Free Invoice Templates to Fill In and Print for Your Business

Managing financial transactions efficiently is crucial for any business. One of the most important tasks is ensuring that clients receive accurate, professional documents for their purchases or services. These documents are not only essential for record-keeping but also help establish clear communication between service providers and customers.

Using well-designed documents can save time and reduce errors in the accounting process. With the right resources, anyone can create professional-looking documents without the need for expensive software or complex design skills. These simple yet effective tools can be customized to suit a variety of business needs, offering a quick solution to create accurate paperwork on the go.

Streamlining the billing process can greatly improve your workflow. Whether you’re running a small business or working as a freelancer, having the ability to easily generate clear, concise records ensures that your financial dealings remain transparent and efficient. It’s an essential aspect of maintaining a smooth, trustworthy business operation.

Free Invoice Templates for Your Business

For any business, maintaining proper documentation for transactions is essential to ensure transparency and professionalism. Having the right tools to create these records quickly can make a significant difference in your workflow. With the right set of customizable forms, business owners can easily produce clear, organized documents that serve both as a legal record and a clear communication tool for clients.

Using ready-made designs can save valuable time, allowing entrepreneurs to focus on core business tasks instead of spending hours creating custom paperwork from scratch. These resources are designed to be simple to use, yet flexible enough to accommodate a variety of business models, whether you’re in retail, services, or freelancing.

Having access to pre-designed solutions also ensures consistency across all your transactions. With each document looking professional and following a standardized format, clients will have no confusion about the terms and details of their orders. This small but important step can enhance your brand’s credibility, helping establish trust with customers.

Incorporating such tools into your daily operations can ultimately streamline the billing process, improve organization, and ensure that your financial paperwork aligns with industry standards. No matter the size or scope of your business, these solutions are a practical resource for simplifying the administrative side of your operations.

Why You Need Printable Invoice Templates

For businesses of any size, having an organized, efficient method to document transactions is critical. Clear, consistent paperwork not only helps track financial exchanges but also ensures that both the service provider and client are on the same page. The ability to quickly create professional records provides a smooth process for both parties, reducing confusion and ensuring proper accounting practices.

Benefits of Using Ready-Made Documents

Customizable, easy-to-use forms save valuable time. Instead of designing your own from scratch, you can quickly input necessary details into a ready-made structure. This saves you from spending precious hours, while also guaranteeing that the document looks polished and professional.

Enhancing Organization and Efficiency

Consistency is key in business, especially when it comes to maintaining accurate records. By utilizing a standardized format, you can ensure that every transaction is documented the same way, making it easier to track sales, payments, and overdue amounts.

| Advantage | Explanation | |||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time-saving | Ready-made forms streamline the creation process, eliminating the need to design each document individually. | |||||||||||||||||||||||||||||||||||||

| Consistency | Using the same format for all transactions reduces errors

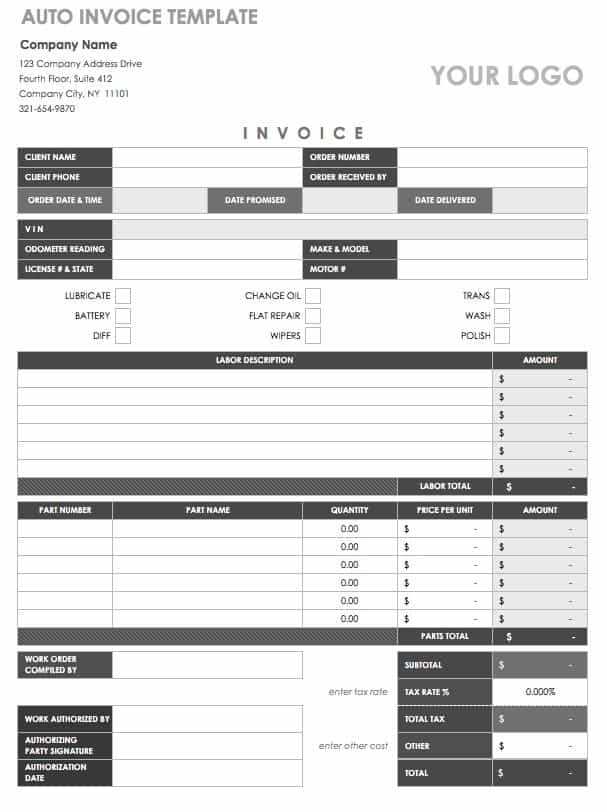

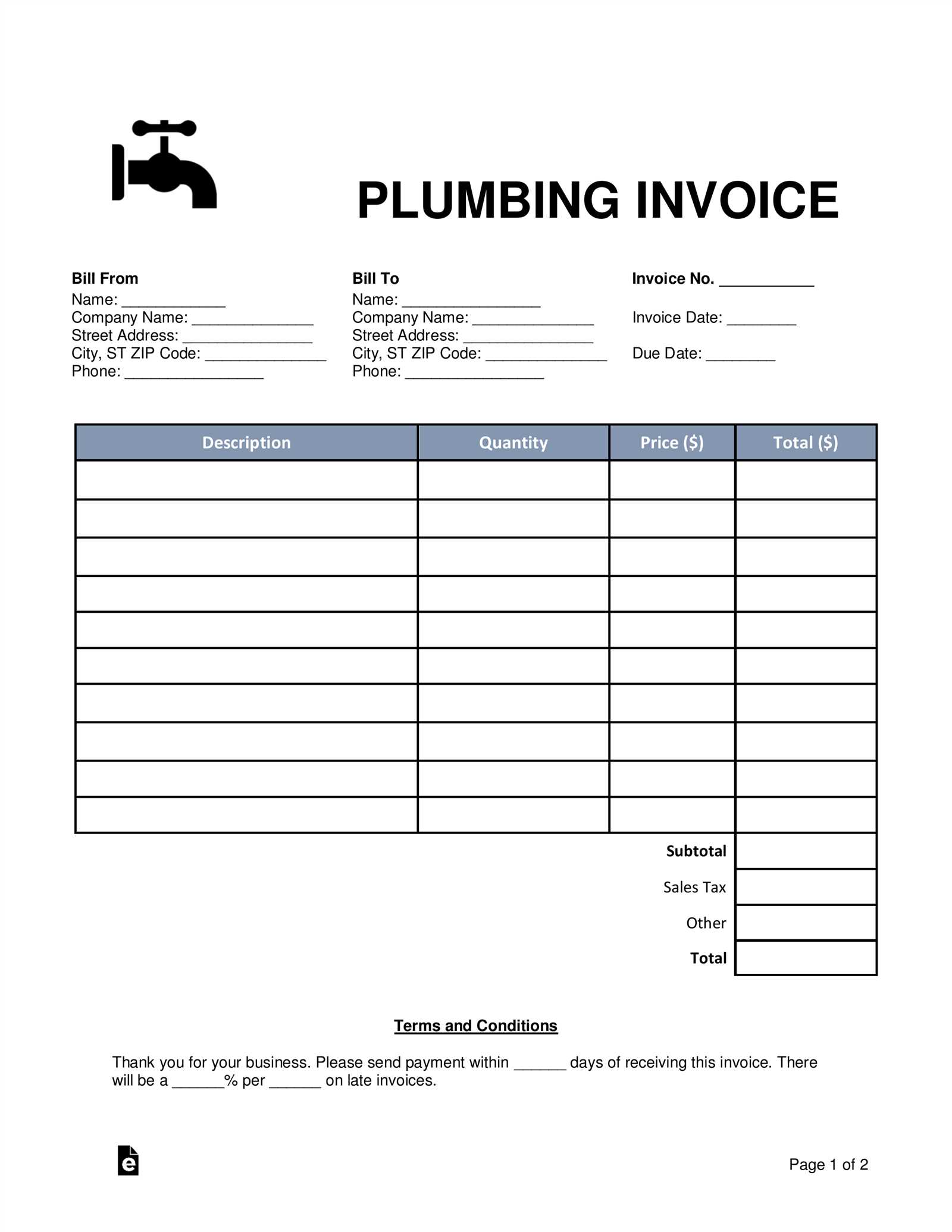

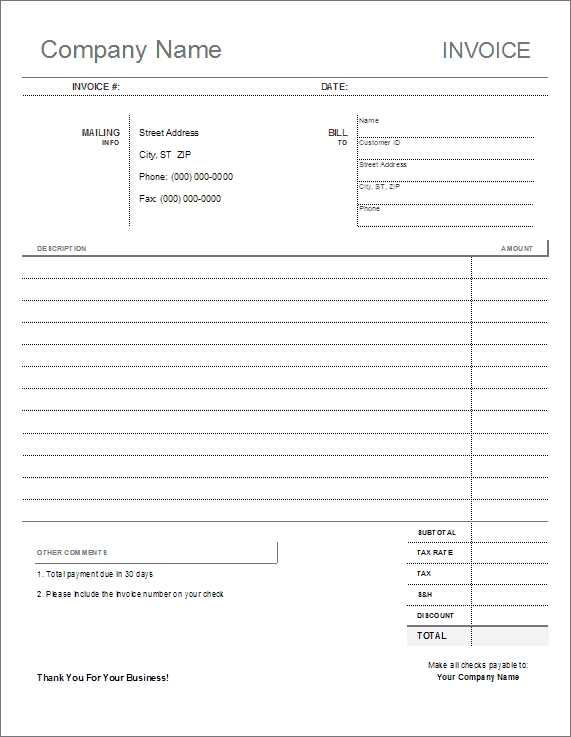

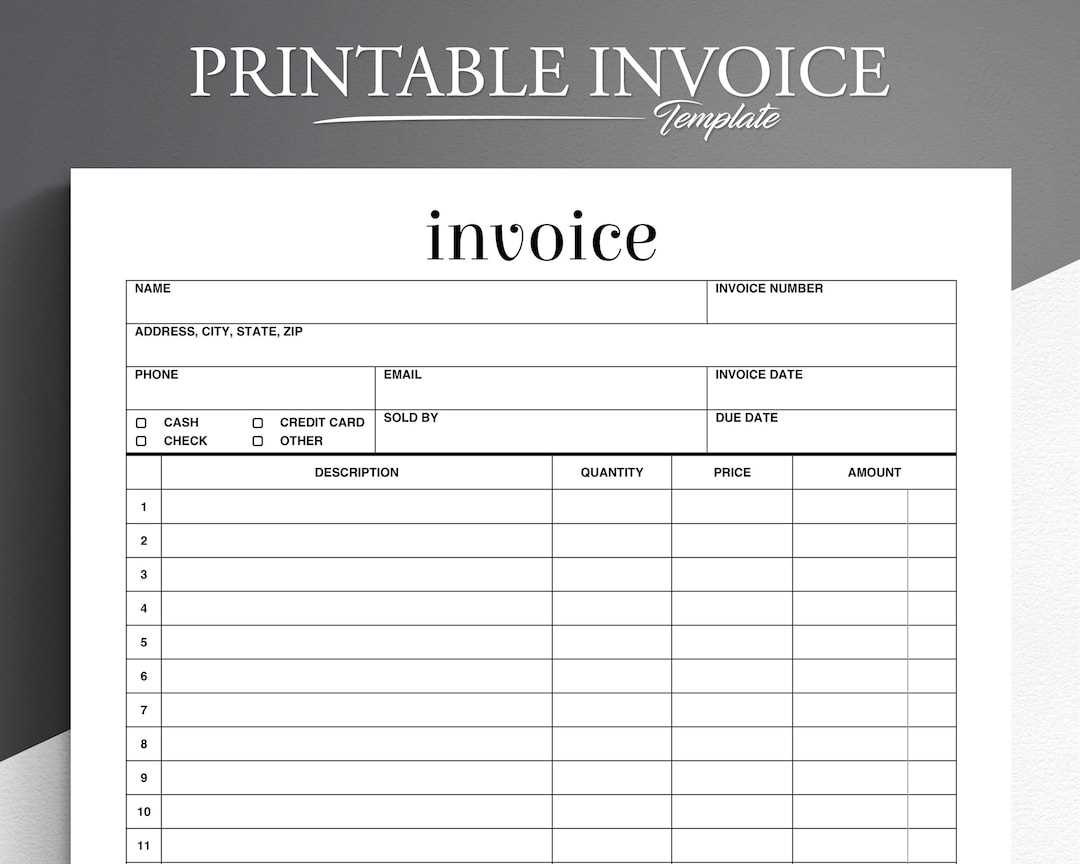

How to Customize Your Invoice TemplateAdapting a pre-designed form to match your business needs is essential for creating documents that reflect your brand while remaining functional. Customizing these tools ensures that all necessary information is included and presented clearly. This allows for a streamlined process that reflects your professionalism and efficiency in handling financial records. Adjusting Layouts to Suit Your BrandOne of the first steps in personalization is adjusting the layout. This involves choosing where to place key details such as your company name, contact information, or the client’s details. Customizing fonts, colors, and positioning not only gives your document a unique look but also ensures it aligns with your business identity. Adding Relevant Information for Specific NeedsDepending on your industry or the nature of the transaction, certain details might need to be included. For instance, service-based businesses may want to add hourly rates, while retail businesses might need space for product descriptions or quantities. Adding such fields allows you to capture all the necessary information while keeping the document clean and readable. Personalizing your records also ensures that they meet legal or tax requirements. Including important terms and conditions or payment instructions helps protect both you and your clients, making the entire process smoother and more transparent. Top Resources for Free Invoice TemplatesWhen looking to create professional documents for your business, finding the right tools can make all the difference. Many online platforms offer customizable solutions that cater to different industries and needs, making it easier for you to generate high-quality records without the need for complex software. These resources are designed to help you quickly create organized, effective forms while maintaining a professional appearance. Some of the best resources offer a wide variety of styles and formats, ensuring that you can find an option that works for your particular business. Whether you need something simple or more detailed, there are countless websites that provide easy-to-use documents that you can customize according to your preferences. Platforms such as Microsoft Office or Google Docs provide basic structures that you can easily download and adapt, while others like Canva or Zoho offer more creative, visually appealing options. These sites often feature additional tools like cloud storage or integrations with accounting software, further simplifying your workflow. Benefits of Using Editable Invoice FormsCustomizable documents designed for business transactions offer significant advantages. These flexible tools allow you to create professional records with ease, ensuring consistency across various financial communications. By having the ability to modify details instantly, users can save time while maintaining accuracy in their records. One of the most notable benefits is the ability to streamline workflows. Instead of starting from scratch each time, users can quickly adjust pre-made structures to suit specific needs. This adaptability not only enhances efficiency but also reduces the chances of human error during document creation.

Step-by-Step Guide to Filling In InvoicesCreating accurate documents for transactions is essential for smooth business operations. The process involves entering specific details that reflect the agreement between parties, ensuring clear communication of payment expectations. Follow these steps to ensure that all necessary information is correctly included in your document. 1. Start with Basic Information Begin by entering your company name, contact details, and address in the header section. Similarly, include the recipient’s name and contact information. This establishes the primary details for the transaction. 2. Include Transaction Dates Next, indicate the date the document is issued, as well as the payment due date. This helps both parties understand the timeline for payment and any potential late fees. 3. List the Products or Services In this section, provide a detailed description of the goods or services offered. Include quantities, unit prices, and any applicable discounts. Each item should be clearly outlined to avoid confusion. 4. Calculate Total Amount Add up the prices of all items listed, accounting for taxes or any additional fees. Ensure the final amount is clearly marked, so the recipient can easily understand the total due. 5. Include Payment Instructions Provide clear instructions on how the recipient can make the payment. Include bank account details, online payment options, or other relevant methods. This ensures the recipient knows exactly how to settle the amount. 6. Double-check for Accuracy Review all the information for correctness. Small mistakes can lead to confusion, so it’s important to verify details such as pricing, dates, and contact information. By following these steps, you ensure that each document is Essential Information to Include in an InvoiceFor a transaction document to be effective, it must contain certain key details that ensure clarity and prevent misunderstandings between the parties involved. These elements are crucial for maintaining professionalism, ensuring payment terms are clear, and providing a record for future reference. Below are the fundamental items that should be included.

Including these vital components in your document ensures transparency, minimizes the risk of errors, and creates a clear understanding betwee How Printable Invoices Save Time

Efficiently creating transaction documents can significantly reduce the time spent on administrative tasks. By utilizing pre-designed structures, businesses can easily generate professional paperwork without having to manually set up each detail from scratch. This not only streamlines the process but also minimizes the chances of errors, allowing companies to focus on more critical tasks. Quick Customization for Specific NeedsPrintable forms allow users to customize documents quickly by filling in only the necessary information. Instead of redesigning a document each time, you simply update the relevant fields–saving time on repetitive data entry and ensuring consistency across all your records. Less Time Spent on CorrectionsBy using established layouts with predefined fields, the likelihood of mistakes is greatly reduced. This means fewer revisions are required, allowing for faster turnaround times when issuing financial records. Furthermore, the automated structure helps ensure that nothing important is overlooked, improving accuracy in the process. How to Design an Effective Invoice TemplateCreating a well-structured document for transactions is essential for clear communication and ensuring smooth financial exchanges. A well-designed layout not only saves time but also enhances professionalism. Below are key factors to consider when crafting an effective document for business dealings.

|