Free Consulting Invoice Templates for Easy Customization and Use

Managing payments efficiently is essential for any business, especially when offering professional services. Clear and accurate documentation ensures timely payments and fosters trust with clients. With the right tools, creating invoices can become a straightforward task that saves you both time and effort.

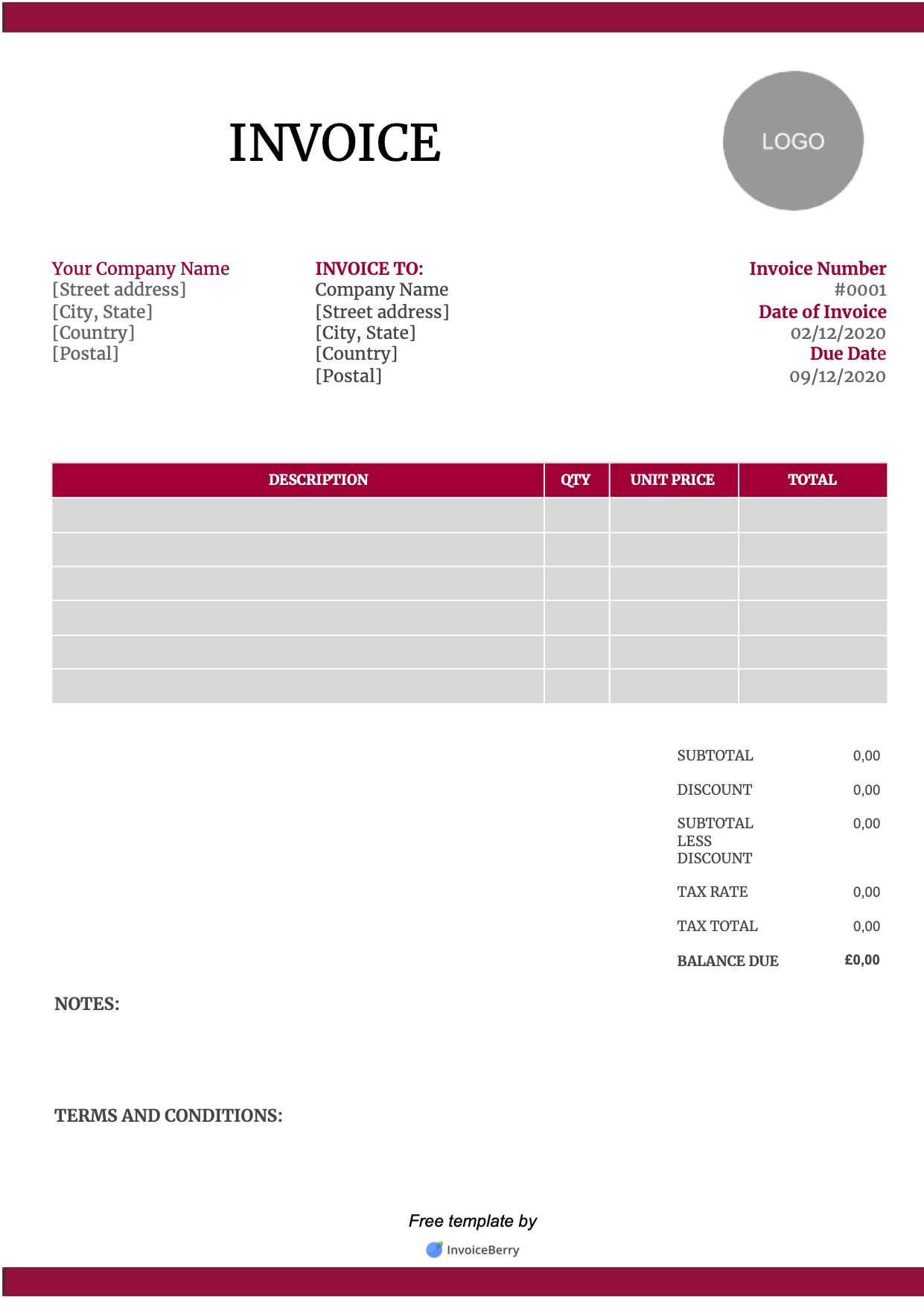

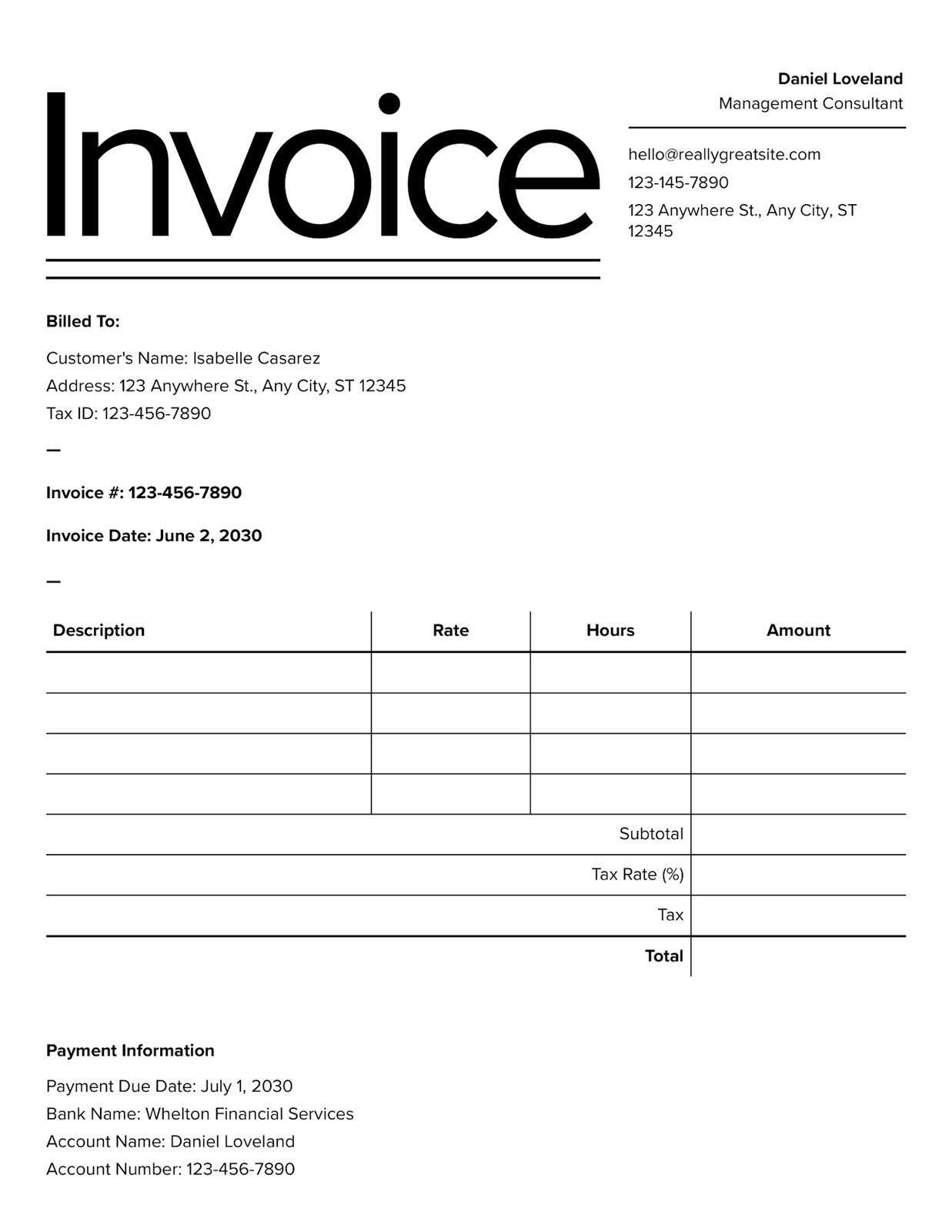

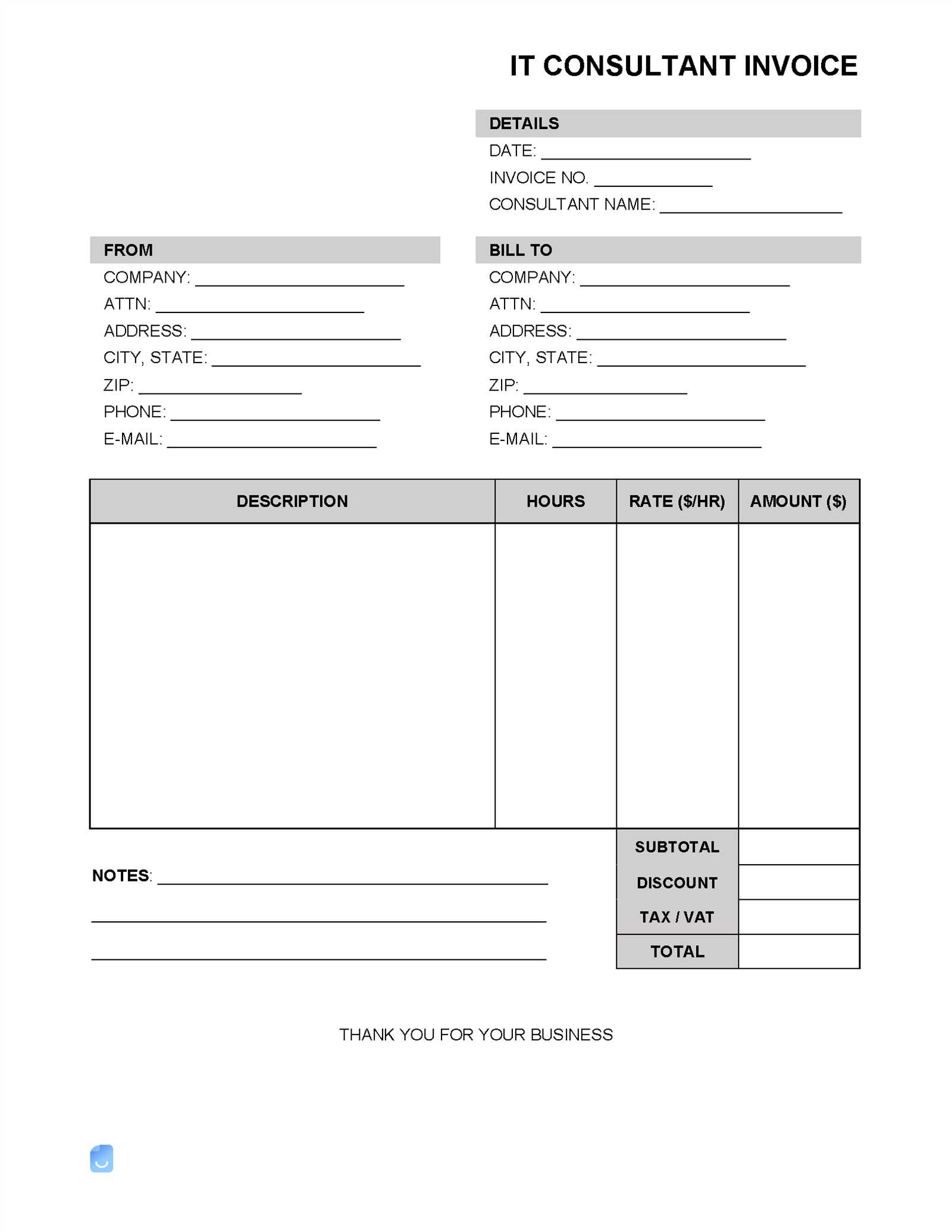

Instead of starting from scratch each time you need to prepare a bill, using ready-made designs can streamline the process. These customizable formats allow you to quickly input the necessary details, ensuring consistency and professionalism in every document you send out.

Whether you’re just starting out or looking to improve your workflow, using these convenient options can help keep your financial processes organized. With a variety of options available, you can find one that suits your specific needs, helping you focus on delivering quality work without worrying about administrative tasks.

Free Consulting Invoice Templates

Having access to pre-designed billing formats can significantly improve the way you handle client payments. By using ready-made structures, you can save valuable time and ensure accuracy in your financial transactions. These tools help maintain consistency, so you never miss important details when preparing a statement for your clients.

These ready-to-use formats are fully customizable, allowing you to adjust them to suit the specific requirements of your business. You can easily include the necessary details such as services rendered, payment terms, and client information, all in a clean and professional layout. This approach ensures that every transaction is documented clearly and effectively.

Whether you are managing one-time projects or ongoing contracts, these useful resources provide a streamlined solution for your billing needs. By implementing them into your workflow, you can focus more on delivering quality work and less on administrative tasks, knowing that your payment records are well-organized and ready for submission.

Why You Need a Consulting Invoice

Proper documentation of the services you provide is essential for both you and your clients. Clear billing ensures that the terms of your work are understood and agreed upon, which helps avoid misunderstandings. By providing a structured record of the services delivered, you create a reliable reference for both payment tracking and future discussions.

In addition to promoting transparency, having a formalized payment request is an important tool for managing cash flow. It outlines the specific details of the transaction, including the work completed, the agreed-upon fees, and the payment deadlines. This clarity helps in reducing payment delays and ensures you are compensated promptly for your efforts.

Moreover, these documents serve as an official record for tax and financial purposes. By maintaining a professional and consistent approach to your billing process, you not only reinforce your credibility but also protect yourself legally by keeping accurate financial records. This is vital for both personal and business financial management.

Top Benefits of Using Free Templates

Utilizing pre-designed billing formats offers a range of advantages that can simplify the payment process and save valuable time. These ready-to-use documents allow you to quickly generate professional records without having to start from scratch. This eliminates the need for complex formatting or worrying about missing important details, providing you with a smooth, efficient workflow.

One of the key benefits is the significant reduction in time spent on administrative tasks. With a structured design already in place, you can focus on filling in the specifics of the job, such as hours worked, services provided, and agreed fees. This means you can send out billing documents faster and spend more time on the core aspects of your business.

Another advantage is the professional look these documents provide. Even if you’re just starting out, using an organized format helps you present yourself as a credible and reliable business partner. The clean layout, precise information, and consistent structure not only impress your clients but also help maintain trust and long-term relationships.

How to Customize Consulting Invoices

Customizing your billing documents is an essential step to ensure that they meet your business needs and provide a clear record of the services you’ve delivered. Tailoring your forms allows you to include relevant details, making your documents both functional and professional. Here’s a step-by-step guide to help you personalize your billing formats effectively.

Step 1: Add Your Business Information

Start by including your business details at the top of the document. This ensures that clients can easily identify who the bill is from. Common elements to include are:

- Your business name

- Address and contact information

- Your business logo (optional)

- Tax ID or registration number (if applicable)

Step 2: Include Client Information

Clearly list your client’s details, including:

- Client name or company name

- Client address

- Contact details

This helps to ensure that both parties are on the same page when it comes to who the payment is for and where it should be sent.

Step 3: Specify the Services Rendered

In the main section, break down the services you provided, including:

- Service description

- Time spent or units used

- Rates or fees for each service

Being clear and detailed in this section minimizes misunderstandings and ensures transparency between you and your clients.

Step 4: Set Payment Terms

Essential Elements in a Consulting Invoice

When creating a document for services rendered, it’s important to include certain details to ensure clarity and professionalism. A well-structured document helps both parties understand the transaction and provides all the necessary information for proper payment processing. There are key components that must be present to avoid misunderstandings and to keep things organized for both the service provider and the client.

Key Information to Include

- Client and Provider Details: Clearly state the names, addresses, and contact information of both parties. This ensures that there is no confusion about who is providing the service and who is receiving it.

- Service Description: List the tasks or projects completed, with enough detail to explain what was done. This transparency helps the client understand the value of the work.

- Date of Service: Specify the time frame during which the work was performed or completed. This can be important for record-keeping and billing cycles.

Financial Breakdown

- Rate and Quantity: Clearly state the hourly rate or fixed price, along with the quantity (e.g., number of hours worked, number of items delivered) so the client knows exactly what they are being charged for.

- Total Amount Due: After listing all charges, the total amount due should be clearly stated. Include any taxes, fees, or discounts applied to ensure transparency.

- Payment Terms: Outline the payment schedule, including due dates, late fees, and accepted methods of payment. This helps manage expectations and ensures timely payments.

Incorporating these elements will help create a comprehensive and professional document that reflects your services accurately and ensures smooth financial transactions between you and your clients.

Choosing the Right Template for Your Business

Selecting the right structure for billing your clients is crucial to maintaining a professional image and streamlining your financial processes. A well-chosen format not only saves time but also helps you present a polished, organized statement of the work completed. It is essential to evaluate your needs and business style to determine the most suitable document structure that will both meet your requirements and resonate with your clients.

Factors to Consider

- Business Type: Different industries may require distinct layouts. For example, a project-based firm might need a detailed breakdown, while a service provider could benefit from a simpler structure.

- Customization Options: It’s important to have a structure that you can easily personalize to reflect your brand identity. Look for formats that allow you to add logos, colors, and custom terms.

- Ease of Use: A user-friendly design saves time. The simpler the process of filling out and sending the document, the more efficient your workflow will be.

Template Comparison Table

| Template Type | Best For | Customization | Complexity | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Simple Format | Freelancers, Small Business Owners | Low | Easy | ||||||||||||||

| Detailed Format | Project-Based Firms, Consultants | High | Moderate | ||||||||||||||

| Error | Potential Consequence | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Incorrect Contact Information | Delayed payments due to communication issues | ||||||||||

| Missing Payment Terms | Confusion over when and how payments are expected | ||||||||||

| Section | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Header |

| Option | Advantages | Disadvantages |

|---|---|---|

| Pre-Designed Formats |

|

|

| Paid Software Solutions |

|

|

Ultimately, the choice between free and paid solutions depends on the scale of your business and the complexity of your financial management needs.

How to Organize Your Invoices Effectively

Efficiently managing your billing records is essential for keeping track of payments, maintaining accurate financial records, and ensuring timely follow-ups with clients. Proper organization can save you time, reduce errors, and make it easier to access past transactions when needed. By adopting a systematic approach, you can avoid confusion and maintain a professional workflow.

Steps to Organize Your Billing Records

- Keep Clear Labels: Ensure each document has a unique reference number and is properly dated. This allows for easy identification and tracking of specific transactions.

- Categorize by Client: Sort your documents by client name or project to quickly locate any record. This method ensures you can easily track the history of your work with each individual or company.

- Maintain Consistent Naming Conventions: Use clear and consistent naming conventions when saving files. For example, include the client name, project, and date in the file name to make searching easier.

- Separate Paid and Unpaid Documents: Create distinct folders or digital labels for paid and unpaid records. This helps prioritize follow-up actions and ensures timely payment tracking.

Tools for Better Organization

- Cloud Storage: Using cloud-based storage services allows you to easily access and organize your records from any location. Many platforms also provide file versioning, which makes it easy to track document revisions.

- Accounting Software: Specialized tools can automatically categorize and store your records, while also helping you track payments, issue reminder

Legal Considerations for Consulting Invoices

When preparing billing documents for professional services, it’s important to consider several legal aspects to ensure compliance and avoid potential disputes. Properly crafted statements help establish clear terms between service providers and clients, safeguarding both parties’ interests.

Accurate Information: One of the most critical aspects is providing precise details about the service rendered. This includes a clear description of the work, the amount due, and the agreed-upon payment terms. Any ambiguity can lead to confusion or even legal challenges. Be sure to include specific dates, hourly rates, or project milestones if applicable.

Tax Compliance: Depending on your location and the nature of your business, tax obligations may vary. Always ensure you comply with local tax laws by properly accounting for sales tax or VAT where applicable. Not including these on your documents could lead to fines or penalties.

Payment Terms: Clearly define the terms of payment, including due dates and any penalties for late payments. Specify whether partial payments are allowed or if the full amount is expected upfront. This clarity will minimize any misunderstanding in future transactions.

Legal Framework: It’s important to align your billing process with any contracts or agreements that have been signed with the client. If a formal agreement exists, ensure that your document references the relevant sections to avoid conflicts. This legal framework serves as a foundation for resolving potential disputes.

Confidentiality: Some contracts require that certain information, such as financial terms or client details, remain confidential. Make sure to adhere to these confidentiality clauses and avoid disclosing sensitive data on public documents.

By paying attention to these legal factors, service providers can ensure smoother transactions and protect themselves from legal issues down the road.

How to Track Payments with Invoices

Efficiently managing payments is essential for maintaining healthy cash flow and avoiding misunderstandings with clients. Properly documenting each transaction allows for easy monitoring of outstanding amounts and ensures timely follow-ups when necessary.

The first step in tracking payments is to assign a unique reference number to each billing document. This number acts as a point of reference for both you and your client, helping to prevent confusion when multiple transactions are involved. Be sure to include the due date clearly on the document, so both parties are aware of when the payment is expected.

Once a payment is made, mark the transaction as “paid” on your records and keep a copy of the confirmation or receipt. It’s helpful to update your financial tracking system or spreadsheet with the payment date, amount, and any remaining balance, if applicable. This ensures that no details are overlooked, and you can quickly spot overdue amounts if needed.

If a payment is overdue, having a clear record of the original terms makes it easier to follow up with the client. Including the original amount, payment due date, and any notes about late fees (if applicable) can help to resolve the situation promptly and professionally.

Finally, always keep a backup of all payment records, whether digital or paper, to maintain a comprehensive history of all transactions. This is not only useful for future reference but also essential for tax reporting and financial auditing.

Where to Find the Best Free Templates

When looking for ready-made documents to assist in billing or accounting, there are many online resources that offer high-quality options. These platforms allow individuals to quickly find formats that suit their needs, saving both time and effort. Whether you’re starting a new project or streamlining your current system, knowing where to find the right documents can be a game changer.

Here are some of the best places to find these useful resources:

- Online Document Platforms: Websites like Google Docs or Microsoft Office provide a variety of pre-designed options. You can customize these documents easily to fit your specific needs while maintaining a professional appearance.

- Business Websites: Many business-focused sites offer ready-to-use formats. These resources are often tailored to suit different industries and can be downloaded or edited directly on the platform.

- Freelancer and Entrepreneur Blogs: Many independent professionals and entrepreneurs share their own custom-made resources. These can be a great source for templates that reflect industry-specific needs and trends.

- Template Marketplaces: Websites like Canva or Template.net offer both paid and free options. These are often highly customizable, allowing for branding and unique style adjustments.

- Open-Source Communities: Platforms such as GitHub or other open-source communities sometimes host collections of billing documents that can be freely used and modified.

Exploring these sources will provide you with various options, ensuring that you can find the right one to match your specific requirements. Be sure to check the customization features to make sure the format aligns with your business’s unique needs.