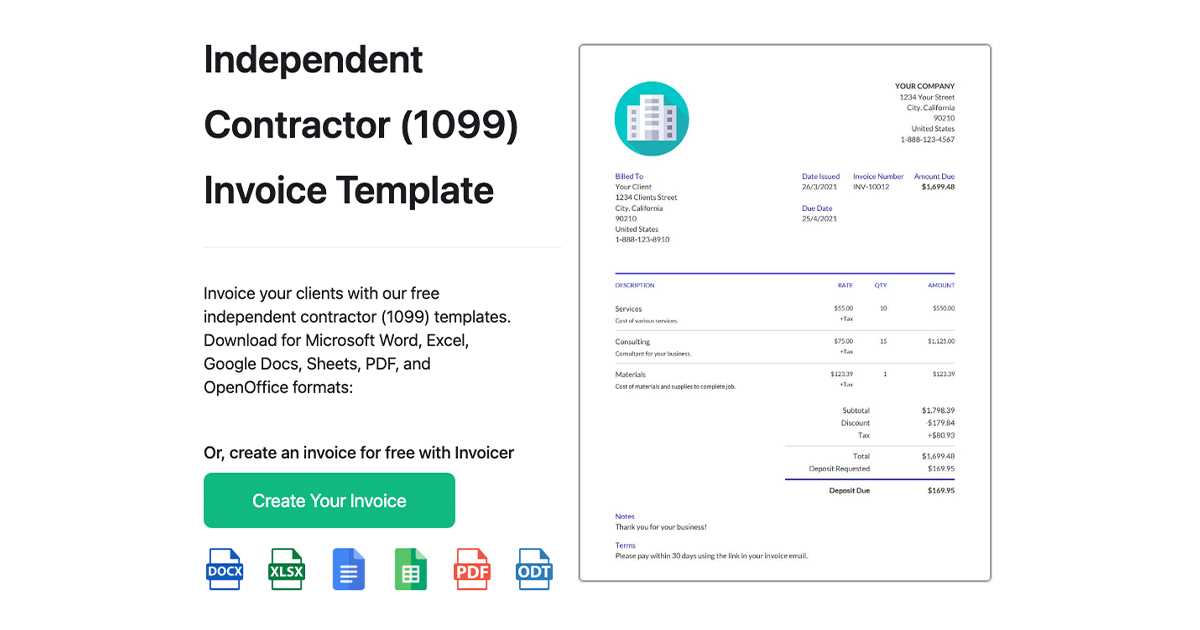

Download Free 1099 Invoice Template for Easy Tax Reporting

Managing business transactions as a freelancer or contractor requires proper documentation to ensure smooth financial operations and compliance with tax regulations. One of the most important aspects of this process is maintaining accurate records of payments and services rendered. Using the right forms can help you stay organized and avoid complications when tax season comes around.

By utilizing a customizable form, you can easily track payments made to contractors or received for services. These forms simplify the recording process, reducing the risk of errors and ensuring that all necessary details are clearly outlined. A well-designed document will help both parties avoid confusion and facilitate faster processing of financial transactions.

Having access to high-quality, editable versions of these forms ensures that you can tailor them to your specific needs. Whether you’re a small business owner or a solo entrepreneur, using the right paperwork can save you time and effort, allowing you to focus on what truly matters–growing your business and meeting your financial goals.

Free 1099 Invoice Template for Tax Filing

When it comes to filing taxes, having the right documentation is essential to ensure accuracy and compliance with government regulations. For independent contractors and small business owners, utilizing a specific form to document payments received can make the process more straightforward and less time-consuming. This form provides a clear record of the amounts paid to workers, which is necessary for proper tax reporting.

Using a customizable form designed for tax purposes has several advantages:

- Helps ensure all required payment details are accurately recorded.

- Reduces the chances of making mistakes during tax preparation.

- Simplifies the process of providing required information to tax authorities.

- Prevents confusion for both the payer and recipient when reviewing financial transactions.

For those looking to streamline their tax filing, it’s beneficial to download an editable version of this document. Many resources offer easily accessible forms that can be quickly filled out and submitted, saving both time and effort. This simple yet effective tool ensures you stay organized throughout the year and ready for tax season.

With the right form in hand, the tax filing process becomes much easier. Be sure to include all the necessary details, such as the total amount paid, the payer’s information, and a clear description of the work performed. This will help ensure that both parties have accurate records and avoid potential issues when filing their taxes.

Why You Need a 1099 Invoice

As an independent contractor or business owner, documenting payments accurately is essential for proper tax reporting. These records not only help you track your earnings but also ensure that you remain compliant with tax regulations. Without the right forms, you risk facing delays or errors when filing your taxes, which could lead to fines or complications with tax authorities.

Using the correct document to record payments offers several benefits:

- Provides a clear and organized record of payments received from clients or employers.

- Ensures that all the necessary information is readily available for tax reporting.

- Helps prevent misunderstandings between contractors and those making payments.

- Simplifies the process of submitting tax forms by providing preformatted fields for essential details.

Having a well-structured document that clearly outlines financial transactions reduces the risk of errors and ensures both parties are on the same page. This not only helps with your personal accounting but also makes the year-end tax filing process more efficient and less stressful.

In addition to simplifying tax reporting, using the correct form can protect you in case of audits or disputes. By keeping accurate and up-to-date records of all payments, you demonstrate professionalism and transparency, which can help build trust with clients and avoid potential legal issues.

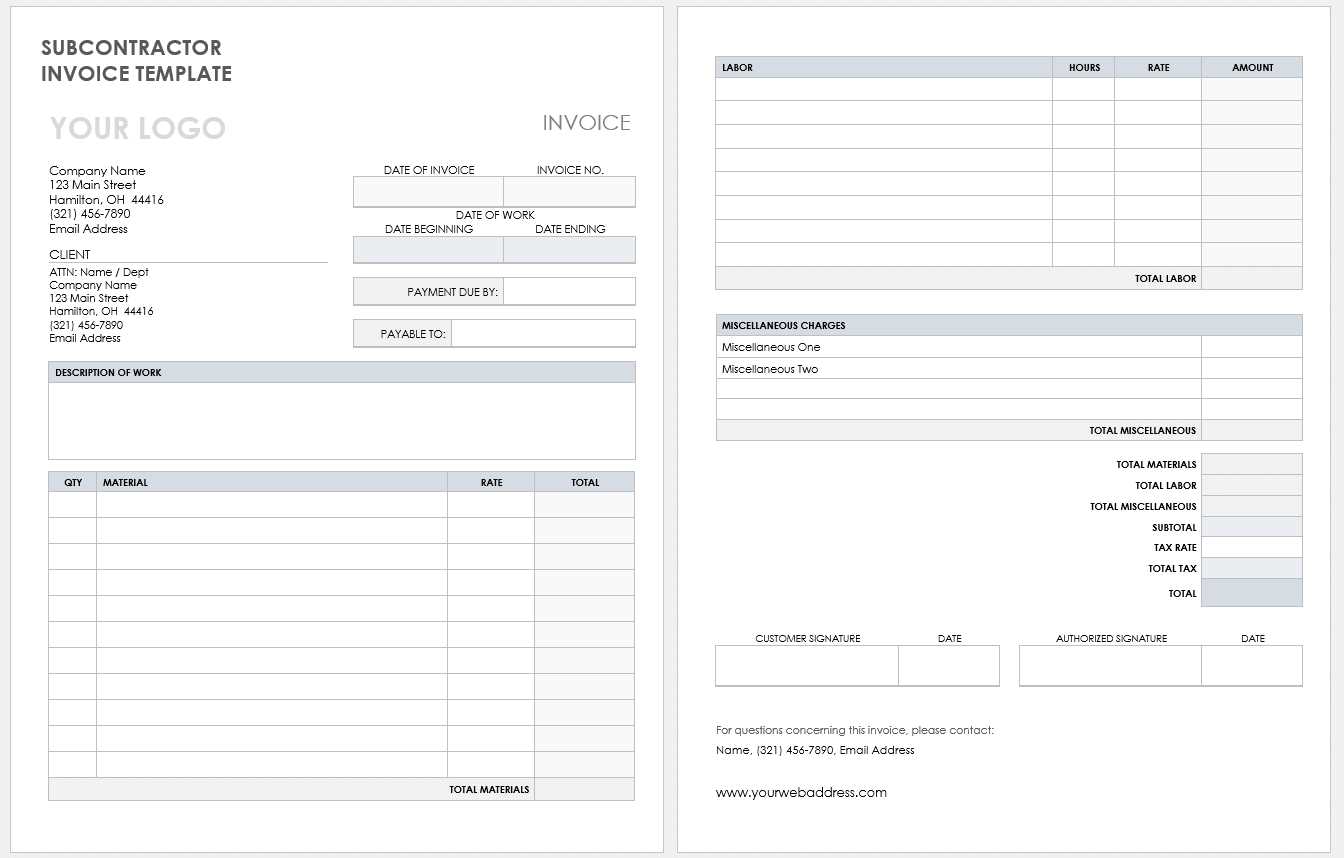

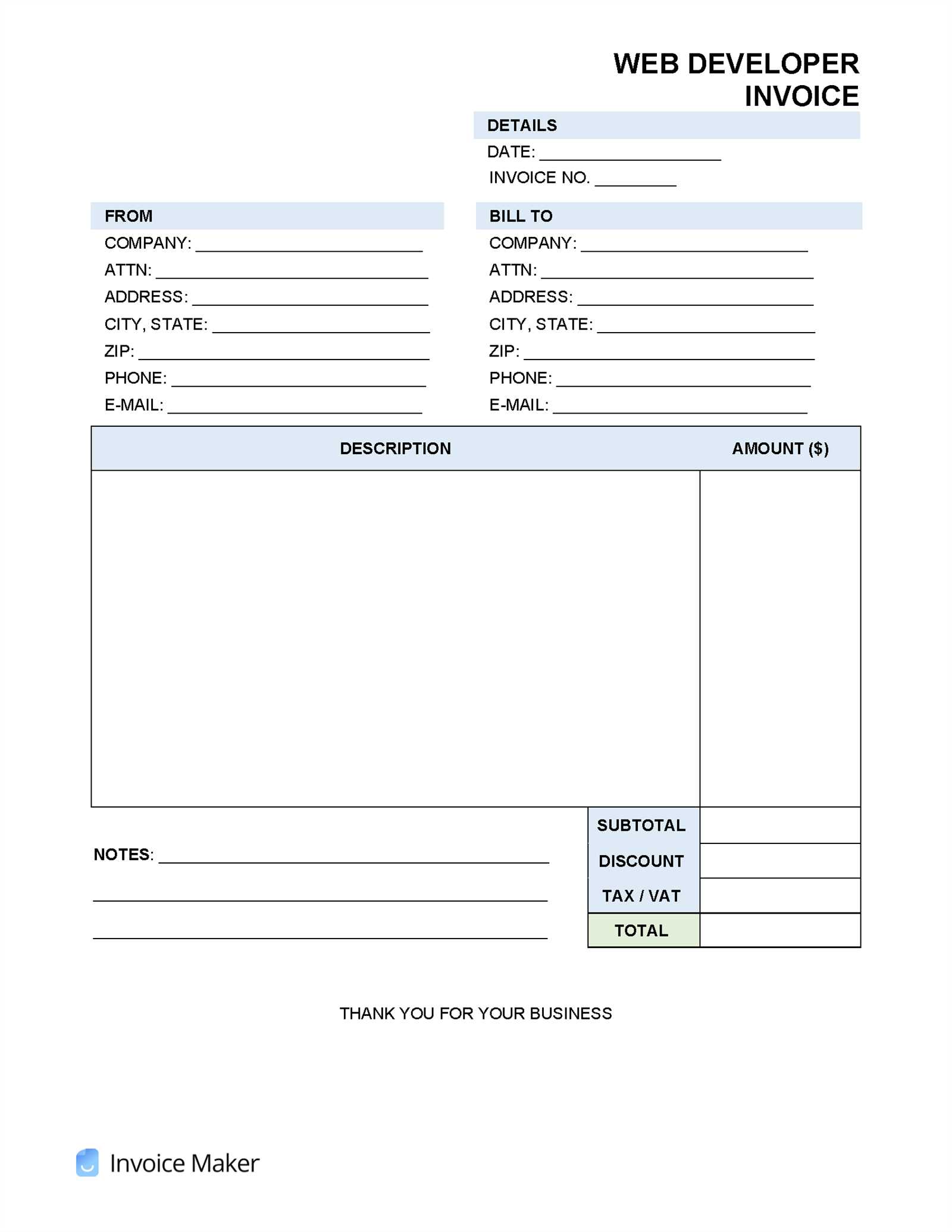

How to Use a 1099 Invoice Template

Using the right document to record payments is a straightforward process that can save you time and effort, especially when it comes to tax filing. The key is ensuring that all the necessary information is included and properly formatted. By following a few simple steps, you can efficiently fill out this document and ensure everything is in order for tax reporting.

To begin, download an editable version of the required form. Most versions are designed to be easy to fill out, either digitally or by hand. Make sure to include the following key details:

- The payer’s name and address

- The recipient’s name and contact information

- The total amount paid during the year

- A description of the services or work provided

- The date or range of dates when services were rendered

Once you’ve entered all the relevant information, double-check for accuracy to ensure that no mistakes will occur when submitting your documents. It’s also important to save the completed form in an organized manner for future reference or in case of audits. If you are working with multiple clients, it’s useful to keep separate records for each one.

Using this simple method allows you to stay on top of your financial records and streamline the tax reporting process. It’s an efficient way to maintain proper documentation while minimizing the chance of errors and ensuring compliance with tax laws.

Benefits of Using a Free Template

Utilizing a pre-designed document for recording payments provides several advantages that can simplify your financial tracking and tax reporting processes. By using a customizable, ready-made version, you save time and ensure that your records are organized and accurate. These documents are typically structured to meet legal requirements, so you don’t have to worry about missing any important details.

Here are some key benefits of using a ready-made form:

| Benefit | Explanation |

|---|---|

| Time-saving | Ready-to-use forms eliminate the need to create documents from scratch, allowing you to focus on your core tasks. |

| Accuracy | Pre-designed forms are created with all essential fields included, ensuring you don’t miss any crucial information. |

| Compliance | These documents are often formatted according to legal standards, reducing the risk of non-compliance when filing taxes. |

| Customization | Editable versions allow you to adjust the form to suit your specific needs or preferences. |

| Cost-effective | There’s no need to hire a professional or purchase expensive software, as many resources offer these forms at no cost. |

By taking advantage of these ready-to-use forms, you streamline your financial processes, reduce the likelihood of errors, and ensure a smoother experience during tax filing season.

Key Features of a 1099 Invoice

When using a payment recording form for tax reporting, it’s important to ensure that the document includes all the necessary details to provide a clear and accurate record. The features of a well-designed form are tailored to facilitate smooth tax filing and prevent any confusion between parties involved. A well-structured document will include essential information that aligns with legal and financial requirements.

Here are some of the key elements typically found in such forms:

- Payer and Recipient Information: The form should clearly list the names, addresses, and contact information of both the payer and the payee.

- Payment Amount: The total sum paid for services or goods provided throughout the year should be specified.

- Description of Services: A brief explanation of the work or services rendered helps clarify the transaction.

- Payment Dates: The dates when the payments were made should be included to establish a clear timeline.

- Tax Identification Numbers: Both parties’ tax identification numbers (TINs) or social security numbers (SSNs) are often required for proper reporting.

- Yearly Summary: Many forms include a section summarizing the total amount paid over the course of the year, providing a quick overview for tax reporting.

These features ensure that the document not only serves as an accurate record for the recipient but also meets the necessary compliance standards for tax authorities. Having a well-structured form simplifies the process of filing taxes and reduces the chance of errors or omissions that could lead to complications down the road.

Common Mistakes When Creating 1099 Invoices

When preparing payment records for tax purposes, it’s crucial to ensure that all details are correct and complete. Mistakes on these forms can lead to delays, fines, or audits. Even small errors can cause confusion between the payer and the recipient, making the tax filing process more complicated than it needs to be. Understanding common mistakes can help you avoid potential issues and ensure accurate documentation.

Here are some of the most frequent mistakes to watch out for:

- Incorrect Personal or Business Information: One of the most common errors is listing incorrect names, addresses, or tax identification numbers. These details must match official records to ensure accuracy during tax filing.

- Missing Payment Details: Failing to include the total amount paid or neglecting to specify the services rendered can lead to confusion or incorrect tax reporting. Always ensure that payment amounts are clearly stated.

- Not Including Payment Dates: Omitting the dates when payments were made is another common mistake. This information helps establish the timeline for tax reporting and provides transparency in the transaction.

- Wrong Tax Identification Numbers: Using incorrect or outdated tax identification numbers for either party can cause issues with tax authorities. Ensure that both the payer’s and the recipient’s numbers are up to date.

- Incorrectly Categorized Services: Descriptions of services provided should be clear and accurate. Vague or incorrect descriptions can lead to confusion and potential audits, especially if the payment is for services in a specific industry.

- Failure to Double-Check Calculations: Mathematical errors in the payment amount or total can cause issues during tax reporting. Always double-check the numbers to avoid mistakes that could complicate filing.

By being mindful of these common mistakes and taking the time to ensure all details are correct, you can avoid unnecessary issues and streamline the process of tax filing. Accuracy and attention to detail are key to ensuring that your financial records are in order and compliant with tax laws.

How to Customize Your 1099 Template

Customizing a payment record form allows you to tailor the document to your specific needs, ensuring it meets both your personal and tax reporting requirements. Whether you’re handling multiple clients or have unique business practices, adjusting the layout and details of the form can help streamline your financial documentation process.

Here’s how you can easily customize your form:

Step 1: Adjust the Layout and Fields

Start by selecting a form that allows you to edit fields such as payer and recipient information, payment amounts, and service descriptions. Customizing these areas ensures that you’re capturing all the necessary details in the correct format. You can add, remove, or adjust sections to suit the nature of your business and the types of services rendered.

Step 2: Add Your Business Information

Personalize the form by adding your business logo, name, and contact information. Including your tax identification number (TIN) and other relevant details ensures that the document reflects your professional identity. This helps both you and your clients keep track of payments and simplifies the process of filing taxes.

By customizing the form to suit your business, you ensure that all important details are captured, making tax season easier and keeping your records organized. Additionally, creating a personalized document helps maintain professionalism in your financial communications with clients.

Choosing the Right 1099 Invoice Format

Selecting the appropriate format for recording payments is crucial to ensure that all required information is clearly presented and easily accessible. The right structure helps streamline your financial processes, making it easier to submit accurate records for tax purposes. The format you choose should not only fit the needs of your business but also comply with regulatory requirements, ensuring smooth filing and minimizing errors.

When deciding on the right format, consider the following factors:

Key Considerations for Format Selection

| Factor | Explanation |

|---|---|

| Compatibility | Choose a format that works with your accounting software or is easily editable to accommodate your business’s specific needs. |

| Clarity | The format should be simple to read and navigate, with clearly labeled sections for both payer and recipient details. |

| Customization | Ensure that the format allows for customization, so you can add or remove fields based on the nature of your transactions. |

| Compliance | Make sure the structure follows legal standards and includes all required fields for tax reporting. |

Choosing Between Digital or Paper Formats

There are both digital and paper formats available, each with its own advantages. Digital formats allow for quick editing, sharing, and storage, whereas paper versions may be preferred for physical record-keeping or when signatures are required. Assess your business needs to determine which format will be most efficient for you and your clients.

By carefully considering these factors, you can select the format that will best suit your business, ensuring a smooth, accurate, and efficient process for payment tracking and tax reporting.

Essential Information to Include on Your Invoice

For accurate documentation and seamless tax reporting, it is crucial to include all necessary details when preparing a financial record. This ensures clarity for both the payer and the recipient, minimizing the chances of confusion or errors. Providing the right information not only simplifies payment processing but also helps maintain professionalism in your business transactions.

Here are the key elements that should be included in every payment document:

Key Details for Accuracy and Compliance

| Information | Description |

|---|---|

| Payer and Recipient Information | Ensure that both your business and your client’s details are accurately listed, including full names, addresses, and tax identification numbers (TINs). |

| Payment Amount | Include the total amount due for services rendered or goods provided, specifying any applicable taxes or deductions. |

| Service or Product Description | Clearly outline the services performed or goods delivered, including quantities, rates, and relevant dates to avoid any ambiguity. |

| Payment Terms | State the payment due date and any late fees or penalties for overdue payments to set clear expectations. |

Additional Elements for Clarity and Organization

While the above details are essential, you may also include optional fields such as invoice numbers for tracking purposes, or specific payment instructions like bank account details or preferred payment methods. These additions can further help streamline your processes and ensure that your records are complete and organized.

By including all of these necessary elements, your financial records will be clearer, more professional, and ready for tax filing and client reference.

How to Save Time with Templates

Using pre-designed documents for business transactions can significantly streamline your workflow. Instead of starting from scratch every time you need to create a financial record, having a ready-to-use structure saves you both time and effort. Templates allow you to focus on the unique details of each transaction while maintaining consistency and accuracy across all records.

Here are some ways that using pre-made forms can save you valuable time:

- Consistency in Formatting: With a pre-designed layout, you ensure that all necessary fields are included, reducing the chances of forgetting crucial information and minimizing the time spent reviewing each record.

- Reduced Repetition: Instead of manually entering the same details over and over again, a template allows you to quickly fill in the specific data for each client or transaction, speeding up the process.

- Faster Processing: Pre-made forms are often compatible with various software and accounting tools, making it easy to import data and automate calculations, which reduces manual entry and the risk of errors.

By utilizing templates, you’re able to cut down on repetitive tasks and enhance your overall productivity, allowing more time to focus on growing your business or handling more important tasks.

Free 1099 Invoice Tools for Businesses

For businesses, having the right tools to manage financial records can save time and ensure accuracy. Various online resources provide cost-effective solutions for managing business transactions, especially for those who need to generate formal documents for tax reporting purposes. These tools offer templates and automated features to help you create professional records quickly and efficiently.

Here are some popular tools available for businesses:

Online Platforms for Record Creation

| Tool | Key Features | Pros |

|---|---|---|

| Tool A | Simple interface, automated data entry, and downloadable formats | Time-saving, customizable, and accurate |

| Tool B | Pre-filled forms, multi-user access, cloud storage | Accessible from anywhere, easy collaboration |

| Tool C | Integrates with accounting software, tax calculation features | Seamless integration with other tools, ensures tax compliance |

How These Tools Can Help Your Business

Using these tools allows businesses to automate and simplify the process of creating necessary documents. By providing structured formats and helpful features like automatic field population and tax calculations, these tools reduce errors and ensure that records are compliant with financial standards. Furthermore, most platforms offer customizable options, making it easy to tailor the documents to your specific needs.

How to Avoid Tax Filing Errors

Accurate tax filing is crucial for businesses and individuals alike to ensure compliance and avoid penalties. Mistakes can easily occur, but with the right preparation and understanding, errors can be minimized. Knowing the common pitfalls and taking steps to address them is essential in maintaining a smooth filing process.

Here are some tips to help you avoid errors when filing your taxes:

- Double-check information: Always verify that all personal and business information is accurate, including names, addresses, and taxpayer identification numbers (TINs).

- Ensure proper categorization: Misclassifying income or deductions can lead to major errors. Make sure that every entry is placed in the correct category to avoid discrepancies.

- Review forms carefully: Thoroughly read through all forms and instructions before submission to avoid common mistakes like missing fields or incorrect data.

- Stay organized: Keep thorough records of all transactions and financial statements. Being organized will allow you to quickly spot errors and ensure your documents are accurate.

- Consult with a tax professional: If you’re unsure about any aspect of the filing process, consider consulting with a tax expert. They can help you navigate complex situations and ensure everything is filed correctly.

By following these tips and remaining diligent, you can minimize the risk of errors and ensure your tax filing is as accurate as possible. Staying informed and organized is the key to a smooth and successful tax season.

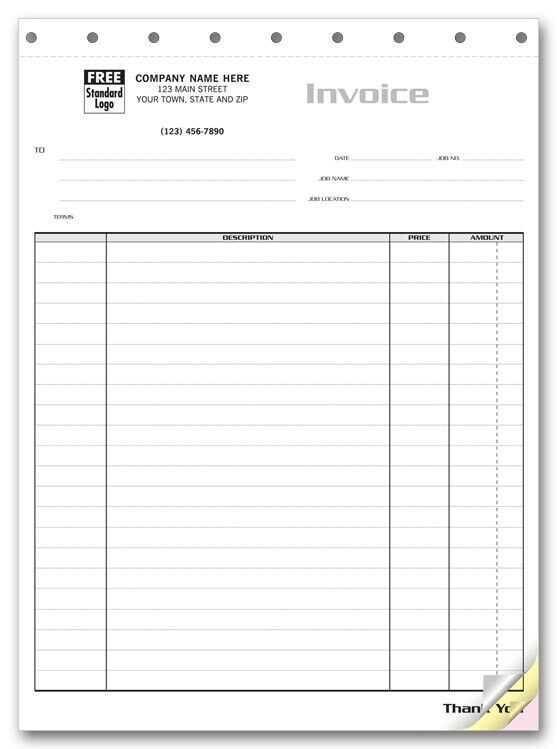

Printable vs Digital 1099 Templates

When preparing official documents for tax purposes, businesses often face the decision of whether to use physical copies or digital versions of the necessary forms. Both options offer distinct advantages and drawbacks, and understanding these differences can help you choose the best solution for your needs. In this section, we will explore the benefits and challenges associated with printable and digital options.

Advantages of Printable Forms

Using physical forms can be beneficial in specific situations. Some of the main advantages include:

- Familiarity: Many people are accustomed to working with paper forms, which can feel more secure and tangible.

- Legal requirements: In some cases, physical documentation may be necessary for submission to certain authorities.

- Reliability: Hard copies are less likely to be affected by technical issues, ensuring that your forms are properly submitted.

Benefits of Digital Forms

On the other hand, digital forms offer a more modern approach to tax filing. Here are some of their key advantages:

- Convenience: Digital forms can be easily created, stored, and shared, making them ideal for busy businesses.

- Time-saving: Electronic submission can be faster, reducing the time spent preparing and mailing forms.

- Environmentally friendly: Using digital documents reduces paper waste and supports sustainability efforts.

Ultimately, the choice between printable and digital forms depends on your business’s specific needs and preferences. By weighing the pros and cons of each, you can determine which method works best for you while ensuring compliance with tax regulations.

Where to Find Free 1099 Templates

When you’re looking to create necessary financial forms for tax reporting, there are various resources available online that offer ready-to-use documents without any cost. These platforms provide options that can be downloaded, customized, and used for different business needs. Below are some common places where you can find such resources.

Online Document Platforms

Many websites dedicated to business resources offer a wide range of customizable financial documents. Some of the most popular include:

- Google Docs: Google Docs offers several templates for tax forms that can be customized directly in the cloud, allowing for easy sharing and editing.

- Microsoft Office Templates: Microsoft Office provides free downloadable forms through Word or Excel that can be quickly adapted to your business needs.

- Template websites: Websites like Template.net and Vertex42 offer free business document downloads, including tax reporting forms.

Government and Regulatory Websites

In some cases, official government websites offer downloadable resources to help businesses comply with tax filing requirements. These are often the most reliable sources, ensuring that the forms meet legal standards. For example:

- IRS Website: The IRS provides downloadable forms and instructions for filing taxes. These can be used to prepare official financial reports.

- State Tax Websites: Many state government websites provide resources for businesses operating within their jurisdiction, including downloadable tax forms.

By exploring these resources, you can easily find the forms you need without the need to invest in paid services, making it simple to stay organized and compliant.

How a 1099 Invoice Affects Your Taxes

Understanding the impact of certain financial documents on your taxes is crucial for both individuals and businesses. When payments are made for services rendered or goods provided, specific records must be filed, which directly influence how much tax you owe or the refund you may receive. These records are essential in ensuring compliance with tax regulations, and the proper filing of such forms can affect both personal and business tax outcomes.

Impact on Self-Employed Individuals

For freelancers and independent contractors, receiving payments through these types of documents means that the amount paid will be included as part of your taxable income. It is important to keep track of these payments throughout the year, as the total reported on these forms will influence your overall tax liability. Here are key considerations:

- Income Reporting: All payments listed must be reported to the IRS, contributing to the total taxable income for the year.

- Self-Employment Taxes: As a self-employed individual, you’ll be responsible for paying self-employment taxes, which cover Social Security and Medicare.

Impact on Business Owners

For businesses, these documents are used to report payments made to contractors or other entities. Proper reporting can help businesses claim deductions for expenses and reduce taxable income. Key considerations include:

- Expense Deductions: Payments made for services, if documented accurately, can be deducted as business expenses, lowering the total taxable income.

- Record Keeping: Maintaining accurate records of all payments and receipts ensures that your business is in compliance with tax regulations and can be used to back up deductions if audited.

In conclusion, how these documents are handled and filed has a significant effect on your taxes. Proper filing ensures you are not overpaying or underreporting your tax liability, protecting you from potential penalties and allowing you to take advantage of tax benefits.

Understanding 1099 Forms for Freelancers

For freelancers, it’s essential to understand the various financial documents that affect their income and tax filings. One of the most common forms used to report earnings from self-employment is a specific tax form. This form is typically issued by businesses to independent contractors and freelancers, outlining the total payments made during the year. Knowing how to read and manage this form can help freelancers stay compliant with tax laws and properly report their income.

Freelancers are responsible for paying their own taxes, including both income tax and self-employment tax. The form serves as a crucial tool in ensuring that the appropriate amount of tax is paid. Here’s a breakdown of the key details included on the form:

| Key Information | Description |

|---|---|

| Income Total | The form includes the total amount paid to the freelancer for the year, which must be reported as income. |

| Taxpayer Identification Number (TIN) | This is the number used to identify the freelancer for tax purposes, such as a Social Security number or Employer Identification Number (EIN). |

| Payer’s Information | The form contains the payer’s business name, address, and TIN, which is essential for verifying the transaction. |

It is important for freelancers to keep accurate records of all payments received. These forms help track earnings for tax purposes, and missing or incorrect information can lead to discrepancies in tax filings, resulting in penalties or missed deductions. By carefully reviewing these forms and ensuring that they match your own records, freelancers can streamline their tax preparation and avoid any issues with the IRS.

Tips for Organizing 1099 Documents

Keeping accurate and well-organized financial records is essential for freelancers and contractors, especially when it comes time to file taxes. The key to managing your financial paperwork is to implement a system that allows easy access to your income and expense details. Properly managing your documents will help you avoid delays, reduce the risk of errors, and ensure that you’re compliant with tax regulations.

Here are some tips to help you stay on top of your financial documents:

- Create a Dedicated Folder: Have a specific folder or filing system for all income-related documents. This makes it easy to locate everything when needed.

- Sort by Date: Organize documents chronologically. Sorting by year and month helps you quickly identify the information you need for tax season.

- Track Payments: Maintain a record of payments received, including any forms that show totals for the year. This ensures you have all the relevant data when filing.

- Use Digital Tools: Take advantage of cloud storage and document management apps to store digital copies. This allows you to access and share documents easily, reducing the risk of losing paper copies.

- Keep Receipts and Contracts: Store receipts and contracts related to payments. These can help clarify any discrepancies and support your income claims if needed.

By using these strategies, you can ensure that your records are well-organized, making tax preparation easier and less stressful. Having everything in order will help you avoid mistakes and take advantage of deductions, ultimately saving you time and effort during tax season.