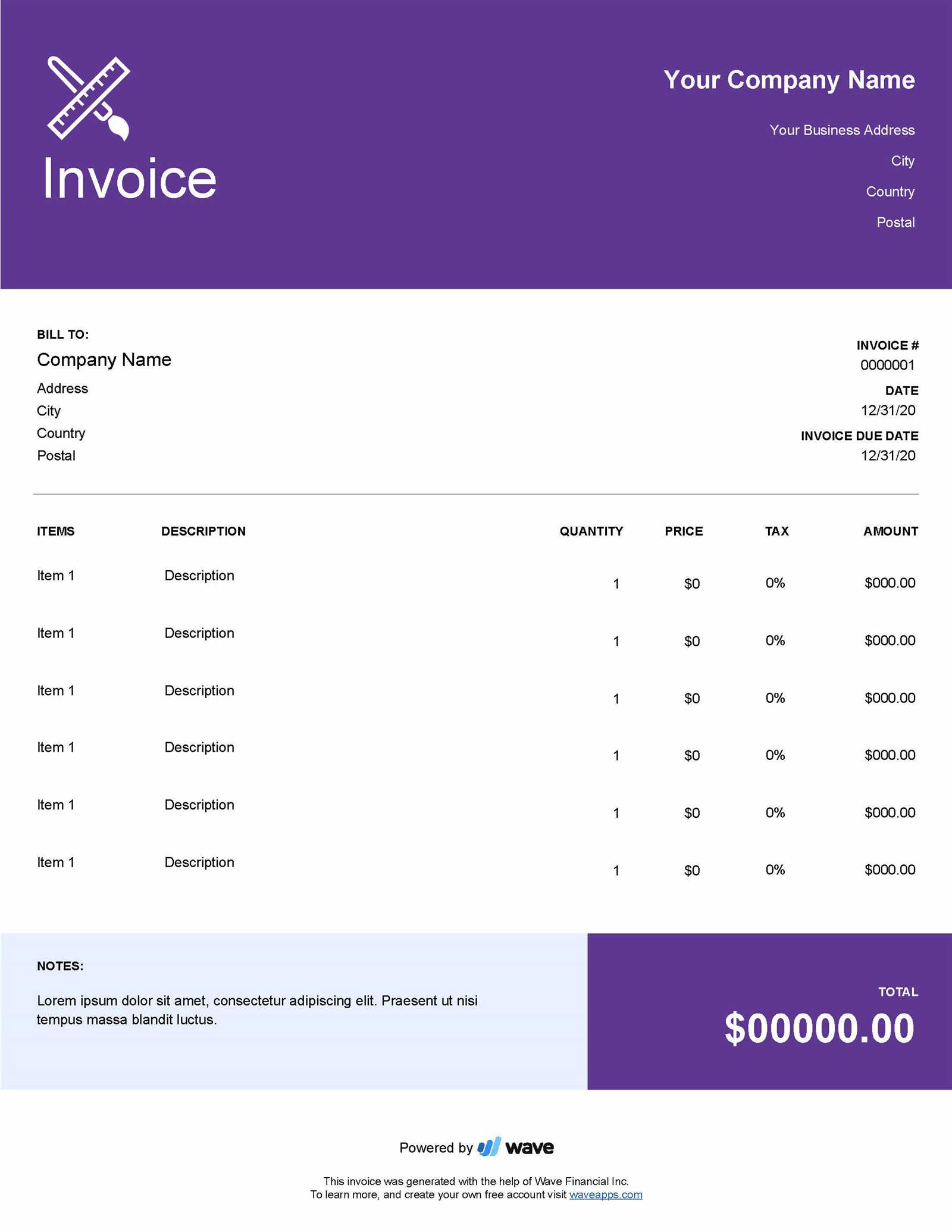

Professional Design and Structure

A well-organized layout is essential for readability. A structured design that guides the reader through the document makes it easier to locate important details such as the total balance due or payment instructions. Having sections like the client’s information, service or product breakdown, and payment methods in distinct blocks allows the document to remain visually appealing and easy to navigate.

How to Customize Your Billing Document

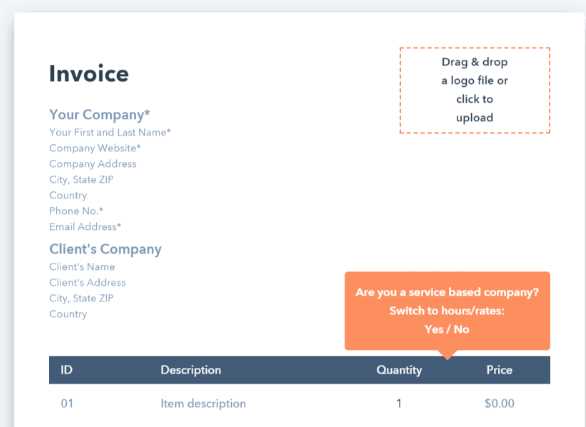

Customizing your financial record to suit your business needs is a straightforward process that can significantly enhance its effectiveness. Tailoring the structure and details allows you to maintain brand consistency and ensure that all relevant information is included. Whether you’re adjusting the layout, changing the font, or adding specific payment instructions, personalizing the document makes it uniquely yours while improving communication with clients.

Here are some key areas to focus on when personalizing your billing document:

| Customization Area | Why It Matters |

|---|---|

| Company Logo | Adding your logo reinforces brand identity and creates a professional appearance. |

| Contact Information | Including your business address, phone number, and email ensures clients can easily reach you. |

| Payment Terms | Clearly stating payment deadlines and any late fees avoids misunderstandings and delays. |

| Itemized List | Providing a detailed breakdown of goods or services helps clients understand exactly what they’re being charged for. |

| Custom Fields | Incorporating additional fields for discounts, taxes, or shipping charges allows you to capture all the specifics of each transaction. |

Free vs Paid Billing Documents: What’s Better?

When it comes to selecting a document for managing business transactions, one of the biggest decisions is whether to choose a no-cost option or invest in a premium one. Both choices have their advantages and drawbacks, and the best option depends on the specific needs of your business. While free options may seem attractive, paid solutions often offer enhanced features and greater customization.

Advantages of No-Cost Options

Free resources can be a great starting point, especially for small businesses or individuals just getting started. They offer a simple way to create professional-looking records without any upfront investment. Here are some of the key benefits:

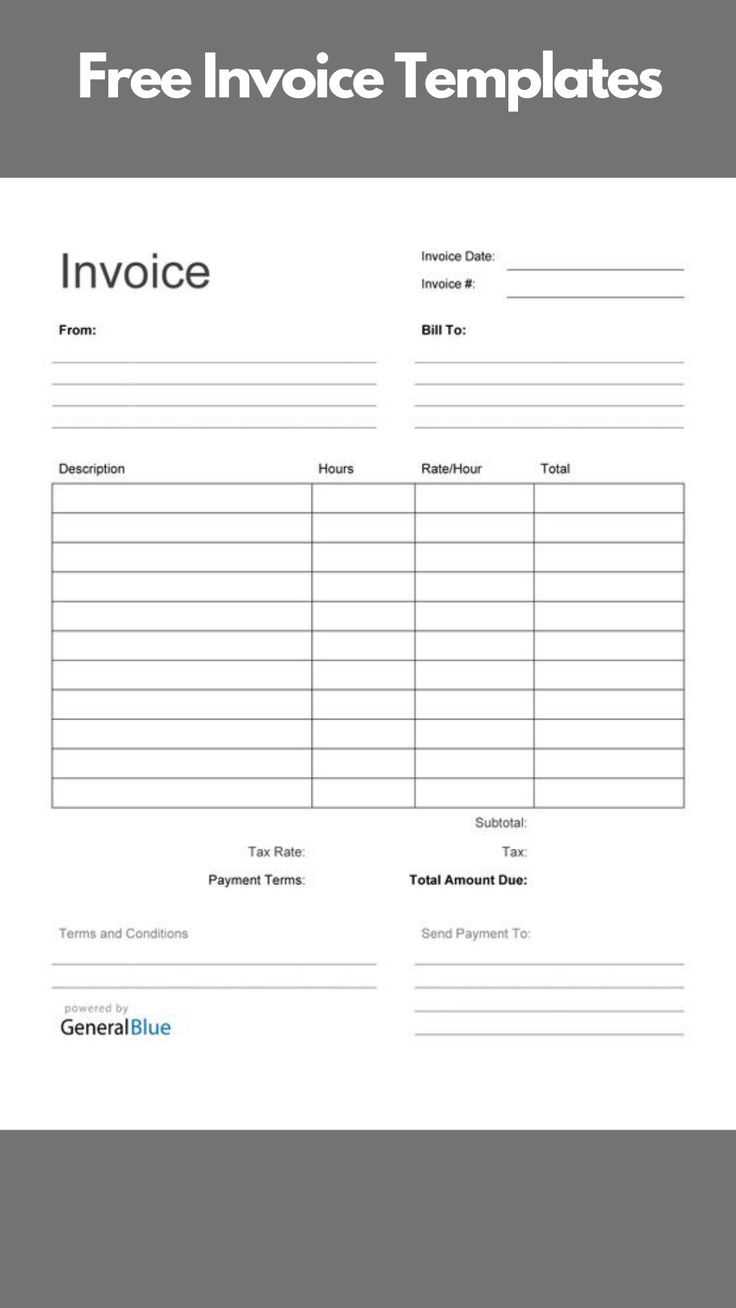

- Low or No Cost: As expected, these options do not require any monetary commitment, making them ideal for those on a tight budget.

- Quick Setup: Most free documents are easy to use and can be customized within minutes, saving time for those who need to get started quickly.

- Basic Features: While they may lack advanced options, these tools still provide the essential features necessary to manage most transactions effectively.

Benefits of Paid Options

On the other hand, premium tools usually come with a range of enhanced capabilities that can better support growing businesses or more complex needs. Here are the reasons why investing in a paid option might be worth considering:

- More Customization: Paid options often offer a wider range of design templates and fields, allowing for a more personalized appearance.

- Advanced Features: Features such as automated calculations, recurring billing, or integration with accounting software are commonly available in premium versions.

- Customer Support: Many paid tools offer dedicated support to help resolve issues quickly, which can be valuable for businesses that rely heavily on these documents for day-to-day operations.

Ultimately, the choice between free and paid options depends on the specific requirements of your business and how much you are willing to invest in the tools that help you manage transactions efficiently.

Top Sources for No-Cost Billing Documents

When looking for a reliable resource to create professional billing records, many online platforms offer high-quality, customizable options at no cost. These sources can save you time and help ensure that your documents maintain a polished and consistent look. Whether you’re just starting out or looking to streamline your current workflow, there are plenty of options available to suit various business needs.

Here are some of the best platforms where you can find useful tools for generating financial records:

| Source | Description |

|---|---|

| Google Docs | Offers a range of simple, editable documents that can be customized to fit your needs. It’s a convenient option for anyone with a Google account. |

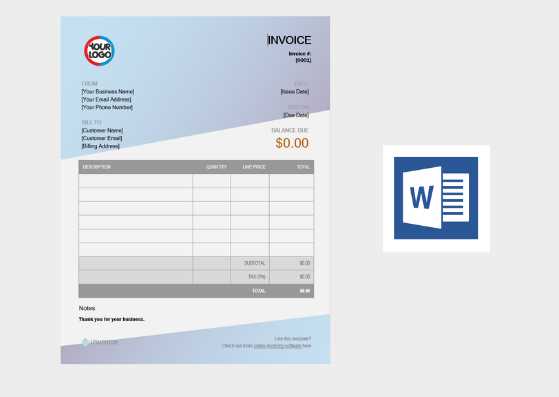

| Microsoft Office Templates | A well-established platform providing various pre-designed forms, which can be easily edited in Word or Excel. |

| Canva | A user-friendly design tool that provides visually appealing templates with drag-and-drop functionality, perfect for businesses that want to maintain a unique style. |

| Zoho | Offers customizable business document templates, with additional options for invoicing and finance management. |

| Invoice Generator | A straightforward online tool for quickly creating basic documents with minimal effort, ideal for freelancers and small businesses. |

These platforms offer diverse options for creating professional, well-structured documents without the need for expensive software. By exploring these sources, you can find the perfect solution that meets your specific business needs.

How to Access and Use Billing Documents Easily

Getting started with pre-designed business documents is a simple and efficient way to streamline your financial record-keeping process. The steps to access these resources are straightforward, and with just a few clicks, you can have a fully customizable document ready for use. This section will guide you through the basic process of accessing, editing, and utilizing these tools to meet your business needs.

Step 1: Accessing the Right Resource

Many online platforms offer a wide variety of customizable options that can be accessed directly from their websites. The key to choosing the right one is finding a source that offers the features you need, whether you require basic designs or more advanced functionality. Here’s how to go about it:

- Search for Reliable Platforms: Choose a reputable website that offers editable files or online creation tools.

- Browse Available Designs: Take a look through available categories, selecting the one that best fits your business style and requirements.

- Sign Up or Log In: Some sites may require you to create an account to access additional features, but many offer a quick registration process.

Step 2: Editing and Customizing the Document

Once you’ve found the right document, editing it to suit your needs is easy. Many online tools allow you to modify text, logos, and colors to match your branding. Here are the key steps:

- Edit Text Fields: Replace placeholder information with your business details, including your name, address, and payment terms.

- Add Your Branding: Upload your logo and choose the color scheme that aligns with your company’s identity.

- Review and Save: Double-check all details, making sure that the document is error-free before saving it in the format you need.

Step 3: Using the Document for Transactions

After creating your customized document, it’s time to use it

Choosing the Right Billing Document for Your Industry

Selecting the right format for financial records is essential to meet the specific needs of your business. Different industries often require tailored documents that highlight certain details or include specific terms. By choosing a document that aligns with your sector, you ensure that all necessary information is clearly presented, which can improve communication with clients and simplify the payment process.

Here are some factors to consider when choosing a document for your business, based on the industry you operate in:

1. Service-Based Businesses

If you offer services rather than physical products, your document should reflect that. These records should clearly outline the type of service, hours worked, and hourly rates or fixed fees. Consider these key features:

- Service Description: Include a clear and concise description of the services provided to avoid any confusion.

- Hourly Rates: If applicable, make sure to include hourly rates or charges for specific tasks.

- Payment Terms: State your payment schedule, such as deposits or installments, if applicable.

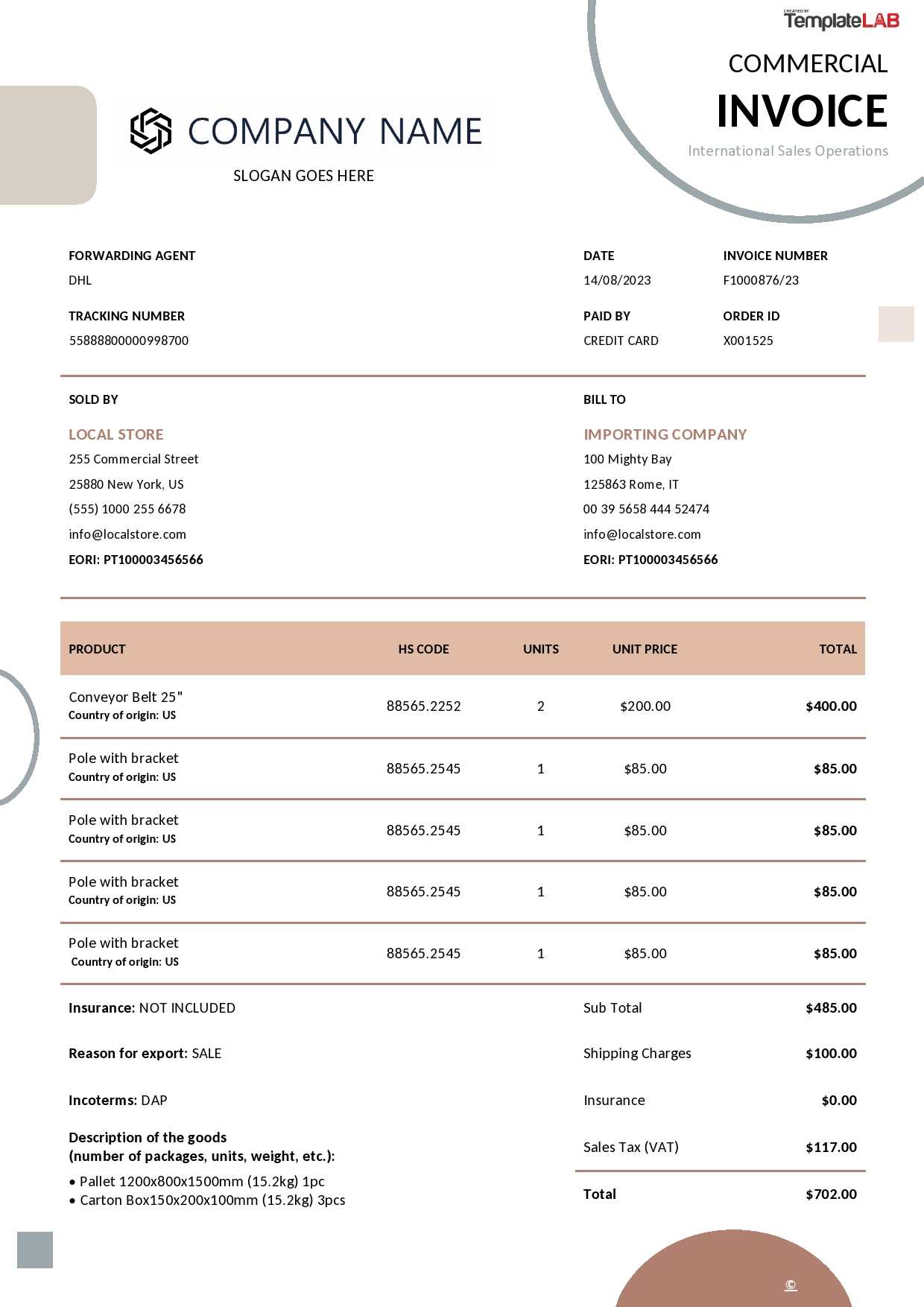

2. Product-Based Businesses

If you sell physical products, your financial document will need to focus on items, quantities, and unit prices. These features are essential for businesses in retail, wholesale, or manufacturing:

- Itemized List: Break down the products sold, including quantities, unit prices, and total costs.

- Taxes and Shipping: Clearly outline any applicable taxes, shipping fees, or additional charges.

- Order Numbers: Including order numbers or SKU codes can help both you and the client track products more easily.

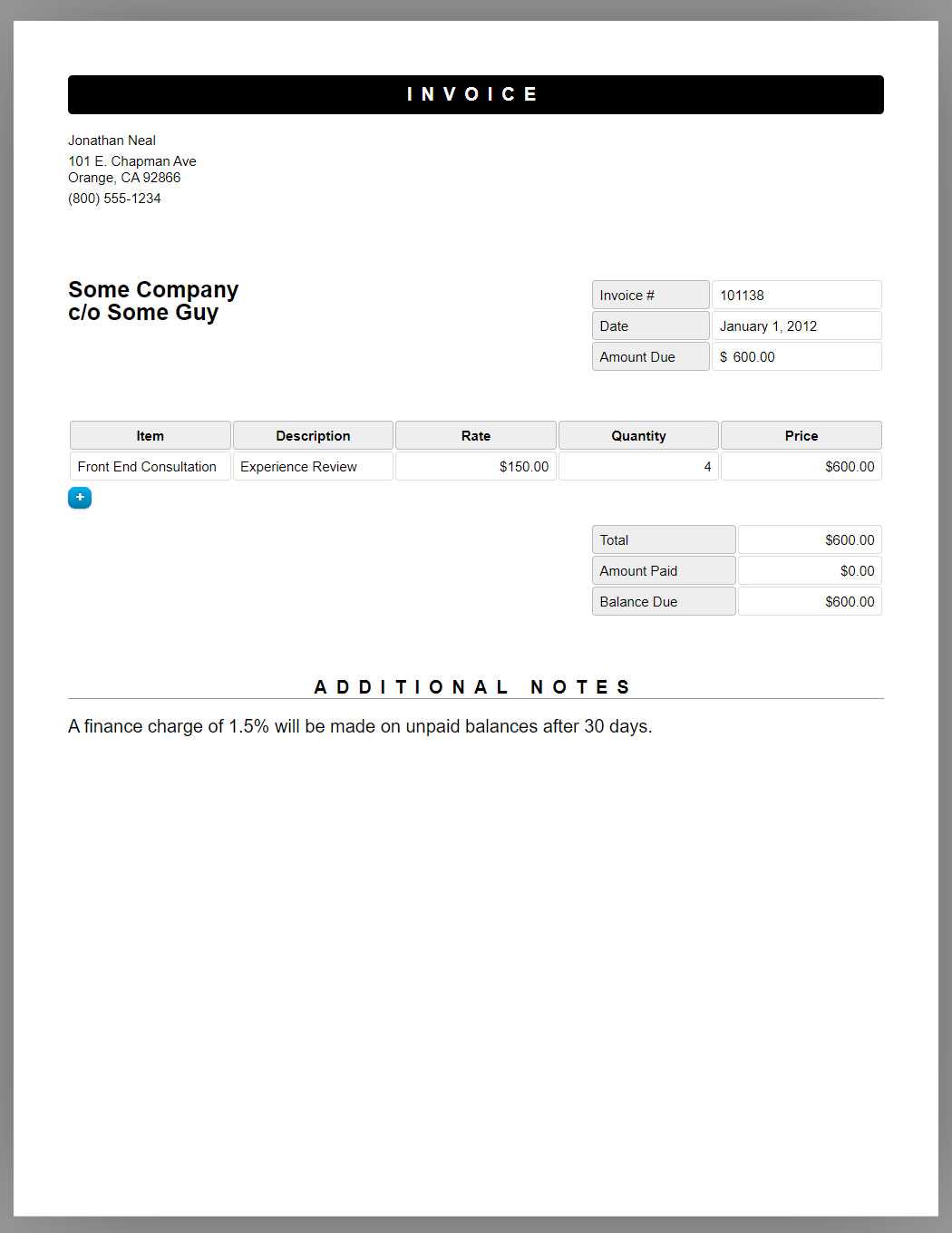

3. Freelancers and Consultants

For independent workers like freelancers or consultants, the document should reflect a professional tone while including all essential details about the work completed. Here’s what to look for:

- Project Breakdown: List the tasks or milestones that w

How to Create Professional Billing Records Quickly

For any business, creating accurate and professional payment requests is essential for maintaining smooth cash flow. Whether you’re handling multiple clients or working on a single project, generating these documents efficiently can save time and reduce errors. Fortunately, with the right tools and a streamlined process, you can create polished records in just a few steps.

Step 1: Choose the Right Format

The first step in creating a professional document is selecting the format that fits your business needs. Depending on your industry, the level of detail you require may vary. To make the process faster, choose a structure that already includes most of the necessary fields. Here are some important elements to look for:

- Basic Information: Ensure your business name, contact information, and logo are included, along with the client’s details.

- Clear Breakdown: Select a format that allows you to list all services or products clearly, along with their prices.

- Payment Terms: Make sure the document includes space for the due date, payment methods, and any late fees or discounts.

Step 2: Customize the Content

Once you’ve chosen the right format, it’s time to fill in the relevant details. The customization process doesn’t have to be complicated. Here’s how you can do it efficiently:

- Fill in Client Information: Include the client’s name, company, and contact details to ensure they know exactly who the payment request is from.

- Specify Services or Products: Clearly list the items or services provided, with q

Top Billing Documents for Small Businesses

For small businesses, having the right document to request payments is crucial for maintaining professional relationships with clients and ensuring timely transactions. Choosing the right structure can save time, reduce errors, and present a polished image to customers. Whether you’re offering products, services, or both, having a document that suits your business model is essential for managing cash flow effectively.

Here are some of the most popular document formats for small businesses, designed to meet the unique needs of various industries:

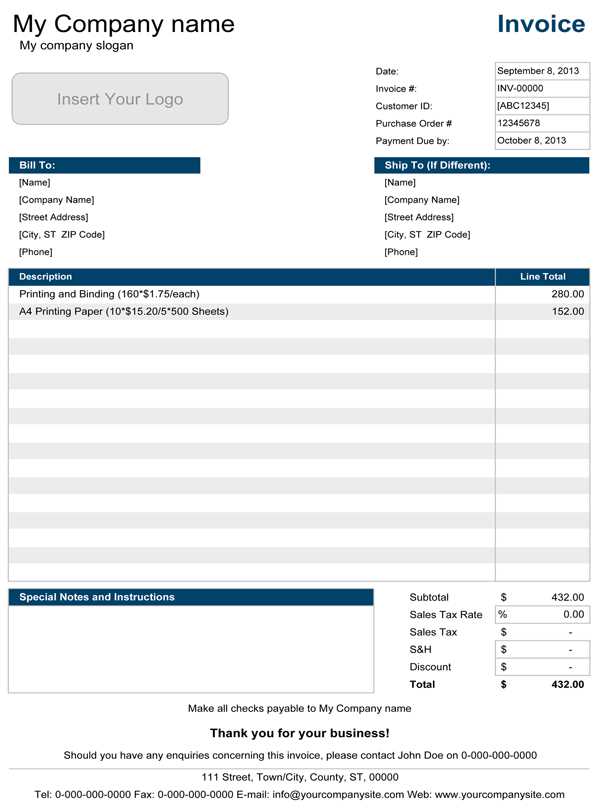

1. Simple and Clean Layouts

For businesses that need to keep things straightforward, a minimalistic structure can be highly effective. These layouts typically focus on the most important details, such as:

- Company and Client Information: Clearly lists both parties’ contact details.

- Service/Product Breakdown: A concise list of the items or services provided.

- Total Due Amount: Easily readable total with space for tax and discounts.

This type of document is particularly well-suited for freelancers, consultants, or small service providers who want to keep things simple yet professional.

2. Itemized Layouts for Product-Based Businesses

For small retail or product-based businesses, an itemized format works best. This layout includes detailed sections for each product, its quantity, price per unit, and any applicable taxes or shipping fees. Key features include:

- Detailed Item List: Each product is broken down with clear descriptions and quantities.

- Discounts and Taxes: Easily incorporate discounts or taxes into the final total.

- Custom Fields: Fields for order numbers, SKUs, or serial numbers to help track inventory.

This structure helps avoid confusion by showing clients the specifics of their purchase while maintaining clarity and professionalism.

3. Service-Oriented Layouts for Consultants and Agencies

Service-based businesses, such as consultants, marketing agencies, or contractors, often benefit from layouts that allow for more detailed descriptions of the work performed. These documents usually include sections like:

- Service Description: A clear outline of the services provided and the time spent on each task.

- Hourly Rates or Project Fees: Detailed pricing structures that reflect the nature of the work.

- Payment Schedule: Flexible payment options or installment

Top Billing Document Formats to Consider

When it comes to managing payments, selecting the right format for your financial records is essential to ensure clarity and professionalism. There are several options available, each suited to different business models and client expectations. Choosing the right one can help streamline your process, improve accuracy, and create a polished image for your company.

Below are some of the most common document formats to consider, each designed to meet specific business needs:

Format Description Best For Simple List A clean, minimal design that provides basic information such as services provided, client details, and total amounts due. Freelancers, small businesses, and consultants who need a quick and easy document. Itemized Breakdown Features detailed information about each item or service, including quantity, unit price, and total cost. Retailers, wholesalers, and product-based businesses that require a breakdown of each transaction. Hourly Rate Designed for service providers, this format includes sections to track hours worked, rates, and totals. Consultants, contractors, and anyone who bills clients based on hourly work. Project-Based Includes space for project details, milestones, and payment schedules, ideal for long-term or complex projects. Agencies, designers, Benefits of Using Digital Billing Documents

In today’s fast-paced business world, managing financial transactions digitally has become a standard practice. Digital records not only simplify the billing process but also offer significant advantages over traditional methods. By utilizing electronic formats, businesses can enhance efficiency, reduce errors, and streamline their workflow, ultimately leading to smoother operations and faster payments.

1. Increased Efficiency and Time Savings

One of the main advantages of using electronic billing documents is the time saved in both creating and processing them. With pre-designed structures, you can quickly generate and send records, eliminating the need for manual data entry. Here’s how this benefits businesses:

- Quick Customization: Easily add or modify client details, services, or amounts without starting from scratch each time.

- Automatic Calculations: Most digital systems include built-in formulas to calculate totals, taxes, and discounts, reducing the risk of manual errors.

- Instant Sharing: Once completed, electronic documents can be shared instantly via email, helping you get paid faster.

2. Better Organization and Record Keeping

Digital billing documents are easy to store, organize, and retrieve. Unlike paper records that can get lost or damaged, electronic files are secure and can be sorted in various ways. Some key organizational benefits include:

- Searchability: With digital formats, it’s easy to search for specific records based on dates, client names, or amounts.

- Cloud Storage: Many systems offer cloud storage options, allowing you to access your files from anywhere and ensuring data backup.

- Reduced Physical Clutter: By moving your records online, you can reduce paper clutter and maintain a cleaner, more organized workspace.

Using electronic billing formats not only saves you time but also ensures that your business is more organized, secure,

How Billing Documents Save You Time and Money

Using pre-designed billing documents can significantly streamline your financial processes, offering numerous advantages for businesses of all sizes. By utilizing a ready-made structure, you can avoid the time-consuming task of creating documents from scratch, while also reducing errors and ensuring consistency across all transactions. These benefits not only improve efficiency but also help save money by reducing administrative costs and improving cash flow management.

Here’s how pre-made financial records can save both time and money:

Benefit How It Saves Time and Money Time Efficiency Pre-designed documents allow you to quickly fill in client information, services rendered, and payment details, eliminating the need to start from scratch each time. Accuracy and Consistency Using a standardized format reduces the likelihood of errors, ensuring that all necessary fields are included and calculations are correct, leading to fewer mistakes and rework. Faster Payments Instantly sending digital records helps expedite the payment process, as clients can quickly review and make payments without waiting for physical documents. Reduced Administrative Costs By automating much of the work, you save on administrative overheads, such as printing, postage, and manual data entry, which can add up over time. How to Edit Your Billing Documents on Different Platforms

Modifying your financial records is a straightforward process, but the steps can vary depending on the platform or software you’re using. Whether you’re working with a word processor, a spreadsheet tool, or specialized accounting software, each option offers unique features to make editing faster and more efficient. Understanding how to make changes on different platforms can help you save time and ensure consistency across all your transactions.

Here’s how to edit your records on some of the most commonly used platforms:

1. Word Processors (e.g., Microsoft Word, Google Docs)

Editing a billing document in a word processor is simple and ideal for those who need a flexible, customizable layout. Follow these steps:

- Open the Document: Start by opening the file you wish to edit.

- Edit Text Fields: Replace or update client details, services, or amounts by clicking and typing in the designated areas.

- Adjust Formatting: Use built-in tools to change fonts, adjust alignment, or add logos for a personalized touch.

- Save and Export: Once the changes are made, save the file and export it as a PDF to send electronically.

2. Spreadsheet Software (e.g., Microsoft Excel, Google Sheets)

For those who prefer a more structured and data-driven approach, spreadsheet software offers easy editing options, especially for businesses with multiple items or services. Here’s how to edit:

- Open the Spreadsheet: Access the pre-made record in your chosen spreadsheet application.

- Edit Data: Modify columns for services/products, quantities, prices, and totals. Use formulas for automatic calculations to avoid errors.

- Update Layout: Adjust rows and columns for better visibility, and add custom fields if necessary.

- Save and Share: After editing, save the document and share it with clients via email, or convert it to a PDF for a more formal presentation.

3. Accounting Software (e.g., QuickBooks, FreshBooks)

Specialized accounting software offers the most advanced editing features, designed to streamline billing and financial tracking. To make changes:

- Log Into Your Account: Open the software and access the client records or billing section.

- Select the Document: Choose the document you wish to modify from your list of transactions or templates.

- Edit Fields: Update client information, services, pricing, or payment terms. The software typically auto-calculates totals and taxes for you.

- Save and Send: Save the updated record and send it directly to the client via email from within the software, or export it to a PDF.

4. Online Platforms (e.g., Invoice Ninja, Zoho Invoice)

Online platforms are ideal for businesses that need quick access to their records from anywhere. Editing on these platforms is intuitive and user-friendly:

- Log In to Your Account: Access your account from any device with internet access.

- Edit the Record: Make changes directly on the platform’s interface, from updating payment terms to adjusting itemized charges.

- Customization Options: Customize the look and feel of your document by choosing templates, logos, and colors that align with your brand.

- Send Directly: After making edits, you can instantly email the document to your client from the platform or download it as a PDF.

Each platform offers different tools for editing, but the process remains relatively simple and intuitive, regardless of the method you choose. By knowing the right steps for your preferred software, you can quickly update your financial records and maintain a smooth workflow for your business.

Common Mistakes to Avoid When Using Billing Documents

While ready-made billing documents can be a huge time-saver, there are certain pitfalls that businesses should be mindful of when using them. Even though these pre-designed records provide a great starting point, failing to customize or double-check details can lead to mistakes that may affect professionalism, client trust, and payment timelines. Here are some common errors to avoid when working with standardized billing formats.

1. Ignoring Customization

One of the most significant mistakes businesses make is not customizing the document to fit their unique needs. Using a generic format without adjusting the essential fields can lead to confusion and reduce the clarity of your record. Always ensure the following:

- Client Details: Ensure your client’s name, address, and contact information are accurate.

- Company Information: Add your company’s branding, logo, and contact information to maintain a professional image.

- Payment Terms: Clearly specify the payment due date and any other relevant terms, such as late fees or discounts.

2. Failing to Review for Errors

Another common mistake is overlooking errors in the document before sending it out. Even though many digital tools include automatic calculations, human error still happens. Before sharing any document with a client, always double-check:

- Amount Calculations: Ensure that the totals, taxes, and discounts are correct.

- Formatting: Check for any formatting issues or inconsistencies that may look unprofessional, such as misaligned text or missing fields.

- Spelling and Grammar: Ensure there are no spelling or grammatical mistakes, as these can affect the overall perception of your business.

3. Using Outdated Information

Keeping your documents up to date is crucial for smooth business operations. Using outdated versions of billing records can lead

How to Organize and Track Your Billing Records

Efficiently managing your financial documents is essential for maintaining smooth business operations and ensuring timely payments. Organizing and tracking your records not only helps you stay on top of outstanding balances but also provides clarity on your cash flow and helps with tax preparation. By establishing a systematic approach, you can streamline the entire billing process, reduce administrative errors, and avoid missed payments.

1. Create a Consistent Filing System

Establishing a well-organized filing system for all your financial documents is key to keeping track of payments and outstanding balances. Whether you choose a digital or physical system, consistency is vital. Consider the following steps:

- Use Folders: Create dedicated folders for each client or project, both digitally and physically. Keep all related records, including payment history and communication, in one place.

- Organize by Date: Arrange all records chronologically, with the most recent documents at the top for easy access. This allows you to quickly find outstanding invoices and track payment progress.

- Label Files Clearly: Ensure each document has a clear and consistent naming convention. Include details like the client’s name, invoice number, and date to avoid confusion when searching for specific records.

2. Track Payment Status

Properly tracking the payment status of each document is essential for maintaining accurate financial record

How to Organize and Track Your Billing Records

Efficiently managing your financial documents is essential for maintaining smooth business operations and ensuring timely payments. Organizing and tracking your records not only helps you stay on top of outstanding balances but also provides clarity on your cash flow and helps with tax preparation. By establishing a systematic approach, you can streamline the entire billing process, reduce administrative errors, and avoid missed payments.

1. Create a Consistent Filing System

Establishing a well-organized filing system for all your financial documents is key to keeping track of payments and outstanding balances. Whether you choose a digital or physical system, consistency is vital. Consider the following steps:

- Use Folders: Create dedicated folders for each client or project, both digitally and physically. Keep all related records, including payment history and communication, in one place.

- Organize by Date: Arrange all records chronologically, with the most recent documents at the top for easy access. This allows you to quickly find outstanding invoices and track payment progress.

- Label Files Clearly: Ensure each document has a clear and consistent naming convention. Include details like the client’s name, invoice number, and date to avoid confusion when searching for specific records.

2. Track Payment Status

Properly tracking the payment status of each document is essential for maintaining accurate financial records. It helps you know when to follow up on overdue payments and ensures you don’t miss any incoming funds. Here’s how you can do it:

- Use a Spreadsheet: Maintain a digital tracking sheet that includes details such as invoice number, amount, due date, and payment status. Update it regularly to reflect payments received and outstanding balances.

- Mark Payment Status: Clearly mark each document with its payment status, such as “Paid,” “Pending,” or “Overdue.” Use color codes or labels to make it easy to identify the current status of each document.

- Set Payment Reminders: Set up automatic reminders for upcoming due dates or overdue balances. This can be done through digital tools or calendar apps, ensuring that you follow up promptly.

3. Use Accounting Software or Apps

If you prefer a more automated approach, using accounting software can simplify the organization and tracking of your financial documents. These tools offer various features to streamline the process, such as:

- Automated Invoicing: Accounting software can generate invoices automatically, ensuring that your records are up-to-date and reducing manual work.

- Tracking and Reporting: Most software platforms offer real-time tracking and financial reports, allowing you to monitor your cash flow and identify patterns in payment behavior.

- Client Profiles: Store client contact information and payment history within the software, making it easy to access relevant details whenever needed.

4. Backup and Secure Your Records

Regardless of how you choose to organize and track your documents, it’s essential to back them up regularly and ensure their security. Consider the following steps to protect your financial records:

- Cloud Storage: Use cloud-based services for storing digital documents to ensure they are safe and accessible from anywhere.

- Physical Copies: If you keep physical copies, store them in a safe location, such as a locked filing cabinet or secure storage unit.

- Backup Files: Regularly back up your digital files to an external hard drive or another cloud-based platform to prevent data loss in case of unexpected issues.

By establishing a solid system for organizing and tracking your financial records, you can save time, avoid errors, and maintain a clear overview of your business’s financial health. Whether using digital tools or a manual system, the key is consistency and attention to detail.

Legal Considerations When Using Billing Documents

When creating and issuing billing records, it’s important to be aware of the legal requirements that ensure your documents are compliant with regulations. Depending on your location and business model, certain elements must be included to protect both your business and your clients. Understanding these legal considerations can help you avoid disputes, fines, or delays in payment.

1. Essential Information to Include

Every billing record should include key details to ensure it is legally binding and clear. These elements will vary depending on the jurisdiction, but generally, you should always include the following:

- Business Name and Contact Information: Ensure that your company name, business address, phone number, and email are clearly visible.

- Client’s Information: Include the name and contact details of the recipient to ensure that there is no confusion regarding who the payment is due from.

- Unique Document Number: Each record should have a unique number for identification and tracking purposes.

- Detailed Description of Goods or Services: Be specific about the products or services provided, including quantities, pricing, and any relevant terms.

- Payment Terms: Specify the agreed-upon payment terms, such as the due date and any penalties for late payments.

2. Taxation and Legal Compliance

In many regions, businesses are required to include specific tax details on their billing documents. Failing to include the correct tax information can result in penalties. Depending on your location, ensure the following:

- Tax Identification Number (TIN): This is often required for businesses to issue legally recognized documents.

- Applicable Tax Rates: Clearly display the correct tax rate applied to goods or services, and break down the total tax charged.

- Tax Exemption Information: If your business or the transaction is exempt from tax, you may need to indicate this clearly to avoid confusion.

3. Payment Deadlines and Penalties

Setting clear payment deadlines and consequences for late payments is not just good practice; it’s often required by law. Be sure to:

- Specify Payment Due Dates: Indicate the exact date by which payment must be received to avoid confusion.

- Outline Late Fees or Interest: If applicable, specify the fees or interest t