Property Maintenance Invoice Template for Simplified Billing and Management

When managing residential or commercial spaces, accurate documentation of work done is essential for both service providers and clients. Clear and organized records ensure smooth transactions and help avoid misunderstandings. For anyone involved in property upkeep, having an efficient system to charge for services rendered is crucial. This article delves into how to structure such documents effectively.

Using a structured billing document offers many advantages. It allows businesses to present detailed information about the services provided, ensuring transparency. It also helps clients easily understand the charges, reducing the likelihood of disputes. Moreover, these records can be used for accounting purposes, improving financial tracking and reporting.

In the following sections, we will explore various aspects of crafting the ideal billing document. From essential details to legal considerations, we’ll cover everything you need to know to ensure your records are both professional and compliant with industry standards.

Understanding Property Maintenance Invoice Templates

Efficient billing is a crucial aspect of managing any kind of service-oriented business, especially in the field of property upkeep. A well-structured document not only helps convey the details of the work completed but also ensures that the financial transactions are clear and transparent. These documents serve as a formal agreement between service providers and their clients, outlining the services provided, the costs involved, and the payment terms.

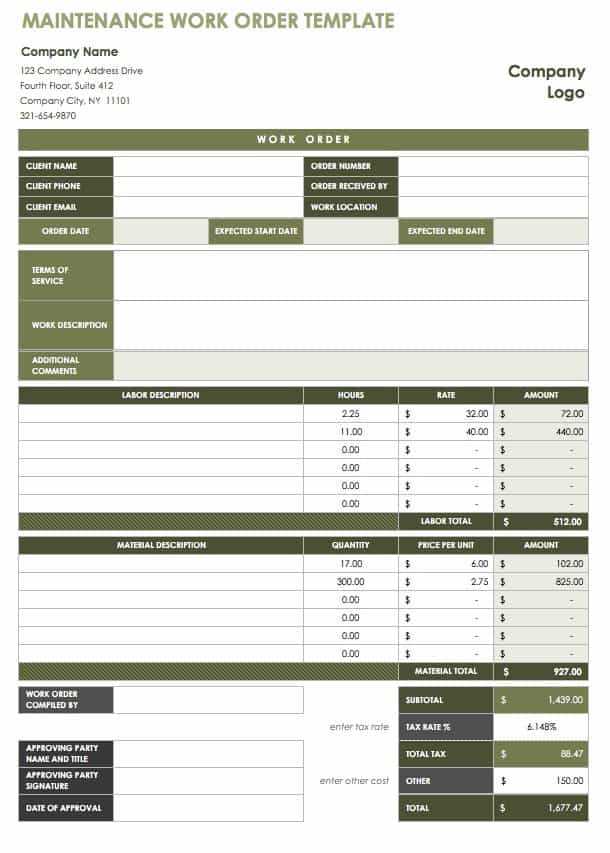

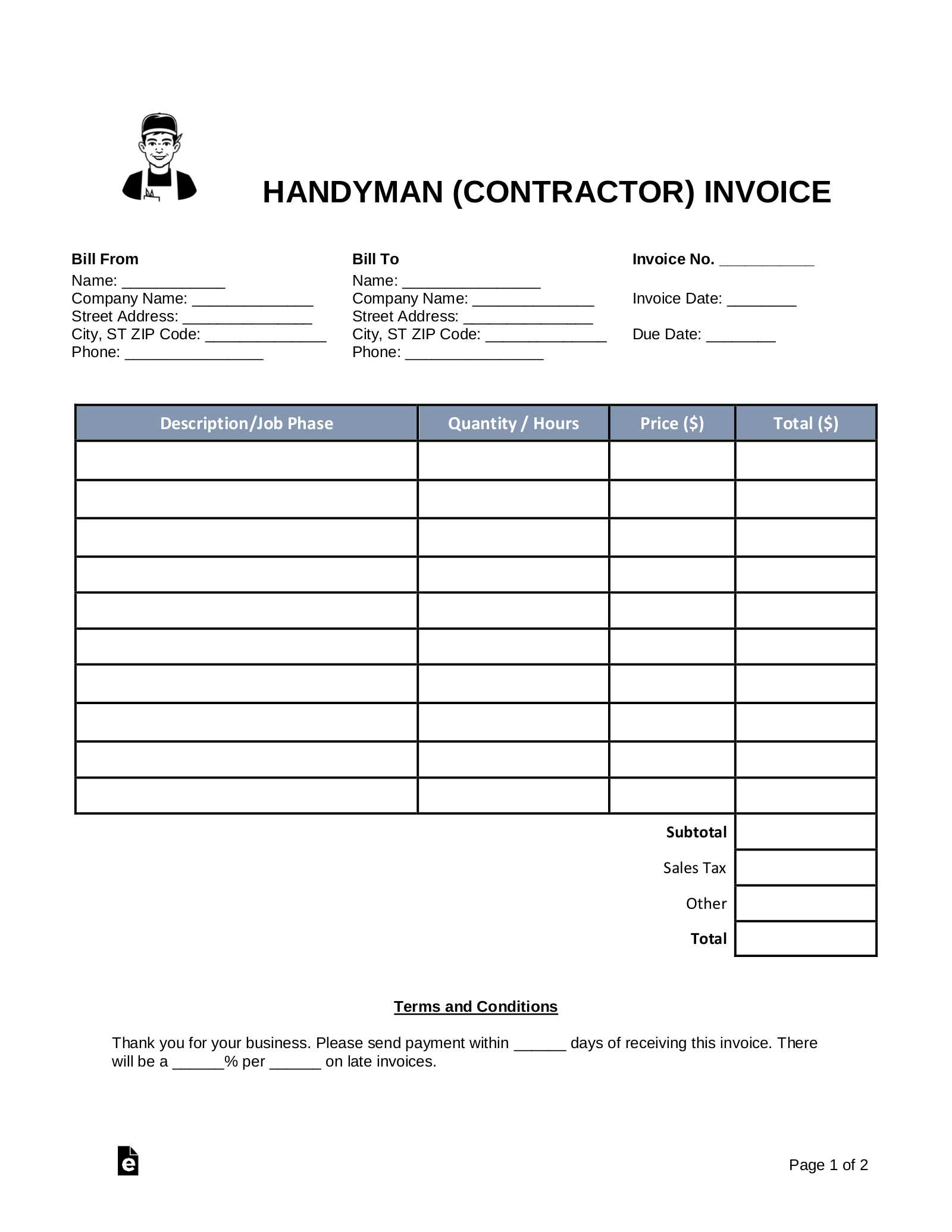

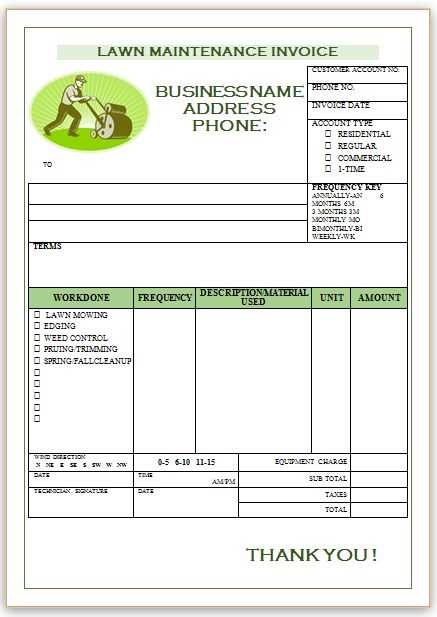

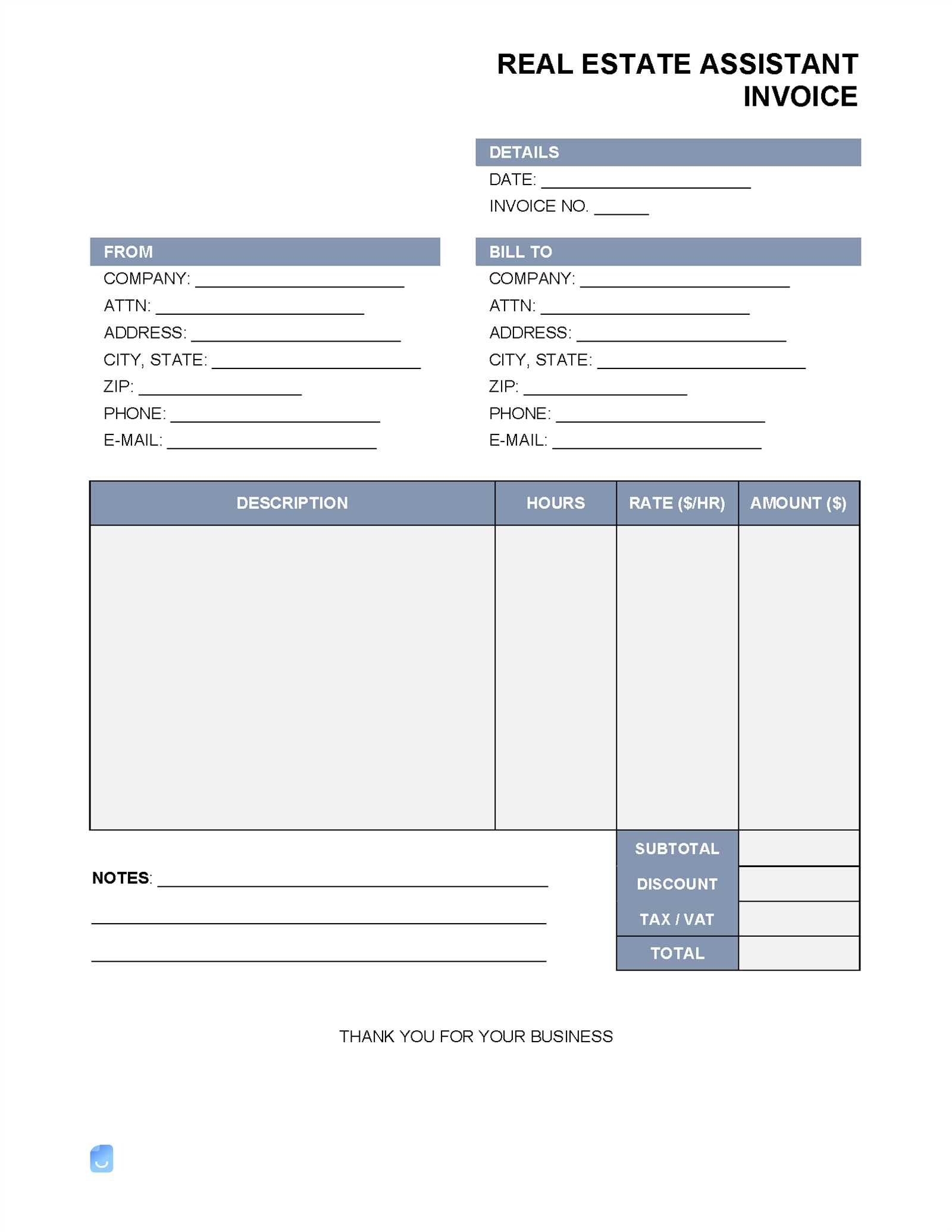

Core Components of a Billing Document

When creating such a record, certain key elements should be included to ensure that the document is comprehensive and easy to understand. These components provide both the service provider and the client with a clear view of the transaction.

- Service Description: A detailed list of tasks performed, including the scope and any specific instructions followed.

- Cost Breakdown: Clear indication of how the charges are calculated, including hourly rates or flat fees.

- Payment Terms: Information about the due date, accepted payment methods, and any applicable late fees.

- Contact Information: Names, addresses, and phone numbers of both parties for reference.

- Dates: The service completion date and the issue date of the document.

Why a Structured Document is Important

Having a well-organized and professional document benefits both the service provider and the customer. For businesses, it streamlines record-keeping, simplifies the process of follow-up on unpaid bills, and ensures that all necessary information is included for accounting purposes. For clients, it creates a sense of trust and professionalism, making it easier to understand the services rendered and the associated costs.

- Professionalism: A structured document enhances credibility and shows attention to detail.

What is a Property Maintenance Invoice

A formal document used to request payment for services rendered plays an important role in any service-oriented business. It serves as an official record of the work completed, the costs associated with it, and the agreed-upon terms between the service provider and the client. This document ensures both parties are on the same page regarding the services provided and the amount due for payment.

Typically, this document includes all the relevant details about the job, from a clear description of the work to the payment methods accepted. It helps streamline the payment process, keeping everything organized and easy to follow for both the contractor and the customer.

Key Characteristics of the Document

To ensure clarity and avoid misunderstandings, the following elements should always be included in such a document:

- Detailed Service Description: A breakdown of the tasks completed, including any special instructions followed during the job.

- Costs and Fees: A clear itemization of the charges, which could include labor, materials, and any other relevant fees.

- Payment Terms: Information on how and when payment is expected, including due dates and acceptable methods of payment.

- Client and Service Provider Details: Names, addresses, and contact information of both parties for reference and communication.

- Job Dates: Dates the service was provided and when the document was issued.

The Importance of a Detailed Record

Providing a thorough and well-organized document benefits both parties involved. For the service provider, it ensures timely payment and proper record-keeping. For the client, it provides transparency and reassurance that all charges are accurate. This document acts as both a proof of service and a reference for future dealings.

- Clarity:

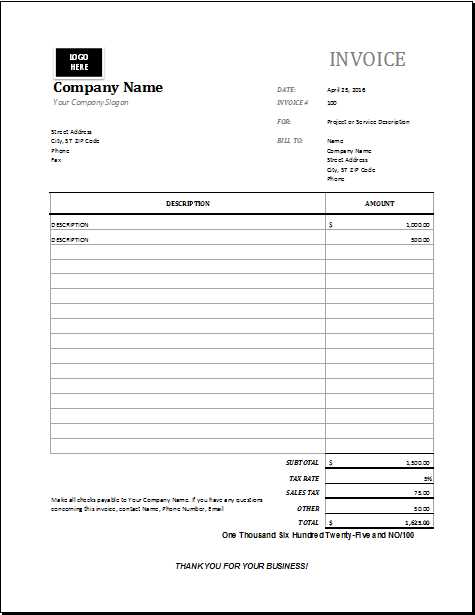

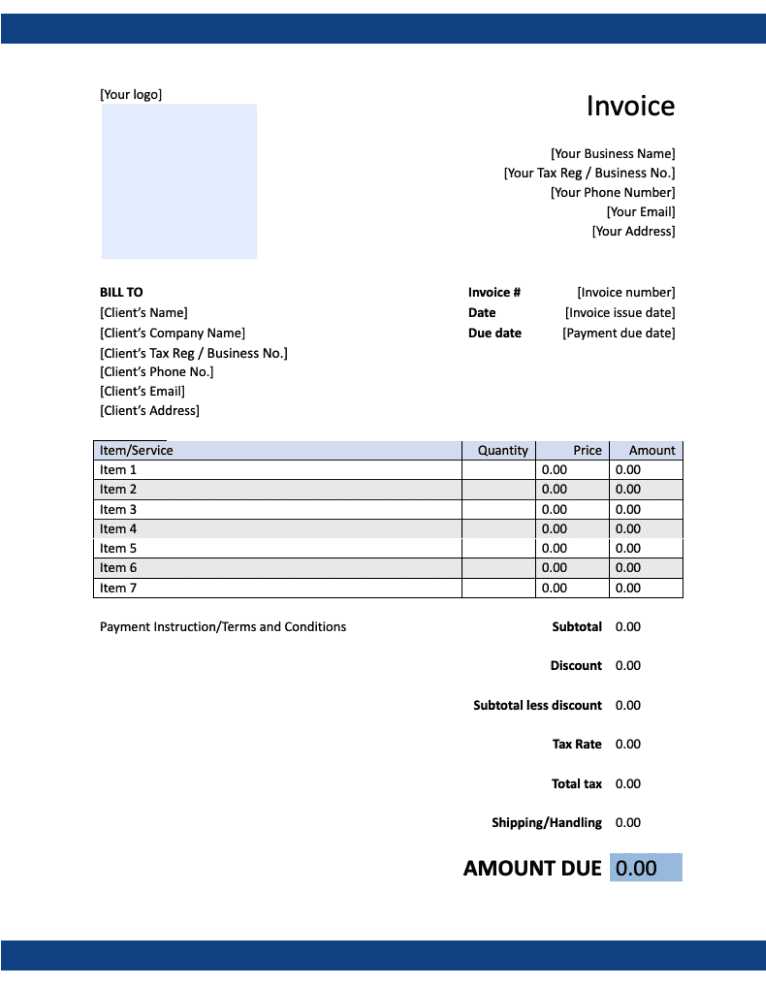

Key Elements of an Invoice Template

When creating a formal request for payment, it’s essential to include several key components to ensure the document is both clear and comprehensive. These elements not only help to organize the information, but also provide a professional format that clients can easily understand. Each part of the document serves a specific function, ensuring that both the service provider and the client are aligned in terms of expectations and responsibilities.

Essential Information for Clarity

The structure of a well-crafted document includes several vital pieces of information. Each section plays an important role in making the document easy to navigate and legally sound. Below are the key elements that should always be present:

Element Description Service Description A detailed list of all tasks or work performed, along with any special instructions followed during the process. Itemized Charges A breakdown of the costs, including labor, materials, and any additional fees or charges associated with the work. Payment Terms Information regarding when payment is due, including accepted payment methods and any late fees for overdue payments. Client and Provider Information Contact details for both the service provider and the customer, including names, addresses, and phone numbers. Dates Clear indication of the service completion date and the date the document was issued. Why These Elements Matter

Including these key components ensures that both the service provider and the client have a clear understanding of the work done and the financial expectations. It helps avoid disputes by providing a d

Why Use a Maintenance Invoice Template

Utilizing a standardized document for billing purposes brings numerous advantages for both service providers and clients. Having a consistent format for requesting payment simplifies the entire process, making it easier to track services, costs, and payments. It also reduces the risk of errors, ensuring that both parties are clear on the work completed and the financial terms agreed upon.

For businesses, using a well-structured form allows for quicker processing of payments, which improves cash flow and minimizes administrative overhead. It ensures that all necessary details are included, reducing the chances of forgetting important information. Furthermore, a clear and professional document reinforces the credibility of the service provider, enhancing their reputation.

Efficiency and Accuracy

One of the primary reasons to adopt a standardized format is the level of accuracy it ensures. When every document follows the same structure, service providers can quickly fill in the relevant information without worrying about missing crucial elements. This consistency leads to fewer mistakes and ensures that both parties understand the terms and conditions.

- Time-saving: Pre-designed structures allow service providers to quickly create professional documents without reinventing the wheel each time.

- Consistency: Standardizing the format reduces the risk of miscommunication and ensures all necessary information is included.

- Fewer Errors: Using a predefined format minimizes the chances of mistakes in calculations or missing details.

Building Trust and Professionalism

By using a formal document that looks organized and professional, service providers send a message of reliability and competence. Clients are more likely to trust businesses that provide clear and transparent billing information. A standardized document helps ensure that all terms are outlined explicitly, which can prevent misunderstandings or disputes down the line.

- Professional Appearance: A well-organized document enhances the image of the service provider, making them appear more reliable.

- Trustworthiness: Clear com

How to Create a Property Invoice

Creating a formal billing document is an essential skill for any service provider. A well-crafted document not only ensures that the client understands the charges but also protects the service provider by clearly outlining the terms of payment and the work completed. The process of creating such a document involves several key steps to ensure clarity, accuracy, and professionalism.

Step-by-Step Guide

Follow these steps to create a comprehensive and effective billing document:

- Include Your Contact Information: At the top of the document, list your business name, address, phone number, and email. This makes it easy for clients to reach you if they have questions.

- Add Client Details: Below your contact information, include the client’s name, address, and contact details. This helps ensure the document is correctly attributed to the right person or organization.

- Provide a Detailed Description of Services: Clearly outline the work performed, including any special tasks or instructions followed. Break the services down into individual tasks if applicable, so the client knows exactly what they’re being charged for.

- List Charges: Itemize all costs involved, including labor, materials, and any additional fees. If you charge hourly, be sure to include the hours worked and the hourly rate.

- Include Payment Terms: Specify when payment is due, any accepted payment methods, and any late fees or penalties for overdue payments.

- Add Dates: Include the date when the work was completed and the date the billing document was created. This provides a timeline for both parties.

- Review for Accuracy: Double-check the document for any errors, including the numbers and service descriptions. Ensuring accuracy at this stage can prevent misunderstandings later.

Tips for a Professional Document

To create a document that reflects your business’s professionalism, consider these tips:

- Use a Clean Layout: Organize the content in a clear and logical order. Use bold headings and bullet points

Common Mistakes in Maintenance Invoices

Even the most experienced service providers can make errors when creating formal payment requests. These mistakes can lead to confusion, delayed payments, or even disputes with clients. It’s crucial to be aware of common pitfalls in order to avoid them and ensure that all transactions are smooth and professional.

Frequent Errors to Avoid

Here are some of the most common mistakes that can occur when preparing a billing document:

- Incomplete Contact Information: Missing or incorrect contact details for either party can create confusion and delay communication. Always double-check the names, addresses, and phone numbers included.

- Unclear Service Descriptions: Vague descriptions of the work performed can leave clients uncertain about the charges. Be specific about the tasks completed and the materials used.

- Incorrect or Missing Dates: Failing to include the correct service completion date or document creation date can complicate payment tracking. Make sure both dates are accurate and visible.

- Not Breaking Down Charges: Bundling costs together without breaking them down into specific items can create confusion for the client. Itemize charges for labor, materials, and other expenses to improve transparency.

- Omitting Payment Terms: Lack of clear payment terms can result in misunderstandings. Always specify due dates, accepted payment methods, and any penalties for late payments.

- Mathematical Errors: Simple calculation mistakes can lead to undercharging or overcharging. Double-check the numbers to ensure accuracy.

How to Prevent These Mistakes

Taking a few extra moments to review an

Benefits of Professional Invoice Templates

Using a well-designed and standardized billing document can offer several advantages for both service providers and clients. A professional approach to documenting payments not only improves the appearance of your business but also ensures that all essential information is clearly conveyed. Whether you’re an independent contractor or part of a larger company, adopting a consistent format can streamline the entire process of financial transactions.

Enhanced Organization and Efficiency

One of the most notable benefits of using a structured form is the increased level of organization it provides. By following a predefined format, service providers can ensure that all necessary details are included without having to worry about missing information. This can save time and reduce errors, allowing for quicker billing and fewer follow-up communications.

- Streamlined Process: Pre-designed forms help to speed up the creation of payment requests, eliminating the need to start from scratch every time.

- Consistency: Using the same format for each document maintains uniformity and ensures that clients receive the same level of professionalism every time.

- Quick Updates: With a template in place, it’s easier to make adjustments, whether adding new services or adjusting pricing without having to redesign the document.

Improved Professional Image

Presenting clients with a clean, well-organized billing document shows that you take your work seriously and care about the quality of your services. A polished document not only reflects professionalism but also helps to build trust with clients, making them more likely to return or recommend your services.

- Trust and Credibility: A consistent and professional look helps establish confidence with your clients, reassuring them that they are working with a reliable business.

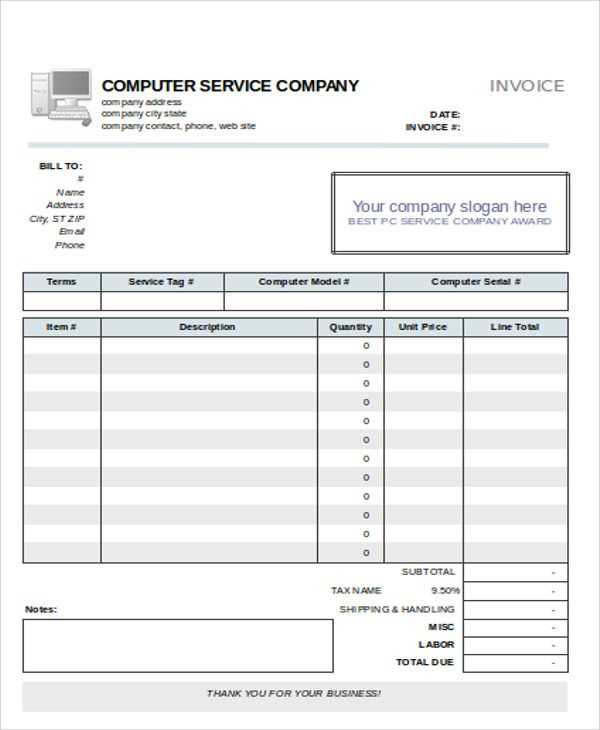

- Branding Opportunities:How to Customize Your Invoice Template

Personalizing your billing document is an essential step in ensuring it reflects your brand and meets your specific business needs. Customization allows you to add important details, adjust the layout, and integrate elements that make your documents more professional and aligned with your company’s identity. Tailoring the format can improve clarity, enhance communication with clients, and make the payment process smoother.

Essential Customization Steps

Here are the key areas to focus on when adapting your document to suit your business:

- Add Your Branding: Include your company’s logo, colors, and fonts to make your document consistent with your overall brand identity. This adds a professional touch and strengthens your company’s visual presence.

- Adjust Layout and Sections: Depending on your business, you may want to adjust the layout to better fit the types of services you provide. You can add, remove, or reorganize sections to ensure that all relevant information is easy to locate.

- Update Terms and Conditions: Customize the payment terms, including due dates, late fees, and accepted payment methods. These terms should reflect your specific policies and business practices.

- Include Special Notes: If you offer promotions, discounts, or warranties, create a section where you can add personalized notes to each document. This is especially helpful for repeat customers or special projects.

- Tailor Pricing Details: Adjust the pricing structure to fit your business model. Whether you charge by the hour, project, or materials, ensure that the format accommodates detailed and accurate billing for each client.

Tools for Customization

There are several tools available to help yo

How to Customize Your Invoice Template

Personalizing your billing document is an essential step in ensuring it reflects your brand and meets your specific business needs. Customization allows you to add important details, adjust the layout, and integrate elements that make your documents more professional and aligned with your company’s identity. Tailoring the format can improve clarity, enhance communication with clients, and make the payment process smoother.

Essential Customization Steps

Here are the key areas to focus on when adapting your document to suit your business:

- Add Your Branding: Include your company’s logo, colors, and fonts to make your document consistent with your overall brand identity. This adds a professional touch and strengthens your company’s visual presence.

- Adjust Layout and Sections: Depending on your business, you may want to adjust the layout to better fit the types of services you provide. You can add, remove, or reorganize sections to ensure that all relevant information is easy to locate.

- Update Terms and Conditions: Customize the payment terms, including due dates, late fees, and accepted payment methods. These terms should reflect your specific policies and business practices.

- Include Special Notes: If you offer promotions, discounts, or warranties, create a section where you can add personalized notes to each document. This is especially helpful for repeat customers or special projects.

- Tailor Pricing Details: Adjust the pricing structure to fit your business model. Whether you charge by the hour, project, or materials, ensure that the format accommodates detailed and accurate billing for each client.

Tools for Customization

There are several tools available to help you easily customize your billing documents:

- Word Processors: Programs like Microsoft Word or Google Docs allow you to modify and save templates with ease. These tools are especially useful for simple customizations like adding logos or changing text.

- Accounting Software: Software like QuickBooks or FreshBooks offers built-in options to customize your documents. These tools often allow you to automate the billing process, making it easier to manage multiple clients.

- Online Generators: Online platforms like Canva or Invoice Generator let you design and personalize billing documents quickly. These tools often include templates that are easy to modify without needing advanced design skills.

Legal Considerations for Property Invoices

When preparing a formal billing document, it’s essential to understand the legal requirements that ensure the transaction is both clear and enforceable. This document serves as a legal agreement between the service provider and the client, and failure to comply with relevant laws can lead to disputes or complications. Knowing the key legal aspects to include in such a document can help protect both parties and maintain transparency throughout the process.

Key Legal Elements to Include

To make sure your billing document is legally sound, there are several critical elements that should be included:

- Accurate Service Descriptions: Clearly detail the services provided to avoid ambiguity. A detailed description helps prevent misunderstandings and ensures that both parties are on the same page regarding what was agreed upon.

- Payment Terms: Specify payment deadlines, accepted methods of payment, and any applicable late fees or interest charges for overdue amounts. These terms help establish a clear timeline and prevent delays in payment.

- Legal Compliance: Ensure that the document complies with any local, state, or federal regulations that apply to the services rendered. This might include tax codes, licensing requirements, or consumer protection laws.

- Signatures or Acknowledgment: While not always required, including space for signatures or an acknowledgment statement can help solidify the agreement. This is particularly important for large or complex jobs.

- Clear Dates: Include the date the service was completed and the date the document was issued. This establishes a timeline for both parties, which is crucial for enforcing payment terms.

Common Legal Pitfalls to Avoid

There are several mistakes that can undermine the legal validity of your billing document. Avoiding these errors is essential to ensu

How to Calculate Property Maintenance Costs

Accurately calculating the cost of services rendered is crucial for both business owners and clients. Understanding the breakdown of expenses ensures that both parties are aligned in terms of expectations and financial obligations. Whether you’re managing routine repairs or complex renovations, knowing how to calculate costs effectively can help maintain profitability while also offering transparency to your clients.

Steps to Calculate Maintenance Expenses

Here’s a step-by-step guide to help you calculate the total cost of the services provided:

- Labor Costs: Begin by calculating the total hours worked on the project and the hourly rate charged for labor. Multiply the number of hours worked by the rate to get the total labor cost.

- Materials and Supplies: Account for the cost of any materials, equipment, or tools used during the job. This can include things like paint, screws, or machinery rentals. Ensure you include the full price of these items.

- Overhead Expenses: Don’t forget to factor in any overhead costs associated with the service, such as insurance, transportation, or administrative fees. These should be proportionally divided across your various projects.

- Additional Fees: If there are any extra charges like disposal fees, special equipment usage, or rush service costs, make sure to add them to the total amount.

- Profit Margin: Lastly, apply a reasonable profit margin to cover your business’s operational costs and ensure your work remains profitable. This percentage will depend on your business model and industry standards.

Example Calculation

To illustrate how these elements come together, here’s a simple example:

- Labor Cost: 10 hours × $30/hour = $300

- Materials Cost: $150

- Overhead Cost: $50

- Additional Fees: $20

- Profit Margin: 20% of the total ($300 + $150 + $50

How to Calculate Property Maintenance Costs

Accurately calculating the cost of services rendered is crucial for both business owners and clients. Understanding the breakdown of expenses ensures that both parties are aligned in terms of expectations and financial obligations. Whether you’re managing routine repairs or complex renovations, knowing how to calculate costs effectively can help maintain profitability while also offering transparency to your clients.

Steps to Calculate Maintenance Expenses

Here’s a step-by-step guide to help you calculate the total cost of the services provided:

- Labor Costs: Begin by calculating the total hours worked on the project and the hourly rate charged for labor. Multiply the number of hours worked by the rate to get the total labor cost.

- Materials and Supplies: Account for the cost of any materials, equipment, or tools used during the job. This can include things like paint, screws, or machinery rentals. Ensure you include the full price of these items.

- Overhead Expenses: Don’t forget to factor in any overhead costs associated with the service, such as insurance, transportation, or administrative fees. These should be proportionally divided across your various projects.

- Additional Fees: If there are any extra charges like disposal fees, special equipment usage, or rush service costs, make sure to add them to the total amount.

- Profit Margin: Lastly, apply a reasonable profit margin to cover your business’s operational costs and ensure your work remains profitable. This percentage will depend on your business model and industry standards.

Example Calculation

To illustrate how these elements come together, here’s a simple example:

- Labor Cost: 10 hours × $30/hour = $300

- Materials Cost: $150

- Overhead Cost: $50

- Additional Fees: $20

- Profit Margin: 20% of the total ($300 + $150 + $50 + $20) = $104

- Total Cost: $300 + $150 + $50 + $20 + $104 = $624

This final total would be the amount billed for the services provided. It’s important to keep detailed records of all expenses to ensure accuracy and avoid disputes with clients.

Best Software for Property Invoices

Choosing the right software to manage your billing and payment documentation can significantly improve the efficiency of your business operations. The best software not only simplifies the creation of financial records but also helps you track payments, manage client relationships, and ensure compliance with tax laws. With a wide variety of tools available, it’s important to select one that fits your specific needs and business size.

Top Software Options

Here are some of the most popular and effective software solutions for managing billing documents:

- QuickBooks: QuickBooks is one of the leading accounting software options, offering robust features for creating and managing financial records. It supports invoicing, tracking expenses, and generating reports. The software also integrates with various payment systems, making it easy for clients to pay directly from their documents.

- FreshBooks: Known for its user-friendly interface, FreshBooks is perfect for small businesses and freelancers. It offers features such as customizable billing forms, automatic reminders for overdue payments, and time-tracking tools for accurate billing. FreshBooks also provides excellent customer support.

- Zoho Invoice: Zoho Invoice is a great option for businesses of all sizes. It allows for creating customized billing documents, automated payment reminders, and time tracking. The software also integrates with other Zoho applications, which can help streamline your entire business process.

- Wave: Wave is a free, easy-to-use option for small businesses or solo entrepreneurs. It provides basic features like customizable billing documents, receipt scanning, and expense tracking. Wave’s simple interface makes it a great choice for users who want to keep things straightforward without paying for expensive software.

- Invoice Ninja: Invoice Ninja is a highly customizable billing solution suitable for freelancers and small businesses. It offers a wide range of templates, recurring billing options, and integrations with payment gateways like PayPal and Stripe. Invoice Ninja also has a free plan with essential features, making it an affordable option for startups.

Key Features to Consider

When evaluating billing software, keep the following features in mind to ensure you select the right tool for your needs:

- Customization: The ability to customize your billing forms to reflect your brand is essential. Look for software that allows you to add your logo, adjust fonts, and personalize other elements.

- Automation: Automating recurring payments, reminders, and late fee calculations can save you time and reduce the chances of human error.

- Payment Integration: Ensure that the software integrates with popular payment gateways to enable smooth transactions and faster payments.

- Reporting: Access to detailed financial reports and analytics is essential for tracking income, managing cash flow, and understanding the overall health of your business.

- Support and Security: Opt for software that offers strong customer support and ensures that your financial data is secure, especially if you are dealing with sensitive client information.

How to Send Property Maintenance Invoices

Sending a well-organized billing document is essential to ensure timely payments and maintain a professional relationship with clients. The process involves not only delivering the document but also ensuring that it reaches the client securely, is easy to understand, and includes all necessary details for prompt payment. Knowing the best methods for sending these documents can help avoid delays and disputes.

Methods of Sending Billing Documents

There are several ways to send a billing statement, each offering its advantages depending on your preferences and client needs:

- Email: One of the most common and efficient methods, email allows you to send the document quickly and securely. You can attach the file in various formats such as PDF or Word, ensuring the client can access it easily.

- Postal Mail: Sending hard copies via postal mail is a more traditional method but may still be required by some clients. It can be beneficial when dealing with clients who prefer physical documents or in legal situations where a signed document is needed.

- Online Billing Platforms: Using online accounting or billing software allows you to send the document directly through the platform. Many of these platforms also provide options for clients to make payments instantly online.

- Text Messages: Some businesses use SMS to send brief payment reminders or links to the full document. This method is especially useful for quick follow-ups on outstanding balances.

Best Practices for Sending Billing Statements

Here are some best practices to follow when sending billing documents to ensure a smooth process and prompt payments:

- Double-Check Information: Before sending the document, verify that all details are correct, including the client’s information, service descrip

How to Send Property Maintenance Invoices

Sending a well-organized billing document is essential to ensure timely payments and maintain a professional relationship with clients. The process involves not only delivering the document but also ensuring that it reaches the client securely, is easy to understand, and includes all necessary details for prompt payment. Knowing the best methods for sending these documents can help avoid delays and disputes.

Methods of Sending Billing Documents

There are several ways to send a billing statement, each offering its advantages depending on your preferences and client needs:

- Email: One of the most common and efficient methods, email allows you to send the document quickly and securely. You can attach the file in various formats such as PDF or Word, ensuring the client can access it easily.

- Postal Mail: Sending hard copies via postal mail is a more traditional method but may still be required by some clients. It can be beneficial when dealing with clients who prefer physical documents or in legal situations where a signed document is needed.

- Online Billing Platforms: Using online accounting or billing software allows you to send the document directly through the platform. Many of these platforms also provide options for clients to make payments instantly online.

- Text Messages: Some businesses use SMS to send brief payment reminders or links to the full document. This method is especially useful for quick follow-ups on outstanding balances.

Best Practices for Sending Billing Statements

Here are some best practices to follow when sending billing documents to ensure a smooth process and prompt payments:

- Double-Check Information: Before sending the document, verify that all details are correct, including the client’s information, service descriptions, and payment terms. This helps avoid any confusion or delays in payment.

- Include Clear Payment Instructions: Make it easy for your client to pay by providing clear instructions on how to submit payment. Include any necessary payment methods, bank account details, or payment links if using online services.

- Send Timely Reminders: If a client hasn’t paid by the due date, send a polite reminder. Many online billing systems allow you to set automatic reminders to ensure timely payments without additional effort.

- Follow Up if Necessary: If the payment is still pending after the reminder, follow up with a phone call or a more direct message to resolve any issues.

- Keep Records: Always retain a copy of the sent document and any correspondence related to the payment. This helps protect your business in case of a dispute or audit.

Tracking Maintenance Work with Invoices

Keeping track of the services provided to clients is an essential aspect of any business. Proper documentation not only ensures transparency and accountability but also helps monitor progress, manage budgets, and provide a clear history of the work done. Using detailed billing documents is one of the best ways to track tasks, hours worked, and resources used throughout the course of a job.

Why Use Billing Documents for Tracking

Billing documents serve as a comprehensive record of all work completed, providing both the client and service provider with a reference point for future discussions or disputes. Here are several reasons why these documents are crucial for tracking:

- Detailed Records: A well-organized document provides a complete breakdown of each task, including time spent, materials used, and any additional costs. This level of detail helps both parties review the work performed.

- Time Tracking: Billing records help ensure that time spent on each project is properly recorded, allowing for accurate billing and easier tracking of labor hours.

- Budget Monitoring: By regularly updating and reviewing your records, you can better track whether costs are staying within budget, identify any overspending, and make adjustments for future work.

- Work History: Maintaining a history of all tasks completed, along with associated costs, allows for quick reference in case of follow-ups or ongoing projects. It also helps build a portfolio of services rendered to clients.

Using Digital Tools for Efficient Tracking

With the advent of digital tools, tracking services has become more efficient and organized. Here are some ways to use digital tools for better management:

- Automated Time Tracking: Many online platforms integrate with time-tracking tools, automatically logging the hours worked on each task. This reduces errors and manual entry.

- Project Management Integration: Some project management software also includes billing functionality, which can track hours and expenses in real time, making it easier to monitor progress and costs.

- Cloud-Based Storage: Storing all documents in the cloud allows easy access from anywhere and ensures that records are backed up and secure. It also facilitates sharing and collaborating with clients or team members.

- Reports and Analytics: Many invoicing tools provide detailed reports on work completed, hours billed, and income earned. These reports can be used to analyze productivity and financial health over time.

Tracking Maintenance Work with Invoices

Keeping track of the services provided to clients is an essential aspect of any business. Proper documentation not only ensures transparency and accountability but also helps monitor progress, manage budgets, and provide a clear history of the work done. Using detailed billing documents is one of the best ways to track tasks, hours worked, and resources used throughout the course of a job.

Why Use Billing Documents for Tracking

Billing documents serve as a comprehensive record of all work completed, providing both the client and service provider with a reference point for future discussions or disputes. Here are several reasons why these documents are crucial for tracking:

- Detailed Records: A well-organized document provides a complete breakdown of each task, including time spent, materials used, and any additional costs. This level of detail helps both parties review the work performed.

- Time Tracking: Billing records help ensure that time spent on each project is properly recorded, allowing for accurate billing and easier tracking of labor hours.

- Budget Monitoring: By regularly updating and reviewing your records, you can better track whether costs are staying within budget, identify any overspending, and make adjustments for future work.

- Work History: Maintaining a history of all tasks completed, along with associated costs, allows for quick reference in case of follow-ups or ongoing projects. It also helps build a portfolio of services rendered to clients.

Using Digital Tools for Efficient Tracking

With the advent of digital tools, tracking services has become more efficient and organized. Here are some ways to use digital tools for better management:

- Automated Time Tracking: Many online platforms integrate with time-tracking tools, automatically logging the hours worked on each task. This reduces errors and manual entry.

- Project Management Integration: Some project management software also includes billing functionality, which can track hours and expenses in real time, making it easier to monitor progress and costs.

- Cloud-Based Storage: Storing all documents in the cloud allows easy access from anywhere and ensures that records are backed up and secure. It also facilitates sharing and collaborating with clients or team members.

- Reports and Analytics: Many invoicing tools provide detailed reports on work completed, hours billed, and income earned. These reports can be used to analyze productivity and financial health over time.

How to Store and Organize Invoices

Effective organization and storage of billing documents are crucial for managing finances and maintaining a well-run business. Keeping these records accessible, secure, and easy to retrieve ensures that you can quickly reference past transactions, track payments, and comply with tax regulations. Whether you are dealing with paper or digital documents, setting up a system that works for your business is essential.

Methods of Storing Billing Documents

There are several ways to store and organize your billing statements. Each method has its advantages depending on your business size, preferences, and the volume of documents you handle:

- Physical Storage: For businesses that prefer hard copies, filing cabinets and binders can be used to organize physical copies of billing statements. This method requires regular maintenance and space but can be effective if you have limited digital infrastructure.

- Cloud-Based Storage: Cloud storage solutions such as Google Drive, Dropbox, or specialized accounting software allow you to securely store and access your documents from anywhere. These services offer features like automatic backups, sharing capabilities, and enhanced security.

- Dedicated Software: Using accounting or invoicing software like QuickBooks, FreshBooks, or Zoho