Free Consultant Invoice Template for Easy and Professional Billing

When managing client relationships and payments, having a well-organized system for issuing bills is essential. A clear, structured approach ensures both you and your clients understand the terms, helping to avoid confusion and delays. A well-designed payment form is a tool that can streamline your entire billing process, ensuring efficiency and professionalism.

Rather than starting from scratch each time, using a pre-designed format can save valuable time and effort. These ready-to-use structures allow you to focus on the work itself rather than the tedious task of creating a document from the ground up. Whether you’re a freelancer or run a small business, this simple resource offers flexibility and ease in generating accurate statements for your clients.

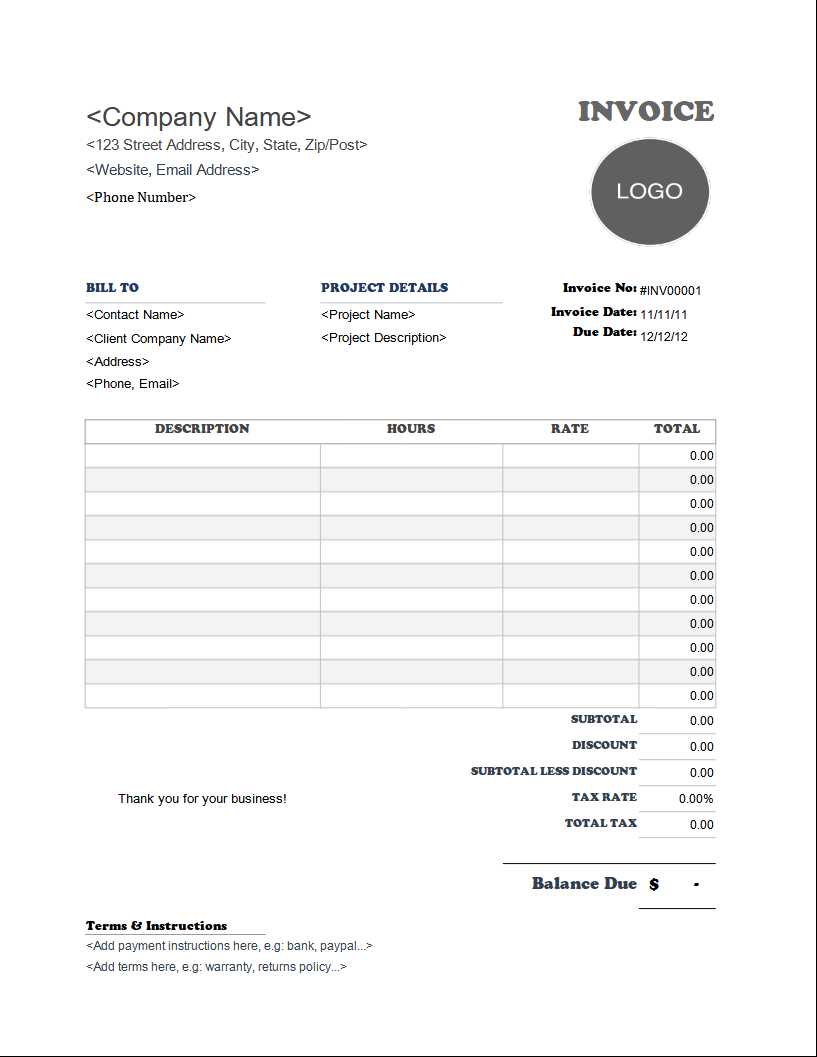

Customizable features in such documents give you the freedom to tailor them to your specific needs. From adjusting payment terms to including detailed service descriptions, these options enhance the clarity and transparency of the billing process. The right structure not only makes the job easier but also fosters trust and professionalism in your business dealings.

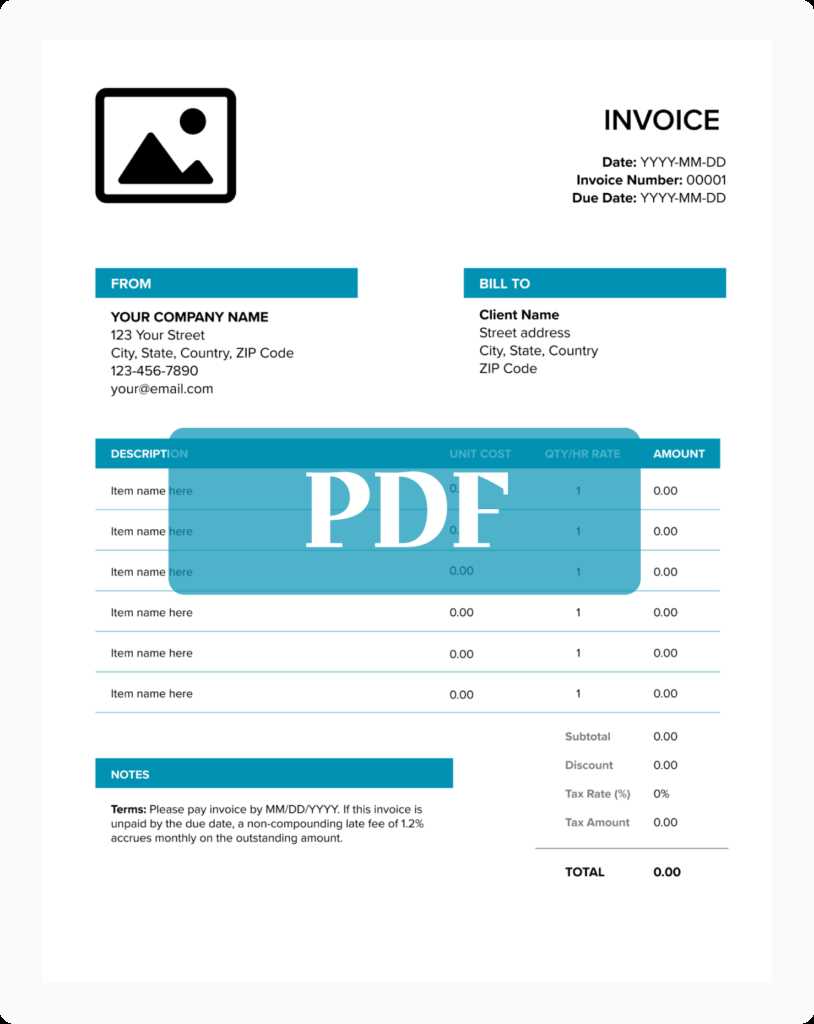

Free Consultant Invoice Template Overview

When running a service-based business, managing payment requests efficiently is key to maintaining a smooth workflow and strong client relationships. An organized, easy-to-understand payment document is essential for ensuring clients know exactly what they are being charged for and how much they owe. Having a standardized format makes this task much easier and reduces the risk of errors or misunderstandings.

Using a pre-designed structure for your billing needs not only saves time but also ensures consistency across all your transactions. Whether you are managing one-time projects or long-term engagements, this resource can be customized to fit various scenarios, providing clarity and professionalism in your communications with clients.

Key Features of a Standardized Billing Document

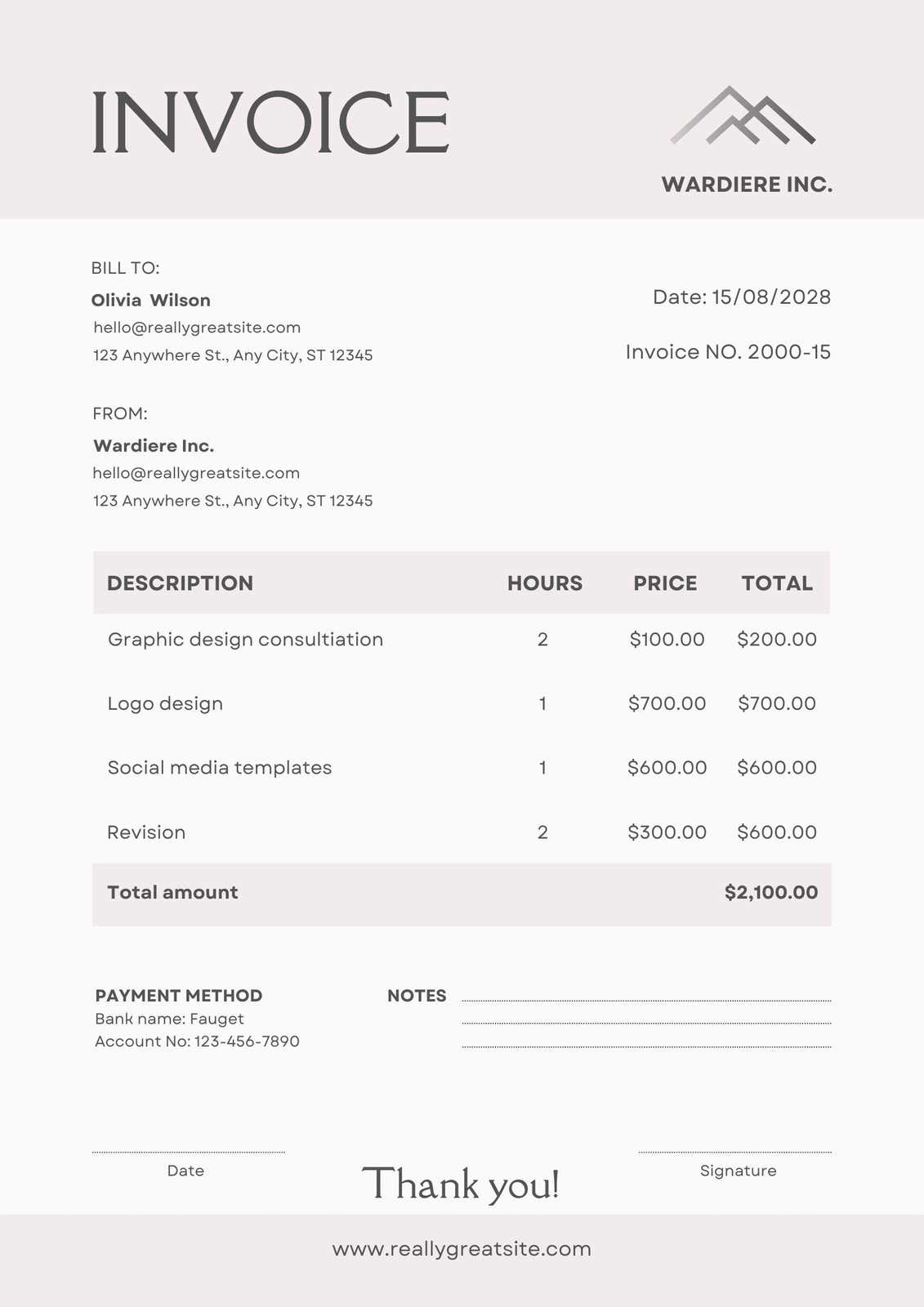

- Professional Design: Clean layout and easy-to-read font that enhances client trust.

- Customizable Fields: Personalize with your business details, client information, and project specifics.

- Clear Payment Terms: Set expectations regarding due dates, late fees, and other essential details.

- Itemized Charges: Breakdown of services or products provided, allowing clients to see exactly what they’re paying for.

- Space for Notes: Provide any extra information or instructions relevant to the billing process.

Why Choose a Pre-Formatted Billing Document?

- Efficiency: Quickly generate accurate statements without starting from scratch every time.

- Consistency: Maintain a professional appearance and ensure all necessary details are included in each document.

- Time-Saving: Reduce the effort spent on formatting and focus more on completing your projects.

- Clarity: Help clients understand exactly what they are being charged for and avoid confusion.

Why Use a Consultant Invoice Template

Managing billing processes efficiently is crucial for maintaining a smooth business operation. Without a structured approach to generating payment requests, time can be wasted on repetitive tasks, and the risk of errors increases. Using a pre-designed document format allows professionals to save time, ensure accuracy, and present a polished image to clients.

Adopting a standardized format for billing has several advantages, from simplifying the administrative side of your work to creating a sense of professionalism that builds trust with your clients. With a few customizable fields, you can quickly adapt the document to suit different projects, ensuring clarity and consistency across all your transactions.

Advantages of Using a Pre-Formatted Billing Document

- Efficiency: Quickly create accurate billing documents without the need for formatting each time.

- Consistency: Maintain a uniform approach, ensuring each bill contains the same essential details.

- Time-Saving: Reduce administrative time by eliminating the need for designing a new document for every project.

- Accuracy: Pre-designed fields ensure you never miss important details, such as payment terms or itemized charges.

Improved Professional Image

- Clarity: Clear and structured documents make it easy for clients to understand their charges.

- Trust-Building: A professional, polished format reflects well on your business and fosters confidence.

- Convenience: Clients can easily track payments and terms, which reduces the chance of payment delays.

Benefits of Free Invoice Templates

Utilizing pre-made billing documents offers numerous advantages for businesses of all sizes. These ready-to-use resources simplify the payment process, ensuring that important details are never overlooked. Instead of spending valuable time creating custom forms from scratch, you can focus on what matters most–delivering quality work to your clients.

By taking advantage of pre-designed structures, professionals can streamline their administrative tasks, improve their overall workflow, and ensure accuracy in every transaction. These tools offer a fast, efficient, and reliable way to manage financial aspects without additional costs or complexity.

Key Advantages of Using Pre-Formatted Billing Resources

- Cost-Effective: Save money by avoiding the need for expensive accounting software or design services.

- Time-Saving: Quickly generate accurate documents without having to manually design or format them each time.

- Ease of Use: Most formats are user-friendly and require minimal effort to fill in with specific project details.

- Flexibility: These documents can be easily customized to suit different types of projects, clients, and business needs.

Improved Accuracy and Professionalism

- Consistency: A standardized layout ensures that all necessary details are included and correctly formatted.

- Clarity: Clear, structured billing information reduces the likelihood of confusion and disputes over charges.

- Professional Appearance: A well-organized document reflects positively on your business and helps build client trust.

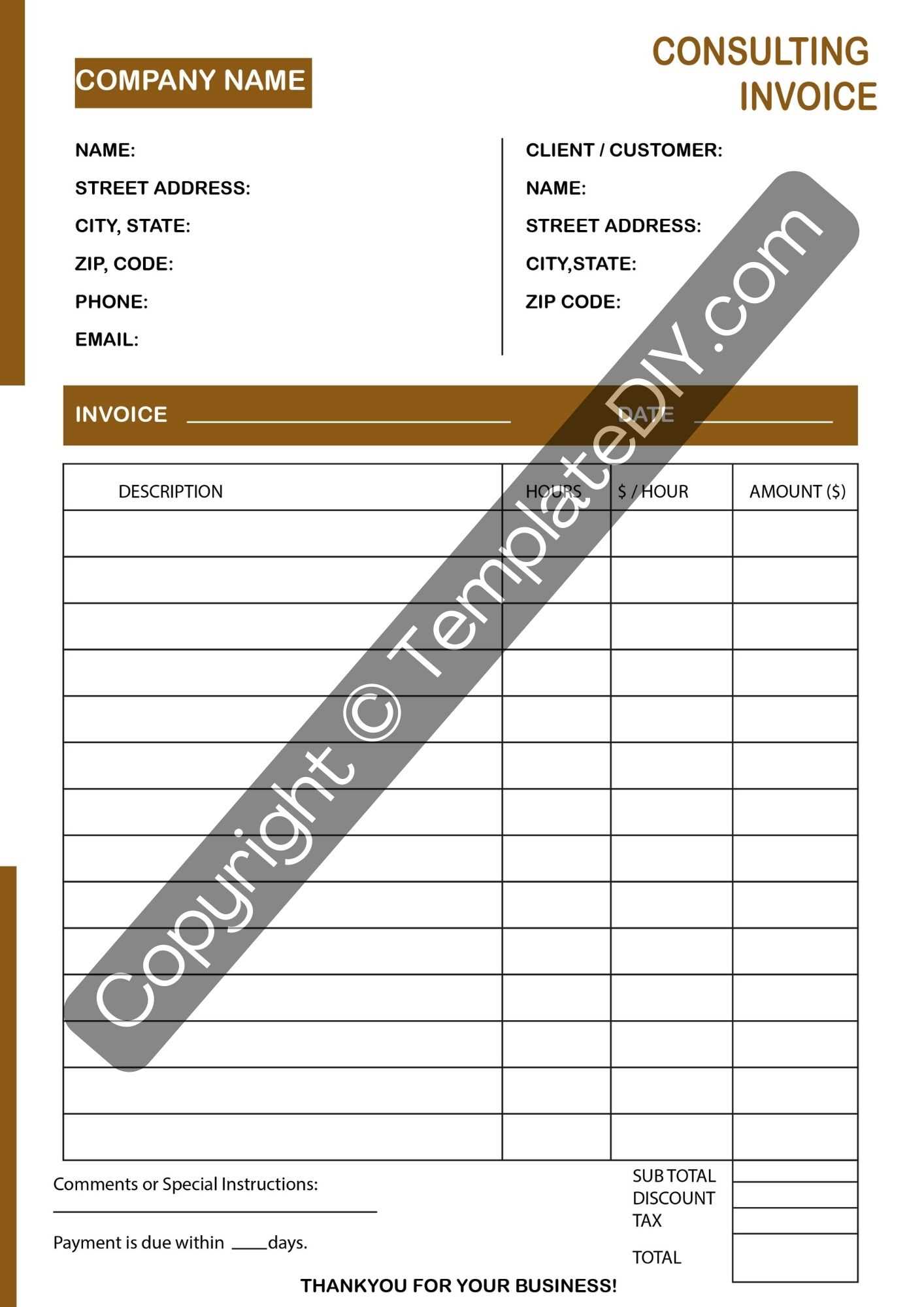

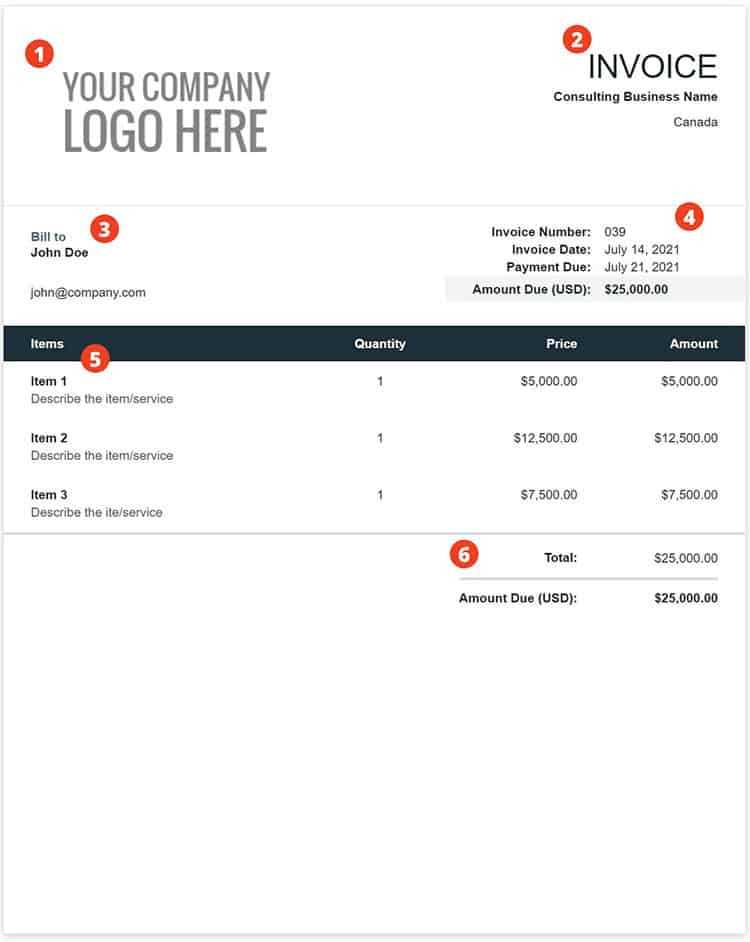

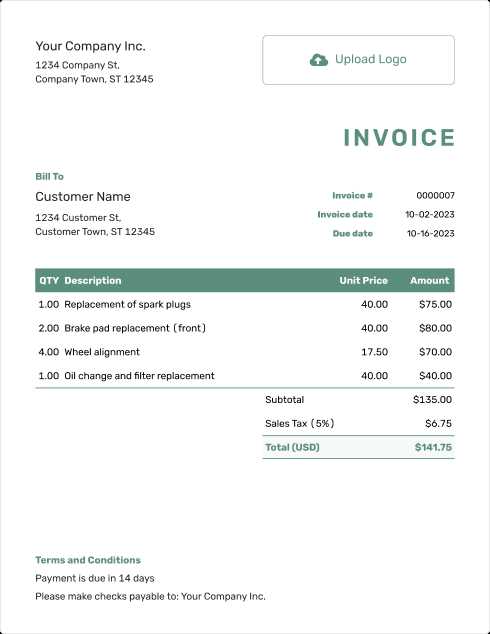

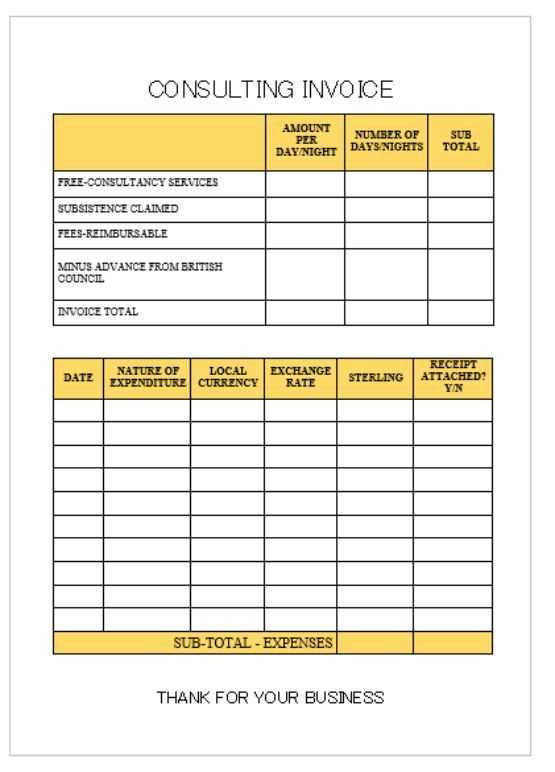

How to Customize Your Consultant Invoice

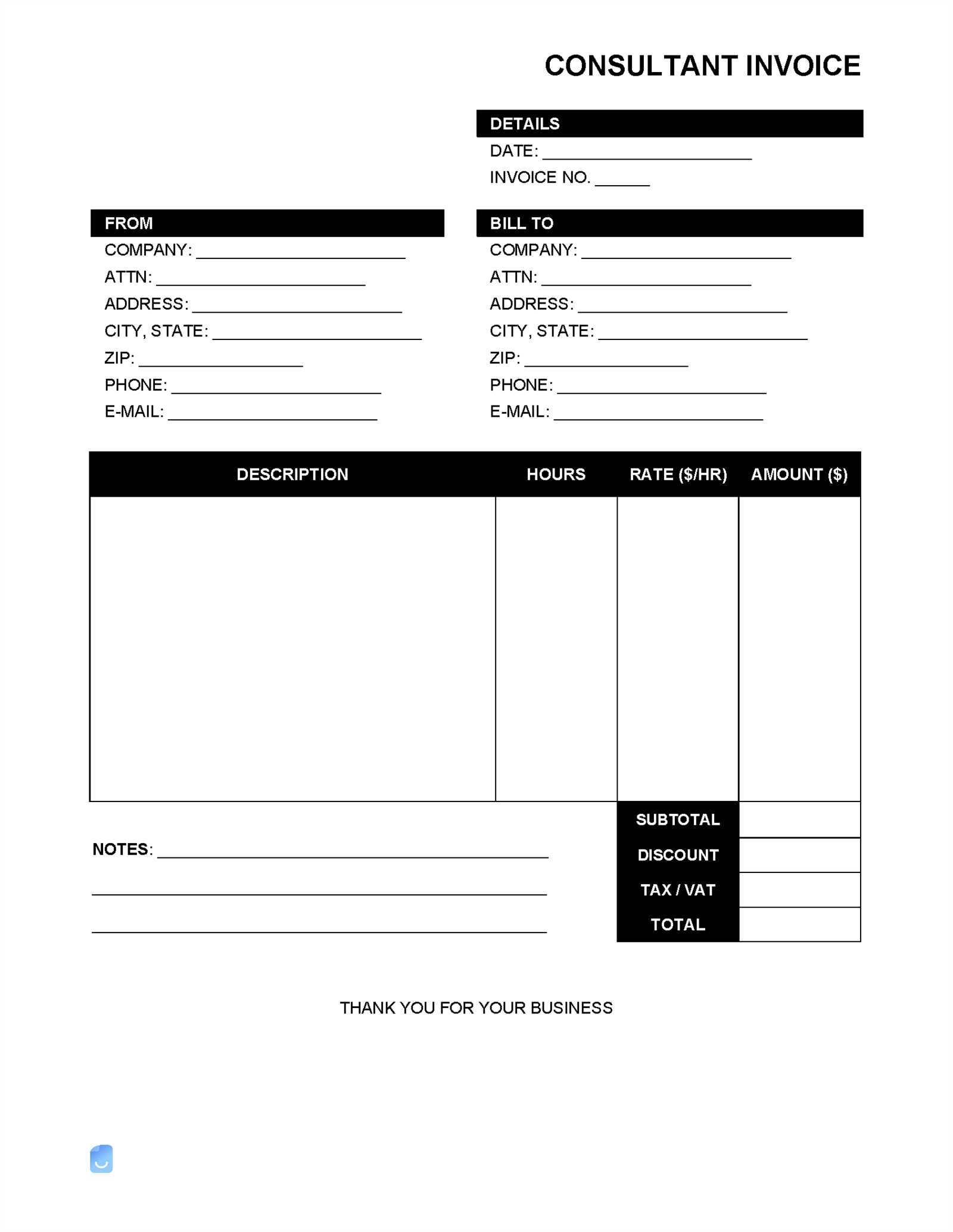

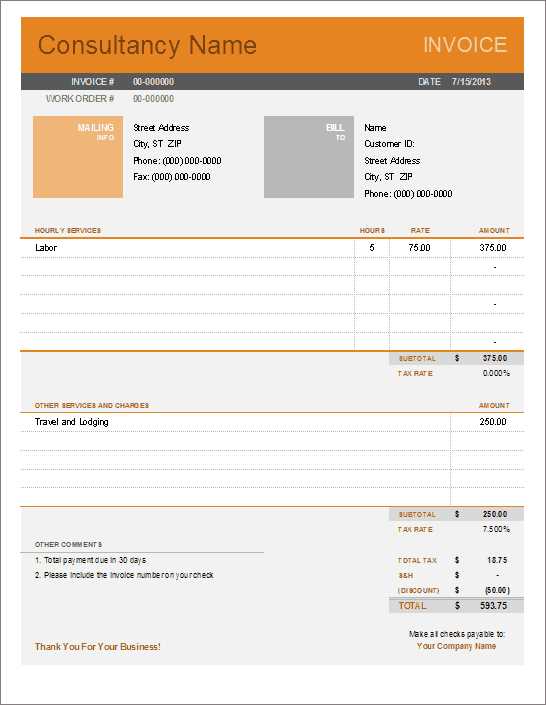

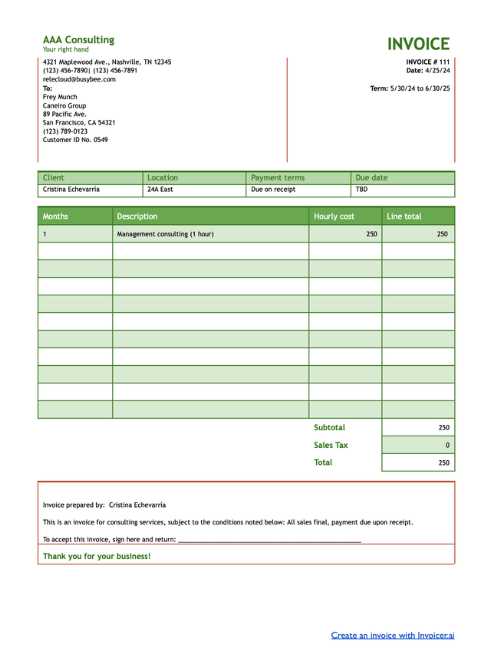

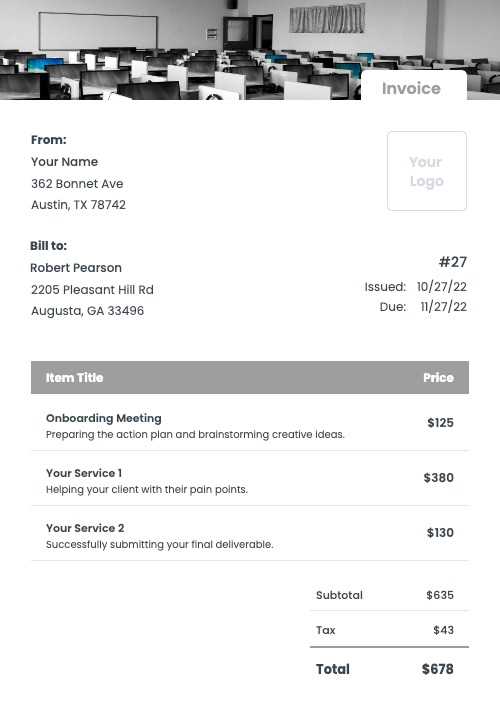

Personalizing your billing document is essential for creating a professional and tailored experience for your clients. Customization allows you to adjust the layout, design, and content to better reflect your business style and the specific details of each project. Whether you’re dealing with different clients or services, making small adjustments can improve clarity and strengthen your professional image.

Customizing the document involves more than just changing names and amounts. You can modify fields to match the unique requirements of each job, add branding elements, or adjust the payment terms to suit your agreements. This ensures that the document not only provides essential information but also aligns with your business practices.

Key Areas to Personalize

- Business Information: Include your company logo, name, contact details, and website link to establish your brand identity.

- Client Details: Customize the recipient section with the correct client name, address, and contact info.

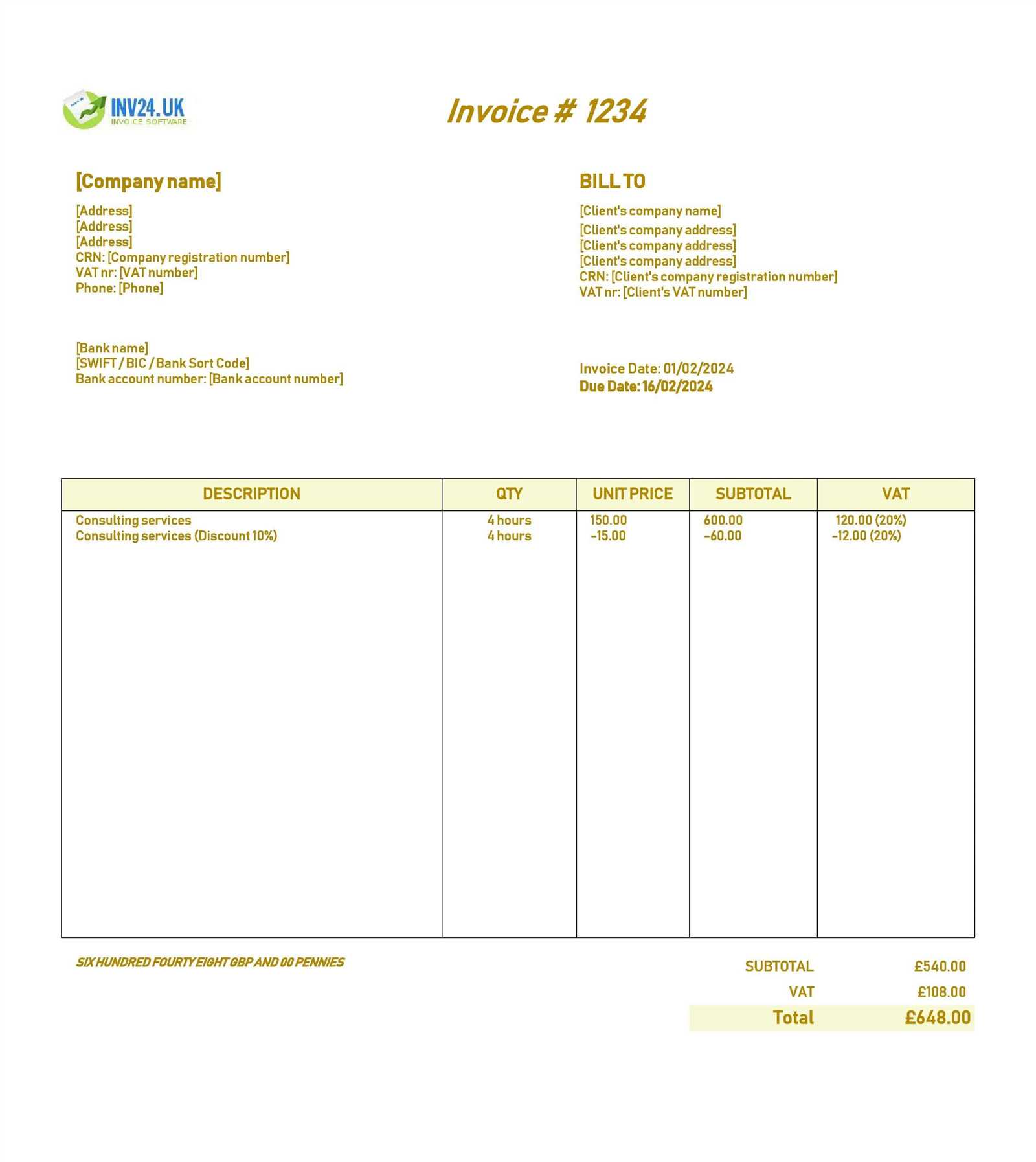

- Service Description: List services provided, with detailed descriptions, hourly rates, and any applicable taxes or discounts.

- Payment Terms: Specify due dates, late fees, or payment methods agreed upon with your client.

- Notes: Add any additional notes or special instructions related to the project or billing process.

Example Layout for Customization

| Section | Customization Options | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Business name, logo, and c

Essential Elements of a Consultant InvoiceA well-crafted billing document should contain all the necessary details to ensure clarity and accuracy for both the service provider and the client. Each section of the document plays a crucial role in communicating the terms of payment, the scope of work, and the expectations for both parties. Including the right elements ensures that nothing is overlooked and helps prevent misunderstandings that could delay payments. To create an effective payment request, it’s important to incorporate specific sections that clearly outline services rendered, the amount due, and other critical details. These components contribute to transparency and foster a professional image, helping to build trust with clients while streamlining your own financial processes. Key Components to Include

Why These Elements Matter

Common Mistakes in Consultant Invoices

Even with a well-organized billing process, mistakes can easily slip through the cracks if the right attention to detail is not given. Common errors can result in delayed payments, confusion with clients, and even damage to your professional reputation. Recognizing and addressing these issues ahead of time can save you time, money, and frustration in the long run. These mistakes often stem from simple oversights or a lack of clarity in how services and payments are structured. However, correcting them is a matter of understanding which details are crucial to include and how to present them in a clear, consistent manner. Below are some of the most frequent issues and how to avoid them. Frequent Errors to Watch For

How to Avoid These Mistakes

|