1099 Invoice Template Excel for Easy Customization

Managing financial records efficiently is crucial for businesses and freelancers alike. One of the most effective ways to ensure accurate tracking of payments and services is by using well-organized digital documents. These documents help streamline accounting processes, ensuring that all necessary information is easily accessible and formatted correctly for tax purposes.

By using a structured format, individuals can create documents that not only meet regulatory requirements but also present a professional appearance. The right layout can help minimize errors, save time, and reduce confusion when it comes to managing payments, deductions, and financial reporting.

Customizing these records allows users to tailor them to their specific needs, whether it’s adding logos, adjusting data fields, or incorporating formulas to automate calculations. The flexibility of modern tools ensures that creating and managing these financial records can be as simple or as detailed as needed.

What is a 1099 Invoice?

When working as an independent contractor or freelancer, it is essential to issue formal documents to record payments for services rendered. These documents are vital for both the service provider and the recipient, as they help keep track of the amount paid, the services provided, and ensure that proper tax records are maintained. These records also serve as proof of business transactions for financial and legal purposes.

Purpose and Importance

The primary goal of such a document is to provide a clear and organized record of a transaction. It includes important details such as the amount charged, the services delivered, and the payment terms. This ensures both parties have a clear understanding of the financial agreement and helps prevent any misunderstandings regarding compensation.

Legal Requirements

In some cases, these documents are necessary for tax reporting. For example, when payments exceed a certain threshold, they may need to be reported to tax authorities. These records help businesses comply with regulations and avoid penalties for inaccurate reporting, ensuring that all parties fulfill their legal obligations.

Benefits of Using Excel for Invoices

Utilizing a digital tool to create and manage financial records brings several advantages, particularly when it comes to organization and efficiency. With the right software, individuals and businesses can easily track payments, manage data, and ensure all financial information is presented clearly and professionally. One of the most popular choices for creating such records is a spreadsheet program, offering a range of features that make it a highly effective solution for businesses of all sizes.

Key Advantages

- Customization: The ability to personalize the layout and content of each document allows for tailored records that meet specific business needs. You can adjust fields, add your branding, and create formulas to automate calculations.

- Automation: By using built-in formulas, it’s possible to automate key aspects of your financial documents, such as calculating totals, taxes, and discounts, reducing the chance of human error.

- Organization: Having everything in a digital format ensures that all records are stored in one place, easy to access, and update as necessary. This makes it simpler to track outstanding payments and past transactions.

Efficiency and Cost-Effectiveness

- Time-saving: Once the initial setup is complete, you can quickly create new records by simply filling in relevant details, saving significant time in comparison to manual methods.

- Low-cost: Many spreadsheet programs are either free or inexpensive, providing a budget-friendly solution for managing financial documents without the need for expensive software.

- Easy sharing: Digital records can be shared easily via email or cloud storage, enabling quick communication with clients or colleagues without the need for printing or mailing.

How to Create 1099 Invoice Template

Creating a professional financial document for tracking services and payments can be a straightforward process when you have the right tools. With a simple and customizable structure, you can ensure that all necessary details are captured, from the amounts charged to the services provided. This allows for efficient management of records, helping both service providers and clients maintain clear financial oversight.

Step-by-Step Process

To create an effective financial document, follow these key steps:

- Start with a blank document: Begin by opening a new file in your preferred spreadsheet program. This will give you a clean slate to design the layout and structure of your record.

- Include key fields: Make sure to add sections for the service provider’s and recipient’s details, service descriptions, payment amounts, and dates. This ensures that all essential information is captured.

- Use formulas for automation: Incorporate basic formulas to calculate totals, taxes, or discounts automatically. This will save time and reduce errors when creating each new document.

Customization and Design

Personalizing the layout can make your records stand out. Consider adding your business logo, choosing a clean and professional font, and adjusting the alignment of text to enhance readability. Customizable fields such as payment terms, due dates, and project descriptions can further tailor the document to your specific needs.

Customizing Your 1099 Excel Template

Personalizing your financial documents can help create a more professional appearance and ensure that the specific needs of your business are met. By modifying the layout, content, and features, you can create a document that not only reflects your branding but also simplifies the process of tracking and reporting transactions. Customization ensures that your records are both functional and aligned with your business practices.

Essential Customization Options

- Design and Branding: Add your business logo, adjust font styles, and select colors that match your brand identity. This will make your document look more professional and cohesive.

- Adding Fields: Include extra fields such as payment terms, due dates, and project descriptions. This provides clarity and helps both parties keep track of all relevant information.

- Organizing Sections: Group similar information together, like service details, payment breakdowns, and tax information, to enhance readability and structure.

Automation Features

- Formulas for Totals: Use basic arithmetic formulas to calculate totals, taxes, or discounts automatically. This minimizes manual input and reduces the likelihood of errors.

- Conditional Formatting: Highlight specific rows or amounts, such as overdue payments or discounts applied, by using conditional formatting rules. This makes it easier to identify key data at a glance.

- Pre-populated Information: Set up fields that can be reused, such as client details or payment terms, to save time when creating new records.

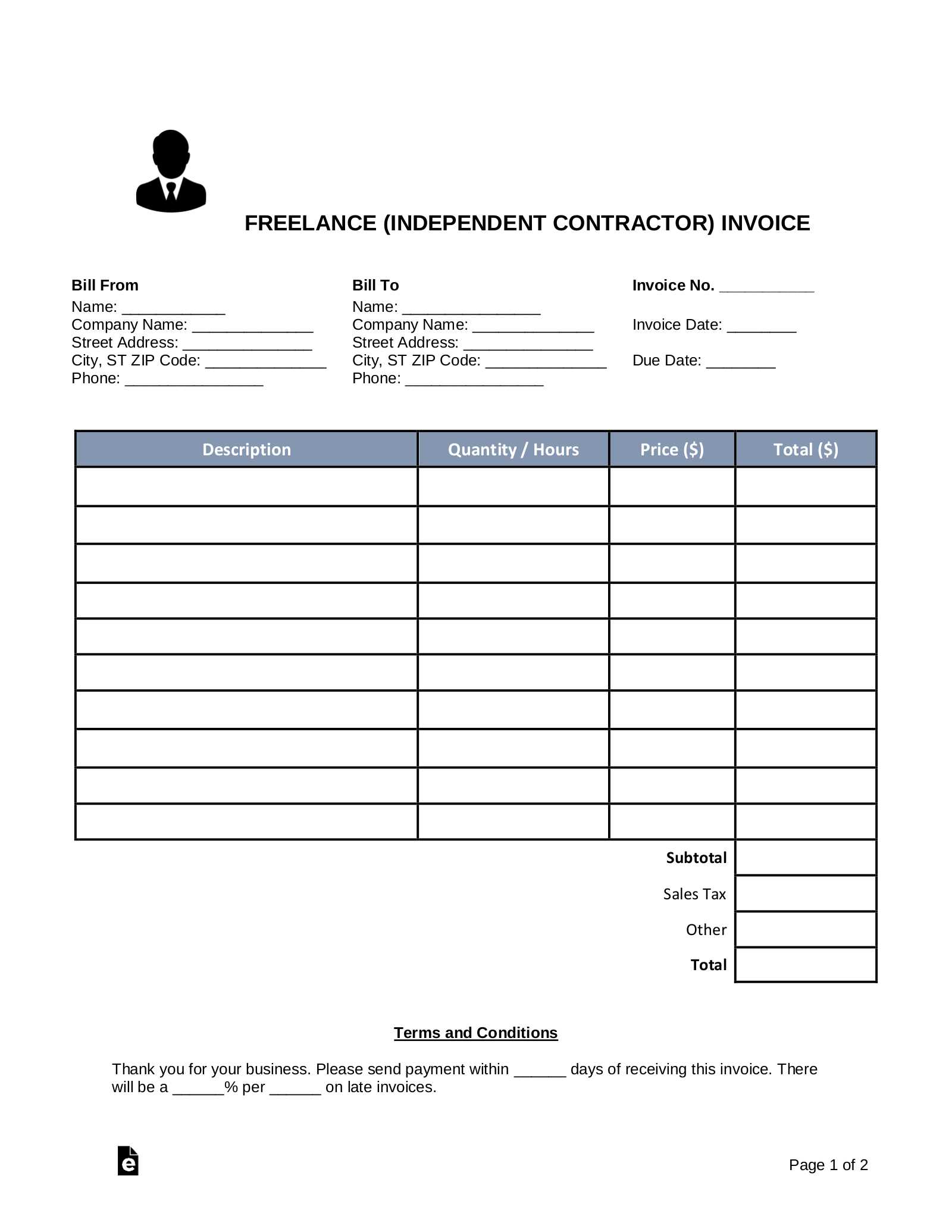

Essential Elements of a 1099 Invoice

When creating a formal document to track services provided and payments received, it’s important to ensure that all critical information is included. The right details help establish a clear financial record and ensure that both parties have a shared understanding of the transaction. A well-structured document should include certain key elements that provide clarity and make it easier to manage accounts, report income, and meet regulatory requirements.

- Contact Information: Include both the service provider’s and the recipient’s name, address, phone number, and email address. This ensures both parties are easily identifiable and reachable if needed.

- Service Description: Provide a clear and detailed description of the services rendered. This helps avoid confusion and ensures that both parties understand the nature of the transaction.

- Payment Details: Include the total amount charged for services, payment terms, and any taxes or additional fees applied. This section should be straightforward and easy to read.

- Dates: Specify the date the services were rendered and the due date for payment. This information ensures there is no ambiguity about the timeline of the transaction.

- Unique Identifier: Each document should have a unique reference number to help track and organize financial records. This is particularly useful for maintaining accurate records over time.

Including these core elements helps ensure that the document serves its purpose and provides both parties with a clear and accurate financial record, reducing the chances of misunderstandings and ensuring compliance with tax regulations.

Tracking Payments with Excel Templates

Efficiently managing payments is crucial for both businesses and freelancers. By using a well-organized document, you can easily track all incoming and outgoing payments, ensuring you stay on top of your financial records. This type of tracking system helps maintain clarity, prevents overdue payments, and simplifies the process of preparing for tax reporting.

Key Features for Tracking Payments

- Payment Date: Keep a record of when each payment is made. This helps in tracking due dates and monitoring timely payments.

- Amount Paid: Document the exact payment amount for each transaction to ensure accuracy and consistency in your financial records.

- Payment Method: Note whether the payment was made via check, bank transfer, credit card, or another method. This gives you a clearer picture of how payments are being received.

- Outstanding Balances: Keep track of any unpaid amounts and set reminders for follow-ups, ensuring no payments are missed.

Using Formulas for Tracking

- Automatic Calculations: Use simple formulas to automatically calculate the total payments received, outstanding balances, and any late fees. This reduces manual work and minimizes errors.

- Conditional Formatting: Highlight overdue payments or large balances to easily spot areas that need attention.

By customizing a payment tracking system in this way, you create a reliable tool to monitor financial transactions and streamline your business operations.

Automating Your Invoicing Process

Streamlining your billing process is key to saving time and reducing errors. By automating routine tasks, you can ensure that your financial documents are generated quickly and consistently without manual intervention. Automation allows you to focus on other critical aspects of your business, all while maintaining accuracy and reducing administrative workload.

One way to automate your billing process is by setting up a system that generates documents based on predefined rules or triggers. For example, after a service is completed, the system can automatically create a document, populate it with relevant details, and even send it to the client via email. This automation helps to eliminate the need for manual data entry, which not only saves time but also reduces the chances of errors.

Another option is to use software that integrates with your accounting system, syncing payments and creating financial records in real time. This ensures that all information is up to date, and that invoices are created and sent promptly after transactions are completed.

Common Mistakes in 1099 Invoices

When creating financial documents, accuracy is essential to ensure smooth transactions and avoid potential complications. Many errors can occur when drafting these documents, leading to confusion, delayed payments, or issues with tax reporting. Recognizing these mistakes early can help maintain a professional and efficient process for your business.

One of the most common mistakes is incorrectly entering payment amounts. Whether it’s a typo or a miscalculation, errors in the payment amount can cause problems for both the sender and the recipient. Double-checking all amounts before finalizing the document can help prevent this issue.

Missing client details is another frequent mistake. Incomplete information, such as missing addresses or contact numbers, can lead to confusion or prevent clients from properly processing the document. Ensuring that all necessary fields are filled in correctly is crucial for smooth transactions.

Failure to track due dates can also create unnecessary delays. Without a clear understanding of payment terms or deadlines, both parties might experience confusion about when payments are expected. Setting clear payment terms and adhering to them can help avoid this issue.

Lastly, not keeping accurate records of transactions can complicate tax preparation and accounting. It’s important to maintain up-to-date financial records for all completed transactions to ensure a smooth and accurate year-end review.

Legal Considerations for 1099 Forms

When preparing financial documents for independent contractors or other non-employee workers, it’s essential to ensure compliance with legal requirements. These forms are vital for tax reporting purposes, and failing to follow the correct procedures can result in penalties or issues with the tax authorities. Understanding the legal aspects involved is crucial for avoiding mistakes and staying within the law.

Understanding Reporting Requirements

One of the primary legal considerations is understanding when and how to report payments made to contractors. In most jurisdictions, payments over a certain threshold require documentation to be submitted to the tax authorities. Missing this step or incorrectly filing can lead to fines or delays in tax processing.

Accurate Information is Crucial

Ensuring that all information on the financial document is correct is another key factor. This includes the recipient’s legal name, tax identification number, and payment details. Incorrect or incomplete data can cause delays or errors in the tax filing process. It’s important to verify this information before submission to avoid complications.

- Ensure the correct classification of workers (independent contractors vs. employees)

- Double-check the amount being reported for accuracy

- File and submit on time to avoid penalties

By following these guidelines and ensuring proper documentation, businesses can maintain compliance with tax regulations and avoid costly legal consequences.

How to Avoid Invoice Errors

Ensuring the accuracy of financial documents is crucial for smooth business operations and timely payments. Common mistakes can lead to delays, misunderstandings, or even legal issues. By following simple steps, you can minimize errors and ensure your records are accurate and professional.

Double-Check All Information

Before submitting any financial document, verify the key details. These include the recipient’s name, payment amount, dates, and service descriptions. Small errors in these areas can cause significant issues down the line. Make sure the payment amounts and terms are correct, and that no details are omitted.

Use a Consistent Format

Consistency helps to avoid confusion. Using a standardized format for all your documents not only saves time but also reduces the chances of mistakes. Having a clear structure for entering details, such as contact information and payment terms, can help prevent errors in the future.

- Ensure correct dates and payment terms are listed

- Double-check numerical entries and calculations

- Review service descriptions to ensure accuracy

- Keep consistent formatting throughout your documents

By following these best practices and staying organized, you can significantly reduce the risk of errors and ensure smooth financial transactions.

Using Formulas in Financial Documents

Incorporating formulas into your financial records can help streamline calculations and reduce manual errors. With the right formulas, you can automate complex tasks such as summing totals, applying tax rates, and calculating due amounts. This approach saves time and ensures accuracy in your financial processes.

Benefits of Using Formulas

Formulas offer several advantages in managing financial documents. By automating calculations, you eliminate the need for manual input, which significantly reduces the chances of mistakes. Additionally, using formulas ensures that your documents are updated dynamically whenever you make changes, such as adjusting rates or quantities.

Common Formulas to Use

Here are some common formulas you can use in your financial documents:

- SUM: Adds up a range of numbers, useful for calculating totals of multiple items or services.

- IF: Allows you to apply conditions, such as calculating different amounts based on a threshold.

- PERCENTAGE: Calculates percentages, such as tax rates or discounts.

- SUBTOTAL: Provides a subtotal of a specified range, which can be adjusted by filtering data.

By incorporating these basic formulas, you can simplify your workflow, ensure accuracy, and avoid tedious manual calculations. With a solid understanding of how formulas work, you’ll be able to create professional and error-free financial documents quickly and efficiently.

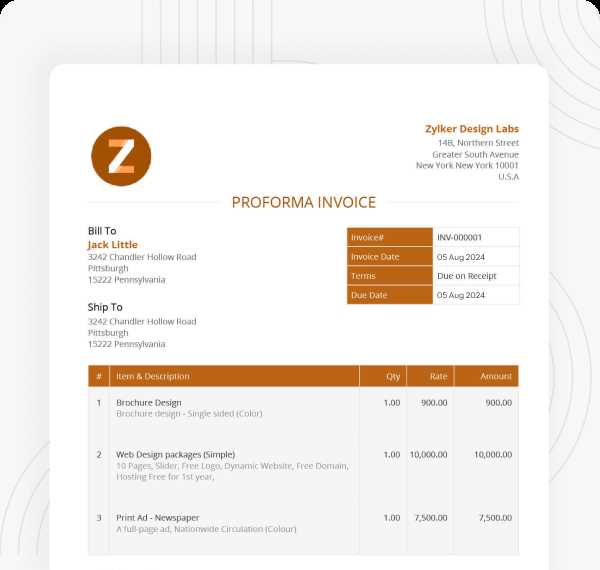

Tips for Professional Financial Documents

Creating professional financial records requires attention to detail and consistency. Ensuring your documents are clear, accurate, and easy to understand can leave a positive impression on your clients and simplify the payment process. The following tips will help you create polished and efficient financial records.

Key Elements to Include

To ensure your document meets professional standards, be sure to include these essential details:

| Element | Description |

|---|---|

| Contact Information | Include your business name, address, and contact details, as well as your client’s information. |

| Unique Identification | Give your document a unique reference number to keep track of transactions. |

| Clear Breakdown | List individual services or products provided, along with their rates, quantities, and totals. |

| Due Date and Payment Terms | Clearly state when the payment is due, and specify your payment terms to avoid confusion. |

| Tax Information | Ensure taxes are calculated accurately and included in the total amount due. |

Formatting for Clarity

Proper formatting is crucial for readability. Here are some guidelines to help your document stand out:

- Keep it organized: Use clear sections for each detail, such as contact info, service breakdown, and totals.

- Use consistent fonts and sizes: Stick to simple, readable fonts and ensure text is large enough to read easily.

- Include a professional logo: If applicable, add your business logo for a polished look.

- Highlight key details: Use bold or colored text to emphasize important information like totals and due dates.

By following these tips, you will create professional, well-organized financial documents that promote trust and clarity in all your transactions.

Ensuring Tax Compliance with Financial Documents

Maintaining proper tax compliance is essential for businesses and freelancers alike. Properly documenting transactions is critical for reporting income and deductions accurately. Failure to adhere to tax rules can lead to penalties, audits, or legal issues. This section covers the importance of ensuring tax compliance when preparing financial records and what you need to consider to stay compliant.

To ensure compliance, businesses need to follow certain guidelines and provide accurate details in their financial documents. Key information such as tax identification numbers, the total amount of services rendered, and taxes calculated must be included correctly. Below are the most important aspects to focus on:

- Accurate Reporting: Ensure that all earned income and applicable taxes are correctly reported in your records. This includes tracking both taxable and non-taxable transactions.

- Correct Tax Rates: Apply the right tax rates based on the goods or services provided. Research current tax rates in your area to avoid mistakes.

- Documenting Exemptions: If any products or services are exempt from taxation, ensure that you clearly note this in your records to avoid issues during tax filing.

- Timely Filing: Stay up to date with filing deadlines. Late submissions can result in penalties, so make sure you file your records according to the required timeframes.

- Tax Identification Number: Always include your business or taxpayer identification number (TIN), as it’s necessary for proper tracking by the tax authorities.

By following these best practices, you can avoid tax-related issues and ensure that your financial records are in full compliance with the law. Remember, keeping accurate records throughout the year will make tax time much simpler and stress-free.

Saving and Sharing Financial Documents

Once you have created your financial record, it is essential to save and share it efficiently. The ability to store these documents securely and send them to clients, colleagues, or tax authorities is crucial for smooth business operations. This section discusses the best practices for saving and sharing your financial files while ensuring accessibility and security.

Saving Your Files

When it comes to saving your financial records, it’s important to choose formats that maintain the integrity of your data and make them easy to access later. Here are a few options:

- Spreadsheet Format: Save your files in the original spreadsheet format, allowing for future edits or adjustments. This is ideal for personal records or when you may need to make changes down the road.

- PDF Format: If you need to send finalized copies to clients or stakeholders, save your document as a PDF. This ensures that the layout and content remain unchanged regardless of the recipient’s software.

- Cloud Storage: For easy access from multiple devices, save your files on cloud-based services like Google Drive, Dropbox, or OneDrive. This also ensures a backup in case of technical issues.

Sharing Your Files

Sharing your documents is often necessary for business transactions. You need to consider security, accessibility, and compatibility when sending files. Below are effective ways to share your records:

- Email Attachments: Attach your files directly to an email for quick and easy sharing. Ensure that the file size is manageable for recipients to download.

- File Sharing Platforms: Use platforms like Dropbox or Google Drive to share links to the files. These platforms also allow you to set permissions for who can view or edit the document.

- Encrypted Files: For added security, consider encrypting your files before sharing them. This adds an extra layer of protection, especially for sensitive financial information.

By following these guidelines for saving and sharing your financial documents, you can ensure they are both secure and accessible when needed, allowing for smooth communication with clients and partners.

Where to Find Financial Record Templates for Spreadsheets

Finding the right forms for tracking and organizing your financial transactions is essential for proper recordkeeping. Many businesses need structured documents to capture payments and other details, which can be managed with the help of various digital tools. This section will guide you to several sources where you can locate these types of forms for spreadsheet software.

Online Template Marketplaces

Several online platforms offer downloadable forms that are compatible with spreadsheet software. These marketplaces often feature templates specifically designed for financial documentation. Some popular sources include:

- Microsoft Office Templates: Microsoft provides a collection of ready-made forms that can be downloaded directly from their site. These are fully customizable and suitable for various financial needs.

- Google Docs Templates: Google offers free forms within its platform, which can be modified to fit your specific requirements. Accessing them is as simple as using Google Drive.

- Template Websites: Websites like Template.net or Vertex42 specialize in providing a wide variety of downloadable forms, including those used for financial management, available in various formats.

Customizable Templates from Financial Software

If you’re using financial management software, many of these tools offer customizable forms as part of their suite of features. These may be directly exportable to spreadsheet software. Here are a few options:

- QuickBooks: Known for its accounting features, QuickBooks allows users to generate financial records that can be exported to spreadsheets for further adjustments.

- FreshBooks: Another accounting software option that provides customizable financial forms that can easily be exported in a compatible format.

- Wave: Wave provides free accounting tools, including the ability to generate financial documents in a format that can be opened and edited in spreadsheet programs.

These resources can significantly streamline the process of managing and organizing financial records, offering a variety of options depending on your preferences and needs.