Ultimate Guide to Creating a Vendor Invoice Template

In today’s fast-paced business environment, maintaining clear and concise records is essential. Streamlined billing documents offer an organized way to keep track of transactions, helping businesses avoid confusion and delays. By ensuring clarity in each document, companies can foster better relationships and avoid potential disputes over payments.

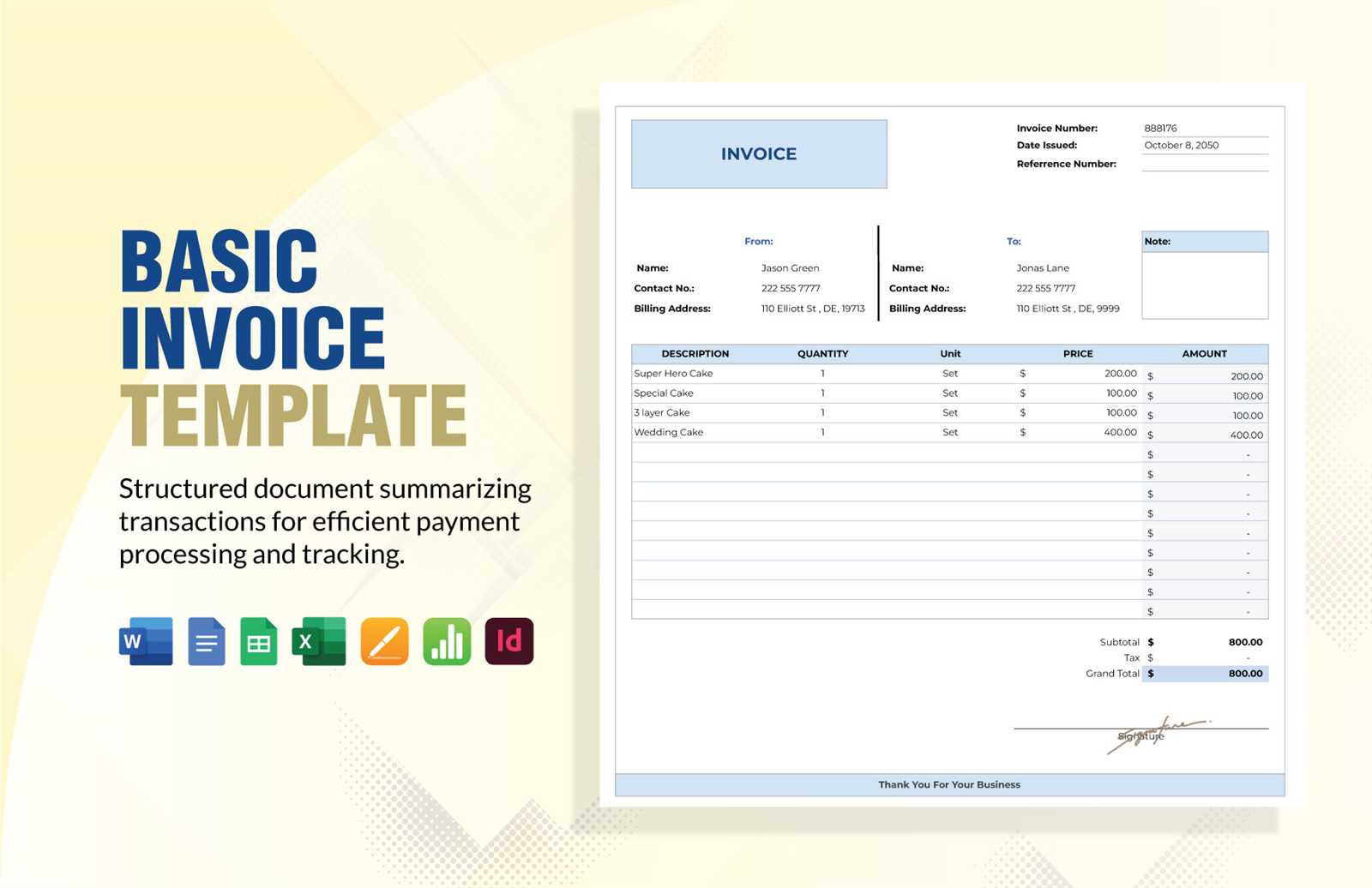

Structured document formats provide a straightforward way to outline details such as the nature of services, costs, and payment timelines. With the right setup, these forms become not only a record of service but also a tool that enhances financial transparency and accountability. Standardizing these forms simplifies the process, saving time for both providers and recipients.

Modern companies benefit greatly from using digital tools for document creation and management. Digital versions are adaptable and accessible, allowing businesses to easily customize their formats to suit specific needs. Such flexibility ensures that each document remains relevant to the transaction at hand, paving the way for smoother operations and improved efficiency.

Understanding the Purpose of Vendor Invoices

Efficient documentation is crucial for smooth financial exchanges in any business setting. Organized billing records ensure that each transaction is clearly defined and traceable, reducing misunderstandings and fostering trust between parties. When records are well-structured, they serve as a foundation for efficient communication and timely payments, essential for healthy business relations.

Structured financial documents accomplish several key goals:

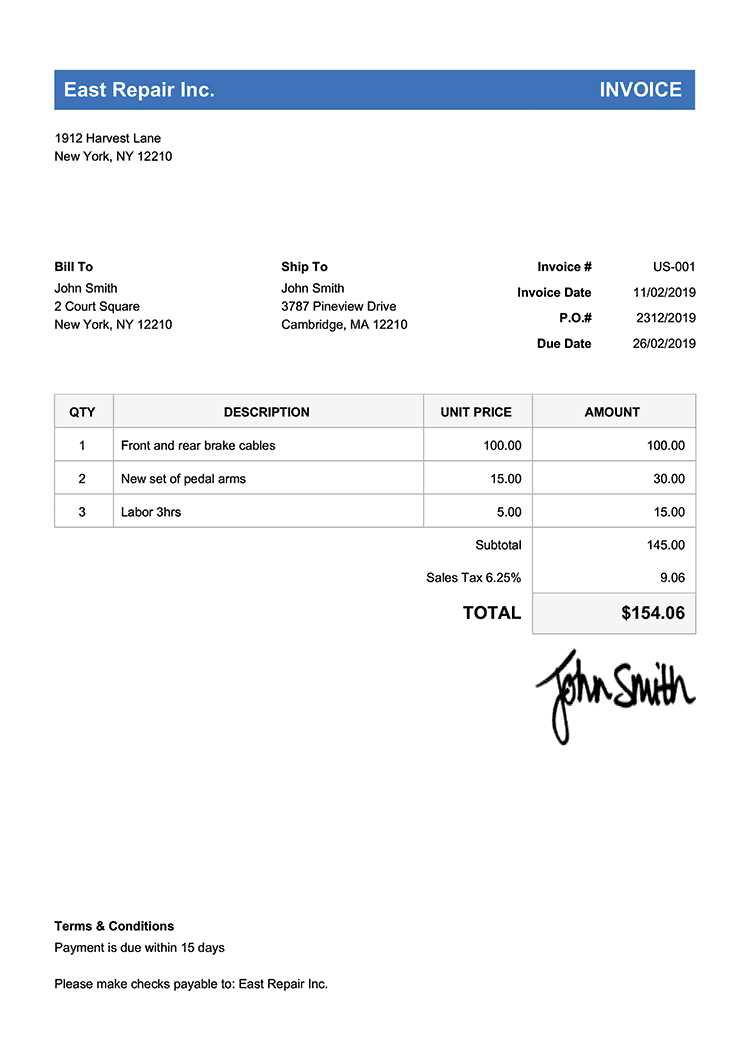

- Clarity of Services and Costs – Detailed records outline the specifics of goods or services provided, including associated costs, which helps to eliminate ambiguity and ensures mutual understanding.

- Defined Payment Terms – Clear payment conditions such as due dates and accepted methods are essenti

Why Businesses Need Invoice Templates

Standardized billing formats play a significant role in the organization of financial transactions within a company. By using a consistent layout, businesses ensure that every financial document is easy to understand, reducing the chances of errors or miscommunication. Standard forms simplify the process of managing payments, allowing businesses to focus more on growth and less on administrative challenges.

Enhancing Efficiency and Reducing Errors

Pre-designed billing formats allow companies to process transactions more quickly and with fewer mistakes. With a ready-made format, there’s less need for manual data entry or formatting adjustments, which lowers the risk of inaccuracies. Each document is consistent in its layout, making it straightforward to complete, review, and send, saving both time and effort.

Promoting a Professional Image

Uniform billing

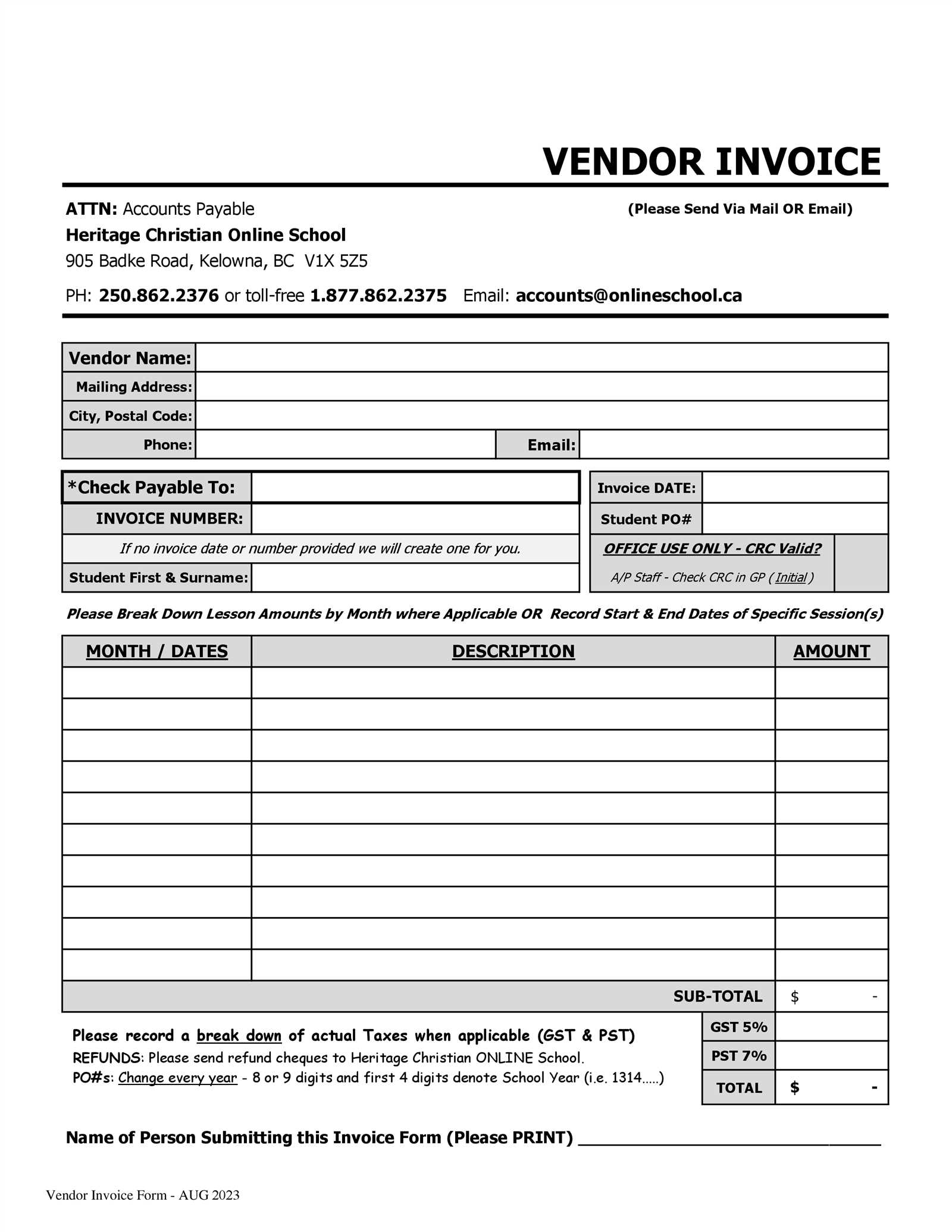

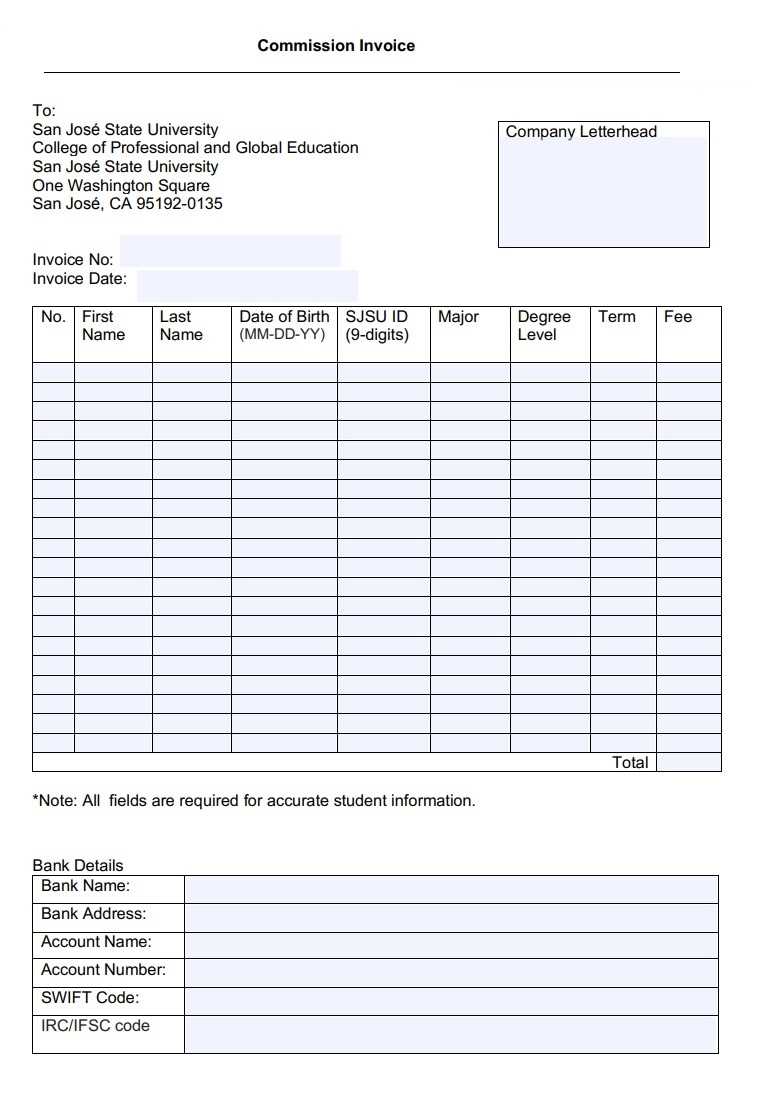

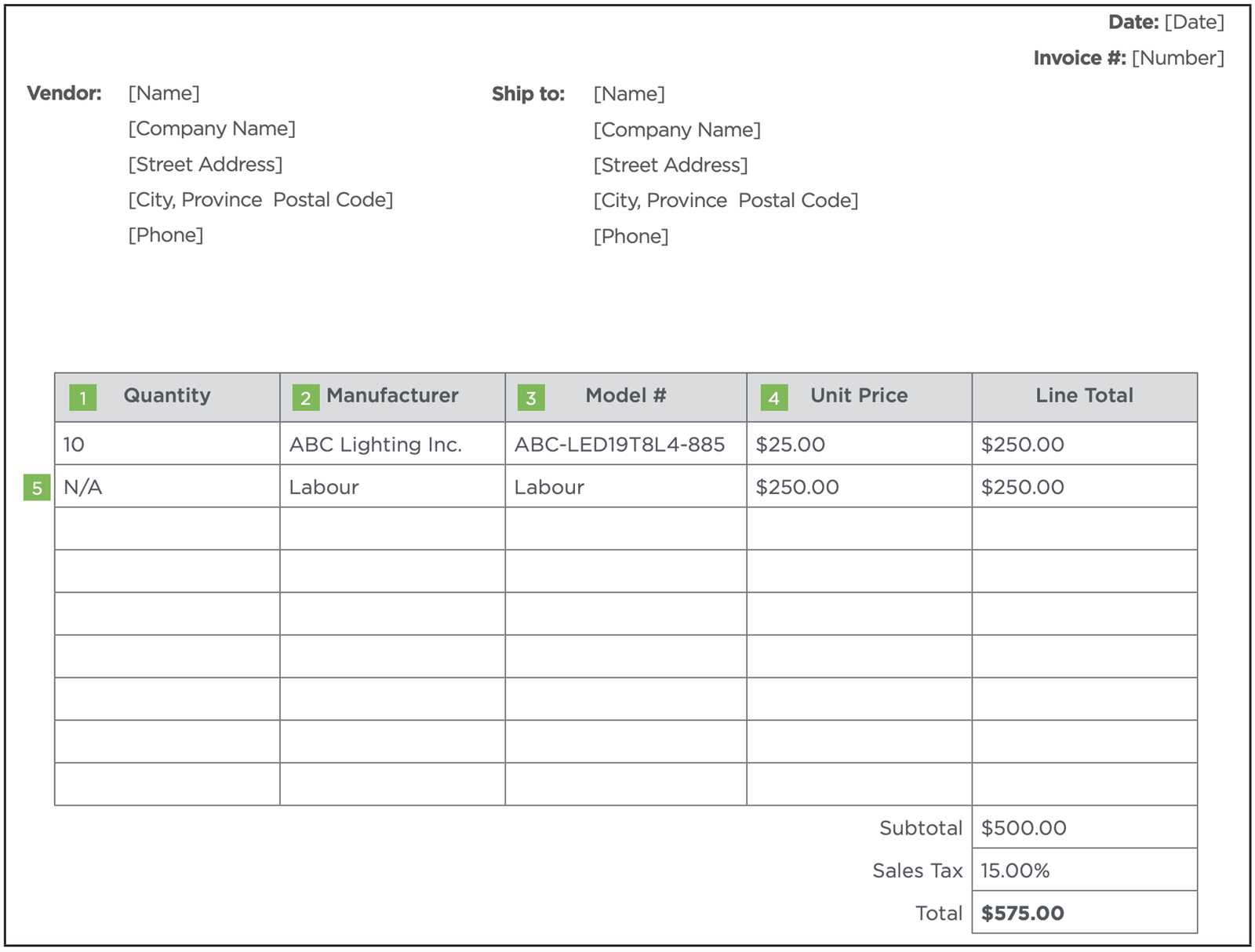

Key Elements in a Vendor Invoice

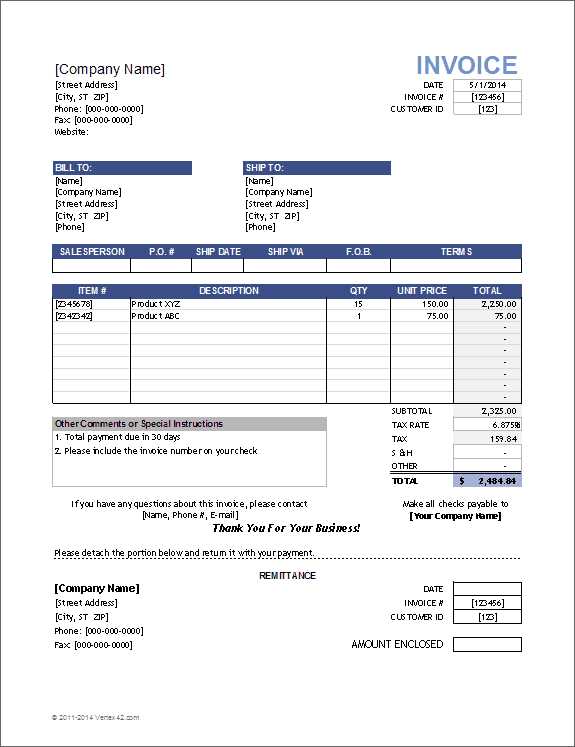

Organized financial documents should contain essential details that make each transaction transparent and traceable. These core elements help ensure that both parties are clear on the specifics of the exchange, reducing misunderstandings and making the payment process smoother. Including all necessary information also enhances the reliability and accuracy of records, which is invaluable for future reference.

Detailed Contact Information

Providing full contact details, including the names, addresses, and contact numbers of both the sender and the recipient, ensures clear communication. This information serves as a primary reference for both parties in case of any questions or follow-up, establishing a reliable channel for further interaction.

Description of Goods or Services

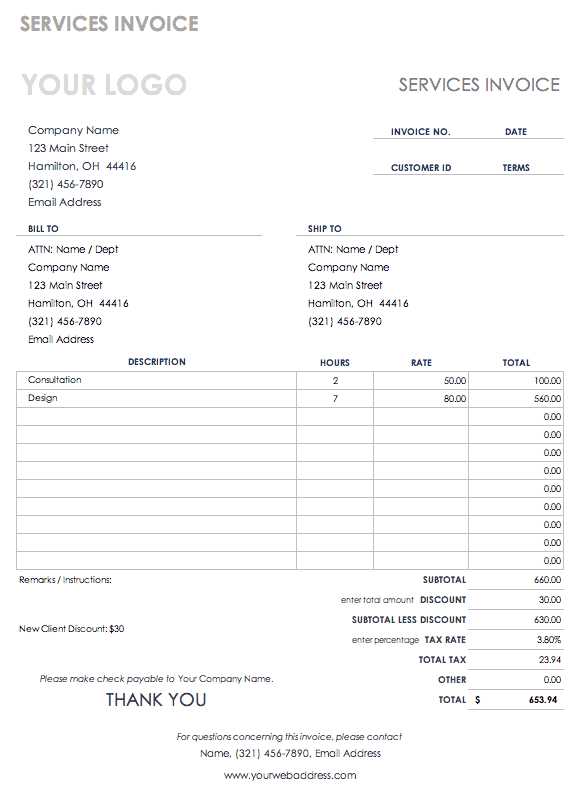

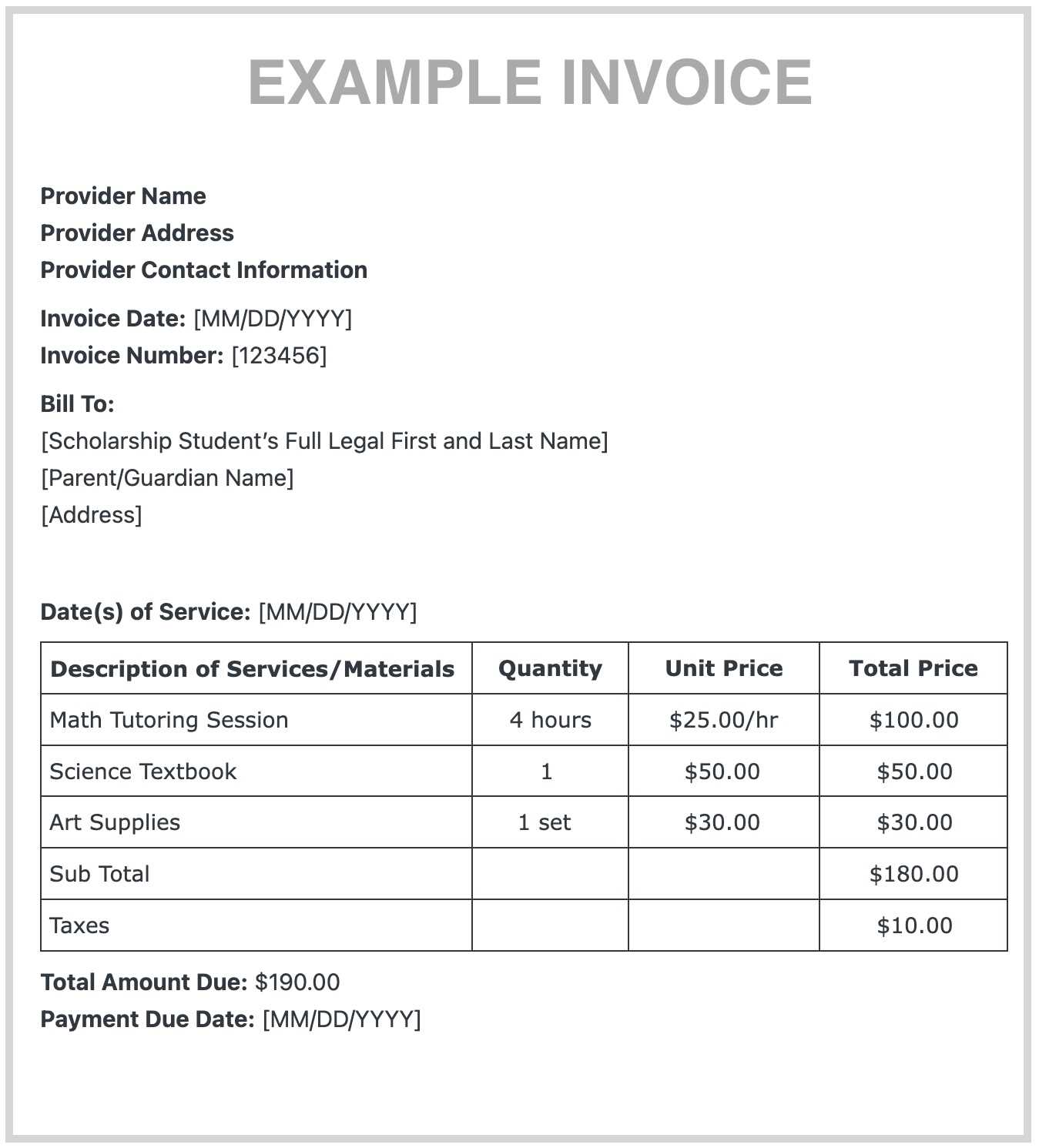

A precise list of items or services included in the transaction is vital. Each entry should have a brief description, quantity, unit price, and total cost to eliminate any ambiguity. Clear itemization of costs helps build mutual understanding and confidence in the accuracy of the charges.

Incorporatin

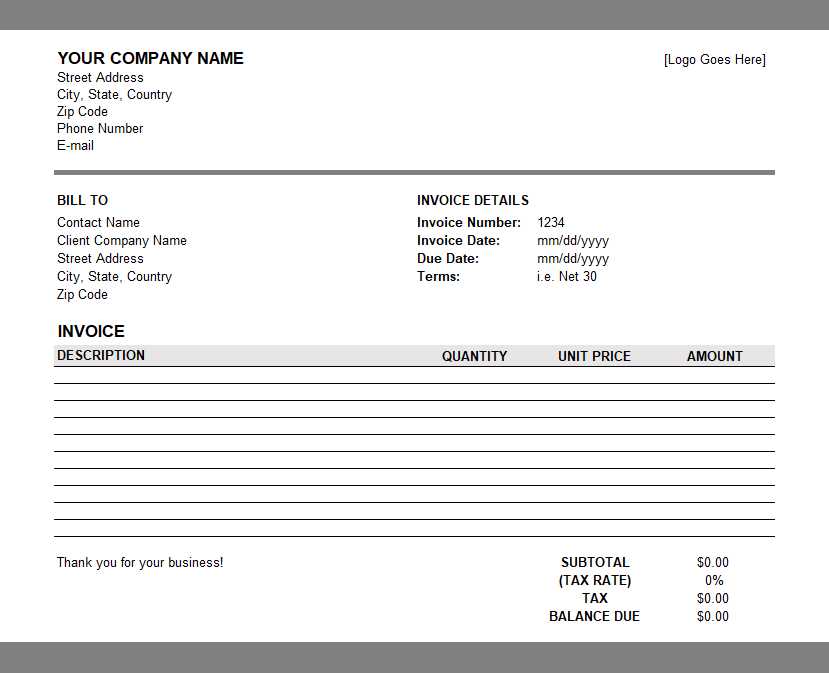

How to Customize Invoice Templates

Personalizing billing formats allows businesses to reflect their unique brand while meeting specific transaction requirements. By modifying certain elements, companies can make each document more relevant to their operations and improve its effectiveness. Customization ensures that every detail aligns with the company’s professional identity and the needs of each transaction.

Adjusting Key Components

To create a format that suits your organization, focus on adapting the essential parts. These might include:

- Logo and Branding – Adding a company logo and using brand colors gives the document a professional appearance that reinforces brand identity.

- Payment Instructions – Specify preferred payment methods and terms to make the process smoother for clients, ensuring timely and convenient transactions.

- Additional Notes or Messages – Including a personalized note or thank-you message can enhance customer rel

Streamlining Billing with Invoice Templates

Using standardized formats for billing helps companies simplify their payment processes and improve accuracy. With a well-structured document layout, businesses can handle financial transactions more efficiently, freeing up time for other essential tasks. Organized, consistent billing formats reduce administrative burdens and ensure that every detail is clear for both parties involved.

Key benefits of using ready-made formats include:

- Consistency in Information – Standard forms ensure that the same important details are included in every document, reducing the likelihood of omissions or errors.

- Time Savings – Pre-designed formats eliminate the need to recreate layouts each time, saving valuable time and allowing businesses to focus on other priorities.Choosing the Right Format for Invoices

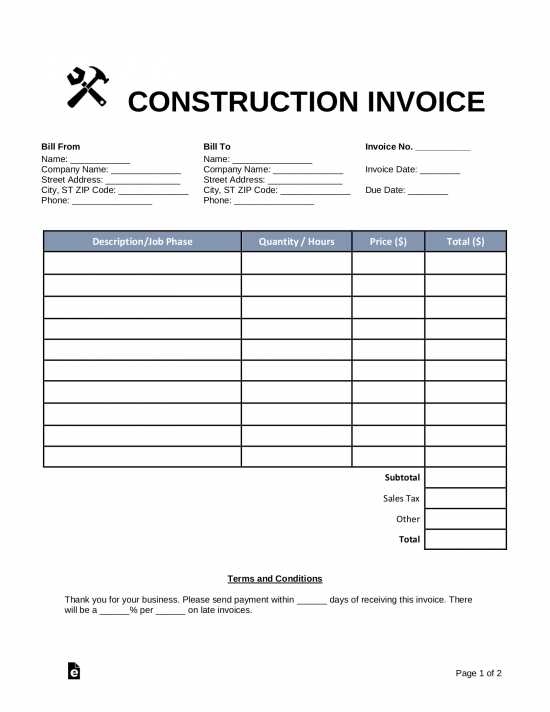

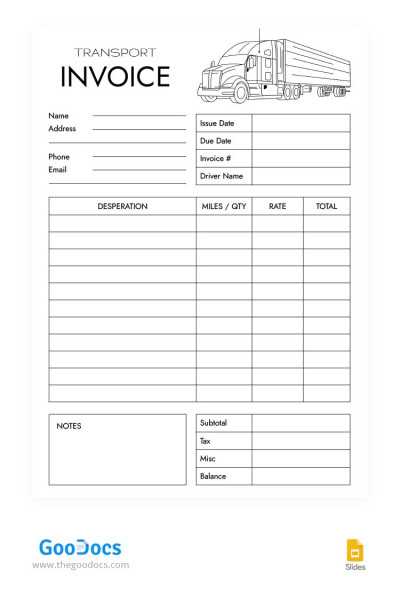

Selecting an appropriate layout for billing documents is crucial to ensure clarity and ease of use. Different formats serve various purposes, and the choice can impact how effectively a company communicates with its clients. A well-chosen design simplifies understanding and enhances the efficiency of payment processing, making transactions smoother and more organized.

There are several factors to consider when deciding on the best format:

Type of Business – Some layouts may be more suitable for service-based businesses, while others work better for product-based transactions. Service-oriented documents might prioritize time logs and hourly rates, whereas those for products often emphasize quantity and unit price.

Complexity of Details – For transactions that require detailed descriptions or multiple line items, a more structured layout is

Essential Information to Include in Invoices

To make billing documents effective, it’s important to ensure that all necessary details are included for clarity and accuracy. Each piece of information plays a role in simplifying the payment process and preventing misunderstandings. A well-organized document helps both the business and the client understand the terms, details, and amounts clearly.

Contact Information – Clearly display the business name, address, phone number, and email. Including client contact details ensures both parties have full reference information on record.

Document Number – Assign a unique identification number to each document for easy tracking and organization. This step is crucial for record-keeping and auditing purposes.

Date of Issue and Payment Terms – The date establishes when the document was created, while the terms indicate the due period. Setting clear terms helps establish a mutually

Tips for Accurate Invoice Tracking

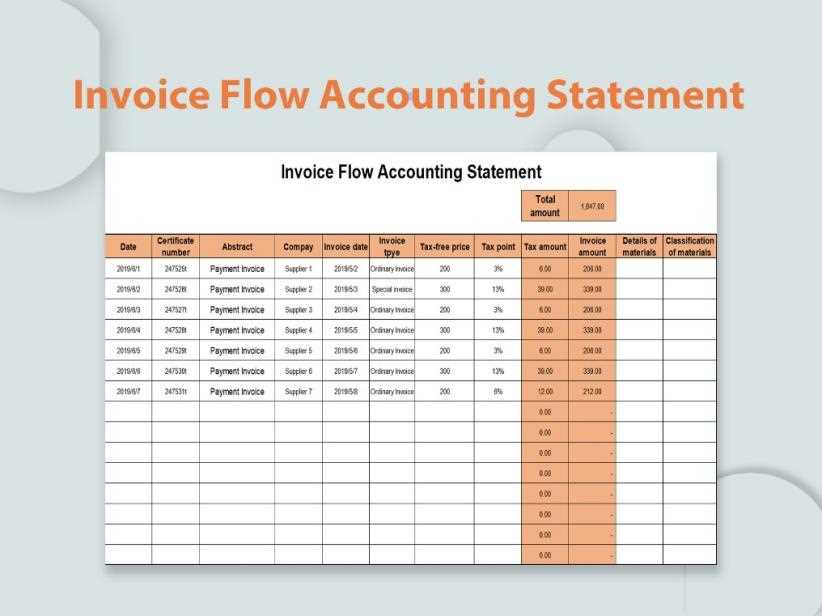

Efficient tracking of billing documents is essential for maintaining clear records and ensuring timely payments. By keeping accurate records, businesses can streamline their financial processes, reduce the chances of missed payments, and improve overall cash flow. Here are several effective strategies for precise tracking.

Organize by Date and Category

Sorting documents by date and category allows for quick access and easy review. Whether organized digitally or in physical files, chronological order helps track deadlines, while categorizing by client or project improves clarity. This method ensures that information is readily available when needed, simplifying both payment follow-ups and financial audits.

Use a Centralized Tracking System

Implementing a centralized system, like accounting software or a dedicated tracking spreadsheet, helps maintain organized records in one place. A reliable system provides visibility into outstanding payments, prevents duplicate entries, and enables quick status

Managing Multiple Vendor Invoices Efficiently

Handling numerous billing documents from various suppliers can be a daunting task. Efficient management not only ensures that payments are made on time but also helps maintain healthy business relationships. Streamlining the process requires organization, effective tools, and a clear strategy to track and prioritize each document.

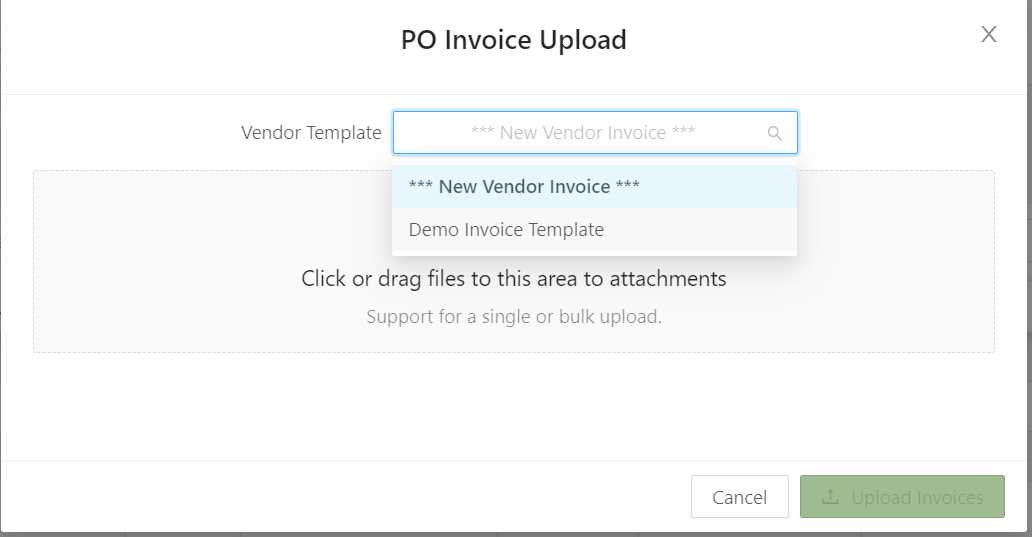

Implement a Digital Management System

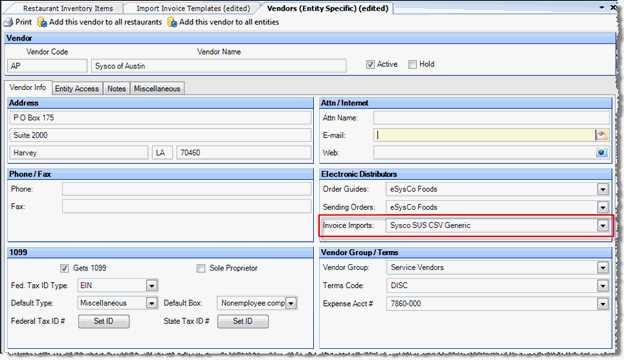

Utilizing a digital management system can significantly enhance the efficiency of handling multiple documents. Software solutions often include features such as automated reminders, tracking capabilities, and easy categorization. These tools allow businesses to monitor due dates, avoid late payments, and quickly access any document needed for reference. Moreover, integrating these systems with accounting software can create a seamless workflow, minimizing manual data entry and reducing errors.

Establish a Review Process

Creating a systematic review process can streamline the management of multiple documents. Designate specific times for reviewing and processing incoming documents, ensuring that nothing gets overlooked. Regular checks can help prioritize urgent payments and identify any discrepancies early on. This proactive approach enables businesses to stay ahead of deadlines and maintain accurate records.

By adopting these strategies, organizations can effectively manage numerous documents, ensuring timely payments while fostering positive relationships with suppliers. A well-organized approach not only saves time but also enhances financial accuracy and reliability.

Creating Digital Templates for Vendors

Establishing digital documents for billing purposes is a strategic move that can enhance efficiency and accuracy in financial transactions. These electronic formats simplify the process of generating and sending essential paperwork while ensuring consistency across all communications. A well-designed document not only saves time but also fosters professionalism and clarity in business interactions.

To create effective digital documents, it is crucial to consider the layout and essential elements that should be included. Start by selecting user-friendly software that allows for customization, enabling the incorporation of branding elements like logos and color schemes. Additionally, ensure that all necessary fields are included, such as dates, item descriptions, quantities, and total amounts. This attention to detail will ensure that the documents are both functional and visually appealing.

Moreover, utilizing formats that are easily editable and shareable, such as PDFs or Word documents, can facilitate quick updates and distribution. By maintaining a library of these digital documents, businesses can streamline their billing processes, reduce the likelihood of errors, and improve the overall efficiency of financial management.

Best Practices for Vendor Payment Terms

Establishing clear and fair payment terms is essential for maintaining healthy relationships with suppliers. Effective payment terms not only enhance financial management but also contribute to building trust and fostering collaboration. By following best practices, businesses can create a balanced approach that benefits both parties while ensuring timely transactions.

Define Clear Payment Schedules

It is crucial to outline specific payment schedules that are mutually agreed upon. Clarity in timelines helps set expectations and reduces misunderstandings. Common practices include offering terms like net 30, net 60, or discounts for early payments. Communicating these terms upfront can streamline the billing process and ensure that all parties are on the same page.

Communicate Changes Promptly

In cases where payment terms need to be adjusted, prompt communication is key. Informing suppliers of changes well in advance can prevent potential disputes and maintain goodwill. Additionally, documenting all agreements in writing ensures that there is a record of what has been discussed, which can be referenced in the future.

By implementing these best practices, organizations can manage payment terms effectively, leading to improved cash flow and stronger relationships with suppliers.

How to Automate Vendor Invoicing

Streamlining billing processes through automation can significantly enhance efficiency and reduce the likelihood of errors. By leveraging technology, businesses can simplify the management of financial documents, making it easier to track transactions and ensure timely payments. Automating these procedures not only saves time but also allows for better resource allocation within an organization.

To begin automating the process, organizations should consider implementing specialized software that offers features such as automatic generation and sending of financial documents. These tools can integrate with existing accounting systems, ensuring seamless data transfer and minimizing manual input. Additionally, setting up reminders for payment due dates can help maintain cash flow and strengthen relationships with suppliers.

Furthermore, using cloud-based solutions allows for easy access to records from any location, promoting collaboration among team members. Training staff on these automated systems is essential to maximize their effectiveness, as well as to ensure that everyone understands how to utilize the technology for optimal results.

Overall, embracing automation in financial documentation leads to more accurate record-keeping and fosters a more organized approach to managing payments.

Common Mistakes in Vendor Invoicing

Managing financial documents can be a complex process, and various errors can arise during this critical task. Understanding the typical pitfalls can help organizations improve their billing practices and enhance overall efficiency. By identifying and addressing these common mistakes, businesses can streamline their operations and maintain healthy relationships with their suppliers.

One prevalent issue is the lack of clear and detailed descriptions of the goods or services provided. When descriptions are vague, it can lead to confusion and disputes over charges. Additionally, failing to include the correct payment terms can cause delays in processing and affect cash flow. It is essential to specify the due date, acceptable payment methods, and any applicable late fees to avoid misunderstandings.

Another common mistake is neglecting to double-check the accuracy of financial information. Simple errors in pricing, quantities, or calculations can lead to significant discrepancies that can frustrate both parties involved. Implementing a thorough review process before sending out documents can help catch these errors early.

Furthermore, not maintaining a consistent format can hinder the ease of processing. Using varied layouts or designs can confuse recipients, making it challenging for them to quickly locate essential information. Establishing a standardized format not only improves clarity but also fosters professionalism in communications.

By recognizing these common mistakes and actively working to avoid them, organizations can enhance their billing processes and ensure smoother transactions with their partners.

Improving Cash Flow with Efficient Invoices

Effective management of financial documents plays a crucial role in maintaining a healthy cash flow for any organization. By ensuring that billing processes are streamlined and efficient, businesses can enhance their ability to receive payments promptly, which is essential for operational stability. When structured correctly, these documents not only communicate essential transaction details but also encourage timely payments.

One of the key strategies for enhancing cash flow is to adopt a clear and concise format for financial documents. This clarity helps recipients quickly understand the amounts due and the payment terms associated with their transactions. Including specific due dates and acceptable payment methods can significantly reduce delays in processing payments.

Moreover, implementing a follow-up system for outstanding balances can greatly improve financial liquidity. Regular reminders can prompt clients to settle their accounts, reducing the likelihood of overdue payments. Automating these reminders through software can save time and ensure consistency in communication.

Additionally, offering incentives for early payments can be an effective strategy to encourage prompt settlement of dues. Discounts or rewards for clients who pay ahead of schedule can motivate them to prioritize payments, ultimately benefiting cash flow.

By focusing on these practices, organizations can create a more efficient billing process that supports timely payments and enhances overall financial health.