How to Use a 1099 Invoice Template for Easy Tax Filing

When managing payments for freelance work or contract-based services, it’s essential to have a clear and professional way to document transactions. An accurate and organized approach to invoicing can help ensure timely payments and simplify tax reporting for both the service provider and the client. The right billing format allows businesses to maintain transparency and minimize errors, which can lead to smoother financial operations.

Creating a structured document that includes all the necessary details for payment processing can save valuable time. By utilizing a pre-designed form, freelancers and contractors can avoid confusion and focus on their work instead of spending time on formatting or ensuring compliance. These documents can include key information such as the amount due, work performed, and client details, which are crucial for both business management and tax purposes.

Whether you are a small business owner or a freelancer, having the right tool for managing payments can streamline your operations and ensure you meet all financial obligations. This guide will explore how to effectively use such a form, from customization options to legal requirements, making it easier for you to manage your billing process and stay organized throughout the year.

Understanding the 1099 Invoice Template

For freelancers and independent contractors, maintaining a clear record of services provided and payments received is essential for both business operations and tax reporting. A properly structured payment document helps ensure all required details are included, reducing the chances of errors or missed information. It provides a formal record that can be used for various purposes, such as filing taxes, keeping track of finances, and ensuring accurate reporting for both parties involved.

Key Elements to Include in Your Document

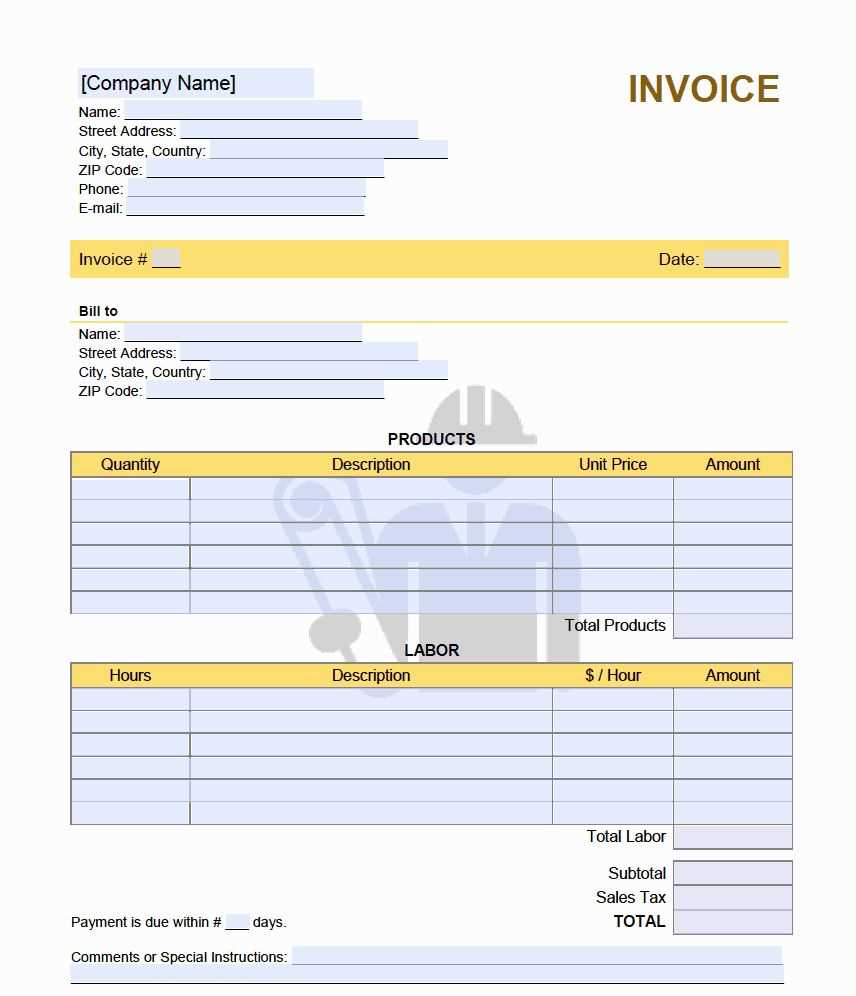

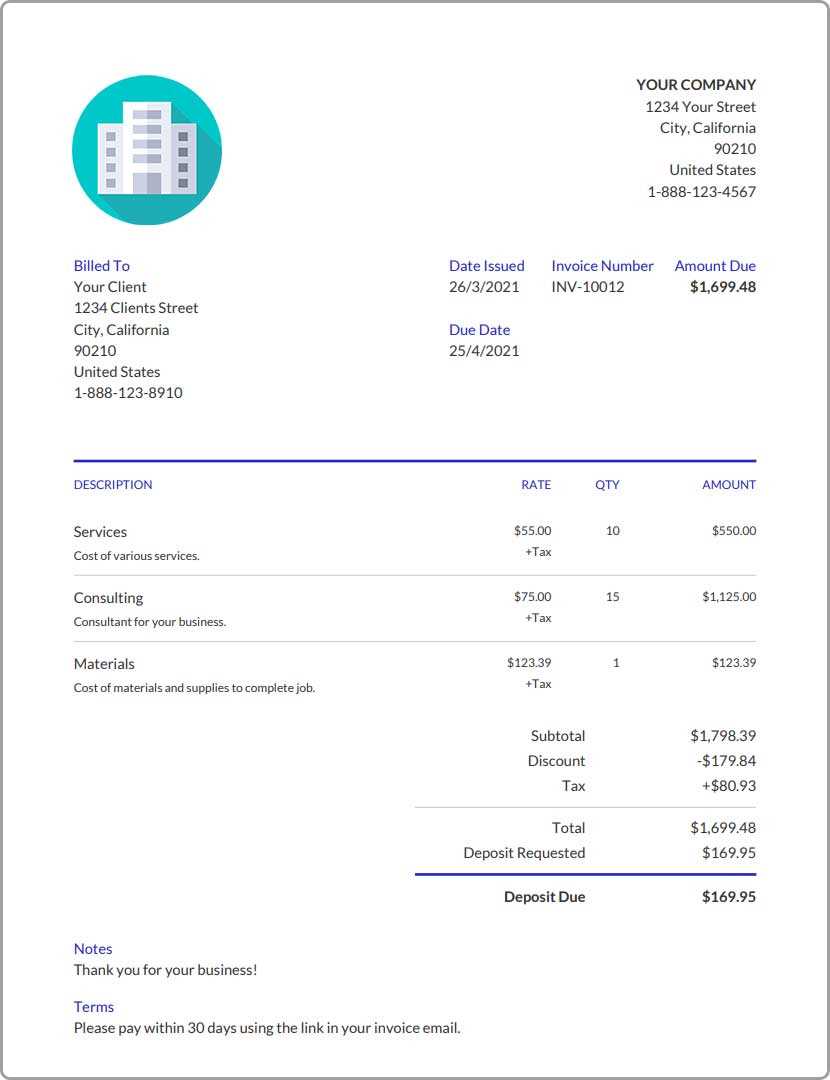

The payment record should contain specific information that makes it easy to understand the transaction. Typically, it includes the total amount owed, a detailed description of services rendered, and the date of the transaction. Additionally, it is important to include the contact details of both the service provider and the client, as well as the payment method agreed upon. This clear layout ensures that the document is both informative and legally compliant.

Legal Compliance and Tax Reporting

In many cases, using a standardized format is important for meeting legal and tax requirements. Certain pieces of information, such as tax identification numbers and payment totals, are necessary for reporting income correctly to the authorities. A well-organized document not only simplifies the filing process but also serves as a safeguard in case of disputes or audits. By adhering to these requirements, contractors and clients can ensure that their financial records remain transparent and trustworthy.

Benefits of Using a 1099 Invoice

Utilizing a standardized payment document offers numerous advantages for both freelancers and clients. It helps streamline financial processes, ensures accuracy in billing, and provides a clear, professional record of transactions. By following a consistent format, contractors can avoid confusion, reduce errors, and simplify their financial management, making it easier to track payments and prepare for tax season.

Streamlined Financial Management

One of the key benefits of using a structured billing document is the ease with which it simplifies financial management. By having all the necessary information laid out in a clear format, contractors can quickly identify the amount due, payment status, and work completed. This not only makes it easier to manage payments but also helps prevent delays in receiving compensation. With fewer mistakes to correct, freelancers can focus more on their work rather than on administrative tasks.

Tax Compliance and Record Keeping

Proper record-keeping is essential for staying compliant with tax regulations. A well-organized payment document can make tax filing significantly easier by providing the necessary details for reporting earnings. By maintaining accurate records, contractors can avoid complications during tax season and ensure they meet all legal requirements. Additionally, having a formalized method of tracking payments ensures that both parties have a reliable reference in case of future disputes or audits.

Key Information to Include in a 1099 Invoice

When creating a payment document for freelance work or contract services, it’s important to include specific details that make the transaction clear, accurate, and legally compliant. These key pieces of information ensure that both the service provider and the client have a proper record for financial and tax purposes. A well-structured document will help avoid misunderstandings and provide a reference for both parties in the future.

Essential Details for Accuracy

Here are the main components that should be included in any billing record:

| Information | Description |

|---|---|

| Service Provider’s Name | The name of the contractor or freelancer offering the service. |

| Client’s Name | The name of the business or individual receiving the service. |

| Date of Service | The date or range of dates when the services were performed. |

| Work Description | A detailed description of the services or tasks completed. |

| Total Amount Due | The agreed-upon price for the work performed, including any applicable taxes or fees. |

| Payment Terms | The method and terms of payment (e.g., due on receipt, net 30 days, etc.). |

| Tax Identification Number | The contractor’s or business’s tax ID, if required by law. |

Including these key details ensures that all necessary information is available for both parties. This will make the payment process smoother and allow for easy record-keeping, especially when it comes to tax reporting at the end of the year.

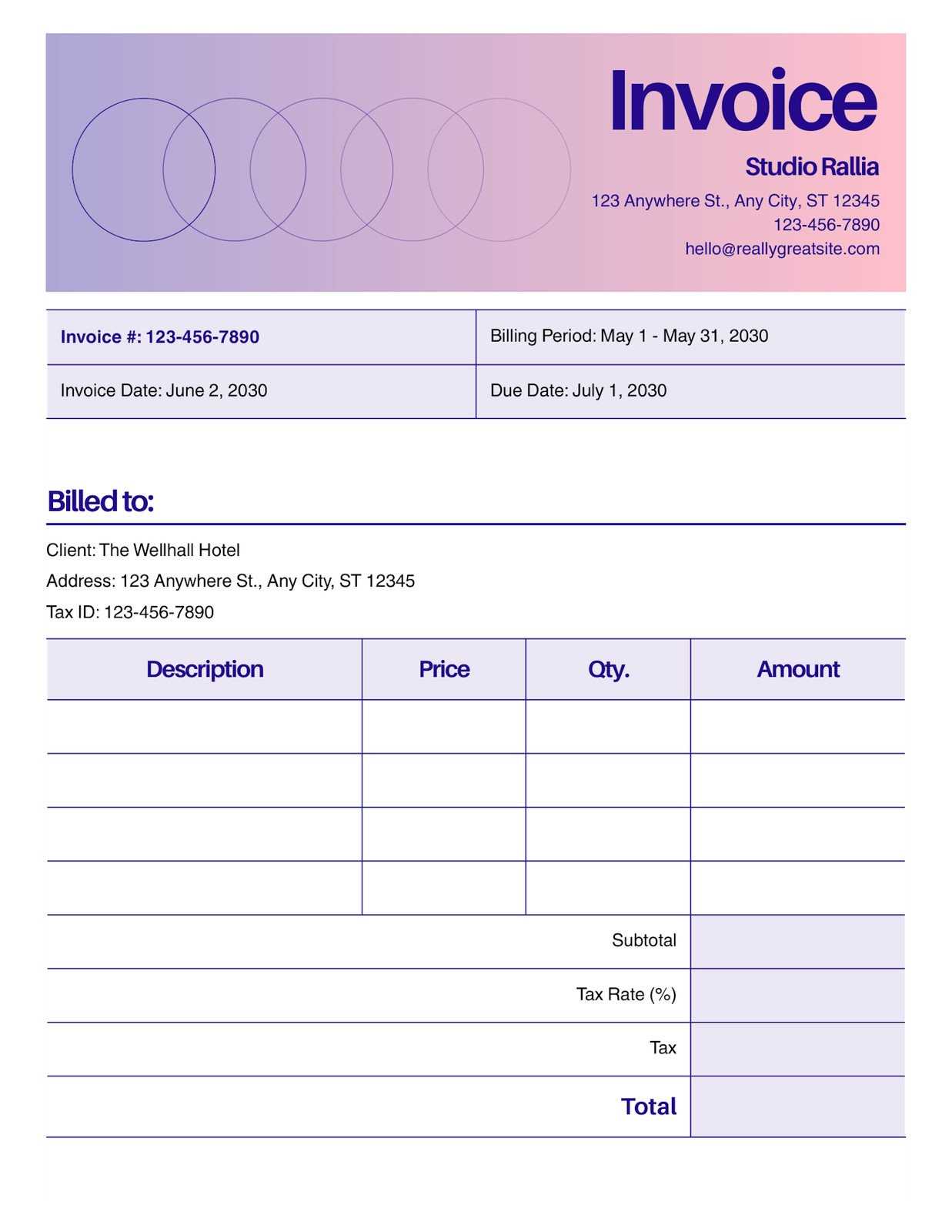

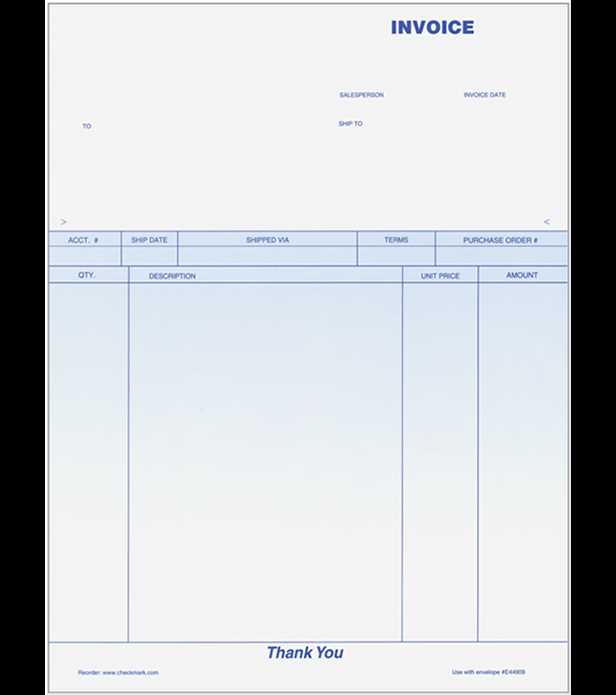

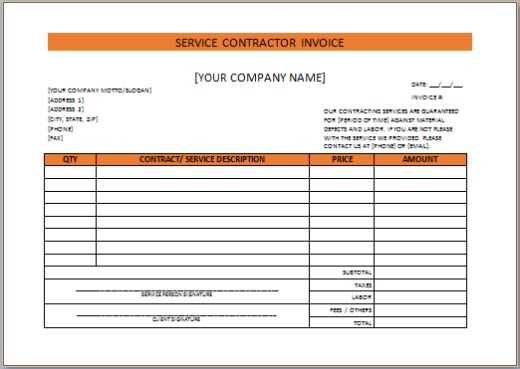

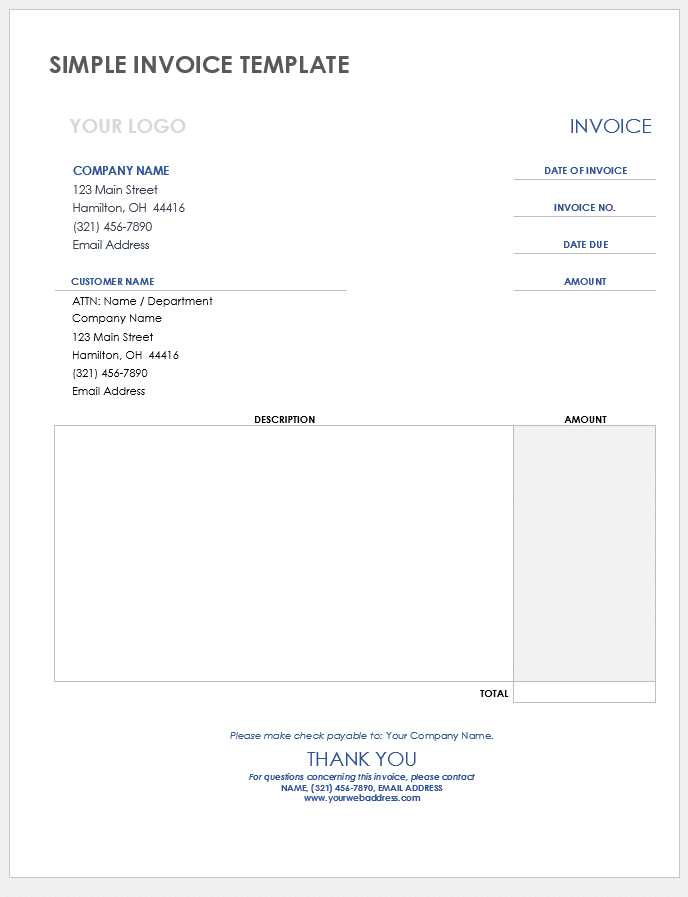

How to Customize Your 1099 Template

Customizing your payment record ensures it aligns with your specific business needs and provides a professional look. Tailoring the document allows you to include the relevant details while also making it unique to your brand or service. Whether you’re adding your logo, adjusting the layout, or choosing the right format, personalization can make your financial documents more efficient and effective.

Steps to Personalize Your Billing Document

Here are some steps you can take to customize your payment document:

- Adjust the Layout: Choose a clean, easy-to-read format. Ensure that sections are clearly separated for easy navigation.

- Add Your Branding: Include your business name, logo, and contact information to give your document a professional look.

- Include Relevant Sections: Depending on the nature of your work, you may want to add or remove sections. For example, some may need a detailed list of services, while others may prefer a simple summary.

- Set Payment Terms: Customize the payment terms according to your agreement with clients, whether it’s immediate payment, net 30 days, or another arrangement.

Best Practices for Customization

To ensure your document is both functional and professional, consider these best practices:

- Keep It Simple: Don’t overcrowd the page with unnecessary in

Common Mistakes to Avoid on 1099 Invoices

Creating accurate payment records is crucial for both freelancers and clients. While the process may seem straightforward, there are several common mistakes that can lead to confusion, delays, or even legal issues. By being aware of these potential errors and taking steps to avoid them, you can ensure that your financial documents are clear, professional, and compliant with necessary regulations.

Frequent Errors in Payment Documents

Here are some of the most common mistakes to watch out for:

- Missing or Incorrect Contact Information: Always double-check that both your and your client’s contact details are up to date and accurate.

- Failure to Include Payment Terms: Clearly stating payment terms helps avoid misunderstandings about when and how payments should be made.

- Omitting Tax Identification Numbers: For proper tax reporting, both parties should include their respective tax ID numbers, especially when required by law.

- Incorrect or Unclear Service Descriptions: Be specific about the services provided to avoid confusion. Ambiguity can lead to disputes.

- Not Tracking Payments Properly: Always mark when payments are received or overdue. Keeping this up-to-date helps with financial record keeping.

How to Avoid These Mistakes

To ensure your billing process runs smoothly, follow these simple tips:

- Double-Check All Details: Before finalizing the document, review all information for accuracy.

- Use Clear and Specific Language: Avoid vagueness by being precise in descriptions, terms, and amounts.

- Stay Organized: Keep a copy of each document and track payment statuses to prevent missing or overlooked transactions.

By avoiding these common mistakes, you can maintain professional and accurate records that will streamline your billing process and help you stay compliant with tax regulations.

When to Use a 1099 Invoice Template

Knowing when to use a structured payment record is essential for ensuring proper financial documentation. This document is particularly useful when working with independent contractors, freelancers, or any non-employee workers. It provides both parties with a clear, formalized record of services rendered and amounts due, helping avoid confusion and ensuring that everything is properly documented for tax and financial purposes.

Using a formal billing document is essential when the service provided involves a contract or one-time project. If the agreement does not include regular pay schedules or if the worker is not a full-time employee, this kind of record is necessary to ensure both the service provider and the client keep accurate, professional records of the transaction.

Additionally, these documents are vital when the total amount paid reaches a specific threshold. In many cases, businesses are required to report payments to independent contractors for tax purposes. By using a formalized payment record, both parties can ensure they are meeting legal requirements and avoid potential issues during tax reporting seasons.

How to Save Time with Templates

Using a standardized document format can significantly reduce the time spent on administrative tasks, allowing you to focus more on your core business activities. A well-designed payment record saves you from repeatedly entering the same information, streamlining the process and ensuring consistency across all your financial documents. By relying on a pre-built structure, you can quickly generate accurate records without having to start from scratch each time.

Time-Saving Benefits of Pre-Designed Documents

Here are some of the ways using a pre-made format can save you time:

- Consistency: Using a consistent structure ensures all necessary information is included every time, preventing errors and omissions.

- Quick Customization: Once your basic format is set up, you only need to change the specific details for each transaction, saving you the hassle of formatting each document manually.

- Automated Calculations: Many document formats come with built-in fields for calculations, reducing the need for manual math and minimizing errors.

- Reduced Rework: With a template in place, you won’t need to constantly redo your document layout, helping you create accurate records faster.

Tips for Maximizing Efficiency

To get the most out of your pre-designed payment documents, consider these helpful tips:

- Use Editable Formats: Choose formats that can be easily edited (like Word or Excel), allowing for quick adjustments when necessary.

- Save Frequently Used Information: Include your business details, payment terms, and other standard elements in the document to avoid re-entering them each time.

- Organize Files: Keep all your documents organized in folders, so you can quickly locate and update the relevant records.

By adopting a pre-built structure, you can greatly reduce the time and effort spent on creating payment records, making your financial processes faster and more efficient.

Free 1099 Invoice Templates for Download

Finding a suitable, pre-designed document for your business transactions can save time and ensure accuracy. There are numerous options available online that offer free, customizable formats for generating financial records. These resources can be especially useful for freelancers and small businesses who need a quick and efficient way to create formalized records without spending time on design or complicated setups.

Where to Find Free Document Templates

There are many websites and platforms offering free downloadable payment record formats that are easy to edit. These can be tailored to fit your specific needs, whether for a one-time project or ongoing work with clients. Here are some popular sources:

- Freelance websites: Many platforms for independent contractors provide free resources for creating professional documents.

- Business template websites: Sites dedicated to business tools often offer a range of free formats for download.

- Online document creators: Tools that allow for easy document creation and customization, with built-in templates for various business needs.

Key Features of Free Payment Records

When downloading a free format, it’s important to ensure that it includes all necessary fields and is easy to customize. Here’s what to look for:

Feature Description Customizable Fields The ability to modify details like payment terms, amounts, and service descriptions is essential for personalized documents. Tax ID Section A section to input both the client’s and provider’s tax identification numbers helps ensure proper reporting. Clear Layout A well-organized document that is easy to read will reduce confusion and improve professionalism. Editable Format Make sure the file is in an editable format like Word or Excel to easily update it for different transactions. By downloading free, customizable payment record formats, you can streamline your documentation process and maintain consistency across all your business transactions.

Choosing the Right Template for Your Business

Selecting the appropriate format for your financial records is essential for ensuring professionalism and accuracy in your transactions. The right document can help you streamline your billing process, make record-keeping easier, and ensure that all required information is clearly presented. Whether you’re a freelancer, contractor, or small business owner, choosing a well-suited format will save time and reduce the likelihood of errors in your paperwork.

When choosing a document structure, consider factors like your industry, the type of services you offer, and how often you need to issue records. A simple, straightforward format may suffice for one-off projects, while ongoing services might require a more detailed layout that includes payment terms and specific project descriptions. Additionally, make sure the format you choose aligns with legal requirements for tax reporting and is easy to customize for each client.

How to Fill Out a 1099 Invoice

Filling out a financial document correctly is crucial to ensure clarity and accuracy in your records. A well-completed payment record includes all the necessary details to clearly communicate the terms of the transaction between the service provider and the client. Knowing what information to include and where to place it will help avoid confusion and ensure that everything is documented properly for both parties.

Essential Information to Include

When completing a payment record, it’s important to provide all relevant details. Here’s a breakdown of the key information you’ll need to include:

Field Details Service Provider’s Name The name of the individual or company providing the services. Client’s Name The person or business receiving the service or goods. Service Description A brief explanation of the work or goods provided during the billing period. Total Amount Due The agreed-upon amount for the service rendered or goods provided. Payment Terms The due date for payment and any other applicable terms (e.g., late fees or early payment discounts). Tax Identification Numbers The service provider’s and client’s tax ID numbers if required by law for reporting purposes. Steps to Complete the Document

To ensure your document is properly filled out, follow these steps:

- Enter Your Business Information: Fill in your business name, address, and contact details at the top of the document.

- Provide Client Information: Include the client’s name and address in the designated section.

- Detail the Services Provided: List each service or product provided, along with the corresponding price or rate.

- Fill in Payment Terms: Specify the payment due date and any terms regarding late payments.

- Verify and Finalize: Double-check all the information for accuracy before sending the document to your client.

By following these steps and ensuring all required fields are filled correctly, you can avoid common mistakes and ensure a smooth financial transaction.

Legal Requirements for 1099 Invoices

When preparing formal billing documents for business transactions, it’s essential to comply with the legal requirements that ensure the document is valid and recognized for tax purposes. These records must include specific information and meet certain standards to be acceptable by tax authorities. Failing to include necessary details or following improper procedures could result in complications, both for the service provider and the client.

In most cases, business professionals are required to report income received from clients in a formal manner. This documentation serves as an official record of earnings, which may need to be submitted to tax authorities at the end of the fiscal year. Therefore, it’s crucial to understand what information must be included and ensure that the format adheres to the rules set by tax regulations.

Key Legal Considerations:

- Tax Identification Numbers: Both the service provider and the client may need to provide their tax identification numbers (TIN) to properly report the transaction.

- Payment Amounts: The total sum received for services or products must be accurately stated in the record, along with any additional charges or discounts.

- Payment Terms: Clear payment terms, including deadlines and conditions for late payments, should be outlined to avoid potential disputes.

- Applicable Taxes: In some cases, sales tax or other applicable taxes must be included, depending on local tax laws and the nature of the transaction.

Ensuring that your financial documents meet these legal standards is vital for maintaining professionalism and avoiding tax-related issues.

How to Handle Multiple Contractors

Managing multiple service providers can be a complex task, especially when it comes to keeping track of their payments and ensuring all legal requirements are met. When working with several independent contractors, it’s essential to maintain organized records for each individual transaction, including payment details, agreed-upon rates, and timelines. Proper management of these documents helps prevent confusion and ensures that each contractor is compensated fairly and on time.

Organizing Contractor Information

To efficiently manage multiple contractors, start by creating a separate record for each one. This will help you track their work, payments, and any tax-related details that need to be reported. Keeping a well-maintained database will save time and reduce the risk of errors. Some of the key information to track for each contractor includes:

- Contractor Name and Contact Information: Ensure that each contractor’s full name, business name (if applicable), and contact details are recorded accurately.

- Work Performed: Document the services provided, including the project scope and any milestones or deliverables.

- Payment Terms: Record the agreed-upon rate and payment schedule for each contractor, ensuring that you comply with all terms of the agreement.

Using Tools to Simplify the Process

Managing multiple contractors can become overwhelming without the right tools. Consider using financial software or templates designed specifically for managing contractor payments and keeping track of relevant documentation. These tools often allow you to store information for each contractor in one place and generate reports quickly. This makes it easier to handle multiple service providers and ensures that payments are processed on time and accurately.

By staying organized and using the right tools, managing several contractors becomes a much smoother process, benefiting both you and your team of service providers.

Formatting Tips for 1099 Invoices

Properly formatting your billing documents is essential for clarity, professionalism, and compliance with tax regulations. A well-organized record not only helps maintain accurate financial information but also ensures that your payments and receipts are processed smoothly. Whether you’re working with a single client or multiple service providers, the layout and structure of your document can impact its effectiveness and usability.

When creating your financial record, focus on making the information easy to read and understand. A clean, consistent format will help avoid mistakes and improve communication with your clients and tax authorities. Below are a few tips on how to format your billing document for maximum efficiency.

Essential Formatting Tips

Here are some key considerations for formatting your record correctly:

Tip Description Clear Header Include a clear title at the top of the document, such as “Payment Record” or “Service Receipt,” to help identify the purpose of the document. Legible Fonts Choose a simple and legible font style (such as Arial or Times New Roman) to ensure easy reading, especially for clients and tax authorities. Consistent Layout Maintain a uniform layout throughout the document, with well-spaced sections for the service provider’s information, payment details, and transaction summary. Detailed Breakdown Provide a clear and detailed breakdown of services or products provided, including the quantity, rate, and total amount for each line item. Proper Formatting for Amounts Ensure all amounts are clearly listed, with the correct currency symbol and formatted to two decimal places. Legal Information Include any necessary tax identification numbers, and ensure that all legally required information is visible and easily identifiable. By following these formatting tips, you can create clear, professional records that meet legal standards and provide a seamless experience for both you and your clients.

Using a 1099 Invoice in Tax Filing

When it comes to preparing your tax return, accurate documentation is essential to ensure compliance and avoid potential issues with the IRS. A payment record can be a crucial document for both the payer and the service provider, as it helps report income correctly and ensures that tax obligations are met. For independent contractors and businesses, understanding how to use these records effectively during tax filing is a critical part of financial management.

For individuals and businesses that issue payments to non-employees, it’s necessary to use the correct documentation when filing taxes. This helps to clearly report income, validate deductions, and prevent discrepancies. Here’s how to effectively utilize your payment records during tax time.

Steps to Use the Document in Tax Filing

- Report Payments: Ensure all payments made to contractors or non-employee workers are properly reported using the appropriate forms during tax filing.

- Track Deductions: If applicable, keep detailed records of any deductions related to contractor payments. This can help reduce taxable income and ensure you’re compliant with tax regulations.

- Include All Necessary Information: Verify that the payment document includes all required details, such as contractor name, address, and the total amount paid, as these details will be necessary for tax reporting.

- File On Time: Submit the appropriate forms before the tax deadline to avoid penalties. Timely filing ensures you meet IRS requirements and helps keep your records up-to-date.

- Consult a Tax Professional: If unsure about how to report certain payments or whether additional forms are necessary, it’s a good idea to consult with a tax professional to ensure accurate filing.

By keeping detailed and accurate records, you ensure a smooth and efficient tax filing process. Properly managing these documents helps not only with tax reporting but also with financial planning and compliance.

Digital vs Printed 1099 Invoice Templates

When managing your financial records, you’ll often face the choice between using digital or printed documents for reporting payments to contractors and freelancers. Each option comes with its own set of advantages and challenges, and understanding these differences is important for selecting the best approach for your business or personal use.

In the modern business environment, many individuals and companies prefer digital documents due to convenience, speed, and the ability to store and organize records easily. On the other hand, printed forms still hold value, particularly for businesses that require physical copies for filing or accounting purposes. Let’s explore the key differences between these two options.

Advantages of Digital Documents

- Ease of Access: Digital documents can be accessed instantly from any device, making it easy to manage and share files.

- Cost-Effective: There are no printing, paper, or mailing costs involved with digital forms.

- Environmentally Friendly: Digital documents help reduce paper waste, contributing to more sustainable business practices.

- Faster Processing: Sending digital files allows for quicker submission, especially when filing online with tax authorities or sharing with contractors.

Advantages of Printed Documents

- Physical Record: Some people prefer hard copies for their records, especially for legal or tax purposes where printed forms are required.

- Tradition: Certain industries or businesses may have a long-standing practice of using printed forms for historical reasons or for maintaining in-person interactions.

- Perceived Professionalism: Some clients or contractors may find printed documents more formal or professional, which can build trust and credibility.

- Offline Use: Printed documents do not require an internet connection or digital device to be viewed or shared, which may be useful in certain situations.

Choosing between digital or printed documents depends on your specific needs, preferences, and business requirements. Digital forms are typically faster, more convenient, and cost-effective, while printed forms may be better suited for certain legal, professional, or personal situations. By weighing these advantages, you can select the option that best fits your workflow.

How to Track Payments with 1099 Templates

Effectively tracking payments to contractors and freelancers is an essential part of financial management. Using structured documents to record each payment helps ensure accuracy, transparency, and compliance with tax regulations. Whether you are a business owner or an independent contractor, it’s important to keep a detailed and organized record of all payments made throughout the year.

Tracking payments allows you to avoid errors when filing taxes and helps maintain proper financial records. Here are some key steps to consider when using forms to monitor payments to contractors.

Steps for Effective Payment Tracking

- Include Essential Payment Information: Make sure to list the payment date, amount, contractor’s name, and the nature of the services provided. This information is crucial for maintaining accurate records.

- Use Unique Identifiers: Assigning a unique reference number or payment code for each transaction helps you organize and track payments more easily. This also aids in identifying discrepancies or duplicates.

- Keep Track of Payment Frequency: Whether payments are made weekly, bi-weekly, or monthly, documenting the payment frequency helps you stay organized and ensures you meet any payment obligations on time.

- Maintain Separate Records for Each Contractor: Organize payment details for each individual contractor separately. This simplifies the process of tracking total amounts paid to each contractor over the year.

- Monitor Payment Status: It’s important to track whether payments have been made in full, partially, or if any payments are pending. This ensures you can quickly address any outstanding issues.

How to Use Payment Records for Filing

- Compile Data for Year-End Reporting: At the end of the year, gather all payment records to prepare for tax reporting. Ensure you have accurate totals for each contractor to complete any necessary filing forms.

- Reconcile Payments with Financial Statements: Cross-reference your payment records with bank statements or other financial documents to ensure that all payments are properly accounted for and no discrepancies exist.

- Stay Organized: A well-organized payment tracking system can save you time and avoid errors when it comes time to report payments to the appropriate authorities.

Tracking payments with accurate and organized documentation helps you streamline your financial processes and ensures that your records are clear and ready for tax season. By following these practices, you can avoid errors and maintain a transparent record of payments made to your contractors or freelancers.