Monthly Invoice Template for Easy Billing and Payment Tracking

Efficient billing is crucial for maintaining a steady cash flow and professional relationships with clients. Using a well-organized document for billing purposes ensures accuracy, saves time, and improves overall financial management. Whether you’re a freelancer, small business owner, or contractor, having a structured way to bill your clients can simplify your accounting and reduce errors.

Automating or customizing your payment requests can help you stay on top of deadlines, track paid and unpaid amounts, and maintain consistency across your communications. With the right approach, invoicing becomes less of a task and more of a streamlined process that supports your business’s growth.

In this guide, we’ll walk you through the essential components needed to create a professional billing document, offer tips on how to personalize it, and show you how to keep everything organized and clear for both you and your clients.

Monthly Invoice Template Overview

Having a structured document for billing purposes is essential for any business that provides ongoing services or products. This type of document serves as a formal request for payment and helps ensure that financial transactions are clear and transparent. By utilizing a consistent format, you can simplify the payment process for both your clients and your team.

The key to an effective billing form lies in its simplicity and clarity. It should clearly outline the services rendered, the amount due, and any terms related to payment. Customization options allow you to adapt the layout to your brand, while ensuring all necessary information is easily accessible and understandable. Streamlining this process not only saves time but also fosters better financial communication between you and your clients.

In the following sections, we will explore how to create, customize, and use a well-organized document that suits your business needs, helping you maintain an efficient payment cycle every time.

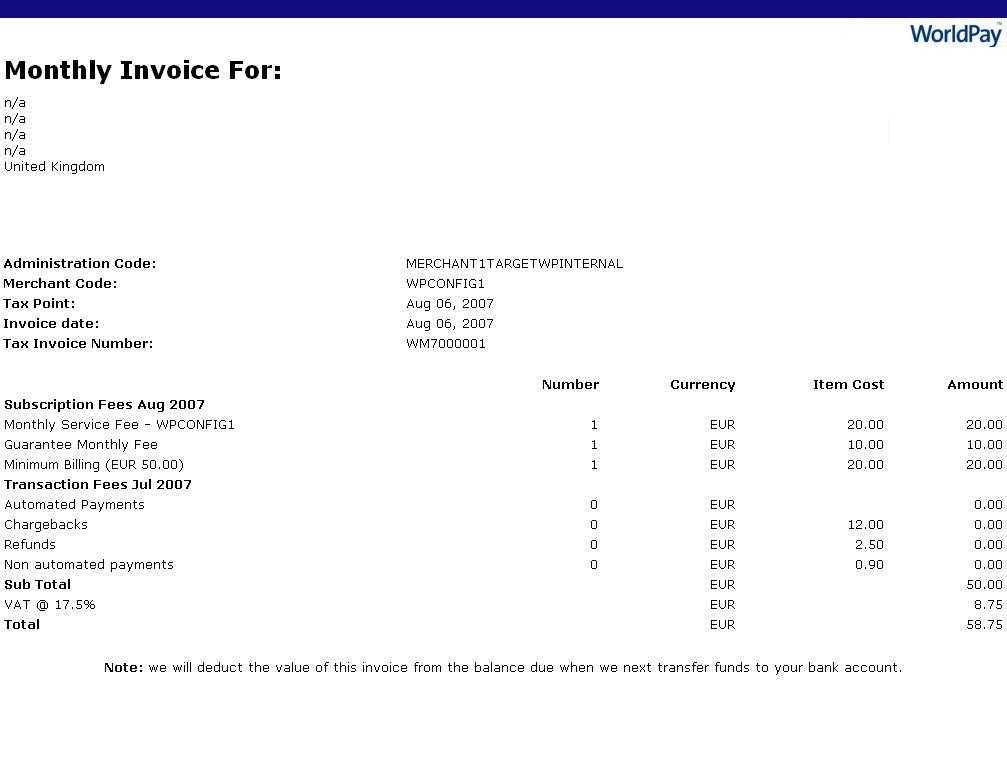

What is a Monthly Invoice Template

A billing document is a formal request for payment for services or goods provided over a specific period. It outlines the details of the transaction, including the amounts due, the services or products rendered, and any applicable terms of payment. This structured document ensures both parties are clear on the financial expectations and helps facilitate a smooth exchange of money for services.

Key Elements of a Billing Document

Typically, a well-organized billing document includes several key components to ensure transparency and accuracy. These elements make it easy for both the business owner and the client to understand the charges and terms involved. Below is an overview of these important sections:

| Element | Description |

|---|---|

| Client Information | Name, address, and contact details of the client. |

| Service Details | A clear breakdown of the services provided or products delivered. |

| Amount Due | The total amount to be paid, including any taxes or additional charges. |

| Payment Terms | Details on how and when payment is expected, including due dates and late fees. |

| Company Information | Your business name, contact information, and payment instructions. |

Why It’s Important

Using a clear and professional billing document not only ensures accuracy but also helps maintain a positive relationship with clients. It provides both parties with a record of the transaction, reducing the risk of disputes and misunderstandings. This document can also serve as an important tool for bookkeeping and tracking payments.

Why Use a Monthly Invoice Template

Utilizing a structured billing document offers numerous advantages for businesses and freelancers alike. By adopting a standardized format, you can ensure consistency and professionalism in your financial communications. This not only saves time but also reduces the likelihood of errors, making the payment process smoother for both you and your clients.

One of the key benefits of using a ready-made form is the ability to quickly generate clear and accurate statements. Rather than starting from scratch each time, having a predefined structure ensures that you don’t miss any important details. It also helps maintain a uniform approach to how services and payments are presented, which improves your business’s overall organization.

Benefits of Using a Standardized Billing Document

| Benefit | Description |

|---|---|

| Time-Saving | Predefined formats allow for quick customization, reducing time spent creating new documents. |

| Consistency | Every document follows the same format, creating a professional and uniform appearance. |

| Accuracy | Ensures all necessary information is included, reducing the chance of mistakes or omissions. |

| Legal Protection | Clear terms and payment details reduce the risk of disputes and provide documentation in case of legal issues. |

| Better Financial Tracking | Helps keep an organized record of payments and outstanding balances for future reference. |

By implementing a consistent and efficient approach to billing, you not only improve your own workflow but also establish a

Benefits of Customizing Your Invoice

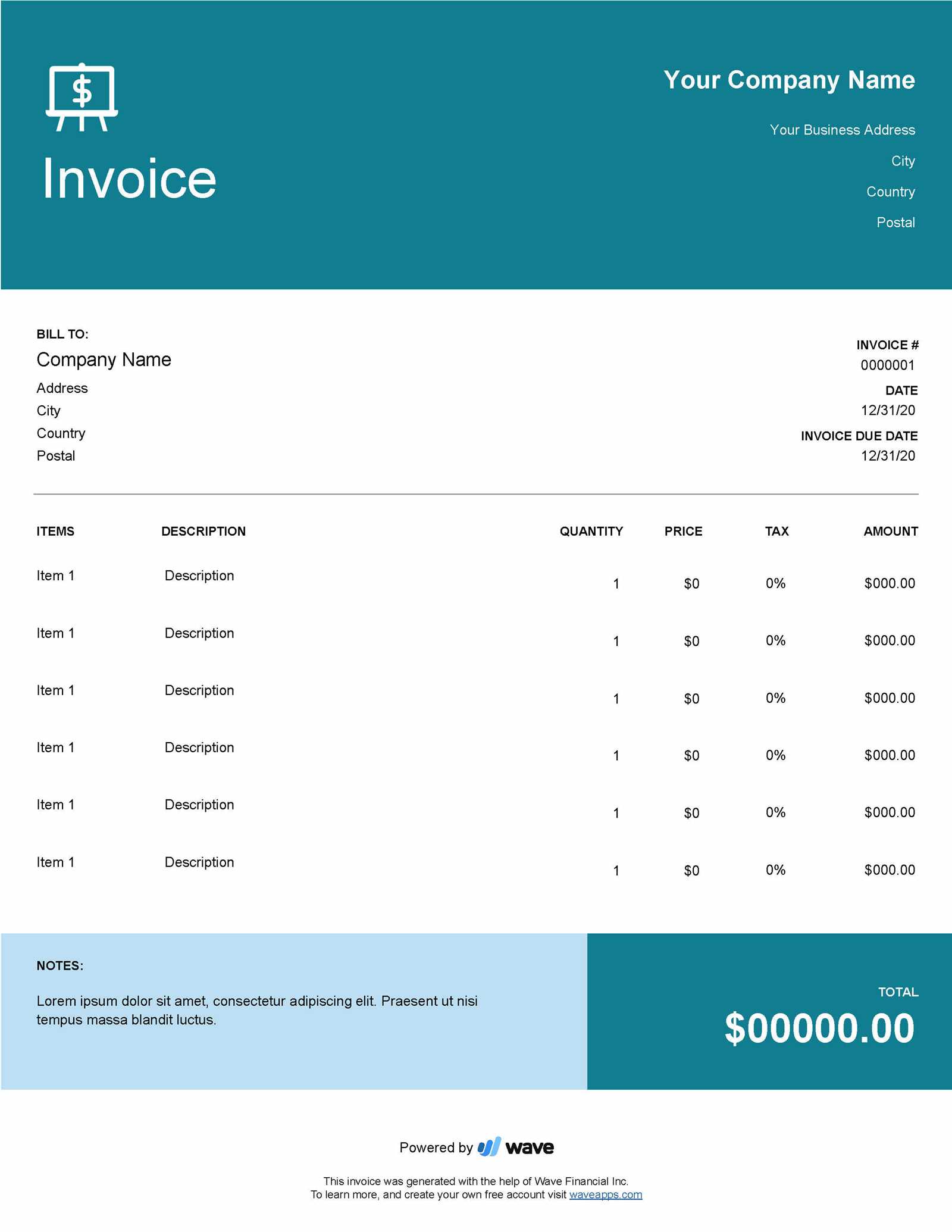

Personalizing your billing documents provides a number of advantages that go beyond just looking professional. By tailoring the format to suit your business needs, you can ensure the document reflects your brand identity while making the payment process more efficient for both you and your clients. Customization helps you include all relevant details and adjust the layout to better serve your workflow.

In addition to improving the document’s functionality, customizing your payment request also enables you to enhance communication with clients. When clients see a familiar and well-designed document, it builds trust and credibility. Moreover, you can highlight important information, such as payment terms or upcoming due dates, ensuring nothing is overlooked.

Advantages of Tailoring Your Billing Documents

| Advantage | Description |

|---|---|

| Brand Consistency | Incorporate your logo, colors, and fonts to maintain a professional brand image across all business communications. |

| Clear Communication | Highlight important information such as deadlines, payment methods, and late fees, making it easier for clients to follow. |

| Client Trust | A custom format reinforces credibility and helps foster a more professional relationship with clients. |

| Improved Accuracy | Personalization ensures that the document includes all necessary details specific to the transaction, minimizing errors. |

| Efficient Workflow | A customized structure can streamline the process, making it quicker and easier to generate and send documents. |

Flexibility for Your Business Needs

By adapting your documents to suit your specific needs, you can ensure that your billing process remains efficient and professional. Customization allows you to meet the unique requirements of your clients and your business, all while maintaining

How to Create a Monthly Invoice

Establishing a system to request timely payments is essential for maintaining a steady cash flow and keeping your business operations running smoothly. Designing a document that clearly outlines service details, due dates, and total costs can streamline your billing process.

To start, outline the fundamental sections that should be included. Begin with a header containing your business name, contact details, and a unique identifier for the transaction. This provides clarity and ensures easy identification of each statement for both you and your client.

Next, organize the main body, which should list all provided services or products in an itemized form. Detail each service with descriptions, quantities, and individual rates to offer complete transparency. This way, clients can easily review what they’re paying for.

In the final section, include the total amount due, preferred payment methods, and the

Key Elements of an Invoice Template

To ensure effective billing, it’s crucial to create a document that includes all necessary details in a clear, easy-to-read format. Each section plays a role in providing clarity, reducing misunderstandings, and ensuring prompt payments.

Essential Information

Begin with the primary information that helps to identify the document and the transaction. This includes your business name, contact details, and a unique reference number. Including the date when the bill is issued is also important, as it serves as a point of reference for both you and the client.

Itemized Breakdown

To provide transparency, outline the services or products in an organized table format. Each item should include a description, quantity, rate, and total cost, allowing clients to see a detailed breakdown of charges.

| Service/Product | Description | Quantity | Rate | Total |

|---|---|---|---|---|

| Consulting | Project

Free Monthly Invoice Templates for DownloadFinding reliable resources for downloadable forms that help streamline billing tasks can be invaluable for businesses of all sizes. Ready-made formats save time and ensure that your documents meet professional standards without needing to create them from scratch. Why Use Downloadable Billing Formats?Pre-designed files make it simple to include all necessary sections, such as contact details, service descriptions, and totals. Using a consistent structure across all your documents also makes record-keeping easier and helps clients quickly understand their charges. Choosing the Right FormatVarious formats are available for download, including PDF, Word, and Excel, allowing flexibility in customization. PDF files are ideal for maintaining a fixed layout, while Excel sheets allow for easy calculation adjustments, especially if rates change frequently. Word documents offer flexibility in design, making it easy to personalize branding and other visual elements. Explore these options and select the best fit based on your business needs and preferences. Free resources make it convenient to maintain a professional appearance without the nee Best Tools for Customizing InvoicesUtilizing the right software can significantly enhance the process of creating tailored billing documents that suit your business needs. These tools provide a range of features to help you adjust layouts, add branding, and streamline your workflow with ease. Popular Software Options

Steps for Using Customization Tools

|