Easy to Use Sub Contractor Invoice Template for Your Business

When working with independent contractors or external partners, clear and accurate documentation is essential for smooth financial transactions. A well-organized payment request can prevent misunderstandings and ensure timely compensation. Properly structured billing documents not only outline the services provided but also set clear expectations for both parties involved.

Effective financial paperwork should be easy to understand and contain all necessary information. This includes the details of the work completed, agreed payment terms, and any other critical facts. Additionally, customizing these documents according to your specific needs helps maintain a professional image while streamlining the payment process.

By utilizing a customizable format, you can quickly adapt to various clients, services, or project types, ensuring that no important details are overlooked. This approach not only simplifies the billing process but also builds trust with partners and clients.

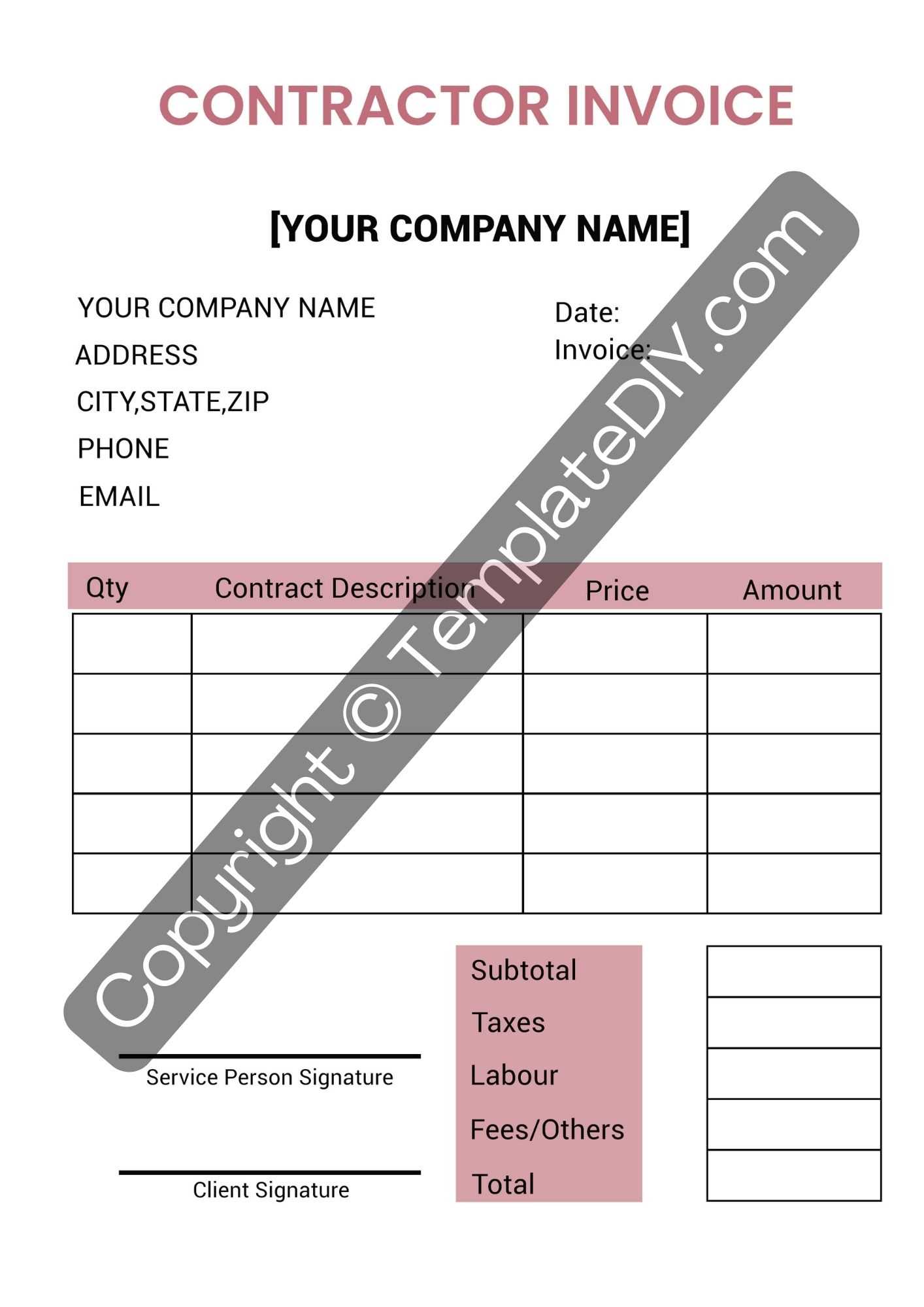

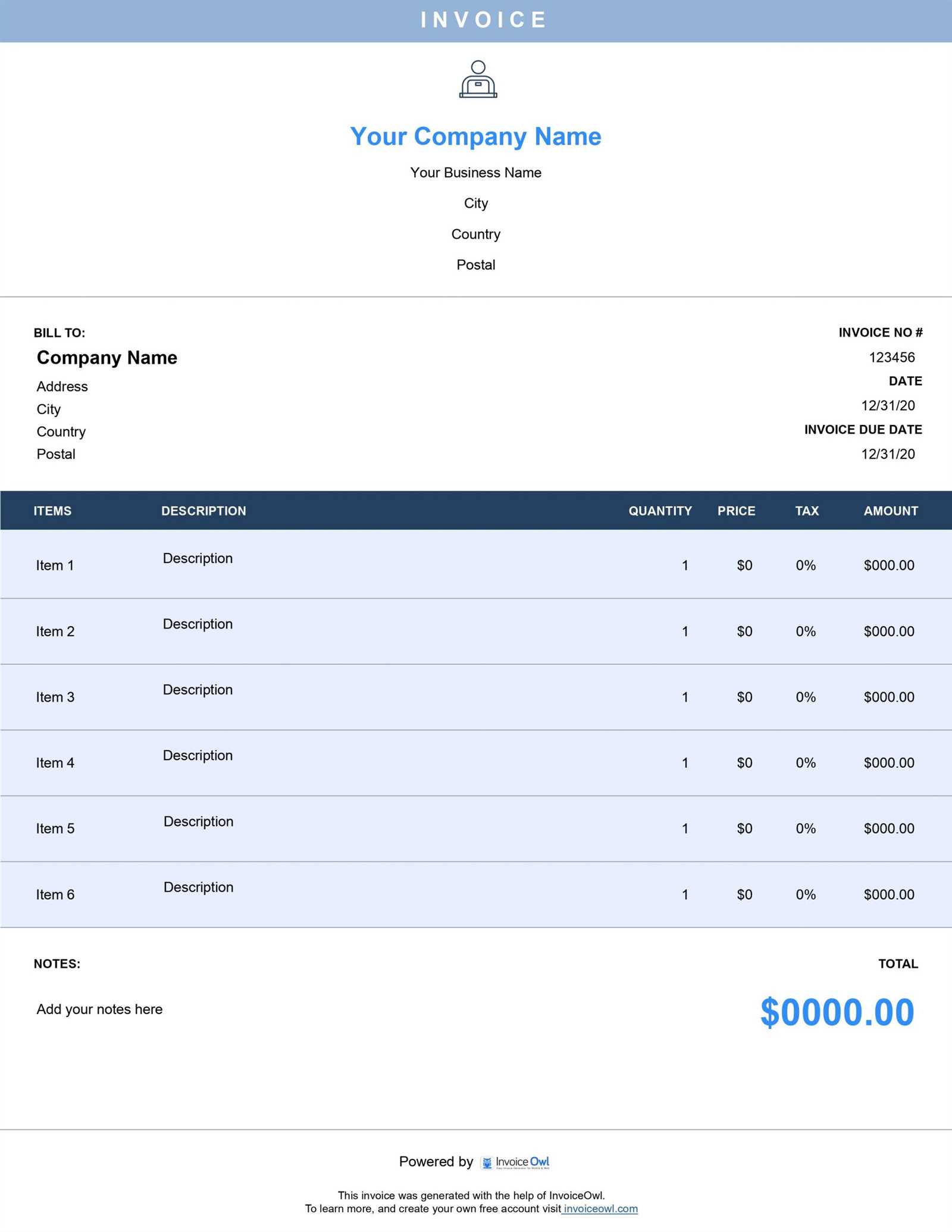

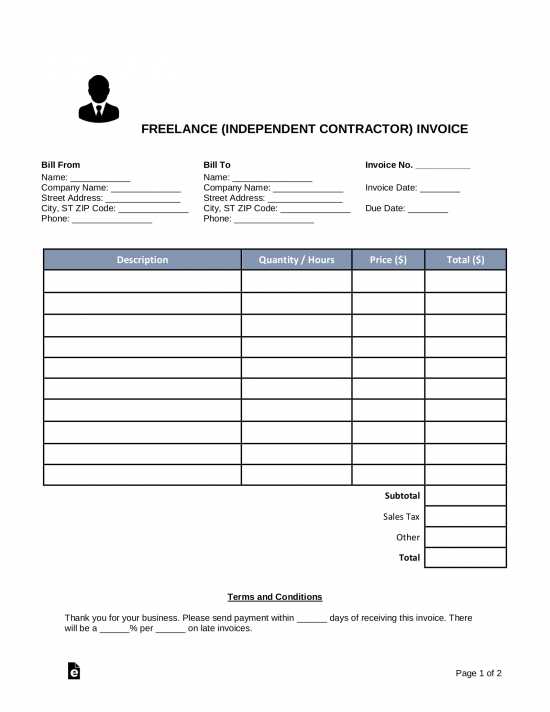

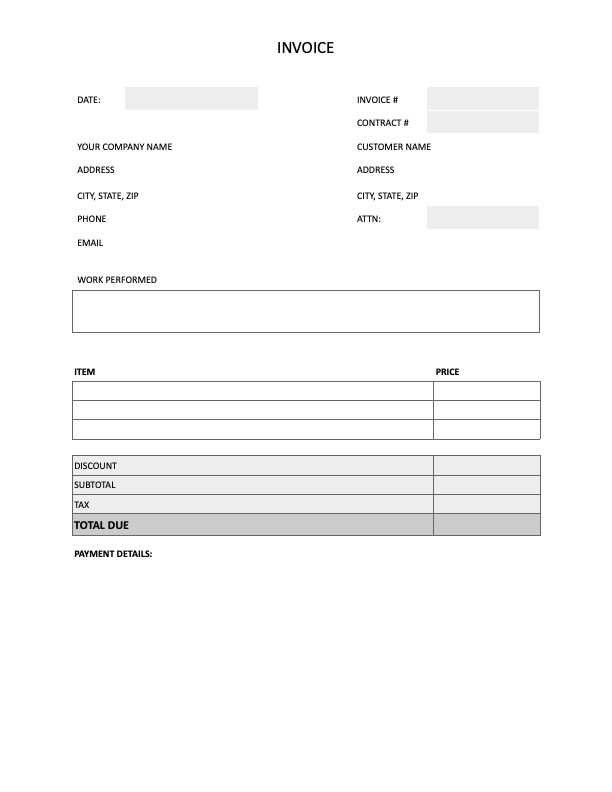

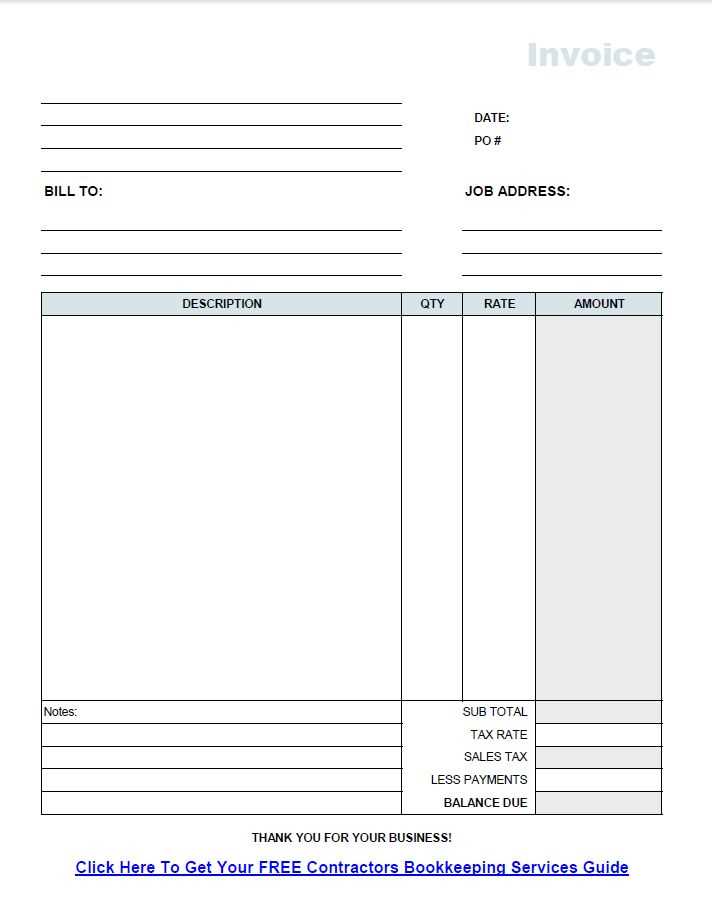

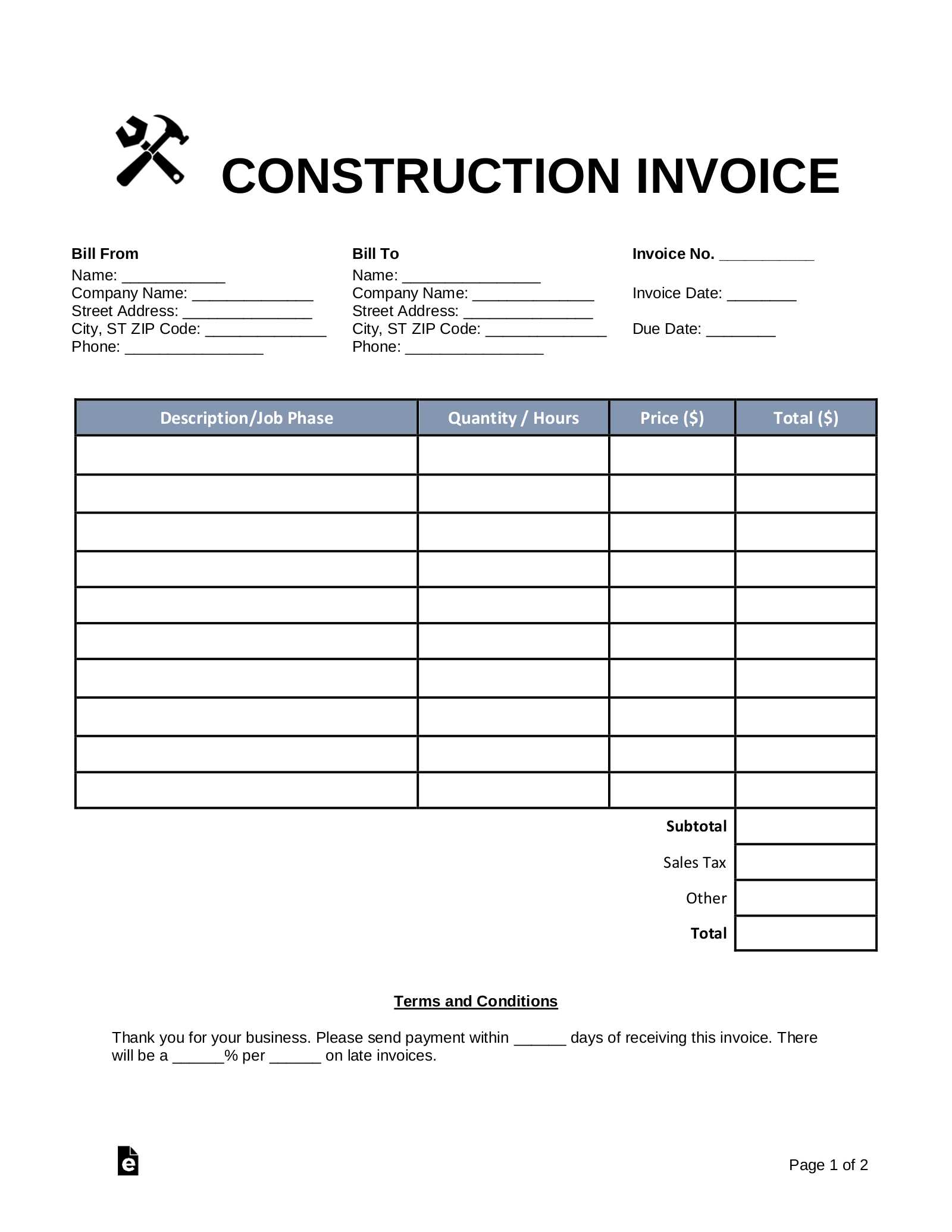

Creating a complete and professional request for payment involves more than just listing services and costs. To ensure clarity and prevent misunderstandings, certain critical elements must be included in any formal financial document. These key components help establish trust between the service provider and the client while making the payment process straightforward.

Essential Information to Include

- Client Information: The name, address, and contact details of both the service provider and the recipient of the payment.

- Clear Description of Services: A detailed breakdown of the tasks completed, along with dates of service and any relevant project identifiers.

- Total Amount Due: The agreed-upon payment for the services rendered, including any applicable taxes or fees.

- Payment Terms: Information on when the payment is due, including any early payment discounts or late fees if applicable.

- Payment Method: Instructions on how the payment should be made, such as bank transfer, check, or online payment systems.

- Reference Numbers: Any contract or project number that will help identify the transaction for both parties.

Formatting for Clarity

- Easy-to-Read Layout: The document should have a clean, organized structure with sections clearly labeled.

- Accurate Dates: Include the date of service and the date the payment is due to avoid confusion.

- Itemized List: Break down the total amount into individual line items to show the cost per service or product provided.

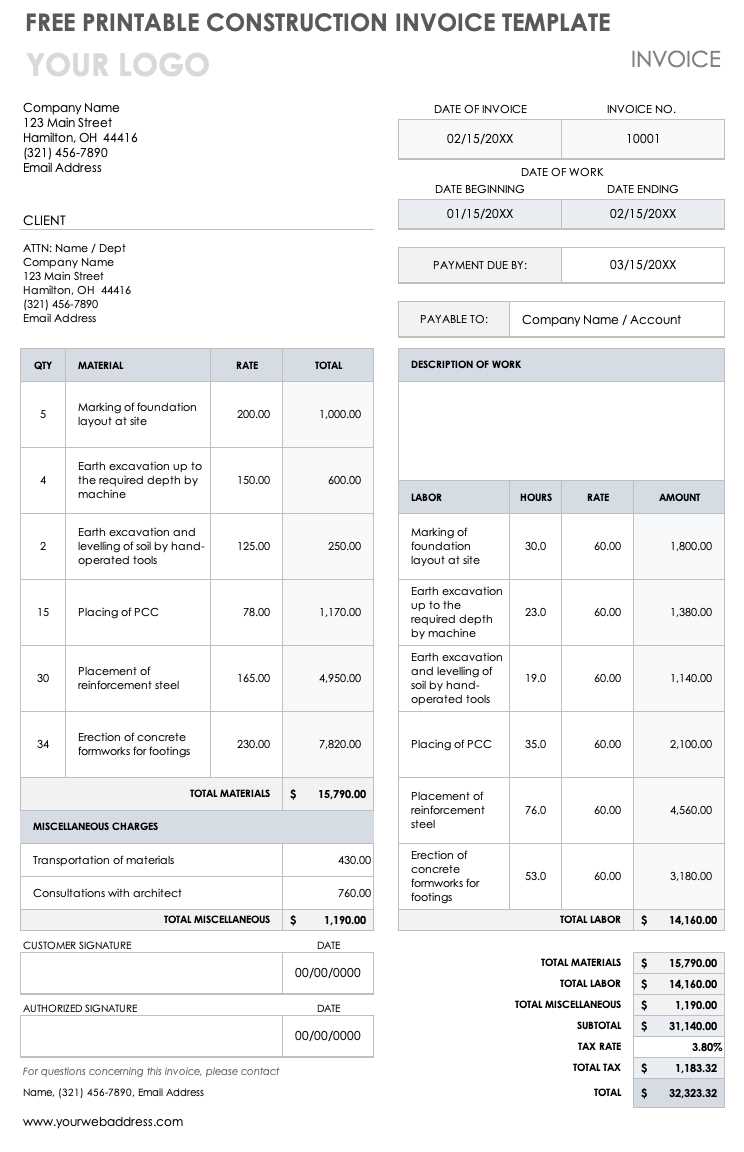

How to Structure the Billing Layout

Proper organization is key when creating a professional payment request. A well-structured document ensures that all essential details are easy to find, reducing the chances of errors or confusion. The layout should be clean, straightforward, and logical, guiding the recipient through the document without overwhelming them with unnecessary information.

Sections to Include

- Header: At the top, include your business name, logo, and contact details, as well as the recipient’s information.

- Document Title: Clearly label the document with a simple heading, such as “Payment Request” or “Statement of Charges.”

- Service Details: Below the title, list the services provided along with their respective dates and rates. This section helps clarify what the payment is for.

- Total Amount: In a prominent place, display the total due, broken down if necessary by individual services or items.

- Payment Instructions: Clearly specify how the payment should be made, including relevant details such as account numbers or payment links.

- Terms and Conditions: Any applicable payment terms, such as deadlines, penalties for late payment, or early payment discounts, should be clearly stated.

Formatting Tips

- Logical Flow: Ensure the layout flows in a natural, easy-to-follow order: start with the recipient and your business details, then move to the payment specifics.

- Clear Sections: Use bold headings and adequate spacing to distinguish between each section of the document.

- Readable Fonts: Choose legible fonts and sizes, keeping text simple and avoiding excessive decoration or complex formats.

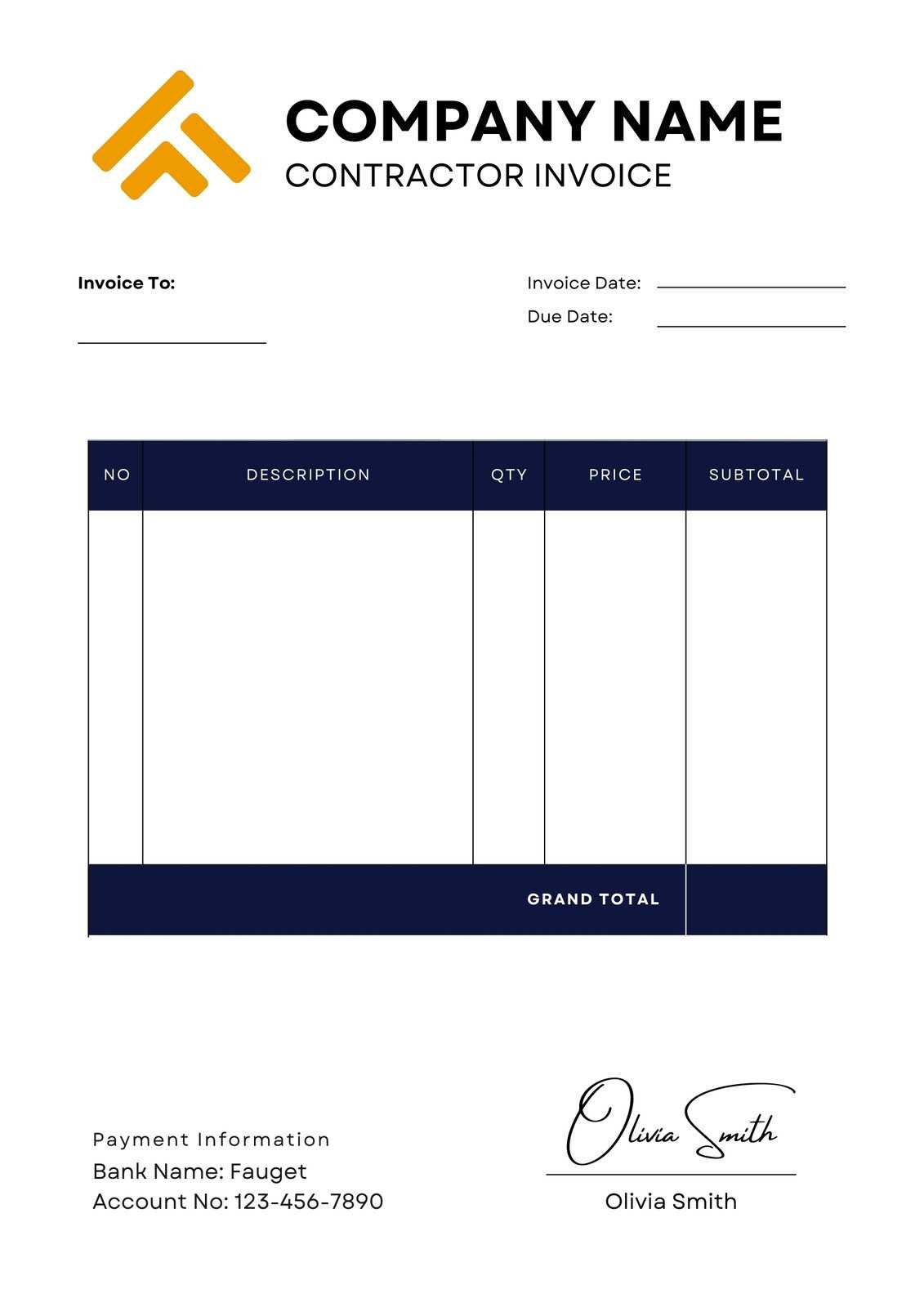

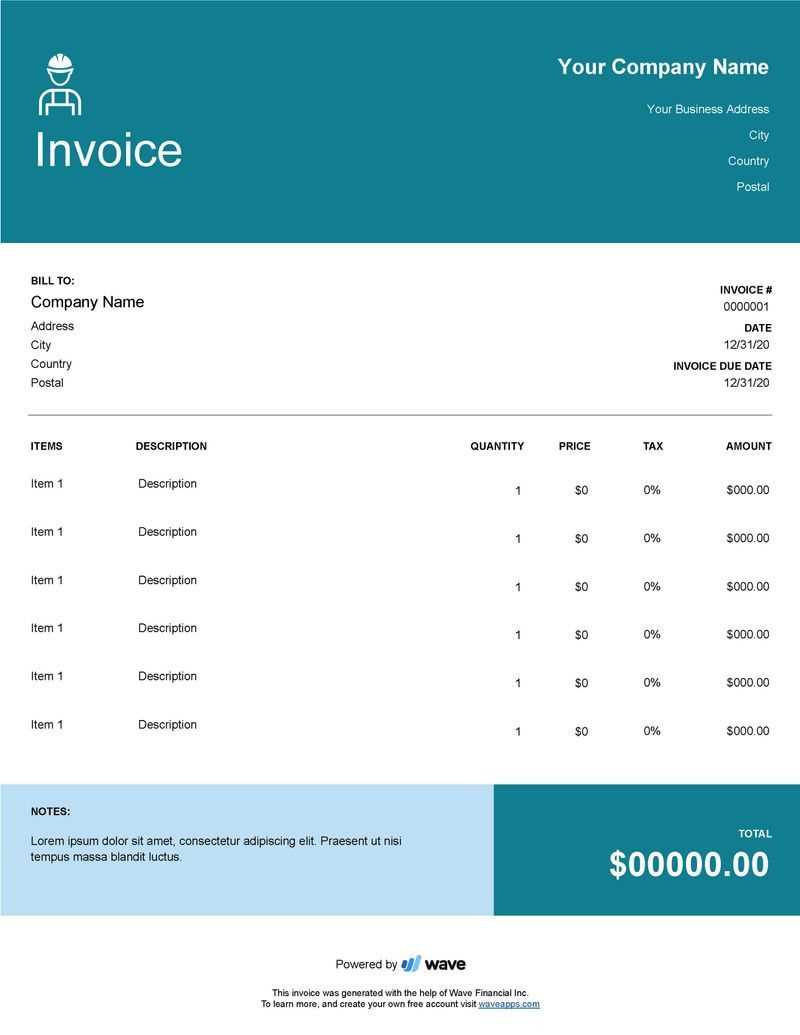

Customizing the Document for Your Needs

Tailoring your payment request to suit the specific requirements of each client or project can help streamline the billing process and present a more professional image. Customization ensures that all necessary details are included while reflecting the unique nature of the work completed. Adapting the format allows you to create a document that works for you, whether you’re handling multiple clients or different types of services.

Start by adjusting sections like the service description or payment terms to align with the specific agreement. For example, if you’re working with a client who prefers itemized billing, ensure each service is listed separately with clear pricing. Similarly, you may want to modify payment instructions or deadlines based on your client’s preferences or regional standards.

Another important customization involves formatting. While some clients may prefer a more formal layout with detailed terms and conditions, others might appreciate a simpler, more straightforward design. Make sure the document is as clear and concise as possible, while still including all relevant information. This approach not only ensures clarity but also reflects the professionalism of your business.

Legal Considerations for Billing Documents

When creating a formal request for payment, it is crucial to consider the legal implications involved in the process. An accurately structured document not only protects both the service provider and the client but also ensures that all terms of the agreement are clear and enforceable. Understanding the legal requirements can help prevent disputes and delays in payment.

There are several key factors to keep in mind when drafting a payment request. For example, you must ensure that the document includes all necessary legal elements such as agreed-upon rates, payment deadlines, and any other terms stipulated in the contract. Additionally, keeping a record of all transactions and having a clear understanding of local tax laws and compliance regulations is essential.

The following table outlines some common legal considerations that should be addressed in any formal financial document:

| Legal Aspect | Details |

|---|---|

| Payment Terms | Specify due dates, late fees, and acceptable payment methods to avoid future disputes. |

| Tax Compliance | Ensure tax rates, such as VAT or sales tax, are accurately reflected and compliant with local regulations. |

| Contract References | Include references to the original agreement or project to ensure both parties understand the scope of work. |

| Record Keeping | Maintain detailed records of all transactions for legal purposes and future reference. |

By addressing these legal elements, you ensure that both parties have a clear understanding of the terms and reduce the risk of any misunderstandings or legal complications down the line.

Tax and Compliance Requirements

When preparing a formal request for payment, it is essential to understand the relevant tax and compliance regulations that apply to your business and location. This ensures that all financial documents are legally valid and that both parties involved are meeting their obligations. Failure to comply with tax laws can lead to penalties, delays in payment, or legal issues.

Key Tax Considerations

- Sales Tax or VAT: Depending on your jurisdiction, you may need to apply the appropriate sales tax or VAT to the total amount due. Make sure to indicate the tax rate clearly on the document.

- Withholding Taxes: For certain types of work, withholding taxes may apply. It is important to account for these deductions and ensure they are correctly reflected in the final amount requested.

- Tax Identification Number: Include your tax identification number (TIN) or employer identification number (EIN) to confirm your status as a legitimate business entity and ensure proper tax reporting.

- Exemption Status: If your business or project qualifies for tax exemptions, this must be clearly stated to avoid unnecessary charges.

Compliance with Local and International Regulations

- Contractual Obligations: Ensure that the terms outlined in your payment request align with the original agreement or contract. This includes payment deadlines, scope of work, and agreed-upon rates.

- Record Keeping: Keep detailed records of all transactions, including payment requests, receipts, and correspondence. This will be essential for audits and financial reporting.

- Cross-border Considerations: If working with international clients, ensure that the correct tax treatment is applied for cross-border services, including any import/export duties or international tax agreements.

By adhering to these tax and compliance requirements, you not only protect your business from potential legal issues bu

Proper Documentation for Billing Accuracy

Maintaining accurate and complete records is essential for ensuring that financial requests are correct and transparent. Proper documentation not only helps prevent errors but also provides both parties with clear evidence of the services rendered and the agreed-upon payment terms. Clear, detailed records support the accuracy of your payment request and minimize the risk of disputes.

Key Documents to Include

- Service Agreement: A written contract that outlines the scope of work, payment terms, and deadlines. This agreement serves as the basis for any billing request.

- Time Sheets or Work Logs: Detailed records of the time spent on each task or service provided. This helps break down the total cost and justifies the requested amount.

- Receipts for Materials or Expenses: If applicable, include receipts for any materials or third-party services purchased to complete the work. This adds transparency to the overall cost.

- Communication Records: Emails, letters, or notes that document discussions regarding the scope of work, pricing, or any changes to the project. These provide a clear record of the agreed terms.

Steps for Ensuring Accuracy

- Double-Check Details: Review all documentation to ensure that dates, amounts, and descriptions match the original agreement or contract.

- Include Supporting Evidence: Attach relevant documents such as time logs, receipts, or approval emails to support the accuracy of the payment request.

- Keep Updated Records: Regularly update your records throughout the project to avoid any discrepancies when it’s time to finalize the payment request.

By ensuring that all documentation is complete, accurate, and well-organized, you can prevent misunderstandings and ensure timely payment for the services provided. Proper records not only protect both parties but also create a foundation for smooth future transactions.

Including Payment Terms and Deadlines

Clear and precise payment terms are crucial to ensure that both parties are on the same page regarding when and how payments will be made. Including detailed payment deadlines, penalties for late payments, and available payment methods can help prevent misunderstandings and avoid delays. Establishing these terms upfront provides clarity and creates a professional framework for the transaction.

Important Elements to Specify

- Due Date: Clearly state when the payment is expected. This can be a specific date or a time frame (e.g., “30 days fro

Tools for Creating Billing Documents

When creating a formal request for payment, using the right tools can streamline the process and ensure accuracy. Various software solutions and online platforms allow you to create professional and customizable billing documents quickly. These tools often offer features such as pre-designed layouts, calculation options, and storage solutions, making the process more efficient and less prone to errors.

Popular Software for Billing Documents

- Microsoft Excel or Google Sheets: Spreadsheets are versatile tools that allow for detailed customization. You can create your own structure with rows and columns, and even use formulas for automatic calculations.

- Accounting Software: Tools like QuickBooks, FreshBooks, or Xero provide built-in templates that can be easily tailored to your needs. They also help you manage payments and track outstanding amounts.

- Word Processing Programs: Microsoft Word and Google Docs can be used to create simple, clean billing requests with flexible formatting options.

- Online Billing Platforms: Services such as Zoho Invoice or Invoice Ninja allow you to create, send, and track payment requests all in one place. These platforms often include advanced features like automated reminders and recurring billing options.

Benefits of Using These Tools

- Time Efficiency: Pre-designed templates and automated calculations save you time, allowing you to focus on other aspects of your business.

- Professional Appearance: Using these tools helps you create polished, professional documents that reflect well on your business.

- Easy Customization: Most platforms allow you to customize details such as logos, colors, and contact information, giving your documents a personalized touch.

Choosing the right tool for creating billing documents depends on your specific needs and business processes. Whether you prefer a simple spreadsheet or an all-in-one accounting platform, the right tool can help you create accurate, professional payment requests every time.

Using Excel for Billing Document Creation

Microsoft Excel is a versatile tool that can help you create detailed and accurate billing requests efficiently. With its built-in functions, customizable features, and easy formatting, Excel offers a great solution for creating professional payment documents. Whether you’re generating a one-time request or need a repeatable structure, Excel allows for flexibility and control in organizing your billing information.

Why Choose Excel for Billing Requests?

- Customizability: Excel allows you to tailor every aspect of your billing document, from layout to calculations, so it fits your business needs.

- Automatic Calculations: Using formulas, you can automate calculations for taxes, discounts, and totals, reducing the risk of errors and saving time.

- Reusability: Once you create a billing structure, you can easily reuse and update it for future requests, making the process faster each time.

- Professional Appearance: With the ability to format cells, adjust fonts, and add branding elements like logos, you can create a polished and professional look.

Steps to Create a Billing Request in Excel

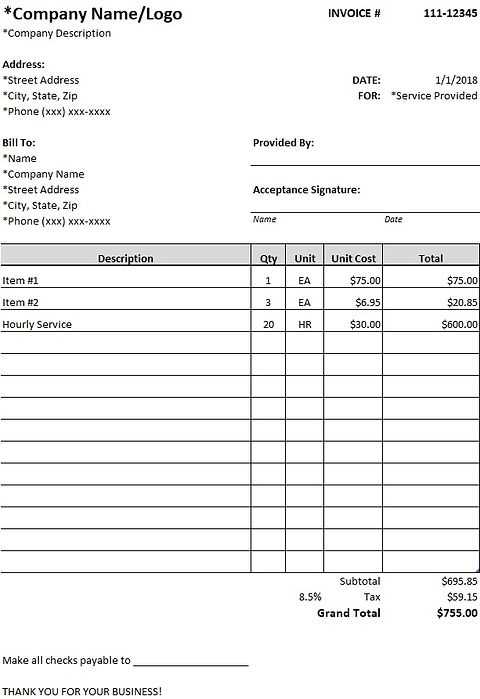

- Set Up Columns: Organize the document by including columns for item descriptions, quantity, rate, total, and any applicable taxes or discounts.

- Use Formulas: Implement basic Excel formulas to automatically calculate totals, taxes, or any other necessary values.

- Include Business Information: Add your company’s name, address, and contact details at the top of the document, along with the client’s information.

- Design the Layout: Adjust the column widths and row heights, and apply borders and shading to make the document easy to read and visually appealing.

By leveraging the power of Excel, you can create customized, professional, and accurate billing documents that save time and minimize mistakes. Whether you’re managing a small business or handling multiple clients, Excel can help streamline your payment request process.

Best Online Platforms for Billing Documents

Online platforms offer an easy and convenient way to create professional payment requests without the need for complex software. These platforms provide a wide range of customizable designs, pre-built structures, and user-friendly tools to help you generate accurate and polished documents quickly. By using these services, you can save time and avoid errors while ensuring that your billing requests meet professional standards.

Top Online Platforms for Billing Documents

- FreshBooks: Known for its intuitive interface, FreshBooks offers a range of customizable options for generating billing requests. It also includes features for tracking payments, setting up recurring requests, and managing clients.

- Zoho Invoice: This platform provides a variety of ready-made designs, along with options to personalize each document. It also supports multiple currencies and payment methods, making it a great choice for international clients.

- Invoice Ninja: Invoice Ninja offers both free and paid plans that give you access to a full suite of features, including customizable billing layouts, payment tracking, and integrations with payment gateways.

- Canva: While Canva is more known for graphic design, it also provides customizable billing document templates. Its drag-and-drop interface allows you to personalize your request with ease.

- PayPal Invoicing: If you use PayPal for transactions, this platform allows you to create and send professional billing requests directly from your PayPal account, with payment tracking and reminders built in.

Benefits of Using Online Platforms

- User-Friendly: Most platforms offer an easy-to-navigate interface that allows even beginners to create professional documents with minimal effort.

- Time-Saving: By using pre-designed templates, you can create a billing request in minutes, freeing up time for other tasks.

- Professiona

Customizing Word Templates for Billing

Microsoft Word offers a simple yet effective way to create professional billing requests by utilizing customizable designs. With its built-in features, you can personalize documents according to your specific needs, ensuring that they reflect your branding and communicate the necessary details clearly. Whether you’re creating a one-time request or setting up a reusable format, Word provides the flexibility to tailor each document with ease.

Steps to Customize Billing Documents in Word

- Select a Base Layout: Start with a blank document or choose from one of Word’s built-in templates that suit your needs. These can be adjusted to fit your specific business requirements.

- Add Your Business Information: At the top of the document, include essential contact details such as your company name, address, phone number, and email. This helps clients easily identify who the request is coming from.

- Personalize with Client Details: Below your business information, input the client’s name, company, and contact details. This ensures the request is directed correctly and adds a professional touch.

- Insert Itemized List: Use tables to create an itemized list of services or goods provided. This helps organize the information clearly and makes it easier for the client to review the details.

- Include Payment Terms: Clearly state your payment expectations, including the due date and accepted payment methods, to avoid confusion and ensure timely payments.

Table Example for Billing Structure

Description Quantity Unit Price Total Consulting Services 5 hours $50.00 $250.00 Website Development 1 project $500.00 $500.00 Total $750.00 Customizing billing documents in Word allows you to create professional, tailored requests that meet your business’s specific needs. By using tables, formatting tools, and personalizing content, you can ensure that each document is clear, accurate, and al

Common Mistakes in Billing Requests

When creating a payment request, it’s important to ensure all the details are accurate and clear to avoid delays and disputes. Unfortunately, there are several common mistakes that individuals and businesses often make when drafting such documents. These errors can lead to confusion, missed payments, and wasted time. Being aware of these mistakes can help ensure that your billing process runs smoothly and efficiently.

Common Billing Mistakes to Avoid

- Missing Client Information: Failing to include the client’s full name, company name, or contact information can cause delays in processing. Always ensure the details are correct and clearly visible.

- Incorrect Dates: Incorrect payment due dates or missing service dates can create confusion. It’s important to accurately specify the date the work was completed and when payment is expected.

- Vague Descriptions: Lack of clarity in describing the products or services provided can lead to disputes. Always include a detailed and specific list of work done, along with quantities and rates.

- Not Including Payment Terms: Failure to specify payment terms–such as the payment due date, late fees, or accepted payment methods–can lead to misunderstandings and delayed payments.

- Forgetting to Include a Unique Number: Not assigning a unique identification number to each payment request can make it difficult to track. Always include an invoice number to help both you and your client stay organized.

- Overlooking Taxes: Ignoring applicable taxes or failing to specify the tax amount can result in legal and financial issues. Ensure all taxes are correctly calculated and included in the request.

How to Avoid These Mistakes

- Double-Check Information: Before sending any billing request, carefully review all the details. Make sure that all client information, dates, descriptions, and amounts are accurate.

- Use a Standard Format: Stick to a consistent structure and format for all payment requests to ensure no important details are overlooked. Consider using a professional layout or software to standardize your documents.

- Consult a Professional: If you’re unsure about tax laws or legal requirements, consider consulting with an accountant or legal professional to ensure compliance.

By avoiding these common mistakes, you can streamline your billing process and improve communication with your clients, ensuring timely and accurate payments.

Overlooking Essential Billing Details

When preparing a payment request, leaving out critical information can lead to confusion, delayed payments, and even disputes. While it may seem like a minor oversight, missing key elements can complicate the payment process and result in a less professional document. To avoid such issues, it’s important to be aware of the essential details that must be included in every request.

Key Information to Avoid Overlooking

- Accurate Client Information: Missing or incorrect client details, such as the name, address, and contact information, can result in delays or misdirected payments. Always double-check this information before sending.

- Clear Description of Goods or Services: A vague or incomplete list of services or products provided can create confusion for both you and your client. Ensure that each item or service is clearly described, including quantities and unit prices.

- Unique Identification Number: Every billing request should have a unique reference number. Without this, tracking and organizing requests becomes difficult for both you and the client.

- Payment Terms: Not specifying payment expectations, such as the due date, payment methods, or late fees, can result in delayed or missed payments. Be clear about when and how you expect to be paid.

- Applicable Taxes: Failing to account for taxes or not specifying the tax rate on your request can lead to compliance issues and confusion for your client. Always calculate and include the correct tax amount.

- Total Amount: A payment request that doesn’t clearly state the total amount due, including any discounts, taxes, and additional charges, can cause misunderstandings. Make sure the total is clearly visible and accurate.

Tips to Ensure Accuracy

- Double-Check All Details: Review your document carefully before sending it to ensure all information is accurate and complete. Taking a moment to check can save you time and hassle later.

- Use a Structured Format: Having a consistent structure for your payment requests helps prevent the omission of important details. Consider using a standard template or layout for every request.

- Consult an Expert: If you’re unsure about any of the legal or tax requirements, it’s best to seek advice from an accountant or legal professional to avoid any mistakes.

By including all the necessary details and double-checking for accuracy, you can ensure your billing documents are clear, professional, and effective in securing prompt payment.

Incorrect Payment Instructions

Providing unclear or incorrect payment instructions can lead to delays or errors in the payment process. It’s essential that the recipient knows exactly how to make the payment, whether by bank transfer, check, or other methods. If the payment instructions are not precise, it may cause confusion or miscommunication, ultimately delaying the receipt of funds.

Common Issues with Payment Instructions

- Incorrect Bank Account Information: Providing outdated or incorrect bank details can cause the payment to be directed to the wrong account. Always ensure that the bank account number, routing code, and other financial information are up-to-date.

- Ambiguous Payment Methods: If the payment options are not clearly outlined, the client might be unsure of how to proceed. Specify whether you accept credit card payments, bank transfers, or other digital payment methods.

- Lack of Payment Deadlines: If the due date for payment is not clearly stated, the payer may not be aware of when the funds are expected. Always include a specific deadline to avoid delayed payments.

- Unclear Currency Information: If you’re working internationally or with clients from different regions, failing to specify the currency for payment can cause confusion. Clearly state whether the payment is due in dollars, euros, or another currency.

Best Practices for Payment Instructions

Here are some steps to ensure that your payment instructions are clear and accurate:

- Provide Complete Financial Details: Include your full bank account number, IBAN, SWIFT code, or other necessary payment details. This reduces the chances of errors during the transfer.

- State Payment Methods and Options: Specify all available methods of payment, including online payment systems, credit cards, and checks, and explain how each method works.

- Indicate a Clear Due Date: Always include a specific payment due date. This helps the payer understand your expectations and ensures that payments are made on time.

- Clarify Any Additional Charges: If there are any fees associated with the payment process, such as transaction fees or penalties for late payment, be sure to include these details in the payment instructions.

Example of Clear Payment Instructions

Payment Method Details Not Keeping Track of Previous Invoices

Failing to maintain a record of past billing documents can lead to confusion and potential financial discrepancies. It is crucial to have a system in place that helps you track all issued bills and payments. This ensures that you can easily verify outstanding amounts, resolve any disputes, and maintain clear communication with your clients or contractors.

Consequences of Not Tracking Past Documents

- Inability to Verify Payments: Without a detailed record, it becomes difficult to confirm whether a payment has been made, leading to unnecessary follow-ups and misunderstandings.

- Unresolved Disputes: If there’s no clear history of previous billing documents, disputes may arise over the amounts owed or services provided. This can harm professional relationships and delay payment.

- Loss of Financial Control: Not keeping track of past transactions can lead to cash flow issues. Missing out on payments or over-billing can affect your financial planning and budgeting.

- Failure to Meet Deadlines: When you cannot reference past due dates or payment terms, it’s easy to miss important deadlines, resulting in late payments or late fees.

How to Effectively Track Previous Billing Documents

To avoid these problems, consider implementing the following strategies:

- Use Accounting Software: Modern accounting software can automatically store and organize your past billing documents. This allows for easy retrieval and monitoring of all financial transactions.

- Maintain a Physical or Digital File System: Whether you prefer physical records or digital files, make sure all bills are stored in a well-organized system. Include relevant details such as dates, amounts, and services rendered for each record.

- Track Payment Status: Always mark bills as paid or unpaid once the transaction is complete. This helps prevent any confusion regarding which amounts are still due.

- Keep Backup Copies: Always have a backup, whether it’s a digital copy stored on a secure cloud or physical duplicates kept in a safe place. This will help in case of system failures or accidental loss of data.

By implementing these methods, you can avoid the confusion and financial mismanagement that arises from not tracking past billing documents. A simple and consistent approach will ensure smoother financial operations and better management of your cash flow.

How to Handle Disputes in Billing

Disputes related to billing can arise for various reasons, ranging from misunderstandings about charges to disagreements over the terms of service. It’s essential to have a clear approach to address these issues promptly and professionally, ensuring both parties are satisfied with the resolution. Proper communication and thorough documentation are key in resolving such disputes effectively.

Steps to Resolve Billing Disputes

- Review the Details: Before taking any action, carefully review the billing document in question. Ensure that all the charges are accurate, and check whether the services or products listed match the agreement or contract.

- Communicate Early: As soon as you identify a potential issue, reach out to the other party. Initiate the conversation respectfully and provide any necessary clarifications to avoid escalating the situation.

- Provide Supporting Documentation: If the dispute involves discrepancies in amounts or services, ensure that you have supporting documentation, such as contracts, emails, or previous communications. This will help clarify your position.

- Stay Professional: Maintain a calm and professional tone throughout the resolution process. Avoid becoming confrontational, as this can prolong the dispute and damage the relationship.

- Negotiate a Solution: Often, disputes can be resolved through negotiation. Both parties should be open to compromise in order to reach a fair solution that satisfies everyone involved.

- Seek Mediation if Necessary: If a resolution cannot be reached through direct negotiation, consider involving a neutral third party or mediator to help facilitate the discussion and find a compromise.

Preventing Future Disputes

While disputes are sometimes unavoidable, there are steps you can take to minimize their occurrence:

- Be Transparent: Clearly outline all terms and conditions at the beginning of any agreement. Make sure both parties understand the payment terms, deadlines, and the scope of services or goods provided.

- Provide Clear Documentation: Ensure that your

Resolving Payment Discrepancies

Payment discrepancies can occur for a variety of reasons, from calculation errors to misunderstandings regarding the scope of work or agreed terms. Addressing these discrepancies promptly and professionally is essential to maintaining a good relationship between all parties involved. A systematic approach to resolving payment issues can prevent further delays and ensure that both sides are satisfied with the final settlement.

Steps to Resolve Payment Discrepancies

- Identify the Issue: The first step in resolving any payment discrepancy is to clearly identify the source of the problem. This could be an incorrect amount, missing charges, or discrepancies between the payment received and the agreed terms.

- Review Documentation: Carefully review the original agreement, work orders, or any relevant documentation. Ensure that all services, products, and payment terms are accurately reflected. This review will help clarify whether the discrepancy is due to an error or a misunderstanding.

- Reach Out Quickly: Contact the other party as soon as the discrepancy is noticed. Prompt communication can help resolve the issue more efficiently and avoid unnecessary delays in payments.

- Discuss the Details: Approach the situation calmly and provide all necessary documentation, such as payment records, contracts, or correspondence, to support your case. Clear and respectful communication can help clear up misunderstandings quickly.

- Negotiate a Resolution: Once the issue is identified and the facts are clear, negotiate a fair solution. This may involve adjusting the payment amount, extending payment terms, or clarifying the scope of work to ensure both parties are on the same page.

- Follow-Up: After reaching a resolution, ensure that any agreed-upon adjustments are made promptly. Follow up with the other p