Freelance Marketing Invoice Template for Seamless Billing

For independent professionals, managing payments and maintaining a clear record of work is crucial to running a successful business. A well-structured document that outlines services rendered and the associated fees helps ensure smooth financial transactions between clients and contractors.

With the right tools, creating a document that communicates professionalism and clarity becomes easier. These documents not only simplify the payment process but also help avoid misunderstandings, ensuring that both parties are on the same page regarding payment expectations and deadlines.

Using pre-designed formats tailored for this purpose can save time and reduce errors. With customizable features, these formats allow for the inclusion of essential details such as rates, deadlines, and payment terms. They also help maintain a consistent appearance that reinforces credibility and trust with clients.

Why Freelance Marketing Invoices Matter

For independent professionals, clear and organized documentation of services provided is vital to ensuring smooth business operations. Having a structured record that specifies work completed and payment details helps avoid confusion and sets clear expectations with clients. It also serves as a professional way to request compensation and protect your rights as a contractor.

Well-crafted payment documents play a crucial role in establishing trust with clients. By outlining key information such as payment terms, amounts due, and deadlines, these documents ensure that both parties are aligned. They also offer a reference point in case of any disputes or misunderstandings regarding compensation.

Beyond the immediate benefit of securing timely payments, a clear and professional document helps build your reputation. It showcases your organizational skills and attention to detail, qualities that clients highly value. Furthermore, maintaining a proper record supports tax filing and financial tracking, making the entire process more efficient and transparent.

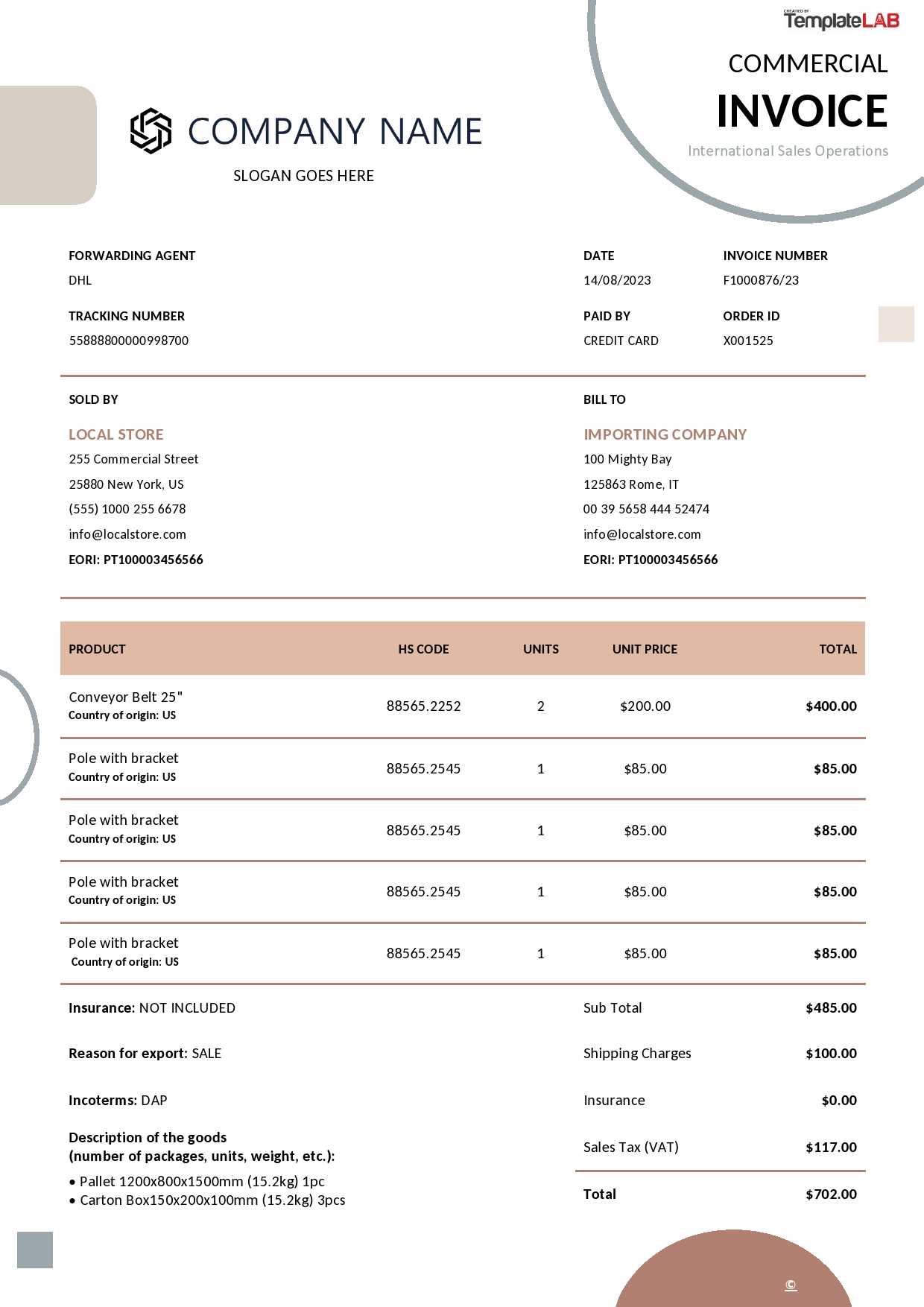

Essential Elements of a Payment Request

To ensure clarity and avoid confusion, a well-structured document outlining the work done and payment due must include several key components. These elements provide the necessary information to both the client and the service provider, ensuring that all parties understand the scope of the agreement and expectations for payment. A professional document not only details the amount owed but also helps maintain smooth communication and trust throughout the transaction.

Key Information to Include

At the core of any payment request, certain pieces of information are essential. This includes the service provider’s contact details, the client’s information, a unique reference number, the date of service, and a breakdown of the services rendered. The document should also specify the total amount due, any taxes applied, and the payment methods accepted. Clear payment terms, such as deadlines and late fees, should also be highlighted.

Formatting and Organization

Presenting this information in a clean, organized manner is just as important as including the right details. Proper formatting ensures that the document is easy to read and professional in appearance. Grouping related information together and using headings, bullet points, and tables can make it easier for the client to quickly review and process the details. A well-organized document encourages prompt payment and minimizes the chance of errors.

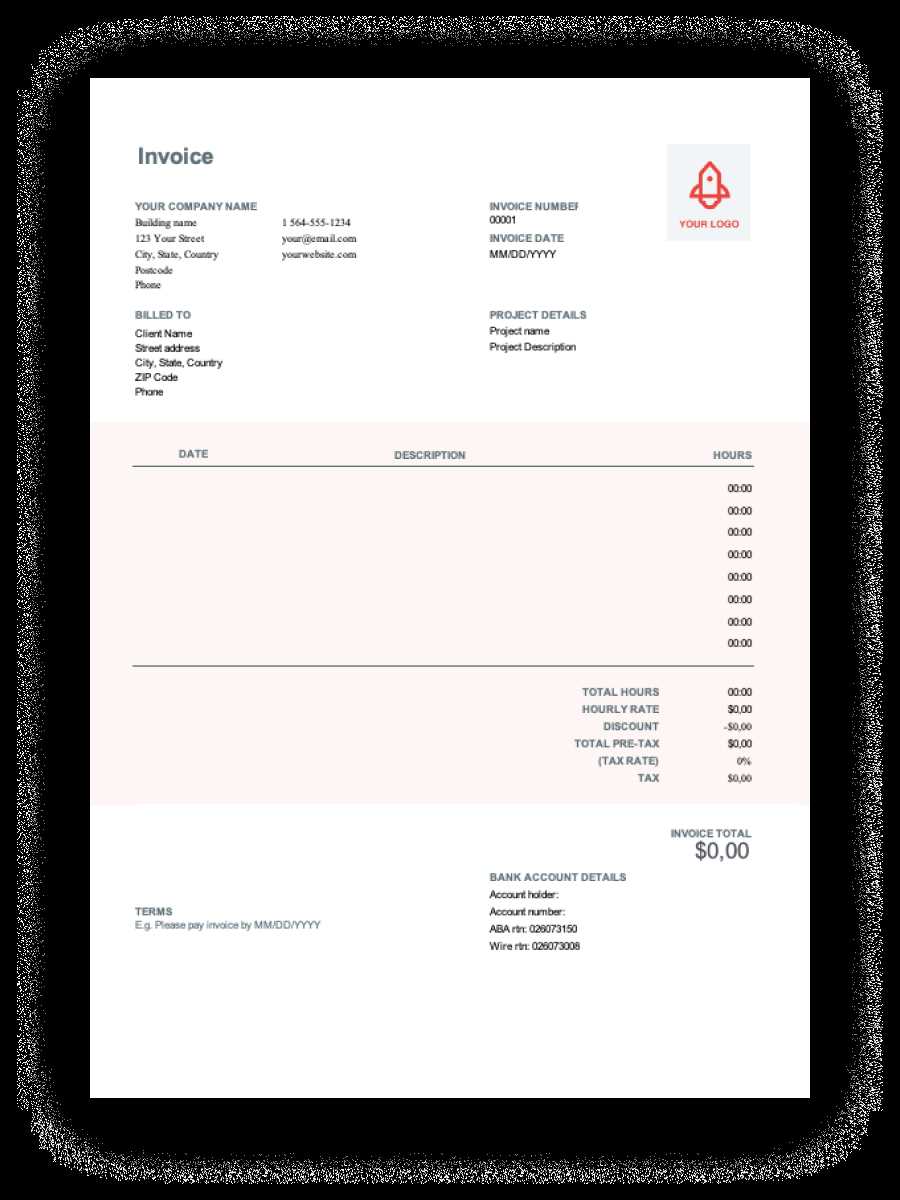

How to Create a Professional Payment Request

Creating a professional document to request payment for services rendered is essential for independent professionals. This document should not only outline the work completed and the amount owed but also reflect your brand’s professionalism and attention to detail. By following a few key steps, you can create a polished, clear, and effective payment request that enhances your reputation and ensures timely payments.

Step 1: Include Your Business Information

The first step in crafting a professional document is to clearly identify yourself and your client. Make sure to include:

- Your full name or business name

- Your contact information, including email and phone number

- Your business address (if applicable)

- The client’s name and address

Providing this information at the top of the document helps establish your identity and makes it easier for clients to reach you if needed.

Step 2: Break Down the Services and Costs

Clearly list the services or tasks you have completed and the corresponding costs. This section should be straightforward and easy to understand. To make it more organized, consider:

- Breaking down each service into line items

- Including the rate for each service and the quantity (if applicable)

- Calculating the total for each item and the overall sum

Be as detailed as possible to avoid any confusion. Clients will appreciate a transparent and easy-to-follow breakdown of your work.

Step 3: Set Payment Terms

It’s important to outline the terms of payment clearly

Customizing Your Payment Request Document

Adapting your payment request document to fit your specific needs and branding is an important step in making a lasting impression on clients. By personalizing the layout and content, you can ensure that the document reflects your professional identity while making it easier for clients to understand the details of the transaction. Customization allows you to create a consistent and recognizable format that enhances your credibility.

When customizing your payment request, start with the design. Choose fonts, colors, and a layout that align with your brand. Incorporating your logo or business name at the top helps clients immediately recognize your brand and adds a professional touch. Adjust the spacing and arrangement to ensure that the document is easy to read and visually appealing.

Next, tailor the content to meet your business needs. For instance, if you offer multiple types of services, create sections or categories that clearly define the work performed. Including personalized payment terms, such as specific due dates or discounts for early payment, further demonstrates attention to detail and strengthens the client relationship.

Top Benefits of Using an Invoice Template

Creating professional financial documents quickly and efficiently is essential for any independent worker. Using a structured document format offers numerous advantages that can save time, ensure accuracy, and promote a clear, organized approach to handling payments and transactions.

- Time Efficiency: Pre-designed formats allow you to fill in essential details without needing to start from scratch each time. This streamlined process saves valuable time.

- Consistency: A standardized format helps maintain uniformity across all your billing documents, making it easier for clients to read and understand the charges.

- Professional Appearance: A well-structured document helps create a polished image, demonstrating reliability and attention to detail, which can enhance your business reputation.

- Accuracy and Organization: Built-in fields for essential details like dates, payment terms, and amounts minimize the risk of human error, ensuring your calculations and information are accurate.

- Legal Protection: Clear, detailed records can serve as evidence in case of disputes. A properly formatted document provides a concrete reference for both parties involved.

- Customizability: You can easily modify elements to fit your specific needs, whether it’s adjusting the layout, adding new sections, or integrating branding to match your business identity.

Freelancer Payment Terms to Include

When working independently, it’s essential to set clear guidelines for receiving payments to avoid confusion or delays. Defining specific conditions up front helps both parties understand expectations and ensures smooth financial transactions. Below are key elements to include in your payment agreements to protect yourself and promote professionalism.

- Payment Due Date: Clearly specify when the payment is expected, whether it’s upon completion of the work or within a certain number of days after the project’s delivery.

- Late Fees: Include information on any penalties for overdue payments. This helps encourage timely settlements and compensates for the inconvenience of delays.

- Accepted Payment Methods: Indicate which methods of payment are acceptable (e.g., bank transfer, online platforms, credit cards) to avoid confusion later on.

- Deposit Requirements: For larger projects, consider requesting an upfront deposit before starting work. This secures your time and effort, especially for long-term projects.

- Payment Milestones: If the work spans multiple phases, break down the payments into installments, tied to specific project milestones or deliverables.

- Currency and Taxes: Specify the currency in which you expect payment and clarify who is responsible for covering any taxes or transaction fees associated with the payment process.

- Refund Policy: Outline the circumstances under which refunds may be issued and any relevant terms, protecting both your interests and your client’s satisfaction.

Designing a Clear and Simple Invoice

Creating a well-organized and easily understandable document for payment requests is key to ensuring that clients know exactly what they are being charged for. A simple design enhances clarity, avoids confusion, and ensures that all important details are communicated effectively. Below are tips for crafting a clean, straightforward document that serves both you and your client.

1. Use a Logical Layout

A clear structure makes the document easy to navigate. Start with essential details such as the client’s name, project title, and your contact information at the top. Group related information together and avoid cluttering the document with unnecessary sections. This logical flow helps clients quickly find what they need.

2. Prioritize Key Information

Make sure that the most important details stand out. The breakdown of services, rates, and total amounts should be prominently displayed. Use bold text or larger fonts for headings to help highlight crucial sections. Avoid overcomplicating the design with too many colors or fonts–keeping things simple is usually more effective.

Additional clarity can be achieved by using easy-to-read fonts and maintaining ample white space between sections. This approach improves readability and creates a professional appearance.

Common Mistakes to Avoid in Invoices

When creating payment requests, small errors can lead to confusion, delays, or even disputes. Avoiding common mistakes ensures a smoother transaction process and strengthens your professional image. Here are some common pitfalls to be aware of and how to prevent them.

1. Missing or Incorrect Contact Details

One of the most common mistakes is failing to provide accurate contact information. Always double-check that both your details and your client’s information are correct. Incorrect addresses, phone numbers, or email addresses can lead to missed communications and delayed payments. Ensure that you include all relevant details in a clear and legible format.

2. Unclear Payment Terms

Another frequent issue is not being explicit about the payment conditions. Be clear about the due date, accepted payment methods, and any penalties for late payments. Vague or missing terms can lead to misunderstandings and delayed settlements. Clearly stating these conditions helps both you and your client stay on the same page, avoiding unnecessary issues down the road.

Tip: Always highlight key terms like due dates and payment methods in bold or with a larger font to make them stand out.

How to Track Payments Efficiently

Keeping track of payments is crucial for maintaining a healthy cash flow and ensuring that all outstanding amounts are settled promptly. A systematic approach helps you stay organized, minimizes errors, and provides a clear overview of your financial status. Below are some tips to help you manage payments more effectively.

1. Use a Payment Tracking System

Implementing a reliable tracking system is key to staying on top of payments. This could be as simple as using a spreadsheet or investing in specialized software. Organize payment information in a way that allows you to monitor the status of each transaction–whether it’s pending, completed, or overdue.

2. Maintain Clear Payment Records

Record all payments, including partial payments, deposits, and balances. It’s important to include the date, amount, method, and any relevant notes regarding each payment. This will help you stay on top of what has been received and what is still due.

| Date | Description | Amount | Status |

|---|---|---|---|

| 10/10/2024 | Project A Payment | $500 | Completed |

| 15/10/2024 | Project B Deposit | $300 | Pending |

| 20/10/2024 | Project C Final Payment | $400 | Completed |

Using Invoices to Strengthen Client Relationships

Creating clear, professional financial documents is not only about ensuring you get paid–it’s also an opportunity to build stronger relationships with your clients. A well-crafted document reflects your reliability, attention to detail, and respect for the business partnership. Here’s how you can use payment requests to foster trust and enhance your client interactions.

- Clear Communication: By providing clients with a transparent breakdown of services, rates, and payment terms, you reduce the chance for misunderstandings. This level of openness builds trust and sets the stage for positive future interactions.

- Timeliness: Sending your request promptly after completing a task shows professionalism and respect for your client’s time. It also demonstrates that you value their business and are organized.

- Customizing the Experience: Tailoring the document to reflect your client’s preferences or adding personalized notes shows that you care about the details of the working relationship. Small touches like a thank-you message can leave a lasting positive impression.

- Payment Flexibility: Offering multiple payment options or setting up flexible terms can make it easier for your client to pay on time. This demonstrates your willingness to accommodate their needs and strengthens the working relationship.

Incorporating these thoughtful elements into your billing process not only ensures that payments are handled smoothly, but also positions you as a professional who values long-term client partnerships.

Best Software for Invoice Management

Managing payment requests and tracking financial transactions can become overwhelming without the right tools. Utilizing dedicated software for managing these tasks streamlines the process, saves time, and reduces errors. The right solution can help you stay organized and ensure your financial operations run smoothly. Below are some of the best options available for handling payment records efficiently.

- QuickBooks: A comprehensive accounting solution that includes features for creating, sending, and tracking payment requests. QuickBooks also integrates with other financial tools, making it a popular choice for managing finances.

- FreshBooks: Known for its user-friendly interface, FreshBooks is a cloud-based platform that offers easy-to-use tools for tracking payments, managing projects, and automating recurring billing tasks.

- Xero: Xero is another powerful cloud-based accounting software that is ideal for managing payment requests and keeping track of financial reports. It offers robust features for collaboration and integrates seamlessly with a variety of other tools.

- Zoho Books: A feature-packed accounting software that helps you track payments, send reminders for overdue amounts, and manage expenses efficiently. Zoho Books also provides automated reports to give you a clear financial overview.

- Wave: This free, cloud-based tool is perfect for small businesses. It allows you to create and send payment requests, track income, and even handle payroll in a simple, intuitive interface.

Choosing the right software depends on your specific needs, but any of these options can help you stay on top of your financial tasks and improve your workflow efficiency.

How to Add Taxes and Discounts

Including taxes and discounts in your payment requests is essential for ensuring clarity and compliance with financial regulations. Properly applying these elements also helps maintain transparency with your clients and ensures that both parties understand the final amount due. Below are some steps and tips for adding taxes and discounts effectively.

1. Adding Taxes

Taxes are an important part of most transactions, and including them accurately is crucial for both legal and business reasons. Here’s how to apply them:

- Determine the Tax Rate: Identify the correct tax rate based on the client’s location or the type of service provided. Tax rates can vary by region and product/service type.

- Calculate the Tax Amount: Multiply the total cost by the tax rate to determine the amount due. For example, if the total is $500 and the tax rate is 10%, the tax will be $50.

- List Taxes Separately: It’s important to clearly separate taxes from the base price to avoid confusion. Make sure to list both the tax amount and the applicable rate on the document.

2. Applying Discounts

Discounts can be a great way to encourage prompt payment or show appreciation for long-term clients. Here’s how to apply them properly:

- Choose the Type of Discount: You can apply a percentage-based discount (e.g., 10% off the total amount) or a fixed amount (e.g., $50 off). Choose the method that works best for your pricing structure.

- Apply the Discount: Subtract the discount from the total amount before calculating any taxes. This ensures that the discount is applied to the correct base amount.

- Clearly Display the Discount: List the discount clearly on the document to ensure the client sees the reduction. It can be helpful to note if the discount is a limited-time offer or tied to specific conditions.

By adding taxes and di

Creating Recurring Invoices for Long-Term Clients

For ongoing projects or long-term collaborations, setting up automated payment requests can save you significant time and effort. Instead of manually creating new documents for each payment cycle, you can streamline the process by establishing recurring payment arrangements. This not only ensures timely payments but also strengthens the relationship with your clients by making transactions predictable and efficient.

1. Establish Clear Payment Terms

Before setting up a recurring arrangement, ensure both you and your client agree on the payment frequency, amount, and terms. Common intervals include weekly, monthly, or quarterly. Be sure to clearly communicate any adjustments to pricing, such as increases over time, and outline how payments will be processed.

- Frequency: Decide whether payments will be made on a fixed schedule or based on the completion of certain tasks.

- Amount: Set a consistent price or specify how much will be billed for each cycle, whether it’s for ongoing work or specific deliverables.

- Terms: Include any late fees or early payment discounts, and set a clear start and end date for the recurring agreement.

2. Automate the Process

Using software that supports automated billing can help eliminate the need for manual tracking and creation of new payment requests each cycle. Many accounting platforms allow you to set up recurring billing, sending out automated reminders or payment requests to clients based on your agreed schedule.

- Automated Reminders: Set up reminders to notify clients ahead of time when a new payment is due, reducing the chances of late payments.

- Payment Methods: Ensure that the client has selected their preferred payment method, and automate payments through systems like bank transfers, online payment services, or credit cards.

By establishing clear terms and automating the process, you not only ensure that payments are timely but also free up valuable time to focus on other areas of your business.

Legal Requirements for Marketing Invoices

When providing services and requesting payment for them, it’s crucial to ensure that all documentation is legally compliant. Properly structured records not only facilitate smooth transactions but also protect both parties involved. Understanding the necessary components and legal obligations for such documents is essential for maintaining transparency and avoiding potential disputes.

Key Elements for Compliance

The fundamental requirement is that each document must clearly outline the specifics of the agreement. This includes the description of the services rendered, the amount due, and the payment terms. Additionally, accurate contact details for both the service provider and the client must be included, as well as a unique reference number for future tracking. These elements ensure clarity and accountability for both sides.

Tax and Reporting Obligations

In many regions, service providers are required to include tax information, such as VAT or sales tax, if applicable. It’s important to ensure that these rates are correctly calculated and reflected in the total amount. Furthermore, businesses must adhere to local regulations by providing the necessary data for tax reporting purposes. Neglecting these can result in fines or delays in processing payments.

Understanding and following these legal obligations helps maintain the professionalism and legitimacy of your transactions, which is essential for long-term business relationships.

Tips for Ensuring Timely Payments

Ensuring that clients pay promptly is essential for maintaining a healthy cash flow and professional relationships. While providing high-quality work is key, clear communication and well-organized processes are equally important. By implementing a few strategic practices, you can reduce delays and avoid unnecessary complications when it comes to receiving compensation.

Set Clear Payment Terms

From the start of any project, make sure to define the payment schedule, including deadlines, late fees, and any other relevant conditions. By outlining these expectations in advance, clients are more likely to understand their obligations and act accordingly. Include these terms in your agreement to ensure mutual understanding.

Send Reminders Before Deadlines

Proactively remind clients about upcoming due dates. A polite reminder a few days before the agreed payment date can prompt timely action. A friendly follow-up can prevent forgetfulness and demonstrate professionalism in your approach to business management.

Clear communication and a structured approach are vital for making sure you receive compensation when due, helping you to build trust and ensure continued success in your business dealings.

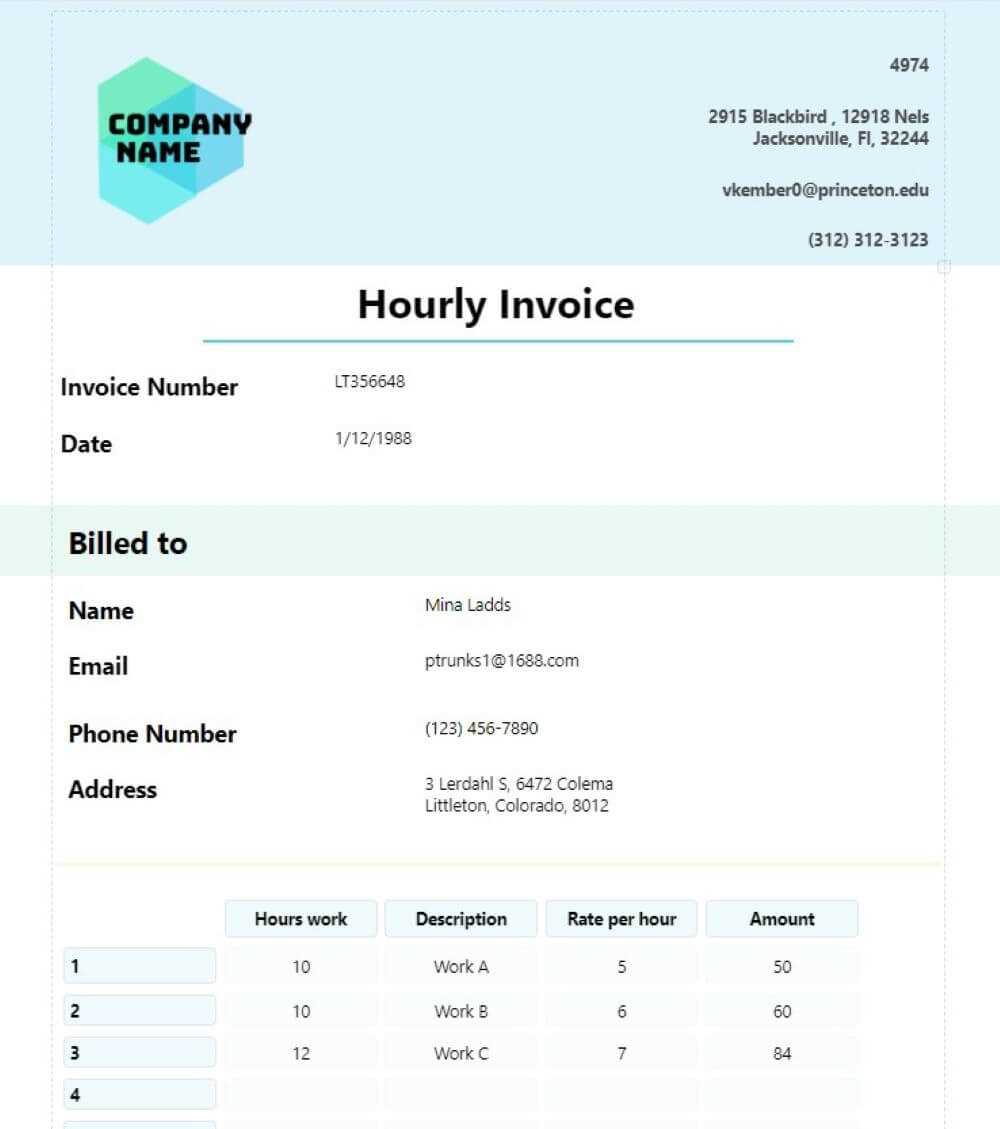

Freelancer Invoice Templates You Can Download

If you’re looking to streamline your billing process, having a structured document ready for each project is essential. There are several pre-designed formats available that allow you to customize details based on your needs, helping to save time and maintain professionalism. These ready-to-use documents ensure that all necessary information is included, from services rendered to payment terms.

Popular Downloadable Formats

Here are some of the most commonly available formats that you can download and personalize for your own use:

| Format | Features | Best For |

|---|---|---|

| Simple Billing Document | Clear breakdown of services and costs | Short-term projects or one-time tasks |

| Detailed Payment Record | Itemized list, including taxes and fees | Ongoing or complex agreements |

| Time-Based Form | Includes hourly rates and total time worked | Hourly-based services |

| Professional Payment Statement | Includes payment terms, contact details, and terms & conditions | Long-term clients or formal agreements |

These downloadable options are customizable to fit your specific business needs, allowing you to maintain clarity and organization in your billing process.