Create Your Own Homemade Invoice Template Easily

Designing your own billing documents can simplify financial transactions and ensure that all necessary information is clearly presented. Whether you’re a freelancer, a small business owner, or managing personal finances, having a personalized document for payments can streamline your workflow.

Customizing these forms gives you control over the layout and content, allowing you to include relevant details like payment terms, service descriptions, and contact information. This approach ensures that each transaction is clear, professional, and tailored to your needs. With the right format, you can present a polished appearance that reflects your business style.

In this guide, we’ll explore how to build a functional and aesthetically pleasing payment document that suits your unique requirements. Whether you’re just starting out or looking to refine your existing process, crafting a document that meets both legal standards and personal preferences is easier than ever.

Custom Billing Document Guide

Creating your own billing document allows for flexibility and personalization, ensuring it meets your specific needs. This section will guide you through the essential steps of building a functional and professional financial form that effectively communicates payment details.

Start by understanding the key components that should be included. These typically cover contact information, a breakdown of services or products, and payment terms. Customization is crucial to ensure that your document aligns with your business practices and personal style.

Once you’ve outlined the structure, the next step is to choose the right format that suits both your style and your clients’ needs. Consider adding sections for tax information, discounts, and due dates. An organized layout will enhance readability and reduce the risk of misunderstandings.

By following this guide, you’ll be able to craft a document that not only looks professional but also functions smoothly within your payment processes. The right approach will help ensure prompt payments and establish trust with your clients.

Why Create Your Own Billing Document

Designing a custom billing document gives you greater control over how transactions are presented to your clients. By crafting your own, you ensure that all necessary information is included and arranged exactly the way you want, providing a more professional and personalized experience.

One key benefit is flexibility. Instead of relying on standard formats, you can adapt the structure to fit your specific business needs, whether that involves adding detailed descriptions, custom payment terms, or branding elements. A personalized form reflects your attention to detail and can help make a lasting impression.

Additionally, creating your own financial document ensures accuracy and consistency across all your transactions. You can easily update information, adjust for tax changes, or introduce new payment options without waiting for external services or third-party providers. Customization empowers you to keep everything streamlined and aligned with your business objectives.

Choosing the Right Document for You

Selecting the ideal billing form for your needs involves considering both functionality and design. It’s important to pick a structure that suits your specific business type, whether you’re a freelancer, a small business owner, or managing personal finances.

Consider the layout that works best for your style of work. Do you need something simple and straightforward, or do you require a more detailed document with multiple sections for services, taxes, and payment terms? Make sure to choose an option that will allow you to easily customize and update as necessary.

Another factor to think about is how the form will be presented to your clients. Will you be sending it digitally, or printing hard copies? Ensure the design is clear, professional, and easy to read regardless of the format. Ultimately, the right document should reflect your professionalism and enhance the client experience.

Key Elements of a Billing Document

Every payment form should include specific information to ensure clarity and facilitate smooth transactions. A well-structured document serves both as a record for you and your client and as a legal tool for tracking payments.

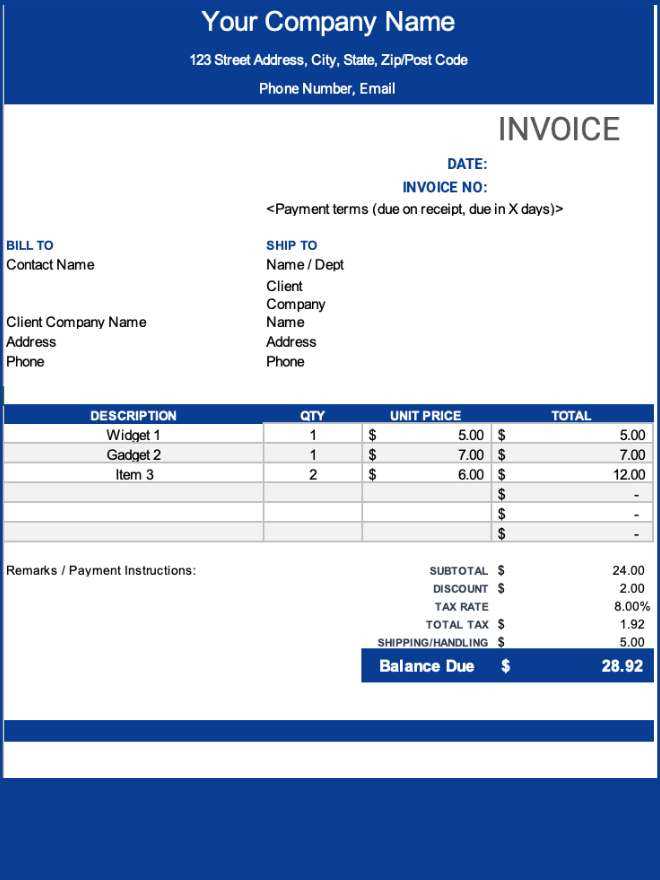

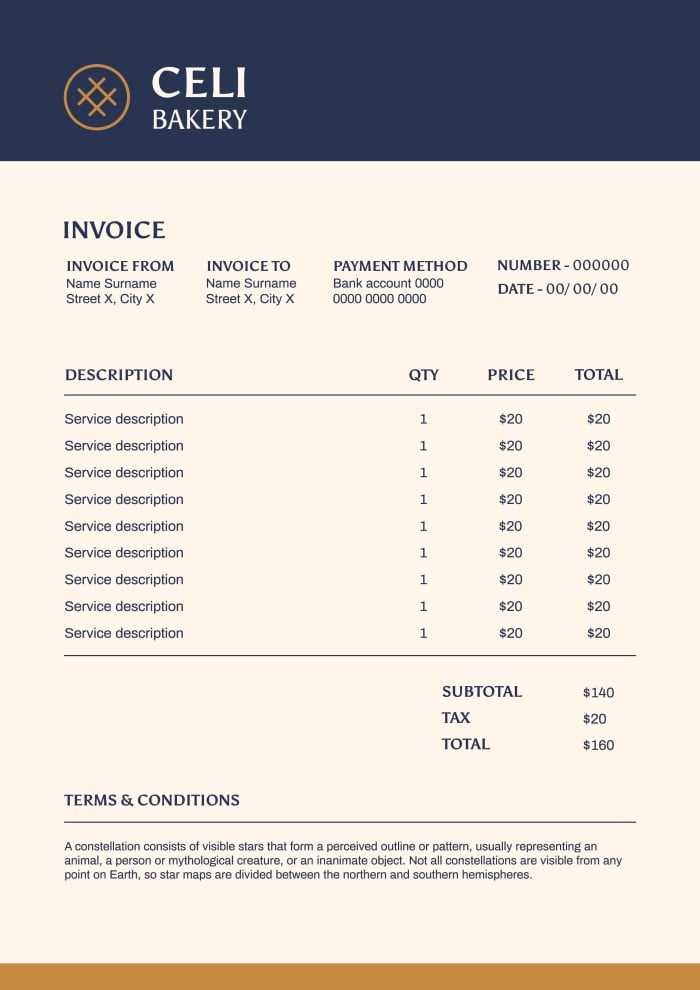

The essential components of such a document include:

- Contact Information: Clearly display your name, business name, address, phone number, and email.

- Client Details: Include the recipient’s name, company (if applicable), address, and contact information.

- Unique Identification Number: Each document should have a unique reference number for easy tracking and organization.

- Description of Services/Products: List the goods or services provided, along with quantities and unit prices, if applicable.

- Payment Terms: Clearly define when payment is due, any late fees, and accepted methods of payment.

- Tax Information: Include applicable taxes, along with tax rates and total tax amount.

- Total Amount Due: Clearly indicate the total amount due after tax calculations.

By incorporating these key elements, your document will be both functional and professional, ensuring all necessary details are clearly communicated to your client.

How to Customize Your Document

Personalizing your billing document allows you to reflect your business style and make sure all necessary details are clearly displayed. Customization ensures that the form aligns with your branding, payment terms, and specific requirements. It’s important to focus on both the aesthetic elements and functional details to create a well-rounded, professional look.

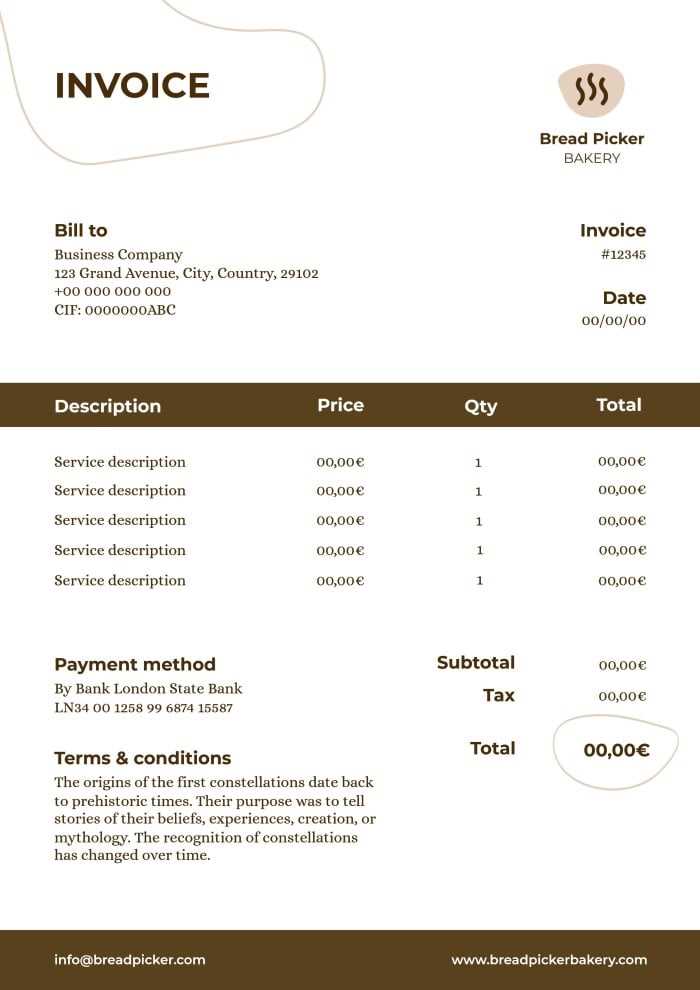

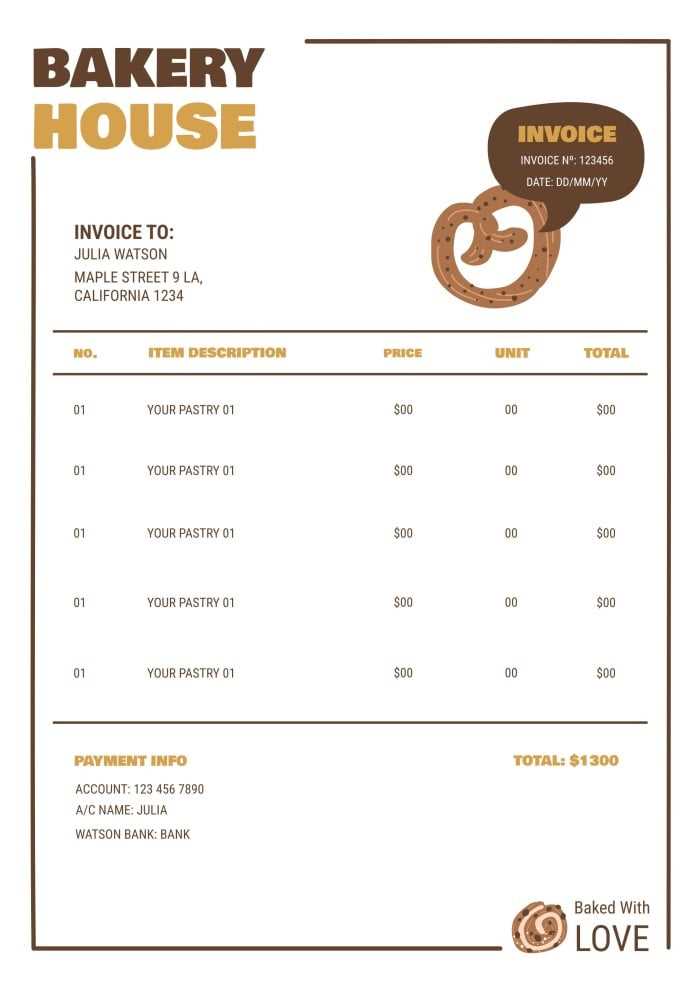

Adjusting the Layout and Design

The layout plays a key role in how easy your document is to read and understand. Start by selecting a clean, simple structure that allows you to add and organize the essential information. You can adjust fonts, colors, and section positioning to match your branding. Consider adding a logo or a custom header for a more personalized touch.

Modifying Fields and Sections

Next, review the sections that need to be included based on your business needs. You might want to add more details about services, include payment options, or provide specific instructions for your clients. Customizing fields like payment terms, discounts, and tax rates ensures that the document is both useful and accurate.

By making these adjustments, you can create a functional and aesthetically appealing document that enhances your professional image and ensures smooth transactions.

Tips for Professional Billing Document Design

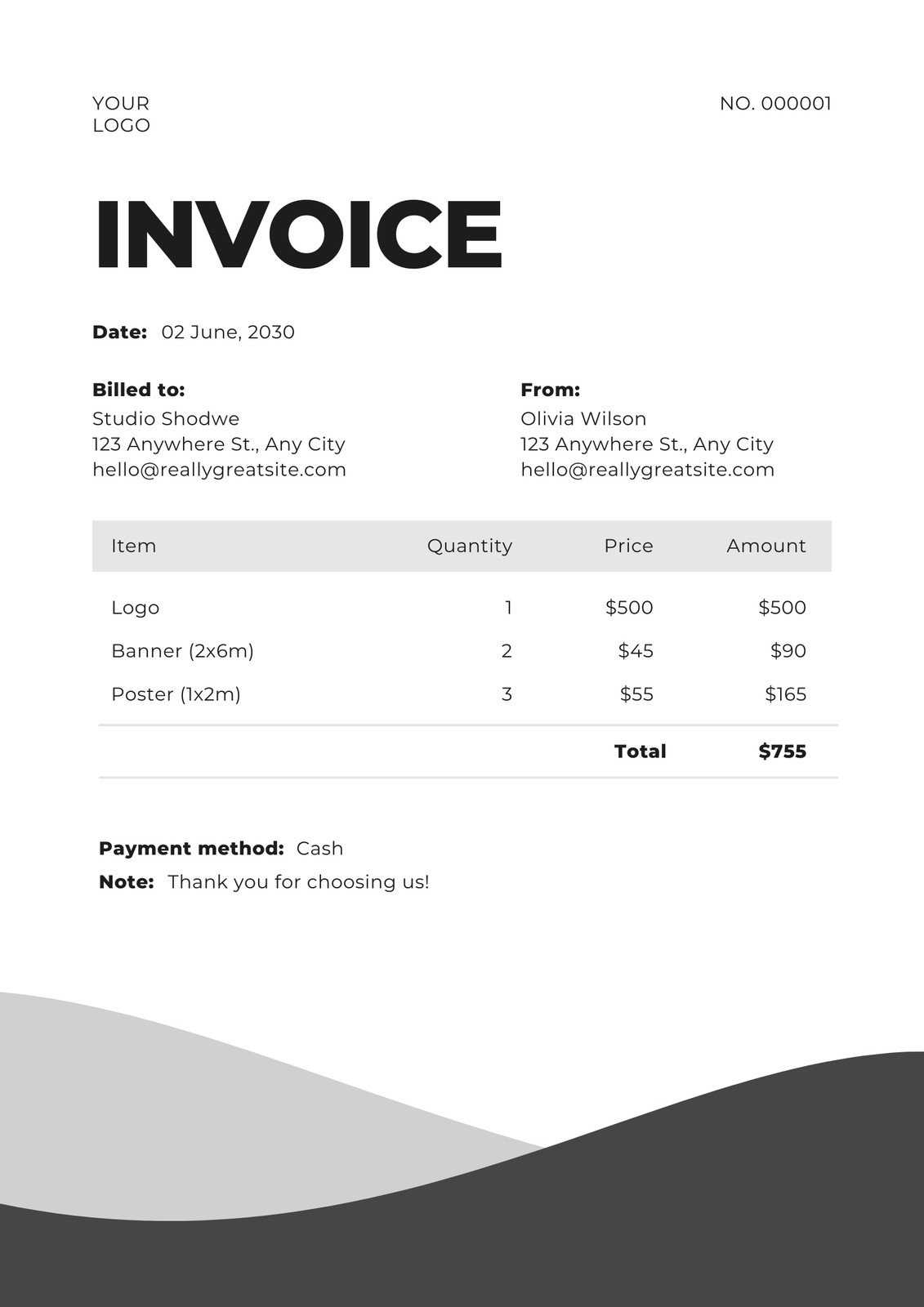

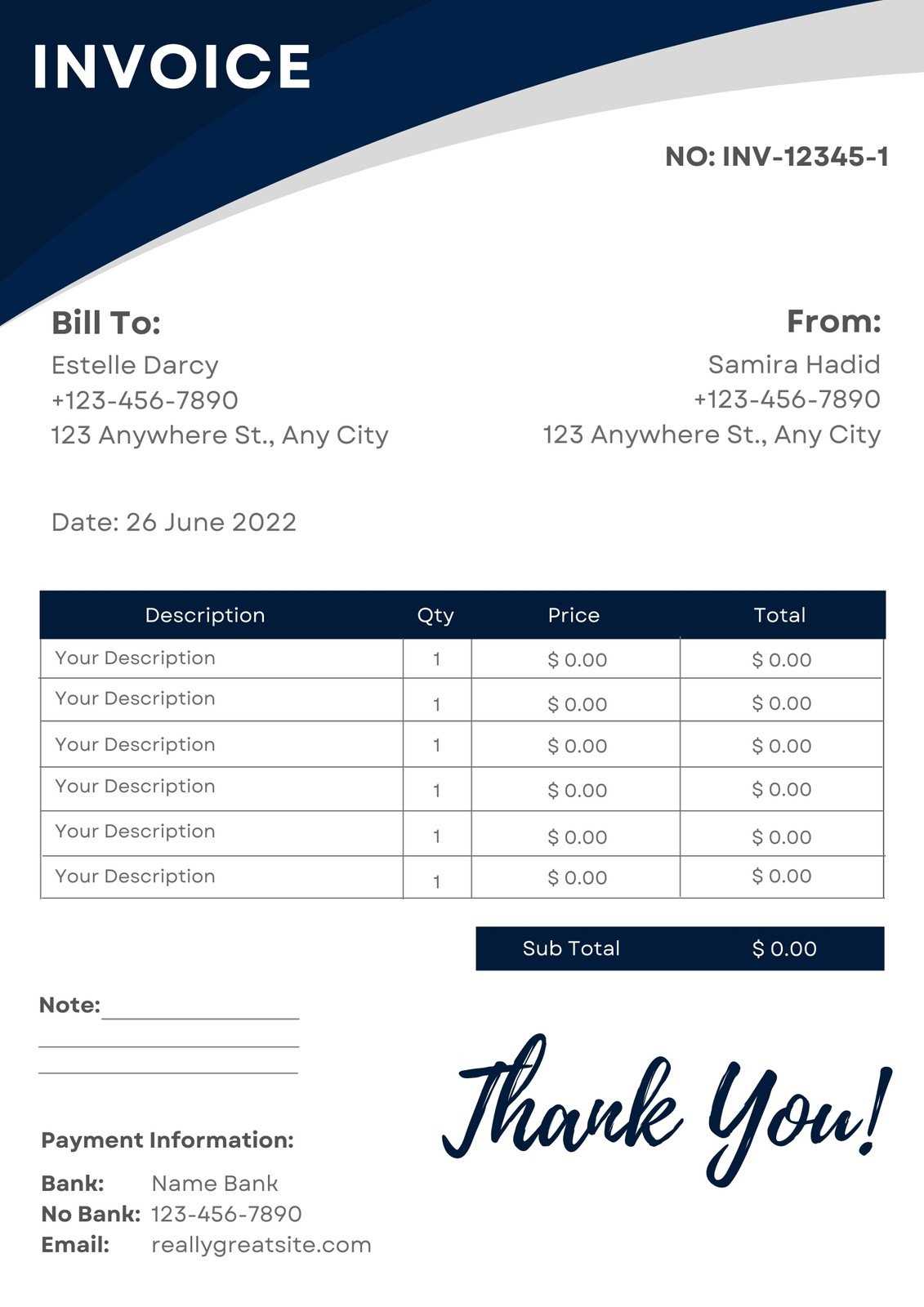

Creating a polished and professional billing document is essential for maintaining a strong, trustworthy relationship with your clients. A well-designed document not only conveys information clearly but also reinforces your brand image. Following these design tips can help you achieve a functional and aesthetically pleasing result.

Focus on Simplicity and Clarity

A clean and straightforward design is crucial. Avoid clutter and ensure that the key information stands out. Keep the layout organized and easy to follow, with clearly defined sections. Here are some tips:

- Use clear headings: Label each section with descriptive titles like “Services Provided” and “Payment Details.”

- Limit colors: Stick to a simple color scheme that reflects your brand, but avoid using too many colors that might distract from the content.

- Readable fonts: Choose easy-to-read fonts and avoid overly decorative or complicated styles.

Ensure Consistency and Branding

Consistency is key in maintaining a professional appearance. Incorporating your company’s brand elements like logo, colors, and fonts helps create a cohesive look. To enhance the design:

- Incorporate your logo: Place your logo at the top of the document for easy recognition.

- Consistent fonts: Use the same font family throughout the document to maintain uniformity.

- Align elements: Make sure all text and numbers are aligned properly for a neat, organized appearance.

By following these tips, you can create a billing document that not only functions efficiently but also represents your business in a professional manner.

Incorporating Your Branding into Billing Documents

Your billing documents are an extension of your business’s identity, and incorporating your branding into them can help reinforce a professional and cohesive image. By aligning the design with your company’s style, you create a stronger connection with your clients and make your communications more memorable.

Using Your Logo and Company Colors

Start by placing your company’s logo prominently at the top of the document. This helps ensure that your client immediately associates the document with your brand. Additionally, use your brand’s color palette for headers, borders, or accent details. This keeps the document visually consistent with other materials, such as your website and marketing collateral.

Custom Fonts and Contact Information

Incorporate your business’s font choices to maintain consistency across all communication channels. Use the same fonts for headings, body text, and any other important details. Additionally, include your full contact information in a footer or header, showcasing your website, phone number, and social media handles. This not only reinforces your brand but also makes it easy for clients to reach you.

By blending these elements, you can create a polished and professional document that strengthens your brand presence while facilitating smoother transactions with your clients.

How to Add Payment Terms

Clearly outlining the payment terms in your billing documents helps ensure both parties understand the expectations regarding payments. These terms define the due date, any penalties for late payments, and the preferred payment methods. Including this information reduces confusion and helps maintain a professional relationship with your clients.

Start by specifying the due date for payment. This can be a fixed date or based on a time frame (e.g., “Due within 30 days”). You may also want to add information about early payment discounts or late fees to encourage prompt payment.

Next, be clear about accepted payment methods. Whether you accept bank transfers, checks, or online payments, list the options available to clients. This ensures that clients know how they can settle the balance and helps avoid delays.

Finally, include any additional terms such as payment plans or penalties for late payments. Clearly outlining these terms helps both parties stay aligned and avoid misunderstandings down the line.

Choosing the Right Billing Document Format

Selecting the right structure for your payment forms is crucial to ensure they are both functional and professional. The format you choose should align with your business needs, allowing you to present details clearly and efficiently while maintaining a streamlined workflow for your clients.

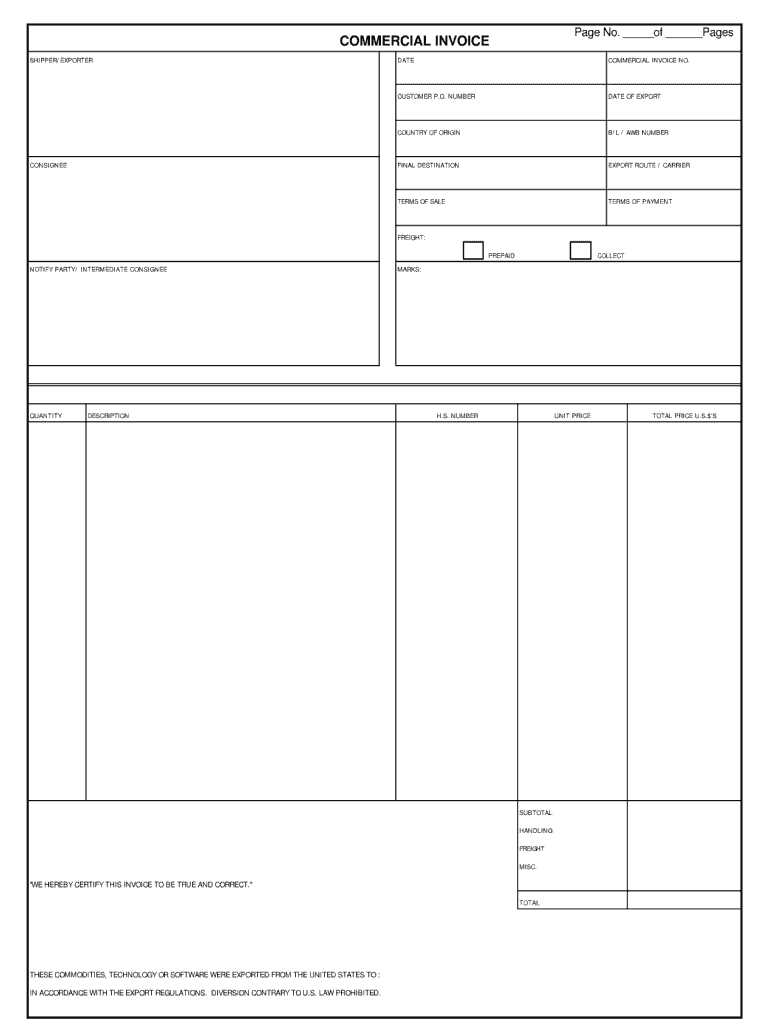

Consider Your Business Type

Different businesses have different needs when it comes to financial documentation. For example, a freelancer may only need a basic document with essential details like services rendered and total payment due. On the other hand, a company providing multiple products or services might require a more detailed layout with additional sections like itemized lists, taxes, and discounts.

Digital vs. Paper Formats

Decide whether you’ll be sending the document electronically or as a physical copy. For digital formats, consider using PDF or editable files like Word or Excel that can easily be shared via email. If you’re providing printed documents, ensure that the format is simple enough to be printed clearly on paper while still maintaining all necessary details.

By selecting the right format, you ensure that your billing documents serve their purpose efficiently and professionally, enhancing your overall business image.

How to Save Your Billing Document

Once you’ve created your payment form, it’s important to save it in a way that allows you to easily access and reuse it for future transactions. Properly saving your document ensures that you can make adjustments when necessary and maintain consistency in your business’s financial records.

First, choose the right file format for your needs. If you plan to make regular edits or customizations, saving the document in an editable format like Word or Excel allows for flexibility. However, if you want to preserve the design and ensure that it’s not easily altered, saving it as a PDF is a secure option.

Organize Your Files: Create a clear folder structure on your computer or cloud storage to keep your documents organized. Label each file with a clear naming convention (e.g., “ClientName_Billing_Document_Date”) so that you can easily locate and differentiate them.

Backup Your Files: It’s a good idea to back up your documents in multiple locations to avoid losing important records. Utilize cloud storage services like Google Drive or Dropbox for easy access from different devices, or save a copy on an external hard drive for added security.

By saving your document correctly and keeping it organized, you ensure that your billing process remains efficient and professional.

Common Mistakes to Avoid When Creating Billing Documents

When preparing financial documents for your clients, it’s important to avoid common errors that can lead to confusion, delays in payment, or misunderstandings. By being aware of these mistakes, you can ensure that your documents are clear, professional, and effective in facilitating timely payments.

Leaving Out Important Information

One of the most frequent mistakes is failing to include all necessary details. Missing key information, such as payment terms, contact details, or itemized services, can result in delays and frustration for both you and your client. Always ensure that you provide a complete breakdown of what is being billed, including:

- Client’s full name and contact information

- Clear description of goods or services provided

- Accurate total amount due, including taxes and fees

Using Inconsistent Formatting

Inconsistent formatting can make your documents look unprofessional and harder to read. Use a clear, consistent structure with properly aligned sections. Avoid using multiple fonts, colors, or confusing layouts. Stick to a simple, clean design that emphasizes clarity. Here’s what to keep in mind:

- Align your text properly: Ensure that dates, amounts, and descriptions are easy to read by aligning text and numbers consistently.

- Use standard fonts: Stick to one or two fonts that are easy to read, such as Arial or Times New Roman.

By avoiding these common mistakes, you can create billing documents that are clear, professional, and ensure smooth financial transactions with your clients.

Why Consistency Matters in Billing

Maintaining consistency in your financial documents is essential for building trust and professionalism with your clients. When your payment forms follow a consistent style, format, and structure, it enhances clarity and ensures a smoother process for both you and your clients. Consistency not only reflects your attention to detail but also helps clients recognize your business’s materials at a glance.

Establishing a Clear and Professional Image

Consistency in your documents promotes a unified image of your business. Whether you are a freelancer or a larger company, maintaining a standard format helps clients immediately recognize your work. It shows that you are organized, dependable, and serious about your business practices. This professional presentation can help build stronger relationships with clients and encourage timely payments.

Reducing Errors and Misunderstandings

By using a consistent layout, you reduce the chance of making errors or overlooking critical details. Repeatedly using the same sections in the same order means less chance for confusion and misunderstandings about amounts owed, due dates, or services rendered. It streamlines communication and avoids potential disputes.

Ultimately, consistency helps you maintain control over your financial records and ensures your business processes run smoothly, allowing you to focus on growth rather than administrative issues.

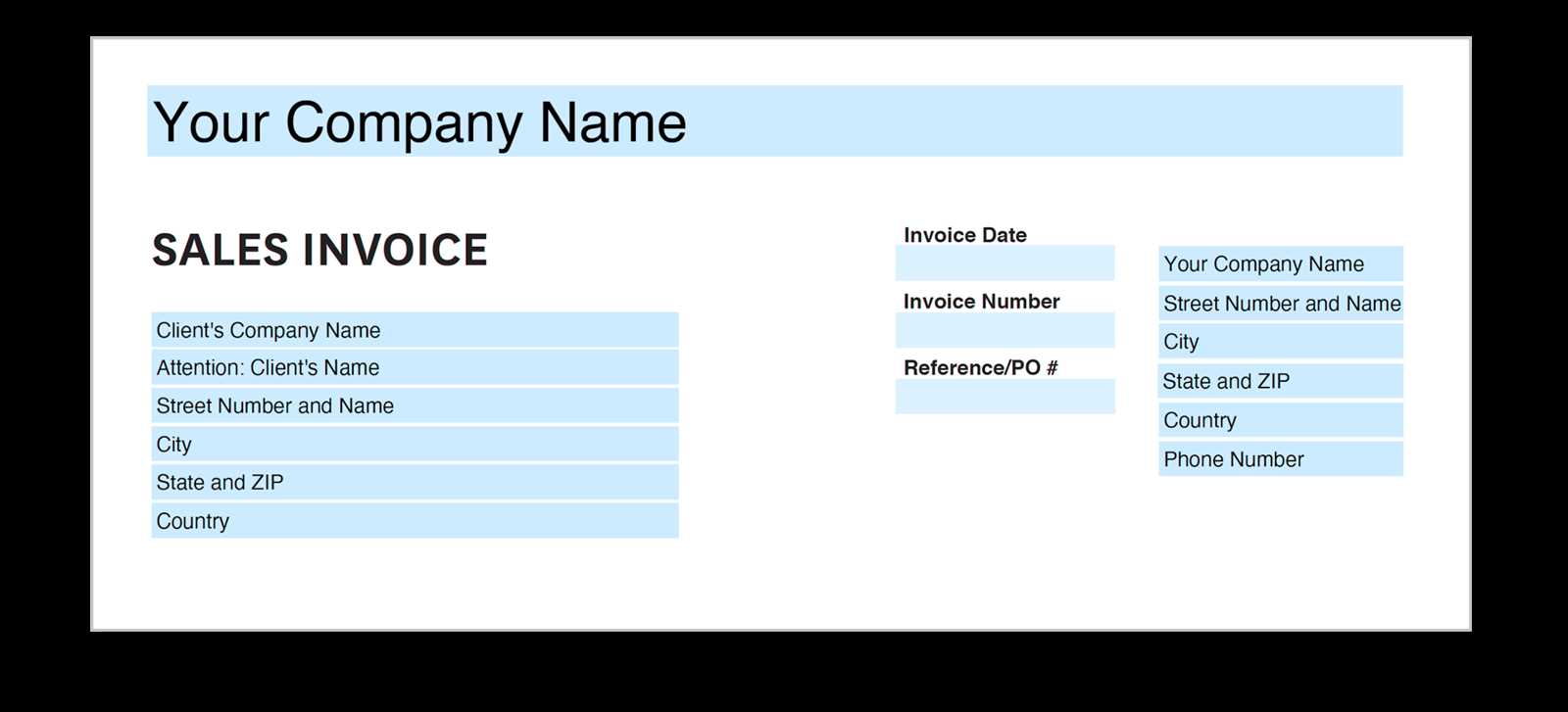

Best Practices for Document Numbering

Implementing a clear and systematic numbering system for your financial documents is essential for tracking transactions, maintaining organization, and ensuring that everything remains in order. A well-structured numbering scheme also helps in identifying and referencing specific records when needed.

Use Sequential Numbers

It’s important to follow a sequential numbering system for each document. This helps maintain a clear, chronological record of transactions and avoids confusion. Here are some key tips:

- Start with a number: Begin with 001, 002, etc., to keep everything in order from the first document created.

- Do not skip numbers: Skipping numbers may cause confusion and could raise questions during audits or reviews.

- Consider adding prefixes: Adding prefixes like “A” or “B” for different clients or projects can help you easily categorize and identify documents.

Include Date and Client Information

Incorporating dates and client-specific information into your document numbering can provide additional clarity and organization. For example, use the year and month as a prefix or suffix, such as “2024-01-001” for January 2024’s first document. This makes it easier to track documents over time and ensures no duplication.

- Example format: YYYY-MM-001, where YYYY is the year and MM is the month of issue.

- Client-specific numbers: For large clients, consider including a client code to streamline your records, such as “C001-2024-001.”

By following these best practices, you can streamline your administrative work, improve organization, and avoid errors in your financial documentation.

How to Include Taxes on Billing Documents

Including taxes in your financial documents is crucial for compliance and transparency. Ensuring that the tax amount is clearly stated not only helps avoid misunderstandings but also keeps your records accurate. By following the proper steps, you can clearly outline the taxes applied to each service or product, making it easier for clients to understand the total amount due.

Understand the Applicable Tax Rates

Before you include taxes on your financial records, it’s essential to know the tax rates that apply to your business and location. Different products, services, or regions may have varying tax rates. Here’s what you need to do:

- Check local tax laws: Ensure you’re applying the correct rate for your products or services, whether it’s sales tax, VAT, or another tax type.

- Separate tax rates: If multiple tax rates apply, be sure to list each one clearly and provide a total for all taxes combined.

Break Down the Tax Amount

Transparency is key when dealing with taxes. To avoid confusion, it’s important to break down the tax amount clearly on your billing document. This way, the client can see exactly how much they are being charged for taxes, in addition to the total cost of the products or services provided. You can present this information in a separate line or section, like this:

- Taxable Amount: The subtotal of the goods or services before tax.

- Tax Rate: The percentage applied to the taxable amount.

- Total Tax: The final tax amount calculated from the taxable amount and tax rate.

By including these details, you ensure clarity and compliance with tax regulations, while also providing your clients with a transparent breakdown of their payment obligations.

Ensuring Your Billing Document is Legally Compliant

Creating a legally compliant financial document is essential for any business. It ensures that your transactions are legitimate, helps maintain transparency with clients, and keeps you protected in case of audits or disputes. To ensure compliance, certain key elements must be included, depending on your business type and location.

Include Required Information

For your document to be legally compliant, it must contain all the necessary details to fulfill regulatory requirements. While these details can vary by region, here are the basic elements that should always be included:

- Business Details: Your full company name, address, and contact information.

- Client Information: The client’s name, address, and any relevant contact details.

- Unique Identifier: A clear, unique number or code to distinguish each document.

- Description of Goods or Services: A detailed list of what was provided, including quantities and unit prices.

- Tax Information: Any applicable taxes, including the rate and the total amount, clearly stated.

- Payment Terms: The payment due date, acceptable payment methods, and any late fee information.

Understand Local Laws and Regulations

Compliance varies depending on the country, state, or region in which you operate. Each jurisdiction may have its own set of rules governing what must be included in a billing document, how taxes are calculated, and what format is required. To stay compliant:

- Consult legal guidelines: Always check local laws or consult a legal expert to make sure you’re following the correct rules.

- Stay updated: Laws and tax rates can change, so ensure your documents reflect the most current information.

- Consider digital compliance: If you are submitting digital versions, make sure they meet electronic documentation standards and are secure.

By including all necessary elements and staying informed about the legal requirements in your area, you ensure that your financial documents are legall

How to Send Billing Documents Efficiently

Sending billing documents promptly and effectively is crucial for maintaining cash flow and ensuring that clients are aware of their financial obligations. The process can be streamlined by using the right methods and tools, reducing the risk of errors, delays, and missed payments. Below are some strategies for optimizing the delivery process.

Choose the Right Delivery Method

There are several ways to send a billing document, and the method you choose can impact both the timeliness of payment and the client’s experience. Consider the following delivery options:

- Email: Sending documents via email is quick, cost-effective, and allows for easy record-keeping. Make sure the document is attached in a widely accepted format like PDF, and include a clear subject line with key details (e.g., invoice number and due date).

- Postal Mail: While slower and more costly, traditional mail may still be necessary for certain clients or countries. Ensure that you send physical documents with proper postage and tracking to ensure they arrive safely.

- Online Payment Platforms: Many businesses opt for digital invoicing systems integrated with online payment platforms. This method allows for instant delivery and easy tracking of payment status, while also offering clients the convenience of paying online.

Automate and Track the Process

Using automated invoicing software can significantly reduce the time and effort required to send out billing documents. These tools allow you to:

- Automate Delivery: Set up automatic email delivery on a specific date or after a trigger event (e.g., completion of a project).

- Track Status: Monitor whether a document has been sent, viewed, and paid. Some platforms even send reminders if payment is overdue.

- Store and Organize: Keep all documents in one place for easy reference and reduce the risk of losing track of payments or due dates.

By selecting the right delivery method and utilizing automated tools, you can ensure that your billi

Tracking Payments and Unpaid Documents

Efficiently monitoring payments and outstanding balances is crucial for maintaining a healthy cash flow and avoiding financial disruptions. By keeping track of which clients have paid and which remain outstanding, businesses can take timely actions to follow up and ensure prompt payments. Below are key steps for tracking payments and unpaid documents effectively.

Monitor Payment Status Regularly

Stay on top of payment schedules by regularly checking the status of your documents. This can be done through:

- Manual Tracking: Keep a physical or digital record of all transactions, including amounts due, paid, and outstanding. This method works best for small businesses with fewer transactions.

- Automated Tools: Use accounting or invoicing software that tracks the status of each document. These systems often include features to mark payments as received and send automatic reminders for overdue balances.

Set Up Payment Reminders

To reduce the chances of overdue payments, it’s important to send reminders at regular intervals. Here are some ways to set up effective reminders:

- Pre-Scheduled Reminders: Many invoicing systems allow you to set reminders to be automatically sent to clients before and after the due date. These can be gentle reminders at first and more urgent as the deadline approaches.

- Personalized Follow-ups: If automated reminders aren’t enough, send personalized emails or make phone calls to clients who have missed payments. This personal touch can often encourage faster settlement.

Identify and Address Unpaid Balances

When payments are overdue, it’s essential to take proactive steps to address the issue:

- Assess the Situation: Review the document to ensure there are no errors or disputes that might be delaying payment. If there are any issues, reach out to the client promptly to resolve them.

- Negotiate Payment Plans: In some cases, clients may need a little extra time or a payment installment plan. Be flexible but set clear terms for when and how payments will be made.

- Implement Late Fees: To encourage timely payments, consider including late fees for overdue amounts. Ensure that this policy is communicated clearly to c

How to Create Recurring Documents

Setting up recurring billing for clients can significantly streamline your business’s operations, especially for services or products that are provided on a regular basis. By automating the creation of repeated charges, you save time and reduce the risk of errors, while ensuring a steady cash flow. Below is a guide to help you create recurring billing documents effectively.

Determine Billing Frequency and Details

Before setting up any recurring charge, it’s essential to clarify the details of the billing arrangement. Consider the following factors:

- Frequency: Decide how often the charge will occur. Common intervals include weekly, monthly, quarterly, or annually. Make sure the timing aligns with the service or product delivery schedule.

- Amount: Specify the recurring amount that will be charged. This can be a fixed sum or vary depending on usage or additional factors (e.g., hours worked, products delivered).

- Start and End Dates: Determine when the recurring billing will begin and whether it will have a set end date. Some clients may need flexible terms or indefinite continuation until cancellation.

Automate the Process for Efficiency

To make recurring billing easier and more efficient, it’s beneficial to automate the process using software or online platforms. Here’s how:

- Use Billing Software: Many accounting or invoicing systems allow you to set up recurring charges, where the system automatically generates the document and sends it to the client on the specified date. Popular tools often allow for customization of frequency, amounts, and payment methods.

- Cloud-Based Solutions: For even more flexibility, cloud-based platforms like Stripe or PayPal can handle recurring payments, providing secure transaction processing and automatic reminders to clients.

By setting clear parameters for the recurring charges and utilizing automation, you can ensure timely and accurate payments while saving valuable time in your administrative tasks.