What is an Invoice Template and How Can It Benefit Your Business

For businesses of all sizes, streamlining billing processes is crucial for maintaining smooth operations and ensuring timely payments. A well-organized document can help manage client transactions, reduce errors, and present a professional image. By using standardized formats, companies can save time and avoid confusion during payment processing.

These documents typically include essential details such as transaction dates, payment terms, and a breakdown of services or goods provided. With the right structure, they not only enhance efficiency but also create a clear record for both the issuer and the recipient. Whether you are a freelancer or running a large organization, utilizing such a system simplifies financial tracking.

In this article, we’ll explore how using a structured billing document can improve your business operations, increase accuracy, and ensure that payments are handled smoothly. Understanding how to use such tools effectively will allow you to stay organized and professional in every transaction.

What is an Invoice Template

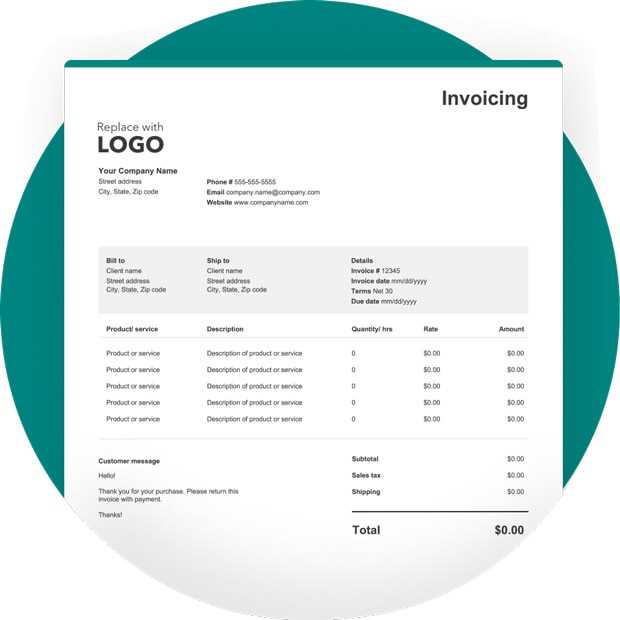

A structured document designed to capture transaction details between a service provider and a client is an essential tool for any business. It serves as a formal request for payment, providing clear information about the goods or services delivered, the total amount due, and the payment terms. By using a predefined format, businesses can ensure consistency in their billing process and avoid confusion.

These documents typically include key sections such as the name of the service provider, recipient details, description of the transaction, payment due date, and any applicable taxes. By having a reliable format to work with, businesses can simplify the process of generating bills and ensure that all necessary information is included, reducing the risk of missing details that could lead to disputes.

Having a consistent structure in place also helps businesses maintain a professional appearance and build trust with clients. With a standard layout, clients are able to quickly understand the terms of the transaction, making it easier for them to process payments on time. Overall, using a well-organized document can enhance both operational efficiency and customer relations.

Understanding the Basics of Invoice Templates

At the core of any business transaction, clear communication of payment details is essential. A well-organized document helps both parties involved understand the terms and expectations, reducing misunderstandings and ensuring smooth financial exchanges. These standardized documents make it easier to record and track services rendered or goods provided, along with the amounts owed.

In the simplest form, such a document includes crucial information like the names of the parties involved, an itemized list of the services or products, and the total amount due. It also specifies payment terms, including due dates and any late fees, providing clear guidelines for when and how payment should be made. By using a structured format, businesses ensure that all necessary details are present, making it easier to follow up and avoid errors in the billing process.

These documents not only streamline operations but also ensure that businesses maintain a professional appearance. They help establish credibility and trust with clients, making them a vital part of any company’s financial workflow.

Why Use an Invoice Template for Billing

Using a standardized document to manage payment requests offers numerous benefits to businesses. It ensures that all essential information is consistently included, reducing the chances of errors or missing details that could delay payments. By adopting a uniform structure, companies can focus on their core activities while streamlining financial processes.

Improved Accuracy and Consistency

A key advantage of using a structured format is the accuracy it provides. Each document follows the same format, which helps eliminate the possibility of forgetting important details like payment terms or service descriptions. This consistency also builds confidence with clients, as they know exactly what to expect from each billing statement.

Time and Cost Efficiency

Generating bills using a predefined format can save significant time. Rather than creating a new document for every transaction, businesses can quickly fill in the relevant information, minimizing administrative work. This efficiency reduces overhead costs and allows more time for other important tasks, such as client communication or service delivery.

Key Elements of an Invoice Template

To ensure that a billing document is both functional and professional, it must include several essential components. These elements help clarify the terms of the transaction, provide a clear record for both parties, and facilitate timely payments. A well-structured document should be easy to understand and contain all necessary information to avoid confusion.

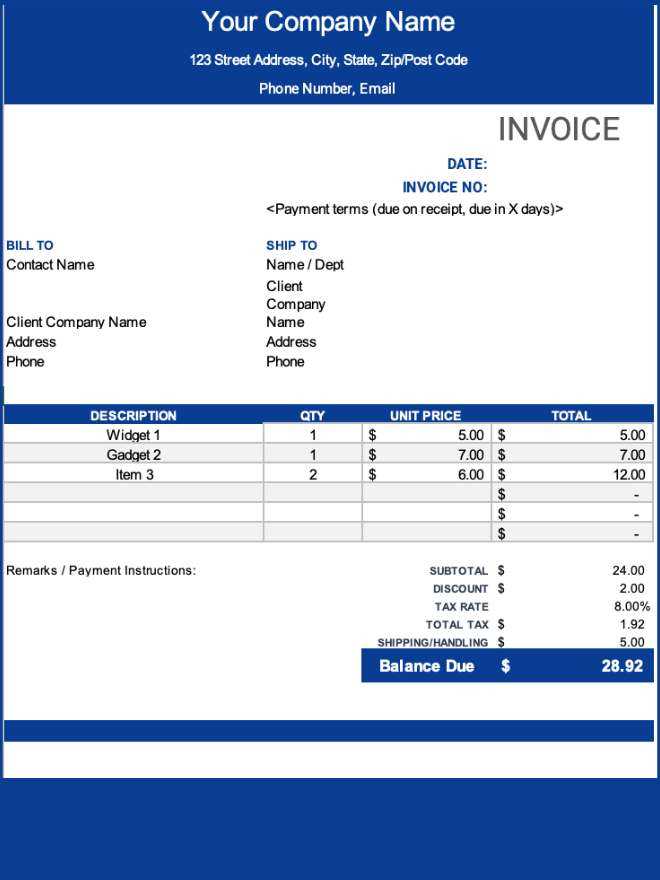

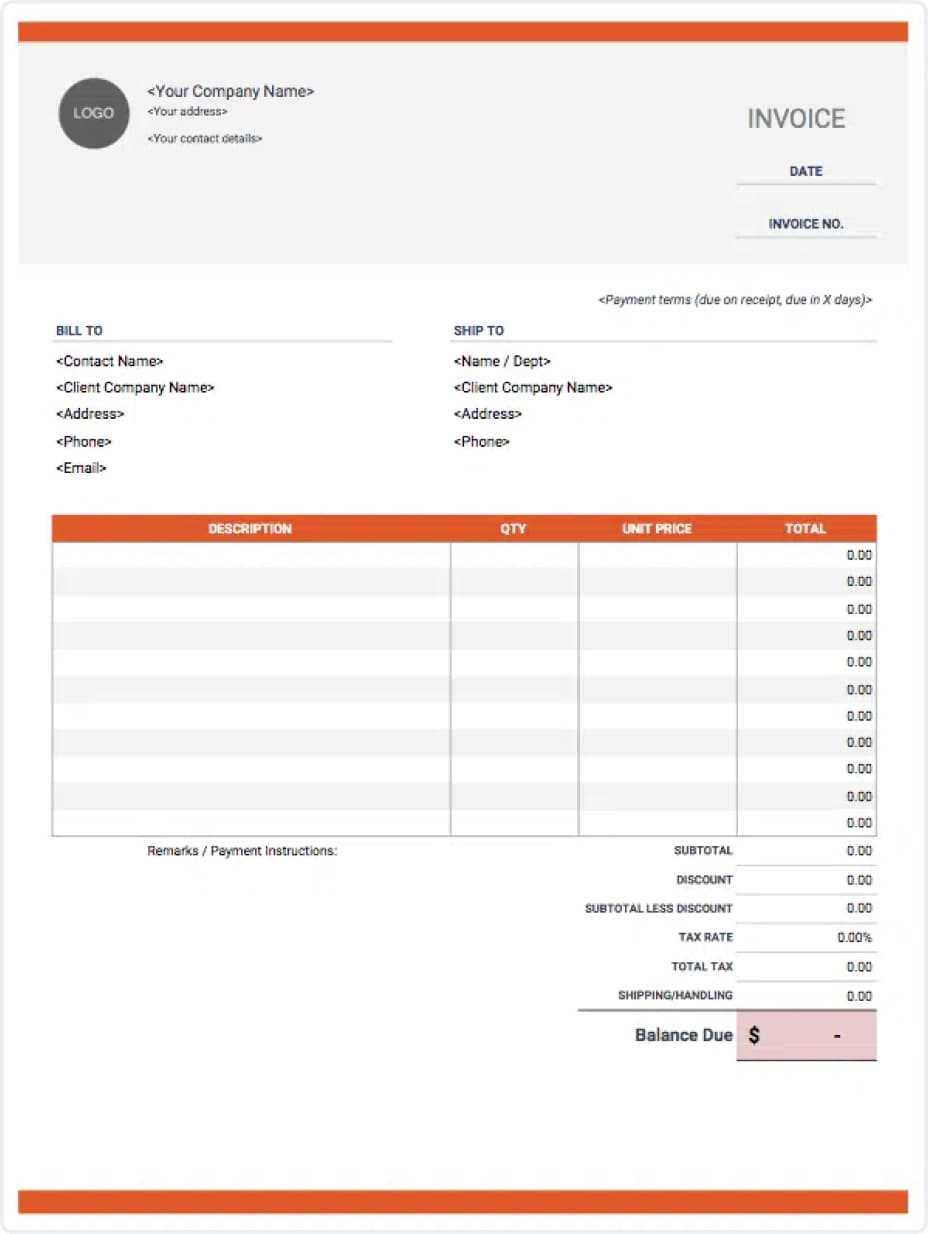

Basic Information

At the top of the document, it’s important to include the contact details of both the service provider and the client. This typically includes the company name, address, phone number, and email. Additionally, a unique identification number for the document helps track the transaction for record-keeping purposes.

Payment Breakdown and Terms

The most critical part of the document is the itemized list of services or goods provided, along with their individual prices. This ensures transparency and gives both parties a clear understanding of what they are being charged for. Along with this breakdown, the payment terms, including the total amount due, due date, and any applicable taxes or discounts, should be clearly stated.

How Invoice Templates Save Time and Money

Pre-designed documents for billing purposes streamline the process of requesting payments from clients. By eliminating the need to create these forms from scratch each time, businesses can focus on their core activities rather than spending excessive time on administrative tasks. The use of standardized formats also ensures consistency and professionalism, leading to quicker payments and fewer errors.

Automating the creation of these documents reduces manual input, lowering the chances of mistakes that could result in delayed payments or misunderstandings. Additionally, businesses can save on labor costs, as the time spent on generating customized invoices is significantly reduced. A well-structured, ready-to-use form can be filled out in minutes rather than hours, improving overall efficiency.

Another advantage is the reduction of operational overhead. Companies can avoid the need for expensive software or dedicated teams to handle invoicing manually. With the right tools, even small businesses can maintain a high level of professionalism while managing their cash flow effectively. This allows resources to be better allocated to growth and customer service, ultimately improving profitability.

Types of Invoice Templates Available

There are various designs and formats for billing documents, each suited to different business needs. Depending on the type of service provided, the industry, or the complexity of the transaction, companies can choose from a wide array of options. These pre-structured forms can cater to freelancers, small businesses, large corporations, and everything in between, providing flexibility in how transactions are recorded and payments requested.

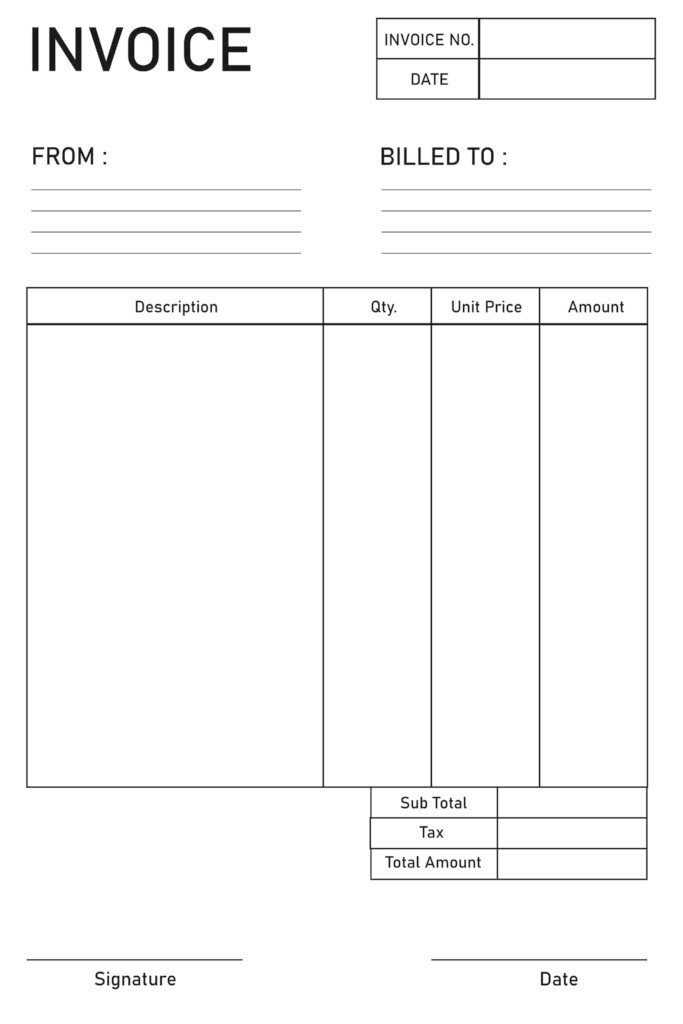

Basic Billing Forms

Simple and straightforward, these are ideal for individuals or small businesses who need to bill clients quickly without any complex breakdowns of services. They generally include essential details such as client information, the amount due, and payment terms. Basic formats are fast to fill out, making them perfect for one-time transactions or ongoing services where minimal customization is required.

Detailed Billing Statements

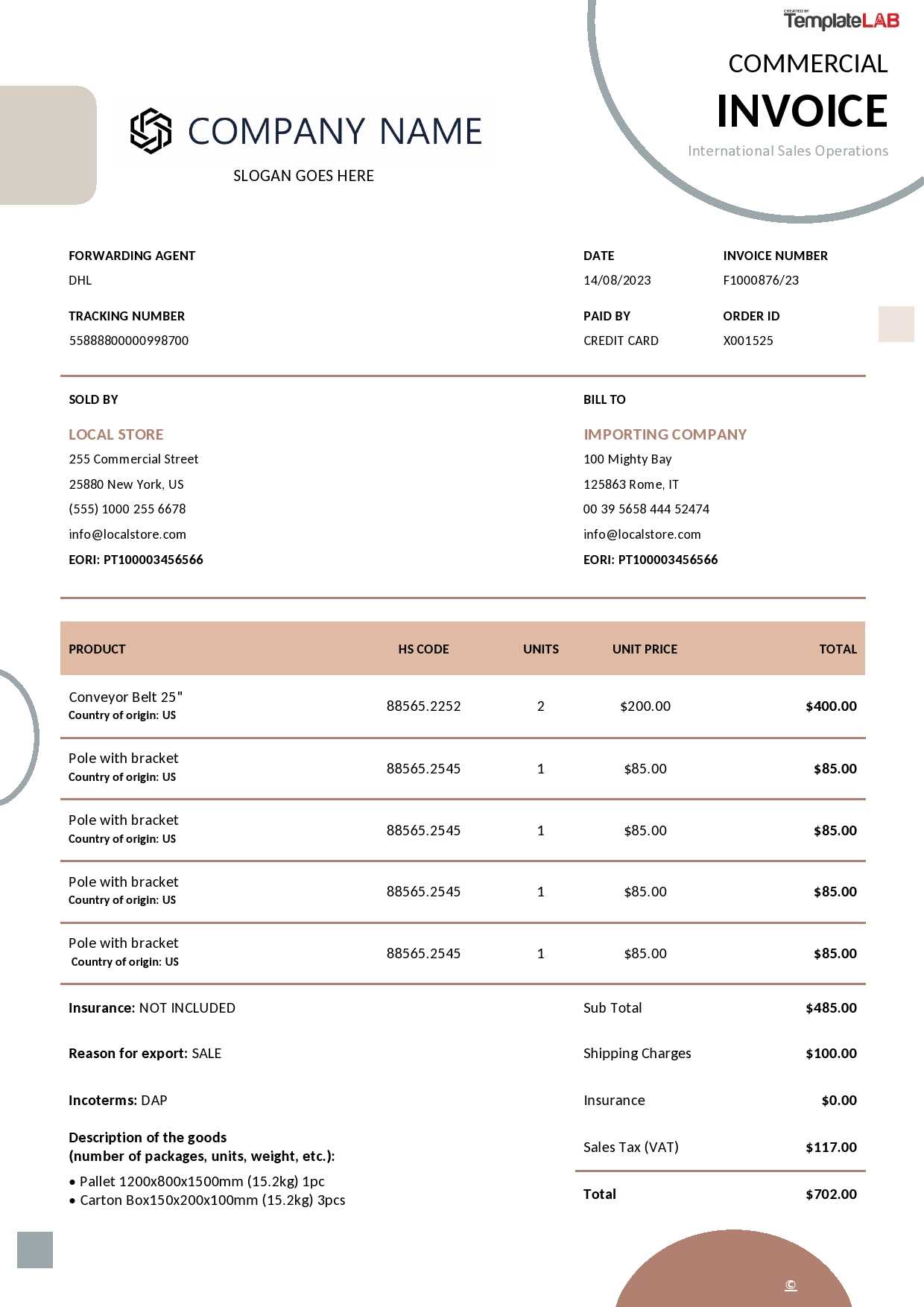

For more intricate transactions, such as those involving multiple services or products, detailed statements offer more structure. These documents typically include itemized lists, tax calculations, discounts, and various charges. They are ideal for businesses that deal with complex contracts or need to provide clients with a clear breakdown of costs.

| Template Type | Best For | Features |

|---|---|---|

| Basic | Freelancers, small businesses | Minimal details, quick billing |

| Itemized | Retail, service industries | Detailed listings, taxes, discounts |

| Recurring | Subscription-based businesses | Automatic billing, subscription cycles |

| Pro Forma | Estimations, pre-sales | Preliminary figures, no payment request |

| Feature | Benefit |

|---|---|

| Recurring Billing | Automatically generate and send documents for clients on a regular schedule without manual input. |

| Payment Reminders | Set up automated reminders to notify clients about due payments, reducing late fees and improving cash flow. |

| Integration with Accounting Software | Automatically sync data between billing and financial systems, ensuring accurate records and reducing duplication. |

| Customizable Fields | Easily tailor forms to suit your specific needs (e.g., adding taxes, discounts, or multiple services). |

By leveraging the power of automation and pre-designed forms, businesses can significantly reduce the time and effort spent on billing, improve accuracy, and provide a more professional experience for clients.

Legal Considerations for Invoice Templates

When creating forms for requesting payments, businesses must ensure that the documents comply with relevant legal requirements. These forms serve not only as a record of the transaction but also as a legal document that could be referenced in case of disputes or audits. Understanding the legal obligations associated with these forms helps protect both parties and ensures that all necessary information is included to avoid complications.

Essential Legal Elements to Include

In order for a payment request form to be legally valid, there are several key components that should always be included:

- Business Information: Your legal business name, address, and contact details should be clearly visible on the form. This ensures that the recipient knows who the document is from.

- Client Details: Always include the full name and contact information of the client being billed. This helps avoid any confusion and ensures the document is tied to the correct party.

- Description of Goods/Services: A clear and detailed description of what is being sold or provided is essential. It prevents disputes over what the client is being charged for and supports transparency.

- Payment Terms: Clearly outline the terms of payment, including the due date, accepted methods of payment, and any late fees or penalties for overdue payments. This can help protect you in case of non-payment.

- Tax Information: Depending on your jurisdiction, tax calculations (such as VAT or sales tax) should be clearly listed. Failure to include correct tax details may result in legal issues or fines.

Jurisdi

Tips for Efficient Invoice Management

Maintaining a streamlined process for handling billing documents is crucial for smooth business operations. Proper organization and timely actions can prevent mistakes and ensure payments are received without unnecessary delays. Below are some practical strategies to enhance the way you manage financial records, ensuring accuracy and efficiency in your operations.

1. Automate Processes

One of the most effective ways to improve workflow is through automation. Utilize software tools to generate, track, and send billing documents automatically. This not only reduces human error but also saves valuable time that can be spent on other important tasks.

2. Set Clear Payment Terms

Clearly state the payment deadlines and conditions in every document. Having transparent terms helps avoid confusion and disputes with clients. Specify the due date, accepted payment methods, and any late fees to encourage prompt settlements.

3. Keep Records Organized

Maintain a systematic filing system, whether physical or digital, to store all completed transactions. By categorizing records based on date, client, or project, you can easily retrieve information when needed, improving both efficiency and accountability.

4. Monitor and Follow Up

Regularly track outstanding amounts to stay on top of overdue payments. Setting reminders for follow-ups or using management software to alert you about pending payments ensures that nothing slips through the cracks.

5. Use Consistent Formats

Sticking to a uniform structure for all financial documents helps prevent confusion and promotes clarity. Consistency in layout, terminology, and presentation makes it easier for clients to review and process payments on time.

6. Offer Multiple Payment Methods

Providing various payment options increases convenience for clients, making it more likely that payments will be made promptly. Offering methods like bank transfers, credit cards, or online payment platforms ensures that you cater to different preferences.

7. Keep Communication Open

Establishing clear and ongoing communication with clients regarding billing matters can help resolve potential issues before they escalate. Be proactive in addressing concerns and always be available for questions or clarifications.

How to Track Payments with Invoice Templates

Effectively monitoring payments is essential for maintaining healthy cash flow and ensuring that financial transactions are accurately recorded. Using a well-structured document can help you track the status of payments, stay on top of outstanding balances, and quickly identify any issues. Below are some strategies for managing payment tracking efficiently through organized records.

1. Include Clear Payment Status Indicators

Incorporating visible payment status fields in your document can help you track whether a payment has been completed, is pending, or overdue. Use options like “Paid,” “Pending,” or “Overdue” and update these statuses regularly. This simple method can quickly show the financial standing of each transaction at a glance.

2. Utilize Due Dates and Reminders

Always set a clear due date for every financial document and incorporate automated reminders to follow up with clients. Some management systems allow for automatic email notifications or alerts when payments are overdue, helping to prompt clients without needing constant manual effort.

3. Track Partial Payments

If a client makes a partial payment, it’s important to update the remaining balance promptly. Having a section to note partial payments ensures that both you and your client can see how much is left to pay, which minimizes confusion and improves cash flow monitoring.

4. Keep Detailed Transaction Records

For every payment, ensure that you document the date, method of payment, and amount received. This detailed record-keeping allows for easy reconciliation of accounts and minimizes the chance of discrepancies or lost payments over time.

5. Regularly Review Outstanding Balances

Consistently reviewing unpaid balances and their due dates helps you stay proactive in managing overdue amounts. By monitoring the status of each transaction and following up on time, you can reduce the likelihood of late payments and keep your financial records up to date.