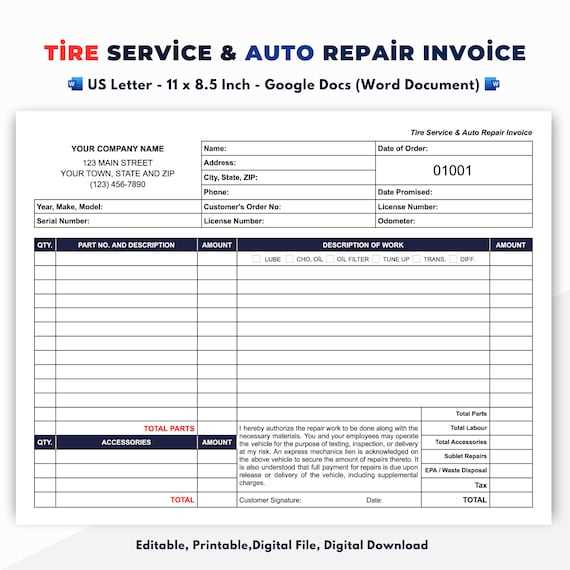

Free and Customizable Workshop Invoice Template for Easy Billing

Managing payments and tracking financial transactions can often be a time-consuming task, especially when handling various types of services. To make this process easier and more efficient, using a pre-designed document can save time and reduce errors. With the right structure, this approach allows professionals to focus more on their work and less on administrative tasks.

Whether you’re a small business owner or an independent contractor, having a standardized way of detailing charges, services, and payment terms ensures clarity and professionalism. A customizable document can be tailored to fit the specifics of your business, enabling quick creation of records and easy tracking of outstanding balances.

In this article, we’ll explore how to design a document that suits your needs and enhances your ability to manage payments seamlessly. By following a few simple guidelines, you can ensure that all necessary information is included while maintaining a clean and organized layout for your clients.

Why Use a Workshop Invoice Template

Creating a consistent and reliable way to document services rendered and payments received is crucial for any business. Without a clear structure, billing can become confusing, leading to misunderstandings between service providers and clients. Utilizing a pre-designed document makes it easier to capture all necessary details, ensuring both parties are on the same page.

Save Time and Effort

By using a pre-built format, you eliminate the need to design a new document from scratch each time. This not only saves time but also reduces the risk of errors. With fields already outlined, you simply input the relevant information, speeding up the process and allowing you to focus on your core work.

Maintain Professionalism

A polished, uniform format enhances your credibility and creates a professional image in the eyes of your clients. A clear and organized document reflects your attention to detail, helping to build trust and improve client relationships. The more streamlined the process, the more confident clients will feel about your business practices.

Additionally, using a standardized document helps avoid missed information, such as payment terms, service descriptions, and pricing. This minimizes disputes and ensures transparency throughout the entire transaction process.

How to Create a Workshop Invoice

Creating a clear and accurate document for tracking services and payments is essential for ensuring that both the provider and client understand the details of the transaction. Whether you’re providing repairs, consultations, or other specialized services, it’s important to include all the relevant information in an organized way. Here’s a step-by-step guide to help you create a document that covers everything needed for smooth financial management.

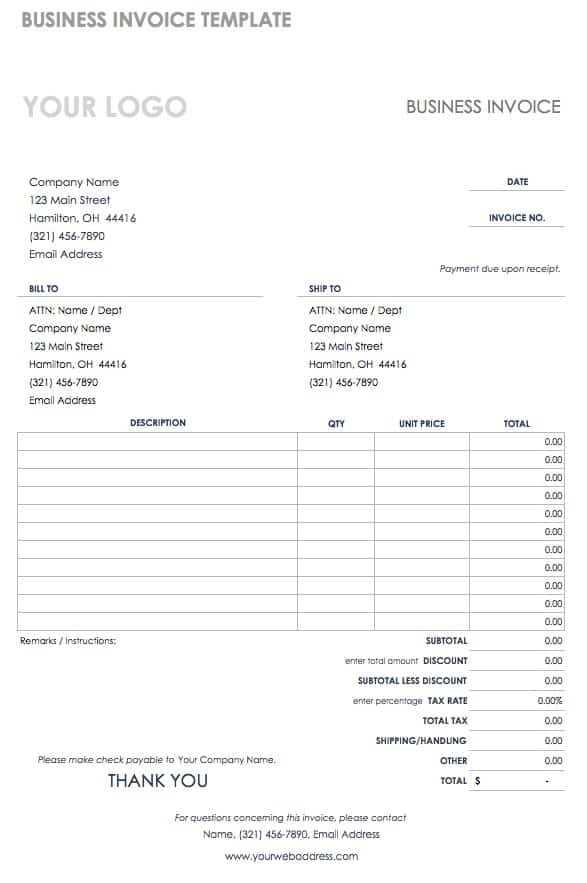

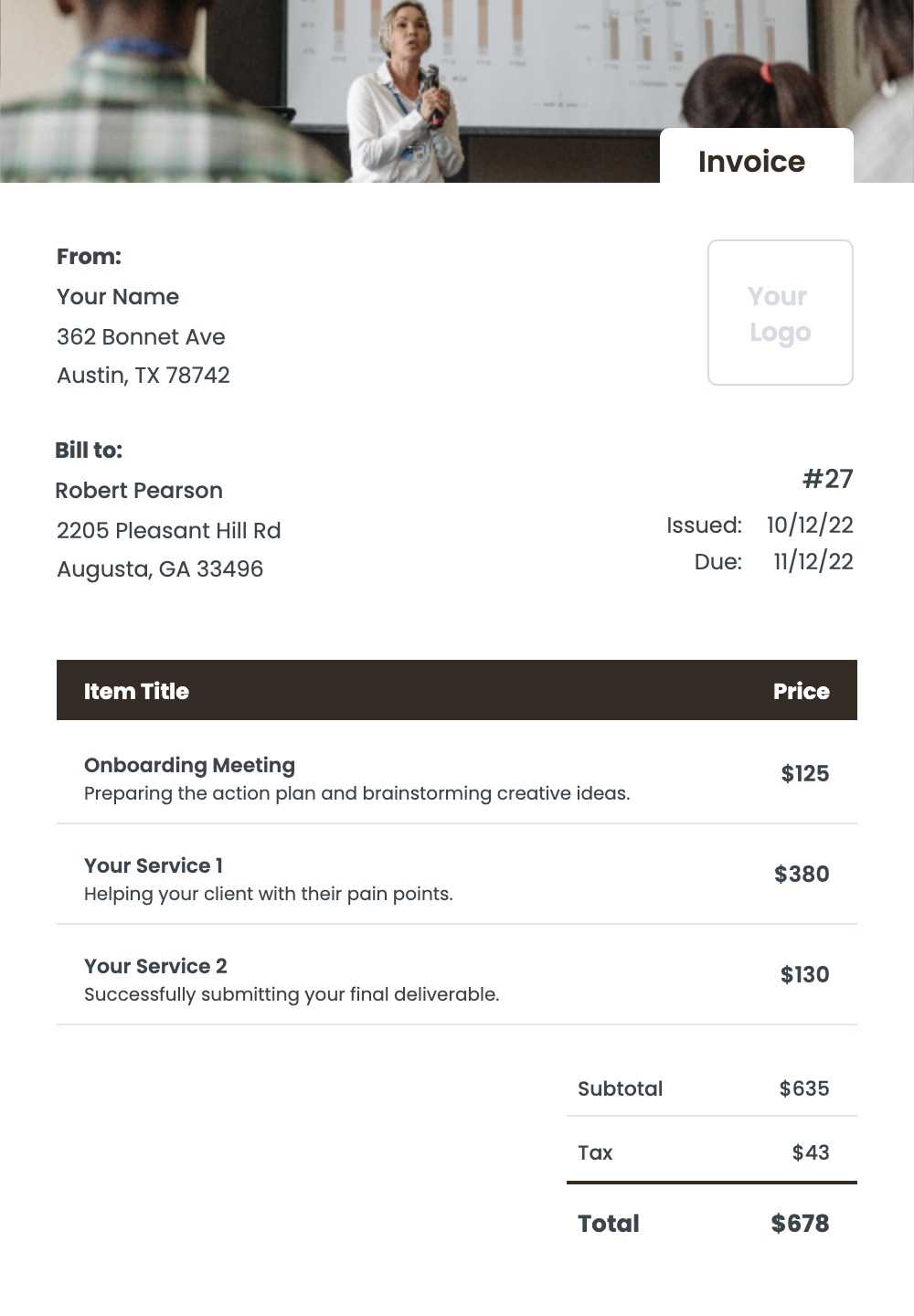

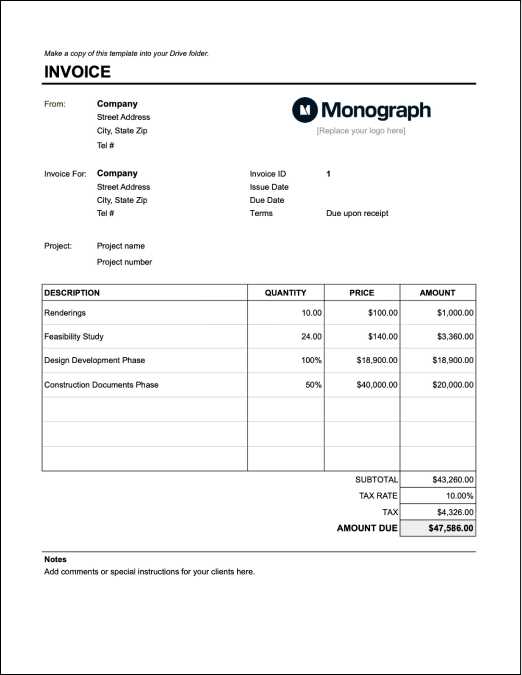

Include Key Information

Start by adding essential details such as your business name, contact information, and the client’s information. It’s also crucial to include a unique reference number for each document, which makes it easier to track and manage your records. Be sure to include the date the document was issued and any relevant payment due dates.

List Services and Costs

Next, describe each service or product provided, including a brief description, quantity, rate, and total cost for each item. This helps to prevent confusion and provides a clear breakdown for your client. If applicable, also include any taxes, discounts, or additional fees, ensuring that the final total is accurate. Clear itemization ensures transparency and can make the payment process smoother for everyone involved.

Finally, always double-check your document for accuracy before sending it to the client. A well-prepared record not only speeds up payment processing but also strengthens professional relationships by conveying attention to detail.

Key Elements of an Effective Invoice

For any business, having a clear and well-structured document for recording services provided and payments due is essential. The key to creating an effective record is to include all the necessary information in a way that is both understandable and easy to follow. Each component should be designed to provide clarity, ensuring that both the service provider and client can quickly review and confirm the details.

Here are the core elements that make up an effective financial document:

| Element | Description |

|---|---|

| Contact Information | Include both your and your client’s name, address, and phone number to ensure easy identification and communication. |

| Document Number | Assign a unique number to each record for reference and tracking purposes. |

| Dates | Specify the date of issue and, if applicable, the due date for payment. |

| Service Description | Clearly describe the services or products provided, including quantity, rate, and total cost for each item. |

| Payment Terms | Detail the payment methods accepted, along with any terms, such as late fees or early payment discounts. |

| Subtotal and Total | Sum up the individual costs, including taxes or any applicable discounts, to calculate the final amount due. |

Including these elements ensures that both parties have a clear understanding of the transaction and can easily process payments without confusion. The more organized and detailed the document, the less likely any discrepancies will arise.

Top Benefits of Using Templates

Utilizing a pre-designed format for documenting transactions offers numerous advantages, making administrative tasks much simpler and more efficient. A standardized structure allows you to avoid repetitive work, reduce errors, and ensure consistency across all your financial records. Whether you’re handling client billing or tracking payments, adopting a ready-made system can save valuable time and effort.

Here are some key benefits of using pre-made structures for your records:

| Benefit | Description |

|---|---|

| Time Efficiency | By using a pre-structured layout, you can quickly input the necessary details, speeding up the process and leaving more time for your core tasks. |

| Consistency | A consistent format ensures that all documents follow the same style and structure, making them easier to read and understand for both you and your clients. |

| Accuracy | Pre-designed formats often include essential fields, reducing the chances of missing important details or making errors that could lead to confusion. |

| Professional Appearance | Using a polished, standardized design boosts your credibility, presenting a professional image to clients and reinforcing your attention to detail. |

| Customization | Although pre-made, many systems offer customization options, allowing you to tailor them to your specific needs and preferences while retaining their efficiency. |

Overall, adopting ready-made formats not only helps streamline your business processes but also enhances communication with clients by providing clear, professional documents that are easy to review and understand.

Choosing the Right Invoice Format

Selecting an appropriate document style is essential for effectively managing transactions and ensuring clarity in records. A well-organized structure allows both parties to understand the terms, itemizations, and any relevant details in a straightforward manner.

Consider the Type of Services Provided

The nature of the services can heavily influence the layout and information needed in the document. For straightforward tasks, a simple format may suffice. However, for complex projects, a more

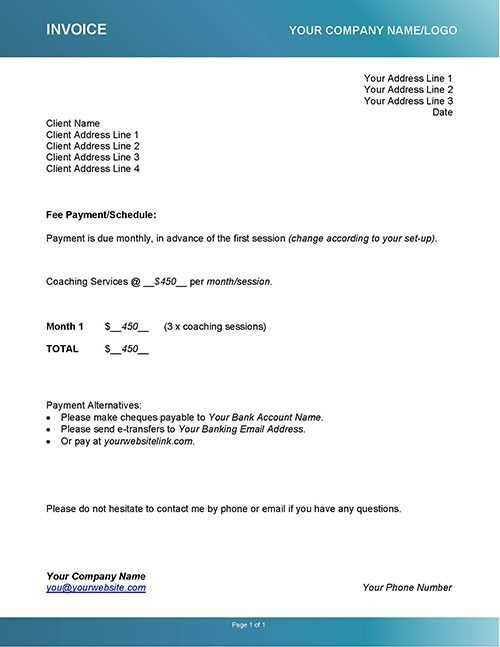

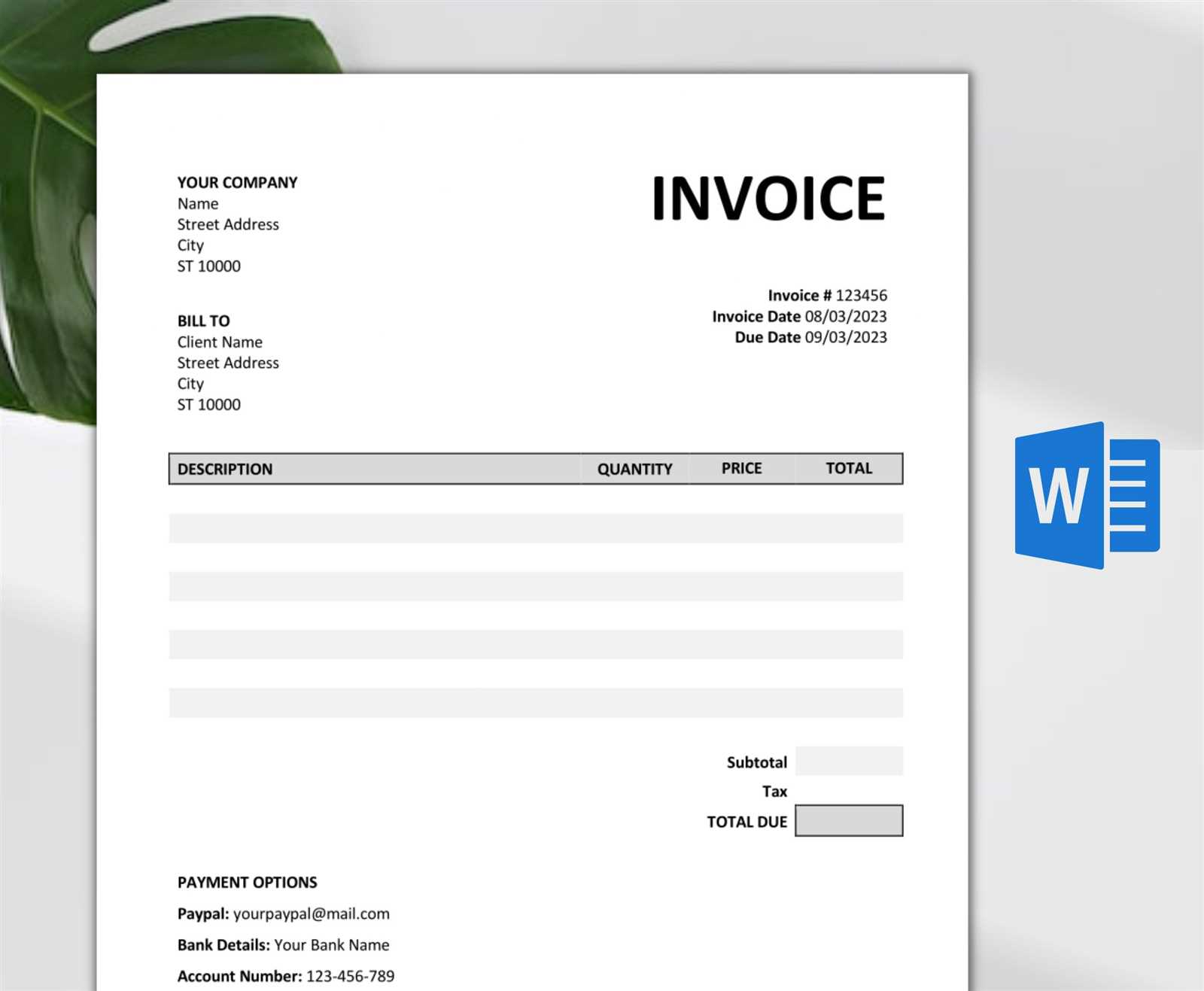

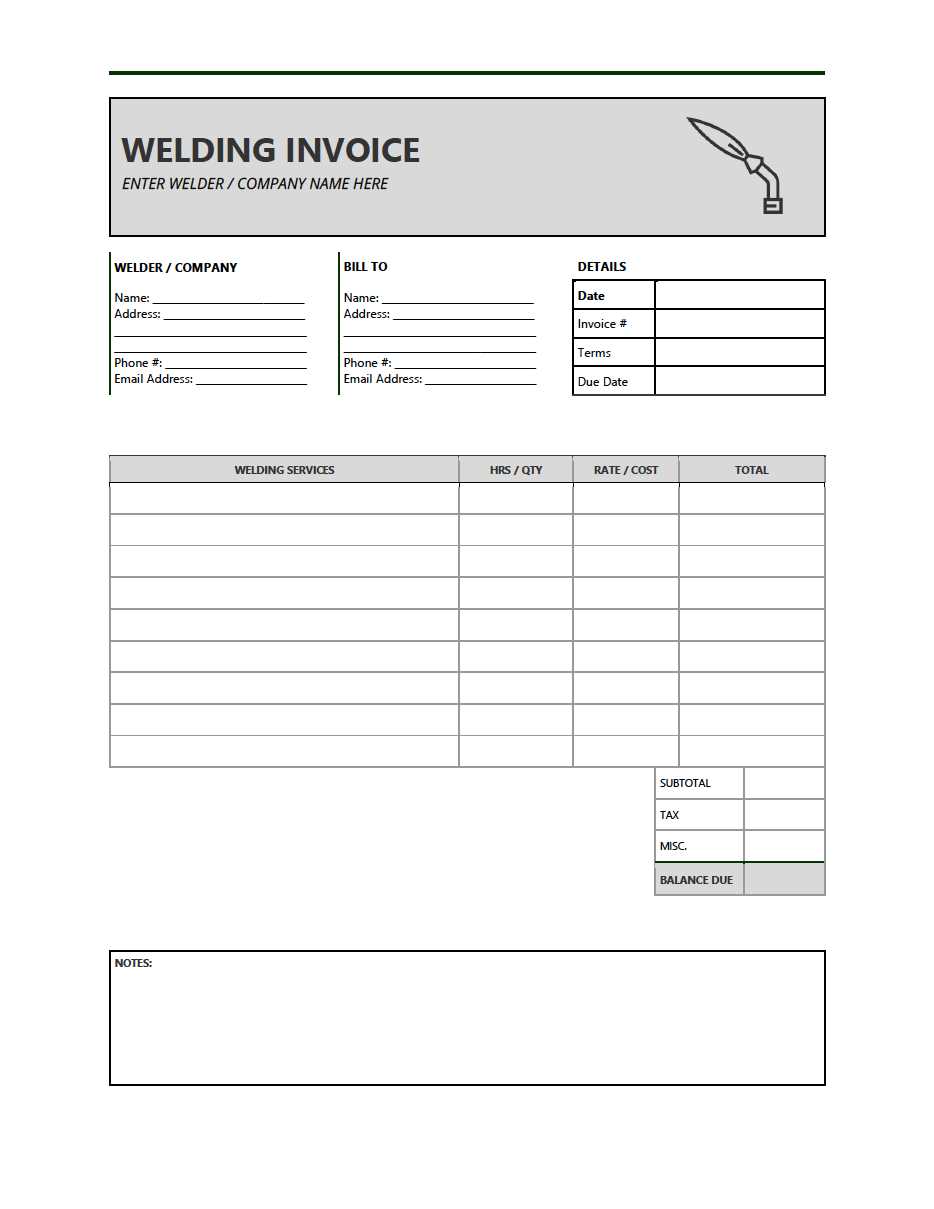

How to Customize Your Invoice

Creating a personalized document can help reinforce your brand and provide essential information in an accessible way. Adjusting the layout, colors, and structure allows for a document that is both visually appealing and tailored to meet specific needs.

Branding Elements

Adding unique elements, such as a logo, color scheme, or specific fonts, can make your document stand out and reflect the identity of your business. Consistent branding across documents enhances recognition and professionalism.

Organizing

How to Customize Your Invoice

Creating a personalized document can help reinforce your brand and provide essential information in an accessible way. Adjusting the layout, colors, and structure allows for a document that is both visually appealing and tailored to meet specific needs.

Branding Elements

Adding unique elements, such as a logo, color scheme, or specific fonts, can make your document stand out and reflect the identity of your business. Consistent branding across documents enhances recognition and professionalism.

Organizing Key Information

Customizing sections for different details makes it easy for clients to find what they need. Use a clear layout to separate primary details, terms, and any additional notes. Here is an example of how to structure the key sections:

| Section | Description |

|---|---|

| Contact Information | Include your business name, address, and contact details for easy reference. |

| Itemized List | Detail each service or product with individual costs and descriptions. |

| Payment Terms | Specify the due date, accepted payment methods, and any late fees if applicable. |

By adjusting these elements, you can create a document that is both functional and representative of your business style.

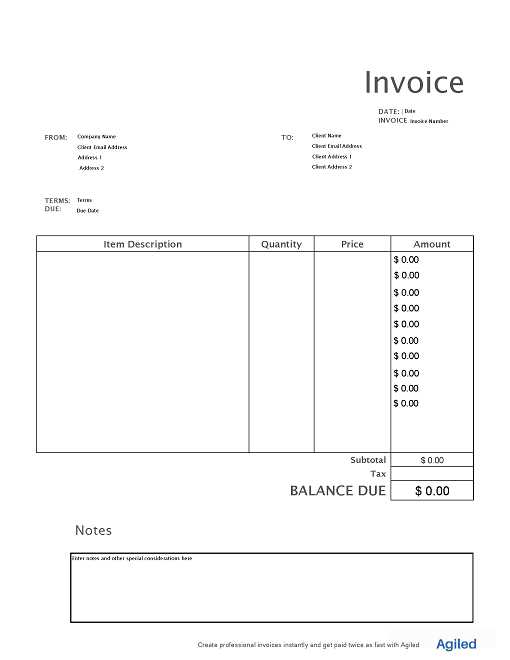

Common Mistakes to Avoid in Invoices

Ensuring accuracy and clarity in billing documents is essential for smooth business operations and positive client relationships. Avoiding common errors can help maintain professionalism, prevent delays, and reduce the likelihood of disputes.

Omitting Essential Details

One of the most frequent issues is leaving out key information. Every document should clearly outline essential points to avoid misunderstandings. Make sure to include:

- Contact Information: Both parties’ names, addresses, and contact numbers.

- Clear Itemization: A detailed list of provided services or products, along with quantities and prices.

- Payment Terms: Due date, acceptable payment methods, and any applicable fees.

Errors in Calcul

How to Add Taxes and Discounts

Incorporating taxes and any applicable discounts accurately is essential for clear and transparent pricing. Properly listing these adjustments helps avoid misunderstandings and ensures that all parties understand the total amount due.

Applying Taxes Correctly

Taxes may vary depending on location and type of service or product. To apply them accurately, consider the following:

- Determine the Correct Rate: Research the applicable tax rate for each item or service category.

- Specify Tax Amounts Clearly: List the tax as a separate line item to make the document clear and transparent.

- Calculate Tax on the Subtotal: Add up all items before applying the tax to avoid calculation errors.

Including Discounts

Offering a discount can be a great way to provide value to clients, but it’s important to

Including Payment Terms in Your Invoice

Clearly defined payment conditions are essential to ensure both parties understand the timeline and methods for completing a transaction. By outlining these terms, you help set expectations, reduce confusion, and improve the likelihood of prompt payment.

Specify the Due Date

Always include a precise date by which the payment is expected. This could be stated as a specific date or relative terms like “30 days from the issue date” to clarify the deadline.

Outline Accepted Payment Methods

Providing a list of accepted methods, such as bank transfers, credit cards, or digital payment platforms, gives clients flexibility and speeds up the process. It’s helpful to mention any preferred methods or details for wire transfers.

Include Late Fees or Early Payment Incentives

If applicable, mention any fees for late payments or discounts

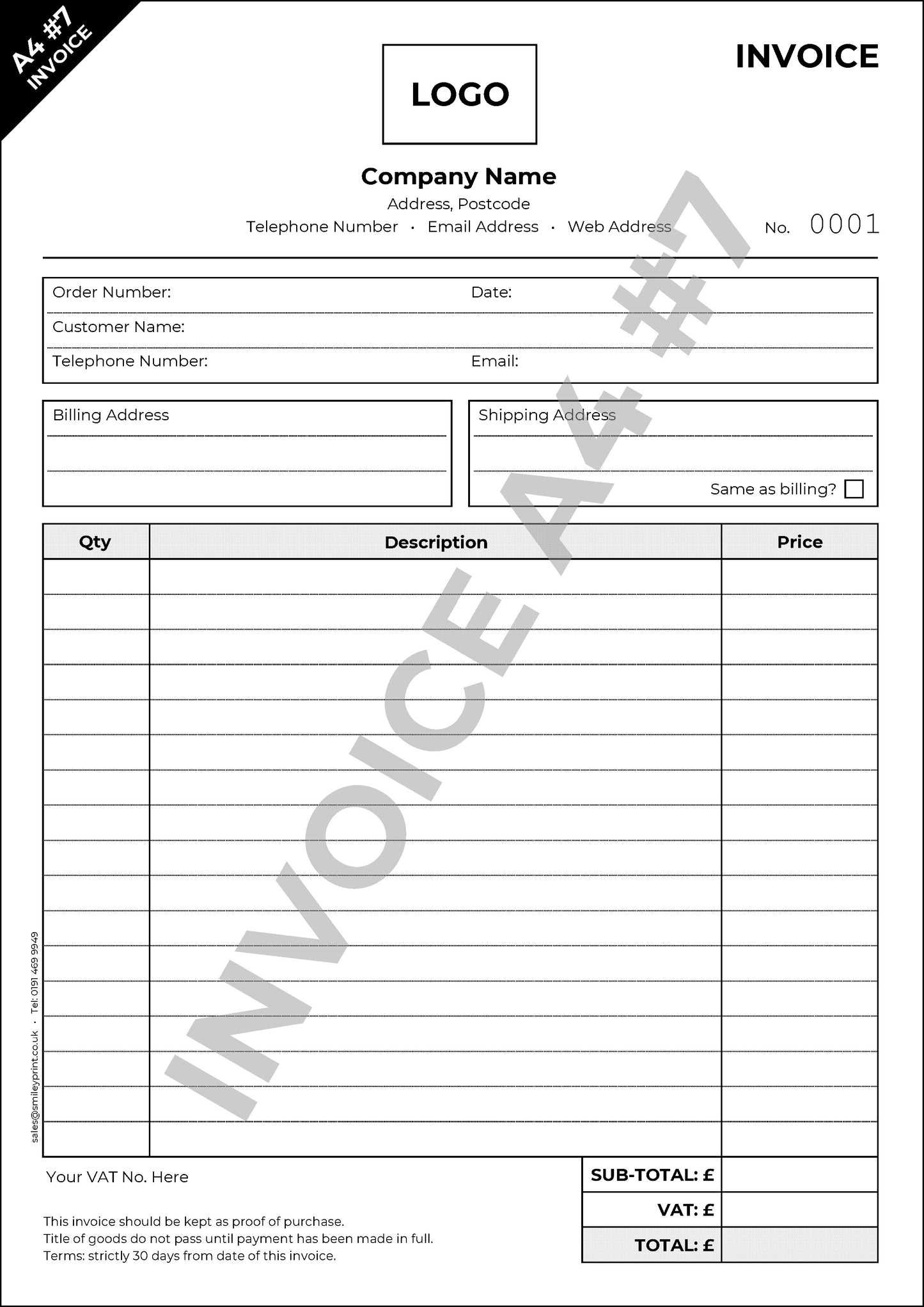

Making Your Invoice Professional

Creating a polished and organized document can leave a lasting impression and reinforce your brand’s credibility. Professional touches demonstrate attention to detail and help clients understand all essential information with ease.

First, ensure the layout is clean and easy to follow. Avoid clutter by arranging details logically, with sections for essential information like contact details, itemized charges, and payment conditions. A readable font and balanced spacing contribute to a more accessible design.

Incorporate branding elements where possible. Adding your logo, company colors, and consistent font choices helps build recognition and conveys a cohesive image. Avoid excessive styling, keeping it simple yet distinct.

Finally, double-check for accuracy. Review all numbers, dates, and terms to ensure clarity and correctness. A well-crafted, error-free document reflects positively on your business, making it more likely that clients will trust and remember your service.

How to Track Payments with Templates

Maintaining a reliable record of transactions is essential for managing finances and ensuring timely payments. Organized tracking can help you stay informed of outstanding amounts, payment dates, and client histories, making your financial workflow smoother and more efficient.

Organize Payment Records

Establish a system that captures key details for each transaction. Include fields for client name, payment due date, total amount, and status (e.g., “Paid” or “Pending”). Keeping these records updated makes it easier to follow up and keep an accurate overview of your cash flow.

Set Up Notifications

Automated reminders can be beneficial for staying on top of due dates. Many platforms allow you to set reminders, notifying you or your clients when payme

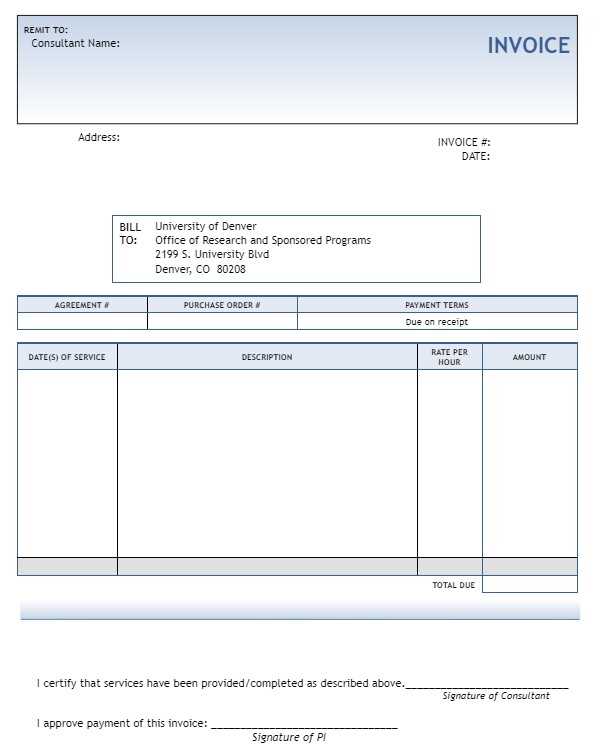

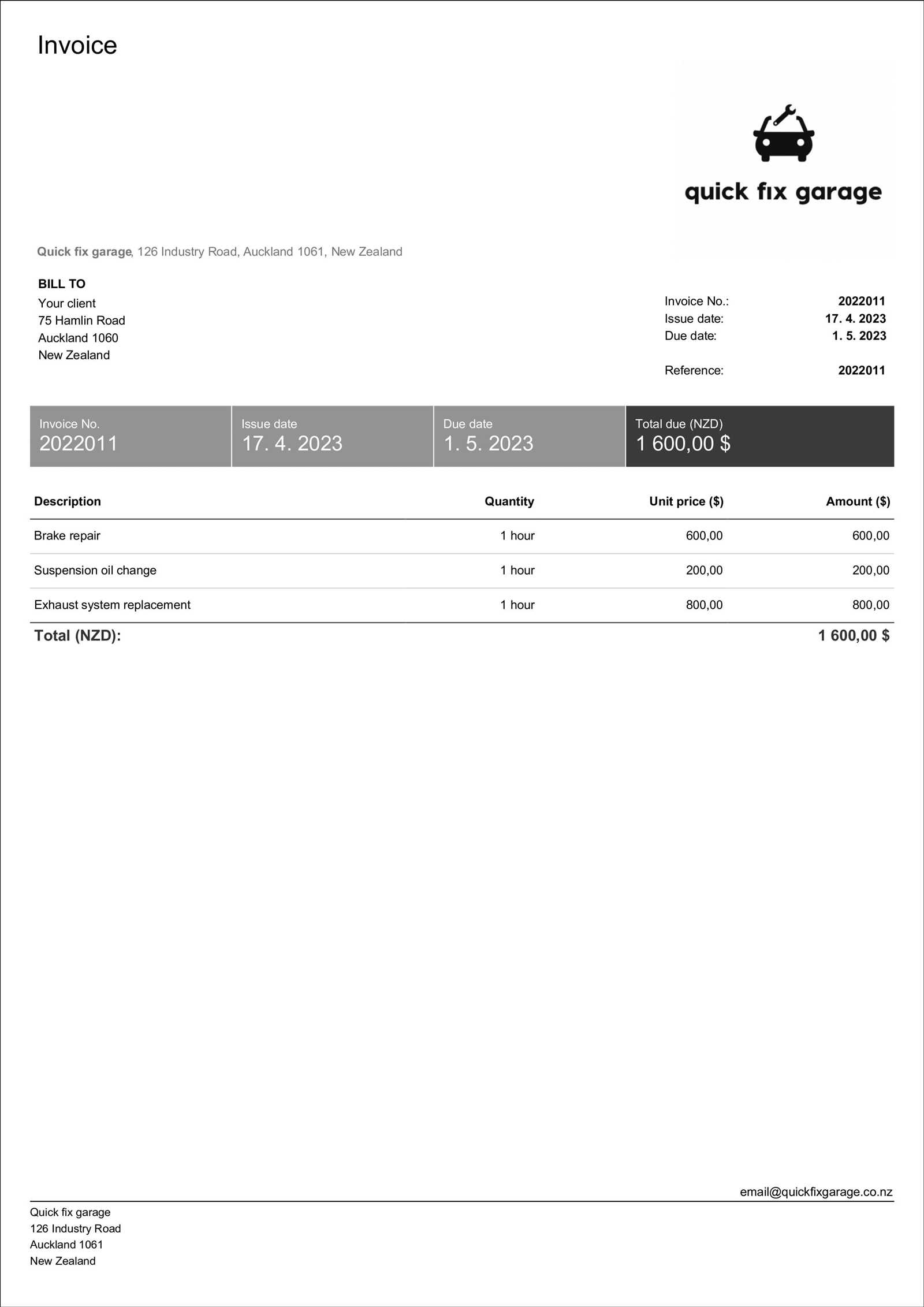

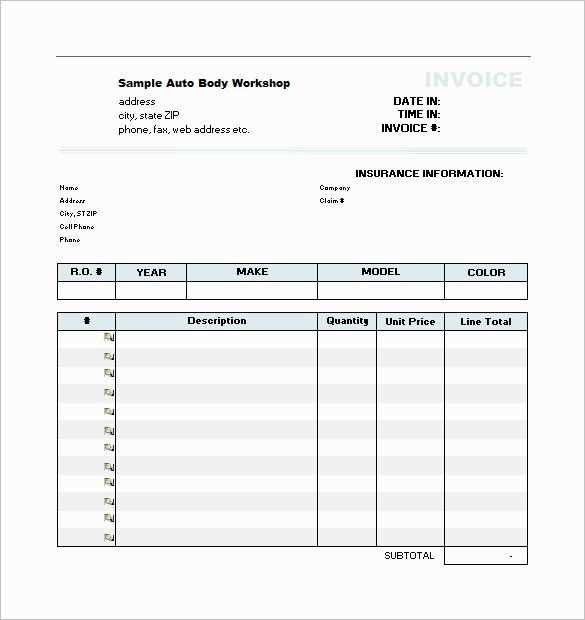

Invoicing for Different Workshop Services

Providing varied services often requires a customized approach to billing. Tailoring each record to reflect specific tasks, materials, and labor hours helps create clarity for clients and ensures accurate payment for each service rendered.

Itemizing Service Types

Breaking down each service category allows clients to see exactly what they are paying for. Include details such as:

- Labor Hours: Specify the number of hours worked and the rate per hour.

- Materials Used: List any parts, tools, or materials required, along with individual costs.

- Additional Services: If there are specialized tasks or unique services, itemize these separately to clarify added value.

Setting Different Rates

Legal Requirements for Workshop Invoices

To ensure compliance with applicable laws, it’s essential that billing documents contain specific information. Meeting these standards not only protects your business but also builds client trust by following industry norms.

Include Basic Identifiers

Each document should contain key identifying details, such as the business name, contact information, and unique document number. These elements make it easy to trace each transaction and help maintain organized records.

Specify the Transaction Date and Payment Terms

The document must clearly state the date of issue and the terms for completing the payment. This may include the deadline for payment, accepted methods, and any applicable conditions, such as late fees. This information clarifies expectations and provides a basis for follow-up if needed.

Provide an Accurate Breakdown of Charges

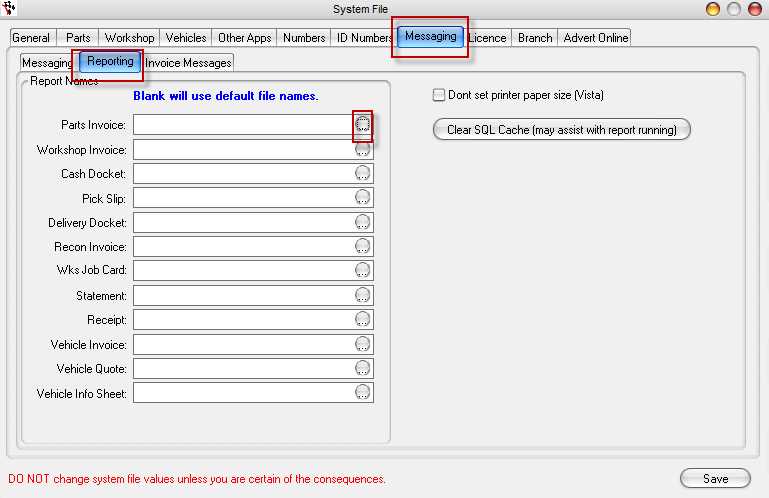

Integrating Invoices with Accounting Tools

Synchronizing billing records with accounting software can streamline financial management, reduce manual entry, and improve accuracy. By linking these systems, you can keep track of transactions in real-time, making it easier to manage cash flow and maintain organized records.

Here is a comparison of some key features that integration with accounting tools can offer:

| Feature | Benefits |

|---|---|

| Automated Data Entry | Eliminates the need for manual input, reducing errors and saving time. |

| Real-Time Tracking | Updates records instantly, providing an accurate view of paid and outstanding amounts. |

| Expense Categorization | Organizes entries under specific categories, making it easier to review finances and prepare for tax season. |