Consultant Billing Invoice Template Excel for Simplified Invoicing

When managing projects or freelance work, keeping track of payments is crucial for maintaining smooth business operations. Having an organized system in place allows for clear communication with clients and ensures timely compensation for services rendered. Whether you are a freelancer or a small business owner, a well-structured method to document financial transactions is key to staying on top of your financials.

One of the most effective ways to handle this process is by utilizing digital solutions that simplify record-keeping. By customizing a financial document to suit your specific needs, you can track charges, calculate totals, and outline payment terms in a way that is both professional and user-friendly. This approach not only saves time but also helps avoid common mistakes that can lead to confusion or delays in payment.

Adopting modern tools allows for the automatic calculation of amounts, which reduces manual errors and speeds up the entire workflow. Having a structured document also allows you to quickly adjust for different services, rates, and project requirements, creating a smooth and hassle-free experience for both you and your clients.

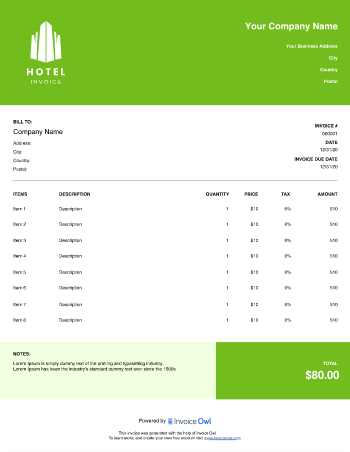

Consultant Billing Invoice Template Excel

Efficient financial management is essential for anyone providing professional services. Having a reliable system to track payments and service charges helps ensure that all transactions are clear and accurate. A well-organized document for recording client payments can streamline your workflow and reduce the risk of errors, ensuring timely compensation for your work.

Using a structured document allows you to easily input service details, including rates, hours worked, and additional costs. With the right tools, you can automate calculations, making the process faster and more reliable. This approach also ensures that each entry is consistent, reducing the likelihood of mistakes when adjusting prices or calculating totals.

Furthermore, a customizable format enables you to tailor the document to suit different clients or types of projects. You can create various fields for payment terms, taxes, or discounts, adapting the layout as needed. This flexibility provides a professional and efficient way to handle financial transactions across multiple engagements.

Why You Need an Invoice Template

Having a consistent and professional method for documenting financial transactions is crucial for any service provider. It not only helps keep your records organized but also ensures that your clients receive clear and accurate details about their payments. Without a well-structured document, it becomes easy to miss important information, leading to misunderstandings or delayed payments.

Professional Appearance and Clarity

A well-crafted document gives the impression of professionalism and reliability. By outlining key details such as services provided, rates, and payment terms, you present your work in a transparent manner. This reduces the likelihood of confusion or disputes with clients, ensuring that both parties are on the same page from the start.

Time and Effort Efficiency

Using a pre-designed structure saves you time and effort. Instead of manually calculating totals or figuring out the format for each new project, a consistent layout allows you to focus on your core work. Automation features, such as auto-calculating totals or applying taxes, further enhance efficiency, making the process smoother and quicker.

Benefits of Using Excel for Invoices

Choosing the right tool to manage financial records is crucial for maintaining accuracy and efficiency. A spreadsheet program offers a flexible and user-friendly platform for organizing payment details. Its powerful features allow for easy customization and automation, making it an ideal solution for tracking charges, calculating totals, and ensuring that your documents remain consistent across projects.

Automated Calculations and Reductions in Errors

One of the primary advantages of using a spreadsheet is its ability to perform automatic calculations. By setting up formulas, you can ensure that totals, taxes, and discounts are computed instantly. This reduces the likelihood of human error and saves valuable time that would otherwise be spent on manual calculations.

Customizability and Flexibility

A spreadsheet allows for extensive customization, making it easy to adjust the layout or add new fields according to your specific needs. Whether you are handling various service rates, different payment terms, or client-specific information, you can modify the structure as required. This flexibility ensures that your financial records reflect the unique nature of each project or client.

Efficiency and Organization

By using a digital format, you can quickly organize and filter data. This makes it easy to find past transactions, track outstanding payments, and monitor your financial status at any time. The ability to store and update records in one central place simplifies your workflow and ensures that you stay on top of your business finances.

How to Create a Billing Invoice

Creating a clear and accurate financial document is essential for ensuring that you are paid correctly and on time. A well-structured record not only helps you track what is owed but also serves as a professional communication tool with your clients. Follow these simple steps to craft a document that reflects your services and payment terms effectively.

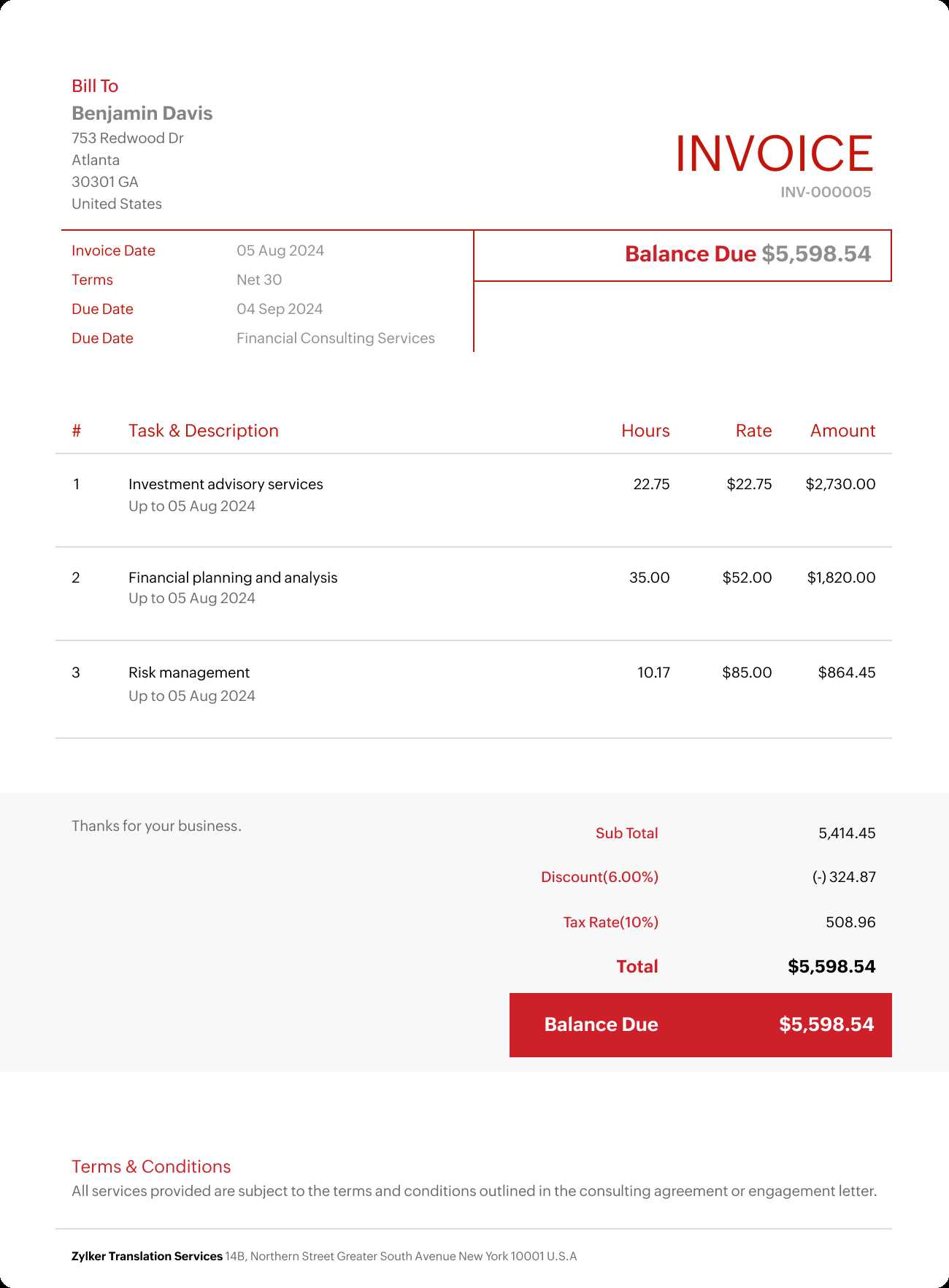

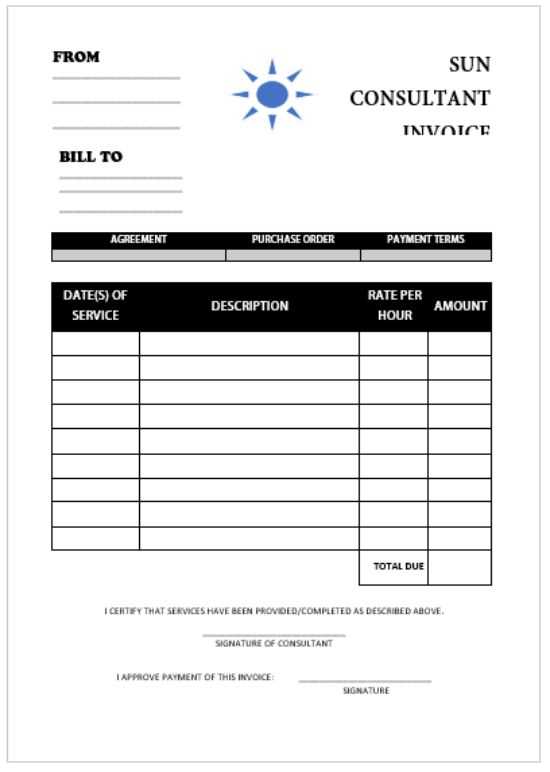

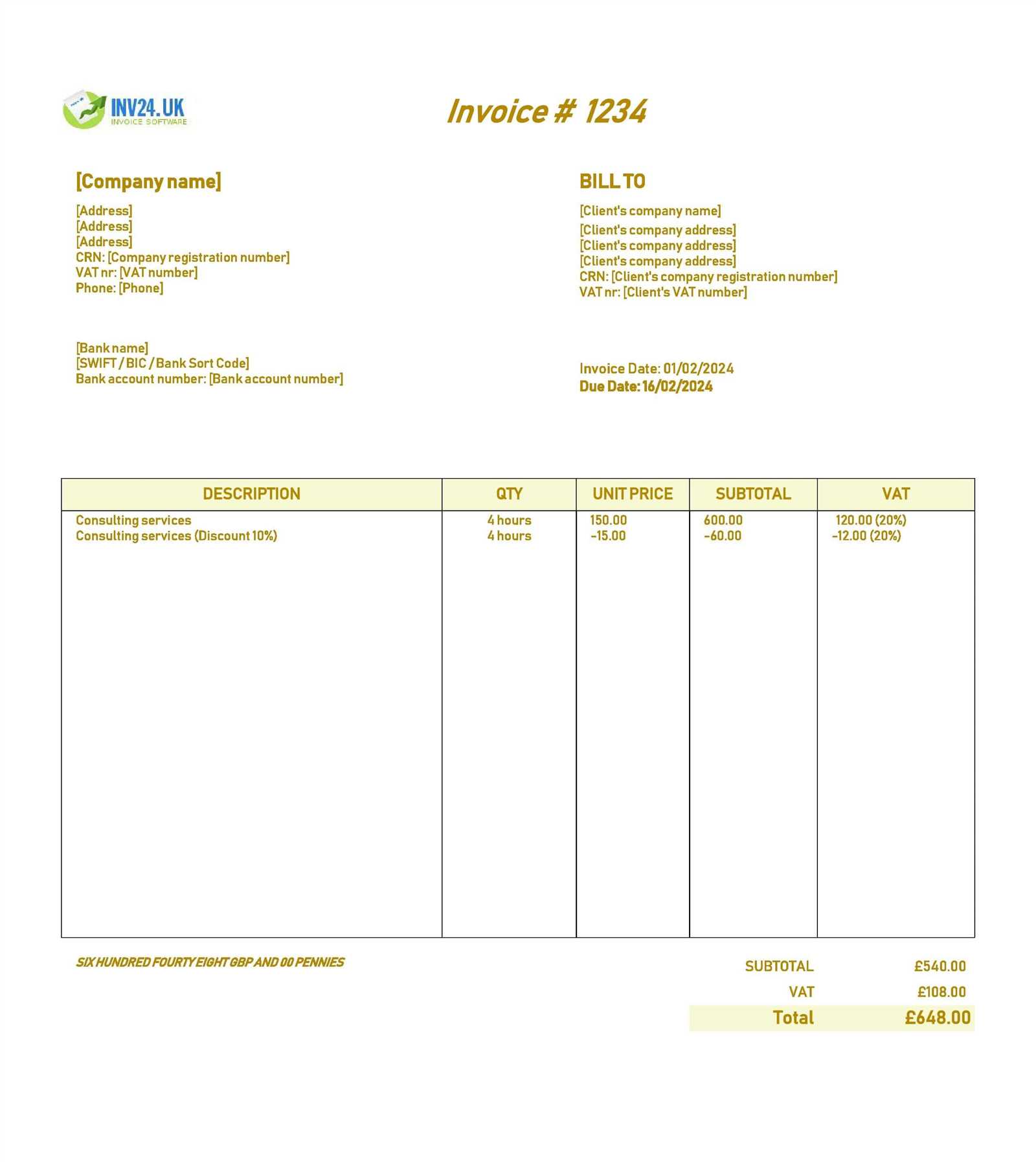

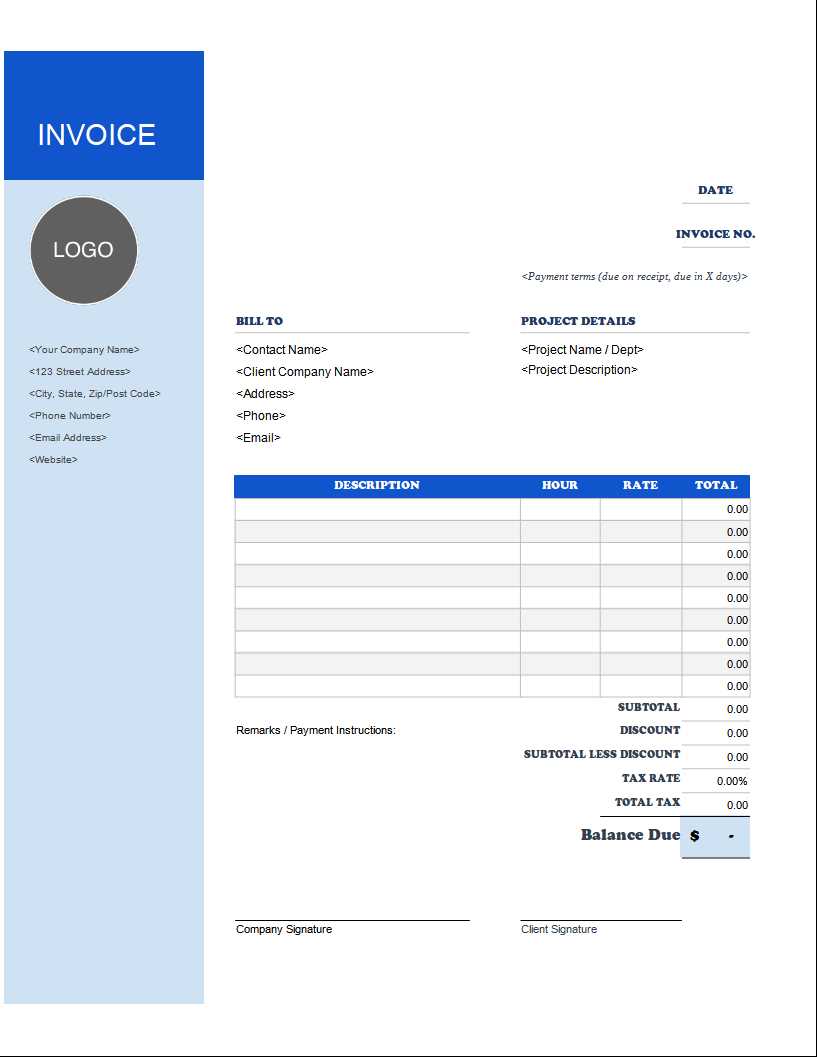

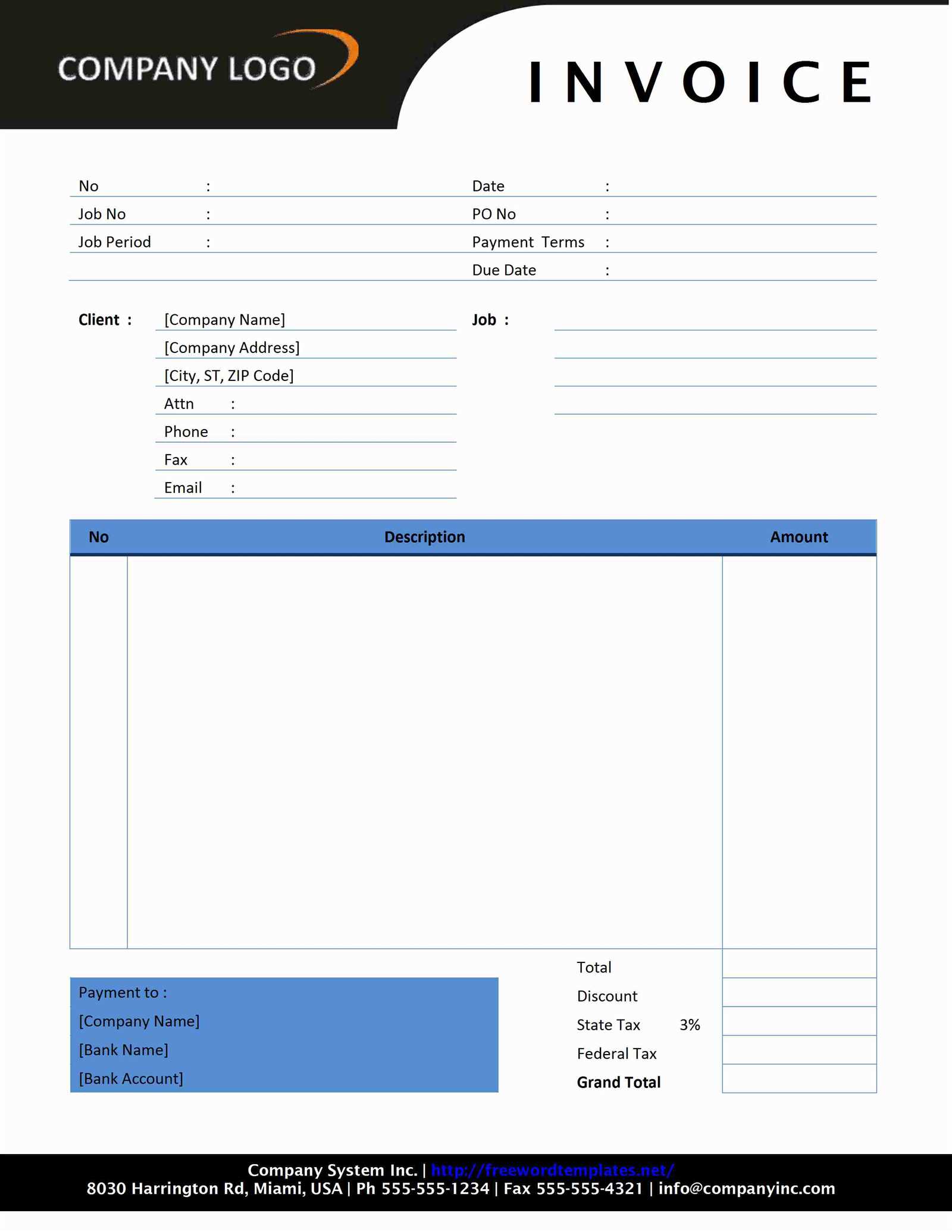

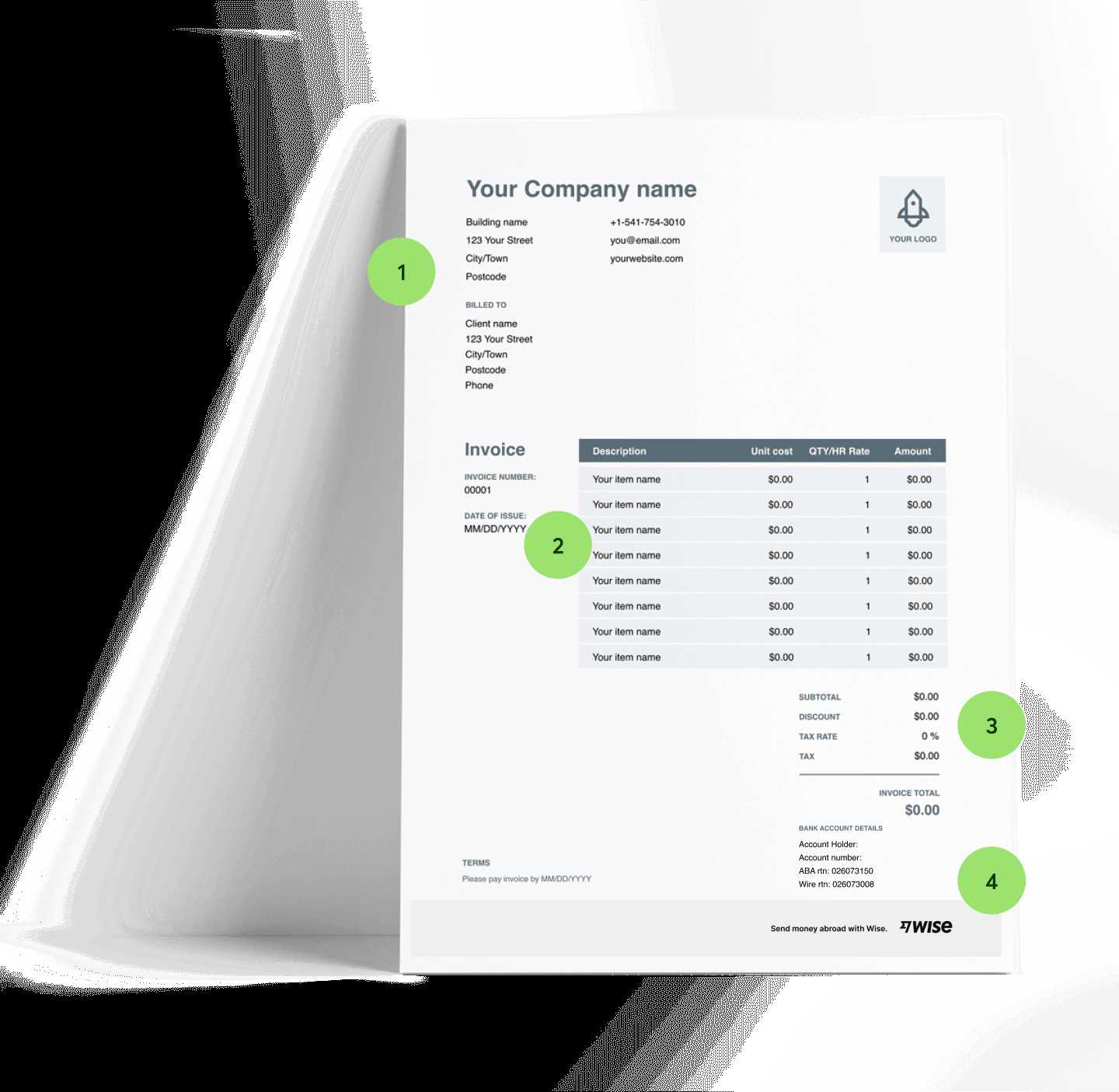

Include Key Information

Start by including all the necessary details that define the transaction. At the top, include your name or business name, contact information, and any relevant client details. Clearly list the services or products provided, including a description, quantity, and unit price. This will help the client understand what they are being charged for and eliminate confusion later.

Calculate Totals and Payment Terms

Next, calculate the total amount due by adding the cost of each item or service, applying any taxes or discounts if necessary. It’s essential to specify the due date, payment methods accepted, and any late fees that may apply. Providing this information up front ensures that the client knows exactly what is expected and can make payment without delays.

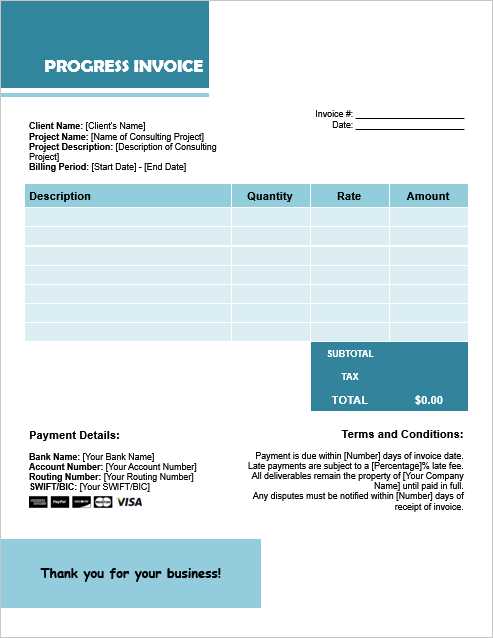

Customization for Different Projects

Finally, tailor your document to reflect the specifics of each client or project. For instance, if you’re working on a long-term project, consider adding a payment schedule. If there are multiple services rendered, breaking them down into categories can make the document easier to read. This level of detail ensures that your financial records are not only accurate but also reflect your professionalism.

Essential Elements of a Billing Invoice

When creating a document for financial transactions, there are several key components that ensure clarity and accuracy. Each section serves a unique purpose, helping both parties understand the nature of the services provided and the corresponding amounts due. These elements facilitate smooth communication, prevent misunderstandings, and make the payment process more efficient.

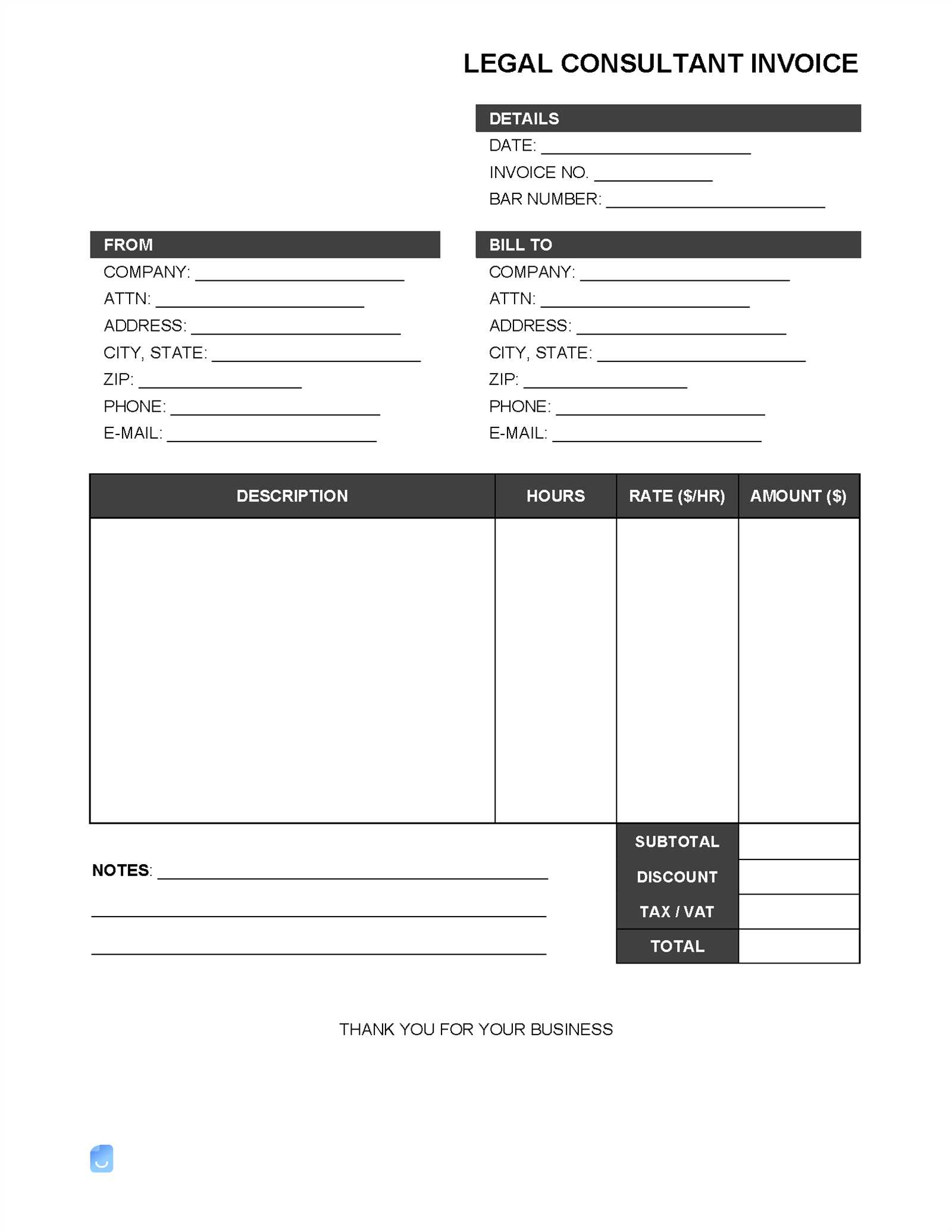

Identification Information: This includes the names, addresses, and contact details of both the service provider and the client. It’s essential that this information is clearly displayed to avoid confusion regarding the parties involved.

Service Description: A detailed list of the services rendered or products delivered is crucial. Each item should be outlined clearly, specifying what was provided, when it was provided, and any relevant details. This helps the recipient understand what they are being charged for.

Payment Terms: Clear instructions on how and when payment is expected are vital. This section should outline due dates, accepted payment methods, and any penalties for late payments. Having these terms stated upfront ensures both parties are aligned.

Amount Due: A breakdown of the amounts charged for each service or product, followed by the total due, ensures transparency. This section helps avoid confusion by offering a clear calculation of the overall sum that needs to be paid.

Unique Reference Number: Including a reference number for each transaction is a best practice. This allows both the service provider and the client to track payments easily, and it acts as a point of reference in case of disputes or inquiries.

Additional Notes or Terms: Sometimes, additional information is required, such as discounts, promotional offers, or special conditions. This area can be used for any further clarification or specific instructions related to the transaction.

Customizing Your Excel Invoice Template

Adapting a financial document to suit your specific needs can streamline your operations and make transactions more professional. Tailoring this document to reflect your brand, services, and preferred format helps enhance clarity and ensure consistency in all your dealings. Here are key steps to personalize this type of document to best fit your requirements.

Adjusting the Layout

One of the first things to consider is how the layout of the document aligns with your business style. You can modify columns, rows, and spacing to match your preferences. A well-organized layout helps ensure that all necessary information is easy to find and understand.

- Branding: Include your logo, business name, and contact details in a prominent location. This adds a professional touch and reinforces your brand identity.

- Organize Information: Arrange sections logically, with clear headings and plenty of space between each one for readability.

- Consistent Fonts and Colors: Choose fonts and colors that align with your company’s visual identity to give the document a cohesive look.

Personalizing the Content

Customizing the content is equally important to make the document fully aligned with your business practices. You can adjust certain fields to suit the nature of the services you provide or to meet specific client needs.

- Service Details: Ensure the description of the services provided is clear and concise. Add any specific details that help the recipient understand the scope of work.

- Payment Information: Modify the payment terms to reflect your

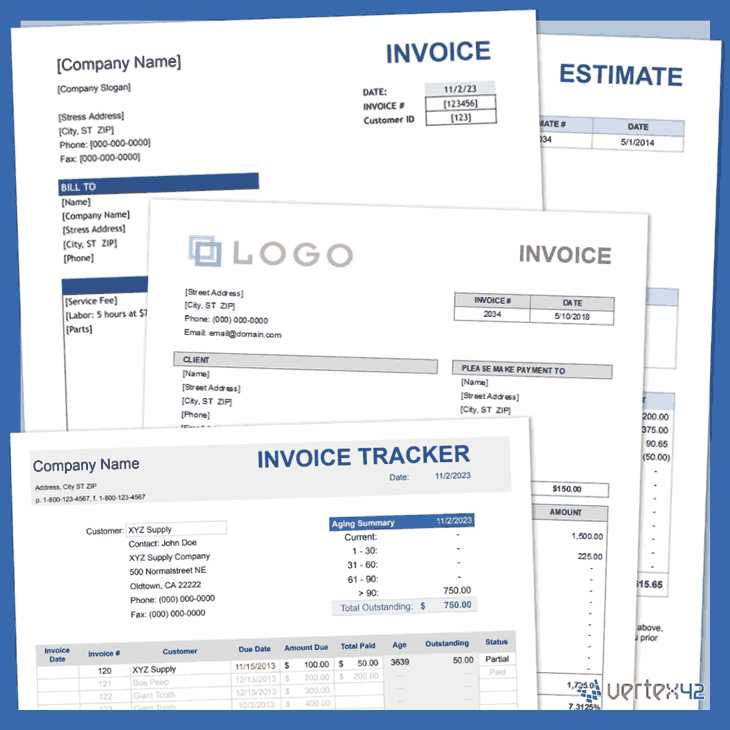

Tracking Payments with Excel Invoices

Efficiently managing payments is a critical aspect of maintaining smooth business operations. By using an organized system, you can easily track the status of each transaction, monitor outstanding balances, and ensure timely receipts. A digital financial document allows you to record and update payment information, helping you stay on top of your finances with minimal effort.

Setting Up a Payment Tracking System

Incorporating payment tracking into your financial document requires adding a few key columns or sections that record transaction statuses, dates, and amounts. This allows you to quickly see which payments are pending, paid, or overdue. Here’s an example of how to structure this information:

Transaction ID Service Description Amount Due Amount Paid Payment Status Payment Date 001 Web Development $1,500 $1,500 Paid 01/15/2024 002 Graphic Design $800 $0 Pending 02/10/2024 003 SEO Optimization $1,200 $1,200 Paid 02/05/2024 Updating Payment Statuses

As payments are made, update the relevant information in the document to reflect the latest transaction status. A simple color-coding system or text labels like “Paid” or “Pending” can help distinguish the status of each entry at a glance. Regularly updating this informat

Automating Calculations in Excel Invoices

Automating the calculation process in financial documents can save valuable time and reduce the risk of human error. By setting up formulas, you can ensure that totals, taxes, discounts, and other numerical data are calculated instantly whenever new entries are added or modified. This streamlines the process, improves accuracy, and allows you to focus on more important tasks.

One of the main advantages of using automated calculations is the ability to instantly update totals based on changes to individual line items. For instance, if you adjust the quantity or price of a service or product, the total amount due will automatically recalculate without the need for manual input. Here are some common formulas to consider:

- SUM: Automatically adds up the values in a specified range of cells to calculate totals.

- Multiplication: Multiply the unit price by the quantity to get the total for each service or product.

- Tax Calculation: Apply a fixed percentage to calculate the tax due based on the subtotal.

- Discounts: Subtract a percentage from the total amount to reflect any discounts offered to clients.

By implementing these formulas, you can create a dynamic document that adjusts to changes in real-time, providing accurate financial data without the need for constant manual updates. This not only boosts productivity but also enhances the professionalism of the document, ensuring that all calculations are correct every time.

Design Tips for Professional Invoices

The design of your financial document plays a crucial role in how it is perceived by clients. A well-designed document not only reflects your professionalism but also ensures that important details are easy to read and understand. Simple design improvements can make your document look more polished and improve its overall effectiveness.

Here are some tips for creating a clean and professional layout:

- Use Clear and Consistent Fonts: Choose professional fonts like Arial or Helvetica for readability. Keep font sizes consistent throughout the document to create a cohesive appearance.

- Prioritize White Space: Avoid clutter by leaving adequate space between sections. This makes the document more visually appealing and ensures that each element stands out.

- Incorporate Your Branding: Include your business logo, colors, and contact information in the header. This personalizes the document and reinforces your brand identity.

- Keep Information Organized: Ensure that sections are clearly separated and labeled, allowing clients to quickly find what they need.

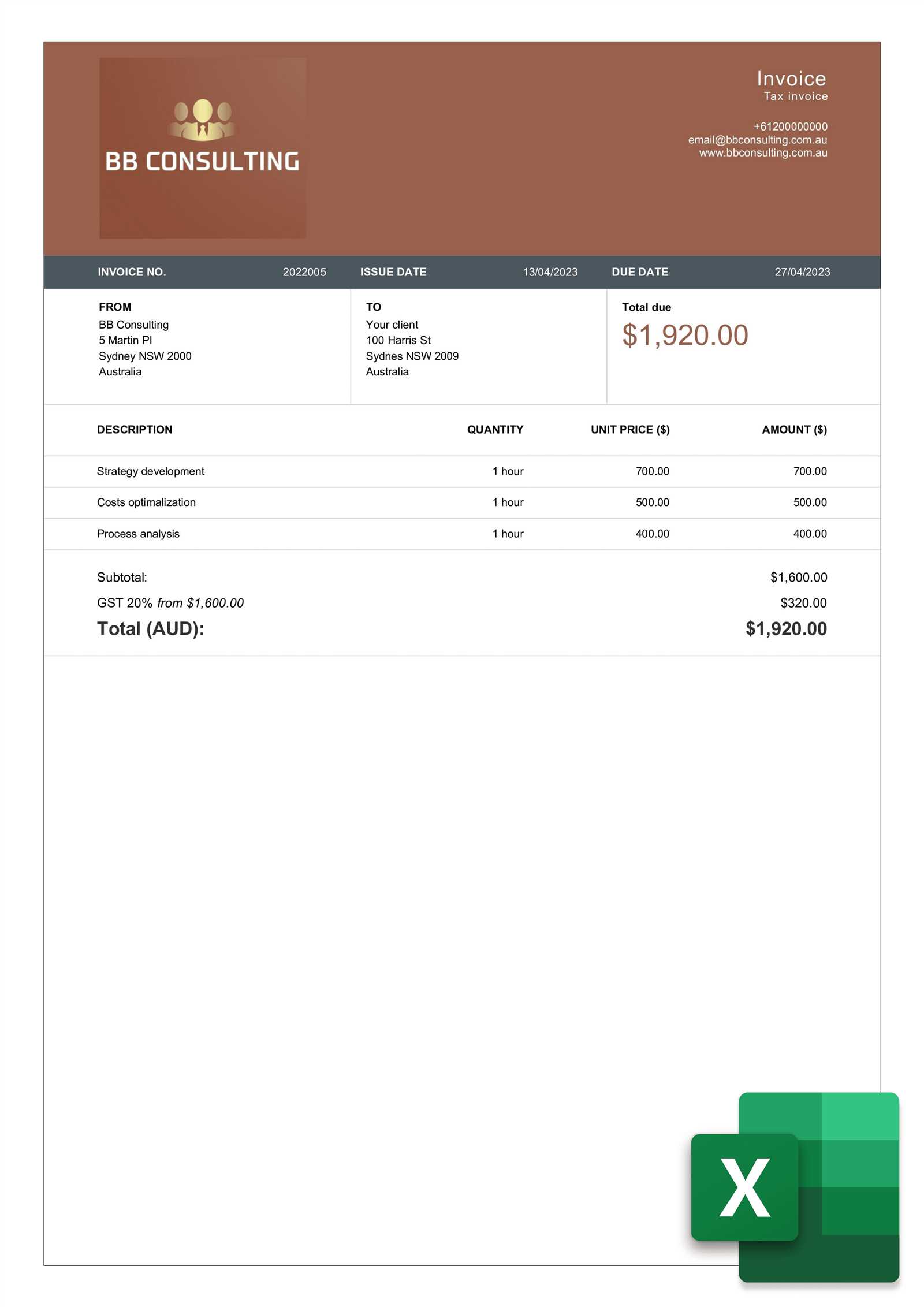

Here’s an example of a simple, clean layout for a professional document:

Item Description Quantity Unit Price Total How to Add Taxes to Invoices

Including tax in your financial documents is essential to ensure compliance with local tax laws and provide clients with a complete breakdown of charges. Tax calculation can be done manually or automated, depending on your preferred system. Adding taxes accurately will help avoid errors and ensure transparency for both you and your clients.

Manual Tax Calculation

To manually calculate tax, you need to multiply the subtotal by the applicable tax rate. For example, if the subtotal is $1,000 and the tax rate is 10%, the tax amount would be:

- Tax Amount: $1,000 x 10% = $100

- Total Amount Due: $1,000 + $100 = $1,100

This method works well for one-time transactions, but can become cumbersome when dealing with multiple items or fluctuating tax rates. It is important to ensure that the correct tax rate is applied based on the location or nature of the goods or services provided.

Automating Tax Calculations

For greater efficiency, automating tax calculations can save time and eliminate errors. By setting up a formula in your financial document, you can have the tax amount automatically calculated based on the subtotal and tax rate. Here’s a simple example:

- Formula for Tax: =Subtotal * Tax Rate

- Formula for Total: =Subtotal + Tax Amount

Using this approach, any change in the subtotal will automatically update the tax amount and total due, making it easier to manage complex transactions.

Managing Multiple Clients with Templates

Efficiently handling multiple clients requires a well-organized system to ensure that all transactions are properly documented and tracked. Using structured documents for each client allows you to easily customize details, track payments, and manage service agreements without starting from scratch every time. This approach can streamline workflows and reduce the chances of errors or missed deadlines.

Creating Client-Specific Documents

When dealing with multiple clients, it’s essential to have a format that allows for quick customization. Instead of creating new documents from scratch, you can use a pre-designed structure where client-specific information, such as names, services, pricing, and payment terms, can be easily updated. This ensures that each document maintains a professional look while being personalized to fit the needs of each client.

- Client Information: Each document should include personalized contact details for the client, ensuring clear communication.

- Service Details: Tailor the descriptions of services provided, prices, and other relevant terms specific to each client.

- Payment Terms: Adjust payment terms, due dates, and any special agreements depending on the client’s needs or previous discussions.

Tracking and Organizing Client Documents

To maintain organization and prevent confusion, keep all client-related documents in a dedicated folder or use a tracking system. You can also use numerical or alphabetical identifiers for each client, making it easier to find and reference the correct information when needed. Having a consistent naming convention for files helps avoid mix-ups, especially when dealing with several clients at once.

With these strategies in place, managing multiple clients becomes a more seamless and efficient process, allowing you to focus on delivering quality service without worrying about administrative tasks.

Handling Late Payments with Excel Invoices

Managing overdue payments is an essential part of maintaining a healthy cash flow for your business. When clients fail to meet payment deadlines, it’s important to have a clear and professional approach to handling these situations. Using a structured financial document allows you to track outstanding amounts and apply follow-up actions efficiently, ensuring that you get paid on time while maintaining positive client relationships.

Setting Clear Payment Terms

To avoid confusion and ensure that both parties are aware of payment expectations, always include clear payment terms in your document. Here are some key details to include:

- Due Date: Specify a clear deadline by which payment should be made.

- Late Fee: If applicable, state the penalty for overdue payments, such as a percentage of the total amount due for each day or week the payment is delayed.

- Payment Methods: Clearly list the accepted payment methods and any instructions for completing the transaction.

Tracking and Reminding Clients of Overdue Payments

Tracking overdue payments is crucial to ensure that no outstanding amounts are missed. A well-organized document with automated calculations can help you easily monitor payment statuses. Additionally, consider sending reminder notices to clients once a payment becomes overdue.

- Set up Alerts: Use conditional formatting or formulas to highlight overdue payments, making it easy to spot late accounts at a glance.

- Send Reminder Emails: If a payment is overdue, promptly follow up with a polite reminder email or call to let the client know the payment is due.

- Apply Late Fees: If your payment terms include late fees, ensure they are automatically calculated in the document once the due date has passed.

By setting up an efficient system to track overdue payments and sending timely reminders, you can reduce the impact of late payments on your business while keeping client relations professional and respectful.

How to Share Your Invoice Files

Sharing your financial documents with clients in a secure and efficient manner is crucial for maintaining professionalism and ensuring smooth transactions. With the variety of methods available today, it’s important to choose the right approach based on convenience, security, and the preferences of your clients. Whether you’re sending a document for the first time or providing regular updates, having a streamlined sharing process can help avoid delays and misunderstandings.

Emailing Your Document

Email remains one of the most common methods for sending financial documents. It is simple, quick, and ensures that your client receives the information directly. To ensure the document reaches your client securely and remains easy to access, consider the following tips:

- Use PDF Format: Convert your file to PDF before sending. This ensures that the layout, formatting, and data are preserved, and it prevents the recipient from accidentally making changes to the document.

- Include a Clear Subject Line: Use a subject line such as “Payment Due for [Service]” to help the client easily identify the email.

- Attach the File: Attach the document to the email and avoid pasting sensitive details directly in the email body.

- Request Confirmation: Ask the recipient to confirm receipt of the document, ensuring that they have received it and can review it.

Using Cloud Storage for Large Files

If the file size is too large to email or if you prefer a more collaborative approach, cloud storage platforms are a great option. Services such as Google Drive, Dropbox, or OneDrive allow you to upload your document and share a link with your client. This method offers several benefits:

- Access Anytime, An

Saving Time with Pre-Made Templates

Using ready-made formats can significantly reduce the amount of time spent on administrative tasks. Rather than creating documents from scratch, professionals can rely on structured designs that have been thoughtfully organized to cover all necessary details. This not only streamlines the process but also ensures consistency and accuracy across multiple documents.

Efficiency in Document Creation

With pre-organized files, much of the groundwork is already done. You don’t have to worry about formatting, sections, or calculations. Everything is in place, allowing you to focus on customizing the content for each specific case. This level of organization means you can handle more clients or projects without getting bogged down by the repetitive nature of paperwork.

Consistent Results Every Time

By using a standard structure, you ensure that every document maintains the same level of professionalism and detail. This consistency is crucial for building a strong reputation and avoiding errors that could arise from starting from scratch each time. The saved time and effort can be directed toward more value-driven tasks, such as improving services or engaging with clients.

Invoice Template Security Considerations

When handling sensitive financial documents, it’s crucial to ensure the safety and integrity of the data. Using pre-designed structures for creating documents can expose you to potential risks if proper precautions are not taken. Whether it’s protecting client information, preventing unauthorized edits, or safeguarding payment details, addressing security concerns is essential for maintaining trust and confidentiality.

Protecting Sensitive Information

Financial records often contain personal or confidential details that must be kept secure. It’s vital to implement password protection or encryption methods to restrict access to only authorized individuals. This ensures that sensitive information such as payment terms, contact details, and amounts cannot be easily viewed or altered by unauthorized parties.

Preventing Unauthorized Modifications

Allowing unregulated changes to your documents can lead to serious consequences, from errors in financial reporting to potential fraud. Utilizing digital signatures, restricting editing rights, or using secure file formats can help prevent unauthorized alterations. These methods create a clear audit trail, ensuring any modification is traceable and verifiable.

Integrating Invoices with Accounting Software

Connecting your financial documents with accounting platforms offers numerous advantages, from streamlining data entry to reducing the risk of errors. By automating the transfer of information, you can create a seamless workflow that saves time, improves accuracy, and provides real-time financial insights. This integration helps manage cash flow, track payments, and simplify tax preparation–all in one place.

Benefits of Integration

- Automated Data Transfer: No need to manually enter data into multiple systems, reducing the chance of mistakes.

- Real-Time Updates: Financial records are instantly updated, providing a clear and current picture of your finances.

- Efficiency: Saves time by automatically syncing important details, such as payment amounts, dates, and client information.

- Improved Reporting: Integrated systems provide quick access to detailed reports, making it easier to track and analyze your financial performance.

How to Integrate Effectively

- Choose accounting software that supports integration with your document management system.

- Ensure that the software has features that align with your financial needs, such as automated entries and invoice reconciliation.

- Test the integration to verify data accuracy and functionality before fully relying on the system.

- Regularly update both the software and integration settings to ensure compatibility and security.

Common Mistakes to Avoid in Invoicing

Creating accurate and professional financial documents is essential for maintaining smooth business operations. However, errors can easily creep in, leading to confusion, delayed payments, or even strained client relationships. By understanding the most common mistakes, you can avoid these pitfalls and ensure your documents are clear, accurate, and timely.

Common Errors and How to Avoid Them

Error How to Avoid It Missing or incorrect payment details Always double-check the payment terms, including due dates, bank account numbers, and accepted payment methods. Failure to include clear itemization Break down each service or product clearly, including quantities, rates, and any applicable taxes. Unclear or inconsistent formatting Use a standardized layout with consistent fonts, headings, and spacing to ensure readability and professionalism. Not tracking previous payments Include a record of prior payments or credits on each document to avoid confusion over outstanding balances. Omitting necessary contact information Make sure all relevant contact information, such as client and business details, is clearly listed for easy reference. Double-Check for Accuracy

Errors in financial documents can lead to delayed payments and even legal complications. It’s essential to carefully review each document before sending it to clients. By establishing a routine for checking and proofreading, you ensure that all necessary details are present, and the information is accurate, helping to avoid

Best Practices for Consultant Invoicing

Creating financial documents with clarity and professionalism is crucial for maintaining strong client relationships and ensuring timely payments. Implementing best practices in document creation not only saves time but also avoids common errors that can lead to misunderstandings. By following structured methods, you can streamline the process and enhance overall efficiency.

Key Guidelines for Effective Documentation

- Be Clear and Detailed: Include a breakdown of services, rates, hours worked, and applicable taxes to avoid any confusion.

- Set Clear Payment Terms: Define payment deadlines, accepted payment methods, and late fees to ensure transparency and accountability.

- Use Professional Language: Maintain a formal tone and avoid jargon. This helps establish trust and ensures the document is taken seriously.

- Follow a Consistent Format: Use a standard layout for all documents, making it easier for clients to understand and for you to track payments.

- Ensure Accuracy: Double-check for errors in amounts, dates, and client details to prevent delays in processing payments.

Tools to Enhance Efficiency

- Use automated software for generating documents and tracking payments to minimize human error.

- Incorporate digital signatures to expedite the approval process.

- Integrate with accounting platforms for real-time updates and seamless record-keeping.

- Regularly update your document templates to ensure they reflect current laws and regulations.