Free Microsoft Word Invoice Template for Easy and Professional Billing

Creating professional documents for payment requests is essential for any business. Whether you’re a freelancer, small business owner, or entrepreneur, having a reliable way to present charges is crucial. With the right tools, you can craft polished and efficient documents that help maintain a smooth transaction process with your clients.

Fortunately, there are many easy-to-use resources available that allow you to design these documents quickly. These tools offer a range of customization options, ensuring you can match the look and feel of your brand while keeping things straightforward. By using customizable formats, you can ensure all necessary details are included without wasting time on manual formatting.

In this guide, we’ll explore how you can access and utilize these resources to streamline your billing process, save time, and create documents that reflect your professionalism. Whether you’re just starting or looking to improve your current system, these solutions provide a user-friendly approach to managing your finances.

Free Microsoft Word Invoice Template Guide

Creating professional documents for billing purposes doesn’t have to be complicated. With a variety of customizable resources available, it’s easy to design clear, polished payment requests that ensure you get paid on time. These ready-made formats allow you to focus on the important details of your business rather than spending excessive time on layout and design.

In this guide, we’ll walk you through the essential steps for creating an effective payment request document, offering tips and highlighting key features that make the process smooth and efficient. Whether you’re handling client payments or managing ongoing services, a solid approach to document creation is essential for maintaining professionalism.

Here’s how to get started with a ready-to-use document structure:

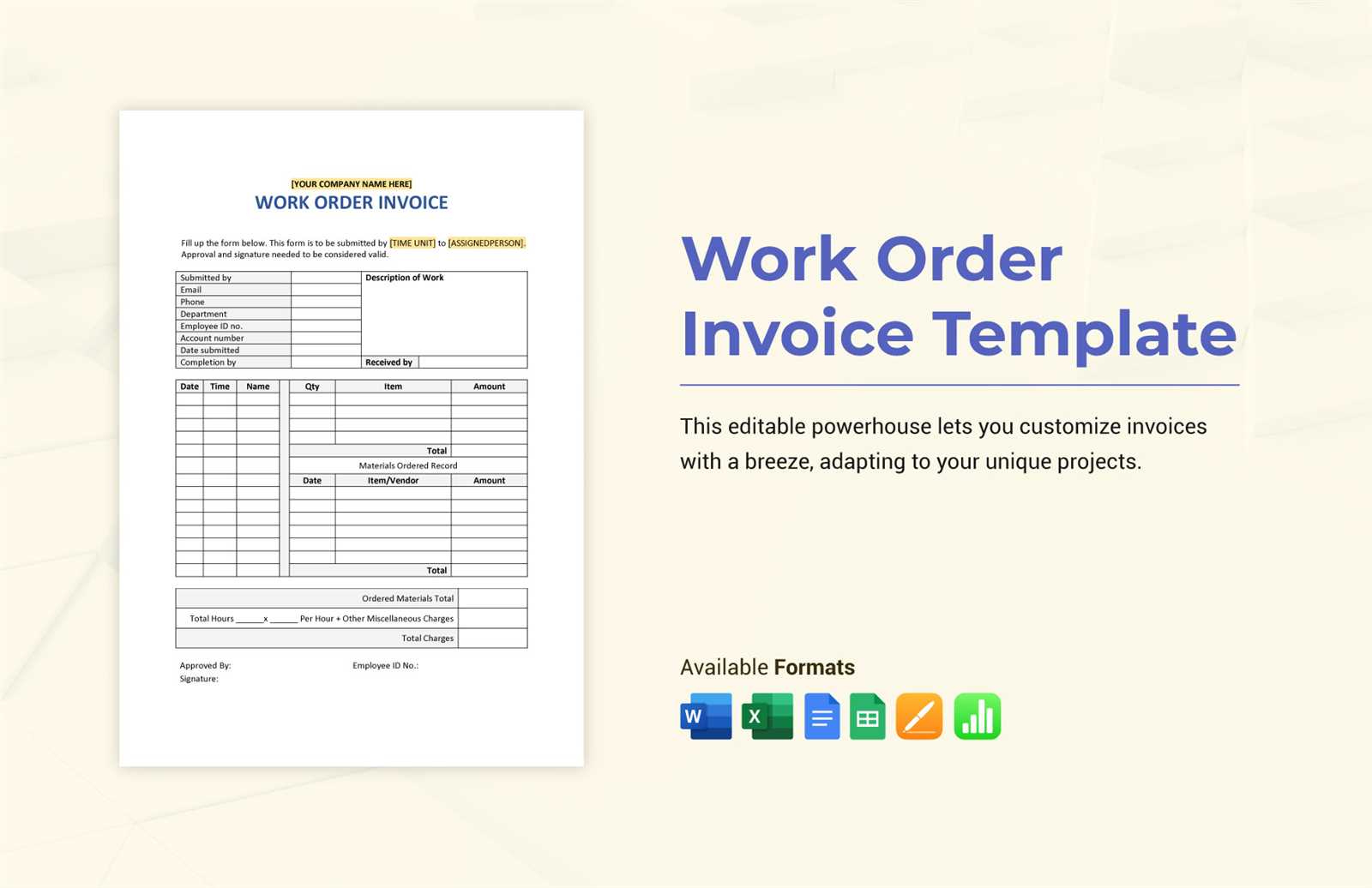

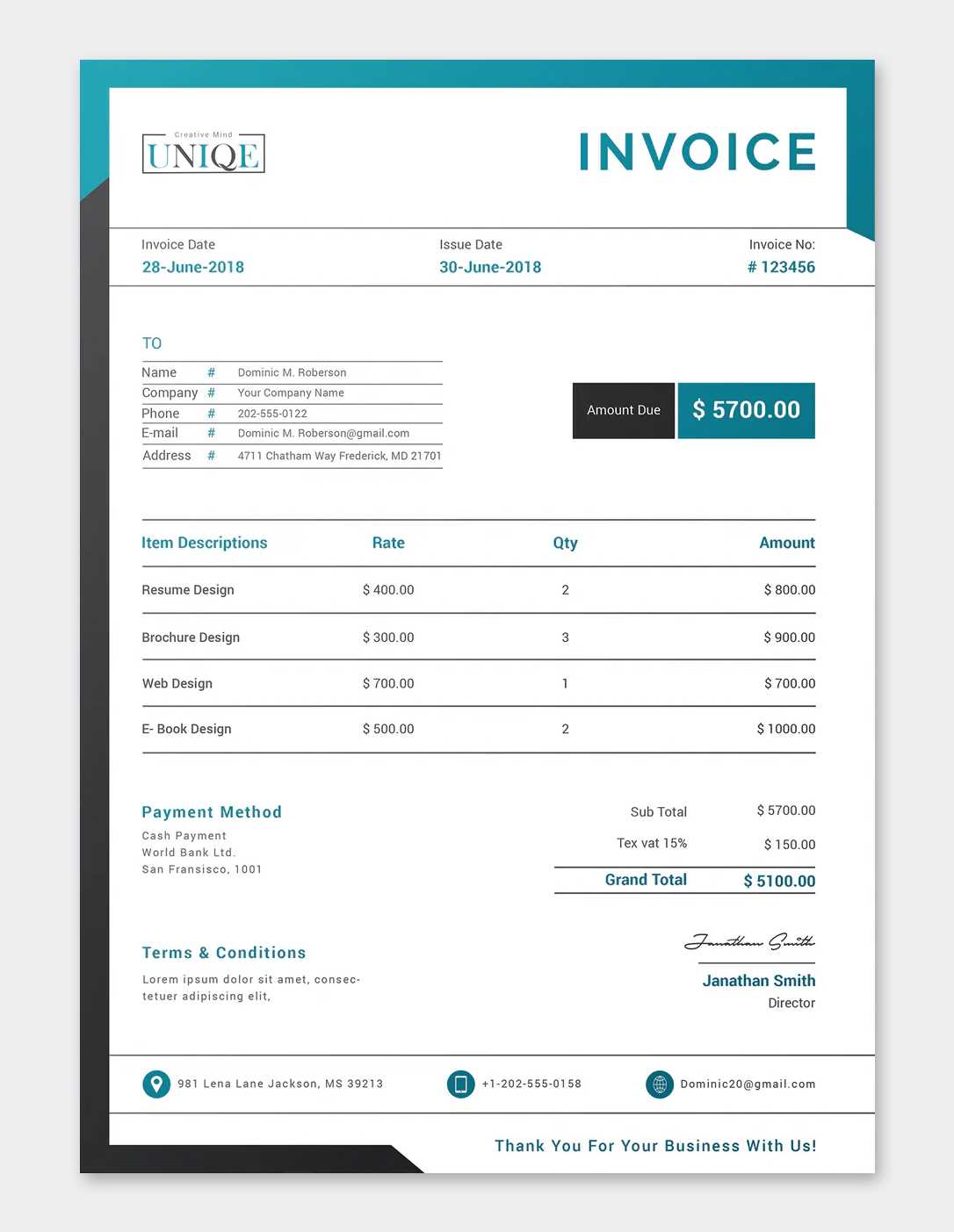

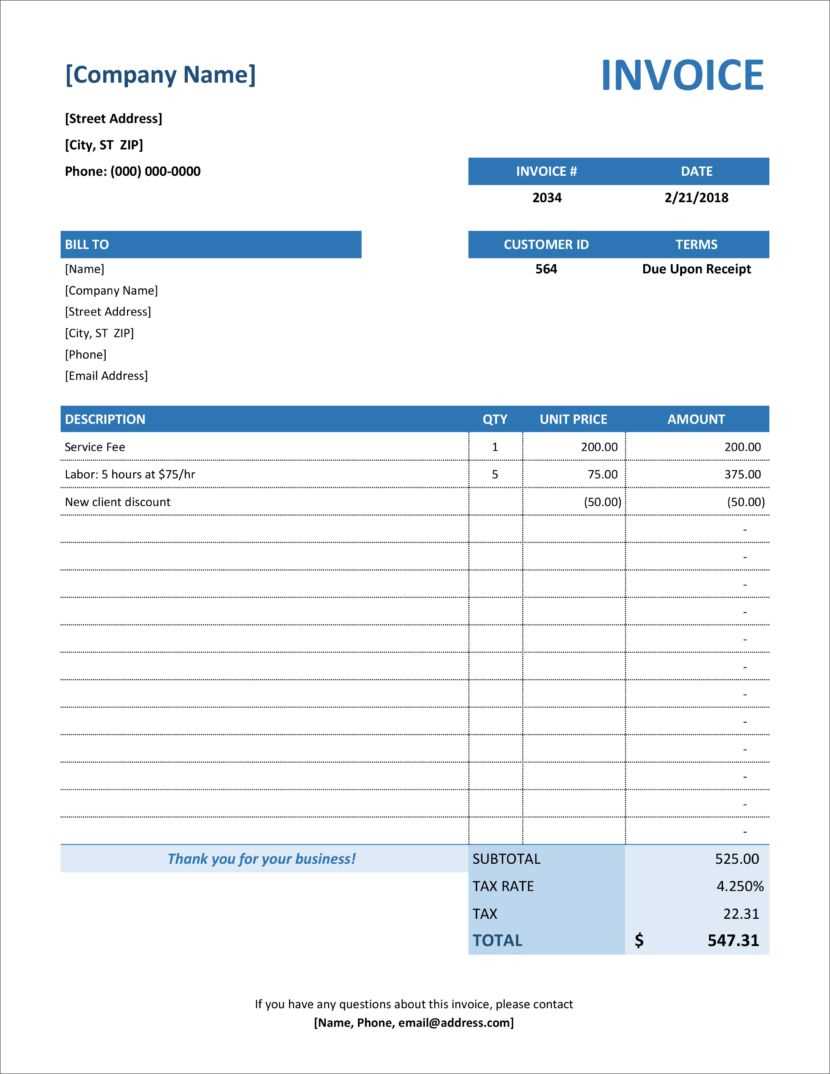

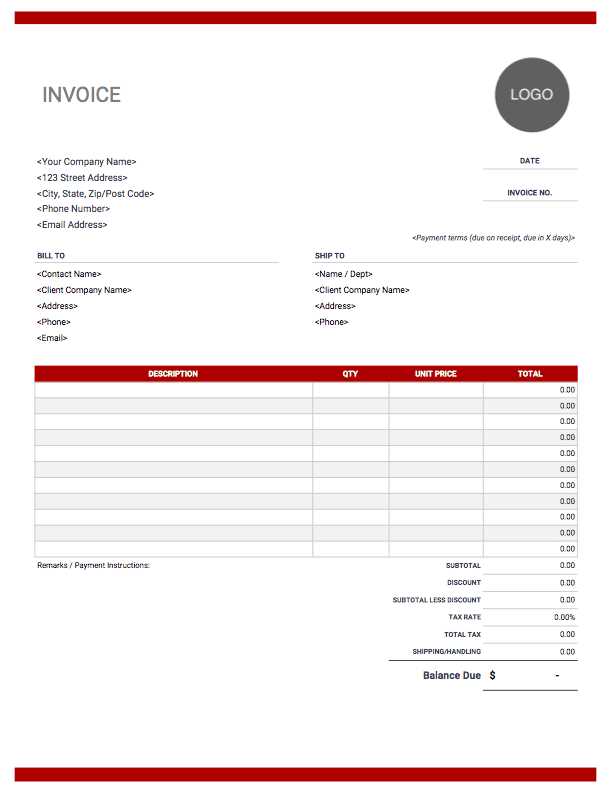

- Choose the Right Format – Select a format that suits your needs, from basic to more detailed layouts, depending on your business type and customer requirements.

- Input Client Details – Always include the client’s name, contact information, and payment terms to avoid confusion.

- List Services or Products – Clearly outline what has been provided and the associated costs. Break down the information to avoid ambiguity.

- Add Payment Instructions – Ensure that clients have clear instructions on how to make payments, including account details or links for online payments.

- Include Branding Elements – Customize the layout with your company logo, brand colors, and contact details for a personalized touch.

By following these simple steps, you can create a well-organized document that not only serves its functional purpose but also leaves a lasting impression on your clients. With a few customizations, these resources can be tailored to suit any business, ensuring you maintain a professional and efficient approach to your billing practices.

Why Use a Word Invoice Template

Using a pre-designed structure for payment requests offers several advantages, especially when you need to maintain consistency and professionalism in your documents. A ready-to-use format can save you time, reduce errors, and help you present information clearly and effectively. Instead of starting from scratch, you can customize an existing layout to fit your specific needs while ensuring all essential details are included.

Here are some key reasons why a standardized format is beneficial for your business:

- Time Efficiency – Pre-designed layouts save you valuable time. You don’t have to spend hours creating documents from scratch or figuring out proper formatting.

- Professional Appearance – A polished, well-organized design instantly enhances your business image, making it easier to build trust with clients.

- Consistency – Using the same format for every request ensures that your documents look uniform, improving the overall presentation of your business.

- Customizability – Even with a fixed structure, these resources can be easily customized to include your business details, logos, and preferred payment methods.

- Reduced Risk of Errors – Templates often include predefined fields and sections, reducing the likelihood of missing crucial information.

By using a pre-made layout, you can streamline the process of creating professional documents while ensuring your clients receive clear and accurate payment requests. This simple solution allows you to focus more on your business rath

How to Customize Your Invoice

Customizing a payment request document allows you to tailor it to your specific business needs while ensuring all the necessary information is included. Whether you’re adding your logo, adjusting the layout, or modifying content, personalization makes your document not only more professional but also unique to your brand. The following steps will guide you through the process of modifying a standard structure to fit your business style.

Here’s how to effectively customize your document:

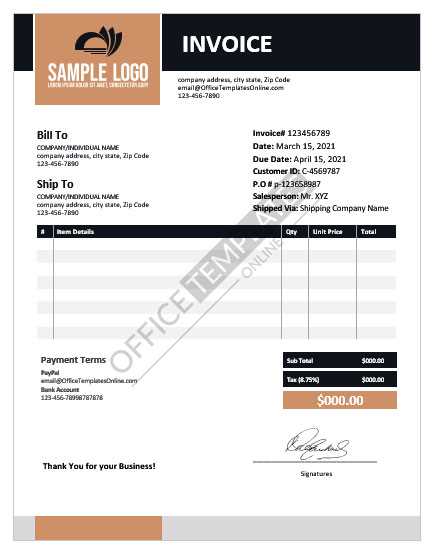

- Add Your Business Logo – Including your company logo at the top of the page makes your document instantly recognizable and adds a professional touch.

- Adjust Font and Colors – Customize the font style and color scheme to match your brand’s identity. A consistent look across all your documents enhances recognition.

- Insert Contact Information – Ensure your business name, address, phone number, and email are clearly visible, making it easy for clients to contact you if needed.

- Modify Layout and Sections – You can rearrange the sections to highlight the most important information, such as payment terms or due dates, according to your preferences.

- Include Payment Instructions – Customize the payment section with specific methods, account details, or links to online payment platforms based on how you prefer to receive payments.

- Personalize Client Details – Always input your client’s full name, address, and any other relevant contact details for a more tailored document.

By making these adjustments, you ensure that each document you send reflects the professionalism of your business while maintaining clarity and consistency for your clients. Personalizing your payment requests is a simple yet effective way to reinforce your brand and enhance communication with customers.

Advantages of Free Invoice Templates

Using pre-designed structures for creating payment documents offers several key benefits. These resources are ideal for those who need professional-looking forms without investing time in designing from scratch. By utilizing readily available layouts, businesses can streamline their financial operations and ensure consistent, error-free communication with clients. Here are some of the top advantages of using these accessible resources:

Cost-Effective Solution

- No Additional Expenses – Most pre-made structures are available at no cost, saving you money on software or custom design services.

- Accessible for Small Businesses – Ideal for entrepreneurs and freelancers who may have limited budgets but still require a professional way to manage billing.

Time-Saving and Efficient

- Quick Setup – Ready-to-use formats reduce the time spent creating documents, allowing you to focus on more critical aspects of your business.

- Easy to Customize – These layouts come with flexible fields that can be easily adapted to fit your business details, saving you the hassle of reformatting.

By opting for these simple yet effective resources, businesses can maintain professionalism in their transactions while also keeping their processes streamlined and efficient. This approach reduces errors, ensures consistency, and supports a smoother workflow for both businesses and clients.

Simple Steps to Create Invoices

Creating a professional document to request payment is an essential task for any business or freelancer. Whether you’re offering goods or services, it’s important to have a straightforward method for documenting transactions. This process can be simplified by following a few key steps, ensuring clarity and accuracy in your financial communications.

1. Include Basic Information

Start by including the essential details that will identify both parties involved in the transaction. This should cover your company or personal information such as name, address, and contact details, as well as the recipient’s information. Clearly label the document with a title that conveys its purpose.

2. Specify the Products or Services

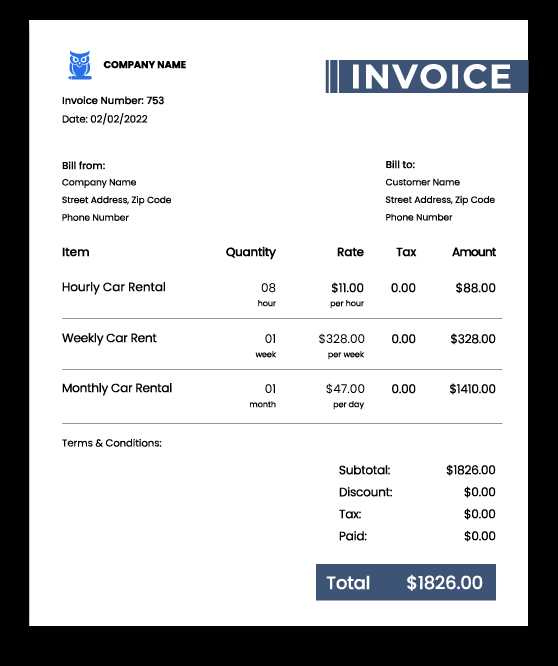

Provide a detailed list of the goods or services provided. For each item, include a brief description, quantity, unit price, and total cost. This section should be easy to understand and provide enough information for the recipient to identify what they are being charged for.

3. Set the Payment Terms

Clarify the payment conditions to avoid any confusion. This includes the total amount due, applicable taxes, and the due date. Additionally, indicate the preferred payment methods and any late fees if applicable.

4. Double-Check for Accuracy

Before sending the document, review all information carefully. Mistakes in numbers, descriptions, or contact details can cause delays or misunderstandings. Ensuring everything is accurate will help maintain a professional relationship with your client.

5. Send and Follow Up

Once the document is finalized, send it via email or another secure method. If payment is not received by the due date, consider following up politely to remind the recipient.

By following these simple steps, you can create a clear, professional document that ensures both parties are on the same page and payment is processed smoothly.

Essential Information on Your Invoice

To ensure smooth transactions and avoid confusion, certain key details must be included in any payment request document. These elements not only clarify the agreement between parties but also help in maintaining a professional image and ensuring prompt payment. By including all the necessary information, you can create a document that leaves no room for misunderstanding.

Contact Details of Both Parties

Identifying the sender and the recipient is crucial in any financial document. The document should start with the full name, address, phone number, and email of both the service provider and the client. This helps in verifying the parties involved and ensures any follow-up communication can happen quickly and without confusion.

Detailed Breakdown of Charges

Clearly outlining the products or services provided is essential for transparency. Each item or service should be listed individually, along with the quantity, unit cost, and total price for each. This detailed breakdown ensures that both parties know exactly what is being billed and helps prevent disputes over charges.

Additional charges like taxes, shipping fees, or discounts should also be included to provide a complete financial picture. Always ensure these are clearly labeled and calculated accurately.

Finally, include the total amount due and the due date for payment. This is crucial for setting expectations on when the transaction should be completed. Accurate and well-structured details will facilitate timely payments and maintain professional relationships.

Where to Find Free Templates

For those looking to streamline the process of creating professional documents, there are many resources available online. Various platforms offer ready-made files that can be easily customized to suit individual needs. These resources are accessible and allow users to create polished documents quickly without the need for designing from scratch.

- Online Document Platforms

Many websites that focus on business solutions provide a wide range of pre-made documents. These platforms often offer customizable options suitable for different industries. Popular sites such as Google Docs or similar online word processors provide accessible options that can be tailored to fit your needs. - Office Software

Most office productivity programs come with built-in options for generating various types of documents. These applications typically offer a selection of basic formats that can be customized with ease. Simply search through the program’s available designs and select the one that best matches your requirements. - Specialized Websites

Numerous online platforms are dedicated specifically to offering business-related resources. These sites often feature extensive libraries of customizable documents and forms that can be downloaded and edited. They may include fields for entering specific details and can be adjusted for various purposes.

By exploring these resources, it’s possible to find exactly what you need without spending valuable time on design. Simply choose the right platform, download the document, and customize it to meet your specific needs.

Design Tips for Professional Invoices

Creating an aesthetically pleasing and functional document plays a key role in the success of your financial communication. A well-designed document not only ensures clarity but also reflects the professionalism of your business. The following tips can help you design a clean, easy-to-read document that maintains a polished appearance and fosters trust with your clients.

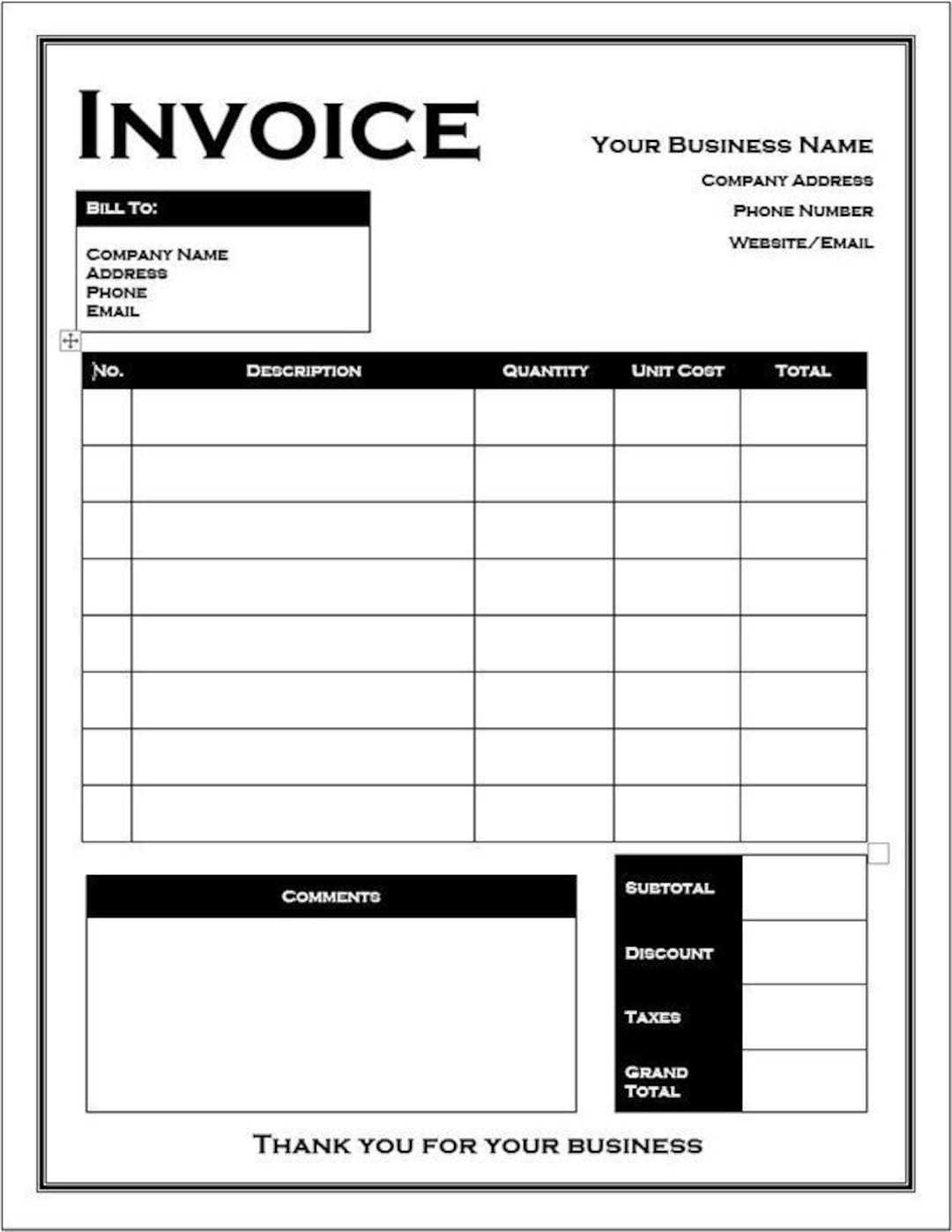

1. Keep It Simple and Clean

The design of your document should be straightforward. Avoid clutter by using clear fonts, ample white space, and a logical layout. Keep the focus on the most important information, such as amounts due and payment instructions. A minimalist design helps the recipient focus on the details without being distracted by unnecessary graphics or overly complex formatting.

2. Consistency in Branding

Incorporating your company’s logo, colors, and fonts helps reinforce your brand identity. Be sure that the design elements you use align with your overall business style, but don’t overwhelm the document with too many colors or decorative elements. Stick to a professional look that conveys reliability and competence.

By focusing on simplicity, organization, and brand consistency, you can create a professional document that is both visually appealing and effective in communicating your financial details.

How to Save Time with Templates

Streamlining your document creation process can significantly cut down on time and effort, especially when repetitive tasks are involved. By using pre-made designs, you can quickly populate essential details without starting from scratch each time. This approach allows for faster and more efficient document generation, freeing up time for other important tasks.

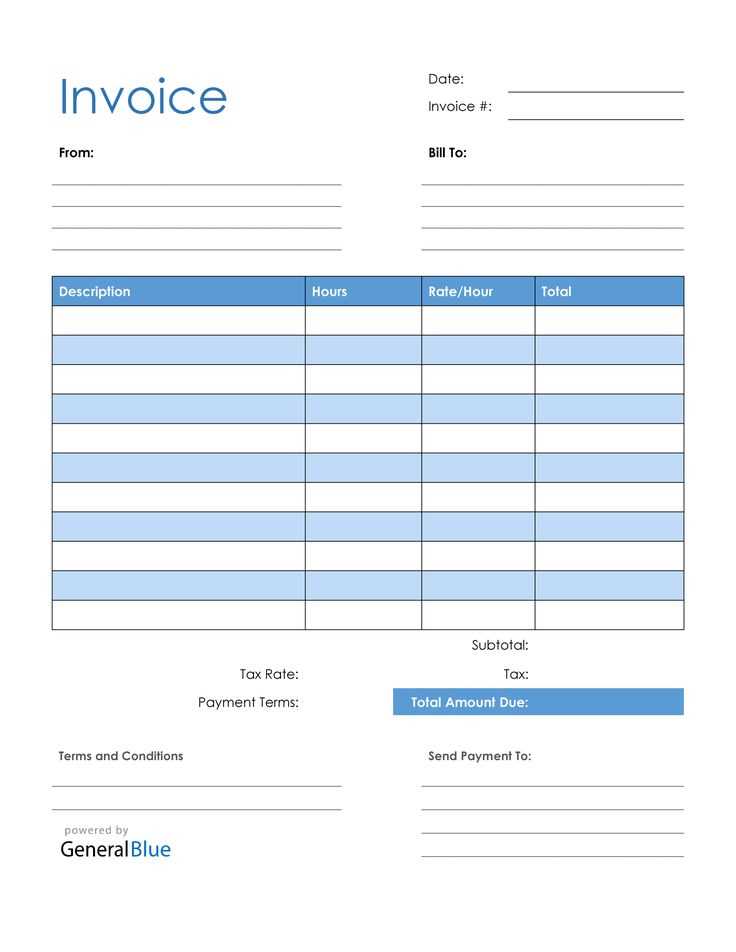

1. Pre-Set Structure and Fields

Pre-designed documents often come with an organized layout, which saves you from having to format each section manually. Fields for essential information like contact details, item descriptions, and pricing are already set up. All you need to do is input the specifics for each transaction. This eliminates the need to recreate the same structure repeatedly, ensuring consistency across all your documents.

2. Easy Customization

Customization is quick and simple when using pre-built designs. You can easily modify text, add or remove fields, and adjust the layout as needed. This flexibility allows you to tailor each document to your unique requirements, while still benefiting from the time-saving elements of a pre-set format.

By relying on ready-to-use designs, you can eliminate the need for repetitive formatting and focus on the content itself, making your document creation process faster and more efficient.

Invoice Formatting for Clarity

Proper organization and clear formatting are key to ensuring that your financial documents are easy to read and understand. A well-structured document reduces the chance of confusion and ensures that both parties can quickly find the necessary details. By following a few formatting guidelines, you can improve the clarity and professionalism of your document.

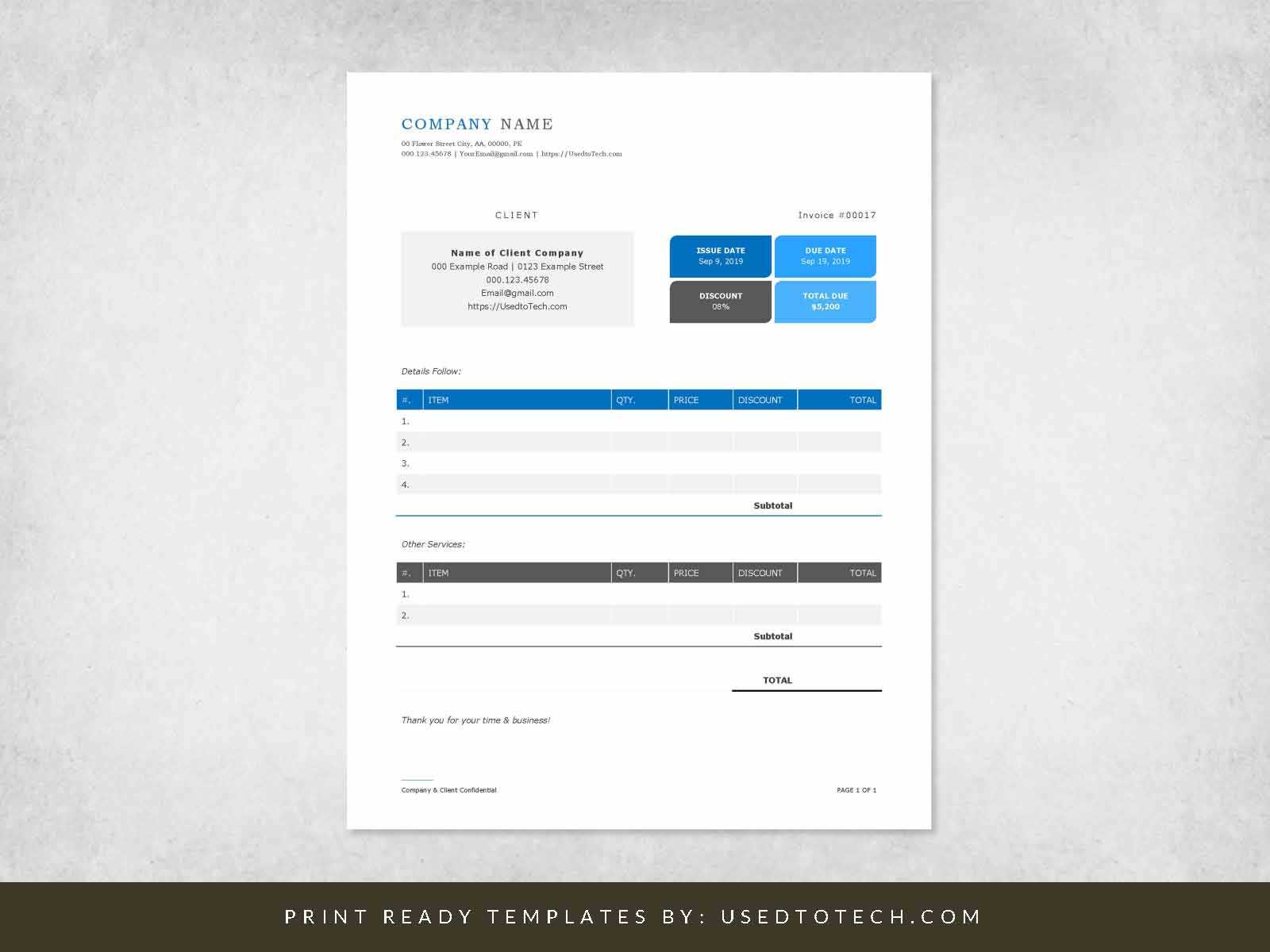

1. Organize Information in Sections

Breaking the document into clearly labeled sections helps the reader navigate the details more easily. Use headings and subheadings to clearly distinguish between different types of information. For example, separate contact details, a breakdown of services or products, payment terms, and totals into distinct sections.

- Contact Information: List your details and your client’s information at the top of the document.

- Services or Products: Use a table or bullet points to itemize each service or product provided, including quantities and prices.

- Payment Information: Include the total amount due, applicable taxes, and any discounts, followed by the due date.

2. Use Tables for Organization

Using tables to present data such as prices, quantities, and totals allows for better readability. Tables help group related information and make it easy for the recipient to compare values at a glance. Ensure that columns are properly aligned and clearly labeled for maximum clarity.

- Columns: Include columns for descriptions, quantities, unit prices, and total costs.

- Alignment: Align numbers to the right for easy comparison, and left-align text for readability.

By organizing your document effectively and using clean, clear formatting, you can make the process of reviewing and processing payments much smoother for your clients.

Understanding Invoice Numbers and Dates

Properly managing the identification and timing of your financial documents is essential for both organizational purposes and legal compliance. Each document should be clearly identifiable with a unique number, and the dates should be accurate to avoid confusion. These elements help track the document’s history and establish clear payment deadlines.

| Element | Purpose |

|---|---|

| Document Number | A unique identifier for each financial document. It allows you and your clients to reference the specific transaction easily and helps with tracking and organization. |

| Issue Date | The date when the document is created and sent. It marks the start of the payment cycle and helps determine when payment is due. |

| Due Date | The date by which payment should be made. Clear deadlines ensure timely payments and reduce the risk of overdue balances. |

By assigning a unique number and clearly specifying both the issue and due dates, you make it easier for your clients to track and process payments efficiently. This practice not only improves your financial organization but also adds a layer of professionalism to your operations.

How to Add Your Logo to Invoices

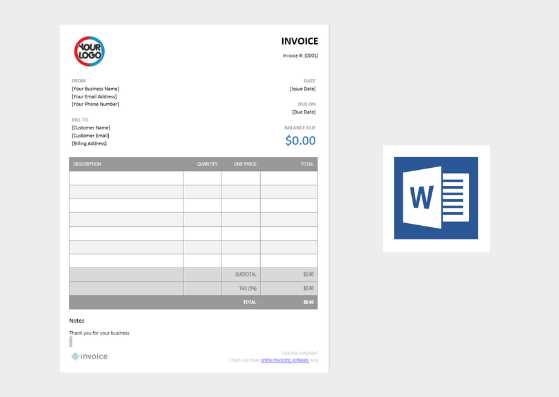

Incorporating your company’s logo into your financial documents helps strengthen your brand identity and adds a professional touch. Adding a logo is a simple yet effective way to make your document look more polished and personalized. Here’s how you can easily include your logo in your documents without compromising the layout or readability.

| Step | Instructions |

|---|---|

| 1. Prepare Your Logo | Ensure your logo is in a high-quality format such as PNG, JPG, or SVG. The image should be clear and easily visible, avoiding overly large file sizes that could affect the document’s performance. |

| 2. Placement | The most common position for a logo is at the top of the document, either centered or aligned to the left or right. Make sure it does not interfere with other critical details like the contact information or payment terms. |

| 3. Resize and Align | Resize your logo to a suitable size so it is visible without taking up too much space. Use alignment tools to position the image consistently with other elements on the page. |

| 4. Save the Document | After adding and positioning your logo, save the document in your preferred format, ensuring that the quality of the logo remains intact after saving. |