Download Free Personal Invoice Template in Word Format

In today’s fast-paced world, having the ability to easily generate accurate and well-organized financial statements is essential for smooth business transactions. Whether you’re a freelancer, a small business owner, or managing personal transactions, the need for clear and efficient invoicing cannot be overstated. A structured document that outlines the services rendered or products sold, along with payment details, helps ensure both parties are on the same page.

Customizable templates offer an ideal solution for this purpose. They provide a pre-designed format, allowing users to quickly insert their own details without the need to design a new document from scratch each time. These formats often include essential fields, such as contact information, pricing, and payment terms, ensuring a consistent and professional presentation for every transaction.

By using simple tools like Microsoft Word, anyone can create, personalize, and send professional billing documents with ease. With just a few modifications, these documents can be tailored to suit different industries, ensuring flexibility and practicality for various needs.

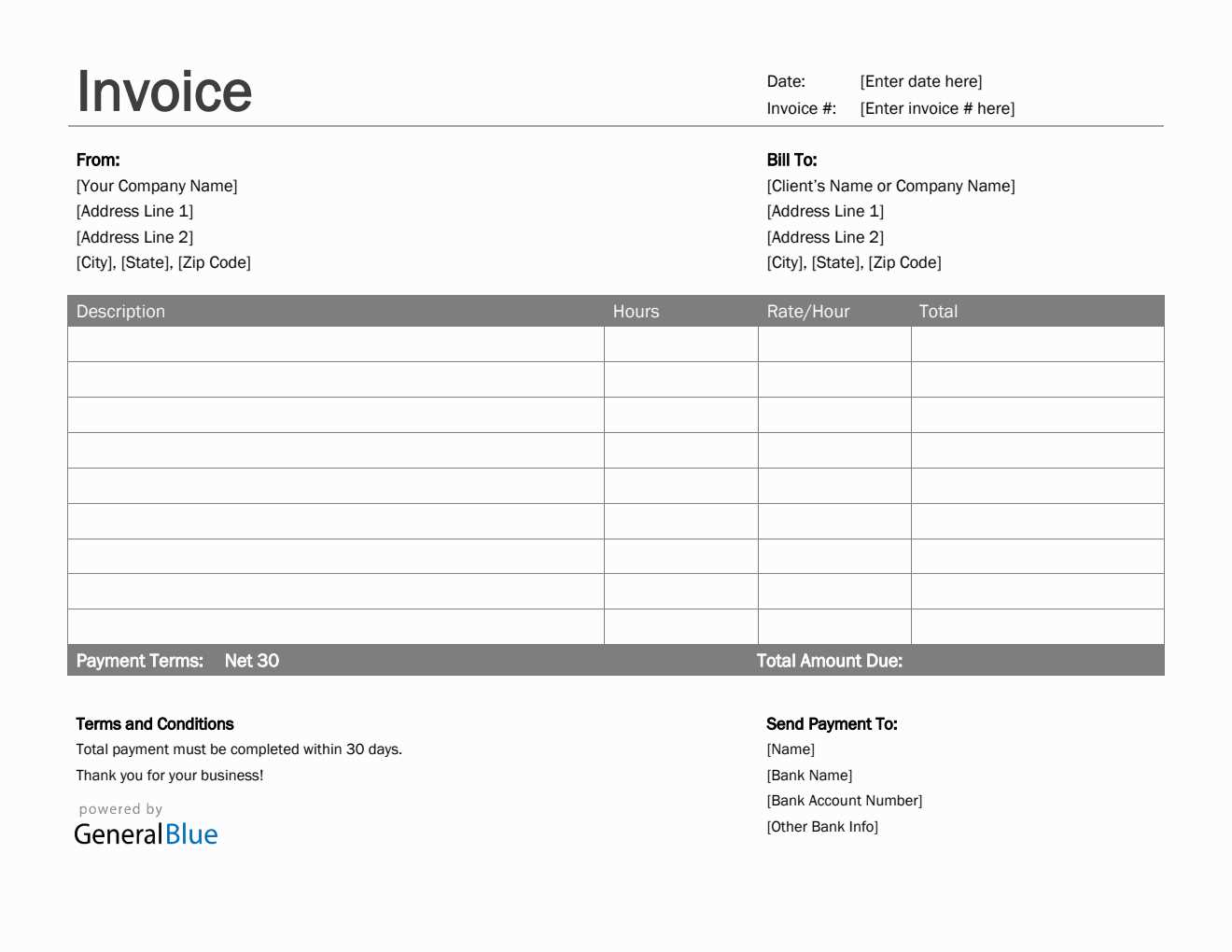

How to Create Personal Billing Documents in Word

Generating accurate and professional financial documents doesn’t have to be complicated. With the right tools, you can quickly create clean, clear, and well-structured statements that outline the terms of a transaction. A straightforward document that highlights the services or products sold, along with the corresponding amounts, ensures that both the payer and payee are aligned on the transaction details.

Using a program like Microsoft Word makes the process even easier. It offers a user-friendly interface, allowing anyone to customize documents without advanced technical skills. Whether you’re billing for freelance work or personal transactions, creating these types of records in Word involves only a few simple steps.

Step-by-Step Guide to Creating a Billing Record

First, open a blank document in Word and begin by adding your contact details at the top, such as your name, address, and email. Then, include the recipient’s information in the next section. This helps both parties identify who the document pertains to and ensures clarity. Following this, create a table or list where you can detail the services or goods provided, along with their prices and the total amount owed. Be sure to include any applicable taxes or discounts in the calculation.

Finishing Touches for a Professional Look

Once the main details are filled in, consider adding a professional touch with a clear heading such as “Payment Due” or “Total Amount.” You can also include payment terms, such as due dates or late fees, and additional notes if necessary. When you’re satisfied with the layout, save the document and send it to your client or recipient. This simple approach ensures you maintain a professional appearance and clear communication in every transaction.

Benefits of Using Billing Document Templates

Using pre-designed formats for financial records brings significant advantages, especially when it comes to saving time, ensuring accuracy, and maintaining a professional appearance. Instead of starting from scratch every time a new document is needed, customizable structures allow for quick input of essential details while ensuring consistency. This approach is especially useful for those who frequently need to create such documents but want to avoid repetitive formatting tasks.

Time-Saving and Efficiency

Pre-designed formats can dramatically speed up the process of creating billing records. By eliminating the need for users to manually set up document structures, these ready-made formats allow for faster document generation. The main benefits include:

- Quick setup: The basic structure is already in place, so users can simply input transaction details.

- Minimal customization: Only a few sections need to be modified for each new record.

- Reduced errors: By following a consistent structure, the risk of forgetting important details is minimized.

Professional Appearance and Consistency

Another major advantage of using structured formats is the professional look they provide. These documents are designed to adhere to common standards, ensuring they are easy to read and visually appealing. Consistency across multiple records also helps establish a reliable and trustworthy image for the business or individual. Some key benefits include:

- Uniformity: All documents follow the same structure, giving clients a clear and predictable experience.

- Clarity: Pre-designed formats highlight essential details in an organized manner, making them easy to understand.

- Branding opportuni

Customizing Your Billing Document in Microsoft Word

When creating a financial statement or payment request, personalization is key to ensuring that the document meets your specific needs and aligns with your brand identity. The ability to easily adjust various elements within a document gives you full control over how your transaction details are presented. Microsoft Word provides numerous options to tailor documents to reflect your unique style and preferences.

Modifying Layout and Structure

The first step in customizing your document is adjusting the layout. Microsoft Word offers a range of layout tools that allow you to control the arrangement of text and tables. You can easily move sections around or resize elements to create a clean, organized look. Some customization options include:

- Changing page orientation: Switch between portrait and landscape views to suit your document’s size and structure.

- Adjusting margins: Set custom margins to fit your content neatly on the page.

- Using tables: Insert and modify tables to display transaction details, including product names, quantities, and prices.

Personalizing Design Elements

For a more professional touch, you can personalize design elements like fonts, colors, and logos. Adjusting these aspects ensures that the document not only looks polished but also represents your business or personal brand. Some options include:

- Fonts and styles: Choose from a variety of fonts to give your document a formal or creative look.

- Color schemes: Customize the text and background colors to match your brand or personal preference.

- Adding a logo: Insert your business logo or other images to enhance the document’s visual appeal and credibility.

By utilizing these customization options, you can create documents that are both functional and aesthetically appealing, helping to improve communication and project a professional image to your clients.

Steps to Download a Billing Document Format

Finding the right format for your financial statements can save you time and effort. With many sources offering ready-made, customizable formats, downloading one that suits your needs can streamline your process. Here is a simple guide to help you get started with downloading a pre-designed structure that you can easily personalize for your transactions.

Step-by-Step Process

Step Description 1. Search for a Format Start by looking for reliable websites that offer free or paid billing document formats. Popular platforms like Microsoft’s official site or third-party template providers are great options. 2. Choose Your Preferred Design Browse through various designs and select the one that best suits your needs. Consider elements such as layout, fields, and overall style. 3. Download the File Click on the download link for your chosen design. It will typically be available in a format compatible with most text editing software, such as .docx or .pdf. 4. Open the Document Once downloaded, open the document in your preferred editing software (like Microsoft Word) to make changes and personalize it. 5. Customize the Content Insert your specific details such as your name, payment terms, and transaction information. Be sure to check for accuracy before saving or sending the document. By following these simple steps, you can quickly access and adapt a professional structure to fit your specific needs, making it easier to create clear, organized billing documents every time.

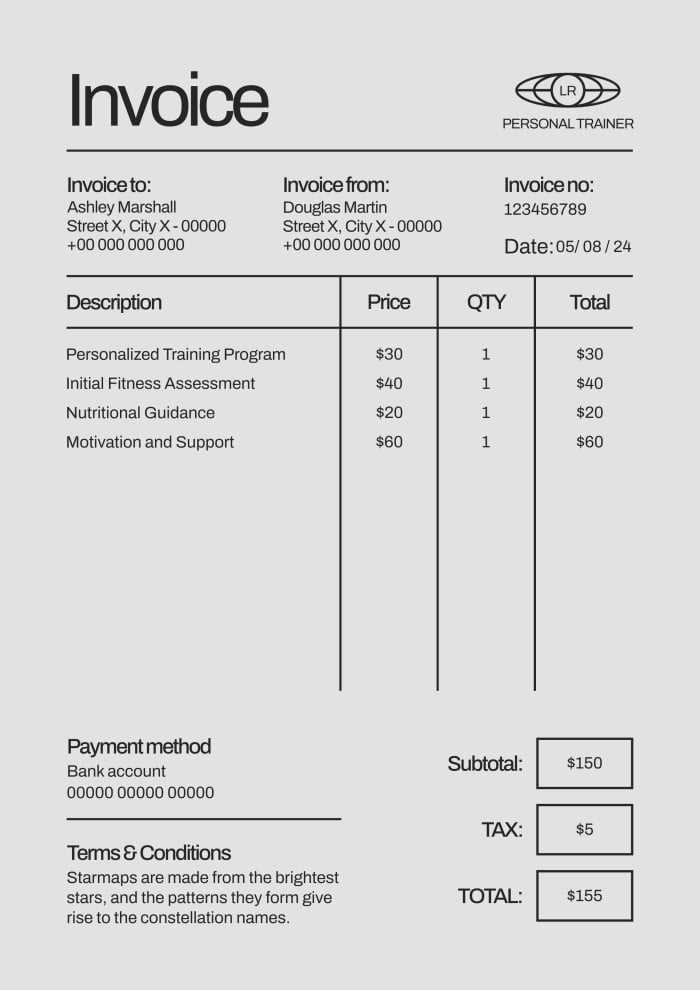

Key Elements of a Personal Invoice

Creating a structured document for billing purposes ensures clarity and professionalism. Each component plays a vital role in detailing the transaction, making it easier for both parties to understand and process the payment effectively.

The following table highlights the essential components that should be included:

Component Description Header Information Includes the name, address, and contact details of both the sender and the recipient. Document Number A unique identifier to keep track of individual transactions. Transaction Date The date when the document is issued. Itemized List Breakdown of products or services provided, including quantities and prices. Total Amount The sum total of all items listed, including any taxes or discounts. Payment Terms Details regarding the payment method, due date, and any applicable conditions. By ensuring all these elements are present, the billing document becomes a clear and comprehensive record of the transaction.

Why Choose Word for Invoicing

Using a flexible and widely available tool for creating billing documents offers numerous benefits. This software is known for its ease of use, versatility, and accessibility, making it a popular choice for generating professional and organized records of transactions.

Ease of Customization: The platform allows users to easily tailor documents to suit specific needs, ensuring that every detail is presented clearly.

Accessibility: Since the software is commonly used, it ensures that files can be opened, edited, and shared effortlessly, regardless of location or device.

Professional Appearance: The range of formatting options helps in creating polished and professional documents that enhance the credibility of the business.

Cost-Effective Solution: Leveraging a tool that many individuals and businesses already own eliminates the need for additional expenses on specialized software.

Overall, this option stands out for its balance of functionality, convenience, and professionalism, making it an excellent choice for managing billing processes.

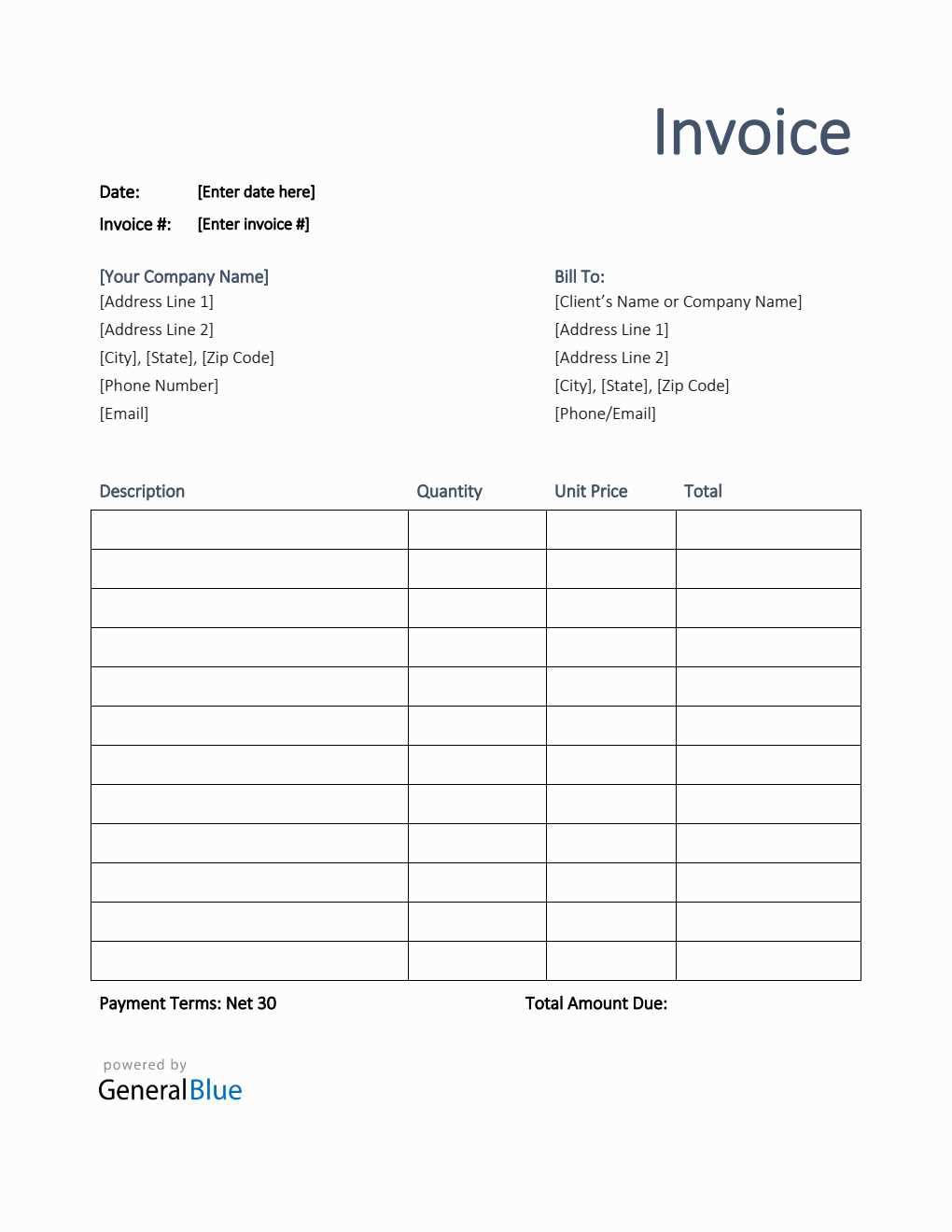

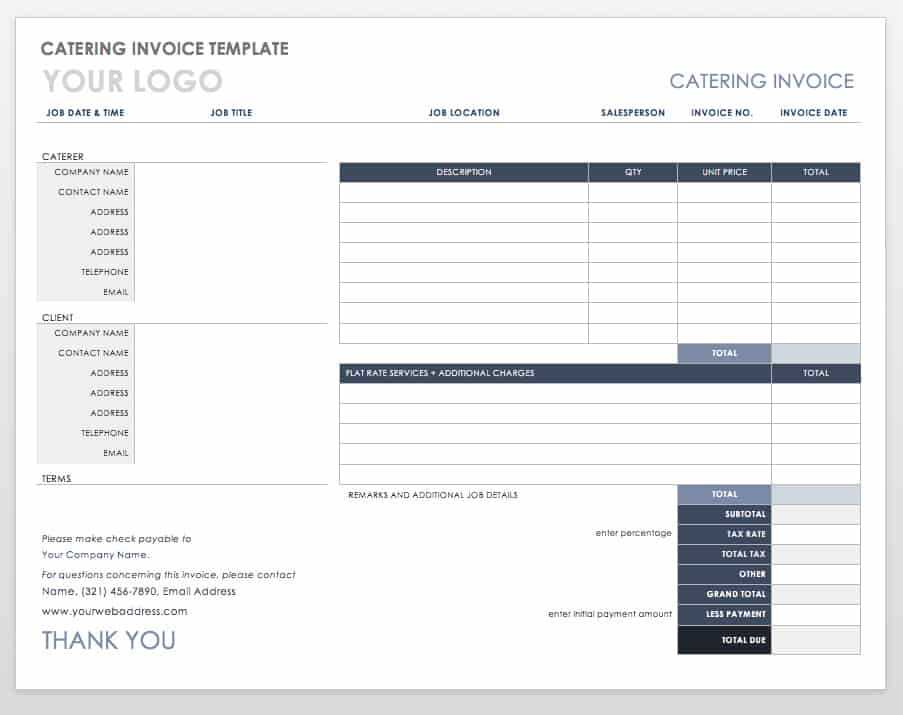

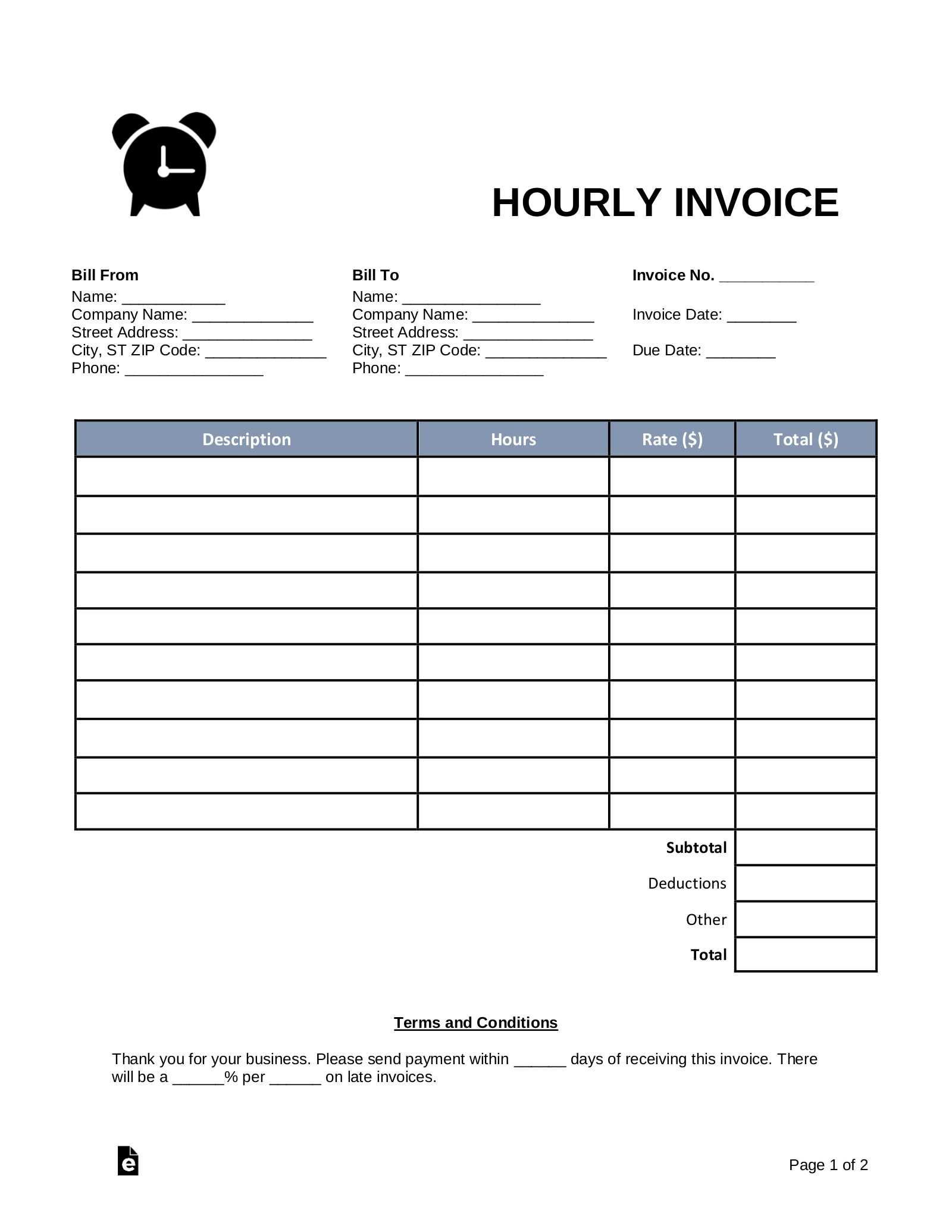

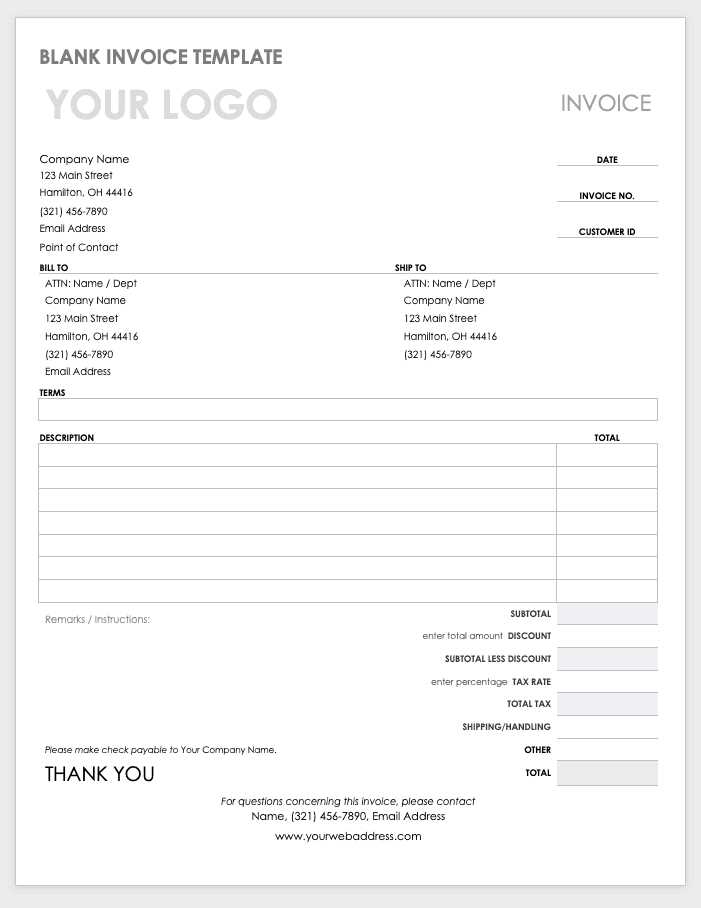

Free Personal Invoice Templates for Word

For those looking to streamline their billing process without incurring extra costs, there are various ready-made options available. These pre-designed files help simplify the creation of professional documents, ensuring all necessary details are neatly organized.

Accessible Options: Numerous platforms offer downloadable files that can be easily customized to fit individual requirements, saving both time and effort.

Professional Design: These layouts come with a polished appearance, allowing users to present their billing documents in a way that reflects well on their business or services.

Ease of Use: With minimal effort, users can quickly adapt these files to their specific needs, making them suitable for various purposes, from simple transactions to more detailed records.

By utilizing these cost-free resources, individuals can effectively manage their billing tasks while maintaining a high standard of professionalism and efficiency.

Common Mistakes to Avoid in Invoices

Ensuring accuracy in billing documents is crucial for maintaining professionalism and avoiding delays in payment. However, there are frequent errors that can undermine the effectiveness of these documents. Recognizing and addressing these mistakes can help streamline the process and improve the overall experience.

- Incomplete Contact Details: Always include full names, addresses, and contact information for both the sender and the recipient to prevent communication issues.

- Missing Dates: Clearly state the issue date and the due date to establish a timeline for the transaction.

- Incorrect Totals: Double-check all calculations, including taxes and discounts, to ensure the total amount is accurate.

- Lack of Unique Identifier: Assign a distinct number to each document to aid in tracking and referencing.

- Unclear Payment Terms: Specify the payment methods and terms to avoid misunderstandings regarding deadlines or methods of payment.

By being vigilant about these common pitfalls, you can enhance the clarity and efficiency of your billing practices, leading to smoother transactions and better relationships with clients.

Formatting Tips for Professional Invoices

Creating a clear and organized billing document is essential for presenting a professional image. Proper formatting not only improves readability but also ensures that all necessary information is easily accessible to both parties involved in the transaction.

- Use Clear Headings: Separate different sections with bold headings, such as “Contact Information,” “Details of Services,” and “Total Amount Due.” This helps in quickly locating specific details.

- Consistent Font Style: Stick to a professional and legible font, using consistent sizes for headings and body text to maintain a uniform appearance.

- Include Ample Spacing: Use enough white space between sections to prevent the document from looking cluttered and to improve readability.

- Highlight Important Details: Use bold or italic formatting to emphasize critical information like due dates or total amounts.

- Align Text Properly: Ensure that all sections are neatly aligned, with important figures and labels clearly positioned for easy scanning.

By following these formatting tips, you can enhance the overall presentation of your billing documents, making them both visually appealing and functionally effective.

How to Add Payment Terms in Word

Including clear payment terms in your billing documents is crucial for setting expectations and ensuring timely payments. This section will guide you through the steps to incorporate these details effectively, making your documents more professional and comprehensive.

Steps to Include Payment Terms

Follow these simple steps to add the necessary conditions for payment:

- Open your billing document and navigate to the section where you wish to include the payment terms.

- Create a new heading labeled “Payment Terms” to clearly define this section.

- List the terms in bullet points or a table format to make them easy to read and understand.

Example Table for Payment Terms

Below is an example of how you can format the payment terms in a table:

Term Description Due Date Payment is expected within 30 days of the issue date. Late Fee A 5% late fee will be applied for payments received after the due date. Accepted Methods Payments can be made via bank transfer, credit card, or PayPal. By clearly stating these terms, you can ensure that your clients understand the expectations, which can help prevent misunderstandings and delays.

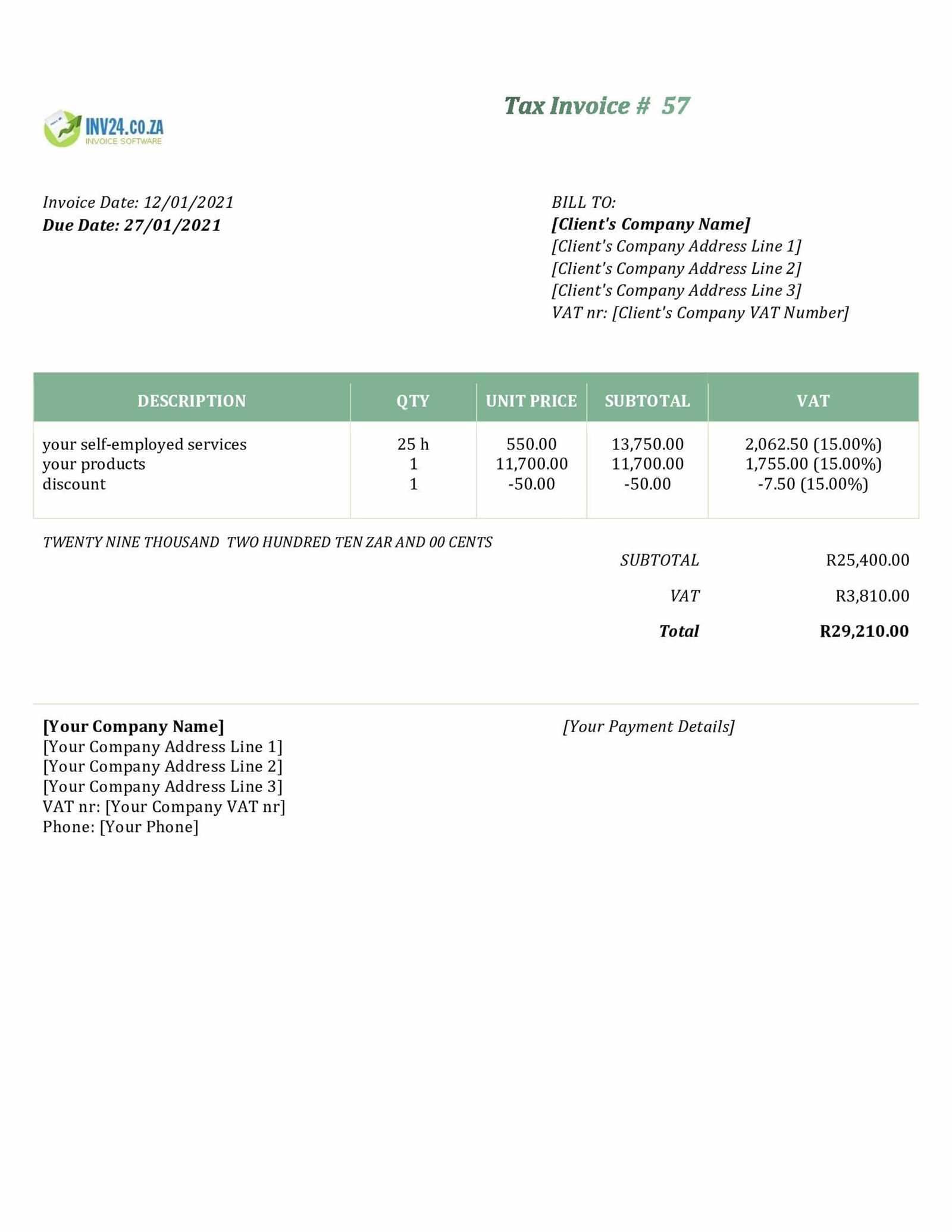

Using Word Templates for Tax Purposes

Preparing billing documents with accurate financial details is essential for tax reporting. Utilizing pre-made formats can simplify this process, ensuring that key information is organized and readily accessible when needed. This section explores how to set up documents effectively for tax-related needs.

Important Information to Include

When structuring these documents for tax purposes, ensure that essential details are included. The table below outlines recommended fields and their descriptions:

Field Description Client Details Full name and contact information of the individual or business being billed. Date of Issue The date on which the document is created, necessary for record-keeping. Service Description A brief but clear description of the products or services provided. Total Amount Sum total of all items, including applicable taxes and discounts. Tax Ide Best Practices for Invoice Numbering

Assigning unique identifiers to each billing document is crucial for efficient record-keeping and seamless tracking of transactions. Proper numbering not only helps in organizing your financial records but also simplifies the auditing and reconciliation processes.

Importance of Unique Identifiers

Unique numbering ensures that each document can be easily referenced and tracked. This practice prevents confusion, especially when dealing with multiple transactions over time. It also aids in quickly resolving disputes or queries related to specific transactions.

Effective Numbering Strategies

Consider the following strategies to implement a consistent numbering system:

Strategy Description Sequential Numbers Assign numbers in a sequential order to maintain a clear and straightforward record of all transactions. Date-Based Codes Incorporate the date within the identifier, such as “2024-001,” to easily track when the transaction occurred. Client-Specific Prefixes Add unique prefixes for different clients, helping to quickly identify which customer the document pertains to. Project Codes Include project-specific codes to link documents to particular assignments or tasks. Adopting a systematic approach to numbering will enhance the organization and efficiency of your financial management, making it easier to handle transactions and maintain clear records.

How to Include Your Contact Information

Providing clear and accessible contact details is essential for ensuring smooth communication with your clients. Properly presenting this information helps in addressing queries, resolving issues, and maintaining professional relationships.

When adding your contact details, it’s important to include all necessary channels through which clients can reach you. This ensures they have multiple options for communication, depending on their preferences.

Essential Details to Include:

- Name: Clearly state your full name or the business name to avoid any confusion.

- Phone Number: Provide a direct line where clients can contact you for immediate assistance.

- Email Address: Include an email address for written communication, ensuring it is professional and actively monitored.

- Physical Address: If applicable, add your office or business address for formal correspondence or visits.

Additional Considerations:

- Ensure the information is up-to-date to avoid missed communications.

- Highlight the preferred method of contact if you want clients to prioritize one channel over others.

By presenting your contact details clearly and prominently, you enhance trust and transparency, making it easier for clients to engage with you when needed.

Ensuring Accuracy in Invoice Calculations

Precision in financial documents is crucial for maintaining trust and avoiding disputes. Ensuring that all calculations are correct helps prevent errors that could lead to overcharging or undercharging, thereby ensuring smooth transactions and client satisfaction.

Common Calculation Errors

To avoid mistakes, be aware of common pitfalls:

- Incorrect Tax Application: Ensure the correct tax rate is applied based on jurisdiction and the nature of the service or product.

- Omission of Discounts: Always include any agreed-upon discounts and verify that they are accurately deducted from the total.

- Rounding Errors: Pay attention to rounding conventions to ensure that amounts are consistent and professional.

Tips for Maintaining Accuracy

Here are some strategies to keep your calculations error-free:

- Double-Check Entries: Review all amounts entered, especially line-item totals and subtotals.

- Automate Calculations: Use tools or software features that automatically calculate totals, taxes, and discounts to minimize human error.

- Regular Audits: Periodically review past documents to identify and correct recurring issues.

By following these best practices, you can ensure that your financial records are accurate, reliable, and professional, thereby fostering better relationships with clients and partners.

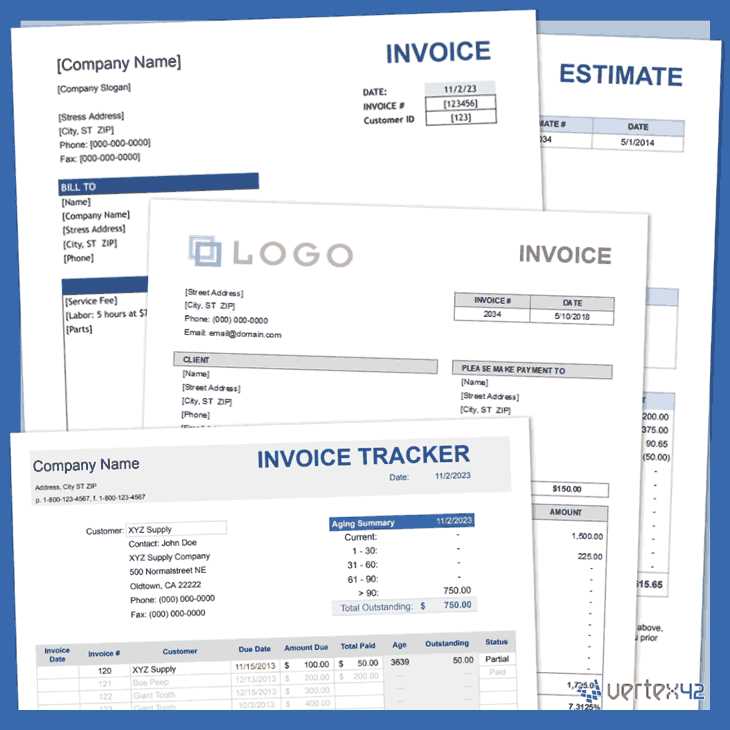

Where to Find Reliable Invoice Templates

Accessing dependable formats for financial documents is essential for ensuring professionalism and consistency in your transactions. Knowing where to locate high-quality designs can save time and enhance the presentation of your financial communications.

Online Resources

Several websites offer a variety of layouts that can suit different needs:

- Office Supply Stores: Many office supply retailers provide free or purchasable designs that can be easily customized.

- Document Creation Platforms: Websites like Canva and Google Docs offer a range of user-friendly options for creating tailored documents.

- Freelance Design Sites: Platforms such as Etsy feature numerous sellers who provide unique and professionally designed formats.

Software Solutions

In addition to online resources, consider using software programs that include built-in layouts:

- Accounting Software: Programs like QuickBooks and FreshBooks often have integrated designs that simplify the invoicing process.

- Office Applications: Popular applications like Microsoft Excel and Google Sheets come with pre-made formats that can be adjusted to fit your needs.

By exploring these options, you can find reliable and appealing layouts that will enhance the efficiency and professionalism of your financial documentation.

How to Save and Send Word Invoices

Efficiently saving and sharing your financial documents is essential for smooth business transactions. Properly storing and transmitting these files ensures they are easily accessible, secure, and professionally presented when sent to clients.

Saving Your Documents

To ensure your documents are saved correctly and are easily retrievable, follow these tips:

- Choose the Right File Format: Save your document in a widely accepted format like PDF to preserve the layout and ensure it can be opened on any device.

- Organize Files by Date or Client: Use a clear naming system, such as “ClientName_InvoiceNumber_Date,” to easily track and find documents later.

- Backup Your Files: Store your documents in cloud storage or on an external drive to prevent loss of important information.

Sending Your Documents

Once saved, you can easily send your documents to clients through various methods:

- Email: Attach the file to an email and include a brief, polite message explaining the document. Ensure the file size is manageable for quick delivery.

- File Sharing Platforms: For larger files, use platforms like Google Drive or Dropbox, where you can upload the document and send a link for easy access.

- Physical Mail: If required, print the document and send it through traditional mail, making sure it’s securely packaged.

By following these steps, you can streamline the process of saving and sharing your financial documents, ensuring they are well-organized and professionally presented for your clients.