Best Invoice Dashboard Template for Seamless Financial Management

Managing finances efficiently is a crucial aspect of any business, and having the right tools can make this task significantly easier. By organizing financial data in an intuitive and visual format, you can quickly track payments, monitor outstanding balances, and analyze cash flow trends. A well-designed solution allows businesses to stay on top of their financial health with minimal effort, ensuring accurate record-keeping and timely actions.

These tools offer a wide range of features that can be tailored to meet the needs of any organization. From tracking overdue payments to generating financial reports, they provide insights that help in making informed decisions. Additionally, many of these solutions integrate with existing accounting systems, further streamlining the process and reducing manual entry errors.

In this article, we will explore how you can implement such a solution to enhance your financial operations. You will learn about its key functionalities, benefits, and the best practices to make the most of these systems. Whether you’re a freelancer, small business owner, or part of a larger enterprise, this tool can help simplify your financial workflow.

Invoice Dashboard Template Overview

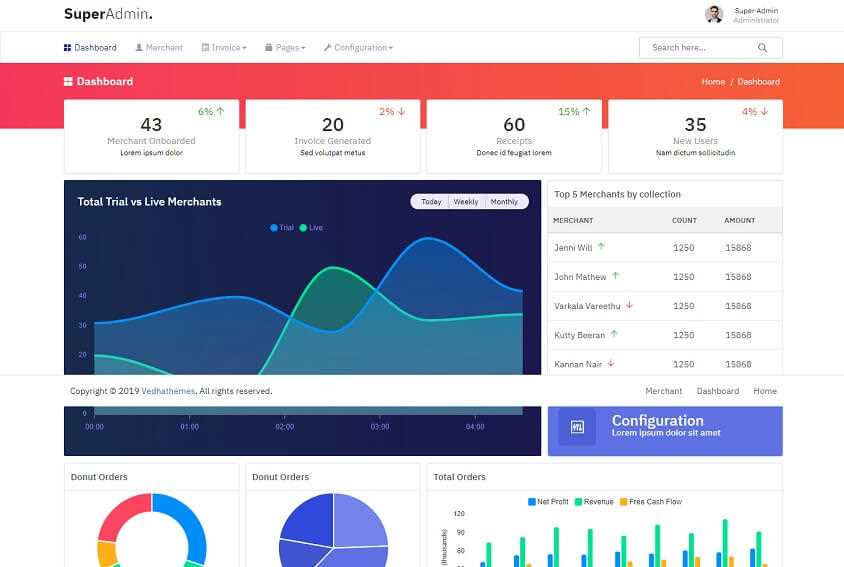

Efficient management of financial data is essential for smooth business operations. A well-structured solution that consolidates and visualizes financial information allows businesses to monitor key metrics and make data-driven decisions quickly. By bringing together essential financial figures in one central location, businesses can enhance their tracking and reporting processes while ensuring accuracy.

Key Features and Benefits

These tools often come with a range of built-in features designed to simplify financial management. They provide clear overviews of outstanding payments, recent transactions, and overall cash flow. Customization options allow users to tailor the layout and data to meet their specific needs, while integration with existing systems can streamline data entry and reporting tasks. Whether it’s for a small business or a large enterprise, these solutions can save time and reduce the risk of errors.

Why This Solution Matters

Using a centralized system for tracking payments and managing financial data ensures that important information is always accessible and up-to-date. The ability to quickly generate reports, monitor trends, and identify potential issues provides significant value to any organization. This approach not only improves operational efficiency but also supports better decision-making and financial forecasting.

Why Use an Invoice Dashboard?

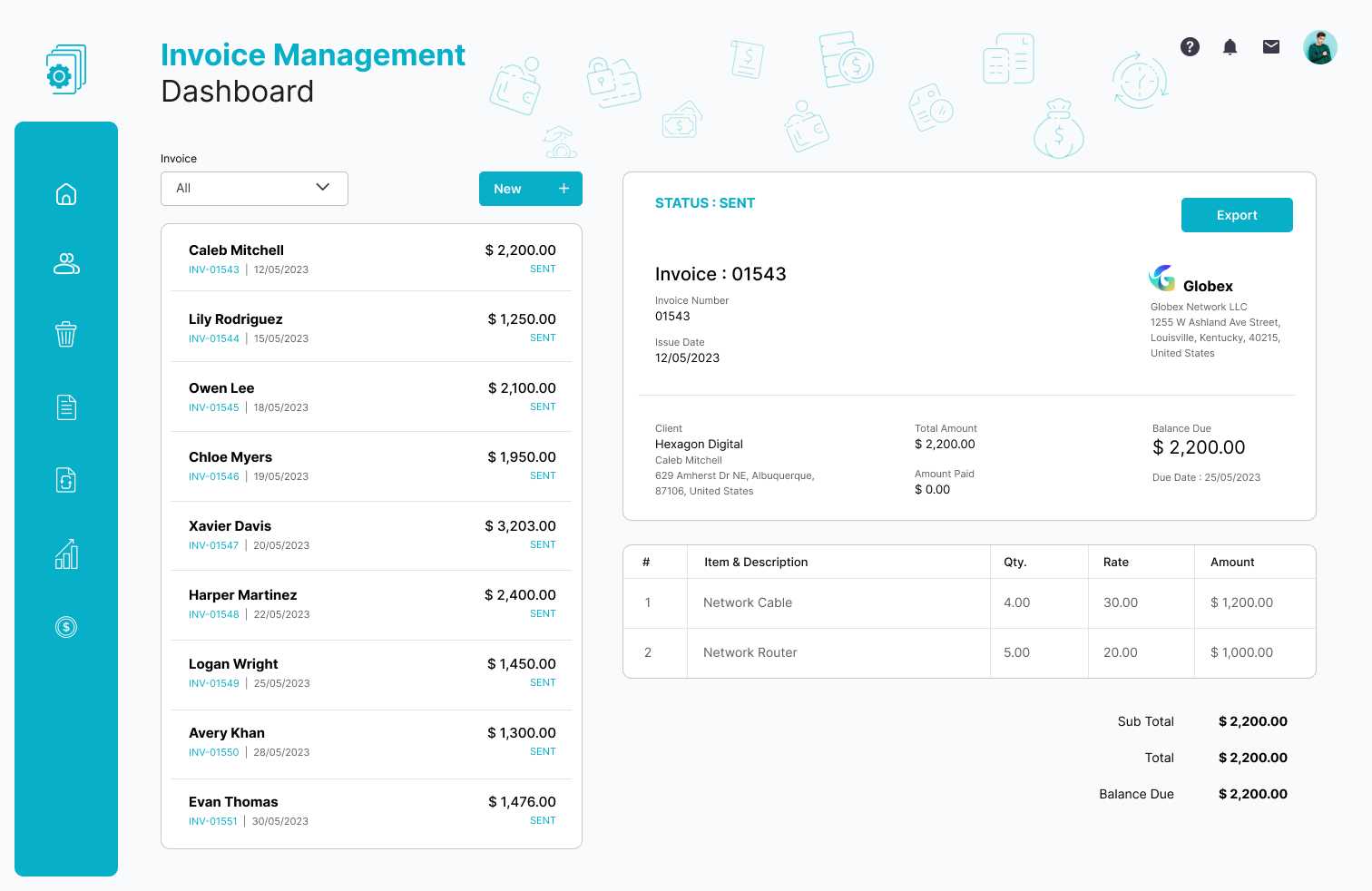

Managing financial data manually can be time-consuming and prone to errors, especially when dealing with multiple transactions and clients. A centralized tool that consolidates financial information provides businesses with a clear, real-time view of their cash flow, outstanding payments, and recent activities. With this tool, it becomes much easier to monitor the financial health of a business and take proactive steps to improve it.

Efficiency and Time-Saving

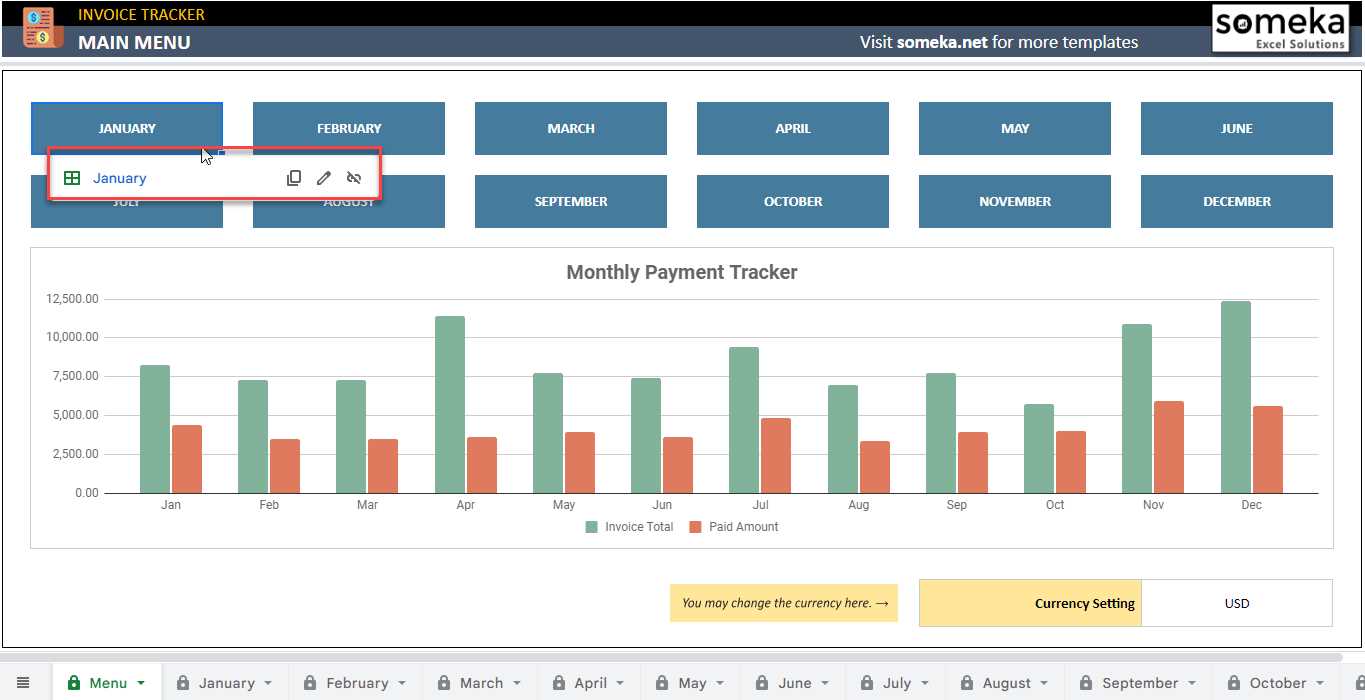

One of the main reasons to adopt such a system is its ability to save time. Instead of manually tracking each transaction or constantly searching for information across multiple platforms, businesses can access everything they need in one place. Key metrics are displayed visually, making it easy to identify patterns, such as overdue payments or sudden shifts in income. This streamlines daily operations and reduces the chances of missing important details.

Improved Decision-Making

With a comprehensive view of financial data, business owners can make better-informed decisions. The ability to analyze trends, track payments, and monitor overall financial performance helps identify areas for improvement. Whether you are looking to optimize cash flow or address outstanding debts, having the right insights at your fingertips allows you to take timely and effective action.

Key Features of a Good Template

An effective tool for managing financial information should offer several important features that enhance both functionality and user experience. It should not only provide clear visual representations of key financial data but also be flexible enough to adapt to different business needs. A well-designed solution empowers users to track transactions, analyze patterns, and generate reports with minimal effort.

One crucial feature is customizability, allowing businesses to tailor the layout, data points, and reporting format to their specific requirements. The tool should also provide real-time updates to ensure that financial data is always current, reflecting the latest transactions and payments. Integration capabilities with other financial software can further streamline operations, minimizing manual input and reducing the chances of errors.

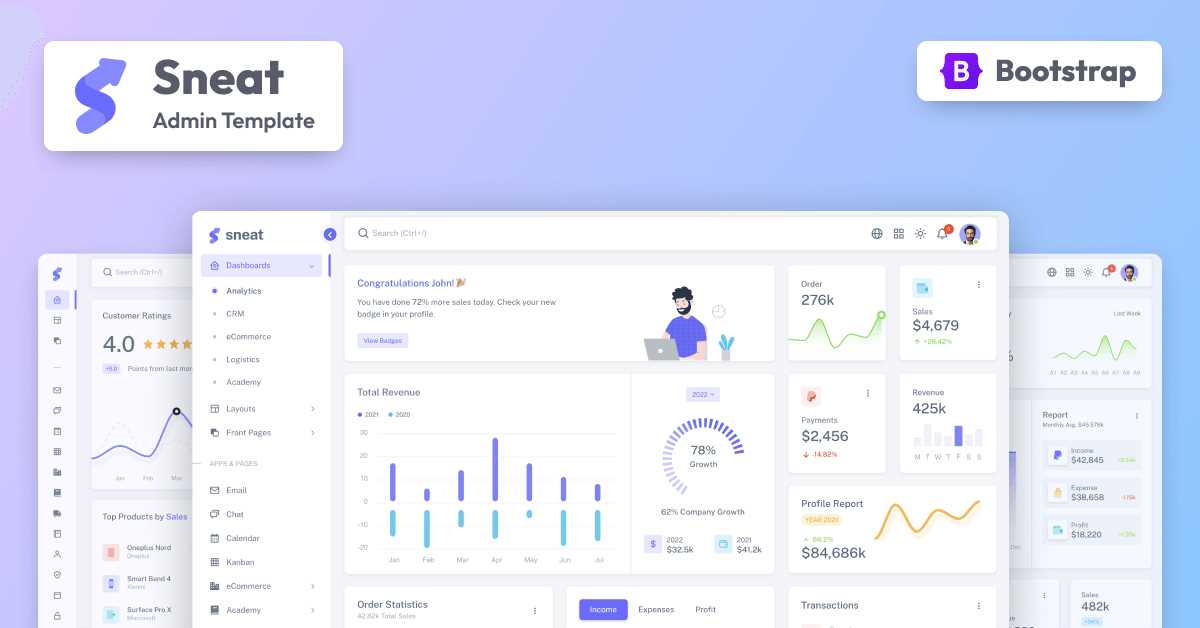

Additionally, the interface should be intuitive, allowing users to quickly navigate between sections without feeling overwhelmed. Visual elements such as graphs, pie charts, and bar diagrams are also important, as they help convey financial information clearly and facilitate better decision-making. Overall, a good solution should combine functionality, ease of use, and flexibility to address various business needs efficiently.

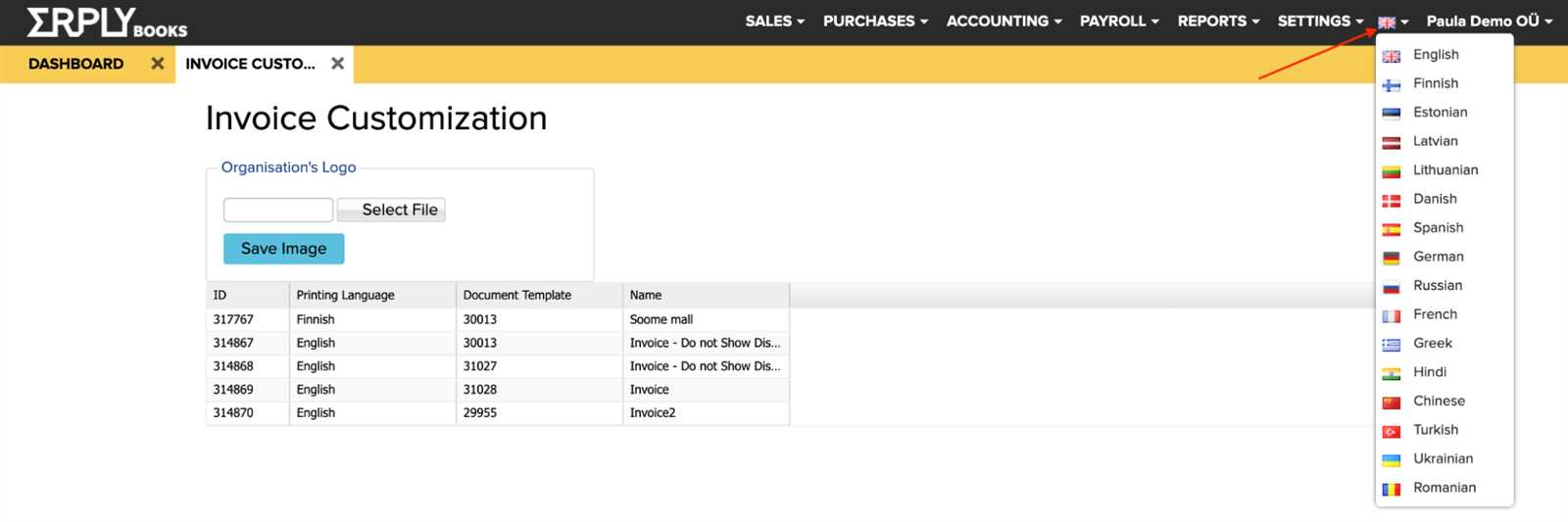

How to Customize Your Invoice Template

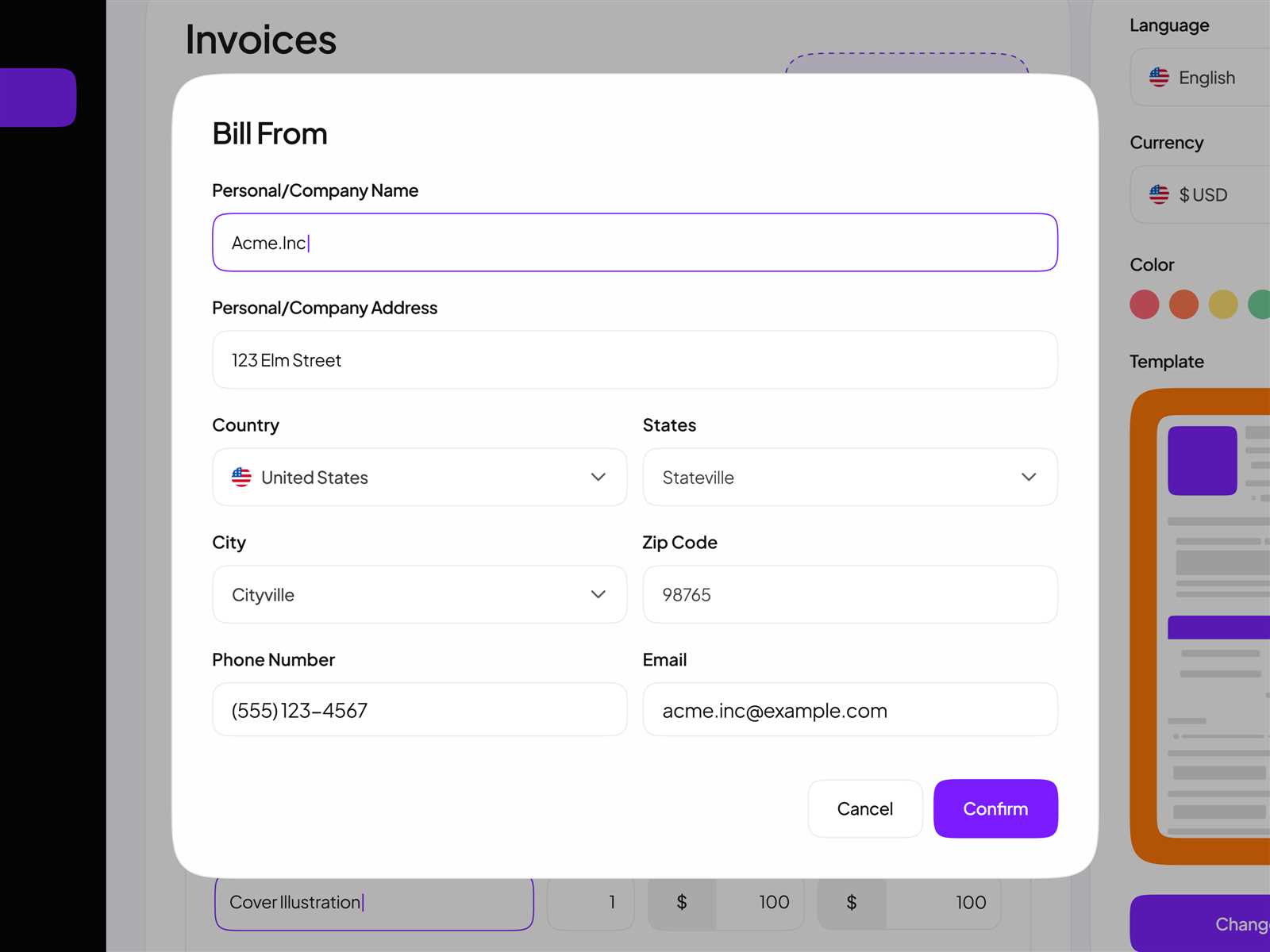

Customizing a financial management solution is a crucial step to ensure it meets the specific needs of your business. Personalizing the layout, appearance, and data structure can make the tool more intuitive and aligned with your workflow. A well-tailored system not only improves efficiency but also enhances your ability to track payments and generate meaningful reports.

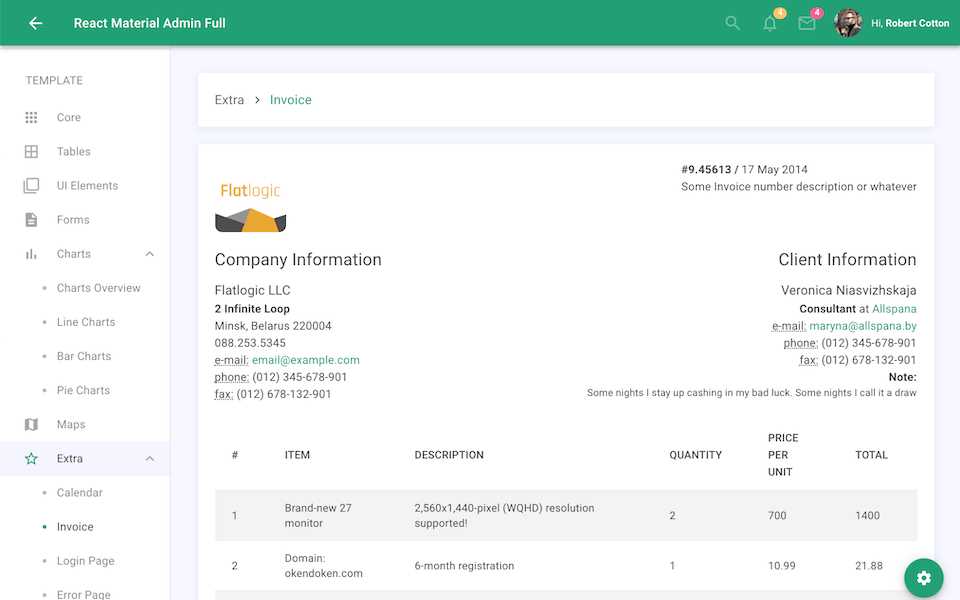

Adjusting Data Fields and Layout

The first step in customization is defining which data points are most relevant to your business. You can add or remove specific fields such as payment terms, client contact details, or transaction history. Modifying the layout ensures that the most important information is front and center, while less critical details remain easily accessible. This flexibility allows you to create a structure that suits your operations perfectly.

Branding and Visual Customization

Another essential aspect of customization is visual branding. By incorporating your company logo, color scheme, and fonts, you can create a cohesive and professional appearance that aligns with your brand identity. Additionally, adjusting graphical elements, such as charts or graphs, can make financial data clearer and more visually appealing, helping both you and your clients interpret the information more easily.

Integrating with Accounting Software

Connecting your financial data management system with popular accounting platforms can significantly streamline the process of tracking payments, revenue, and expenses. This integration ensures seamless data flow, reduces manual data entry, and improves overall efficiency in managing financial records. With the right setup, users can automatically sync transactional data to maintain up-to-date accounts and generate detailed financial reports.

Key Benefits

Integrating your system with accounting software offers several advantages, including:

| Benefit | Description |

|---|---|

| Time Savings | Automatic synchronization eliminates the need for manual data entry, saving valuable time. |

| Accuracy | Reduces human error by ensuring consistent and accurate data transfers between platforms. |

| Real-Time Updates | Provides up-to-the-minute insights into your financial standing, enabling quicker decision-making. |

Integration Process

The integration process typically involves connecting your system to the accounting platform via an API or direct integration tool. Once connected, data such as transactions, customer details, and payments are synchronized automatically. Ensure that both platforms support the necessary features for smooth communication, and configure settings to align with your business needs.

Top Benefits of Invoice Dashboards

Utilizing an organized visualization of financial data can offer businesses valuable insights into their cash flow, payment statuses, and client relationships. By consolidating key metrics into a single view, companies are better equipped to manage their financial operations, improve decision-making, and track important milestones in real time. This approach helps to streamline processes, enhance productivity, and maintain a clear overview of the financial health of the business.

Key Advantages

Here are some of the top benefits that come with using such a system:

| Advantage | Description | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Enhanced Financial Visibility | Gives an at-a-glance view of all transactions, helping to monitor payment cycles and outstanding balances. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Improved Decision Making | With real-time data and analytics, businesses can make informed choices regarding budgeting and resource allocation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time Efficiency | Automates data collection and reporting, saving time on manual entry and calculation

Choosing the Right Template for Your BusinessSelecting the right system for tracking and managing your financial transactions is essential for maintaining a smooth and efficient operation. The ideal solution should be adaptable to your specific business needs, whether you’re handling a large volume of payments or managing a smaller client base. Understanding the unique requirements of your company is key to choosing the most effective tool for the job. Customization plays a crucial role when selecting a solution. It’s important to choose one that allows you to adjust settings and features to match your business processes. Whether you need custom fields for client information or specialized reports for tracking specific metrics, the system should be flexible enough to evolve as your business grows. Factors to ConsiderWhen evaluating different systems, consider the following factors:

Integration with Other Tools

Consider how well the system integrates with other platforms you may already use, such as accounting software or payment gateways. A well-connected solution can save time and reduce errors by automating data transfers between systems. Seamless integration ensures that information flows effortlessly and that your financial data is always up to date. Invoice Dashboard Template for FreelancersFreelancers often manage multiple clients and projects simultaneously, making it crucial to have a streamlined system for tracking payments, billing cycles, and financial obligations. An effective tool can help simplify these tasks, providing a clear overview of outstanding balances, upcoming payments, and project statuses. Such a solution ensures that freelancers can stay organized and focus on their core work without worrying about missed deadlines or inaccurate records. Features to Look ForFor freelancers, an ideal system should offer the following features to maximize efficiency:

Benefits for FreelancersBy using such a solution, freelancers can enjoy several benefits:

Benefits of Payment Tracking ToolsUtilizing an efficient payment tracking system offers several advantages:

|