Easy to Use Maintenance Invoice Template for Quick Billing

Managing payments for services provided can become a complex task without the right tools. Organizing and presenting a clear record of the work completed, along with associated costs, is essential for smooth financial transactions. By using structured documents, businesses can ensure accuracy, avoid misunderstandings, and maintain a professional image with clients.

For those in need of streamlining the payment process, having a pre-designed structure can save valuable time. These documents help track labor, materials, and additional expenses in an easy-to-understand format. Whether you’re working with regular clients or offering one-off services, the right document can simplify communication and ensure that payments are processed quickly and without errors.

In this guide, we will explore how to create, customize, and use these essential billing documents. From formatting and content organization to legal considerations, each step plays a crucial role in making your financial exchanges smoother and more efficient.

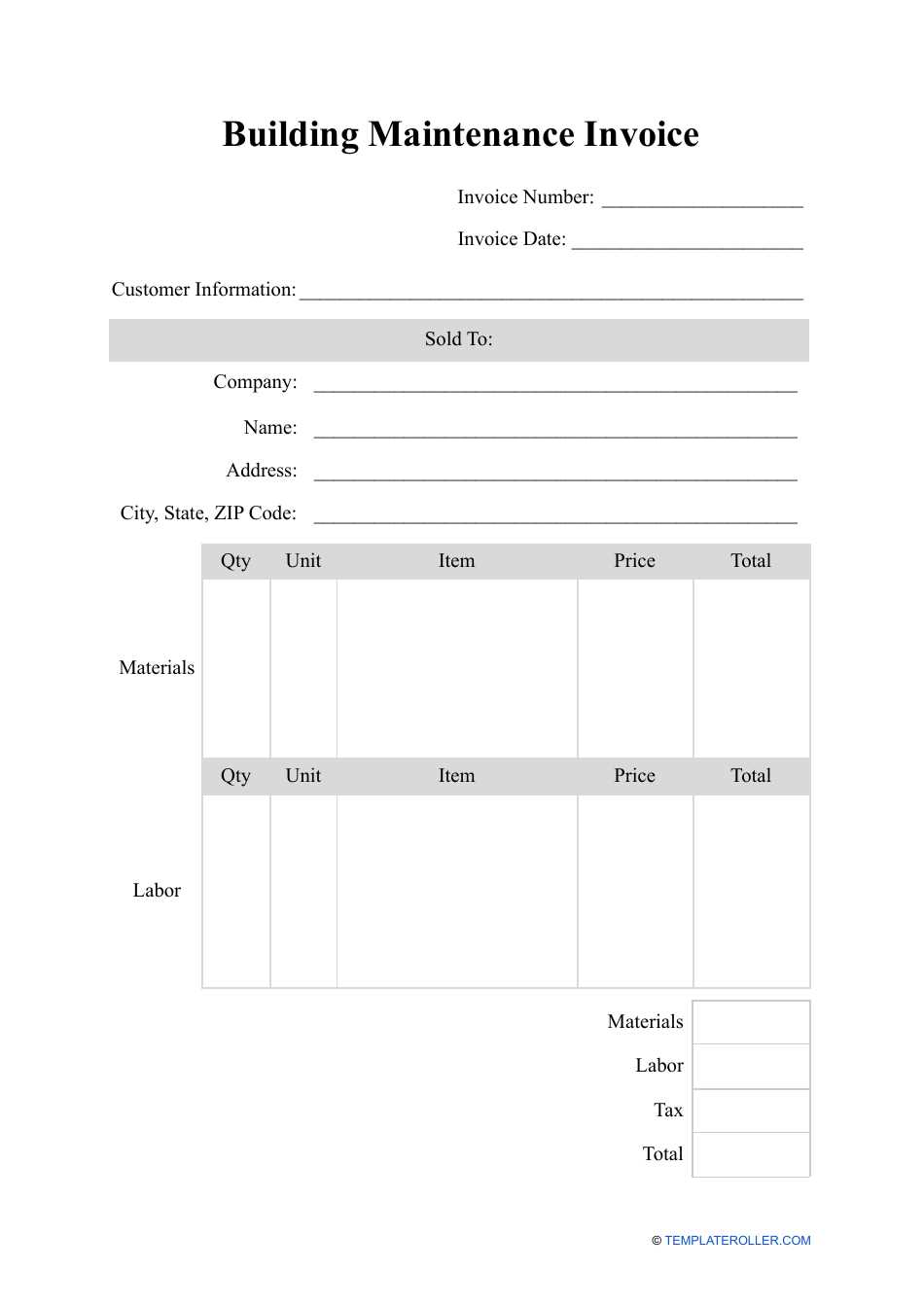

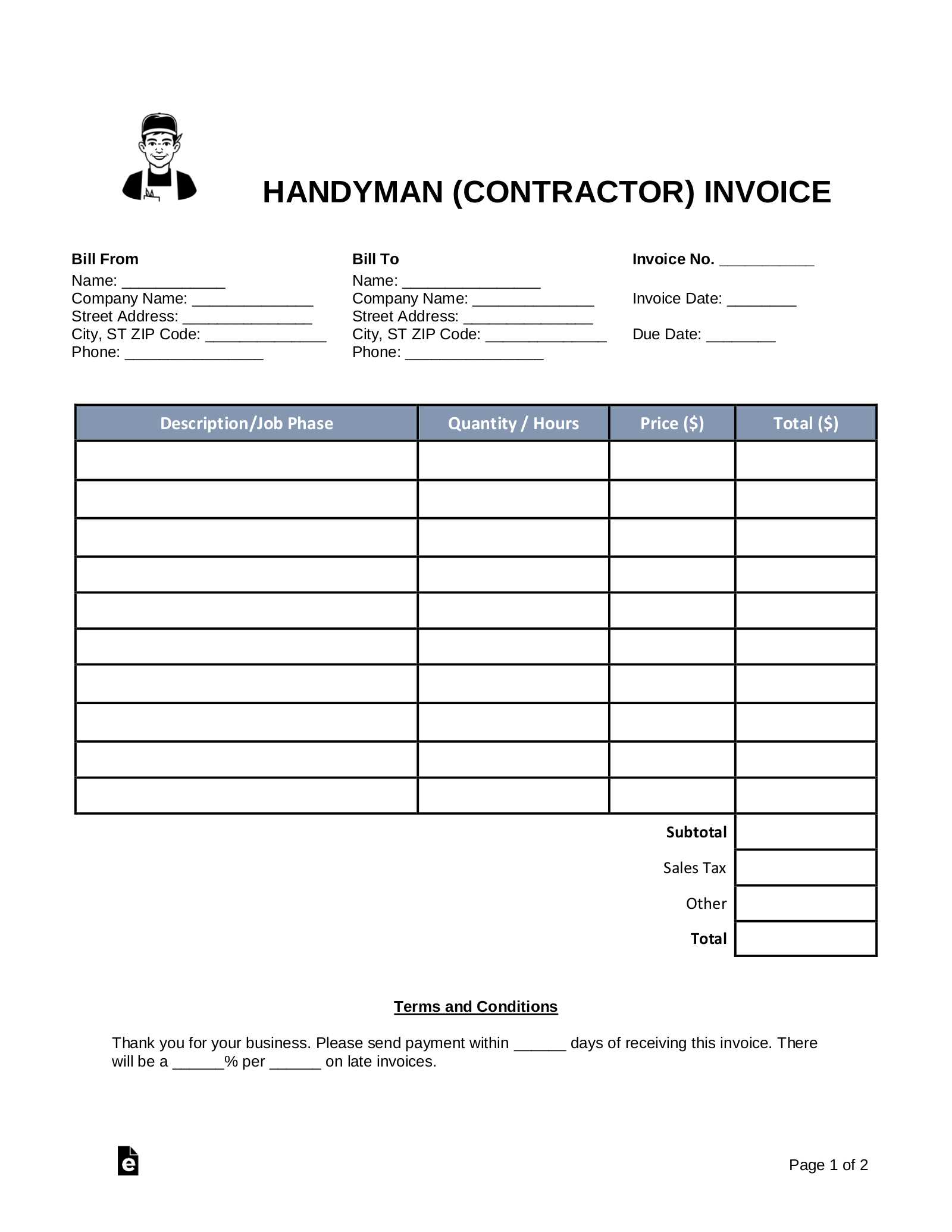

Essential Features of a Maintenance Invoice

For any service-related business, creating a clear and comprehensive document is crucial for smooth financial transactions. An effective document not only communicates the costs involved but also ensures that both parties are aligned on the services rendered. Key elements should be included to avoid misunderstandings and make the payment process as straightforward as possible.

Clear Breakdown of Services and Costs

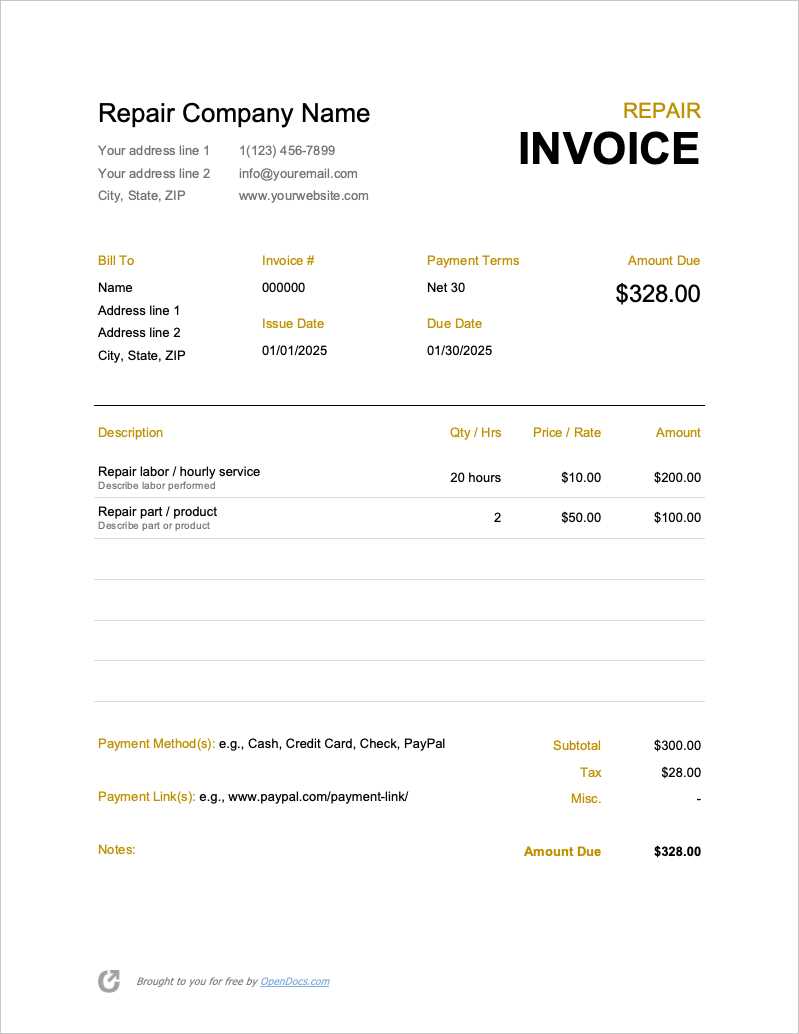

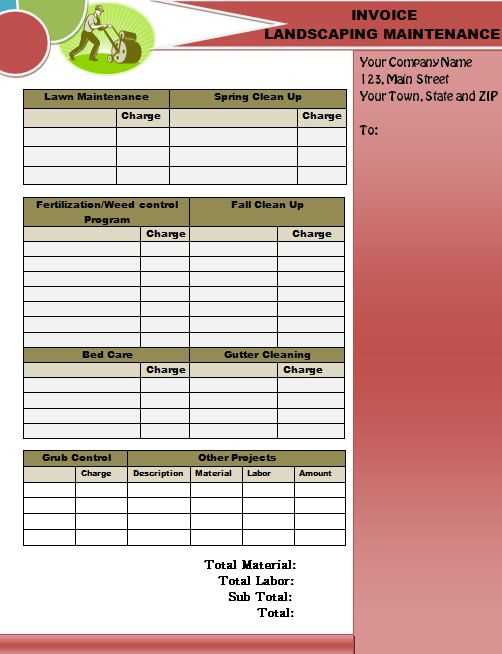

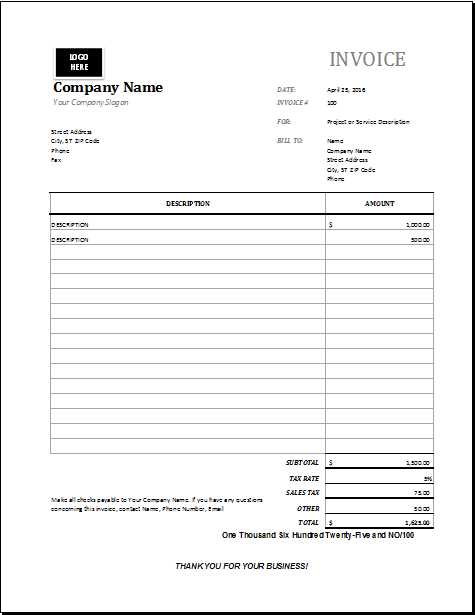

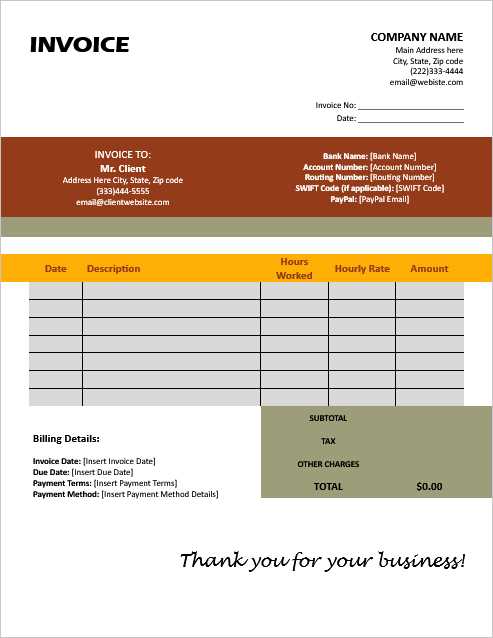

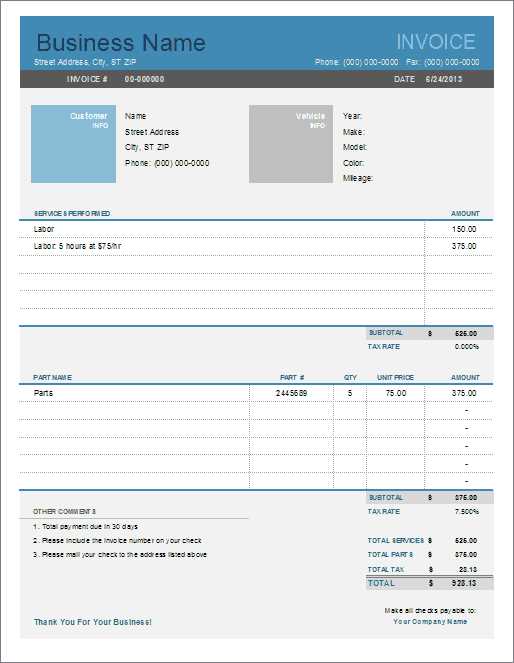

The most important feature of a well-structured billing document is a detailed description of the work performed. Each service should be listed separately with the corresponding cost for transparency. Additionally, any materials used or additional charges should be clearly identified. This breakdown of charges allows the recipient to understand exactly what they are paying for.

Proper Contact Information and Terms

Another essential element is including accurate contact details for both parties involved in the transaction. This ensures that if there are any issues or questions, they can be resolved quickly. Additionally, specifying the payment terms, including the due date and acceptable methods of payment, helps set expectations and avoid delays in processing payments.

How to Create a Maintenance Invoice Template

Creating a well-structured document for service charges can be an essential step for businesses aiming to streamline their billing process. With a clear format, both parties can easily understand the work completed and the associated costs. To create an effective billing document, it’s important to start with a simple and organized layout that includes all the necessary details.

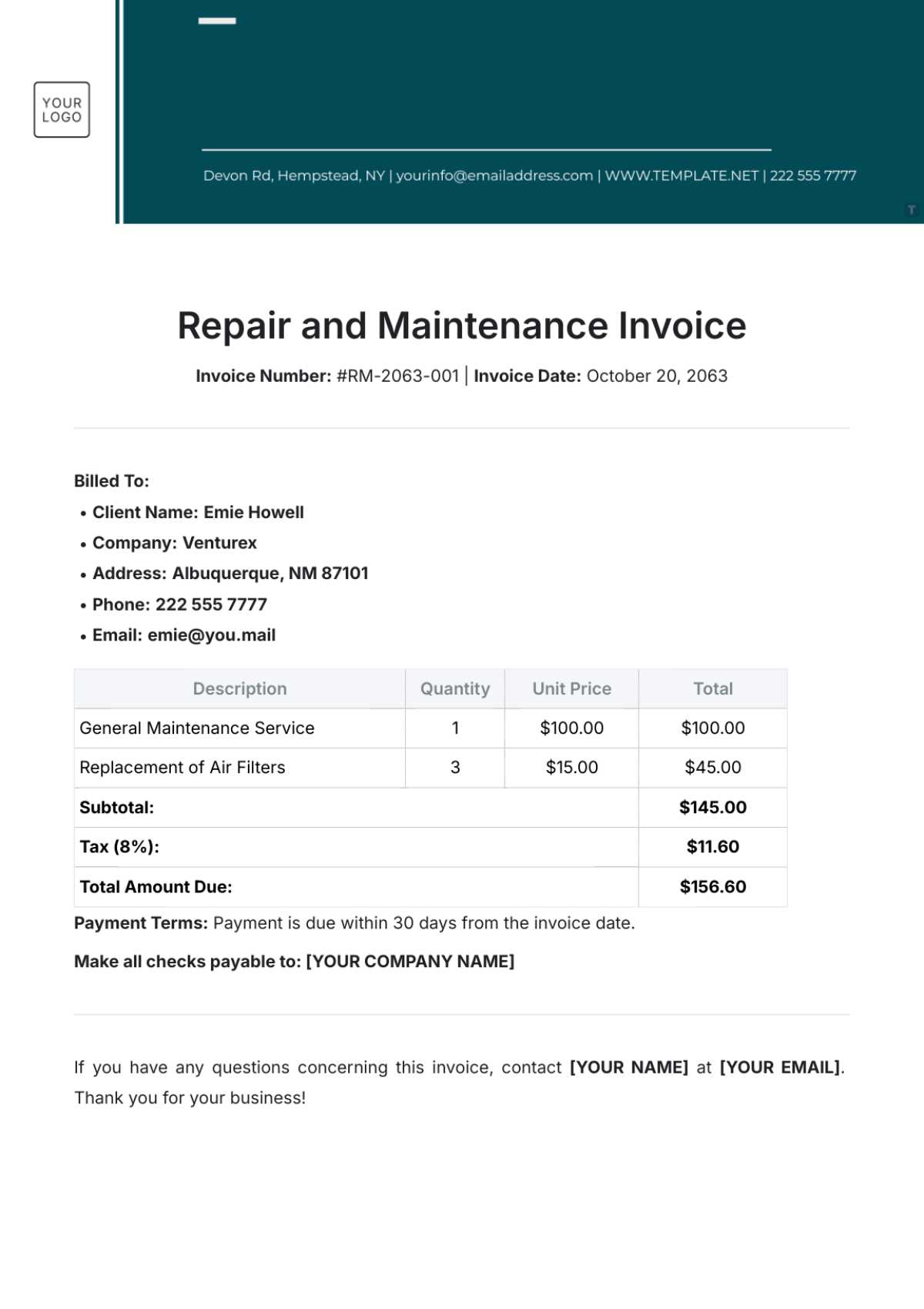

Start with a Professional Layout

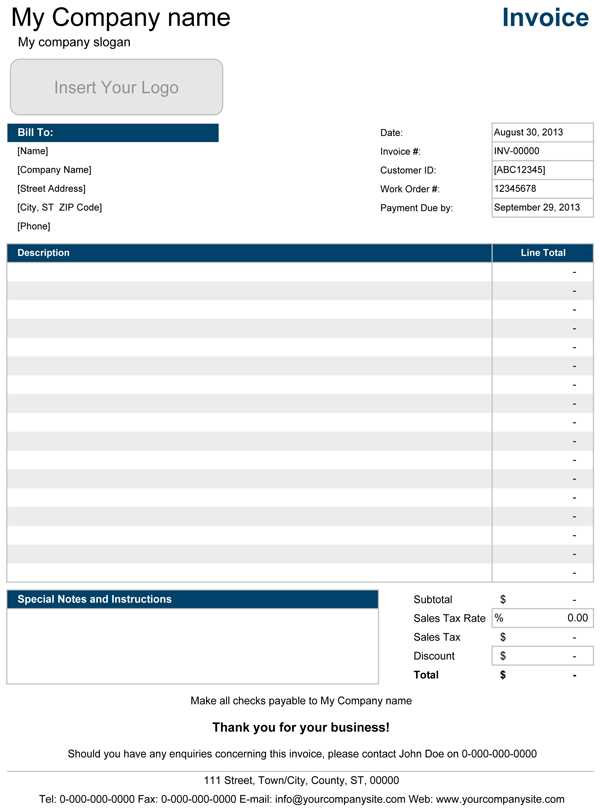

The first step in designing a functional billing document is choosing a clean, professional layout. Use consistent fonts, clear headings, and well-spaced sections for easy reading. The layout should be simple, ensuring that essential information such as the service provider’s contact details, the client’s information, and the breakdown of costs are clearly visible. A user-friendly design will help avoid confusion and create a positive impression.

Include Key Information for Accuracy

Ensure the document includes all relevant details such as the date of service, a detailed list of tasks performed, and any products or materials used. Each service or item should have its own line with an associated cost to ensure clarity. Including terms of payment–such as the due date and accepted methods–helps manage expectations. Don’t forget to add your business name and contact details for easy follow-up if needed.

Top Benefits of Using Billing Templates

Using pre-designed structures for documenting charges brings several advantages to both service providers and clients. These ready-made formats save time and ensure accuracy in every transaction, allowing businesses to focus on their core services while maintaining professionalism in financial communications. With the right format, managing payments becomes more efficient and streamlined.

Time Efficiency and Consistency

One of the primary benefits of using pre-built formats is the significant time savings. By using a consistent layout, businesses can quickly generate documents without worrying about starting from scratch each time. Key advantages include:

- Quick Generation: Pre-made fields allow you to enter details rapidly.

- Uniformity: Each document follows the same structure, promoting consistency across all communications.

- Reduced Errors: Automated formats reduce the chance of forgetting essential details.

Professional Appearance and Accuracy

Templates also help maintain a professional image. The polished look of these documents enhances trustworthiness and confidence in clients. Additionally, they ensure that all important elements are included, reducing the likelihood of mistakes. Key benefits include:

- Standardized Design: Presenting a professional format to clients reinforces the business’s credibility.

- Complete Information: Templates include all necessary fields, ensuring accuracy and avoiding missed details.

- Clear Breakdown: A structured format allows clear itemization of services and costs.

Customizing Your Billing Document Layout

While pre-designed formats provide a solid foundation, personalizing your billing document can make it more relevant to your business needs and client expectations. Customization allows you to incorporate branding elements, adjust sections based on the services you offer, and ensure that all the necessary details are highlighted in a way that suits your operations.

Adding Your Branding Elements

One of the simplest ways to personalize your document is by including your business logo, company name, and contact details at the top. This adds a professional touch and makes the document instantly recognizable to clients. Additionally, choosing a color scheme that aligns with your brand helps reinforce your company’s image and creates a cohesive look across all your communications.

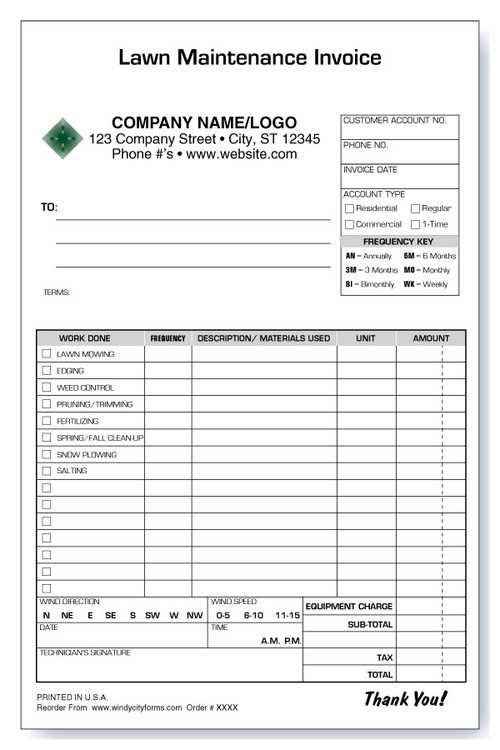

Adjusting Layout to Fit Your Services

Every business is unique, and your document should reflect the specific services you offer. For example, if you regularly work with different pricing tiers, you can create sections that highlight these variations. You can also add specialized fields, such as service categories or discounts, that are relevant to your pricing structure. Customizing the layout in this way ensures that every detail is captured and easily understood by your clients.

Common Mistakes to Avoid in Billing Documents

When preparing billing documents, small errors can lead to confusion, delayed payments, or even disputes. It’s important to ensure that each detail is correct and clearly presented. Common mistakes often arise from overlooking minor but crucial elements, which can ultimately affect the efficiency and professionalism of the transaction process.

Here are some of the most frequent errors to watch out for:

- Missing Contact Information: Failing to include either your contact details or those of the client can result in delays if follow-up is needed.

- Unclear Service Descriptions: Not providing enough detail about the work performed or materials used can lead to misunderstandings about what the client is paying for.

- Incorrect Pricing: Typos in rates, quantities, or totals can cause confusion and disputes. Double-checking numbers is essential.

- Omitting Payment Terms: Leaving out important payment terms, such as due dates and methods of payment, can delay processing and result in missed deadlines.

- Inconsistent Formatting: Using different fonts, colors, or layouts throughout the document can make it look unprofessional and harder to read.

Free Templates for Billing Documents

Finding high-quality, free resources for creating billing documents can be a great way to save time and ensure accuracy. Many online platforms offer pre-designed structures that are easy to customize and adapt to your specific needs. These free formats allow businesses to create professional documents quickly without the need for expensive software or design expertise.

Here are some key advantages of using free resources:

- Cost-Effective: Accessing free designs eliminates the need for purchasing premium software or hiring professionals to create a custom layout.

- Easy Customization: Most free options are editable, allowing you to add your own branding, pricing structure, and other specific details.

- Instant Access: Many websites provide immediate downloads, so you can start using the layout without delays.

- Variety of Designs: With a wide range of available formats, you can find a style that matches your business’s tone and needs.

Free resources not only save money but also provide the flexibility to create professional, customized billing documents that meet your specific requirements.

Best Practices for Billing Document Formatting

Creating a clean and professional appearance in your billing documents is crucial for ensuring clarity and building trust with your clients. A well-organized document helps avoid confusion, reduces the chances of errors, and ensures that all necessary details are easy to find. The layout should facilitate smooth communication and reflect the professionalism of your business.

Here are some key formatting practices to follow:

- Clear Section Headings: Use bold, larger fonts for headings to separate different parts of the document, such as service descriptions, payment terms, and contact information. This helps the reader quickly locate important sections.

- Consistent Font Style: Stick to one or two easy-to-read fonts throughout the document. Avoid using decorative fonts that can distract from the content.

- Well-Spaced Layout: Ensure there is adequate spacing between sections, making the document less cluttered and more visually appealing. Proper spacing also makes it easier for the recipient to read and understand the information.

- Highlight Key Information: Use bold or italics for important details such as payment due dates, totals, or contact information. This ensures they stand out and are not overlooked.

- Readable Currency and Numbers: Clearly format the monetary amounts and quantities to avoid confusion. Always use a consistent format for currency, and ensure decimal points are aligned for easy comparison.

Following these formatting practices ensures that your billing documents are not only professional but also functional, making the payment process smoother for both you and your clients.

Tracking Payments with Billing Documents

Effective tracking of payments is essential for managing cash flow and maintaining financial organization. By incorporating specific tracking features into your billing documents, you can easily monitor which payments have been received, which are pending, and which require follow-up. This ensures that you stay on top of your finances and can quickly address any payment-related issues that arise.

Including Payment Status Fields

One of the most effective ways to track payments is by adding a clear section that specifies the payment status. By including checkboxes or fields for “Paid”, “Pending”, or “Overdue”, you create a quick reference that helps you track outstanding payments at a glance. This also provides your clients with a clear picture of what has been paid and what remains due.

Setting Up Payment Due Dates

Another essential element for tracking payments is specifying the due date for each charge. This allows both you and the client to know when payment is expected, making it easier to follow up if necessary. Including a section for “Date Paid” alongside the due date ensures you can easily track when payments were actually made and confirm their accuracy.

How to Add Taxes and Fees to Billing Documents

When preparing a billing document, it’s important to account for taxes and additional fees that may apply to the service or product provided. These charges need to be clearly outlined so that both you and the client have a transparent understanding of the total amount due. Including tax rates, service fees, or any other charges ensures that the final amount is calculated accurately and that your business stays compliant with legal requirements.

Calculating and Including Taxes

To ensure accuracy when adding taxes, first determine the appropriate tax rate based on the jurisdiction where the service was provided. Then, calculate the tax amount by applying the rate to the subtotal of your charges. The tax should be listed as a separate line item so that it’s clear how much is being added to the base cost.

Adding Additional Fees

If there are extra charges, such as service fees or delivery costs, these should also be clearly stated. Like taxes, these should be broken out in the document to avoid confusion. Below is an example of how these charges can be presented:

| Description | Amount |

|---|---|

| Service Charge | $50.00 |

| Tax (5%) | $10.00 |

| Total Due | $160.00 |

By clearly breaking down taxes and additional fees, you ensure transparency and prevent misunderstandings with your clients. Always double-check the calculations to ensure accuracy before finalizing the document.

Digital vs Printable Billing Document Layouts

When managing your financial records, choosing between a digital or printable format for your billing documents depends on your business needs and client preferences. Both options offer unique advantages and potential drawbacks. Understanding the differences can help you decide which format works best for your operations and how you interact with clients.

Advantages of Digital Formats

Digital formats are often more convenient for businesses that handle a large volume of transactions. These documents can be easily created, stored, and shared electronically, saving time and reducing paper waste. Digital billing also allows for faster payments, as clients can pay online directly from the document. Additionally, you can automate parts of the process, such as tax calculations and payment reminders.

Advantages of Printable Formats

Printable layouts provide a tangible record that can be handed over to clients in person, mailed, or included in physical files. This format is useful for businesses with clients who prefer traditional paper-based documentation or when hard copies are required for legal or accounting purposes. Printable documents also offer the flexibility to be signed manually if needed.

| Feature | Digital Format | Printable Format |

|---|---|---|

| Convenience | Easy to create, store, and share electronically | Requires printing and physical distribution |

| Speed | Faster transactions, quick online payments | Slower payment process, requires mailing or in-person delivery |

| Cost | No paper or printing costs | Costs associated with paper, ink, and postage |

| Security | Encryption and password protection options | Risk of loss or damage to physical documents |

In conclusion, digital formats offer speed, convenience, and lower costs, while printable formats provide a more traditional and formal approach to billing. Choosing the right option depends on your business type, client preferences, and the level of automation you desire.

Billing Documents for Small Businesses

For small businesses, managing financial transactions efficiently is crucial for maintaining smooth operations and healthy cash flow. Utilizing structured billing documents helps business owners keep track of services provided, amounts due, and payment deadlines. The right document layout can make the billing process straightforward, professional, and easy to understand for both the business and its clients.

Simple and Clear Designs

Small businesses often benefit from streamlined, easy-to-understand formats that focus on the essentials. A well-organized billing document should clearly list the services or products provided, the cost associated with each item, taxes, and any applicable discounts. Providing this information in a concise and transparent manner ensures clients can quickly comprehend what they are paying for and reduces the chance of disputes.

Customizing to Your Brand

Customizing billing documents to reflect your business’s branding helps create a professional image and fosters trust. Adding your company’s logo, color scheme, and contact details not only makes the document look more polished but also ensures that clients easily recognize your business. Personalization enhances the customer experience and can make it easier to track payments and correspondence.

For small businesses, using the right billing layout can save time and improve client relationships, making financial transactions smoother and more efficient.

How to Include Labor and Material Costs

When preparing a billing document, it’s important to clearly outline the costs associated with both the labor provided and the materials used. These two components are essential for giving clients a transparent breakdown of the total amount due. Including these charges separately helps to avoid misunderstandings and ensures that both parties understand what is being charged and why.

Labor Costs

Labor costs typically include the time spent by workers on the project, whether it’s for repairs, installation, or any other services provided. When including labor charges, make sure to:

- Specify the hourly rate: Indicate the rate charged for each worker involved in the service.

- Detail the time spent: Break down the number of hours worked and include a brief description of tasks performed.

- Include worker information: If necessary, list the names or positions of workers to provide transparency.

Material Costs

Materials used during the job should also be clearly itemized. This includes everything from raw materials to special tools or equipment that were purchased for the task. When including material costs, consider the following:

- Itemize each material: List each product or material used, along with the quantity and unit price.

- Include any applicable taxes or fees: Make sure to factor in taxes that apply to the materials purchased.

- Provide receipts or proof of purchase: If possible, attach receipts or references to material costs for verification.

By carefully detailing both labor and material costs, you can create a clear, fair, and professional billing document that reflects the true value of the work performed.

Streamlining Your Billing with Layouts

Efficient billing is essential for smooth business operations. By using well-designed document layouts, you can automate many aspects of the process, saving time and reducing errors. Streamlining your billing process not only improves the experience for your clients but also helps ensure that you get paid promptly and accurately.

Using pre-designed layouts simplifies the creation of billing documents by providing a consistent structure that you can adapt for each job. This consistency ensures that all necessary information is included and that you can produce professional documents quickly. A streamlined approach also allows for better tracking and management of financial records.

| Benefit | Explanation |

|---|---|

| Consistency | Pre-designed layouts ensure that all relevant details are always included. |

| Time-saving | With a standardized format, you can quickly fill in specific details without needing to start from scratch each time. |

| Accuracy | A well-structured layout reduces the risk of omitting important information, like charges or client details. |

| Professionalism | A clean and consistent format gives a professional impression to clients, enhancing trust. |

By adopting a streamlined approach, businesses can make billing faster, easier, and more efficient. Whether using a digital or printable format, utilizing a standardized layout helps you stay organized and maintain a professional image.

Ensuring Accurate Details in Your Billing Documents

Accuracy is essential when preparing billing records, as any mistake can lead to confusion, delayed payments, or even disputes with clients. Ensuring that all the information is correct not only builds trust but also helps you maintain a professional reputation. Careful attention to detail is key in providing clear and transparent documents for your clients.

Key Information to Double-Check

Before finalizing your billing document, verify the following key details:

- Client Information: Ensure that the client’s name, address, and contact details are correct and up-to-date.

- Service Descriptions: Clearly list all services or products provided, including dates and a brief description of each.

- Amount Charged: Confirm that the amounts for services, materials, and any applicable fees are accurate, including any discounts or adjustments.

- Payment Terms: Specify payment deadlines, methods, and any late fees or interest charges that may apply.

- Tax Information: Double-check tax calculations to ensure they are accurate and comply with local regulations.

Reviewing Before Sending

It’s always a good idea to review the document one last time before sending it to your client. A second review can help catch errors that may have been overlooked initially. You may also want to have a colleague or another team member review the document for accuracy. This added step can further reduce the chances of mistakes and ensure that the document reflects your business’s professionalism.

By ensuring accurate details in your billing documents, you provide a transparent, trustworthy experience for your clients, ultimately fostering stronger relationships and smoother transactions.

Legal Requirements for Billing Documents

When preparing any kind of billing document, it’s essential to adhere to legal requirements to ensure compliance with tax laws and avoid potential disputes. The specific rules may vary depending on your location, industry, and type of services provided. Being aware of these legal obligations helps protect your business and ensures that your clients receive clear, legitimate documents.

Key Legal Elements to Include

To comply with legal standards, make sure that your billing document includes the following details:

- Business Information: Include your company’s legal name, address, contact details, and business registration number.

- Client Information: Clearly list the client’s name and contact details.

- Unique Reference Number: Every document should have a unique number for identification and tracking purposes.

- Detailed Breakdown of Services: Provide a clear list of services or products, with dates and individual prices, to avoid confusion.

- Tax Details: Include relevant tax information, such as the applicable tax rate and the amount of tax charged, if necessary. Ensure compliance with local tax regulations.

- Payment Terms: State the payment due date, the accepted payment methods, and any late fees or interest charges for overdue payments.

Additional Considerations

Some regions may have additional rules regarding the inclusion of specific information, such as environmental fees or labor charges. It is also important to keep copies of all documents for record-keeping and auditing purposes. Ensure that you are aware of the legal requirements in your area to avoid non-compliance and any potential penalties.

By following the legal requirements for billing documents, you safeguard your business, reduce the risk of legal issues, and establish a professional, trustworthy relationship with your clients.

How to Manage Recurring Billing Documents

For businesses that provide ongoing services, managing recurring billing records can be a crucial task. Establishing a system for these repetitive transactions helps ensure that payments are processed on time and that your clients are charged consistently. A streamlined approach also reduces the potential for errors and missed payments, providing a stable cash flow for your business.

To efficiently handle recurring charges, it’s essential to automate the process as much as possible. You can set up billing cycles, track payment dates, and customize the details of each document. This way, you ensure that both the service provided and the charges reflect the agreed-upon terms, without requiring manual input for each cycle.

Steps to Set Up Recurring Billing

Follow these steps to simplify your recurring billing process:

- Define Billing Frequency: Decide on the interval for recurring charges (weekly, monthly, quarterly) and ensure that both you and your client are in agreement.

- Create a Template: Use a standardized format that you can easily adapt for each cycle. This saves time and ensures consistency in the details included.

- Set Up Reminders: Schedule automated reminders for clients and for your own tracking, ensuring that no payment or document is overlooked.

- Track Payments: Keep an accurate record of all transactions to quickly identify overdue payments or discrepancies.

- Review Terms Periodically: Regularly assess the pricing, terms, and conditions of your services to make adjustments as needed.

By organizing and automating your recurring transactions, you can reduce manual effort and maintain a professional, reliable service for your clients, while ensuring that payments are processed smoothly every time.

Improving Cash Flow with Billing Documents

Effective management of financial transactions is vital for maintaining a healthy cash flow in any business. The timely and accurate creation of payment requests ensures that clients are billed correctly and promptly, reducing delays and improving the speed at which payments are received. By optimizing your billing practices, you can establish a more predictable revenue stream, reduce late payments, and keep your business financially stable.

Strategies to Enhance Cash Flow

There are several strategies you can employ to boost your cash flow through efficient billing practices:

- Clear Payment Terms: Set clear expectations regarding payment deadlines, methods, and any late fees. This will encourage clients to settle their bills on time.

- Prompt Billing: Send payment requests as soon as the service is completed or within a pre-agreed timeframe to ensure that payments are processed without delay.

- Automated Reminders: Use automated systems to remind clients about upcoming or overdue payments. This can help prevent missed deadlines and encourage quicker responses.

- Offer Incentives: Consider offering discounts for early payments or charging interest for late payments. This can incentivize clients to pay faster.

- Monitor Overdue Accounts: Regularly review accounts for any overdue payments and follow up promptly to resolve any outstanding issues.

Automating the Process

Automating your payment request process can also help improve cash flow by reducing the time and effort spent on manual tasks. Automated systems can generate and send billing documents, track payment statuses, and even send reminders when payments are due. This allows you to focus on providing quality services while ensuring that payments are handled efficiently and on time.

By improving your approach to financial transactions, you not only enhance cash flow but also foster stronger, more professional relationships with your clients, leading to more reliable and consistent income for your business.